Some observers are looking at the Gamestop affair (google Gamestop if you don’t know what that is) and arguing that the stock market is frothy and overdue a correction. Even if that is true and I am not sure it is, I also think something more important is happening. After decades of domination by institutions and hedge funds, retail investor numbers are exploding around the world and this is going to make a huge difference to markets and share prices going forward. Personally, I think it is really good news.

Retail investors, what in the old days were known as private clients, used to be an important factor in stock markets, especially between the wars. After the second world war savings were channeled into pensions, life insurance, unit trusts and hedge funds and the private client became a dying breed.

Now he is coming back as the hedge funds short selling Gamestop shares found to such dramatic effect last week. Wow! Some smug hedge fund managers, who thought they were the masters of the universe, have just learned a sharp lesson.

Three things are bringing back the private investor. First, is the long bull market. When interest rates are low or even negative, rising share prices look very appealing. Second, is easily accessible commission free trading from platforms like Robinhood. Third, is social media and the availability of huge amounts of information, which levels the playing field between amateur and professional investors. We can all be experts now.

This return of private investors is going to bring huge new flows of money into shares and that will help drive the bull market. It is also joining with another powerful force, the technology revolution, with ever-faster chips, artificial intelligence and super-fast 5G networks driving an accelerating pace of change.

This bull market is no accident and nor is it a bubble. Shares are rising because the businesses driving and riding the technology wave are growing faster and for longer than any businesses in history. It is an amazing time.

Argenx SE/ ARGX Buy @ €307 – “We know that FcRn antagonists, as a new class of medicines, have tremendous potential to transform the treatment of serious autoimmune diseases”

Etsy/ ETSY Buy @ $231 – “We have more conviction than ever that Etsy’s mission to keep commerce human is incredibly powerful.”

O’Shares Internet Giants ETF/ OGIG Buy @ $61.42 – “The companies in OGIG create a portfolio of digital empowerment and digital transformation of the economy.”

Par Technology Corp./ PAR Buy @ $79 – “We are in the very early innings of a generational change in restaurant operations.”

ServiceNow Buy @ $589 – “In 2020, for the first time in history, we saw digital transformation spending accelerate despite GDP declining globally.“

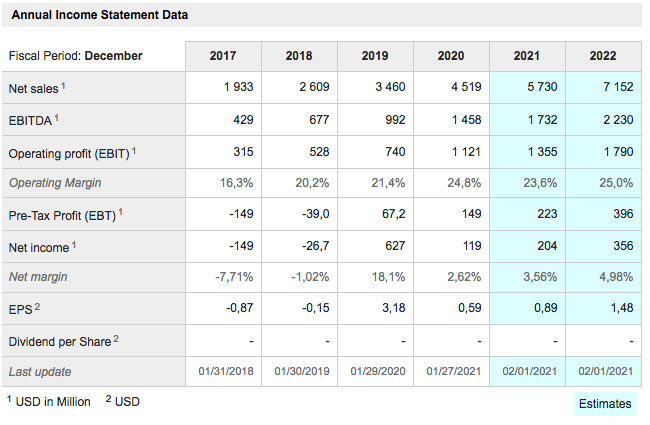

Silvergate Capital Corporation SI Buy @ $126.50 – “As we look to 2021 and beyond, I’m extremely excited about the opportunities and multiple areas of growth ahead.”

Tencent Buy @ HK$733 – “This quarter marked the second anniversary of our strategic organization upgrade intended to enhance our strength in consumer Internet and extend our presence to industrial Internet.”

Tesla Buy @ $854 – “Musk wants to eventually build 20m electric vehicles a year over the next decade.”

Argenx SE Buy @ €371 Times recommended: 3 First recommended: €190 Last recommended: €253

Argenx raises US$1bn to drive development of exciting drug pipeline

Argenx is a Belgian bio-pharma working to develop new drugs to target rare auto-immune conditions. It plans to launch its first drug, efgartigimod, in 2021 and recently signed an agreement with a fast-growing Chinese biopharma, Xai Lab Limited (also in the QV portfolio) to develop, make and market the drug in China.

In another signal of intent Argenx has just raised US$1bn in a global share offering, which was very well received. We know they are ambitious because in 2019 they said “During the past year, we transformed into a late-stage clinical development company ready to run five registrational and seven earlier-stage clinical trials. This momentum fuels our ambition to have five product launches in five years starting in 2021.”

Most recently the company announced. “We are excited to enter a new chapter for argenx as we look toward commercialization and achieving our mission of reaching patients with debilitating rare diseases. We’ve submitted a BLA [a biologics license application[ to the FDA [US food and drug administration] for efgartigimod in gMG [refractory generalized myasthenia gravis – a condition causing muscular weakness] and expect to have global efgartigimod trials ongoing this year in six indications and two formulations.

We hope to continue to demonstrate the broad opportunity of our FcRn antagonist within autoimmune diseases in 2021 and beyond,” said Tim Van Hauwermeiren, chief executive officer of argenx. “In parallel, establishing global commercial infrastructure within the U.S. and Japan continues to be a top priority. Now through our collaboration with Zai Lab in China and with the appointment of a general manager in Europe, we’ve solidified and accelerated our capabilities to bring efgartigimod and our future immunology candidates to patients worldwide.”

Like most of you I don’t really understand what they are talking about in this rarified world of developing new drugs with unpronounceable names. I try to choose the wheat from the chaff among biopharmas by applying my 3G principles – great story, great chart, great growth. Argenx ticks all the boxes for me and I think they are a major biopharma in the making.

What is also clear is that the industry is in a ferment of excitement and huge sums are being raised for research.

Etsy Buy @ $231 Times recommended: 12 First recommended: $30 Last recommended: $210

Covid-19 puts a rocket under Etsy and helps a fringe player move to the mainstream

Etsy is an American e-commerce website focused on handmade or vintage items and craft supplies. The site follows in the tradition of open craft fairs giving sellers personal storefronts, where they list their goods for a fee of US$0.20 per item.

As of 31 December, 2018, Etsy had over 60m items in its marketplace, and the online marketplace for handmade and vintage goods connected 2.1m sellers with 39.4m buyers. At the end of 2018, Etsy had 874 employees. In 2018, Etsy had total sales, or gross merchandise sales (GMS), of US$3.93bn on the platform.

I have recorded these figures so we can look at what has happened since 2018. A key earlier development was that in May 2017 the board replaced CEO, Chad Dickerson, with Josh Silverman. Among other things he raised the percentage that sellers on the site had to pay when they made sales. In July 2019 the group bought the music based marketplace, Reverb, for $275m.

Then came Covid, e-commerce generally exploded and in April 2020 Etsy issued a call to all sellers to make masks, which on a recent count represented 11pc of total sales. Now we can fast forward to the Q3 figures released on 22 October. Blast-off hardly does justice to what is happening.

“Active buyers grew by 56pc year-over-year to 69m active buyers for the 12 months ending in the third quarter. And that’s out of a total base of 138m unique buyers who’ve ever bought on Etsy. So one way to interpret that is that half of everyone who’s ever bought on Etsy has bought in the last 12 months.

We’re seeing a real step function increase in purchase activity from all of our prior cohorts. About 50pc of that was purchases of non-masks and about 10pc was the purchase of masks.

If we look at the second quarter of 2020, you’ll see that overall e-commerce grew at an astonishing 45pc year-over-year. That number would have been unthinkable a year ago. But Etsy grew more than twice as fast. And again in the third quarter, you’ll see Etsy’s growth was sustained. So we expect that Etsy gained significant market share yet again versus the overall e-commerce.”

Helped by this step change in the scale of the business Etsy is moving aggressively onto the front foot. They are making dramatic improvements to the search function so that search will use data about the searcher to refine the search results. They are stepping up advertising to raise awareness and also spending heavily on the infrastructure of the business.

In the years immediately after the IPO Etsy looked like a player on the fringes of e-commerce; that perception has changed with a vengeance. As Joel Silverman puts it “we believe that Etsy has an incredibly compelling growth potential for months, years and decades to come. And we have a lot of conviction around making the investments that are going to allow us to achieve that full potential.”

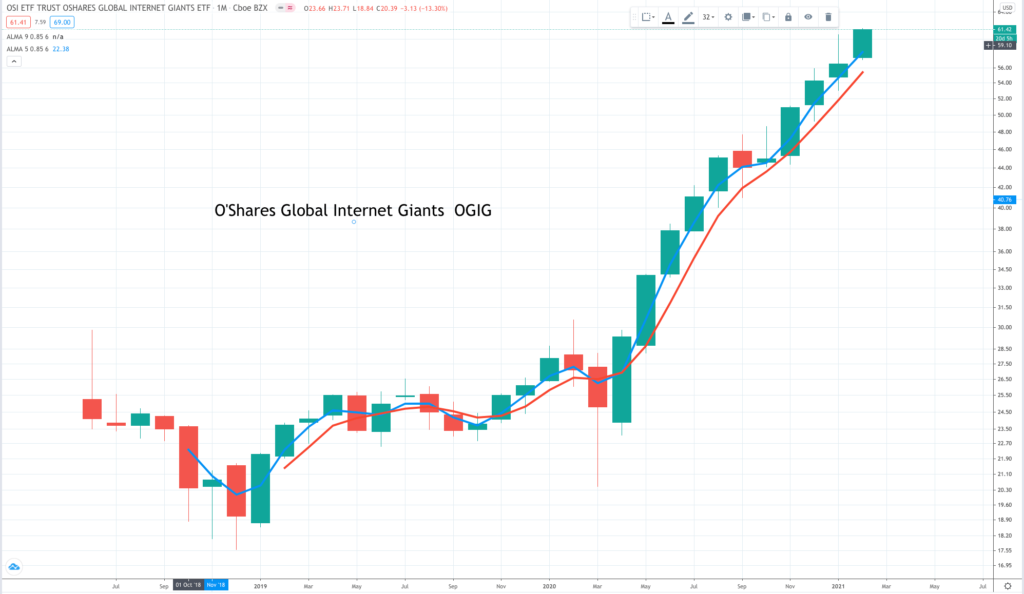

O’Shares Global Internet Giants ETF/ OGIG Buy @ $61.42 Times recommended: 7 (includes six times recommended in Quentinvest for ETFs) First recommended: $34 Last recommended: $58.50

OGIG is the nearest thing in ETFs to a proxy for the Quentinvest share portfolio

I don’t usually write about ETFs in Great Stocks. ETFs are shares, bought and sold in the stock market like any other shares but they are not businesses. Instead they are what they say on the tin, tradeable portfolios of shares. I am putting OGIG in Great Stocks partly because it is managed differently to most ETFs, more actively if you like but mainly because it is special. In the Lord of the Rings trilogy there were quite a few rings, duh but there was also the one ring, the ring to rule them all. OGIG is a bit like that in the world of ETFs but without the evil. You won’t turn into Gollum if you buy the shares.

Most ETFs track indices like iUSA, an ETF, which tracks the S&P 500. Funds like that are known as passive trackers, no thinking involved so management fees are very low (a total expense ratio of 0.07pc).

OGIG tracks an index but a special one constructed according to proprietary in-house rules. This means OGIG is not really a passive index tracker but more a fund managed according to a set of rules and those rules are expressly designed to make OGIG a very exciting performer. Its expense ratio is 0.48pc but that is still low and very good value for the performance being delivered.

This is the key element in the description of the fund. “O’Shares Global Internet Giants ETF (OGIG) is a rules-based ETF designed to provide investors with the means to invest in some of the largest global companies that derive most of their revenue from the Internet and e-commerce sectors that exhibit quality and growth potential.”

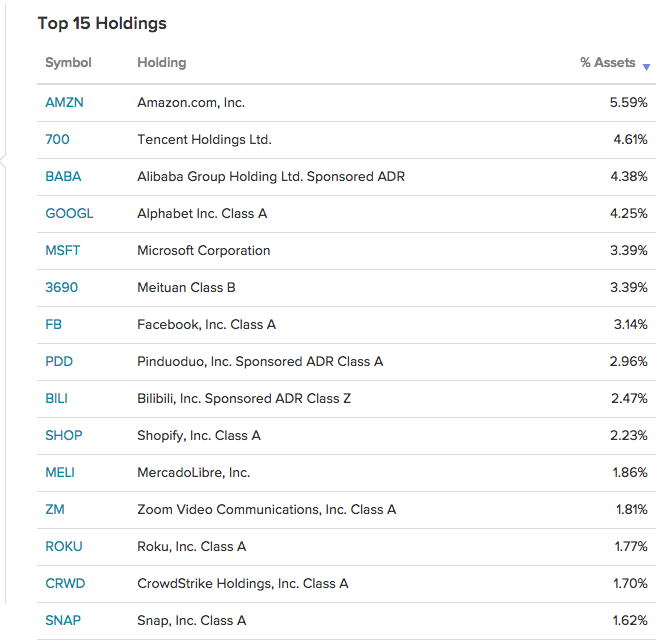

Quality and growth potential is exactly what I am looking for in Quentinvest for Shares so no surprises that the shares that find their way into OGIG are very like the shares I choose for QV for Shares. Below is their list of top holdings.

I feel like echoing John McEnroe’s famous expression – “You can’t be serious”. Every single one of these stocks is in the QV for Shares portfolio, most of them have been there for years. Talk about great minds think alike. I love this ETF. How could I not?

Par Technology Corp. Buy @ $79.18 New entry

New leadership takes restaurant POS hardware supplier, Par Technology, on a journey to the cloud

Par Technology is a global market leader in providing point of sale (POS) systems for restaurants, used in over 100,000 locations in 110 countries. It also has a smaller business providing solutions for governments, which they describe as strategic, which probably means it will be sold one day.

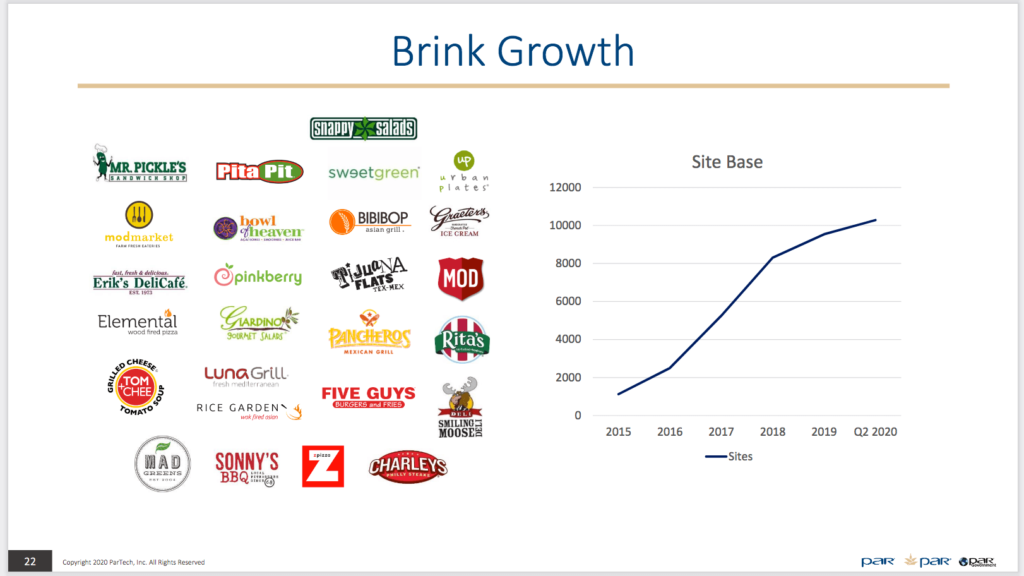

The reason why the shares are shooting higher is that these assets on the restaurant side are being used as a springboard to build a much more exciting business in the future, a cloud technology business generating SaaS (software as a service) recurring revenue. This new business is called Brink and it is already growing fast. The chart below shows what is happening with a slight Covid-inspired slowing of the rate of growth latterly as the restaurant industry hit a lockdown brick wall.

Part of the trigger for this new sense of purpose and excitement at Par Technology is the arrived at the end of 2017 of Saveet Singh as CEO of the business. Singh is both a serious technology player and a high-energy individual with venture capital experience. It is no surprise that his arrival has been a wake-up call for the company.

I have been looking at a 2020 presentation by the company and the associated letter from the CEO. They make electrifying reading. Here is a sample. “Over the last year, we have gone through a deep restructuring, divested an asset, acquired two businesses, completed two large fund raises, rebuilt the management team and,most importantly, emphatically driven our culture in a new direction. We did all this, while adding significant resources to our product and pushing a culture of transparency and accountability with our customers.”

What is the end game for all these efforts. “Our goal is to become the world’s largest restaurant technology business.” I love it when I see that level of ambition with a company, which is already delivering tangible results in its progress towards that goal. And PAR is staring from a great place. They already have their hardware in 100,000 locations so they are preaching to the converted.

This transition from a legacy business model to the cloud, the exact journey which Par is on, has been a game changer for some important businesses. Think Microsoft, Adobe, Intuit (accounting software) and even Netflix as it transitioned from DVD rental to video streaming. It could easily be a game changer for Par too and their chart (see above) is consistent with a massive move.

Par has another classic 21st century enterprise software business strategy too, which is to add more products so that the average revenue per user (ARPU) goes up. More customers each paying more can drive dramatic growth in revenue. As part of this strategy the company has acquired Restaurant Magic to add back office services to its customer facing offerings. It also acquired 3M Drive-Thru Communications Systems, which supplies wireless head sets for staff taking customer orders.

I think this business is just starting on a new era of strong growth.

ServiceNow Buy @ $589 Times recommended: 8 First recommended: $243 Last recommended: $583

ServiceNow prospers as the go-to business for companies as they progress on the journey to digital transformation

Software solutions provider, ServiceNow, is not a newly emerging star. On the contrary this is such an outstanding business that in October 2019 they were able to persuade Bill McDermott, the first American CEO of European software giant, SAP, to leave that job and become the new CEO of ServiceNow. Since when the company has continued to go from strength to strength.

ServiceNow is totally a 21st century company, founded in 2004. One brief description says the business ‘develops a cloud computing platform to help companies manage digital workflows for enterprise operation’. Here is what they say. ‘Our 6,200+ global enterprise customers include nearly 80pc of the Fortune 500. They all rely on ServiceNow solutions using the Now Platform—the intelligent and intuitive cloud platform—for successful digital transformation.’

Investors were delighted when the company reported its Q4 2020 results and the shares moved strongly higher. As McDermott noted. “We significantly beat expectations across the board, bringing great momentum into the new year. We delivered over 30pc organic top line growth, 25pc operating margins and $1.4bn in free cash flow, just an outstanding performance and a testament to our ServiceNow strong culture.” The company has 12,643 employees and is a magnet for top technology talent.

Like others, ServiceNow is surfing a mighty technology wave. “The secular tailwinds of digital transformation, cloud computing and business model innovation have all intersected at a perfect moment in time. A paradigm shift is happening worldwide. In 2020, for the first time in history, we saw digital transformation spending accelerate despite GDP [gross domestic product] declining globally. Digital investments are at an all-time high and are expected to continue growing. According to IDC, worldwide digital transformation investments will total more than $7.4 trillion by 2044. the digital economy is firing on all cylinders. ServiceNow is the platform company for digital business.”

I still don’t now exactly what they do but here is a clue. “The Now Platform, what I call the platform of platforms, offers the speed, flexibility and innovation companies need. Our simple low-code app development enables fast workflows to solve any business challenge, delivering consumer-grade digital experiences. And Now Platform enables easier and faster implementation, delivering unbeatable time to value and fast ROI [return on investment]. That’s the beauty of the Now Platform: One platform, One data model and One architecture.”

The business is one fire. “We grew billings by more than 40pc year over year organically. We delivered 89 deals greater than $1m and now have close to 1,100 customers paying us over $1m annually.”

The world clearly needs ServiceNow. Who is to say this won’t be a trillion dollar business one day.

Silvergate Capital Corporation Buy @ $125.50 New entry

Customer numbers explode at Silvergate, the bank offering dedicated services for digital currencies

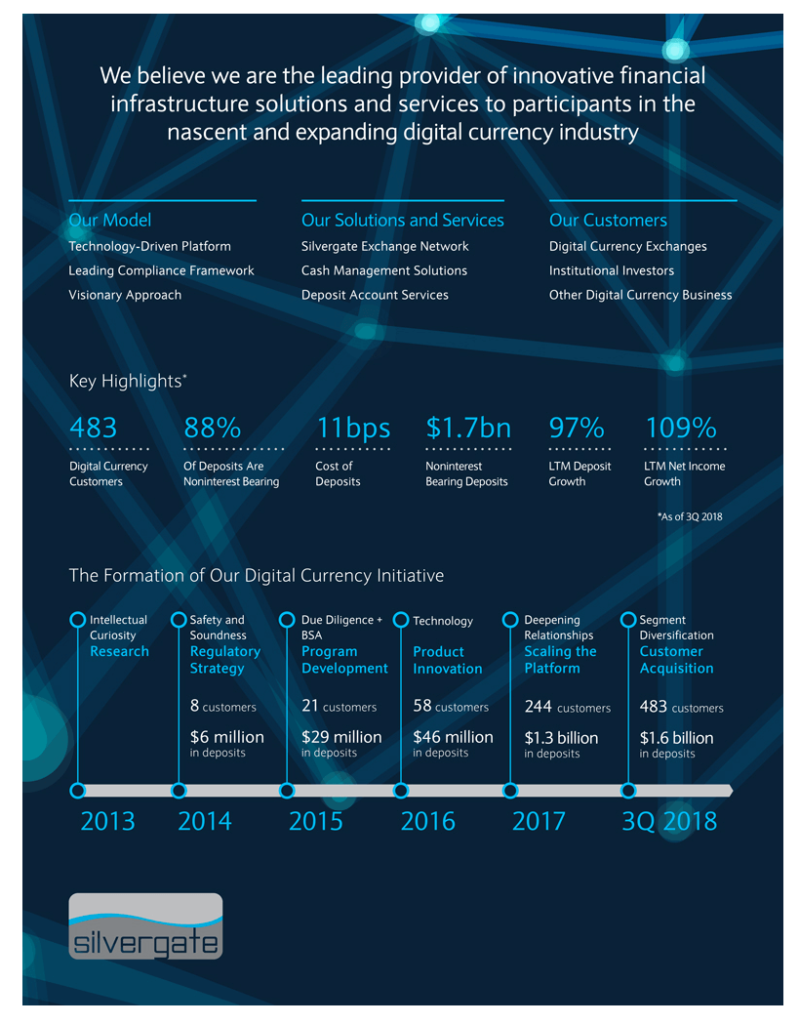

Silvergate Capital (Silvergate) is the parent company of Silvergate Bank, the leading provider of innovative financial infrastructure solutions and services to participants in the nascent and expanding digital currency industry. They say “We began pursuing digital currency customers in 2013 and have been deliberate in our approach to serving this community since then. Today, we have 700+ digital currency and fintech customers that are using our platform daily to grow and scale their businesses.”

The company floated in November 2019 and I have taken the graphic below from their prospectus to give subscribers a quick insight into what they do and how strongly they were growing even before the latest explosive rise in bitcoin and ether prices. Customer numbers have grown from eight to 483 in less than five years and it is only now that people, including Elon Musk, are talking seriously about cryptocurrencies receiving institutional acceptance.

Cryptos are booming and Silvergate looks superbly placed to benefit in a low risk way. “We believe that the market opportunity for digital currencies, the need for infrastructure solutions and services and the regulatory complexity have all expanded significantly since 2013. Our ability to address these market dynamics over the past five years has provided us with a first-mover advantage within the digital currency industry that is the cornerstone of our leadership position today.”

Their timing could hardly have been better. “The digital currency market has grown dramatically since 2013, with the aggregate value of the five largest digital currencies increasing from $10bn in 2013 to $175bn as of 30 September, 2018.” I couldn’t find a comparable current figure but bitcoin alone is now at $600bn.

Latest news unsurprisingly is that business is booming. “In the fourth quarter, digital currency activity on the Silvergate Exchange Network, or the SEN, continued to escalate rapidly with a record of 90,000 transactions and over $59bn in SEN volumes. Transaction dollar volumes of this magnitude represent 62pc growth on a sequential basis, and demonstrate how the combination of network effects and our scalable platform have led to the rapid adoption of the SEN by the digital currency community. As of year end, we had a total of 969 customers, up over 20pc year-over-year, and our pipeline of potential new digital currency customers remains robust with more than 200 prospects at year end.”

Silvergate will soon have over 1,000 customers v the 483 they had on flotation in November 2019. They are also developing important new products. “I’m also excited to provide an update on SEN Leverage, which allows Silvergate customers to obtain U.S.dollar-denominated loans collateralized by their investment in Bitcoin… As of year end, we had approved lines of credit totaling $82.5m versus $35.5m at the end of the third quarter. We are in the early stages of scaling SEN Leverage, and are confident that we have a significant runway for platform revenue growth in the coming years.”

One analyst, who otherwise likes the stock, thinks they are currently 20-30pc overvalued after their recent steep rise. On these prospects I would say – who cares. The opportunity looks massive for a company claiming first mover advantage in an incredibly exciting business area.

Tencent 700 Buy @ HK$733 Times recommended: 9 First recommended: HK$304.8 Last recommended: HK$736

Tesla TSLA Buy @ $854 Times recommended: 15 First recommended: $75.96 Last recommended: $872

Tencent and Tesla – two of the most innovative businesses of the 21st century

These two businesses have more in common than you might think. Their shares have been among the greatest performers of the last decade. They are not dissimilar in valuation. They both still believe the best is yet to come. Tencent even owns a piece of Tesla. They bought 40.85m shares (adjusted for share splits) for $1.85bn in March 2017. Today those shares are worth around $35bn.

There are other ways in which the two companies can collaborate. As one observer noted. “Tesla and Tencent are two amazing companies. Together, their alliance will bring each company tremendous opportunity going forward. Not only can Tencent adapt games to Tesla cars, but they are able to develop exclusive games and content. Tesla’s recent appearance in a Tencent game is not accidental—nor is it simply clever marketing. It is much more than that: An electrifying glimpse of the wide-open road ahead.”

Tesla is by no means the only brilliant investment made by Tencent, which has stakes in a string of QV companies such as Afterpay, Pindudoduo, BiliBili, Futu Holdings, 12pc of Snap, nine per cent of Spotify, 25.6pc of Sea Limited and probably more. I haven’t been able to find a number for what they are all worth but it could be hundreds of billions of US dollars. It could easily become trillions of dollars in the future and they are still investing at a furious rate.

Apart from its investments, Tencent is an incredible success story with a dominant position in Chinese video games and apps like WeChat (international), which along with Weixin (mainland China) has 1.2bn users. Other exciting business include fintech and cloud services. Latest revenue grew 29pc and profits rose 34pc.

I am on record as saying I expect Tesla to become the biggest company in the world by market value but Tencent could be a contender too.

All eyes are on Tesla currently for its plans to expand its range of electric vehicles and dramatically increase production. They sold 0.5m vehicles in 2020 and seem to be targeting 0.75m for 2021. I think that could be a low ball figure but certainly at least 50pc annual growth in unit sales is expected for the foreseeable future.

In addition, there is the equally explosively growing solar energy business that Musk has said could eventually be bigger than the vehicle business. Even more exciting is the possibility than all this, vehicles and solar panels, could be just the springboard for a gigantic services business in the future where transport and power are consumed as services, paid for by subscription as we move into an era of autonomous vehicles, artificial intelligence and the Internet of Things.

It really could turn out that Tesla is just getting started.