Building blocks falling into place for a new bull market as technology shares convalesce

Back in the day bear markets, periods of generally falling share prices, could last for years. The idea was that stock markets followed a cycle rather like cycles in farming markets with several years of plenty followed by one or two lean years. These cycles seemed sufficiently reliable that people even tried to predict stock market trends based on the idea of cycles.

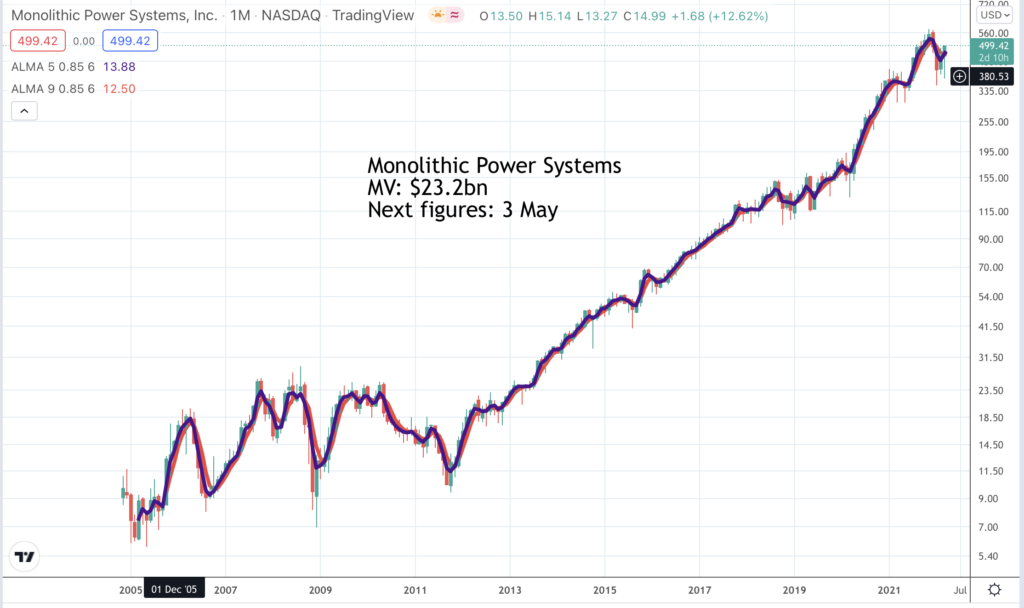

This pattern no longer seems to hold with bear markets coming more in the form of short, sharp shocks. You can see these in the chart above. The periods of falling prices can be severe but never seem to last much more than three or four months before the rise resumes.

The two that were different and more like full on bear markets were the downturns in 2000-2003 and 2007-2009. The first related to the bursting of the Internet bubble and the second to the financial crisis.

Since then we have had corrections rather than bear markets although some of the share price falls have been severe. The latest correction has been no exception and has particularly affected many of the shares that did best previously. In that respect we are almost looking at a new beginning with the recovery in share prices that may now be taking shape.

It is early days with some of the indicators we use on Great Charts still pointing down. Many shares still have falling moving averages and the Coppock indicators which began falling in the middle and latter part of 2021 are still heading lower. However it is beginning to look as though, as with earlier corrections, shares are finding buyers at the lower levels and many shares may have reached their lowest points for this correction and are now convalescing/ heading higher.

One group that I have already identified as having weathered the correction in style is the mega caps, the group of US quoted technology giants which are valued at over a trillion dollars. The companies in this select group are Apple, Alphabet, Amazon, Microsoft and Tesla.

Below is the chart of Alphabet showing that after a strong rise since March 2020 the shares have spent seven months consolidating. This could be a top area forming but that seems unlikely given the strong fundamentals underpinning the group. Alphabet consists of three outstanding businesses, Google Search, YouTube and Google Cloud. When Alphabet last reported its Q4 and full year 2021 results all of these businesses were storming ahead. Big as Alphabet is it is still becoming bigger. Q4 revenues were $75.3bn, up 33pc in constant currency on a year earlier.

It is staggering how strong Google’s businesses are.

“We continue to generate strong free cash flow with $18.6bn in the quarter and $67bn in 2021. We ended the year with $140bn in cash and marketable securities. We also repurchased a total of $50bn of our shares in 2021. Total Google Services revenues were $69.4bn, up 31pc. Google Search and other advertising revenues of $43.3bn in the quarter were up 36pc, with broad-based strength across our business, led again by strong growth in retail. YouTube advertising revenues of $8.6bn were up 25pc, reflecting strength in both direct response and brand advertising. The deceleration in the growth rate versus the third quarter of 2021 was driven primarily by lapping a strong recovery in brand in the fourth quarter of 2020.”

The beauty of being a technology driven business is the endless scope for making improvements. Search is unrecognisable from the clunky experience in the early days and continues to improve as the group invests massively in areas like artificial intelligence. Innovation is the life blood of all these technology businesses and the thing that drives growth, creates moats against the competition, gives them pricing power and generates all that cash.

For all these reasons I expect the Alphabet share price and that of the other mega caps to head steadily higher over time. These are almost certainly the most amazing businesses that have ever existed, which is why they are wonderful investments and should be core holdings in every portfolio.

The newest recruit to the mega cap group is Tesla, whose chart is shown below. Like the other mega caps there is an army of analysts poring over Tesla, its results and its prospects. This can lead to an obsession with detail at the expense of the big picture. Tesla is at the centre of the world’s efforts to move away from fossil fuel cars. It is struggling to meet demand and its brand has become synonymous with electric vehicles.

At the heart of Tesla’s business are its gigafactories to make batteries and cars. It has just opened its latest Gigafactory in Berlin to serve continental Europe.

“Gigafactory Berlin-Brandenburg is Tesla’s first manufacturing location in Europe and our most advanced, sustainable and efficient facility yet. Slated for completion this year, it will manufacture hundreds of thousands of Model Y vehicles and millions of battery cells. We’re currently hiring across a wide variety of skill and experience levels—no automotive experience necessary. Join us at Gigafactory Berlin-Brandenburg to solve the next generation of engineering, manufacturing and operational challenges as we accelerate the world’s transition to sustainable energy.“

The air of excitement around the business is palpable and is a major draw to would be employees many of whom will be working on design and innovation. The scope for improvement is massive in so many areas including factory productivity, range of vehicles and more obviously research intensive areas like autonomous driving.

Not the least amazing thing about Tesla is the sheer growth. Sales of $24.6bn in 2019, itself up massively from earlier years, is forecast to grow to $128bn by 2024. Like the other mega caps the bigger Tesla becomes the stronger it becomes able to finance faster growth, more intensive r&d and bigger roll outs in areas like charging facilities.

An interesting development is the revived enthusiasm for share splits. Both Alphabet and Amazon have announced 20:1 share splits and Tesla is reportedly going to put a stock split up for a shareholder vote. These splits don’t make any difference to the value of the shares but they make them easier to buy for retail investors and are widely regarded as a sign of confidence. Tesla’s last split was a 5:1.

There is another group of shares I like which is related to the mega caps and these are technology and US stock market focused ETFs. There are the plain vanilla ones like QQQ which tracks the Nasdaq 100, ONEQ, which tracks the Nasdaq Composite and SPY which tracks the S&P 500 and there are the three times leveraged varieties like QQQ3 and SPXL, which do the same thing but with leverage.

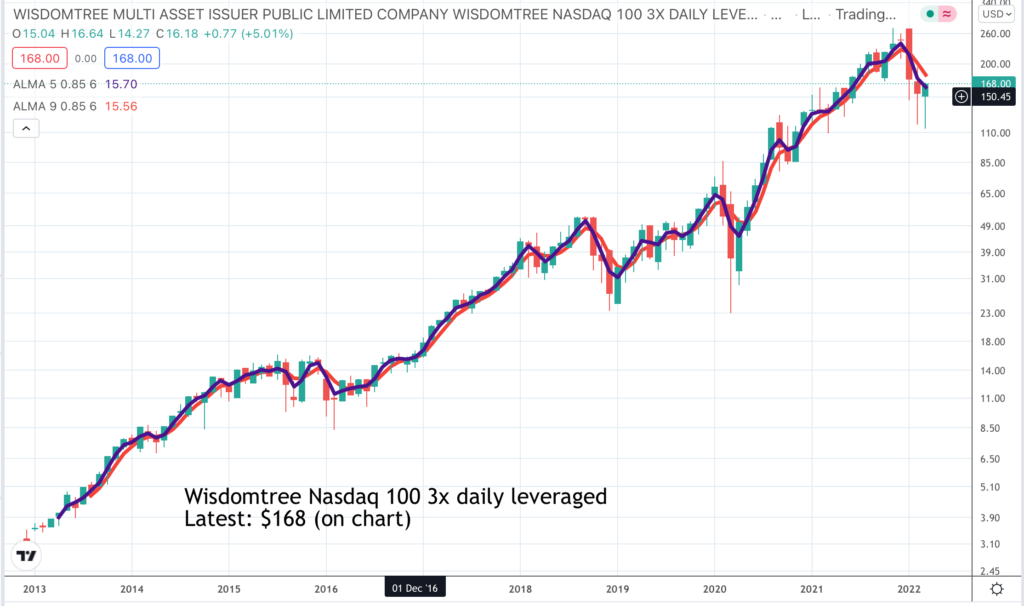

Commentators often say that the leveraged ETFs are not suitable for long-term investment because they are not only volatile but volatile in an erratic way because of the effect of being rebalanced daily. But this daily rebalancing often works to the advantage of investors because the ETFs are continually being focussed on the strongest performers. As a result, over time, given favourable markets, they can do much better than three times the performance of their non-leveraged counterparts.

Since December 2012, the first date when QQQ3 was available, QQQ is up 5.5 times but QQQ3 is up 56 times and that is despite being sharply down from its November 2021 peak. Leveraged ETFs benefit from markets which are in sustained uptrends and do less well when shares prices are choppier and more volatile.

However I believe the reason for the strong secular uptrend in US shares is the continuing and accelerating technology revolution in which US companies play a disproportionately large role. As a result I expect US shares to continue to do well which favours investment in leveraged ETFs like QQQ3, a chart of which is shown below.

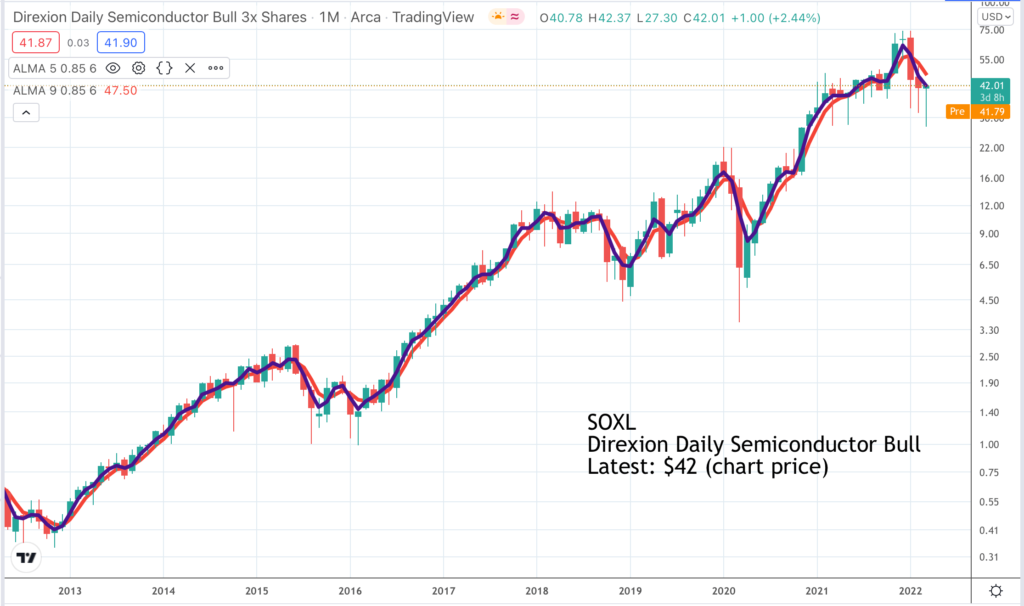

Although it has done extremely well QQQ3 is not the best performing leveraged ETF. The star performer is SOXL, which tracks semiconductor shares and has been an incredible performer. Since 2013 SOXL is up 120 times. The shares have been volatile over that period which makes a strong case for using a $-cost averaging programme to buy them. Buy some every month and you are going to do well. Another leveraged ETF I like is TECL, which gives three times leveraged exposure to the technology sector and has been another great performer.

I first realised that the leveraged ETFs did better than you would expect from their leverage when I thought about buying regular ETFs like QQQ in a leveraged account. ETFs with built-in leverage can only be bought in a share account whereas in a CFD or spread betting account you can buy shares with five times leverage.

I assumed this meant that straightforward ETFs bought in a leveraged account would outperform ETFs with built in leverage because of the effect of five times leverage v three times. I was amazed to discover this was not the case. Even competing against the extra leverage the ETFs with built in leverage do twice as well.

There is a case for doing a bit of everything. You could buy regular ETFs in a leveraged account, leveraged ETFs in a share account and mega caps in a leveraged account or if you are wary of leverage buy them all in a share account. My personal preference is to do as much as I can in a spread betting account because all gains are tax free.

One way to reduce the volatility over time is to make sure that all purchases are funded with new money paid into the account. This means that you do not use any paper profits as equity to fund further purchases. Over time in a rising market this should mean that your level of leverage falls, possibly quite sharply in a strong market. If you do what I do which is reinvest all your gains in further purchases your portfolio becomes a bit like a suicide mission. The first serious shakeout is going to hurt and if you try to hang in there you could easily find yourself being wiped out.

As you might imagine I don’t try to hang in there. Once my indicators and common sense tell me that we are in a correction I sell out, usually completely. I lose a big chunk of my gains but can still do very well. This is because my gains can be huge. It is not unknown for me to multiply my initial stake money ten fold in a good period in the market. My wife describes what I do as gambling not investing and she has a point but it is great fun. Like Yul Brynner, the modernising King of Siam, in the musical ‘The King and I’ I am always trying to make my approach more scientific.

Another key part of my strategy with Great Charts and Quentinvest generally is to focus on shares in companies offering quality growth. I call these shares 3G, standing for great chart, great growth and great story. It is a bit of a zen thing because how ever much you try to describe it there is always some indefinable bit of magic that characterises a great growth share and distinguishes it from all those companies which may be growing but are not great.

I am going to list here some great growth shares for your attention.

Palo Alto Networks has a particularly strong chart, which followed excellent quarterly results ahead of expectations and a successful shift by the business to a more cloud-focused strategy. Cyber security seems likely to only increase in importance going forward in a world where countries engage in cyber warfare and with increasing use of economic sanctions raising the stakes on stealing technology.

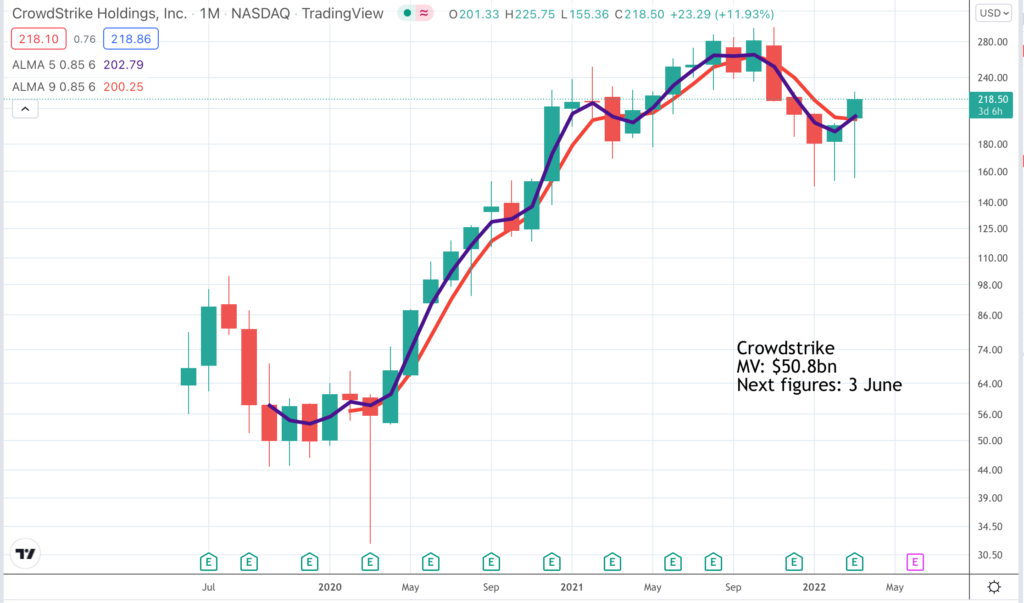

Another exciting cyber security business is Crowdstrike which specialises in identifying and protecting against nations engaging in cyber warfare. Latest results from the business were outstanding.

“This quarter’s results are headlined by an acceleration in net new ARR [annual recurring revenue] growth for the second consecutive quarter to reach $217m. Record 19pc non-GAAP operating margin and record free cash flow of $127m or approximately $197m when excluding the IP transfer tax payment related to the acquisition of Humio. Second, our success outside of traditional endpoint security is now punctuated by both scale and hypergrowth as we surpassed the $150m ARR milestone, while growing in excess of 100pc year over year for our IT hygiene, vulnerability management, identity protection and log management modules collectively. Third, we exited the year with tremendous momentum for ARR derived from Falcon deployments in the public cloud, where ARR eclipsed the $100m milestone and grew 20pc quarter on quarter as we lead the effort to transform security for the public cloud. And fourth, as you can see from our outstanding results, our growth engine is executing on all cylinders, which includes our thriving partner ecosystem.“

Third in a trio of cyber security stocks is Fortinet. The chart looks as though the shares ae consolidating before a new advance. The fundamentals are impressive. Latest results were outstanding. “Billing increased 42pc to $1.064bn, exceeding $1bn in quarterly billing for the first time in Fortinet history. Global G2000 billing growth accelerated to over 50pc; total revenue growth, 33pc to $867m, with product revenue up 51pc, our highest quarterly product revenue growth since going public in November 2009. With very strong business momentum, we remain focused on growth.” Prospects also look good. “As organizations continue to consolidate toward a platform approach and as network security expands to local and wide area network to the work-from-anywhere environment and to the cloud, Fortinet is strongly positioned to significantly capture market share of a projected total addressable market of more than $174bn by 2025. We are confident that this trend, together with the relentless focus on organic innovation, will drive better-than-industry average long-term growth for Fortinet. The group’s products have particular benefits in a world of flexible working. “Work-from-anywhere is here to stay. The COVID-19 pandemic has greatly expanded the work-from-anywhere model. According to Gartner, organizations are facing a hybrid future, with 75% workers saying their expectation for working and flexibility has increased. Today, Fortinet announced the industry’s most complete solution to enable organizations to secure and connect work-from-anywhere by unifying Fortinet’s broad portfolio of zero trust, endpoint and network security solution within the Fortinet Security Fabric. Fortinet delivers security that follows users whether on the road, at home or in office to provide enterprise-grade protection and productivity.”

Other charts which look increasingly promising are those for the two cryptocurrencies, bitcoin and ether. As I have frequently noted before I use charts to follow the cryptos. The basic fundamentals are unchanging. Strong global demand meeting limited supply. On past occasions buy signals have worked well but this always happens when a strong secular uptrend is in force. We have what looks like a new buy signal with the moving averages turning higher while the latest downtrend has been broken. It is possible that all the trading since March 2021 will turn about to be a consolidation. This could support a massive rise in price. There are also growing parallels between the performance of the cryptos and that of shares generally with both investment categories rising together.

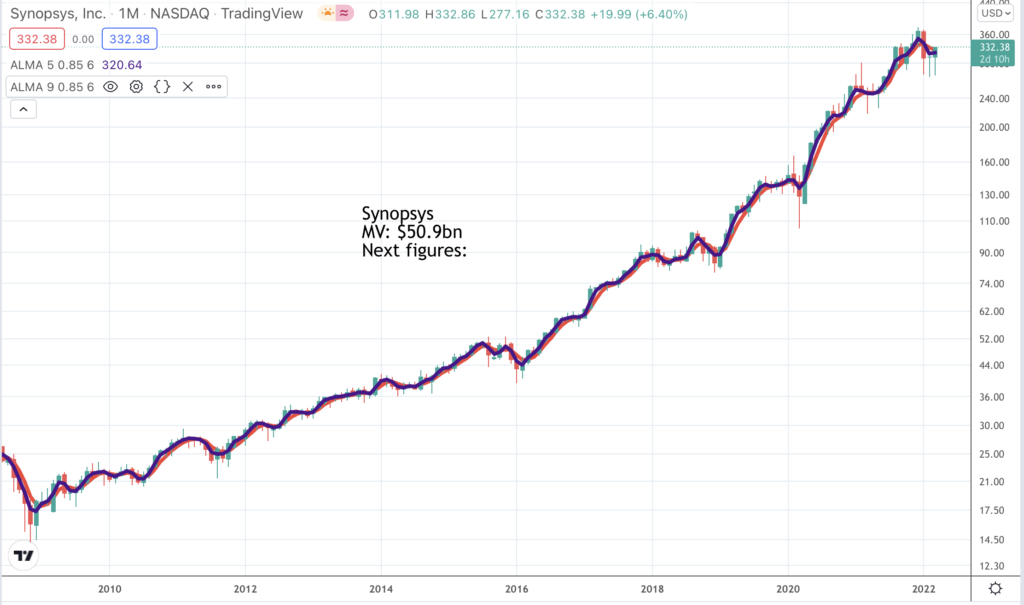

The number of shares looking promising is growing all the time. Two I like are Synopsys and Monolithic Power Systems. In the latest quarterly report Synopsys co-CEO, Aart de Geus, explained why the business was doing so well. “Q1 was an excellent start to the year. Building on the strength and momentum from 2021, we met or exceeded all of our key guidance targets with strength across all product groups and geographies. Revenue was $1.27bn with GAAP earnings per share of $1.99 and non-GAAP earnings at the high end of our target range at $2.40. As a result of this solid start and confidence in our business, we are raising our full year revenue and earnings guidance. We’re also executing well on the long-term accelerated revenue growth and margin expansion objectives we communicated to you in December. The excellent results can be attributed to three reasons; strong semiconductor market, strong technology with increasing differentiation, strong execution by our teams and adoption of new products. Our market is very sound and growing in a way that is positive for Synopsys. As the power and impact of massive amounts of Big Data are increasingly realized, demand for Smart Everything continues to intensify. As a result, customers ranging from traditional semiconductor companies to AI start-ups, hyperscalers and vertical system houses are all investing heavily and prioritizing design activity. Rapidly escalating technical complexity, as Big Data and AI software are brought together in increasingly advanced ways, means that today’s products require highly complex chips, systems of chips and more security and safety. As a result, customer investments are increasing across all market segments.”

Monolithic Power Systems is a semiconductor business which is growing strongly. “In 2021, MPS surpassed the $1bn revenue milestone by achieving record full-year revenue of $1.2bn, 43pc higher than the prior year. This performance represented consistent execution against our strategies and being recognized by more first-tier companies for our superior technologies, product quality, and excellent customer support. As we see more high-quality growth opportunities ahead of us, we continue to invest in our infrastructure and operational capabilities. In 2021, MPS grew capacity by 40pc.” Demand growth is broad-based. “Turning to our full year 2021 revenue by market segment compared with 2020. Automotive revenue was up 87.5pc. Computing and storage revenue up 47pc; industrial revenue up 54.5pc; consumer revenue up 28.1pc; and communications revenue up 15.3pc, demonstrating just how broad-based our full year 2021 revenue improvement was.” Looking further ahead the company almost sounds like Buzz Lightyear. “Looking ahead, MPS is on track to expand capacity in 2022 well beyond $2bn, allowing the company to successfully ramp new product revenue and achieve strategic market share gains in 2023, 2024, and beyond.” No wonder the chart looks strong.

I could carry on making recommendations as there are a good number of shares looking promising in current market conditions. However I think it can be more helpful for subscribers to rerecommend shares I like such as the mega caps and broad-based ETFS and add some new recommendations. This makes it possible to build a portfolio from strength over time. In a world of accelerating technological change there are always going to be a large number of companies doing well, which is what makes the 21st century such an exciting period for growth share investors.

Shares and ETFs recommended in this issue.

Apple AAPL Buy @ $175.6

Alphabet. GOOGL Buy @ $2,829

Amazon AMZN. Buy @ $3,379

Microsoft. MSFT. Buy @ $310.70

Tesla. TSLA. Buy @ $1091

QQQ Buy @ $364.0

ONEQ. Buy @ $55.99

SOXX. Buy @ $489

SPY. Buy @ $455

QQQ3. Buy @ $178

SOXL. Buy @ $42.7

SPXL. Buy @ $123.25

TECL. Buy @ $62.89

Palo Alto Networks. PANW. Buy @ $625

Crowdstrike. CRWD. Buy @ $222

Fortinet. FTNT. Buy @ $338.5

Bitcoin. Buy @ $48,002

Ether. Buy @ $3,474

Synopsys. SNPS. Buy @ $332

Monolithic Power Systems. MPWR. Buy @ $499