Snowflake SNOW. Buy @ $356. Times recommended: 1 First recommended: $311

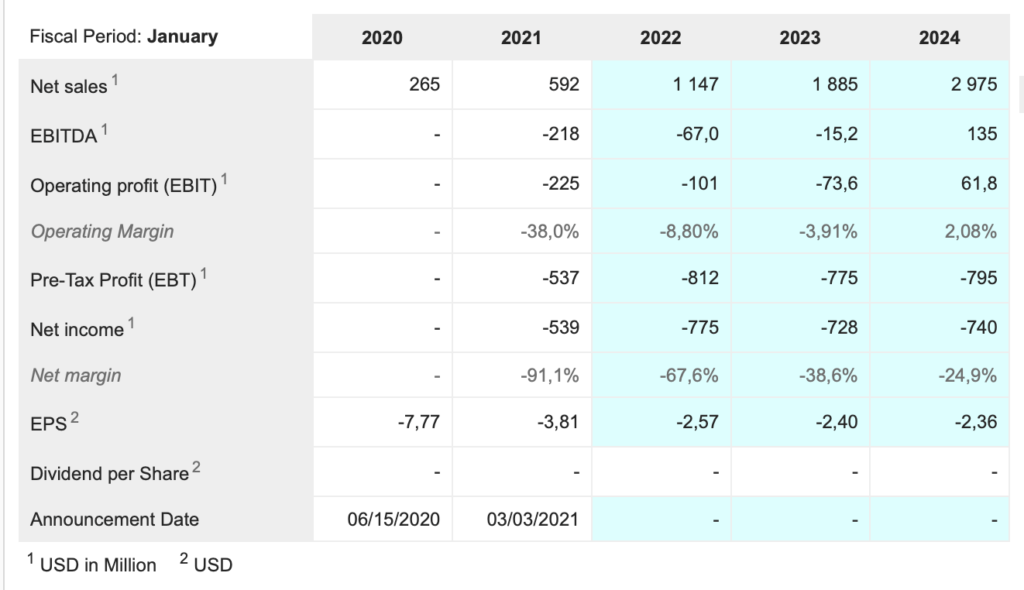

Two things to start off saying about Snowflake. One of the three Gs is great growth and they certainly score there with sales predicted to rise from $265m to $2.98bn in four years. The other is what they do – data warehousing. I can imagine generations of earlier investors asking what on earth is that; it sounds totally weird but it is what they do and in a world of artificial intelligence it has a critical role to play.

Snowflake operates the Data Cloud, their core product offering that aims to bring the world into an interconnected ecosystem, with a technology infrastructure that allows its customers to ‘consolidate data into a single source of truth to drive meaningful business insights, build data-driven applications and share data’.

A notable aspect of Snowflake’s business model is its consumption-based revenue model instead of a subscription-based model that is typically the hallmark of SaaS companies. This means that revenue is recognised based on consumption rather than based on subscriptions.

Snowflake’s key value proposition to its customers is simple. Its cloud-agnostic platform allows for diverse data types to be worked on at the same time across multiple users on its high performance platform without latency, while requiring almost “near-zero maintenance”, enabling its customers to focus on their core business rather than on their infrastructure capacity limitations. Snowflake believes it is the only company that operates a “multi-cloud” platform.

This value proposition is delivered through Snowflake’s architecture with three independent layers allowing massive scalability that is limited only by ‘its customers’ imagination and Snowflake believes those boundaries are shifting quickly as well’.

Physical boundaries between data sets dictated by technology legacies have no meaning or significance in data science. Science sees the world’s data as a single universe that is easily, seamlessly and frictionlessly traversed as if it’s one giant database. That is the essence of the Snowflake Data Cloud: world-class workload execution, coupled with practically unfettered data access across clouds, cloud regions and geographies.

Snowflake’s scalability removes the capacity limits that typically affect legacy on-premise data centres. Capacity limits affect concurrent workloads at any one time, placing a key impediment on productivity improvements. Snowflake customers can choose to run as many operational workloads as they want concurrently, constrained only by their financial budgets for their consumption.

Snowflake believes that the legacy on-premise data solutions, or disparate cloud solutions such as infrastructure clouds and application clouds that many companies operate in today, provide the company the biggest opportunities to migrate them over.

Since Snowflake’s platform allows immense scalability potential, the company will also focus on driving increased usage within their existing customers. The company’s direct sales teams will be the key drivers behind this effort to continue driving for more consumption, especially from their larger customers.

Snowflake’s main revenue segment is in the Americas, as EMEA and APAC collectively formed just 15pc of Q4’21 revenue. The company will continue to expand its global footprint in order to capture the growth in multi-cloud adoption worldwide.

They recently announced an ambitious plan of achieving $10bn in revenue by 2028.

Snowflake estimates a $90bn TAM [total addressable market] for the data cloud, but this number could increase with the recent information that “90pc of all the data that has been created were done over the last two years.” If all that data was created within the last two years, can you imagine what the opportunity looks like 10-years from now?

The biggest challenge for businesses trying to use the Snowflake platform is the length of time it takes to get Snowflake up and running, because of the extensive data migration from companies with an on-prem legacy system, moving all that data into the cloud. The average company on the Snowflake platform takes around 249-days before consuming snowflake’s product. The length of time has now been reduced to 212-days. Now imagine, if it takes a company more than 200+ days to patiently migrate data into Snowflake’s cloud, do you think that such customers will easily churn after a few months? Not likely. Hence, companies that are signing up conduct extensive due diligence before making the decision. This is a major strength for Snowflake because customers who have signed up are more than likely going to last on the platform for multiple years. Snowflake has improved its platform optimisation to deliver more value to its customer base. Although a higher time period to use a product leads to high customer acquisition costs, in Snowflake’s case, it is a strong moat that customers are willing to wait so long. It means they will last longer on the platform and it will be very hard to churn.

This is what one analyst has to say about Snowflake’s strategy.

“I believe Snowflake’s long-term ambition is to control a large empire of the entire data analytics and Artificial Intelligence space. For example, Amazon AWS has been built in such a way that almost a third of the entire technology market today touches or is somewhat connected to AWS. Similarly with Microsoft Office suite, in corporate America, it is difficult to not interact with a Microsoft product.I believe that Snowflake’s long-term goal is to be embedded within the entire data analytics and AI ecosystem.”

As a result of becoming an ecosystem that every company running ML [machine learning] and AI computation would eventually touch, this will increase the long-term viability and stickiness of the platform. As part of building the ecosystem, Snowflake has established major partnerships with companies like Deloitte. Consulting firms discussing digital transformation with large corporations can now discuss Snowflake as part of the engagement. It was recently announced at the last quarterly call that Snowflake has surpassed over $100m in deal flow with Deloitte. Snowflake’s aim is to be the central nervous system and unified systems within the data ecosystem and that includes winning system integrators like Deloitte, who spoke glowingly about their partnership with Snowflake at the latter’s Investor Day.

Snowflake has one of the highest ever dollar-based net retention and expansion rates at 168pc, arguably one of the highest DBNER within the SaaS industry. Customers realize that they can run multiple clusters and workloads at the same time. The loyalty of customers gives us some visibility into future revenue. Just as a reminder DBNER is the increase in spending by existing customers during the financial year. Growth from new customers comes on top which helps explain why Snowflake is growing so fast.

I am afraid the above is not the most coherent because I am still building my understanding of Snowflake at the role it plays in enabling technology infrastructure to work effectively. My impression is that the group has remarkable technology and thus a remarkable opportunity. Also, as we can see, the business is growing at an incredible rate.

All this together has contributed to the high valuation and the extreme post-IPO share price volatility. The obvious conclusion is that Snowflake is growing so fast because it is in the early stages of becoming a very large business. If so the shares are worth buying even on a demanding valuation.

In the very long term buying shares on high valuations can prove a sound strategy. This is because high valuations reflect exceptionally rapid growth and it is the fastest growing companies in the early days that go on to become giants over the long haul. Snowflake has the makings of just such a superstar. The business was only founded in 2012 yet is already valued over $100bn. It is clearly providing a service that its sophisticated and knowledgeable customer base finds extremely useful.

The supercharged growth may also reflected the consumption based revenue model. It is effectively tapping into the growth of its customers who are a who’s who of the technology revolution. Snowflake is like a royalty on digital transformation.