Share prices are like dancers pirouetting around corporate fundamentals

Share prices have always been volatile but they have become more volatile in recent years. This could be a function of globalisation, technological advance and another more recent phenomenon which is much greater retail participation in stock markets, which for decades have been dominated by institutional investors.

Giant investors like pension funds, insurance companies and actively managed investment trusts tend to be slow and steady in their investing patterns. The first two particularly have regular cash flows to invest so rarely become sellers on a major scale. In the past bear markets occurred when they stopped buying because of rising interest rates and fear of recession. They rarely invest with borrowed money.

This pattern may be changing. Prolonged lockdowns slowed consumption more than government-supplemented income leading to a huge build up in savings at a time when interest rates in the developed world were falling to derisory levels. This allied to strong performances by high growth technology companies fuelled growing participation by retail investors aided by the emergence of zero commission trading platforms and other phenomena such as fractional investing (buying less than one share in highly priced companies like Amazon).

Minimal interest rates also encouraged investors to buy shares on margin, often choosing to invest in companies more because their share prices were rising than because of much knowledge or conviction about the underlying fundamentals.

This is a perfect cocktail for volatility. Private investors don’t have regular cash flows to invest. They do borrow money. They panic easily because they have so little idea why they bought a share in the first place. So when the selling/ profit taking starts it quickly feeds on itself and shares can fall astonishingly sharply for little apparent reason.

The underlying excitement is still there so on signs of a rally sellers are as quick to plunge back in as they were to sell. For someone like me who has been investing for decades the wild movements can be both puzzling and testing.

Shares in a company I like, Upstart, which is having a serious go at disrupting huge markets like personal loans and more recently auto loans, is a good example. On 11th May the company reported more than quadrupled earnings on sales up 90pc. Both numbers were well ahead of expectations as was the upgraded full year guidance. In the two days before the figures were announced the price had dived 30pc as jittery investors sold out. In the next two weeks the price roared higher, rising 2.4 times (140pc), from trough to peak before a final wild day in which the price hit $191.89 before closing at $164.

Other stocks including some of the high growth Chinese technology companies are producing even wilder rides. Li Auto (see below and inside) has only been quoted since last July. In that time it has declined to a low of $14.29, rocketed to $47.7, fallen back again to $15.89 and is currently around $25.

Nobody can predict these moves but with staggered buying programmes you can profit from them as long as you choose shares in companies that win in the end.

Carl Zeiss Meditec/ AFX Buy @ Euro150 – “Advancing eyecare every step of the way.”

Li Auto/ LI. Buy @ $25.60 – “The company delivered 4,323 Li ONEs in May…”

Logitech International/ LOGI Buy @ $132 – “What excites us even more is the increase in the number of workspaces if more companies shift to hybrid work.”

Nvidia/ NVDA. Buy @ $688 – “Computing for the age of AI (artificial intelligence.”

Prologis/ PLD Buy @ $122 – “We believe the best years for the company are still ahead of us.”

S4 Capital/ SFOR Buy @ 620p – “We effectively represent a royalty on the growth of digital marketing transformation.”

Up Fintech Holding Limited/ TIGR Buy @ $26.05 – “Total trading volume also surged past US$123.8bn, nearly triple the same period in 2020.“

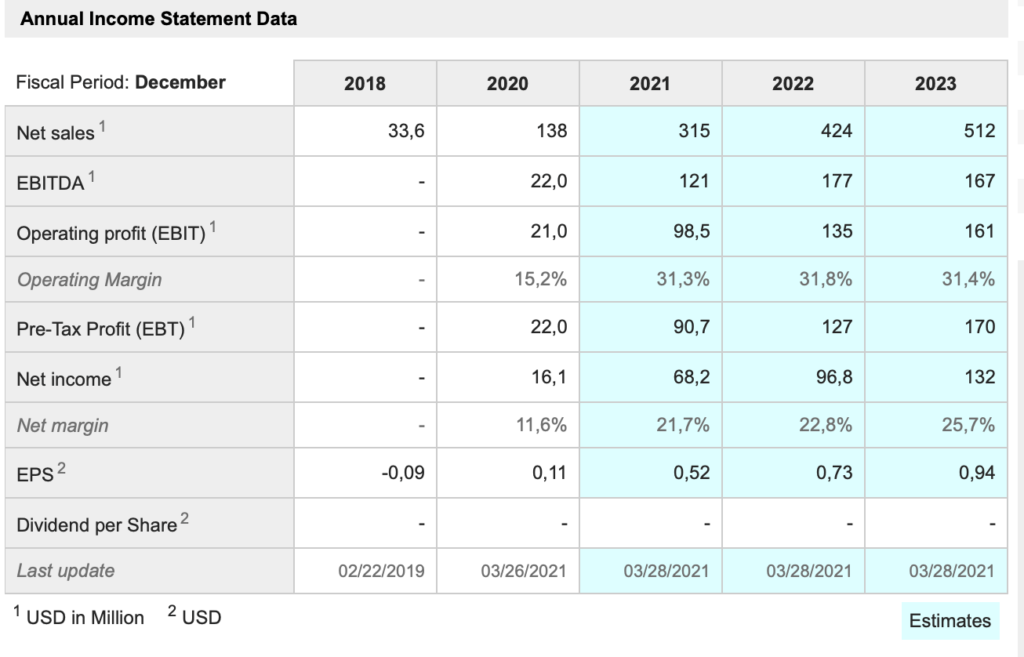

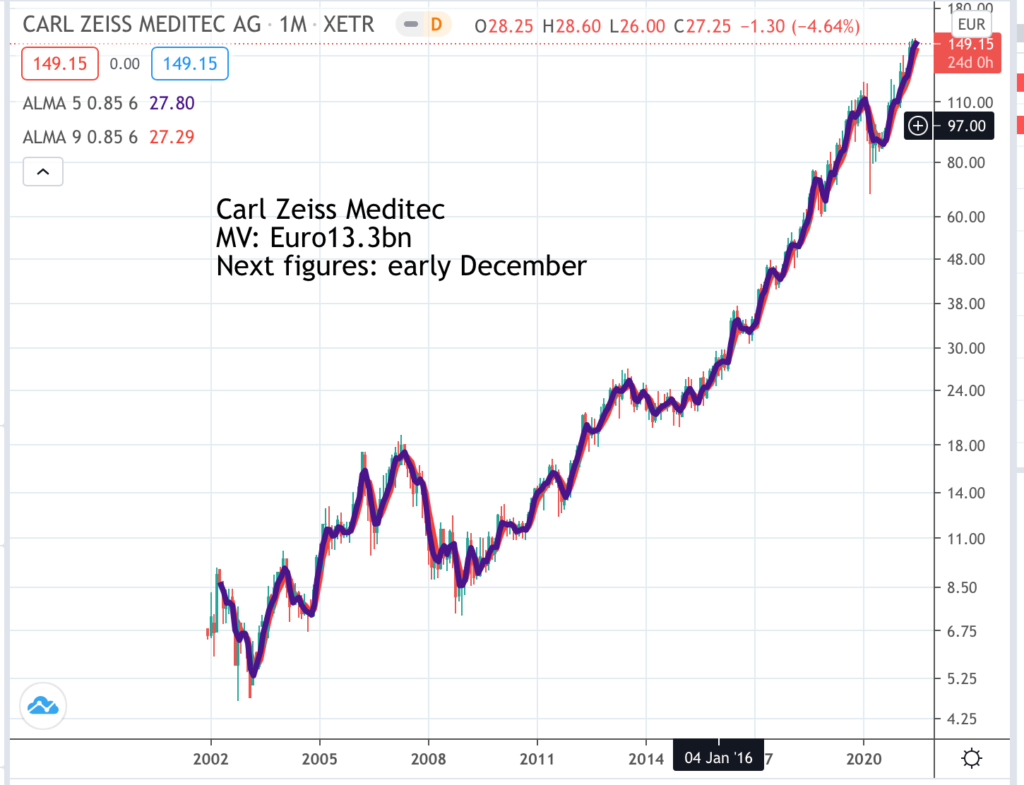

Carl Zeiss Meditec/ AFX. Buy @ Euro 150

Leadership in laser surgery helps Carl Zeiss Meditech grow recurring income and Asia Pacific region as a percentage of sales

In the days before my cataract operations I wore glasses and became very familiar with Zeiss lenses, renowned for their high quality. Carl Zeiss Meditec (AFX) does not make spectacle lenses but is a majority owned subsidiary of an unquoted company called Carl Zeiss AG, which is itself controlled by a foundation with Zeiss in the name. Originally founded by Carl Zeiss in the middle of the 19th century I am not sure if Carl Zeiss AG is the company which makes Zeiss lenses but Carl Zeiss Meditech is more of a medical technology company which makes ophthalmic products for applications such as laser surgery and cataract operations and has another fast growing microsurgery division, making products for dentistry and other applications, which accounts for around a quarter of sales.

The group took its present shape and became quoted in 2002, when it acquired/ merged with Asclepion Meditech. This was a critical deal because it helped AFX become the market leader in a fast growing market for laser surgery to correct problems like shortsightedness and astigmatism.

Not only is refractive laser surgery the fastest growing part of the business but it generates over 60pc recurring revenue from treatment packs and services. It is also very popular in the APAC region, especially China and Japan. Since 2010/11 RF laser has compounded sales annually at 23pc a year giving the business a 25 pc share of the global market with is Smile technology. It haas taken APAC to a 41pc share of group revenues with around 60pc roughly evenly divided between Europe and North America.

The other parts of the group including surgical ophthalmology for conditions like cataracts and glaucoma have grown more steadily but are still doing well. As RF laser surgery becomes a larger part of the business the faster growth in this division is increasingly moving the needle for the whole group leading to accelerating growth.

Features of the latest six months performance, the first half of the 21-22 financial year, including continuing strong growth in sales in the APAC region taking its share to over 46pc of total revenue. Sales and marketing costs fell sharply because of ~Covid-19 leading to sharply higher margins and a 58pc increase in earnings before interest and tax. The microsurgery business was negatively affected by Covid-19 and sales fell in the period although bookings turned positive in the later months.

The strongest performer continued to be RF laser helping the ophthalmic devices business to grow by 14.7pc to account for 76.9pc of total revenue. Overall group revenue grew by 7.4pc and the group expects a good performance in terms of both sales growth and high margins going forward. The exceptional jump in margins was partly caused by lower sales and marketing costs. As these return to more normal levels margins will narrow but still remain elevated.

There are a number of reasons for expecting the group to do well in future including its strong involvement in ophthalmic care across the whole patient lifetime, it’s leading market position, its high spend on innovation and the power of the Zeiss brand. Two other factors cited by the growing are an ageing and more affluent global population and increased healthcare spending in RDE (recently developed economies).

It all adds up to a picture of continuing growth and a strong share price trend for a business that has been a great performer since the 2002 IPO.

Li Auto. LI. Buy @ $25.60

Li Auto goes from start-up in 2015 to sales of 32,624 extended range plug-in hybrid electric vehicles (revenues: $1.45bn) in its latest year

Li Auto is another Chinese company in the electric vehicle space. It’s an exciting space because these companies are playing for massive stakes. Companies which intend to have a range of models in production are inevitably intending to become very large businesses. This means that if they succeed an investment while they are still small and virtually in the start-up phase should be very rewarding.

Li Auto was founded in 2015 by Li Xiang who is currently chairman and CEO. He is a charismatic individual who is frequently compared to Elon Musk. He originally was in partnership with the founder of rival electric car manufacturer, Nio, but the two fell out over strategy so Li Xiang set up his own company with powerful backers like Bytedance and Meituan (a food delivery giant whose shares are in the QV portfolio).

Tesla, Nio and Li Auto all have different strategies for their electric vehicles. Tesla makes EVs, which you charge at home or on route using Tesla’s growing network of charging stations. Nio emphasises its battery swap technology, which offers a speedier solution. Li Auto majors on PHEVs or plug-in hybrid electric vehicles. This means that in addition to the battery it has a fossil fuel engine which acts as a generator to power the battery. The result is massively extended range to a claimed 800km.

So far Li Auto has just one model, the Li 1. I watched a video about it and it does seem to be an impressive vehicle. It seats six or seven, which, amazingly, makes it a mid-sized vehicle by US standards but massive for its intended Chinese customers. The fit out is luxurious with Napa leather seats, four screens fulfilling various functions in the front, the ability to respond to spoken commands so a rear seat passenger can ask the window to open and their window will open and it seems to be very good value at a renminbi price which equates to almost exactly US$50,000.

Just for clarity the fossil fuel motor is not to drive the car but to charge the battery. This means it does not need to be very powerful and is neither very noisy nor heavy on fuel.The car is still heavy at some 2.3 tonnes. It is a beast as one observer described it. He was very enthusiastic about the car but possibly not an entirely objective observer.

As noted in the first page editorial the shares have been spectacularly volatile as they dance up and down around the fundamental performance being delivered by the business. This has been somewhere between very good and amazing. In late May the company announced quarterly revenues in renminbi equivalent to US$546m so an annual run rate well over $2bn. Vehicle deliveries were up 334pc to 12,579 and gross margins were 17.3pc. This is by any standards an electrifying performance (pun intended).

It is understandable that investors veer between enthusiasm and caution given that this is a competitive space and the company is still making losses albeit generating cash.

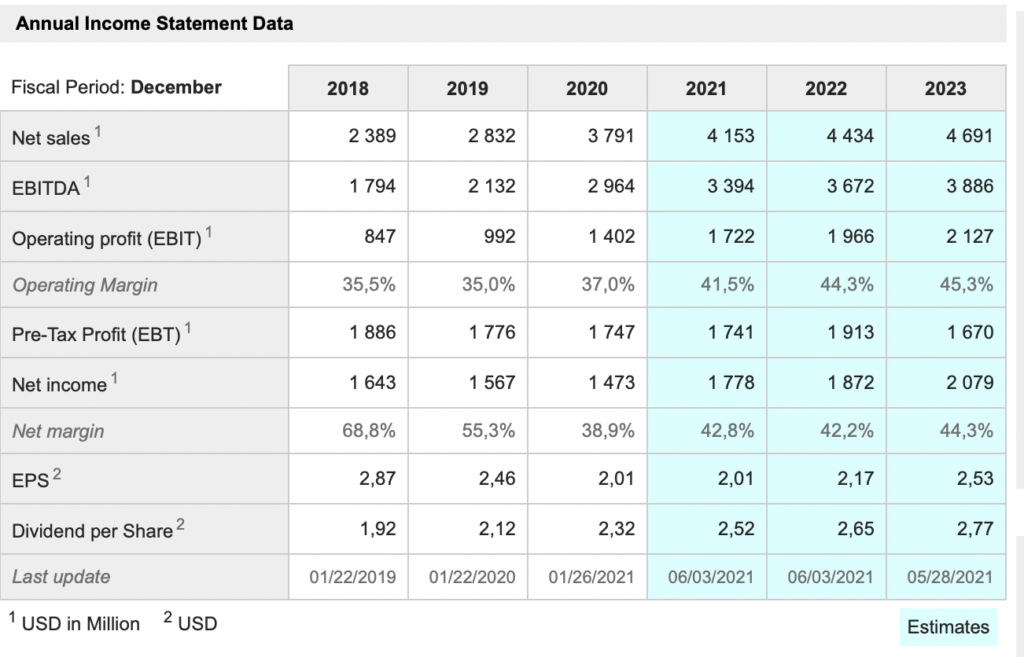

I don’t claim to be any kind of expert on the car industry or regarding electric vehicles. However I am impressed by the energy of Li Xiang. He is clearly a man who walks the talk. The car looks like the real deal, its pricing is competitive and the growth being projected in the table below is suitably explosive.

The footprint of the business is also growing rapidly. “In April 2021, the company delivered 5,539 Li ONEs, representing a 111.3pc increase compared to April 2020. As of April 30, 2021, the Company had 73 retail stores covering 53 cities, in addition to 143 servicing centers and Li Auto-authorized body and paint shops operating in 105 cities.”

In April the group took advantage of a soaring share price to raise US$862m with an issue of convertible notes so it is well funded on attractive terms. The money is to be used to develop new models including a BEV, which is a battery electric vehicle. There is a growing number of acronyms for the differs types of EVs but the Tesla Model S is a BEV. They don’t have fossil fuel generators but typically offer battery configurations with a longer range than the battery only bit for a regular hybrid vehicle, known as an HEV.

The likelihood is that Li Auto is actively researching battery technology with a view to extending the range on its BEV when it arrives and probably offering an even more competitively priced vehicle. If it can do this it really will become a serious player with an excellent prospect of building a large business.

Electric vehicle companies are also all researching and working with players in the autonomous vehicle space so the rush to gain some kind of first mover advantage becomes of critical importance.

li Auto looks to me like a contender referencing something Marlon Brando once said in a famous movie, though perhaps not the ideal home for your life savings given the share price volatility.

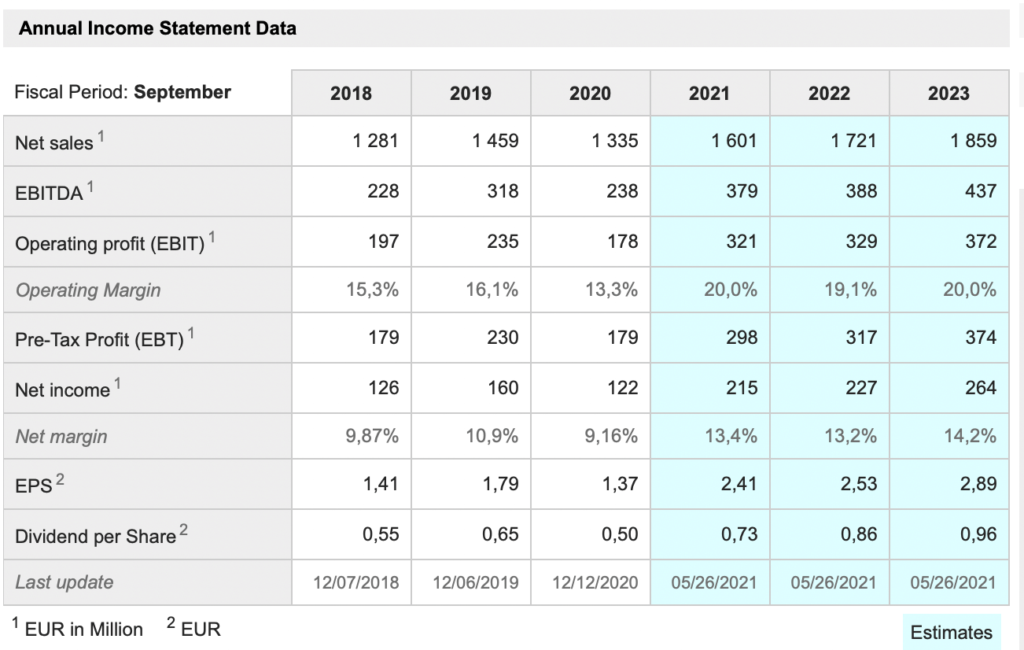

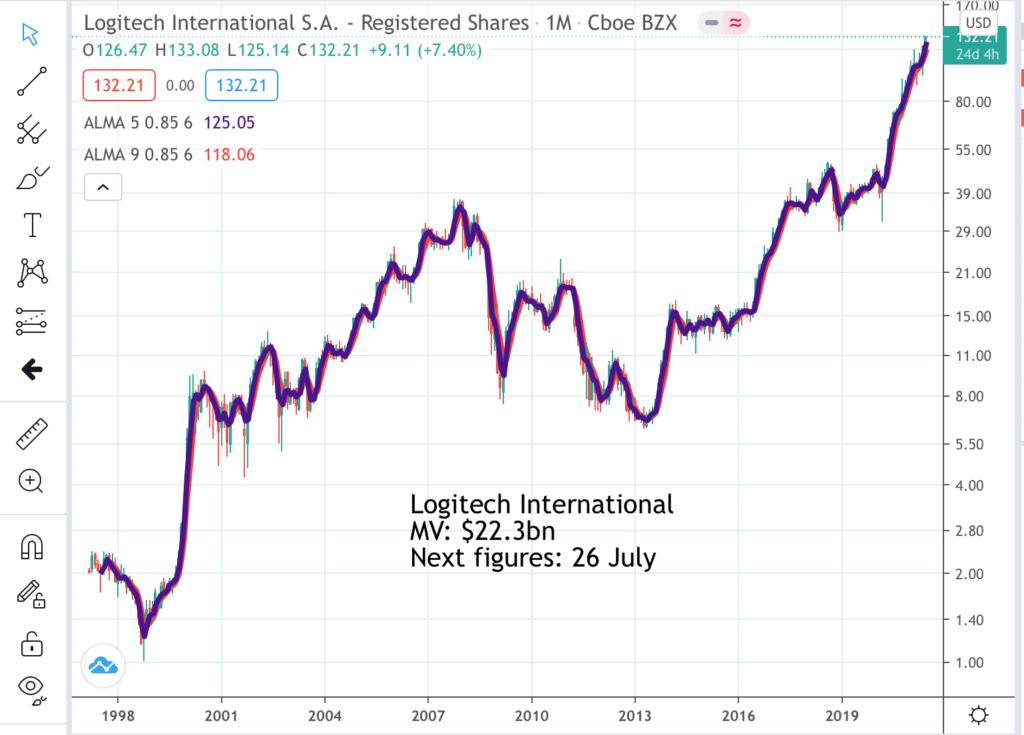

Logitech. LOGI. Buy @ $132

Logitech sees huge opportunities for growing peripheral sales as workers combine work from home with going to the office

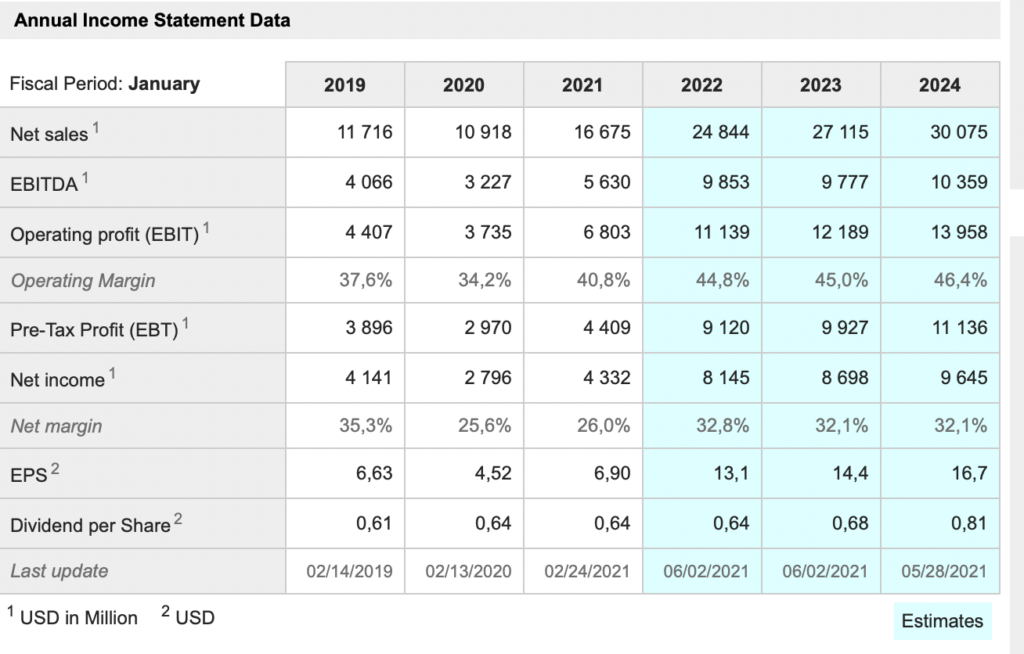

Logitech International is on a similar valuation to Li Auto but with more reassuring short-term fundamentals. Sales are growing strongly, albeit not so explosively as at Li Auto but Logitech has other metrics moving higher such as ebitda, profits, earnings per share and even dividends per share. This is a stock that widows and orphans could think about adding to their portfolio although I am a great believer that in the stock market one should embrace risk rather than always try to avoid it.

Logitech makes peripheral devices to enhance the digital experience. This started with accessories like mice and keyboards for desktop computers but has grown to embrace the cloud connected world of devices and all the activities like gaming and listening to music that make up the experience.

Regular acquisitions have also played an important rule in extending the product offerings and taking the group into new market areas. The company is seeing its growth accelerated by Covid-19 as the world goes through a digital transformation.

As CEO, Bracken Darrell, puts it. “Behaviours that were formed during the pandemic are clearly set to endure. Video callings meteoric rise will not reverse. Most calls are moving permanently to video. A place in your house having one for each person to work or study or do both is here to stay. While gaming was popular long before the pandemic, people are using it more and more for social interaction. This year gaming took an even bigger step towards prominence in our culture. And the number of podcasts, videos, streamers and creators continued to grow throughout the pandemic emboldening more and more people to think maybe they could get in on the streaming act and create video for other people. While our long-term strategy is unchanged our opportunities have changed, they are bigger and they are broader. On top of that we now have a bigger, more profitable base to grow from.”

Basically the tailwinds driving Logitech’s growth are becoming steadily stronger. “What does all this mean for Logitech? More video enabled rooms, more video enabled workspaces that need to be equipped and upgraded with our growing portfolio of offerings, more streamers and more creators looking for more equipment or gamers looking for better gear.”

The group is also appealing to millennial and Gen Z consumers with its strong emphasis on sustainability. All products will now contain a carbon label measuring their carbon impact similar to the calorie labels impacting the food industry.

This is having a dramatic impact on the numbers. “Logitech delivered the best year in our history, with fiscal year 2021 sales up 74pc and operating income more than tripling to $1.3bn. What drove those impressive results was not just one category or one time pull forward. These results were broad based across virtually all our categories and regions, including countries that never fully locked down and those that are furthest along with their post-COVID recovery programs. Said another way, the secular trends we keep talking about are really secular and they are still secular. They will keep growing. Our PC peripherals categories were already growing consistently every year, but they increased over 50pc in fiscal year 2021 to $1.9bn”

The group is not going to keep growing at that rate but the positive trends remain in place, the group is continuing to broaden and innovate its product portfolio. and it will keep finding acquisition opportunities. As Bracken says if people are going to work from home and at the office “This means more mice, keyboards, webcams, speakers, headsets, mikes.”

Prospects for the business look outstanding.

Nvidia NVDA. Buy @ $688

Nvidia’s SOCs (systems on chips) are so key to so many on-line activities it almost is the technology revolution

I know I did Nvidia in the last issue of Great Stocks but since then they have released a stunning set of quarterly figures and the shares look red hot. I think of Nvidia as one of the stocks that stock market historians of the future will look back at and wonder why everybody investing in recent years didn’t buy and hold such an obvious winner from the technology revolution.

The company has its fingers in so many critical pies from video games to data centres to autonomous vehicles. Its products are literally at the heart of the action. The leather jacketed CEO and founder, Jensen Huang, is the epitome of the charismatic technology trailblazing leader. Last but not least the growth and the opportunity look explosive.

As CFO, Colette Kress, put it – “Q1 was exceptionally strong with revenue of $5.66bn and year-on-year growth accelerating to 84pc. We set a record in total revenue in gaming, data centre and professional visualization, driven by our best ever product lineups and structural tailwinds across our businesses.”

I suppose if you want to be the ultimate nit picker you could seize on her use of the word ‘exceptionally’ as pointing to slowing growth going forward but then again a company with quarterly sales of $5.66bn would need a TAM (total addressable market) the size of the solar system to keep growing at that rate for long.

Nvidia invented the GPU (graphical processing interface) chip that is critical to the success of the video gaming industry. They are the reason that instead of games featuring clunky tennis players batting a dot to and fro across a net on a black and white screen we have the increasingly vivid realism and complexity of today’s video games, which are rapidly becoming almost cinematic in quality. Quarterly sales in this sector were $2.8bn, up 106pc from a year earlier.

This is what they say. “Based on the Ampere GPU architecture, the 30 series has been our most successful launch ever, driving incredible demand and setting records for both desktop and laptop GPU sales. Channel inventories are still leading and we expect to remain supply constrained into the second half of the year….The RTX 30 Series also offers NVIDIA Reflex, a new technology that reduces system latency. Reflex is emerging as a must-have feature for eSports gamers who play competitive titles like Call of Duty: Warzone, Fortnite, Valorant and Apex Legends. We estimate that about 75pc of GeForce gamers play eSport games and 99pc of eSports pros compete on GeForce.”

There are so many exciting things going on at Nvidia. “At GTC we announced the upcoming general availability of NVIDIA Omniverse Enterprise, the world’s first technology platform that enables global 3D design teams to collaborate in real time in a shared space, working across multiple software speeds. This incredible technology builds on NVIDIA’s entire body of work and is supported by a large, rapidly growing ecosystem. Early adopters include sophisticated design teams at some of the world’s leading companies such as BMW Group, Foster and Partners and WPP.”

Automotive revenues are still small and stagnating at $164m but it is surely just a matter of time before this takes off. “Atlan, which targets automakers’ 2025 models, will follow the NVIDIA DRIVE Orin SOC [system on a chip] which delivers 254 TOPS [trillion operations per second] that has been selected by leading vehicle makers for production timeline starting next year. The NVIDIA DRIVE platform has achieved global adoption across the transportation industry. Our automotive design win pipeline now exceeds 8bn through fiscal 2027. Most recently Volvo Cars announced that it will use NVIDIA DRIVE Orin, building on our next great momentum with some of the largest automakers including Mercedes-Benz, SAIC and Hyundai Motor Group.”

Last but definitely not least is data centre, which will be strengthened by the acquisition of Cambridge based Arm Holdings. “Moving to Data Centre – revenue topped $2bn for the first time, growing 8pc sequentially and up 79pc from the year-ago quarter, which did not include Mellanox (an Israeli tech company acquired in the last 12 months)”.

In a way nothing changes at Nvidia. They are always bursting with exciting about prospects and bringing amazing new products on stream but they are the very definition of wow! I will be amazed if they do not join the $trillion club in the not too distant future.

Prologis. PLD Buy @ $122

US logistics property specialist, Prologis, sees a perfect storm driving rents, values and replacement costs higher worldwide

In the USA property companies are called REITs (real estate investment trusts). They have to distribute all their earnings in dividends, which makes them attractive to investors seeking income. Prologis is a REIT with a difference because it specialises in owning assets which form the backbone of the Internet. There is one thing the Internet cannot do virtually and that is deliver the stuff that consumers have bought from businesses, B2C, or that they have bought from each other, B2B. The bigger the world of e-commerce and digital transformation grows the more important this logistics backbone becomes.

Prologis has been creating and acquiring assets at a rapid rate such that it has 92m square metres of owned or co-owned facilities in 19 countries. It leases these assets to a diverse customer base of 5,500 companies.

In its quarterly report released on 19 April for the quarter ending 31 March the company explained why demand for its assets was so strong. “There is great momentum moving through the supply chain that is signaled by retail sales, import volumes and rising inventory levels. This will continue as inventory to sales ratios have just begun to rise as companies race to keep pace with demand.”

This is feeding directly through to activity at Prologis.“Given our high volume of lease signings, our operating portfolio was 96.4pc leased at quarter end. Our leasing mix continues to broaden with strong demand continuing from space sizes above 100,000 square feet and small spaces demand is improving.”

It is as much about an improving economy as it is about e-commerce. “E-commerce demand remains elevated, representing 25pc of new lease signings in the first quarter. The balance of leasing is diverse, with outsized growth among companies that provide food and consumer products as well as renewed momentum in the construction segment as housing expands. In the U.S., we now expect net absorption of 300m square feet in 2021, which would be the highest in history.”

It is evident that supply is becoming tight. “Many of our markets faced shortages of land logistics uses. In addition, obsolescence and conversions to higher and better use have added to this broad-based scarcity. Vacancies are below 2pc in many of our top markets such as Southern California, Toronto, Germany’s main markets and Tokyo. Our supply watchlist continues to include just four markets. Houston, Madrid, Poland and West China, which taken together account for just over 5pc of our NOI.”

And replacement costs are rising sharply. “More recently, we’ve begun to see a rapid acceleration in replacement costs. In the U.S., we expect replacement cost to increase 20pc to 25pc over the two-year period through 2021, the fastest rate ever.”

These pressures are being reflected in rising rents and valuations. “Rent growth for the quarter, which was up 2.4pc in the U.S., outperformed our expectations. We are raising our 2021 rent forecast to 6.5pc in the U.S. and 6pc globally. Our in-place to market rent spread now stands at 13.6pc up 80 basis points sequentially. This represents future annual incremental organic NOI [net operating income] growth potential of more than $600m. Turning to valuations, logistics assets values are up a record 7.5pc over the last two quarters.”

This creates a favourable situation for a company which already owns a substantial portfolio. “We estimate that the value of our real estate rose by more than $10bn over the past two quarters.”

Prologis uses debt finance at low rates from the bond markets and this leverage adds to the rate at which rising values boost assets per share, while rising rents raise the group’s dividend paying capacity.

Bottom line, Prologis is looking at a glittering future. “Our efforts over the past 10 years to reposition the portfolio and balance sheet have set us up to outperform in 2021 and beyond. You’re probably tired of us saying this, but it continues to be true, we believe the best years for the company are still ahead of us.”

S4 Capital SFOR Buy @ 620p

Martin Sorrell, one of the greatest acquirers of our age, sees S4 Capital as like a royalty on the growth of digital marketing

Once described by the august founder of a business he acquired as a poison dwarf or words to that effect, Sir Martin Sorrell has had an extraordinary career and has a reasonable claim to be regarded as the most accomplished acquirer of media assets on the planet. He helped the Saatchi brothers build their advertising empire to such effect he was known as the ‘third Saatchi”. He then took a tiny shell company called Wire & Plastic Industries, what might now be known as a SPAC, and turned it into the advertising behemoth, WPP. Now he is doing it again but purpose-built for the digital age with his latest venture called S4 Capital.

I can remember reading Saatchi & Saatchi annual reports which literally were a full-on tutorial on the advertising industry and were it was going or should be going. They were fascinating and obviously on the money because Saatchi & Saatchi delivered one of the longest periods of sustained strong growth ever achieved by a UK-quoted company. How much of that was the Saatchi brothers and how much Martin Sorrell we may never know but evidently there was plenty of talent around.

It is almost staggering to see how fast the new group has moved, going in their words from a peanut to a unicorn (value over $1bn/ £1bn – actually over $4bn/ £3bn) in just two years with a string of acquisitions made and over 4,400 employees in 31 countries.

One of the challenges the group has set itself is to have 20 ‘whopper’ clients generating over £20m in billings annually. It has already reached five making that 20 target look very achievable.

Covid-19 has been a negative damping down activity and ad spend but also a positive speeding up the move to all things digital which is good news for a business like S4 Capital which describes itself as purely digital.

The shares have been powering steadily higher since March 2020 partly because the pandemic sell-off was absurdly overdone, especially for digital businesses like S4 but also because of a stream of m&a activity and other good news from the business.

The recent quarterly update showed the business powering ahead. There are now almost 5,000 employees and latest like for like sales and profits grew buy 35pc. “A strong rebound in global GDP growth in 2021 and 2022″ will drive 20pc per annum growth in digital advertising, as the pandemic accelerates digital transformation. The company will now target even stronger sector leading 30pc like-for-like revenue and gross profit growth (up from 25pc previously) and strong operating EBITDA margins in 2021.”

As a result the group sees a strong chance of realising its three year target of doubling in size organically. It is also planning to increase its fire power with a bond issue.

You almost wonder why Sorrell is doing all this. He is at least 73 years old and worth several hundred million pounds. He must just love playing the game, doing something he is exceptionally good at and maybe making a contribution along the way.

The company partly explains its success by saying – “As we effectively represent a royalty on the growth of digital marketing transformation, we have benefited from our clients continuing to increase their investment in digital content and data & digital media.”

The shares are highly rated on a prospective PE ration approaching 100 but that reflects the outstanding growth, the near certainty of further earnings enhancing acquisitions, the premium for having Sorrell at the helm and the value of a royalty on digital transformation.

It looks a price worth paying to me.

Up Fintech Holding Limited. TIGR. Buy @ $26.05

Massive shift in investment flows from institutions to diy retail investors powers explosive growth at online share trading platforms like Up Fintech

UP Fintech Holding Limited (TIGR) is an online share trading platform. It is similar to the incredibly fast-growing Futu Holdings, which has been alerted numerous times on QV and recently reported outstanding results including a hugely successful launch in Singapore. TIGRt has also been described as the Asian Robinhood. The latter is a US share trading platform with a hotly anticipated circa $50bn IPO likely some time this year.

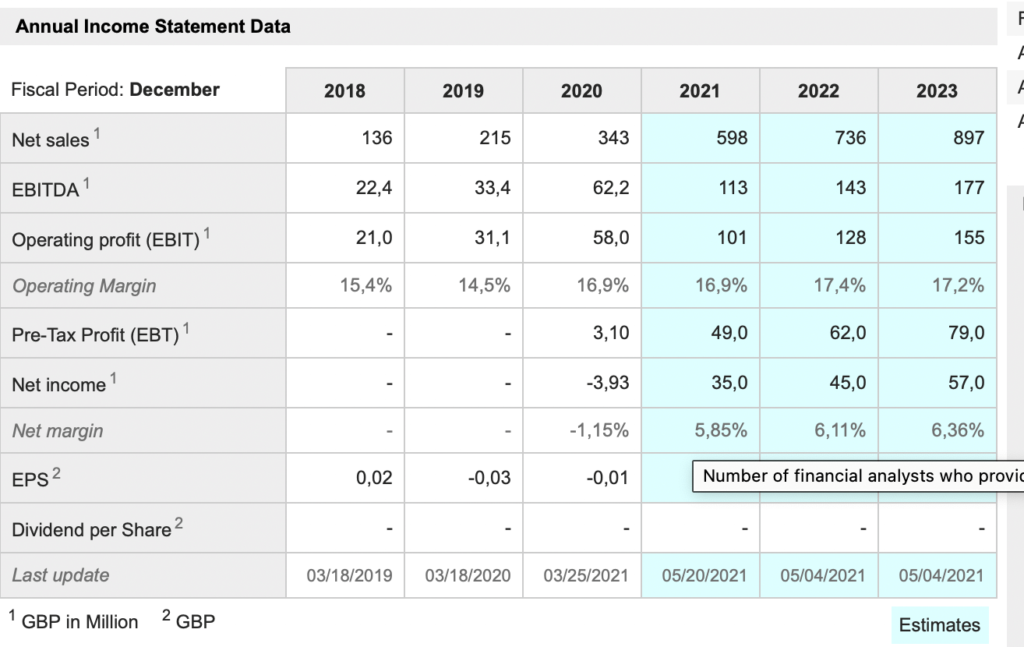

TIGR is much smaller than Futu, which in turn is smaller than Robinhood’s expected valuation. This gives TIGR considerable speculative appeal, albeit that none of these staggeringly fast growing businesses would be top of mind for widows and orphans. That, of course, is what makes them so appealing for the QV portfolio, which is all about aggressive growth.

The rate at which these online trading platforms is growing is spectacular. So much so that they are changing the investment landscape as a new army of retail investors discovers global stock markets and especially fast-growing US and Hong Kong quoted technology stars, for the first time. I think it is a bit like the French Revolution with the peasants storming the Bastille and bringing in a whole new order.

If we view TIGR, Futu, Robinhood and others as the enablers of this revolution we can see (a) why they are growing so fast and (b) why they may continue to grow rapidly for the foreseeable future. Like the technology revolution itself this whole thing, diy investing on a global scale, might be just getting started.

Below are a few snippets, taken from the Q1 2021 earnings report, to give the flavour of what is happening at TIGR. “Total revenues were US$81.3m, a 255.5pc increase from the first quarter of 2020, and were bolstered by solid increases in commissions, interest income, and revenues derived from our corporate business….We added over 117,000 funded accounts, and the aggregate value of assets clients allocated to our platform surpassed US$21.4bn. Total trading volume also surged past US$123.8bn, nearly triple the same period in 2020…..Market adoption of our ESOP [employee stock ownership programme] service has been phenomenal; we added 41 clients in the first quarter and now serve 165 in total. On the investment banking side, in the first quarter we participated in 14 IPOs, of which we underwrote eight. Most notably, our U.S. subsidiary served as the lead bank in an IPO for the first time. In just over two short years, we have become a leading underwriter for assisting new economy corporate clients raise financing on international capital markets and we look forward to serving them with the wide range of capabilities integrated into our fintech ecosystem….. Our innovative platform is attracting new investors across a diverse range of countries. We continue to gain momentum in the Singapore market and added new features to our suite of trading products available for local clients, namely U.S. over the counter (OTC) equities, daily leverage certificates, as well as our digital wealth management product, The Fund Mall, which empowers investors to allocate their capital across a rich range of global mutual funds that span numerous countries and asset classes.”

This is growth on a par with or ahead of what was happening to the US economy in the 19th century when it overtook the UK and spawned a whole generation of US millionaires and multimionaires. These are phenomenally exciting times for these companies and for their investors.