This is a fantastic chart with a double whammy buy signal but also an exciting pattern developing. I see it as a diamond pattern. You make think that is a bit of a stretch but look hard and it is there. Not on this chart because I have changed it to a 12-monthly candle stick but you can see it on the three monthly chart. This is a classic mid-term continuation pattern so a breakout which may already be occurring should theoretically repeat the advance we saw before the pattern formed. I like these very long term charts because they highlight the consolidations and the breakouts.

Repeating the 2019-2021 advance is insane because the advance was 37 times from $12 to $417. Do that again from the recent low of $106 and the shares would go to $3,922 to take the market value to approaching $12.5 trillion.

I am sure that seems an unimaginable number but who would have thought in 2010, when the business was valued at $3bn that not much more than a decade later the value would top $1 trillion. We live in an age of wonders when any thing is possible and there is an aspect to Tesla, and other mega caps that the bigger they get the greater their potential.

The rate at which Tesla is growing is mind-blowing with sales forecast to rise from $3.8bn for calendar 2021 to $163bn for calendar 2025.

I have picked up just one comment from the chat rooms.

I’m still blown away by the number of people here who think Tesla is just a car company. At the moment, most of their income stems from cars but in the near future, other Tesla revenue streams will grow exponentially that have nothing to do with car sales.

John, Yahoo Finance, 16 February 2023

There is something on the same Iines in Seeking Alpha.

Tesla, Inc. (NASDAQ:TSLA) is, in some ways, a difficult company to describe. It makes cars, and most of its revenue comes from vehicle sales, so it would be easy to simply call it a car company. Yet for a car company, itis involved in many other areas that other car companies do not, and probably should not, go into. Solar panels, solar roofs, home and grid-scale battery storage, battery recycling, electric vehicle (“EV”) charging station deployment, autonomous transportation software development, robotics, and the development of Artificial General Intelligence (“AGI”) are just some of the many side hustles, so to speak, that Tesla is engaged in alongside its core EV production business.

Due to the many current and prospective business lines of Tesla, some have taken to describing it as being not a simple carmaker, but as, in the words of an analyst at Oppenheimer, a technology conglomerate that is just well-known for selling cars. I am inclined to agree, and I believe that along with its car business, Tesla’s many ancillary activities, once mature, will make it a titan in the business community the likes of which we may never have seen before.

The Long View Investor, 17 July 2023

This guy is seriously bullish which is unusual for Seeking Alpha where most of the commentators are bearish. Listen to what he says at the end of a lengthy analysis.

Tesla is primed for moonshot growth, according to relatively clear trends in its business units and based on its history of execution on its EV business, yet these are being dismissed by the stock market almost entirely. As a result of this dynamic, Tesla’s current pricing by the market is completely unsustainable, as the company’s projects will generate increasing investor attention as they start ramping up and contributing to Tesla’s revenues, profits, and EPS. Investors will then pile into the stock when they belatedly realize how much Tesla’s earnings are set to grow.

As an aside, while researching for this piece, I came across Australian YouTuber Steven Mark Ryan, posting on the channel Solving the Money Problem, who stated that he believes Tesla is “the best risk-adjusted opportunity in the stock market today.” I initially dismissed this as influencer hyperbole, but having crunched the numbers and done some gut checks, I understand why he says this, and I believe he is likely correct.

Tesla, Inc., appears to be severely undervalued by the market in even a very conservative bear case scenario for 2030, meaning the company is all but certain to reward clear-eyed, forward-looking investors who invest in it today, hold their stock throughout the decade, and marvel at the company’s staggering shareholder returns between now and then.

The Long View Investor, 17 July 2023

This guy expects 2030 earnings per share of $409 or much, much more. On a PE ratio of 20 that would put the shares over $8,000 v $290 currently; that would take the market value over $25 trillion which is double my chart forecast.

I know this is the imagination letting rip but so far that has worked much better for these shares than traditional number crunching.

Strategy – Going for the Moonshots

Looking at distant vistas The Long View sees the shares at $8,000 or even higher against today’s price, down almost five per cent to $279 on disappointment with the latest quarter which did not beat on all numbers and sounded the faintest note of caution about the coming quarter.

That is such a non-event for long term investors who will look with great interest at that $8,000 prediction.

US Economy Like Britain in the 19th Century

I have been thinking about the US economy. I see parallels with the UK economy in the 19th century which had its ups and down but not much problem with inflation. Economies left to their own devices don’t have inflation which is entirely created by governments printing money. The US government has stopped printing money and this is already leading to a rapid cooling of inflation.

Looking ahead I can see inflation coming right down to two per cent or even lower as AI and AGI start to work their magic. This in turn should help interest rates to fall perhaps as early as 2024 and perhaps back down to two per cent or even lower.

This will be bullish for all asset prices including bonds, equities, property, cryptocurrencies, Impressionist paintings and much else. It will also set the tone for interest rates elsewhere so I would not be at all surprised to see UK property prices resuming their climb in 2024.

As for US shares, there is a possibility of a perfect storm with share prices going a little bit crazy. Real Wild West type bull markets are rare. I have seen two in my lifetime, the Poseidon nickel boom in the late 1960s when shares routinely doubled in a day and Poseidon shares rose 280-fold in a year; that was insane and excited me so much that I went to work in West Australia for a local stockbroker, before going on to edit my first investment newsletter.

The next Wild West boom was in the run-up to 2,000, when just putting .com on the end of a company name put a rocket under the shares. The biggest name that survived from those days was Amazon.com and what a performer that was.

Could we be shaping up for another boom like that based on AGI [Artificial General Intelligence} and all the wonders that follow from that; I think we could so no need to be in a rush to sell if the shares you hold rise strongly.

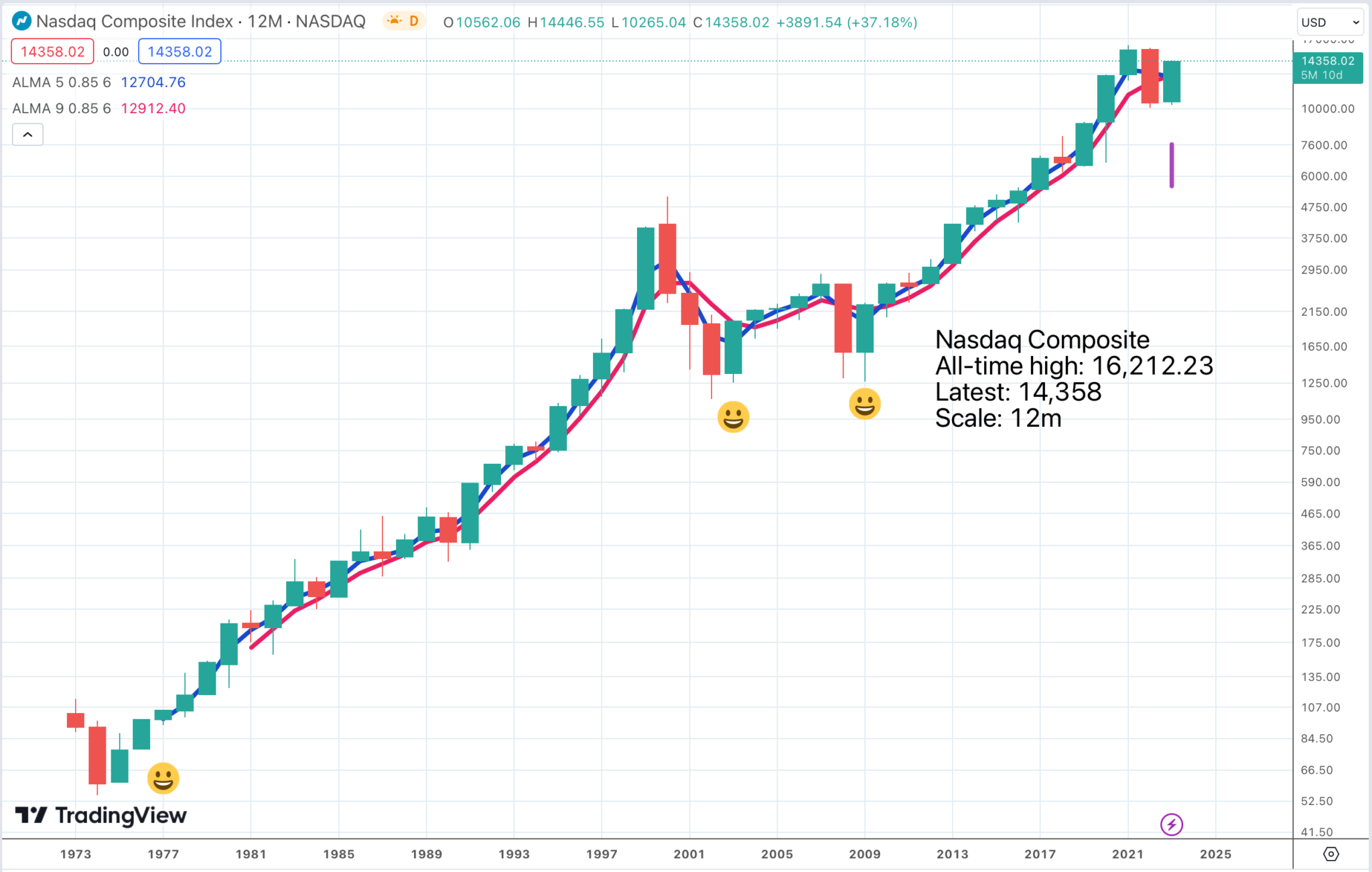

This is a chart I don’t look at very often, the Nasdaq Composite index, showing clearly the bull market which began in the mid-1970s and roared on almost unbroken until 2000. Then came the decade of bear markets ending in early 2009. This was succeeded by another fabulous bull market which ran until middle to late 2021. Shares, especially technology shares, corrected sharply in 2022 but are off to the races again, especially the Mega Caps now known as The Magnificent Seven – Apple, Microsoft, Amazon, Alphabet, Nvidia, Tesla and Meta Platforms.

These shares have done so well in 2023, fired up by the latest developments in AI, that the Nasdaq 100 is having a special rebalancing, taking effect on 24 July, to reduce their weightings which would otherwise have gone over 60pc.

This may have a temporary depressing effect on their shares but longer term is a sign of strength, not weakness.

It is still very early days in this new bull market and there will be many exciting developments including IPOs of some amazing companies which will electrify investors.

Buy QQQ3

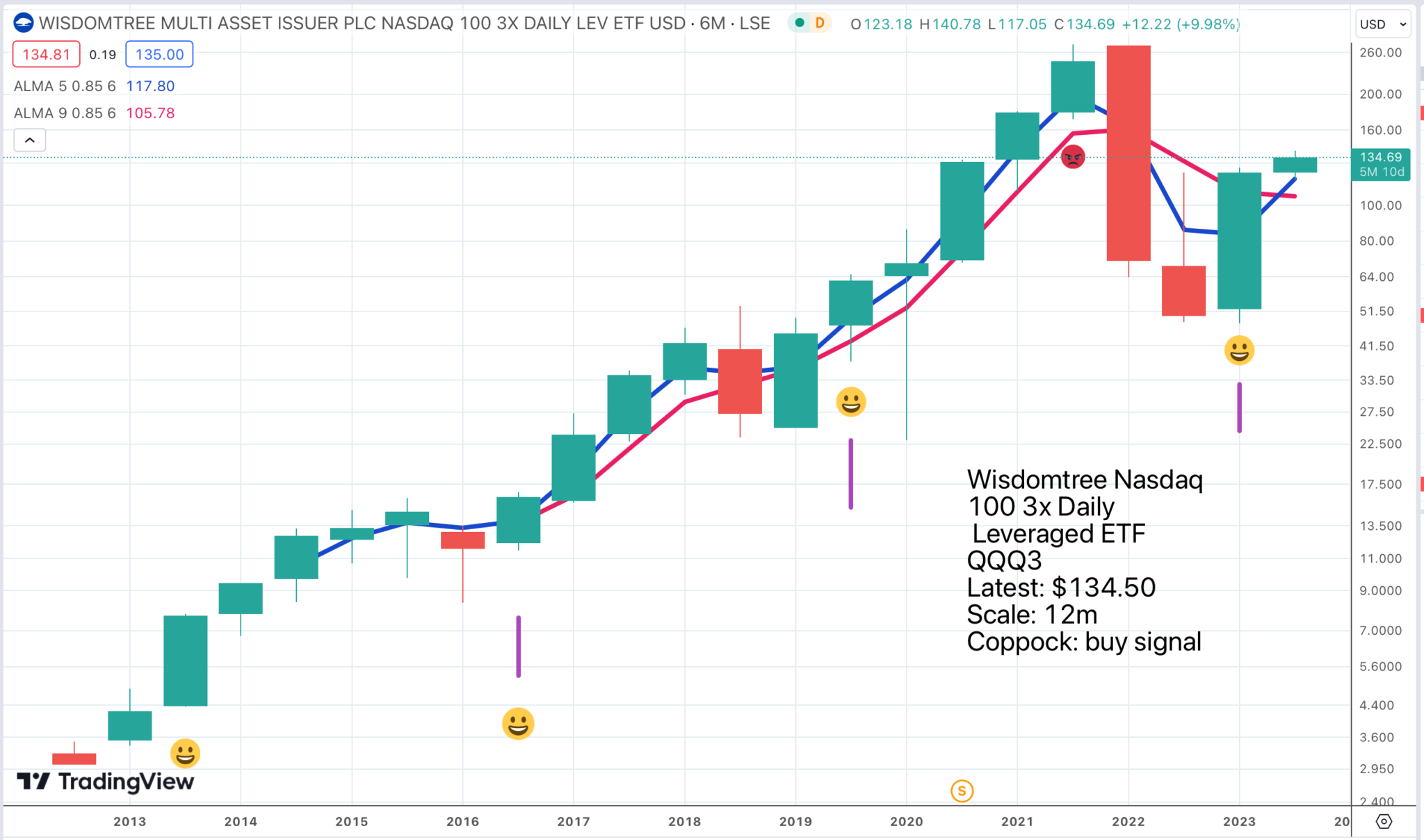

One of the simplest but most exciting ways to participate in this boom is to buy QQQ3.

This is the chart of QQQ3, which is a leveraged (and compounding daily) way of investing not just in the pulsatingly healthy US economy but the companies spearheading a technology revolution which is going exponential. This is an insanely exciting situation and makes QQQ3 a no-brainer investment.

Note the double ‘whammy’ buy signal and the sheer performance of this stock since 2012 when it was created.

It’s obvious, screamingly obvious but that is often the case with the best decisions. People try to be too clever and miss what is in front of their noses. Just go for it guys and get ready to start laughing all the way to the bank and no need to wear a white suit, play drippy songs on the piano and talk endlessly about your mum.

Share Recommendations

Tesla TSLA Buy @ $275

Wisdomtree Nasdaq 100 3x Daily leveraged. QQQ3. Buy @ $136.50