Upstart Holdings. UPST. Buy @ $318. Times recommended: 13 First recommended: $62.50 Last recommended: $273.20

I am becoming even more exciting about shares in Upstart Holdings, a company which is using artificial intelligence (AI) and machine learning (ML) to disrupt credit markets. They are already one of the fastest climbing shares I have ever seen. They went public at $20 in December 2020. Over the next four months the price rocketed to $165 at which point severe turbulence set in. They fell back to $41.77, rebounded again and spent several months consolidating around $125. The company then reported a very strong Q2 2021 and the shares took off again.

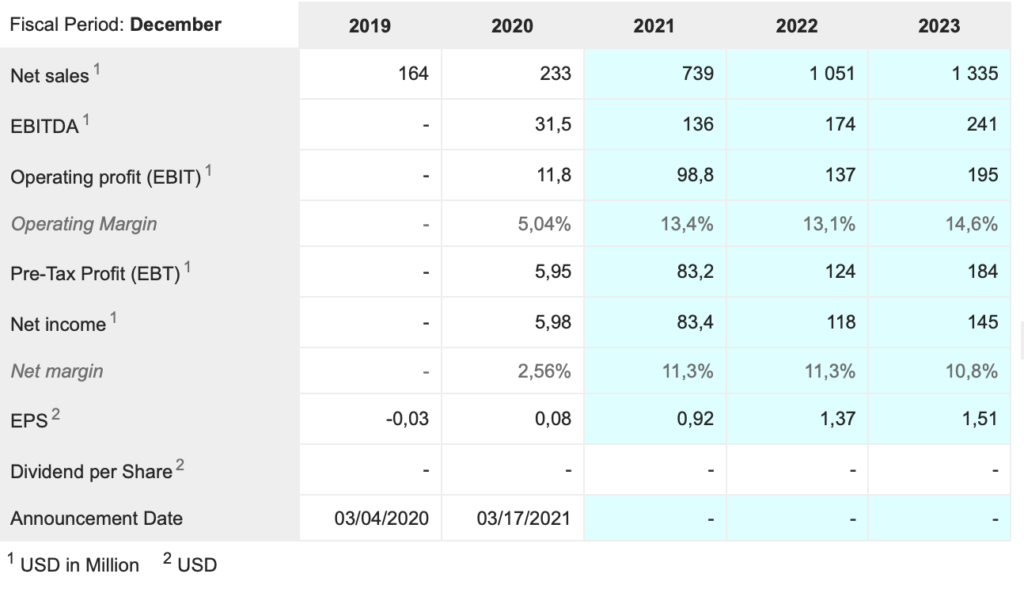

“Our Q2 revenues grew to $194m, up 60pc compared to the prior quarter. June was our first month with more than 100,000 loans and more than $1bn in origination volume on our platform. And we achieved this growth while also delivering record profits with adjusted EBITDA of $59.5m and GAAP net income of $37.3m. We’re also happy to report that more than 97pc of our revenue came in the form of fees from banks or loan servicing with 0 credit exposure or demands on our balance sheet.”

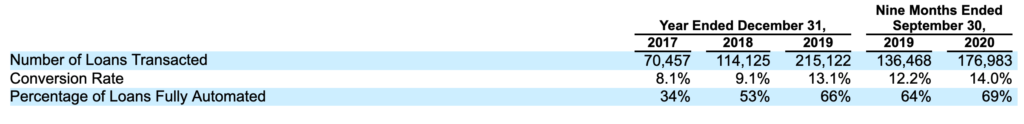

The growth is incredible. In June 2021 alone the group delivered over 100,000 loans and $1bn in value originated on the platform. You can compare this with the figures for number of loans made below. In one month alone they are fast approaching all the loans made in 2018. The group made a little over 300,000 loans in 2020, which was adversely affected by Covid-19, especially in the early part of the year.

The implication is that in June 2021 the group is running at 1.2bn loans a year or four times the number made in 2020 and over 12 times the number made in 2018. The further implication is that Upstart’s business is taking off. This won’t come as a surprise to them because that is exactly what they expect to happen. Indeed there is a case for saying that amazing as the figures are they don’t reflect the most exciting likely development which is a huge increase in the number of banks using Upstart’s platform. This is currently around 25 and CEO and co-founder, Dave Girouard, expects the number to grow into the 100s in the not too distant future.

It has been a slow and unpredictable process because banks are naturally risk averse and what Upstart Holdings is offering is a whole new technology platform for evaluating credit risk and deciding to whom to make loans and at what rate. It is a huge change for banks to take on board. The guys responsible for the p&l love what Upstart is doing because it means making many more loans with fewer defaults. The credit guys are more cautious but slowly but surely they are coming on board.

I have been watching an interview (10 September 2021) with the CFO, Sanjay Data, who was asked some very searching questions.

First of all his questioners wanted to know what AI was all about. His answer, as a layman, was to think of AI as a way of using data to make predictions. The simplest way is regression analysis where you assume a constant relationship between the variables and just project trends into the future. The model becomes much more complicated, much more useful and uses much more computing power, if you allow the variables to affect each other.

In the case of Upstart with over 1600 variables being used to predict the likelihood that a given loan will be repaid these calculations become incredibly complicated but have great predictive power. In another interview with chief technology officer and co-founder, Paul Gu, he said that banks using Upstart’s platform will see 70pc fewer defaults making the same number of loans, which he described as a stunning result or they can double the number of loans for the same number of defaults. It ought to be a no-brainer for banks to use either Upstart’s software or something like it and one day it will be.

The next question for Sanjay was what are the barriers to entry. Why won’t there be many rivals to Upstart in a few years time? He says their head start is critical. You can hire 300 PhDs and input all the same variables into the spread sheet but until you have the loan history and the data banks that Upstart is accumulating at such a rate you won’t be able to make the predictions.

Furthermore big banks who did build the history would keep the results to themselves and small banks don’t have the resources. Upstart’s barriers to entry are stronger than might be imagined and growing all the time. It is a bit like Amazon which started by selling books online. Surely anyone could do that; it turns out apparently not.

Another question was about the product cycle. Upstart is very much innovation driven and each quarter they have to prioritise what they will try to do and guess what the impact will be on their model. Because this is hard to do their future guidance tends to err on the conservative side which helps explain why recent quarters have smashed expectations and sent the shares sharply higher.

This problem could be even greater in coming quarters as the company moves into new areas. They have launched a Spanish language version of the loan application process. As they say Spanish speakers make up 15pc of the US population and are a demographic which is typically underserved by lenders so perfect for the Upstart treatment.

They have also recently launched an auto finance product. This market is six times the size of their original personal loans market because most Americans buy cars with finance. It is also very inefficient because many Americans struggle to get finance and many who do pay too much.

Upstart is initially targeting the auto loan refinance market and has established a presence in 47 states covering 95pc of the population of the US. This effort should start to deliver results in Q4 2021.

They have also acquired a company called Prodigy which is helping auto dealers modernise their operations. They describe it as Shopify for car dealers. This will enable them to offer loans at the point of sale. Prodigy has already doubled the number of dealerships on the platform and should start to have an impact in 2022.

In answer to what comes next after auto finance Sanjay references most areas of credit and said there were inefficiencies in the mortgage market for example. And all these opportunities are just in America. There is also a vast opportunity in expanding globally.

My impression from all of this is that Upstart could continue to grow rapidly for a long time into the future. You could even say that it needs to grow rapidly as part of my favourite battle for territory. It’s best defence against competition is its lead and the number of loans already processed using its platform. The company has every incentive to keep moving as fast as possible to build and improve its algorithms. As it does this banks will grow in familiarity and confidence with what they are doing encouraging more of them to (a) come on board, (b) offer more than one Upstart product and (c) drop their requirement for all loans to pass a Fico score hurdle.

My conclusion from all this is that there could be more explosive growth to come from Upstart which helps explain why investors are struggling to value the business. Back in the 1980s and 1990s there was a phenomenon known as Wintel. Intel supplied the chips, Microsoft supplied the software and IBM and others built the hardware for the desktop computing revolution. Computers had a logo on them saying ‘Powered by Intel’.

We could see a similar phenomenon in credit markets with loans being made by banks but being described as ‘Powered by Upstart’ and just as with the desktop computers there could be an awful lot of them in credit markets worth trillions of dollars.

I don’t know where Upstart is going or if they can stay the course but it seems to me that they have a phenomenally exciting opportunity. They think so too. This is what CEO, Girouard had to say with the Q2 figures.

“Upstart is a leading AI lending platform, and our second-quarter results continue to demonstrate why this category can generate enormous value in our economy. They also demonstrate why Upstart has an opportunity to become one of the world’s largest and most impactful fintechs in the years to come. Lending is the center beam of revenue and profits in financial services, and artificial intelligence may be the most transformational change to come to this industry in its 5,000-year history. It’s our view that AI-led disruption targeting dramatic inefficiency in one of the largest segments of our economy is worthy of your attention.”

I have used this quote before but like Girouard I still think it is worthy of your attention and worth repeating. If Upstart does become a giant company nobody can say he didn’t tell us what to expect.

One last point is the recession threat. People keep saying that Upstart will have problems come the next recession. First, they have weathered Covid-19 very well. But secondly they say that the message from their algorithms is that individual specific risk is far more important than macroeconomic risk in evaluating whether loans will be repaid or not. Banks are typically obsessed with the macroeconomic picture. Upstart say it is not a key variable in their calculations.

I love shares that are blazing with excitement and potential. They may crash and burn but they also can be game changers in a portfolio. I believe Upstart Holdings is just such a share. The potential for the company to become a fintech giant five or 10 years from now looks enormous, especially if you consider (a) what they have achieved in the last decade and (b) the size of the market they are addressing. I could say also (c) that I am incredibly impressed by the quality of leadership at this business. If anyone can do it these guys can.

The valuation looks daunting at first sight and may well lead to share price volatility but if I am any where near right about the likely growth of the business in coming years even the current high valuation will soon look outstanding value. If a business is doubling in size annually it goes from small to big to huge amazingly quickly.