Transition phase continues with extended profit-taking in high-growth

Armed with 20:20 hindsight we can see that lockdown created a uniquely favourable set of circumstances for many high-growth technology companies and their shares. As high streets and physical locations shut down consumers flooded to the Internet, which put digital transformation at the top of the agenda for all businesses and organisations. At the same time consumers unable to spend in their usual pattern built up large savings, some of which was channelled into the stock market.

Last but not least many of the old familiar shares of the pre-Covid era were in companies suffering and even battling for survival. The result was large investment flows focused on a relatively small group of exciting companies that had been star performers in the pre-Covid era and were doing even better during lockdown. Shares prices in the favoured group, an echo of the nifty-fifty of the 1970s equity boom, soared in value. Selected shares enjoyed incredible price rises. Shopify rose 75-fold between 2016 and the 2021 peak and is still up 55 times.

It has been valued for growth. Even at the latest price the PE ratio forecast for 2023 earnings is over 200 times. Investors, who worried about these high valuations, would never have bought Shopify in the first place because it has always looked expensive but now there is an alternative. The global economy is poised for a period of dramatic growth as conditions move back towards normal and old behaviour patterns at least partly return perhaps with a dramatic initial surge.

Already shortages are appearing. Digital transformation may become less of a priority for companies battling to cope with demand. Some old-school businesses may start delivering technology-type growth but with their shares on dramatically lower valuations. This is finding reflection in the stock market. Buyers are coming for more old-school businesses, while red-hot techology shares that have dominated the last three years are seeing extended profit-taking.

It would not be a complete exaggeration to say that we have parallel bull and bear markets taking place in bipolar stock markets. As always with Quentinvest we go where the action is. In this environment QV recommendations are still focused on 3G shares (great chart, great growth, great story) but for the moment the names are different. Recent shares to be featured in Quentinvest were a furniture maker, a carpet maker, a chain of home improvement stores, a chain selling parts for cars and a business supplying consumables for research facilities.

This will lead to a shift in emphasis in portfolios, which should happen naturally as investments are made in the new names. This is still compatible with never selling. The great technology companies are still great businesses and the unfolding technology revolution will bring them back into favour again, especially as share prices fall while sales and profits continue to rise but presently sector rotation looks to be the name of the game.

Ashtead AHT Buy @ 4815p- “We now expect full year results ahead of our previous expectations”.

Berkshire Hathaway. BRK.B. Buy @ $290 – “The unrecorded gains in the value of Berkshire’s subsidiaries have become huge”.

BOTB (Best of the Best) BOTB Buy @ 3110p – “I am excited about the future and look forward to updating shareholders further at the time of our full year results.”

Games Workshop. GAW. Buy @ 10870p – “The largest and the most successful tabletop fantasy and futuristic battle-games company in the world”.

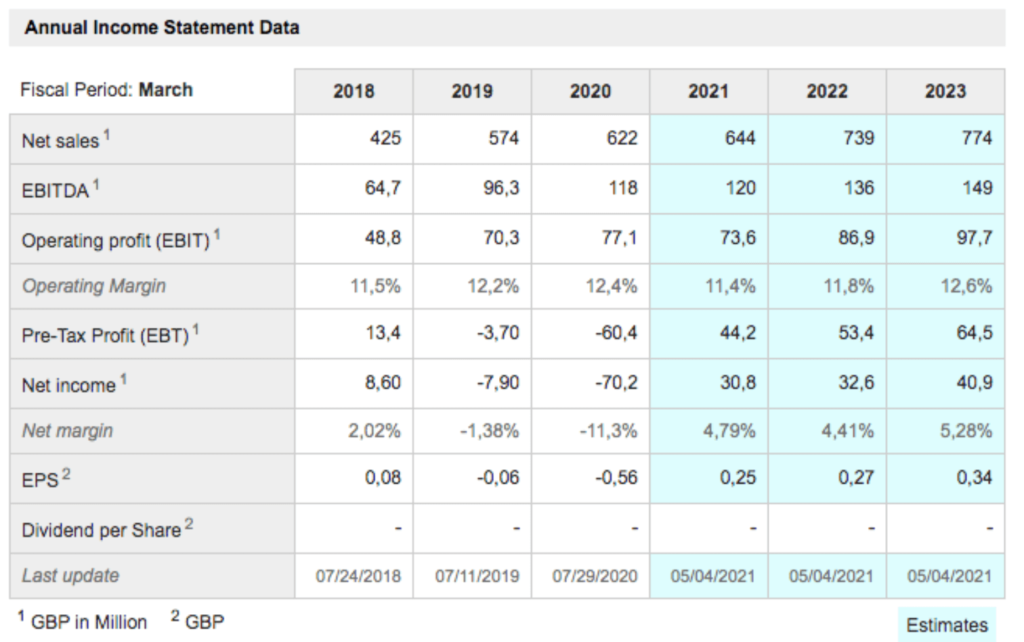

Halma. HLMA Buy @ 2580p – “Another record year for revenue and profit driven by solid organic growth and a record year for acquisitions”.

Liontrust Asset Management LIO. Buy @ 1606 – “This takes net inflows for the year to £3.5bn and the AuMA to £30.9bn, which is just shy of double the £16.1bn on 31 March 2020”.

Victoria. VCP. Buy @ 1070p – “The trading outlook for the current FY22 financial year is very encouraging in terms of both revenue and margins”.

Ashtead. AHT Buy @ 4815. Times recommended: 16 First recommended: 1803p Last recommended: 4675p

UK’s Ashtead winning the battle to become the dominant North American equipment rental concern with its ‘cluster’ strategy

I recently featured a US home improvement company called Home Depot in QV for Shares partly because of its use of share buybacks to enhance shareholder value. Home Depot is also famous for its cannibalisation strategy, whereby it groups stores in clusters to build sales even though new stores may take sales from existing ones. Ashtead is doing something similar in equipment rental with its cluster strategy and being very successful. Ashtead is worth around $30bn whereas Home Depot is capitalised at $362bn and with a much higher rating for its shares. I think this may be unfair creating a great deal of headroom for the Ashtead valuation to increase.

I had a look at the respective sizes of the markets being addressed by these companies. Home improvement is a $400bn market seen rising to $500bn by 2024, which means Home Depot has about a third of the market. Equipment rental is a $66bn market and growing steadily, which suggests that Ashtead has around 7.5pc market share. It is also a fragmented market with two large players, United Rentals and Ashtead. Both are growing by acquisitions in fragmented markets and by opening greenfield sites. You can see why this must be a scary process for smaller incumbents making them ready to sell to the encroaching giants.

Ashtead especially comes across as an invincible growth machine, not only run with Swiss/ Japanese levels of efficiency but with a business model taking it relentlessly into new geographies and new specialties. It is no longer just about construction and construction equipment. There are many opportunities out there like sporting events, pop festivals, conferences, where equipment hire makes far more sense than ownership. Even tools can be rented instead of owned adding flexibility and lowering start-up costs for tradesmen.

Ashtead is a famous example of the rubbish theory of value. In 2003 (see chart) the business was perceived as being virtually bust. Equipment rental companies use borrowed money to buy equipment. If rental demand dries up and interest rates soar, as happened in 2003 and again in 2009 they can look very exposed. The group is battle hardened now and massively bigger and stronger. It really is the Berkshire Hathaway of the equipment rental business and this has created a virtuous circle of growth. The group generates more cash enabling it to fund more greenfield sites, more acquisitions and a newer, bigger, more conveniently located range of equipment, which generates more cash to fund more growth.

It is way past the point of critical mass. It has won the battle in the geographies where it operates. It is almost now a mopping up operation. Nobody can compete. Furthermore, as it grows, the rental proposition becomes ever more appealing to holdout equipment owners to the point where it becomes a question whether it makes sense for anyone to own when they could rent.

The group had a capital markets day in April where it outlined its plans for strong, even accelerating growth. The legions are marching. No way is this empire anywhere near finished with growth, conquest and devastating success in the battle for territory. The expected Biden-funded orgy of infrastructure spending, which may be replicated in the UK, only adds fuel to the fire.

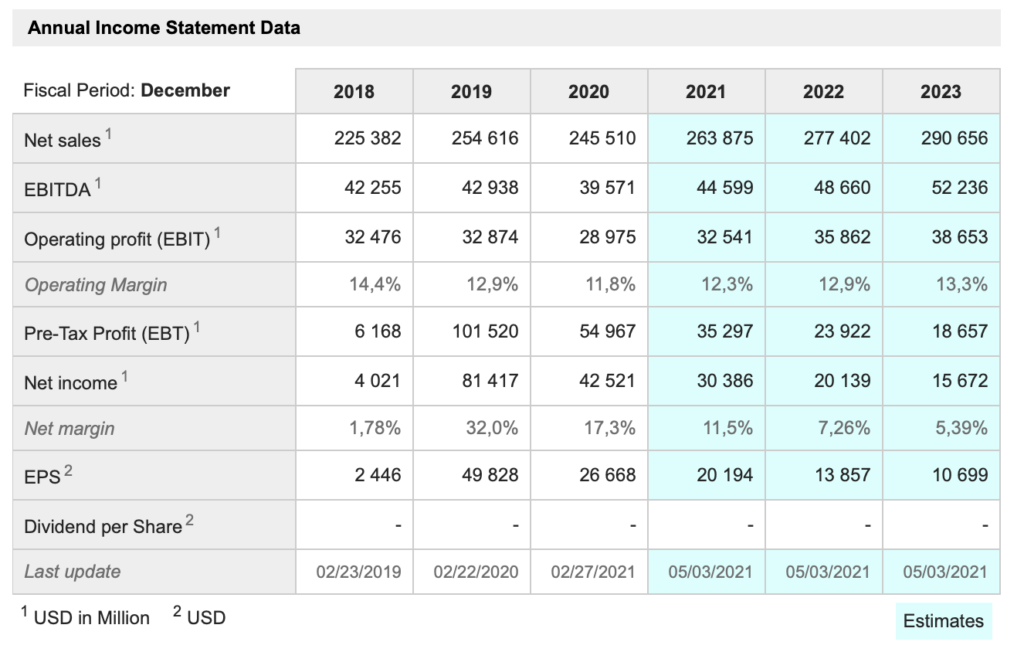

Berkshire Hathaway B BRK.B. Buy @ $290 Times recommended: 1. First recommended: $271

Berkshire Hathaway keeps winning even though Warren and Charlie are 90 and 97 respectively as they ‘never bet against America’

Even Warren Buffet is beginning to wonder if Berkshire Hathaway shareholders have discovered the secret of eternal life as well as endlessly increasing prosperity. A small group of shareholders that has been meeting since the middle of the 20th century is still meeting and two more of the group are in their late 90s.

I have been reading Warren and Charlie’s latest letters to shareholders, which look back at where the group has come from, to the present and what is happening now and forward to what might happen if they do eventually prove mortal. Buffett is amusingly self-deprecating. He talks so much about his mistakes that you almost wonder how he has been so successful. This is why we need the letter from Charlie Munger to explain how his friend, Buffett, has built this powerful system of capital allocation that is like a perfect mini-capitalist economy without the friction and the transaction costs.

There is obviously more to it than that; these two old men have a wonderful instinct for spotting great companies and great leaders. In this issue I have tried to illustrate what I think Berkshire Hathaway is all about by choosing a group of companies from the QV for Shares portfolio, which operate in very much a Berkshire Hathaway fashion. You could call this issue of Great Stocks the Warren Buffett tribute issue.

Whenever you think that Buffett and Munger (the latter, amazingly, in his capacity as a lawyer, is representing Bill Gates in his divorce from Melinda) might finally be losing the plot they pull off another coup. They have recently invested heavily in RH, a US furniture group, which is growing fast, has a charismatic leader and has aspirations for world conquest. I knew about RH, had another look, was impressed by what I saw and promptly began featuring them in my publications.

One of the aspects of the Buffett philosophy is that he realised that buying all of companies (takeovers) and bits of companies (investing), were actually very similar. It was all about allocating capital to achieve high returns. He started with value investing, buying dud stocks cheaply for one last puff as he put it but, when Munger arrived, he adopted a new strategy. This involved investing for the long-term, forgetting about buying mediocre stocks at great prices and concentrating on buying great stocks at reasonable prices. It is easier to do this as a long-term investor because you can focus on what the shares might be worth a decade from now.

A key to his approach is no debt and strong cash flow so he is never forced to sell no matter how severe the financial crisis and is always ready to capitalise on opportunities. Most of the cash generation comes from some great businesses which Berkshire Hathaway owns outright, in particular its insurance, railway and utility businesses. As Buffett puts it most of Berkshire’s value resides in four businesses. Top of the assets are the property/ casualty insurance businesses, which are massive with $138bn of float (unearned premiums awaiting possible claims), which is available for investment. Second equal are BNSF, America’s largest railroad measured by freight carried and a 5.4pc stake in Apple, which cost a net $24bn but is currently worth $117bn. Last of the big four is a utility called Berkshire Hathaway Energy which has increased earnings from $122m to $3.4bn during the group’s 21 years of ownership.

Like Apple, Berkshire Hathaway often finds that one of its best investments is to buy back its own shares. In the case of Apple this meant that BH was able to raise $11bn by selling Apple shares, reducing its cost of investment from an initial $36m but still ending up with a stake increased from 5.2 to 5.4pc. In the case of Berkshire Hathaway this meant that last year the group bought back $24.7bn of shares increasing BH shareholders ownership of the underlying assets by 5.2pc without them having to reach for their wallets.

Some of the free cash flow goes into building the fabled ‘never sell’ or almost never investment portfolio including names like American Express, Bank of America, Coca-Cola, Verizon Communications (a US-based spin-off from Vodafone), US Bancorp, Moodies, Chevron, General Motors and not mentioned but later acquisitions like RH and Amazon. A guiding light for Buffett in all his investments is his belief in great American brands.

I haven’t said anything about current trading because it is never that relevant with Berkshire Hathaway. A recovering economy will be good news and they are still buying back their own shares, which suggests Warren and Charlie see them as good value.

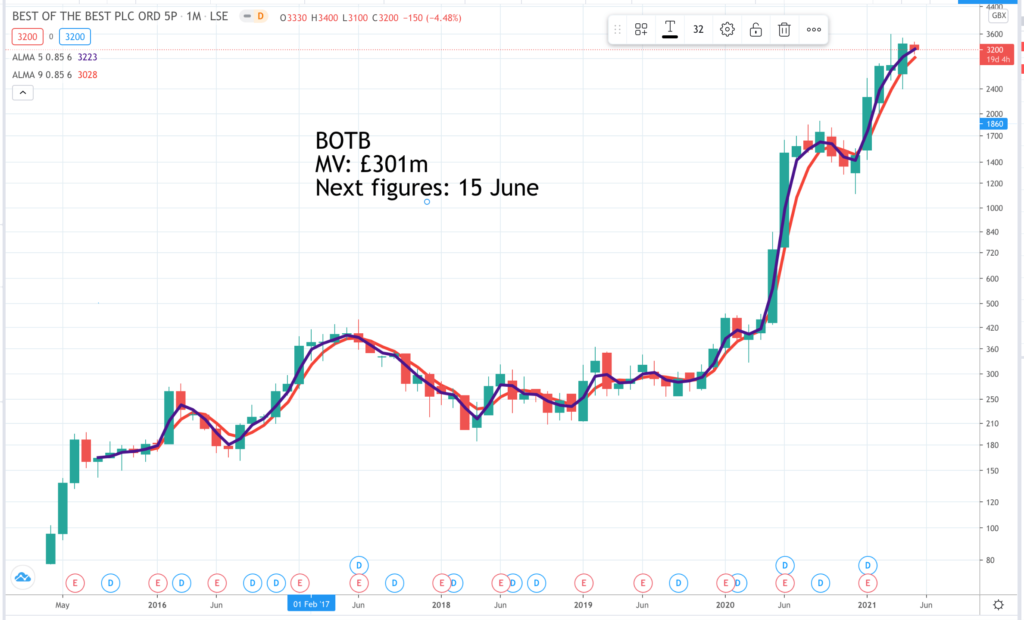

BOTB (Best of the Best). BOTB. Buy @ 3110p. Times recommended: 10 First recommended: 1480p Last recommended: 3180p. Highest recommended: 3340p

Mark Slater Investments buys a nine per cent stake in BOTB as group strengthens board ahead of next stage of growth

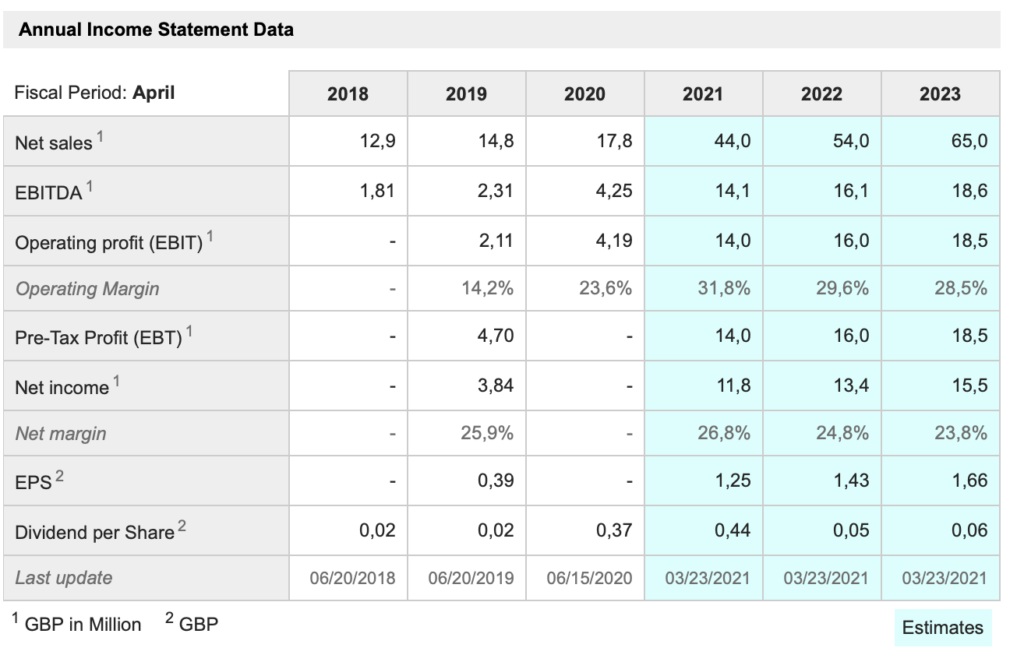

I have been writing a lot about BOTB recently so if the shares don’t perform I will have egg on my face but I still think they are massively underpriced and have exciting opportunities for further growth. The back story is that a company which began offering cars as prizes in spot the ball competitions (i.e. skill as well as luck) in airports has transitioned into a fully online operation. This enables it to scale dramatically, while having fewer employees, just 21 at the last count for a business forecast to have sales of £44m for the year to end-April 2021.

Profitability and cash generation is spectacular with ebitda margins around 30pc and all of profits typically feeding through to free cash flow, enabling the company to fund enormous special dividends. The group has already paid a 40p special dividend for the fiscal 2021 and the final dividend could well take the full year payout to 100p a share unless the group starts to change its strategy and spend more on growth.

I say this because the recent placing of around a quarter of the company’s shares has brought in new shareholders, who may be more interest in growth than in dividends, albeit presently it seems they can have both. Also because the group had the chance to sell the whole business with many interested suitors but decided to remain independent, presumably because of the growth opportunities it saw ahead.

As a regular player in their competitions (I recently competed to win a Rolls-Royce for around £5) I think they have an amazing business – almost too good to be true. They set up the competitions; we compete; a tsunami of cash rolls in and this is happening now three times a week!

Part of the attraction is that the top management led by William Hindmarch (brother of Anya of handbags fame) are such steady, conservative people, not at all like the bookies you might imagine running such a business. They have been growing it steadily but surely for a decade principally because of the success of their online operations, which are now the whole story.

What happened during lockdown was that sales took off triggering a profits explosion as the rise in costs lagged far behind. Latest interim results (for the period ended 30 October 2020) showed sales rising from £7.6m to £22.09m and profits up from £1.38m to £6.80m. Sales momentum has continued so a strong full year result looks certain. My guess is earnings per share between 125p (the house broker’s forecast) and 150p for a soon to be historic PE ratio between 25.6 and 21.3. The dividend yield on a 100p payout would be 3.125pc.

All this for a company growing explosively and with an eminently scaleable business. The share price looks way too low to me, which raises the question of why the founder and top management have just sold 25pc of the business for what looks a ridiculously low price, £24 a share against £31.10 currently. My guess is that this is part of becoming a serious public company with better liquidity in the shares, greater placing power with an institutional following and more up to date procedures. William Hindmarch’s 81 year old dad is stepping down, while keeping most of his shares, as a new chairman is sought and a new executive and non-executive director have been appointed (the former has run online marketing for BOTB since 2010; the latter with m&a experience in the gaming industry).

My hope is that as well as continuing strong growth we may see some exciting ‘something new’ developments at BOTB. In February 2020, when announcing the termination of the strategic review into the possible sale of the business William Hindmarch said ““With an online-only model and an increasingly proven track record on marketing investment, I am excited about the future and look forward to updating shareholders further at the time of our full year results.”

This ties in with Warren Buffett’s theory that companies that rely for their growth on buying other companies will often find that the best companies are not up for sale. BOTB is too good a business to sell, at least completely. By selling part of it the Hindmarch family have cash in the bank and an exciting opportunity to take the group to the next level.

What is not clear is whether the recent surge in sales and profits is because of lockdown or because of dramatically increased and better targeted marketing spend. Most likely it is a bit of both, which augurs well for an exciting future.

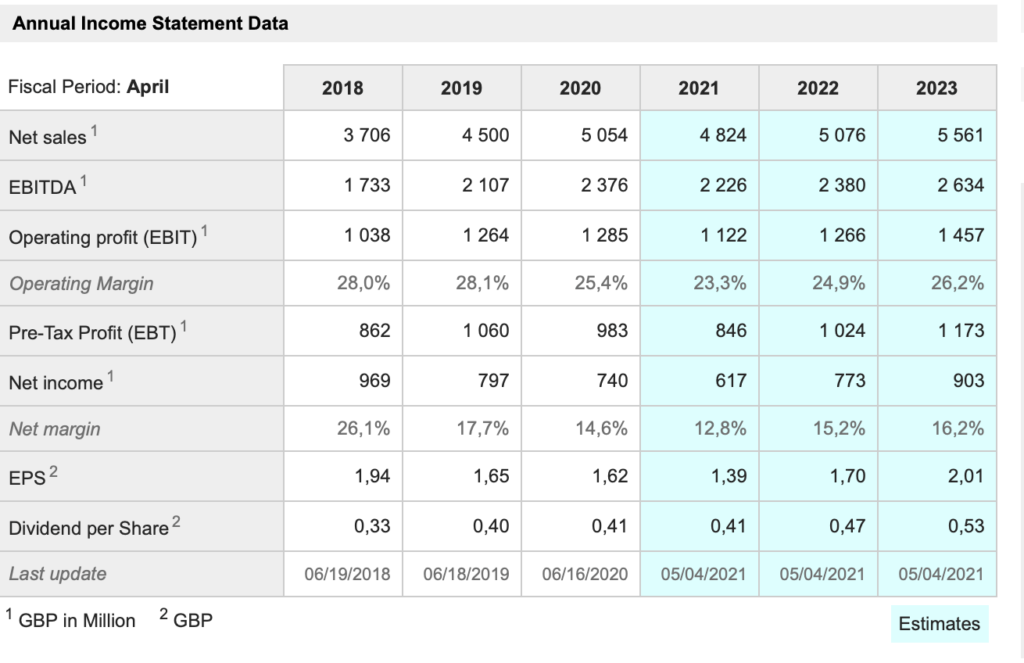

Games Workshop. GAW. Buy @ 10870p. Times recommended: 19 First recommended: 1356p Last recommended: 10460p. Highest recommended: 10980p

Games Workshop with its conservative management and niche market monopoly is a classic Buffett-style business

Given that many of Games Workshop’s collectible models are sold from bricks-and-mortar stores the group has had a brilliant lockdown. The company itself was sufficiently worried initially to take government help but then gave it back when they saw the world wasn’t ending after all. Shares are now rallying ahead of a June trading update, which should show that the company continues to deliver a positive trading performance. Given the price of the models the company may also be benefiting from the strong trend in the luxury goods sector as a whole.

Games Workshop has got the Buffett feel all over it. “Our ambitions remain clear: to make the best fantasy miniatures in the world, to engage and inspire our customers, and to sell our products globally at a profit. We intend to do this forever. Our decisions are focused on long-term success, not short-term gains.” As can often happen with this kind of long-term aspiration the short term gains can be amazing as well.

A massive ‘something new’ happened at Games Workshop on 1 January 2015, when Kevin Rountree became CEO and set about making GAW a more professional business ready to invest to take advantage of multiple opportunities. The change was as dramatic as replacing a gaggle of tribesmen armed with pickaxes with a fully trained and equipped Roman legion. Shortly after Rountree’s taking charge the shares took off and are up over 20-fold since. His predecessor, Tom Kirby, who I met, was not a bad custodian of the business but ran it with such dominance and attention to every penny spent that it just couldn’t spread its wings as it has done under Rountree.

Two examples are the explosion in third party sales and the steep rise in royalty income. Games Workshop sells through its own stores, through an online shop, through third party stores and has a sideline using the group’s IP to generate royalties. In Kirby’s day the main sales driver was its own Games Workshop one and two-man stores reflecting his desire to be in control but that has changed dramatically. In 2015 trade sales were £43.9m, retail was £46.9m, mail order, aka online, was £25.6m and royalties generated £1m.

Now fast forward to 2020 and retail has increased to £78m, online is £51.7m but trade, which includes online sales by third party stores, has exploded to £140m and royalties, about which Kirby was so suspicious, produced £16.8m, most of which is profit. These changes have come about partly by taking the brakes off but also because Rountree assembled a talented team of managers, whose job it was to make these things happen.

Most recently the company has been investing in the UK and internationally to add production capacity at home at distribution capabilities abroad as the group advances inexorably on its path to world conquest. The company has also become vastly more proficient at marketing, especially using all the possibilities of social media and online video streaming. What was a company selling great models for painting and staging war games is increasingly a total ecosystem of experiences in the fantasy worlds they have created.

There are also many more partnerships with companies like Frontier Developments which is working on developing a top-of-the-range video game based on GAW IP and Far Eastern partners to help make miniatures with more appeal to Asian markets.

Games Workshop has a wonderfully addictive hobby and returns on capital employed to die for, ranging around 100pc in recent years. It makes obvious sense to invest more aggressively to drive this machine forward. If Games Workshop was a Ford before it is a Ferrari now and this is why it is giving its shareholders such an exciting ride.

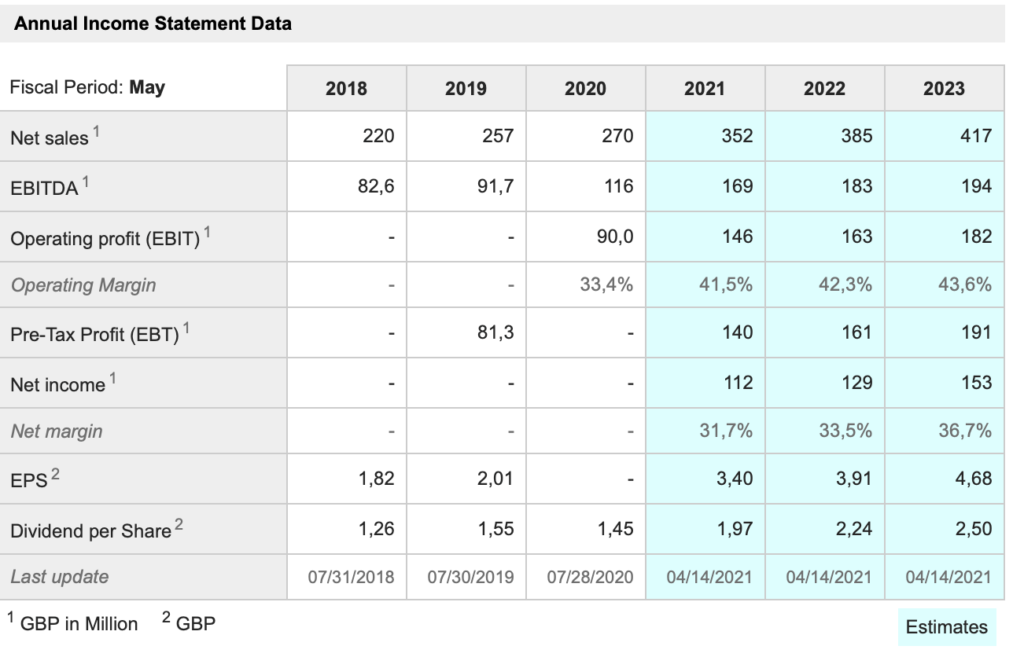

Games Workshop doesn’t do share buybacks but it does look after its shareholders with generous dividends. The shares are worth buying for the steadily rising income they provide.

Halma HLMA. Buy @ 2580p. Times recommended: 11 First recommended: 1490p Last recommended: 2630p. Lowest recommended: 1385p

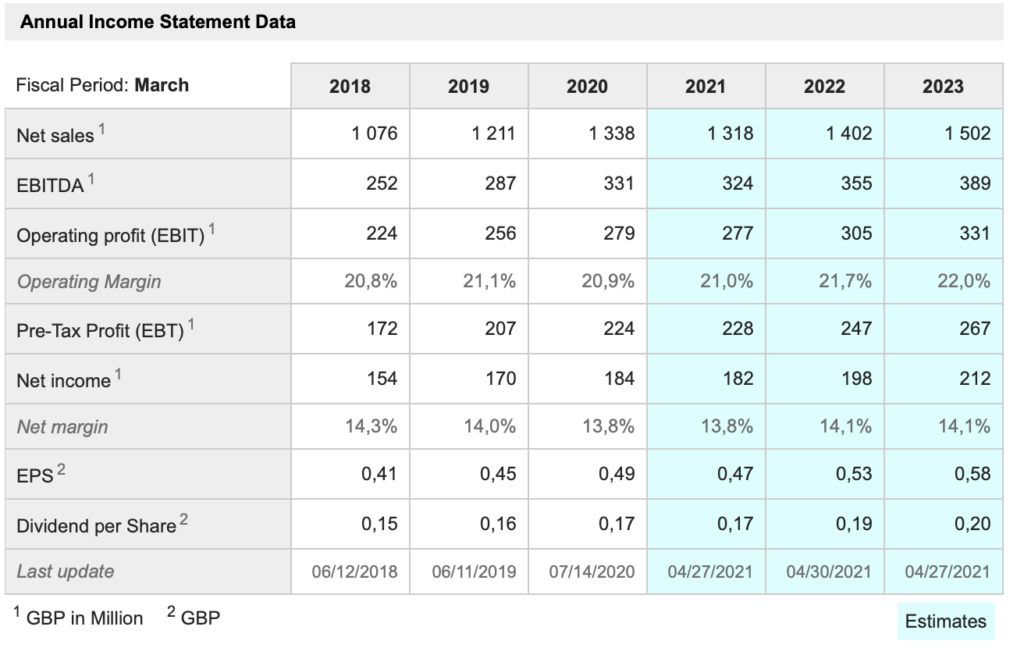

Halma uses acquisitions to deliver relentless growth but in a focused way so avoiding Buffett’s scorn for conglomerates

Back in the day there was a certain kind of conglomerate which used its inflated share price to buy cheap, poor quality businesses, which not only instantly boosted earnings per share but enabled further growth by sacking half the workforce of the acquired company. Although it was born in the 1970s and is highly acquisitive, in other respects, Halma could not be more different. When it buys companies nobody loses their job; it only buys niche businesses that can stand comparison with the other excellent businesses already in the Halma stable and managements are very much encouraged to stay on and flourish, which they do. Like Berkshire Hathaway, Halma is parsimonious with its valuable equity and invariably buys for cash.

The results of this strategy have been incredible. I haven’t got all the numbers because of breaks in the share price record but I suspect that Halma is the greatest performing UK share of all time and amazingly it it has stayed true to its business model, developed under an unsung genius called David Barber, and is performing as effectively as ever. If current CEO, Andy Williams arrived at a Berkshire Hathaway agm and attendees knew what he had achieved in his tenure since February 2005 I am sure he would receive a standing ovation. Just like Kevin Rountree the proof is in a share price up 17.5 times since he took charge.

Halma is constantly on the hunt for suitable acquisitions. A classic example is the just announced purchase for £42m of US company, PeriGen, whose advanced technology protects mothers and their unborn babies by alerting doctors, midwives and nurses to potential problems during childbirth. Its software solutions use artificial intelligence to provide an automated early warning platform during labour, enabling healthcare professionals to assess complex data more easily and allowing them to spend more time on direct patient care.

Halma typically does several deals like this every year, year after year but it is not a conglomerate but highly focused on what it calls a safer, healthier, cleaner future. All its acquisitions fit into these categories, often have synergies with existing businesses within the group and are invariably already good, well run profitable businesses, which shareholders of the master company would be happy to own a part of on a standalone basis. Where Halma scores is that like Berkshire Hathaway it provides an excellent home for these businesses when owners want to cash in some or all of their chips but leave management, which may be themselves, able to do their thing in a supportive environment.

Perigen even has a return on sales, between 18 and 22pc, which is slightly higher than Halma’s own.

The constant purchase of these mostly small, well run businesses that fit into an overall framework also give Halma great flexibility so that it occasionally sells businesses that no longer fit. The company is a bit like a share portfolio, which is maintained in tip top order. As well as being now organised around three core sectors, safety, environmental and analysis and medical, the group is also geographically diversified. Out of total 2020 sales of £618.4m, £87.6m arose in the UK with bigger chunks in North America (£255m), continental Europe (£127.2m) and Asia Pacific (£100m).

It is a bit like the QV hunt for 3G (great growth, great chart, great story) companies. Halma knows exactly what sort of businesses it is looking for which helps in finding them. Then with group profit margins in all sectors running in and around the 20s per cent any non-performers stand out like sore thumbs.

A trading update for the full year to end March indicated an expectation that results would be broadly similar to the previous year. This is both an improvement on earlier expectations and an impressive achievement in such a badly disrupted trading period. It may also create opportunities for such a well-funded and respected group, named best company of the year by Management Today in January 2021, to make attractively priced acquisitions.

The future looks like more of the same but with an excellent chance of an ever stronger tailwind as global growth picks up steam.

Liontrust Asset Management. LIO. Buy @ 1606p. Times recommended: 8. First recommended: 1200. Last recommended: 2566p. Lowest recommended: 1030p

Liontrust poised to benefit as world returns to a more normal, less technology focused investment environment with broader-based performance

Given a following wind by the stock market and a good performance by the fund managers asset management groups make wonderful investments. Hence the QV rule, if you like the funds don’t buy them but buy shares in the managers because they will perform better. This is because of the operational leverage. It makes little difference to a team of fund managers or even a single manager if the fund he is managing is £10m, £100m or £1,000m so as funds managed increase revenues climb sharply but costs may hardly move sending profits through the roof. I remember in an earlier bull market recommending shares in Perpetual Fund Managers, which became one of the best performers in the entire UK stock market over the next several years.

There is a double whammy effect because rising stock markets not only lift the value of funds under management but also attract stronger inflows from new investors. We are seeing all of this happening at Liontrust, which recently reported net inflows of £1bn for the last three months and £3.5bn for the last 12 months. Helped by rising stock markets total funds under management ended the year at £30.9bn, up 92pc since March 2020.

Since revenues are typically a relatively stable proportion of funds managed and costs should not rise sharply it is no wonder that analysts see group net income rising from £13.0m to £23.6m and then £52.0m for the year to 31 March 2022. Earnings per share are on course to nearly quadruple between the year to 31 March 2020 and the year to 31 March 2022.

After that they understandably have pencilled in slower growth with eps up from 85p to 97p but that is a complete guess since it depends on what stock markets do and how inflows into the group develop. It seems reasonable to be positive but as with other aspects of the future what may happen is a mystery and could be worse or much better than these expectations.

What I like about Liointrust Asset Management is the whole Warren Buffett thing. They are very well managed, have excellent fund managers and follow a well tried playbook, which delivers consistent results. Twelve funds have been short-listed for manager of the year awards. Not only that but the pace of growth is quickening still further. Between 31 March 2021 and 16 April 2021 funds under management and advisory, AUMA, have climbed from £30.9bn to £32.5bn.

Liontrust was not always such a star performer. Things began to look up when John Ions became CEO in May 2010. The shares which had been in freewill prior to his appointment fell a little further to a 2011 low point of 58p but since then it has been onwards and upwards with a vengeance. At 1606p the price is up nearly 28-fold under his stewardship and Liontrust Asset Management pays dividends so the total return (share price appreciation plus dividends reinvested) would be even better bearing in mind that the dividend payment projected for 2023 is higher than the share price was in 2011.

Liontrust has long been going where the money flows are going which means a big move into ESG investing. ESG stands for environmental, sustainable, governmental, aka socially responsible, investing which is hugely important to millennials and younger generations. My children are continually insisting that they only want to invest in businesses that are helping to save the planet and regard my approach to investing as woefully lacking in ethical standards. I want to save the planet but when it comes to the stock market I just want to make money.

The good news about Liontrust Asset Management is that it scores strongly on both counts. AUMA in the sustainable management team exceeds £10bn and it has also announced plans for a sustainable investment trust. The group is confident about the future as well they might be given past achievements and how strongly the business is growing right now.

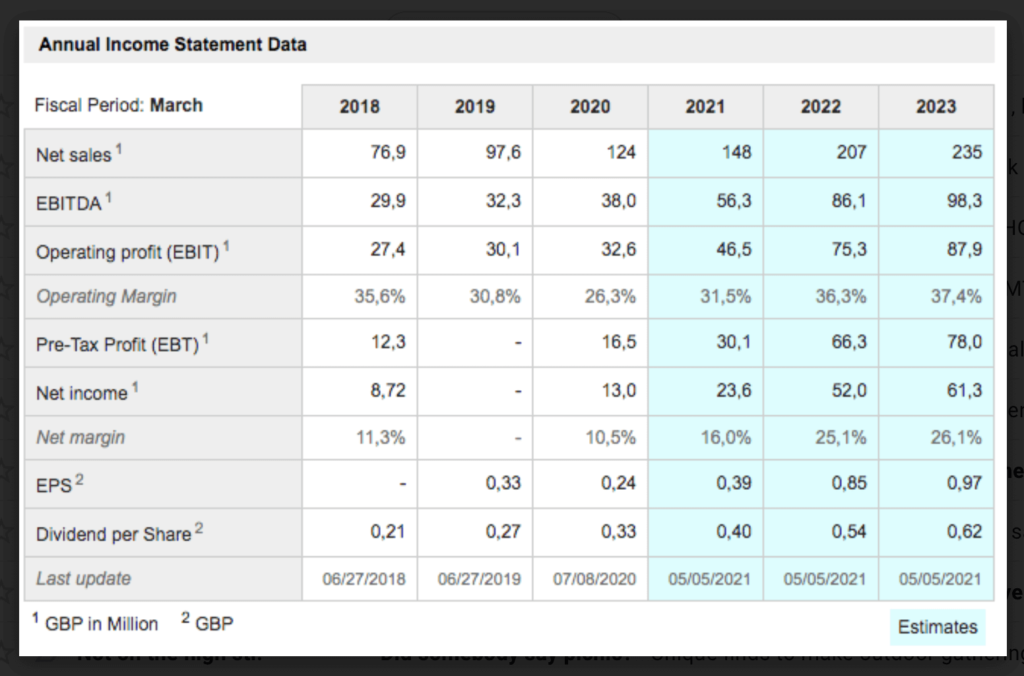

Victoria. VCP. Buy @ 1070p. Times recommended: 8 First recommended: 614p Last recommended: 884p. Lowest recommended: 528p

Victoria on an acquisition charge, which could deliver startling growth in ebitda, profits and earnings per share

I have just written at length about Victoria in an alert on Quentinvest so here I am going to look at other aspects of the business and why it offers such an exciting opportunity. In the alert I said that ebitda in the next year or two could approach £200m v £120m expected for last year and that this made the shares look cheap against similar acquisition-driven businesses like Halma (see above) and Keywords Studios.

The latter are more expensive because Halma has been doing this for decades with great success and for Keywords, video games is perceived as a much faster growing sector than floor coverings. All this may be fair enough but against that is the opportunity for Victoria, with a top team of experienced acquisition specialists, operating in a fragmented market, with a still modest market share but fast becoming a scale player and the go-to company for businesses looking to be bought.

I think the next several years could be an exciting period for Victoria. They must think so too because they have just done two out of character things. First, they have used precious capital not to make acquisitions but to buy back their own shares. Secondly, a company, which has previously been determined to keep its equity scarce and valuable has issued £175m of preferred equity to raise money with associated warrants to subscribe for shares at 350p. You could say, of course, that the two actions are offsetting and so to an extent balance each other out.

My reading of it is that the company decided to buy back its own shares partly because in its own words they were ‘very materially undervalued’ at the then price of 350p but also because they see them going up a long way in future. Like me they think their own shares are one of the most exciting investments out there right now. Secondly, they were ready to raise equity capital because that is high powered money which supports additional borrowings for debt-funded deals and puts them in a great position for a blitzkrieg of acquisitions as a battered global economy slowly emerges from lockdown.

They have already done two deals, spending £90m to acquire £17bn of ebitda. They lost an estimated £50m of turnover in March and April 2020 because of lockdown so if we add that back to turnover on 20pc ebitda margins we bring in another £10m of ebitda. Executive chairman, Geoff Wilding, says there are more chunky acquisitions in the pipeline (that’s why they have been raising money) and he also sees strong activity in housing markets in Europe and the UK driving demand for floor coverings. This means we have a baseline of £147m for ebitda for fiscal year 21-22 and plenty going on to drive that figure significantly higher.

This is what makes me think these shares are both exciting and excellent value. I am sure Warren Buffett would love them although they are too small fry for him as an investment and not for sale as a company. Exactly what he says. Good larger businesses are rarely available for sale. Smaller businesses can be because of the many dynamics that can drive decisions to sell. Victoria is an increasingly scary competitor but a great home for a business where an owner wants to raise cash but allow his managerial colleagues to continue doing what they do with considerable autonomy and great support.

Another thing which Warren Buffett would love about Victoria is their mission statement. None of the usual stuff about stakeholders and saving the world. Victoria exists ‘ to create wealth for our shareholders’ and that’s it. A job, incidentally, which they are doing very well with the total return on the shares since Geoffrey Wilding arrived in October 2012 amounting to around 60-fold appreciation.