Tesla. TSLA. Buy @ $1020. MV: $1.01 trillion. Next figures: 2 February. Times recommended: 19 First recommended: $75.96 Last recommended: $863. Highest recommended: $872

Tesla is shaping up as one of QV for Shares top recommendations. It is up 13.5 times on my original recommendation in QV. It was actually first recommended in Great Stocks (formerly Quantum Leap) before Quentinvest existed, at $17.66. It is up 58 times on that recommendation.

I should also note that in the race to be valued at $1 trillion Tesla has arrived. It is now in another race to become the most valuable company on the planet. The present leader is Apple, valued at $2.45 trillion.

Part of my thesis is that Apple and Tesla have some things in common. They both sell devices which are stuffed with proprietary software. The big difference is that the devices that Tesla sells are bigger and more expensive even though Apple’s kit is not exactly cheap. This is the simplest reason for expecting Tesla to eventually become more valuable than Apple.

The global market for mobile phones is expected to reach $795bn by 2027. The global market for new car sales is expected to reach $9 trillion by 2030. Tesla is fishing in a much bigger pond and has a bigger lead over rivals than Apple does in the smart phone market.

Apple does other things but so does Tesla. Among the most important of which is solar energy which Elon Musk has said will eventually be bigger than the car business. He also recently floated a rather bizarre kite suggesting that Tesla will be making humanoid robots one day based on the current amazing advances in artificial intelligence.

Since Musk recently overtook Jeff Bezos as the world’s richest man, cheekily sending the latter a silver medal to mark the fact, I think we have to listen to what he says with respect. This guy has a knack of making things happening.

The proximate cause for the latest burst of strength in the shares was the announcement that the Hertz car rental company wants to buy 100,000 Teslas for its rental fleet. In a world where demand is already outstripping supply that is a massive order though it will be fulfilled over a number of years.

I have been reading another interesting story suggesting that the price of Teslas, which has already come down dramatically from the early days could still fall much further. Specifically the author is suggesting that we are not so far from the days when Tesla will be selling its bottom of the range model for $15,000, which will open up a huge market.

Musk has already hinted at great interest in services associated with the car market. One in which he is particularly interested is insurance where a lack of data means that insurance premiums are very high. I know this. The annual insurance on my ancient BMW is more than the car is worth. Tesla has the data to sell car insurance much more cheaply, which could then become yet another selling point for the cars.

Imagine a car which drives itself, comes when called, is cheap to run and insure and cheap to buy if you decide to buy it rather than lease or rent. Cars like this are going to take over and Tesla seems to have a considerable lead in reaching this point.

Incidentally I just want to throw out to my subscribers something astonishing which I have just read.

“I have been following the company [Tesla] very diligently, studying every piece of news about it, and putting my money where my mouth is: On a weekly basis, I have been writing two put contracts priced at about 10-20pc lower than the current price and expiring four weeks later; occasionally, I had to roll over these options for another four weeks at a lower strike price. This investment strategy has been generating for me a good consistent weekly income.”

I don’t know exactly how this works but I am going to look into it. It sounds like a very clever strategy. Now back to the bull case for Tesla. I have just been watching a fascinating video entitled, ‘Vertical integration, Tesla’s secret weapon’. Most car companies, much like Apple, outsource large parts of the manufacturing process. Companies like Ford and GM rely on hundreds of suppliers for key components, other third parties for self-driving software and externally owned petrol stations to fuel their cars. Tesla does almost all of this in-house including building the charging network for the cars and there are even rumours that as well as developing and making batteries it may go into lithium mining.

This high degree of vertical integration means the company has much more control over the whole process and many more opportunities for innovation. Tesla is an innovator in a way that no other car company in the world comes near. People don’t necessarily realise this yet because the fossil fuel cars made by rivals like Mercedes, BMW and Porsche are such beautiful miracles of engineering. They are but the improvements made each year are incremental. These cars were wonderful 20 years ago. I know because I own a 20 year old BMW which is a pleasure to drive but also a museum piece. Tesla is creating the future and doing it at speed.

Tesla is famous for its giga factories to make batteries and cars. Here is another interesting quote. “The company expects the Shanghai factory to continue to scale to produce over 1,000,000 cars a year and there are rumours of a second Giga Factory in China.” Tesla is moving at a pace that other auto companies can only dream about. This may be because it was born as a technology company led by geeks who think like geeks whereas other car companies are led by engineers who think like engineers. Mercedes used to own a piece of Tesla but sold out because they could not deal with the way Tesla did things, in particular the speed at which they implemented new technology.

Fossil fuel cars are very complicated and need wonderful engineering to make them safe. Teslas are batteries on wheels churning out data which Tesla can use to make them perform better. It’s a totally different approach. Think of a CEO of a regular auto company who has also founded a space exploration business bent on sending humans to Mars!

Personal prediction: Elon Musk is going to be the world’s first trillionaire.

More from the rumour factory. “Tesla currently has six factories in California (the first Fremont factory), Nevada, Texas, New York, Shanghai and the latest one in Berlin. In addition, there are rumours about new Giga factories in China, India, Japan, Korea and the UK.” The rumours make sense because Musk said long ago that shipping objects as heavy as cars from production site to market was a costly waste of resources.

The boldest prediction I have seen is that Tesla has such a lead in electronics, a lead which is extending all the time, that in 15 years it will account for 50pc of all new cars sold.

Are there risks to this analysis? Of course there are but that’s investing. It’s a game of probabilities and in this game Tesla looks to have a very good chance.

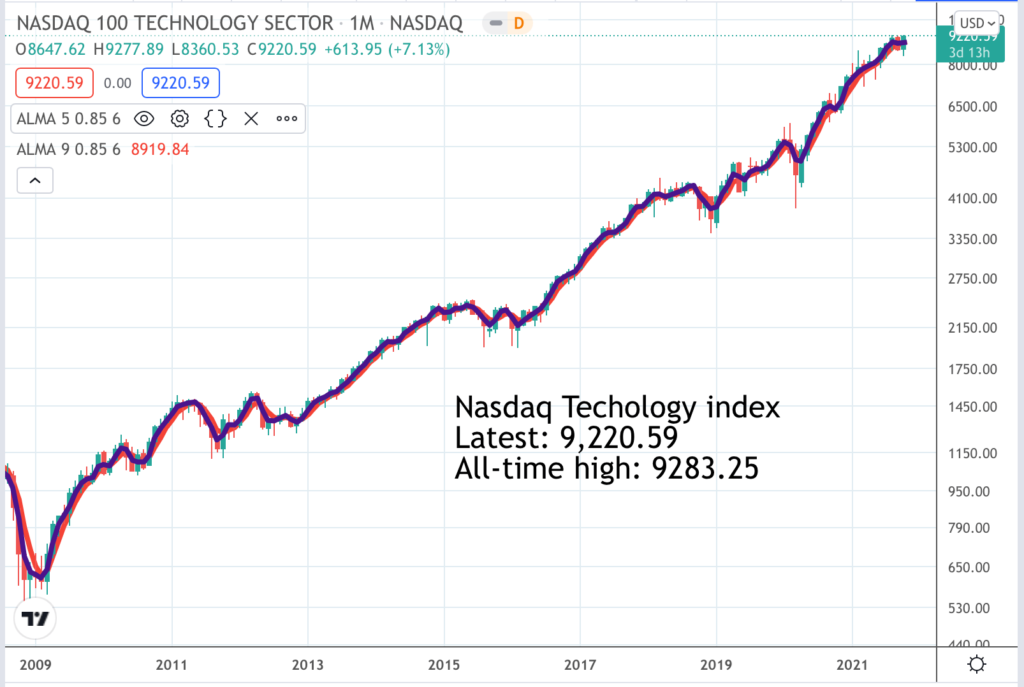

I have chosen a new graphic (an illustration from my e-book) instead of the usual Strategy one for this piece. It relates to my view of the stock market as a game of snakes and ladders. Currently we are on a ladder, which is good news for investors. Also, especially since 2009, the ladders have been bigger and longer lasting than the snakes which is the reason why overall the US stock market is making such great progress.

Rising stock markets climb a wall of worry and that can be true of individual stocks as well. Even now there is a chorus of observers insisting that Tesla is a wildly over-valued car company. But what if Tesla is not primarily a car company but is first, last and foremost a technology company and one of the most innovative businesses on the planet. Would that justify a higher valuation particularly if that innovation is being directed to saving the planet?

I am sure that many people think that Musk is a bit crazy. Look at the names he has given his children, which lately have become completely unpronounceable. But equally there is no question that he is some kind of genius. When he says he is going to do something like make 100s of thousands of affordable Model 3 cars nobody believes him and then he does it. He says he is going to make batteries dramatically cheaper. Who is to say he won’t. Will he cover a map of the world with gigafactories? Most probably, he will. Will solar energy become a bigger business than automobiles? Maybe the answer to that is yes. Will he start selling batteries to other car companies? Will people stop owning cars as transport becomes a service business? Who knows but with this guy anything is possible, including stuff I have not even mentioned here.

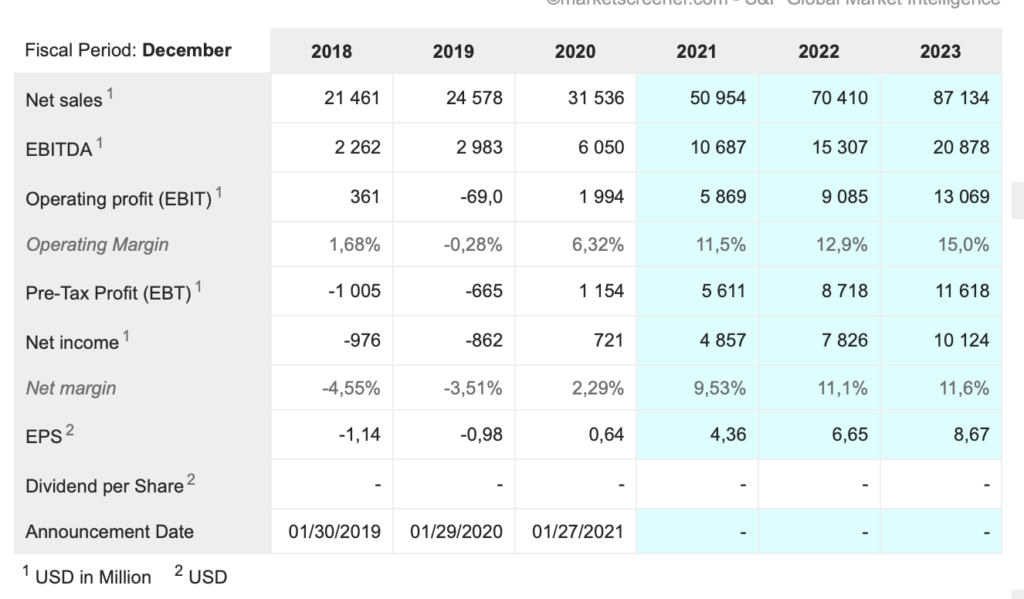

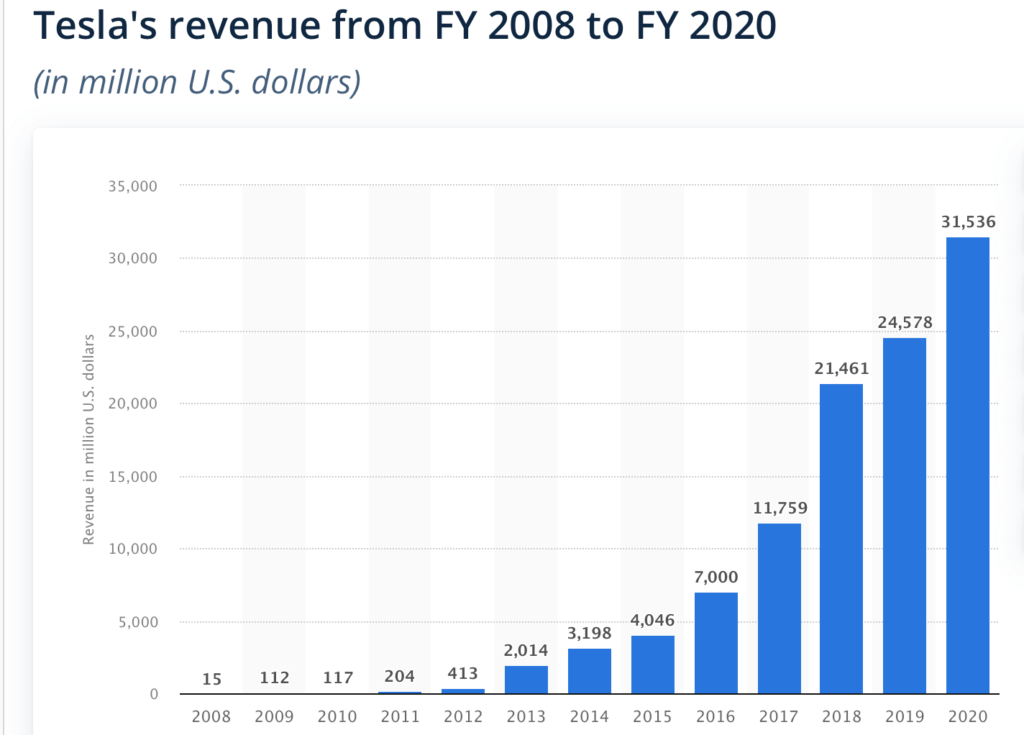

And then if you want to think in old style statistical investment terms just look at how fast this business is growing. I have included a chart below.

Tesla is a total event and surely a must-own investment even at $1 trillion market value. I can imagine another nought on that number one day.