I nearly called this story ‘Poised for blast-off’ because I am becoming increasingly excited about prospects, especially for US technology shares but others too as we emerge on the other side of the Covid-19/ global economic lockdown shock. The bears have indulged in an orgy of pessimism, some are still doing it but to me it is obvious that this is a temporary shock. There will be lasting consequences but many of those may be good ones and the implications for technology businesses range between bullish and fantastically bullish imo (in my opinion) as Tesla’s Elon Musk might say.

As an aside, I am increasingly suspecting that crazy genius, Elon Musk, is going to become the wealthiest individual the world has even seen, maybe even the world’s first trillionaire. He has one company, Tesla, aiming to disrupt the world’s car and electricity supply industries and another, Space X, planning to land people, including himself apparently, on Mars as part of a programme to lessen humanity’s dependence on one fragile planet. The first manned flight is set for 27 May. He even seems to have a solution to hair loss since there are pictures of a younger Elon Musk rapidly going bald but now he has a full head of hair. Is there anything this guy can’t do?

The chart above of my favourite Nasdaq 100 index looks promisingly poised. It has rallied back strongly enough from the pandemic-inspired lows to make the last five month’s trading look like a consolidation pattern. I think new highs and an exciting chart breakout are just a matter of time. We are already seeing breakouts with individual shares. The Nasdaq 100 is a bit misleading about how the broad mass of stocks are doing because it is a weighted index so a handful of big cap stocks (see below) account for over half the performance of the index.

For a broader picture we can look at the Russell 3000 index (also above) which charts the performance of all the US-quoted shares considered suitable for institutional investment. This is also a weighted index and dominated by the same stocks that figure so largely in the Nasdaq 100 but the top 10 only account for around 21pc of the Russell 3000, a fifth instead of over half. It is lagging the Nasdaq 100 but looks to me to be turning higher. As far as I am concerned, the Covid-19 bear market is over, albeit that some stocks in the front line of the crisis – airlines, cruise shop operators etc are still in the wars. Their problem is that they are bust or are going bust and are engaged in a desperate battle for survival; most businesses are not in that grim situation and a surprising number, which I will be featuring in coming issues of QV, are doing very well.

I think the global economy is going to move progressively from lockdown not just to recovery but into a full-blown global economic boom and the effect on share prices could be seismic. I am still being subjected to a tidal wave of gloom from stock market wiseacres, who are confusing a temporary, albeit devastating economic shock, with a depression. This is absurd. A temporary economic shock is exactly that; there is a huge spike in unemployment numbers but what do you expect if half the global economy stops working and indeed gets paid to stop working. It’s temporary! It is not a decade of depression like what happened in the 1930s.

There can be argument about the speed of recovery and the lockdown is going to have some structural effects. I think we are seeing a massive acceleration in the shift from offline (bricks and mortar, cash, cheques, fossil fuel, offices and even meetings in person, which I have always thought were an excuse for drinking too much coffee and wasting time) to online; and from old-style computing to the cloud and a world where more and more things are supplied as a service paid for by subscriptions or ads.

This is why I think the time has come and even maybe long passed, when it is time to look at portfolios and dump everything that smacks of the 20th century. We need to reinvent our lives and our portfolios for the 21st century, make sure they are looking forwards and not backwards. If you are not sure what that means I suggest you rebuild your portfolio or maintain your portfolio around the stocks I have been featuring and will be featuring in Quentinvest. Some of them go wrong; that is always going to happen in an unpredictable world but most of them succeed.

I have been looking at the Quentinvest portfolio in recent issues and have recently recommended 107 stocks, mostly from the existing portfolio but with some new names. The first group on 14 April were the premier league of current recommendations, the first division if that makes it simpler. The second smaller group, later in April, could be categorised as the championship or second division. These are all stocks that can be held or even bought for a 21st century portfolio. There is a heavy emphasis on the US and on technology although the dividing line between technology and non-technology shares is becoming increasingly blurred.

Halma may not spring to mind as a technology stock but they are making a huge effort to reinvent themselves as a business for the digital age. They are not alone. Technology is unavoidable in 2020 but it is harder for companies created in a non-digital era to adapt though I am sure Halma will. Many shares in the QV portfolio were created in or came to prominence in the new millennium and the digital era.

It is a bit like how I feel about Tesla. It was built from scratch to make electric cars, which function increasingly as computers on wheels. I see Tesla as Apple for cars, which is why I have often thought Apple might buy Tesla one day. It is hard for other companies like General Motors to adapt and catch up. They are just too old school and they don’t have Elon Musk. Do you think he was ever interviewed for a job at GM? Of course not; he was too busy founding the business that became Paypal.

Before returning to the subject of which shares I think you should be buying I want to briefly cover the former QV recommendations that I now see as having dropped out of divisions one and two into what I think of as divisions three and four.

In division three are Abbvie, Align Technology, Arista Networks, Baidu, Beyond Meat, Booking Holdings, Diageo, Dropbox, Ferrari, Fevertree, First Derivatives, Hargreaves Lansdown, iRobot, JD Sports, LendingTree, Lyft, Aptitude Software, On the Beach, Palo Alto Networks, Restore, Unilever and Xilinx. These are all good businesses but not setting the world on fire right now. If I had these shares I would sell and replace them with something more exciting but they are all capable of doing well as times improve and moving back up to the higher divisions.

In division four are the basket cases. They could recover but they are really struggling now. The list includes Accesso, Asos, Burford Capital, Canada Goose, Corporate Travel Management, Craneware, Genscript Biotech, Get Swift, Inogen, IQE, James Cropper, NMC Health, Superdry, Victoria, Weight Watchers, Wirecard AG, Wisetech Global and Yu Group. If your approach to investing is anything like mine and you ever held these stocks you sold them long ago. If you still hold any of them you are being far too patient with the duds. When a stock goes wrong you need to get out, move on, redeploy the funds in a business that is doing well, not badly. It really is that obvious. ALL THE SHARES IN YOUR PORTFOLIO SHOULD BE IN COMPANIES THAT ARE DOING WELL! They key is to dump the duds and not be preoccupied with taking a loss; taking losses is part and parcel of being an efficient investor. I sell shares at a loss all the time, don’t give it a thought.

During March and April, when I thought there was a wonderful opportunity to cash in on the pandemic-inspired panic by buying shares and ETFs at historic low prices, I have been making recommendations en masse. Now I am going to carry on making recommendations still very much with a portfolio approach in mind but in smaller groups. My first group is effectively big tech but I am adding one share, which is not big tech but is playing a huge role in the modern world and increasingly applying technology to what it is doing. The list of 12 shares is below. I think of them all as must-own shares for a 21st century portfolio. If you are holding shares in say Barclays, Royal Dutch Shell, Tesco or BT instead of one of these you really need to get with the programme and move your thinking into the new millennium.

One of the reasons why I am so bullish is that I believe across the globe there are individuals and institutions with all the wrong shares in their portfolio and not enough of the right ones. As they slowly but surely change and refocus their portfolios forwards instead of backwards massive sums of money are going to flow into the stocks I like.

The 12 shares in my behemoths portfolio are:

Adobe Systems/ ADBE MV: $171bn Buy @ $356 Next figures: 11 June

Alphabet/ GOOGL MV: $920bn Buy @ $1349 Next figures: 23 July

Amazon.com/ AMZN MV: $1156bn Buy @ $2317 Next figures: 23 July

Apple/ AAPL MV: $1289bn Buy @ $297.50 Next figures: 28 July

Facebook/ FB MV: $590bn Buy @ $207 Next figures: 22 July

Microsoft/ MSFT MV: $1371bn Buy @ $180.5 Next figures: 16 July

Netflix/ NFLX MV: $187bn Buy @ $424 Next figures: 20 July

Nvidia/ NVDA MV: $180bn Buy @ $293.50 Next figures: 21 May

Paypal Holdings/ PYPL MV: $147bn Buy @ $125 Next figures: 6 May

Tesla/ TSLA MV: $142bn Buy @ $768 Next figures: 29 July

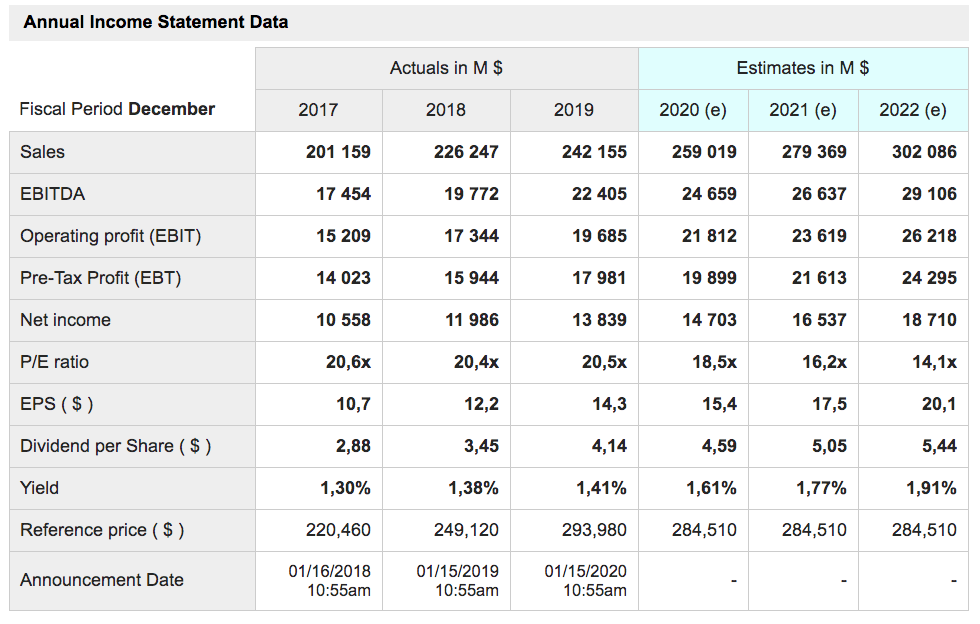

United Health/ UNH MV: $277bn Buy @ $293 Next figures: 16 July

Visa/ V MV: $380bn Buy @ $178 Next figures: 23 July

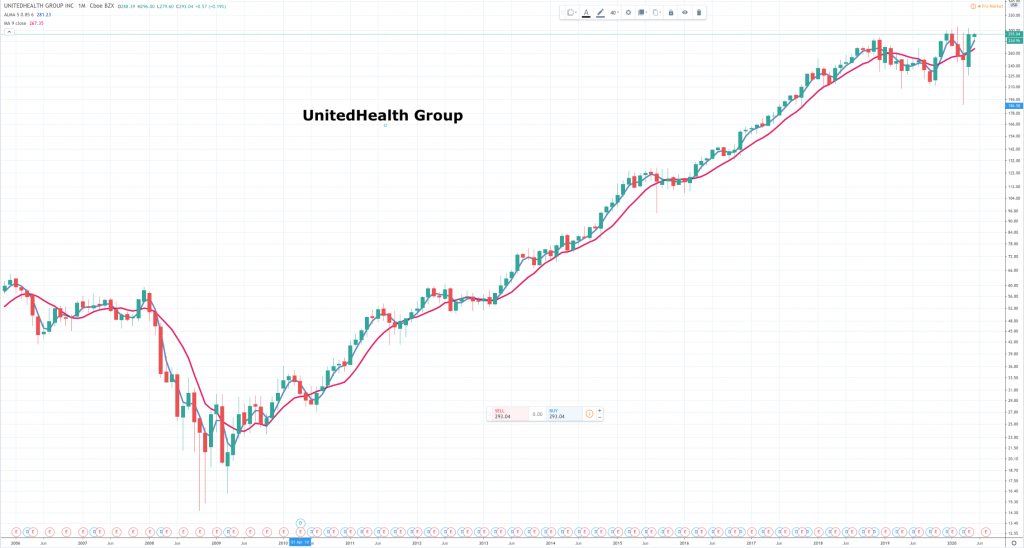

The newcomer to the QV for Shares portfolio is UnitedHealth. UnitedHealth Group is an American for-profit managed health care company based in Minnesota. It offers health care products and insurance services. It is the largest healthcare company in the world by revenue, with 2019 revenue of $242.2bn. UnitedHealthcare revenues comprise 80pc of overall revenue; the balance comes from things like pharmacy services.

I tend to think of UnitedHealth as American capitalism’s version of the NHS. Most UK people seem to assume that health services in America are a rapacious disaster and that poor Americans can’t afford health care and die in their 40s, while wealthier Americans spend 50pc of their income on health care. Much as I admire the efforts of UK health care workers in the current crisis I suspect the above beliefs are a travesty of the truth. UnitedHealth seems like an amazing company and the scale of the business is staggering. It provides access to medical services for 27m people and arranges for discounted access to care through networks that include 1.3m physicians and other health care professionals and more than 6,000 hospitals and other facilities.

UNH operates primarily as am insurer with over 130m customers worldwide. Just like the tax-supported NHS. UNH uses revenue generated from healthy customers to pay for the sick.

You can see how it works from an example: “Take appendicitis. Five percent of the population will get appendicitis at some point in their lives, and many of those will need an appendectomy. The average individual health insurance cost was about $4,700 in 2017 and the surgery is closer to $17,000—hence the people who didn’t need the surgery, the other 95pc, cover the ones who do. (I agree that $17,000 seems a staggering bill for an appendectomy: I am a bit baffled as to where that comes from but it certainly makes the case for having insurance)

Health insurance is one of those phrases that’s gone from clear to idiomatic to bearing no resemblance to its original meaning. Most forms of insurance in other realms involve paying a small amount to insure against the risk of massive loss. Health insurance as it’s currently constituted, at least in the U.S., means partnering with an enormous corporation to pay for even routine maintenance. It’s akin to your home insurance policy covering vacuuming.

In the US, since 23 March, 2010, you’re required to use insurance whether you want to or not. The result: 300m mandated customers and only a handful of approved insurers. UnitedHealthcare offers cheaper plans than some of its competitors given comparable deductibles, thanks to a larger network of physicians and other medical clients.

The group has 325,000 employees and all of those who were not actually sick have carried on working through the crisis with the 200,000 members of the non-clinical team all working from home.

The latest earnings report, dated 15 April, is almost entirely devoted to the group’s response to the coronavirus crisis. One effect of this is that almost all elective surgical procedures have been deferred, while the US health system responds to the pandemic. The group sees this as swings and roundabouts and is not expecting much impact on its expected earnings for fiscal 2020. This is hardly surprising since many people have to have medical insurance and they are hardly going to rush to cancel during a pandemic.

Looking at what United Health is doing, advancing billions to care providers to help them with any liquidity problems and generally going full throttle to respond to the crisis, makes you realise that President Trump’s ravings about disinfectant or whatever are almost irrelevant. Other people, who actually know what they are doing, have the job in hand.

Anyone who thinks the NHS has written the book on health care provision might need to look at a business like UnitedHealth before being too certain of their pontifications. This is one terrific business and the employees are just as dedicated as people anywhere else.

This is the first in a planned series of articles to help subscribers position their portfolios to take advantage of the historic bull market that I believe has been temporarily interrupted by the Covid-19 pandemic and is going to become even bigger, better and more exciting as the new millennium continues to unfold. In other articles I will be looking at some very exciting groups of shares indeed. In general, I think of the companies and shares about which I will be writing as must-owns for a forward looking investor.