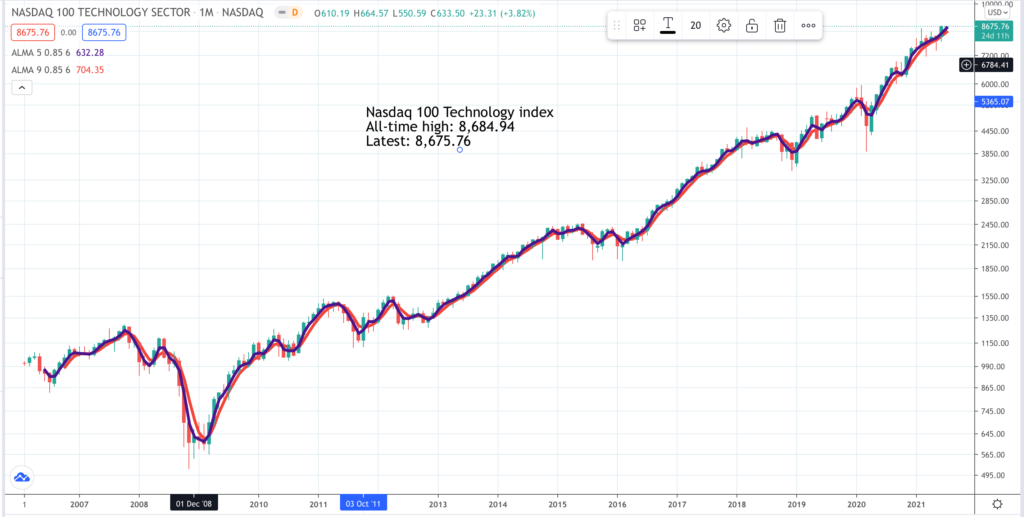

If the world is at an early stage in an all-embracing technology revolution as I believe it is then we would expect a stock market index reflecting that revolution to be in a strong uptrend. It is. Since 2009 the Nasdaq 100 Technology index has risen over 15 times. There is no sign of any loss of momentum in either the revolution or the index. On the contrary all the signs are that the rate at which the corporate world and indeed the whole world is investing in digital transformation is not just growing but accelerating. This is an extraordinary period in human history and in the history of the planet.

There are problems such as the effect of climate change and rising populations destroying habitat and the natural world. There will be solutions. There are many shares that are in powerful uptrends and this progress is being reflected in a strong performance by ETFs focussed on technology. I look at three below.

Allianz Technology Trust. ATT. Buy @ 302p. Times recommended: 1. First recommended: 272p

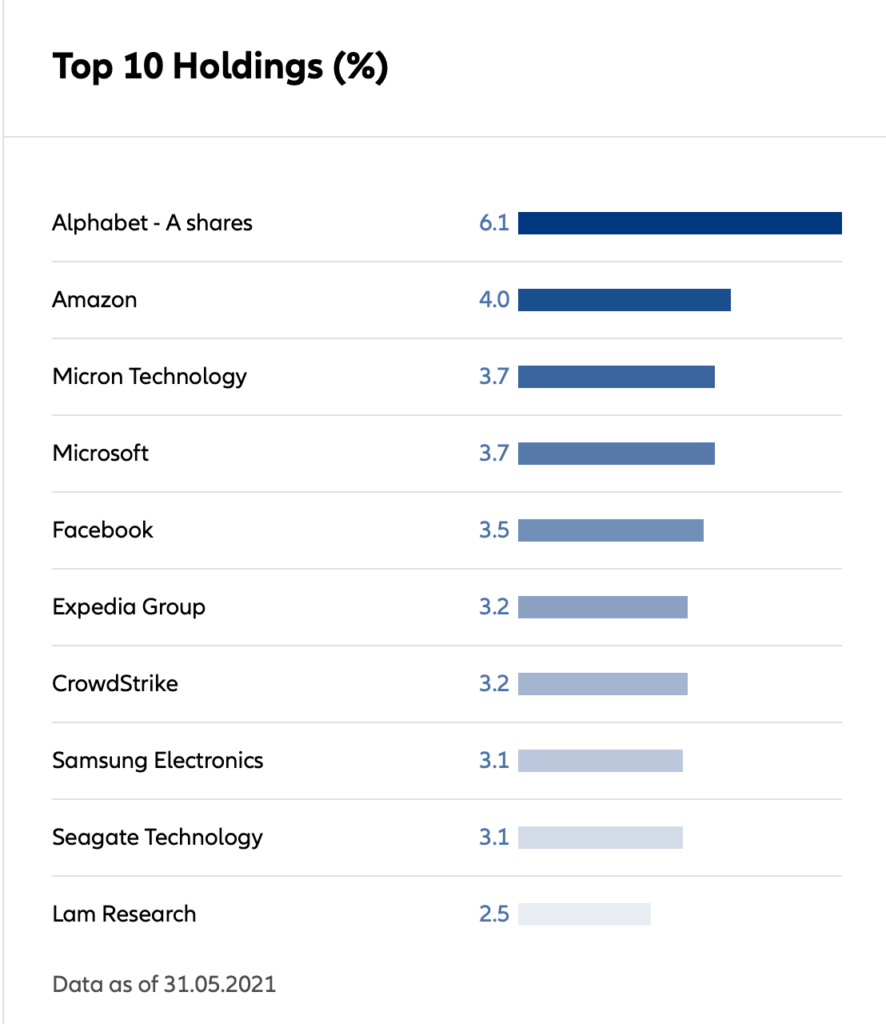

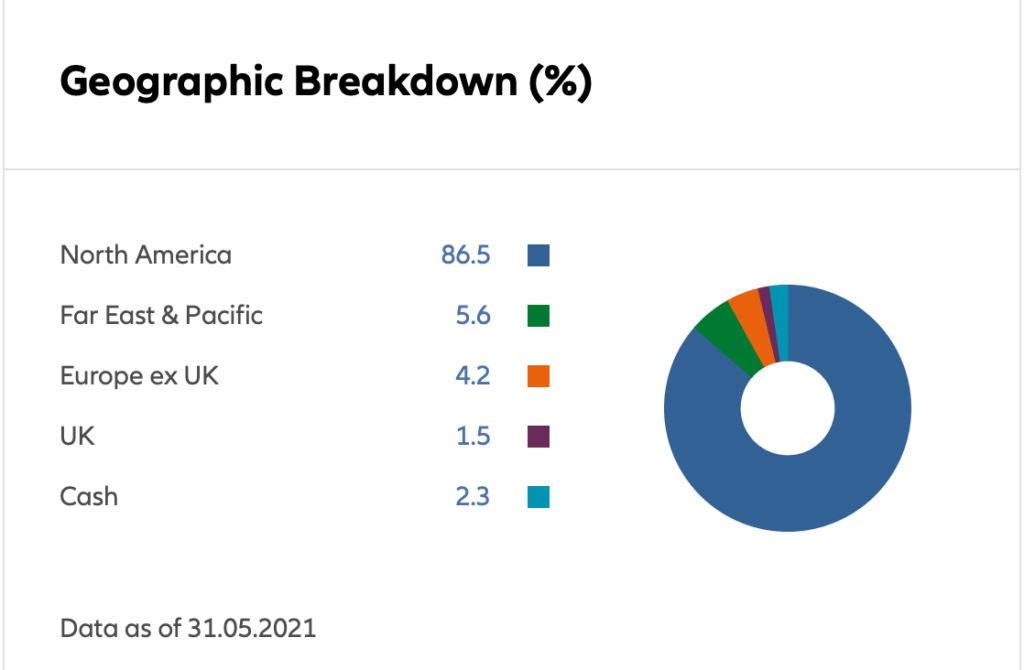

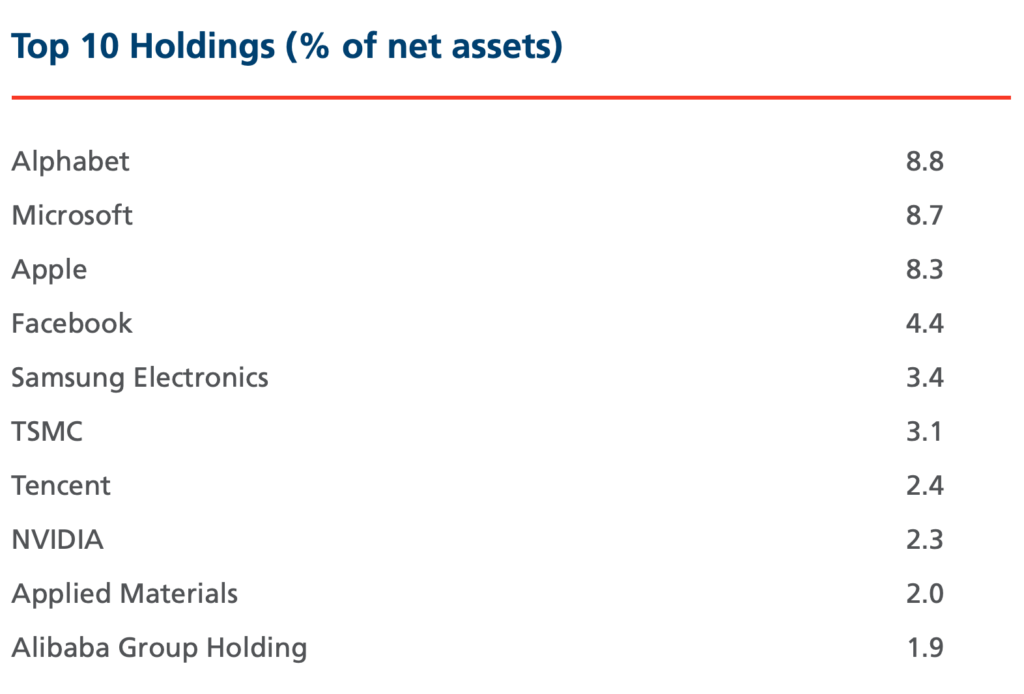

Many of the usual suspects appear in the top 10 holdings of which seven are in the QV for Shares portfolio. What is striking is the geographical distribution for a UK based investment trust. Only 5.7pc is in Europe and the UK, which tells a story of how backwards Europe has been in driving forward the technology revolution. North America is overwhelmingly dominant and the Far East is starting to make a mark.

There is another reason why the trust is so US-focused. “Allianz Technology Trust is managed by the highly experienced AllianzGI Global Technology team based in San Francisco. The team benefits from its close proximity to Silicon Valley where many of the world’s key technology companies are headquartered.”

The trust strives for superior long-term returns by identifying major trends ahead of the crowd and participating in stocks that have the potential to become tomorrow’s Microsoft, Google or Apple. The portfolio tends to be overweight in high growth mid cap companies and underweight in mega cap companies.

Among companies where they have large holdings they mentioned a few in their latest report. “We believe Okta is on a multiyear journey benefiting from massive tailwinds such as zero trust, digital transformation, and cloud transition, which will likely provide a catalyst for growth for years to come.”

On Amazon they noted – “Given the early stage of the corporate migration to the cloud, AWS is well-positioned to become potentially the largest and most profitable technology platform. Advertising related revenues accelerated to 73pc year-on-year growth, and retail continues to be strong in every region, but with notable improvements in operating efficiency in international markets. The company delivered a very strong 8.2pc operating margin on the quarter, and management provided guidance that was 7pc above street expectations for revenue. In our view, the pandemic is strengthening Amazon’s long-term competitiveness as demand for e-commerce and cloud computing has increased and will likely remain high post the pandemic. Overall, the company continues to delight its customers in ways that are allowing it to capture a larger and larger share of spend, both consumer and enterprise.”

Their comments sometimes take a short term view because that is the time scale they are writing about but in their investing, just like Quentinvest, they take a long term view and have a stunning portfolio likely to deliver strong capital appreciation for years into the future. Their past performance closely reflects that of the Nasdaq Technology index (see above). It is actually slightly better with a gain of 18.5 times, which is impressive since it is not easy to beat an index which is periodically rebalanced around the best performers.

O’Shares Global Internet Giants. OGIG. Buy @ $56.91. Times recommended: 7. First recommended: $33.02. Last recommended: $58.50

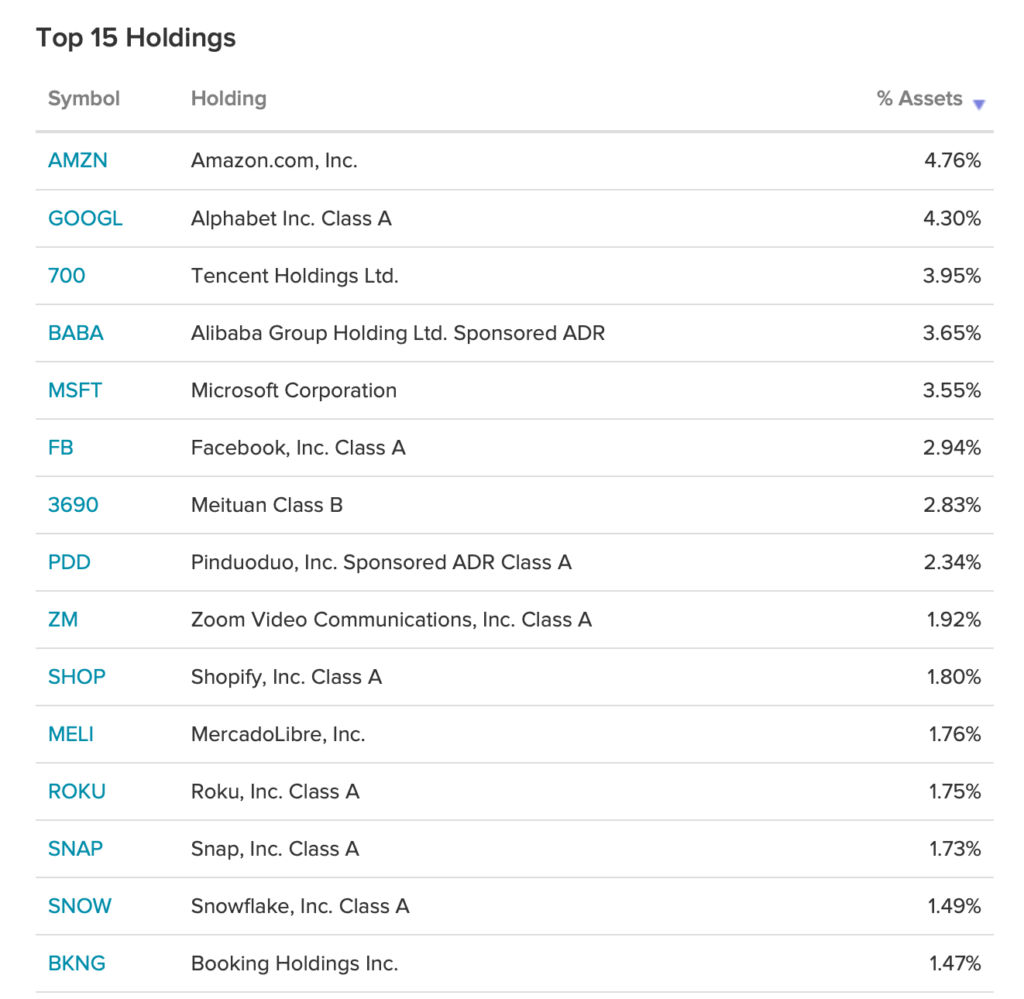

Easy to see why I like OGIG so much. Every single stock in the list of top 15 holdings below is in the QV for Shares portfolio. There is even the same mix between US and Chinese technology and e-commerce stars. The fund uses a rules based approaching to choosing shares which is focused on revenue growth, which they believe is a great indicator for share price growth. It is an aggressive fund but one which should do very well if I am right in my contention that we are still just at the dawn of the technology era.

Polar Capital Technology. PCT. Buy @ 2438p. Times recommended: 8 First recommended: 1672p Last recommended: 2045p. Highest recommended: 2120p

Polar Capital Technology Trust is not an ETF. It is an actively managed UK quoted investment trust with a total focus on technology. There is a team of nine managers who live and breathe digital transformation. They are good. The fund has been quoted since 1996 but started with a baptism of fire. First came the Internet bubble. Then the Nasdaq meltdown when the bubble burst and finally the financial crisis in 2008/09. Since then the price is up 20-fold from 120p in 2009 to the latest price above 2400p.

They don’t share my enthusiasm for never selling. They even trade around core holdings. Personally I wonder if that improves their results but they obviously think so or they wouldn’t do it. What they do is a great deal of research into the very latest trends in technology and try to position their investments accordingly. Major themes currently are hybrid working and the impact of artificial intelligence which they expect to replace smart phones and the cloud as the driver of innovation.

Te lead manager, Ben Rogoff, gives talks on video about where he sees the trend. So for example he agrees that tech growth may slow as we come out of lockdown but he expects this to be temporary with a reaccelerating thereafter. Where high quality tech shares have sold off he sees this as a buying opportunity.

Below are the top 10 holdings as at a recent date.

Again every single stock is in the QV for Shares portfolio. No surprise that I expect Polar Capital Technology to continue to deliver great results for its shareholders.

There is plenty of overlap so no need to buy all three of these shares. They are all actively managed or leaning in that direction so not like conventional ETFs. They are all great performers so classic 3G in in terms of growth, story and chart. These are ideal stocks to buy a chunk now or build a holding over time.

An idea of the pace of change came from reading the Allianz Technology brochure on investing in technology. This was written in 2018 and things have changed even since then. They talk about four big trends. The first is semiconductors where they don’t even mention Nvidia although it is in their portfolio. The second is e-commerce where they talk about global e-commerce sales in 2017 of $2.3 trillion. The figure for 2020 was $4.48 trillion and this is projected to rise to $5.4 trillion for 2022. The other mega trends are computer hardware and software. For the latter they mention the cloud but without giving it the central role in driving digital transformation it would receive today. Sorry. Next sentence says cloud computing, potentially the biggest change in technology since the Internet. This is well observed because 2017 was a perfect moment to invest in a wide range of enterprise software businesses – think Shopify etc., delivering software as a service from the cloud.

As they say the impact of technology is becoming overwhelming. “Evolving technology as a percentage contributor to world output growth has risen from 33pc in the mid 20th century to 50pc in modern times. And technology’s share of the S&P 500 index jumped from 6.3pc in 1990 to exceed 25pc for the first time in early 2018.”

Looking forward the brochure talks about four key areas of innovation – security, the cloud, artificial intelligence and the Internet of Things. These are all exciting areas and no doubt more will emerge. It is a great time to be investing in technology-related shares. The three listed above give great exposure and have impressive track records.