The Reinvention of Palo Alto Networks

Palo Alto Networks (PANW) is a business that has been substantially reinvented in the last five years and that is what is driving the strong share price performance.

Our Q4 revenue grew 26pc, marking our 12th consecutive quarter revenue growth north of 20pc. Our billings grew 18pc against a very strong 44pc growth in Q4 a year ago, and RPO [remaining performance obligations] grew 30pc, ahead of our revenue growth. Our Q4 operating margins expanded by 760 basis points, driving $1.44 in non-GAAP earnings per share, and we achieved 39pc adjusted free cash flow margins for the year. Our performance in Q4 did not come as a surprise to us. We’ve been investing in our next-generation security portfolio for some time now to position ourselves in a leadership position for the future of the cybersecurity market.

It is this next-gen portfolio driving that is our growth transformation and enabling our leverage. Lee and his team will expand on this in the forward-looking portion of our program. We achieved several important milestones in this quarter, especially in our software and cloud-based businesses this year. Our combined SASE [secure access service edge], Cortex, and cloud bookings were north of $1bn in Q4. Our Cortex platform surpassed $1bn in annual bookings last quarter, and we achieved the same milestone with SASE this quarter.

We also exceeded $500m in Prisma Cloud ARR [annual recurring revenue]. These product performances have all contributed to the strong growth we continue to enjoy in NGS [next generation security] ARR. Remember that our NGS business is largely a capability new to us in the last five years and is primarily cloud-delivered. This quarter, we added more net new ARR than any other pure-play cybersecurity company. Our platformization is continuing to drive large-deal momentum.

Nikesh Arora, CEO, Palo Alto Networks, Q4 2023, 25 August 2023

No surprise that CEO, Nikesh Aurora, took over the top job in 1 June 2018, when the shares were around $67.

Table of Contents

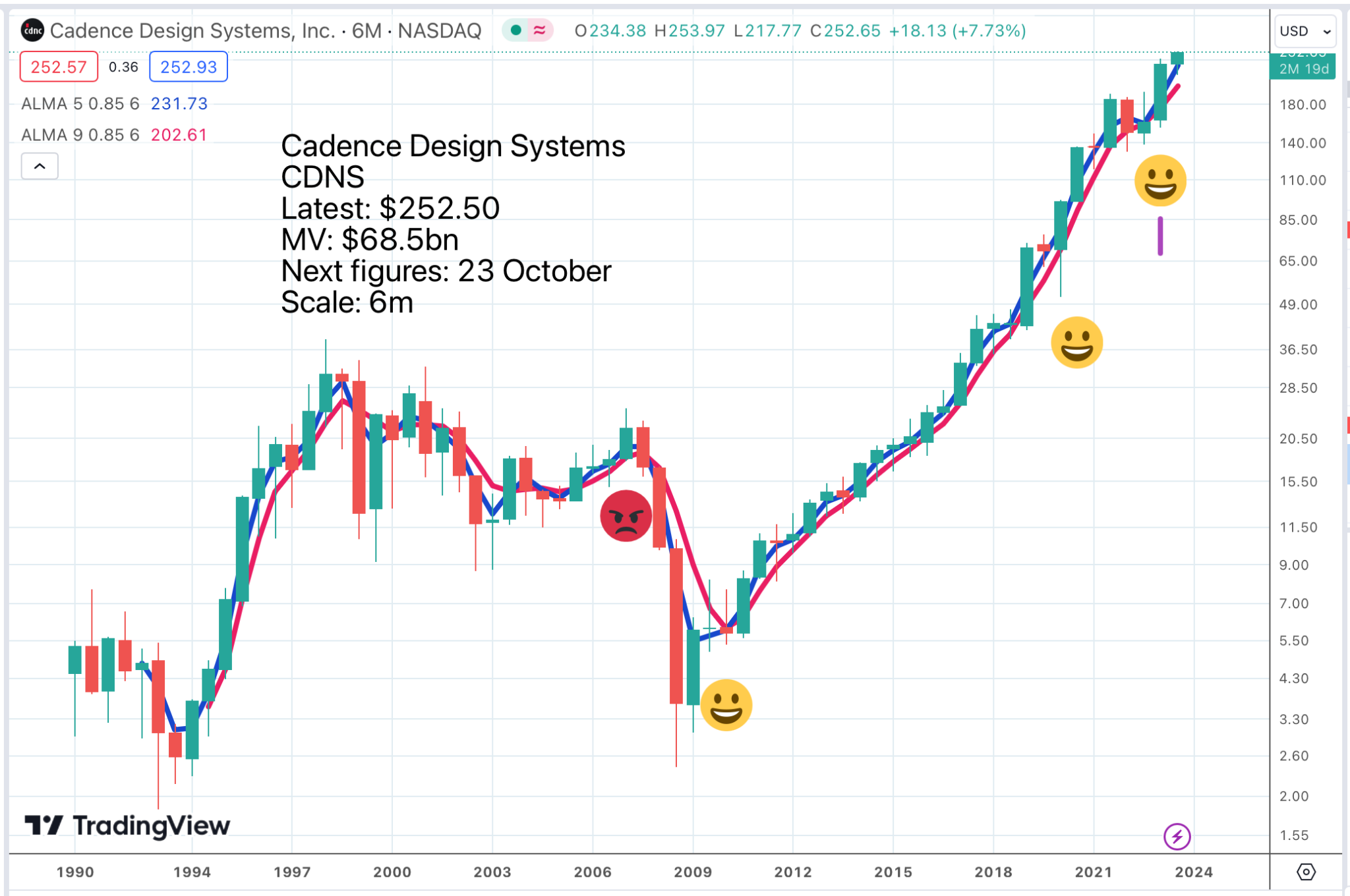

CDNS is operating at the sharp end of Generative AI.

With its unparalleled promise, Generative AI is beginning to make a significant impact globally. Our dedicated focus on AI over the past several years, combined with our computational software expertise and invaluable data that lies at the core of AI, uniquely positions us to deliver to the tremendous potential of this transformational technology.

Anirudh Devgan, CEO, Cadence Design Software, Q2 2023, 24 July 2023

CDNS is playing with the big boys.

Our solutions are enabling marquee AI infrastructure platform companies to deliver their next generation-compute, networking and memory products. For instance, in his Computex keynote earlier this quarter, Jensen Huang of NVIDIA noted that NVIDIA is a big Cadence customer and commented on the expanding strategic partnership between NVIDIA and Cadence to accelerate EDA [electronic design automation], system analysis, AI and digital biology.

Cadence has successfully collaborated with Tesla on the development of their game changing Dojo AI supercomputer. Tesla utilized a broad array of Cadence solutions across digital, custom analog, verification, 2.5D and 3D IC [A 3DIC is a three-dimensional integrated circuit (IC) built by vertically stacking different chips or wafers together into a single package] and system analysis for developing Dojo chips and solutions.

We are very excited to extend our partnership to Tesla’s next generation Dojo and FSD [full service driving] platforms. Our customers, like Tesla, are able to leverage the power of revolutionary Cadence Cerebrus Generative AI technology to optimize the quality of results of their groundbreaking AI chips and related solutions.

Anirudh Devgan, CEO, Cadence Design Software, Q2 2023, 24 July 2023

Like Cadence, Synopsys, is on a Roll.

Technology industry trends are playing to our strength. The AI-driven Smart Everything era is putting positive pressure on the semi-conductor industry to deliver more. Despite economic challenges, semiconductor design starts and R&D investments continue unabated. Our relentless innovation drive has made Synopsys a catalyst for our customers’ success in this new growth era for semiconductors. In fact, the market is playing out much as we expected when we planned the year and we are executing accordingly.

For AI monetization, we see three distinct value stream. First, through our design participation and the explosive growth in demand for AI chips. Second, by pervasively embedding our pioneering AI across our full EDA stack, which we call Synopsis.ai. And third, through AI-driven efficiency transformations, as we optimize and automate our own internal workflows.

In this new era of Smart Everything, these chips in turn, drive growth in surrounding semiconductors for storage, connectivity, sensing, AtoD [analog to digital] and DtoA [digital to analog] converters, power management, et cetera. Growth predictions for the entire semi market to pass $1 trillion by 2030 are thus quite credible. We are uniquely positioned to benefit.

Aart de Geus, CEO, Synopsis, Q3 2023, 16 August 2023

Strategy – New Highs and Promising Consolidations

The US stock market is still convalescing. Against the background of sharply rising bond yields share prices collapsed in 2022, have rallied in 2023 and are currently wobbling around. Market breadth is poor with many shares still sliding and even on plus days for the indices many more shares falling to new 52 week lows than those climbing to 52 week highs.

The market is being sustained by mega caps and Generative AI and those are the shares where I am mostly looking for buy recommendations in the current climate. Observation suggests that the technology revolution is as exciting as ever and based on such metrics as research & development spending at major technology companies the rate of progress is likely to continue accelerating.

Another metric of which I have recently become aware is students doing MAs and PhDs in technology related areas. Back in the day finance used to be where the money was but increasingly it is all about technology and student numbers are exploding.

Warfare still involves boots on the ground as we are seeing in Ukraine and the Gaza Strip but how long will that remain the case. The brutality of modern warfare is horrific but sadly wars are like the ultimate form of consumption with goods being bought and immediately destroyed and the goods in this case are packed with expensive technology. How soon before tanks go into battle with no human personnel on board at all.

Gosh that sounds scary. We will be teaching Generative AI how to fight and when super computers start fighting each other. The mind boggles. In a way that may be what is already starting to happen in the corporate world with all the big players piling up on Nvidia chips to build their own super computing capabilities.

At least we can buy the shares and make some money before we are all enslaved.

Buy signals don’t come with guarantees or investing would be too easy but nevertheless this is an encouraging chart for a long-time QV favourite. The chart shows a broken down-trend line and the shorter blue line moving average clearly turning higher.

The company is positively metronomic in its ability to deliver great results.

I am pleased to report that in the second quarter, we exceeded our guidance across both top and bottom-line metrics, delivering strong durable growth at scale, incredible leverage, and operating within our target model on every metric. Even with a challenging macro backdrop, we delivered an impressive quarter, highlighting CrowdStrike’s structural competitive moat, making Falcon the definitive cybersecurity platform for the cloud era. Financial highlights for the quarter include ending ARR of $2.9bn, up 37pc year over year with record contribution from cloud security, identity protection, and log scale next-gen SIEM together surpassing $500m in ARR; record non-GAAP operating margin of 21.3pc, record non-GAAP net income, which grew 109pc year over year; GAAP profitability for the second consecutive quarter; record Q2 free cash flow of $188.7m; and an over 80pc year-over-year increase in deals involving eight or more Falcon platform modules. Our commitment to operational excellence and the utilization of AI within our platform and across our entire organization is driving enviable leverage in our financial results even as we aggressively invest in fueling growth. We are raising our revenue outlook for the year and bringing in our timeline to sustainably achieve our non-GAAP target operating model.

George Kurtz, CEO, Crowdstrike, Q2 2024, 30 August 2023

As with so many cutting edge technology businesses Generative AI is already playing an important role.

Charlotte AI is the engine powering our portfolio of generative AI capabilities across the platform, utilizing CrowdStrike’s high-fidelity data advantage. Charlotte AI helps Falcon users of all skill levels to do more in the platform by automating workflows, which fuels module adoption and reduces the mean time to detect and respond. The net benefit to customers from our pioneering use of AI in a single platform is faster results, better security outcomes, and lower overall costs, ushering in a new era of machine speed security. We showcased Charlotte AI earlier this month at Black Hat, where we’re the only vendor of consequence to showcase a live, not PowerPoint, demo of generative AI in action. Public reception was fantastic, and we will release Charlotte AI pricing at Falcon.

George Kurtz, CEO, Crowdstrike, Q2 2024, 30 August 2023

Opportunities Look Huge for Crowdstrike

When you look at even the legacy areas almost 50pc of the market is still available from a legacy perspective.

Also the platform areas that we called out are just massive TAM [total addressable market] opportunities. And as I mentioned in the script, they could each be an IPO [initial public offering] business on a stand-alone basis, as big as they are.

George Kurtz, CEO, Crowdstrike, Q2 2024, 30 August 2023

Time to Start Building That Portfolio

As I look at what is happening, there is still a bear market feeling in the market overall but there are also individual stocks looking exciting like the first daffodils of spring. I am again thinking that building a large portfolio could be a great strategy and less stressful than a one or two stock focused strategy.

Also impressive is that these buy signals are taking place against the background of such a dramatic rise in bond yields, which as earlier noted, is Kryptonite for share prices, especially those that seem to have most in common with Superman. In 2021 Crowdstrike was trading on a market value to sales ratio of over 50; it may soon be closer to 10; yet the business looks as exciting as ever.

Share Recommendations

Palo Alto Networks. PANW. Buy @ $259

Cadence Design Systems. CDNS. Buy @ $253

Synopsys. SNPS. Buy @ $495

Crowdstrike CRWD. Buy @ $188