People often think that a share has to be a small cap to offer really exciting investment potential but that need not be the case. Google was valued at around $25bn when the shares were floated in August 2004. This may seem small beer now but it seemed like a lot at the time. Nobody could have imagined that less than two decades later the business would be valued at $1,587bn.

At the time few would have thought that any company would be valued at over $1.5bn yet Apple, which was then valued at less than $10bn now has a value fast approaching $3 trillion, closely followed by Microsoft at almost $2.5 trillion.

Tesla has been over a trillion dollars and is currently $612bn. Tesla shares are close to $200, a decade ago they were $2.

There is a company, already big, which is coming up fast on the rails and I think is going to overtake all these businesses to become the largest in the world and this represents an incredibly exciting investment opportunity.

I expect some of you have already guessed the name of this company but let me give you a clue. Below is a recent quote from the CEO.

Table of Contents

“We’re now at the tipping point of a new computing era with accelerated computing and AI that’s been embraced by almost every computing and cloud company in the world,” he said, noting 40,000 large companies and 15,000 startups now use NVIDIA technologies with 25m downloads of CUDA software last year alone.

Jensen Huang, Computex keynote, 28 May 2023

It turns out to be a good clue because the name of the company is included in the quote. My impression from quotes like this and from the staggering increase in Q2 2024 guidance just announced by Nvidia from just over $7bn revenue to $11bn is that Nvidia is at the dawn of a period of incredible growth and excitement.

Like QQQ3, Nvidia is a must-own share

It is imperative that ALL my subscribers make sure to have a position in this stock. My two must-owns for all my subscribers are Nvidia and QQQ3, which should be purchased immediately on Tuesday by any subscriber who does not yet own them.

I am not going to attempt to analyse Nvidia. I am not qualified to do so and it is not a key part of the investment decision for me anyhow. I am very Zen about these things. I get a feeling, a hunch, and I back my hunches. My hunch is that Nvidia is the most exciting company in the world and one of the most exciting companies of all time.

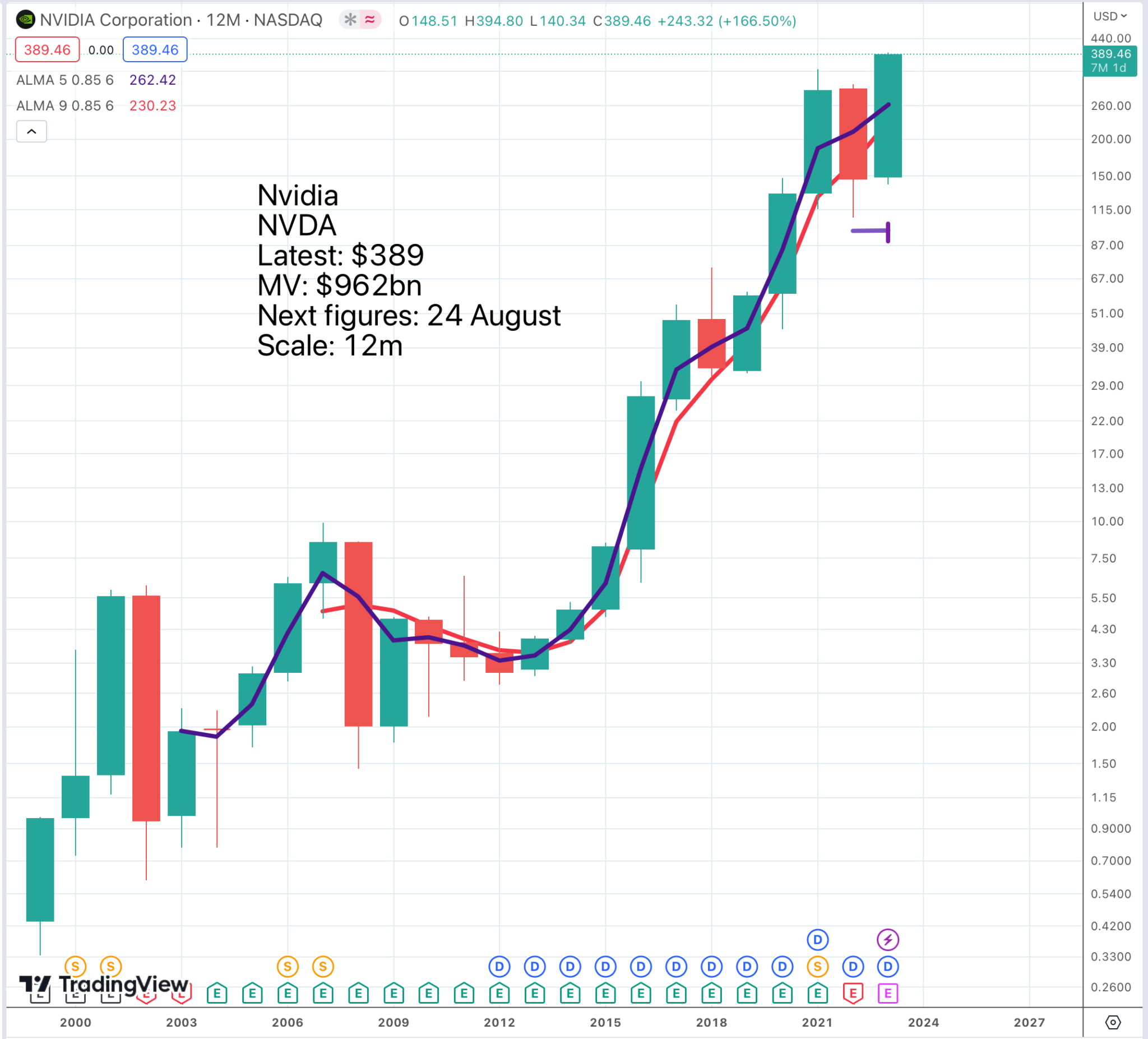

I felt the same about Google in 2004 and how right I was about that one. incidentally I have been a huge fan of Nvidia and Jensen Huang ever since that mighty chart breakout in 2016. I think we are seeing a repeat of that breakout in 2023, a breakout which has just happened.

What do shares need to really go through the roof? They need a massive tailwind and that is being provided by accelerated computing and AI, where Nvidia reigns supreme.

They also need a moat, a barrier against competition to give them pricing power. Nvidia has that with its domination of GPU technology. This company invented the graphical processing unit, the chip that is making accelerated computing and AI possible. It is a massive first mover advantage. Since then it has been about finding new, ever more exciting, applications for the technology.

I often say that for me share analysis is 10pc fundamentals to establish that a share is 3G (great growth, great story, great chart) and 90pc the chart. Nvidia is different. The chart is great but looks similar to many other charts at the moment with a correction in 2022 and a breakout to a new peak, or, for many shares, close to it.

What a story!

What is critical for Nvidia and makes it so exciting is the power of the story. Nvidia is at the heart of Ai and AI is taking the world by storm. This is what makes Nvidia potentially huge. It reminds me a bit of Tesla when their big run began except that there was extraordinary scepticism about Tesla, which is not the case with Nvidia.

The graphic below gives a flavour of how fast things are moving at Nvidia

I have also found a quote from somebody who does understand Nvidia’s technology and this guy thinks that Nvidia’s market value is going to overtake Apple, so multi-trillions.

For context, the A100 GPU was a monumental release for Nvidia as the Ampere architecture unified training and inference onto a single chip, whereas in the past Nvidia’s GPUs were mainly used for training.

The result is a 20x performance boost from a multi-instance GPU that allows many GPUs to look like one GPU. The A100 offered the largest leap in performance to date over the past 8 generations. One year later, the Ampere architecture had become the best-selling GPU architecture in the company’s history.

The A100 was special but it’s the H100 that is Nvidia’s iPhone moment. The reason is quite simple – it’s the release that will help Nvidia breakout from hardware and put the company firmly on the map for AI software.

Hardware has allowed Nvidia to become a $700B market cap company, but it is the recurring revenue from AI software that will propel Nvidia into a market cap worth trillions.

Forbes, 24 May 2023

My minimum target is $1,000

So let’s assume that this guy and I am right about Nvidia and the shares are going to climb to at least $1,000, which is my minimum target. Suppose we had a crystal ball and we KNEW that was going to happen, what would we do.

Everybody must decide their risk threshold. Mine is high so this is what I would do.

First I would make Nvidia my largest holding, probably as large as all my other holdings put together.

Second, I would buy the shares in a spread betting account. This would protect my gains against tax and enable me to leverage my position.

How much leverage? We have just seen a massive breakout by the stock and an increase in guidance so large it is almost a black swan event. I would gear up fivefold and I would compound my position by reinvesting all newly created equity into further purchases of Nvidia stock until I held enough to move the needle.

Strategy or how to spread bet

Let us suppose you want to place a spread bet on Nvidia, what exactly do you do.

First you need a spread betting account with a platform such as IG. You go into your spread betting account and search for Nvidia, which is an all-sessions share so trading takes place around the clock, most days.

While in your spread betting account, having selected Nvidia, on the right you will see little boxes for sell and buy. Click on buy and the box will be highlighted showing the latest buying price. The minimum bet is 0.06 per point. I prefer to make my bets in US$ rather than £, which are often offered first so you may need to change £ to $.

A bet of a full point is equal to owning 100 shares. Remember that and you will always know what you are doing. A bet of 0.06 per point is like owning six shares, present worth around $2,340. Look further down and you will see that in order to place this bet the required margin is £378.78 or $467.66, which is a fifth of $2,340 for five times leverage. That is the amount of money you need to put into your account to make this bet.

If it goes wrong and your are a beginner investor the most you can lose is the amount of equity you put into your account, which is an important safeguard.

Most likely, if you invest using the full five times leverage you will get margin calls. I do all the time and I pay no attention unless my margin gets dangerously low. If I really believe in the share I will hang in there like a limpet. IG will close your position if your equity drops below 50pc of the required margin. They do this to protect themselves.

Just for the record I never use stop losses. I think they are a complete waste of time, great for IG but a formula for endless small losses for investors.

I also never use limits. If I want to buy I want to buy.

That’s the basics but this is just the beginning.

The power of compounding

As I have said in the past I am a very aggressive investor. It’s Formula 1 or nothing for me so even five times gearing is not enough. What I will then do is invest all my gains in fresh purchases still on five times leverage. This is what can produce the most staggering returns.

It is the same effect that makes QQQ3 a more dramatic investment than would be imagined from the three times leverage.

Of course, it is risky but the returns can be so spectacular that you do not need to risk that much money. You could start with say $5,000 in your account and still achieve incredible results.

Obviously you don’t have to to bet the ranch on just Nvidia. Another strategy is to build a portfolio investing in a diversity of shares and I will give you plenty of names for doing this on Quentinvest. Make Nvidia your benchmark and only invest in other shares if you think they are at least as exciting.

You can do all of this on a CFD account but there the gains are taxable, which is why I don’t use CFDs much any more.

Lastly you can do it on a share account, where there is no leverage so you cannot be forced to sell and you can use tax wrappers like SIPPs and ISAs. Thanks to spread betting I never bother with them.

Investment for me is more of a game, a hobby, which is why I can be so aggressive.

Life becomes harder for leveraged investors when shares are extended to the upside; that is why it is important to act decisively close to the moment of breakout. It is not so hard to buy QQQ3 now, fresh off a golden cross on the moving averages on a 3m candlestick chart, but at $300 that is a tougher decision.

There is a lot of hype around AI but that does not mean we are at a top or even close to it. I have seen these booms before and it is unbelievable how excited investors can become. Remember the Dutch and their tulips (not that I was around for that one) and the AI boom has a million times more substance than the search for a black tulip and also has only just begun.

Share recommendations

Nvidia. NVDA. Buy @ $389

Invesco Nasdaq 100 3x daily. QQQ3. Buy @ $102.5