I don’t often use this chart but it’s a good one. The Nasdaq Composite index is a broad based index, somewhat like the S&P 500 or the FTSE All-Share. You can see on the chart there have been three historic bear markets. One in 1974 for the oil crisis, which ignited inflation and drove interest rates into the teens. Another came after 2000 when the pre-2000 Internet bubble burst and the attack came on the World Trade Centre. Finally came the 2008 bear market when the global banking system nearly fell off a precipice.

Compared to those upsets Covid-19 has been a blip, partly because in many ways it has accelerated the technology revolution so boosting many of the shares in the index.

The big picture is the power of the secular bull market in US stocks. Since the bottom of the bear market in 1974 the index has risen 256 times. Since the 2009 low point it is up over 11 times. Broadly speaking, US shares, especially those with what I call 21st century businesses, have been a great place to be and there is nothing in the tea leaves to suggest a change in that pattern unless something like Covid comes out of nowhere to change the rules.

What you can see since 2009 is a number of corrections which can feel quite scary at the time but are short-lived. I don’t know if this pattern is going to continue of corrections which last a maximum of three months, peak to trough but it seems at least a reasonable possibility. This means that patient investors who can ride out these setbacks will see their portfolio moving ahead again quite quickly.

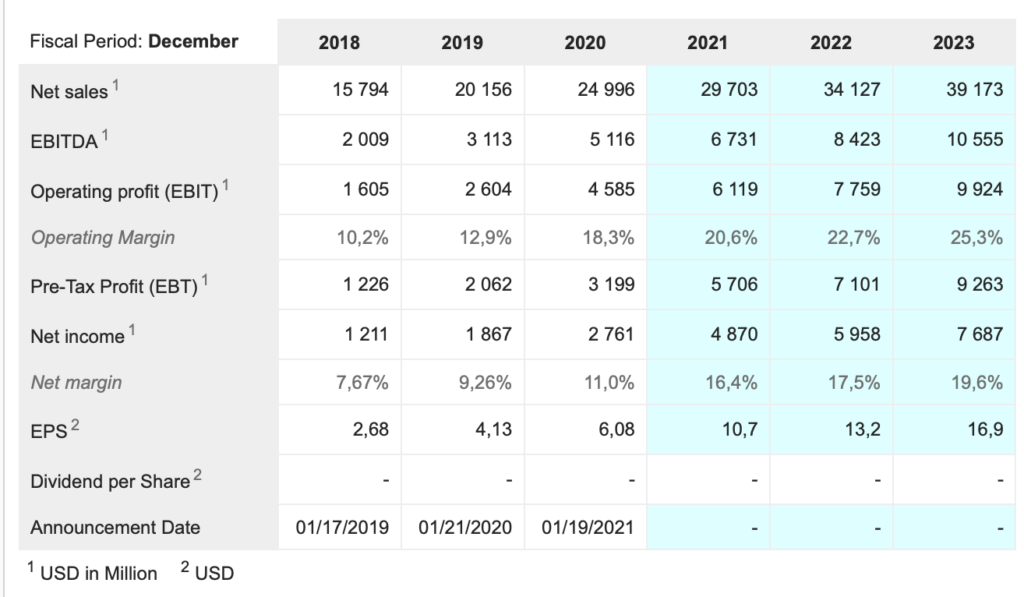

Netflix NFLX. Buy @ $665. MV: $295bn. Next figures: 19 January. Times recommended: 25 First recommended: $174.13 Last recommended: $634 First recommended in Great Stocks for Quentinvest (formerly Quantum Leap): $9.43

There are two ways of approaching video streaming leader, Netflix, as an investment. You can wrap wet towels around your head to cool your over-heated brain, study statistics until your eyes glaze over and come to some conclusion. This will involve massive assumptions and will become less meaningful for every year into the future that your analysis extends.

Or you can read the letters of co-CEO, Reed Hastings, and see what he thinks. This is much easier and I think much more valuable. After all he is the guy, who, in the teeth of widespread scepticism, has taken the business from a value of $346m on its first day of trading in May 2002 to a value of nearly $300bn less than 20 years later.

It is obvious that he is a clever and resourceful man as is his co-CEO, Ted Sarandos, the long time chief content officer at Netflix. They also have very good employees, not surprisingly given the amazing pay and perks that they receive on starting work at Netflix. This is a business bursting with top talent which can also provide a stimulating and challenging working environment for its staff who are at the cutting edge of the global entertainment industry.

Reed Hastings believes that far as Netflix has already come it still has a long way to go, There is a piece in the investor relations section of the Netflix web site called long-term view. The key point here is that Netflix believes that streaming entertainment is replacing linear TV. If you think about that for a moment it goes a long way to explain why the shares have done so well. In 2002 linear TV was a huge multibillion industry. It still is but since then Netflix, as the streaming market leader, has taken a big bite out of that pie, a big enough bite that its 2021 sales are going to approach $30bn.

There is still a huge amount to go at. I don’t know exactly how you put a number on the value of the globe entertainment and media industry but one figure I found was $2 trillion+ against which $30bn is a drop in the ocean. The doesn’t mean that Netflix is going to take some huge chunk of that first figure. There is a lot of competition. What it does mean though is that the market is big enough that a company full of resourceful people like Netflix will always find opportunities to grow their business.

The latest significant move is into video games. There are loads of stats on the value of this market but one I found says it should reach $250bn+ by 2025. It is very competitive with many powerful established players but so was the content market when Netflix first made House of Cards in 2012/13. I see no reason why they should not be a massive success in the video games market and this will add greatly to their appeal, helping them sell many more subscriptions all over the world. The extra value should also enable them to charge more for the service in time and with so many subscribers any increase in price has a dramatic impact on profitability.

Another area where Netflix has played a pioneering role is increasing local content with Hollywood production values. Initially the plan was to create this content to attract subscribers in the local market but it turns out that much of this content has global appeal. The latest staggering example is a Korean series called Squid Game.

“There is no better example of this (local content with international appeal) than Squid Game, a unique Korean story that first captured the zeitgeist in Korea and then globally. Released on September 17, it has become our biggest TV show ever. A mind-boggling 142m member households globally have chosen to watch the title in its first four weeks. The breadth of Squid Game’s popularity is truly amazing; this show has been ranked as our #1 program in 94 countries (including the US). Like some of our other big hits, Squid Game has also pierced the cultural zeitgeist, spawning a Saturday Night Live skit and memes/clips on TikTok with more than 42 billion views. Demand for consumer products to celebrate the fandom for Squid Game is high and those items are on their way to retail now.”

Squid Game may be a game changer for Netflix almost as dramatic as House of Cards was in 2013. Content like that makes it a no-brainer for so many people to subscribe even if they also have Amazon Prime, Disney+, HBO or whatever. As a piece of public relations for the service Squid Game is spectacular and in a world with over 6bn people online in one form or another the number of people who could subscribe to Netflix but don’t yet is huge even if China is closed to them.

In line with that is this quote from the latest quarterly results. “We are still quite small, with a lot of opportunity for growth; in our largest and most penetrated market, according to Nielsen, we are still less than 10pc of US television screen time. Our approach as always is to improve our service as quickly as we can so that we can earn a greater share of people’s time.”

Another key feature of Netflix from a shareholder’s point of view is what is happening to profit margins. This is what they said in the letter to shareholders with the Q4 2020 results.

“We’ve made good progress growing our profitability with FY20 operating margin of 18pc rising five percentage points over prior year. For FY21, we’re now targeting a 20pc operating margin, up two percentage points from 2020 and higher than our previous 19pc forecast, due to a more favorable revenue outlook. As we said last quarter, we intend to continue to grow our operating margin each year at an average rate of three percentage points per year over any few-year period, but we anticipate some lumpiness. Some years we’ll be a little over (like in 2020), some years a little under (like in 2021), but we are trying to keep on an average three percentage points per year long-term trajectory.”

After many years of losses Netflix is becoming a very profitable business. Netflix employees are very well paid but there are not many of them, maybe around 10,000 to generate revenue of $30bn this year. The elephant in the room as far as costs are concerned is content. Last year Netflix had revenue of $25bn and spent over $15bn on content.

If it steps up spending on content margins fall. If it takes its foot slightly off the accelerator margins go up. Over time as revenue grows it will be able to spend heavily on content but still enjoy improved margins which explains the above quote with its confidence that margins will climb steadily over time.

This also explains why the chief content officer has become the co-CEO. Ted Sarandos’s role in the business could hardly be more important. At Netflix content really is king, which is why having a monster hit like Squid Game is so important both in itself and as a validation of the group’s approach.

Other streaming businesses like Disney+, Amazon and HBO also have great content, Disney perhaps especially but nobody has cracked generating content on a global scale the way Netflix has and that could prove crucial in driving subscriber numbers worldwide.

Most of all though an investment in Netflix is a bet on management. These guys have proved time and again that they have an unrivalled ability to take the right decisions to grow the business. Just because the business is big that does not mean it cannot become a whole lot bigger. The world is their oyster and the world is a big place.

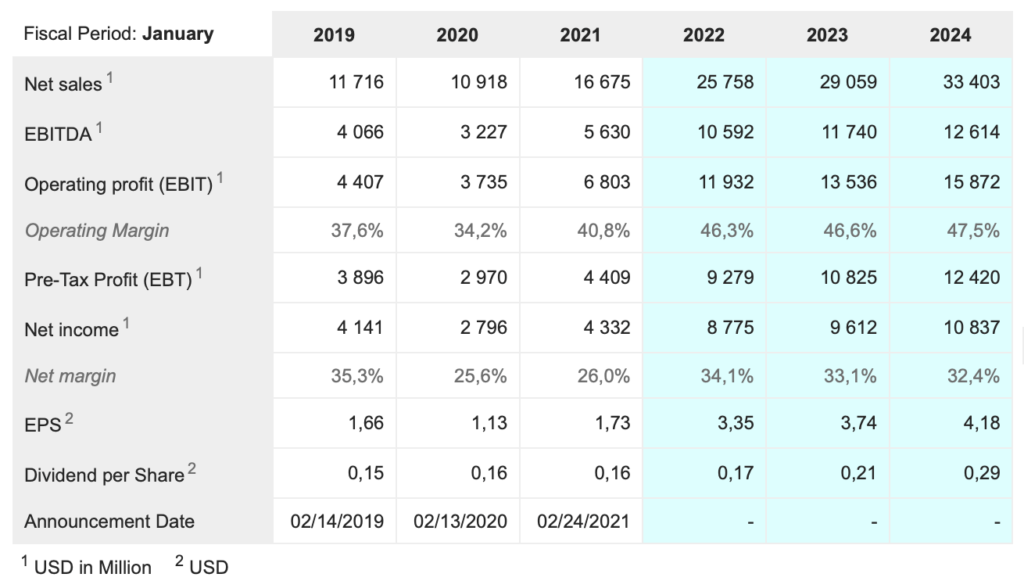

Nvidia. NVDA. Buy @ $245. MV: $617bn. Next figures: 18 November. Times recommended: 31 First recommended: $41.18 Last recommended: $224. Lowest recommended: $36.80. First recommended on Great Stocks for Quentinvest (formerly Quantum Leap): $17.08

Nvidia is an obvious super stock. It invented the GPU (graphical processing unit) chip which has revolutionised the gaming industry. Its chips are used in data centres, supercomputers and the development of autonomous vehicles. It is a hotbed of innovation and it is still led by 59 year old, Jensen Huang, who cofounded the business when he was 30. It is negotiating to complete the $40bn acquisition of Cambridge, UK-based, Arm, first announced in September 2020.

All this good stuff means the shares are highly valued. I am mainly concerned with the growth which is illustrated in the table below but even if we use earnings per share for the year to 31 January 2024 of $4.18 the price earnings ratio is still 58.6, which would have seemed stunningly high to an earlier generation of investors.

A new element in the case for Nvidia is the pivotal role the company’s computer chips are playing in the development of AI (artificial intelligence). If you accept the premise that it is early days in the application of AI to all the world’s problems and challenges and that Nvidia’s products stand at the heart of this process then you can still make a very strong general case for the shares.

In a nutshell, AI is going to be huge therefore Nvidia is going to be huge. They certainly think so.

“Today, the universe of supercomputing has expanded rapidly to incorporate AI, advanced data analytics, and cloud computing. The era of the CPU-centered monolithic supercomputer is coming to a close. The next era has begun…… We used to think of a CPU server as the basic unit of computing. But to meet the demands of today’s machine learning and AI workloads, we must optimise the entire data centre, from end to end. The new unit of computing is the data centre itself.”

There are multiple references to AI in the latest Nvidia presentation.

“NVIDIA ClaraTM Discovery is our suite of acceleration libraries created for computational drug discovery—from imaging, to quantum chemistry, to gene variant-calling, to using Natural Language Processing to understand genetics, to using AI to generate new drug compounds.”

“Next-generation data centres are an orchestration of three pillars: the GPU ( graphical processing unit) for accelerated computing, the CPU (central processing unit) for general-purpose computing, and the DPU (data processing unit), which processes and moves data in the data centre. The introduction of the NVIDIA GraceTM CPU and the NVIDIA BlueField® DPU make NVIDIA a three-chip company, aimed at rearchitecting the data centre for AI.”

“At the beginning of the big bang of modern AI, we recognized the need to create a new kind of computer for a new way of developing software. This computer would need new chips, new system architecture, new ways to network, new software, and new methodologies and tools. It all comes together as DGX—a computer for AI, supercharged by the NVIDIA A100 GPU.”

“AI began in research labs and was then adopted by cloud computing providers. Now we stand at the cusp of the next wave of AI adoption: AI automation at enterprises. The next wave of AI is at the edge, and it will revolutionise the world’s largest industries.“

“Companies are integrating 5G, AI, and autonomous machines to create smart services. The opportunity to automate is endless: retail checkout, autonomous forklifts and tractors, pick-and-place robots, and intelligent hospital rooms. Until now, without deep learning AI, no computer software was able to handle the diverse and seemingly infinite conditions in the real world.”

And finally to the role of Jensen Huang.

“He’s been at the helm of NVIDIA since co-founding the company at age 30 in 1993 and has led NVIDIA from the maker of computer graphics cards to become the premier platform for artificial intelligence and machine learning. This positions NVIDIA at the forefront as the computing industry contemplates a fundamental shift in processing.”

I have been saying for a long time than in a world of accelerating technological change Nvidia is one of the obvious must-own stocks. Investors often shy away from the obvious, thinking it must be too late to invest. My observation is almost the opposite. The best stocks to buy do have a kind of obviousness about them like Microsoft with its desktop software in the 1980s and 1990s and Apple with its ecosystem of designer devices and smart phones in the new millennium.

What is stunning and often catches investors by surprise is just how big a successful company can become. In 2021 it is hard to imagine a $10 trillion company yet within living memory a billion dollar company seemed almost unimaginably huge. We live in a world which is scaling up at an incredible rate and one of the key drivers of that whole process is Nvidia.

The world of equity investment is dominated by quantitative analysis. Highly paid analysts employed by investment banks, stock brokers and fund managers crunch reams of statistics and couch their conclusions in numerical terms. This has the advantage that it enables them to make comparisons between stocks and refer to something scientific to deduce whether stocks are cheap or dear. It seems to make sense but unfortunately it doesn’t work.

On Quentinvest I am looking for stocks that rise 10 times, 100 times, even 1,000 times. Statistical analysis never predicts such incredible moves. Analysts typically make detailed forecasts one or two years out and then assume growth reverts to some usually much lower mean. In their world miracles never happen but in the real world they do.

The only way to anticipate these miracles is to throw most of the statistics into the rubbish bin where they belong and make a more qualitative assessment. This is why, in Quentinvest, the overwhelming focus is on the story and the magic, the bits you cannot quantify.

Netflix and Nvidia have wonderful stories and are full of magic. That is why they are great investments. Not because of some boring numbers that make them cheap or dear. Keep buying the magic and like JK Rowling you will do very well.