I have mentioned Moderna before as having a high potential chart pattern. It is just in the process of giving a golden cross buy signal and has been trading broadly sideways for 10 months. The Coppock is negative and will at some point turn higher. The chart stars are starting to align for Moderna, which makes it interesting to try and see if there is something new and exciting happening on the fundamental front. Don’t expect too much from me on this because I am not a biochemist but it is at least worth having a look.

Negative Coppocks don’t happen very often

Before I do that though I want to look at the combination of base patterns with negative Coppocks because they don’t happen very often. It turns out they have never happened in the case of Moderna. The first calculation I have is for January 2020 which was plus 5.33. The indicator rose to a peak 90 in January 2022. It is falling at the moment and is presently plus 63.92. Coppock doesn’t have a strong message for Moderna so this is going to be all about the pattern chart break out.

Apple has a strong long-term chart as you would expect from the company that has the highest market value of any business in the world. This is a business that is almost in charge of our future, developing and improving new devices all the time to make our lives better and their turnover greater. In the process they have created the world’s most valuable brand.

A valuable brand is important because it means you can charge a brand premium for your products which drives profitability and strong free cash flow. Apple has sales around $400bn on which it achieves an operating margin of around 30pc! That is incredible.

This in turn is driving free cash flow of around $110bn a year or $2bn plus a week! Part of this money is used to buy back shares. Five years ago Apple had over 20bn shares in issue. The latest figure is 15.9bn.

Apple may be building a base pattern. I have wavered on this in the past since it could also be a top area.

As always the chart could go either way but it looks promising. Apple shares took off in 2003 so this has been a stock for the new millennium. Since 2000 the Coppock indicator has spent most of the time in positive territory. In the past whenever the Coppock has been negative it has been worth buying the shares. Coppock is on the brink of becoming negative now.

There is a good argument for saying that a negative Coppock plus a buy signal from my other indicators is a good moment to buy shares where we have confidence in the fundamental attractions of the business. This applies to Apple so I would be tempted to buy the shares if we get a trend line break plus a golden cross moving average once the Coppock line has become negative. This is especially the case since I am expecting a buy signal for the whole market some time early next year.

Since 2000 Apple has spent around four years with Coppock in negative territory and 18 years when the Coppock was positive. A reasonable strategy would be to make regular purchases while Coppock was negative just as I am doing with the ETFs I am looking at.

Carvana battles spiralling debt

Now let’s have a look at a stock with a completely different risk profile – Carvana. The Coppock indicator has gone from plus 457 in May 2021 to minus 180 currently. Coppock turned negative in April 2022 since when the price has dropped dramatically so you would want to think twice before buying the shares while Coppock is falling.

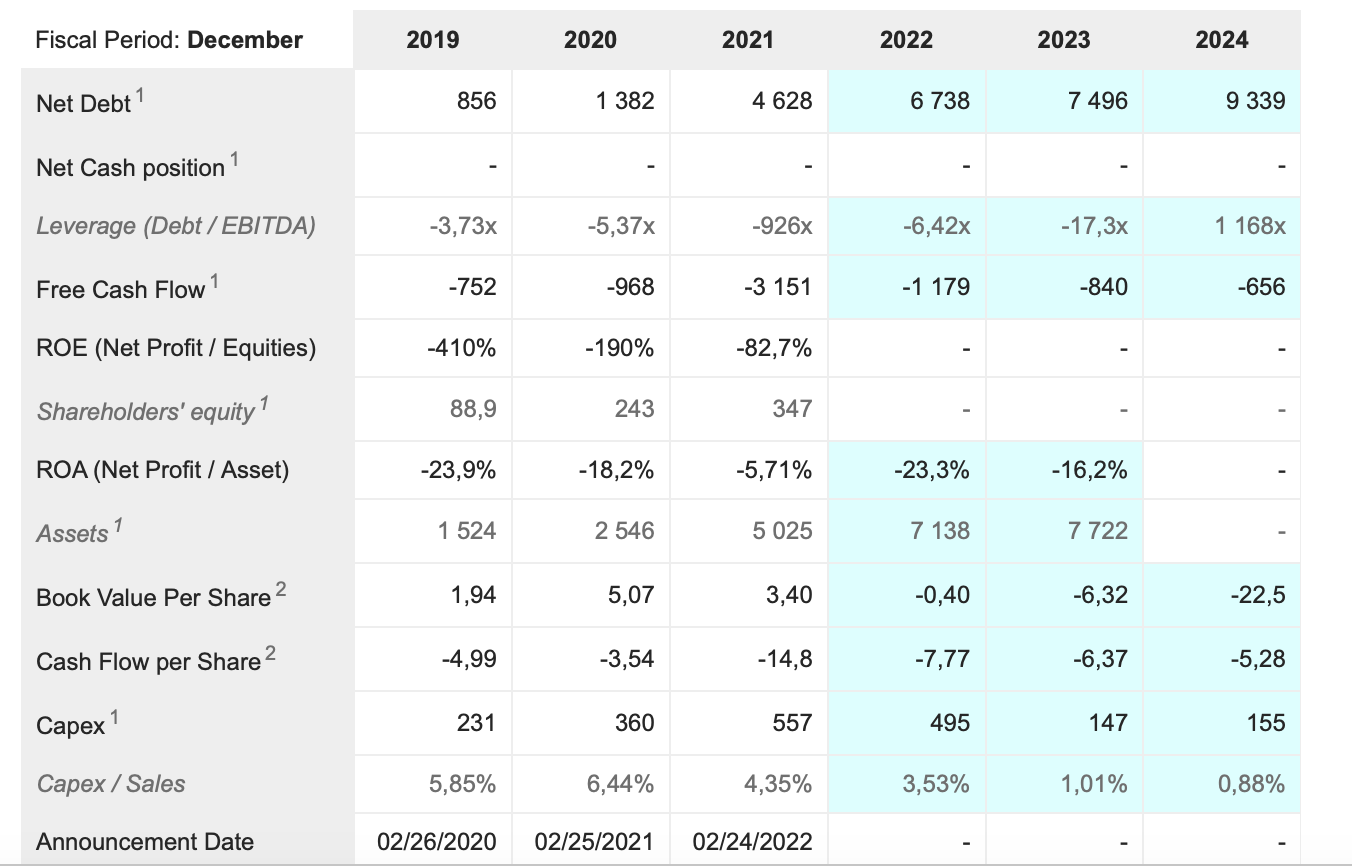

As you can see from the table below Carvana is drowning in debt. There are three possibilities with companies which are drowning in debt. One is that the lenders withdraw their support and the business goes bust. The second is that they enter a living dead state. They keep going but only with the help of their lenders so there is never any value for the holders of the equity. The third possibility is that they cut costs while keeping the infrastructure and sales intact and gradually return the business to health. If they do this there can be tremendous value in such bombed out shares.

Carvana is one to watch. The founders took billions out of the company by share sales at higher levels so they don’t necessarily care that much what happens at least in terms of their personal finances but if they did manage to revive the business they could make another fortune and they are clever guys and not the first to get carried away by a booming market where money seemed to grow on trees.

On the fundamental front we need evidence that things are going in the right direction which may take a while. A similar example was Barrett Developments, the house builder, which loaded up with debt just before the financial crisis of 2008-09. The shares fell from 866p to a low of 22p as many investors priced the company for bankruptcy. This was avoided, the company slowly began to recover and in February 2020 briefly regained the old peaks. They are currently 405p. Miracles can happen and I think Carvana is a good prospect which I will be watching closely. The Coppock indicator for Barrett Developments turned higher from around minus 180, similar to Carvana now, in April 2009, giving a timely buy signal.

Below are the debt and free cash flow numbers for Carvana.

Creating a new generation of mRNA-based medicines at Moderna

It is finally time to get back to the subject of Moderna and the potential for mRNA. The truth is I have no idea what that potential is; if I did I would probably be working for Moderna, BioNTech or one of the other companies doing research in this area. I thought I would try and get the idiot’s guide from wikipedia. There is no idiot’s guide. It is what it is, genes, proteins, messenger RNA and so on and what that is about I have only the vaguest clue.

We need to come at the potential for Moderna some other way. The CEO and founder of Moderna is a guy called Stephane Bancel. He is a 50 year old Frenchman who owns nine per cent of Modern making him worth some $6bn. He is evidently an impressive individual.

I think you get the general idea from these two graphics that Moderna is an exciting business with ambitious plans. Moderna is about applying the science of mRNA to create new vaccines and drugs. A purchase of the shares is a gamble on two things. The first is that Moderna’s large pipeline will come up with exciting novel drugs and vaccines. The second is that new pathogens like Covid-19 will emerge generating massive demand for Moderna’s products.

As and when we get more exciting data on specific developments in either of these areas that would be an exciting moment for buying the shares, assuming that it coincided with a positive chart.

Nvidia heads for new Coppock buy signal

Nvidia is arguably the most exciting semiconductor business in the world. At any given moment there are ups and downs in demand with demand for gaming chips weak at the moment but artificial intelligence looking exciting. Longer-term prospects for the business look strong in line with an ever unfolding technology revolution.

Marked above are points where the Coppock chart turned higher after becoming negative. In lighter blue is marked a moment when Coppock turned higher but not from, a negative position. As it happens that was a great moment to buy as signalled by an explosive chart breakout from a huge base pattern.

Coppock has just become negative again at around minus 50 so the next buy signal will be a dark blue. On past form it will be a moment to be positive about the shares which are already behaving in a promising way with what looks like a golden cross on the moving averages.

Strategy

I am still learning about the application of Coppock but every chart I look at tells me it can be a game changing indicator. I have a long track record with Coppock because back in the 1970s I resurrected the calculation of Coppock at The Investor’s Chronicle and made it part of the armoury there. Since then I have never stopped using it but have recently begun to apply it much more widely and the more I do this the more impressed I am.

What we need to see now is whether predictions made using Coppock come good. I am very hopeful that they will and then I will learn even more about how to use it and how to combine it with my other indicators.