QV for ETFs portfolio storms higher – +64.6pc on ALL recommendations and virtually every one is a winner

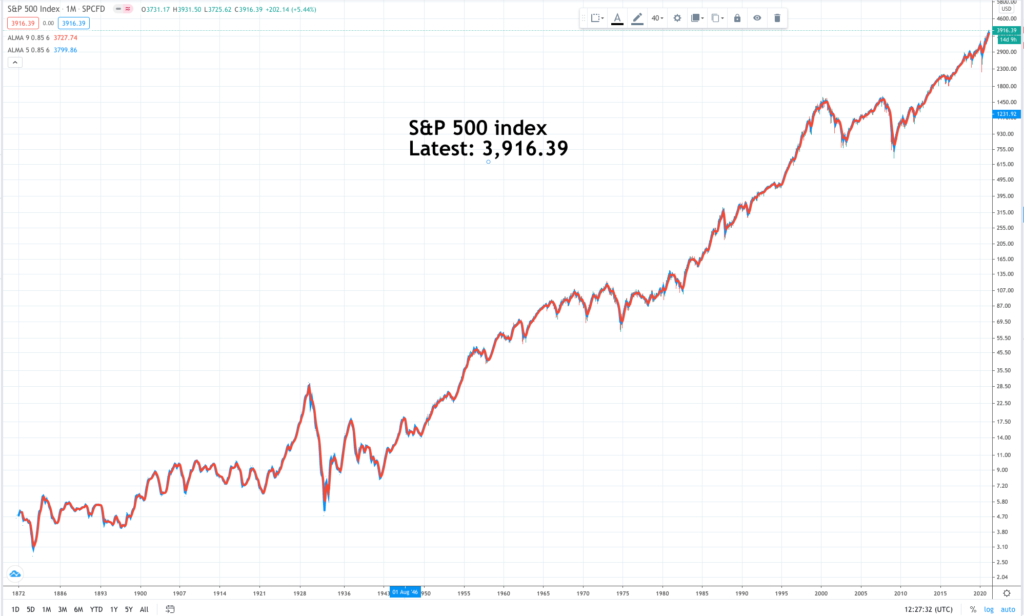

It can be bumpy at times but over a lifetime one would have to say – what an index! Launched at 100 in 1970 the S&P 500 index has risen almost 40-fold. This performance by America’s S&P 500 index is one reason why Warren Buffett has accumulated such vast wealth and indeed why he recommends an S&P 500 tracker, of which there are two in the QV portfolio, as an excellent long-term investment.

Like me he thinks investing for short-term gains is like playing the lottery and a great way to lose money. The strong performance by the ETFs in the table means that I could recommend buying almost all of them, which may be a bit over the top.

Instead I am going to look at some groups, which look timely to buy now, starting with four funds from Ark Investment Management. Unlike most ETFs these funds are actively managed but heavily thematic so targeting trends that are driving strong returns.

Ark Management Group, led by Tesla super bull, Cathy Wood, is delivering great results with actively managed funds

ARK Innovation ETF. ARKK. Buy @ $155. Times recommended: 4 First recommended: $55.33 Last recommended: $$78.50. Lowest recommended: $346.96

Ark Fintech Innovation. ARKF. Buy @ $62.26. Times recommended: 3. First recommended: $30.67. Last recommended: $37

ARK Autonomous Technology & Robotics. ARKQ Buy @ $98.50. Times recommended: 1 First recommended: $63.63

Ark Next Generation Internet. ARKW Buy @$186.50 Times recommended: 3. First recommended: $68.15. Last recommended: $100

The idea of ETFs is that they passively track an index. This makes their returns more predictable and since they are effectively unmanaged the charges can be kept very low. The Ark funds are unusual because they are active managed albeit that they still manage to keep fees very reasonable.

The key to their approach is that they are all about innovation and not afraid to back their beliefs. Six of the top 10 holdings in ARKK are in the QV for Shares portfolio including each of the top four. Top of the list and 9.33pc of the fund is Tesla. The CEO and founder of Ark, 65 year old Catherine Wood, is famous on Wall Street for her stance on Tesla. Years ago, before the latest 5:1 share split, she talked about the shares reaching $7,000, which is equivalent to $1,400 in post split form.

Her argument is that Tesla is going to evolve into a TaaS (transport as a service) business. Instead of buying cars people will rent them or may even pay a subscription for access. Tesla will have the data, the cars, the charging system, the autonomous technology and will still be a business built around innovation. It is easy to see how she could be right and if she is that Tesla could become a very valuable business.

She is equally bullish about many other shares. The common theme being that the companies she and her team pick are cutting edge innovators changing the world.

Innovation is one powerful theme. Another is the rise of China’s middle class. Companies catering to this increasingly numerous and affluent group are enjoying explosive growth and this is reflected in some impressively performing ETFs.

Global X China Consumer Discretionary CHIQ. Buy @ $43.23. Times recommended: 2 First recommended: $21.45. Last recommended: $34

Global X China Consumer Staples CHIS Buy @ $39.50. Times recommended: 2 First recommended: $25 Last recommended: $27.3

Fidelity China Special Situations FCSS Buy @ 491p Times recommended: 1 First recommended: 373p

Loncar China Biopharma CHNA Buy @ $40.83. Times recommended: 1 First recommended: $36.50

The most unusual of these funds from my perspective is CHIS, the consumer staples fund. The top 10 holdings make up 58.5pc of the fund but at first glance I thought I had never come across any of them. It turns out I am familiar with the biggest holding, KweichowMoutai, which is one of two alcoholic beverage businesses in the list. The Chinese obviously like a drink because the shares have been incredible performers, up 216 times since 2006. They were recommended in one of my publications some time ago.

The next category I am going to feature is ETF blue chips – the big beasts of the category but size and a broad spread of holdings is no impediment. These funds are making great progress.

iShares Edge World Momentum IWMO. Buy @ $63.63 Times recommended:14 First recommended: $37.05 Last recommended: $61.16

Invesco QQQ ETF QQQ Buy @ $333.28. Times recommended: 20. First recommended: $151.89. Last recommended: $322

SPDR S&P 500. SPY. Buy @ $391. Times recommended: 4. First recommended: $283.34. Last recommended: $367

The S&P 500 is the one Warren Buffett recommends but you can see from my recommendation counts that my preference is for QQQ, which tracks the Nasdaq 100 rather the S&P 500 tracker. This is all about my enthusiasm for technology shares, which are more heavily weighted in the Nasdaq 100 than in the S&P 500. A bias to the more broadly based S&P 500 would be a good thing if technology shares fell out of favour but I doubt that is going to happen. Since 2009 the S&P 500 index is up nearly six times while the Nasdaq 100 is up nearly 14 times. I don’t think that is a flash in the pan. I think that is a trend.

Another group I am singling out is what I call special situations, which is really just a random selection of ETFs that I want to recommend.

Amplify Online Retail. IBUY. Buy @ $139.2. Times recommended: 3. First recommended: $62.55 Last recommended: $85.50

iShares Expanded Tech Software. IGV. Buy @ $383. Times recommended: 8. First recommended: $201.5. Last recommended: $311

Global X Fin Tech FINX. Buy @ $52.17. Times recommended: 7 First recommended: $25.6. Last recommended: $40.6 Lowest recommended: $25.09

Wedbush Video Game Technology. GAMR. Buy @ $93.65. Times recommended: 7. First recommended: $51.30. Last recommended: $64. Lowest recommended: $42.33

O’Shares Global Internet Giants. OGIG. Buy @ $63.61. Times recommended: 7 First recommended: $34. Last recommended: $58.50

Polar Capital Technology. PCT. Buy @ 2410p. Times recommended: 8. First recommended: 1672p. Last recommended: 2045p

The oddball here is GAMR, the video gaming ETF. which after a great performance is down from a recent peak of $120.76. This is no reflection on the fund but all to do with a dramatic share price surge in a company called Gamestop. The latter is a struggling chain of bricks and mortar video game stores, whose shares were caught up in a short squeeze and rocketed from $3.90 to $483 in six months. This made them the largest holding in the fund but they have since collapsed to $50.24, creating a temporary boom and bust in the GAMR fund. I expect normal service to be resumed at GAMR, which is benefiting from a global boom in the video gaming market. Gamestop may also do OK from here because the founder of a hugely successful online pet services business, Chewy, has become a major shareholder in Gamestop, which was the initial trigger for the short squeeze and he clearly intends to develop the e-commerce opportunity.

Leveraged funds have a deserved reputation for extreme volatility but they can still be great long term investments. On Quentinvest I have been getting some incredible results from leveraged ETFs and I am a big fan

Wisdomtree Nasdaq 100 3x daily leveraged. QQQ3 Buy @ $158. Times recommended: 15. First recommended: $31.40. Last recommended: $139.10. Lowest recommended: $30.50

Direxion daily S&P 500 3x leveraged 3USL Buy @ $1,102. Times recommended: 8. First recommended: $572.25 Last recommended: $877. Lowest recommended: $332

Direxion Semiconductor 3x daily leveraged SOXL. Buy @ $686. Times recommended: 8. First recommended: $211.94. Last recommended: $364. Lowest recommended: $102

Direxion Technology 3x daily leveraged. TECL Buy @ $482. Times recommended: 3 First recommended: $222. Last recommended: $300

Direxion China Internet 2x daily leveraged. CWEB. Buy @ $105. Times recommended: 2. First recommended: $48.95. Last recommended: $61

Microsectors FANG 3x daily leveraged. FNGU. Buy @ $42.07 Times recommended: 1 First recommended: $12.488

Investors are understandably nervous about leveraged ETFs. They know about the volatility and they are repeatedly reminded that because these ETFs are rebalanced daily, as opposed to mostly quarterly for the indices they are tracking, that performance can diverge. It can but not by much and that divergence could be positive as well as negative.

My impression is that, once you accept the volatility, leveraged ETFs make amazing investments, not least because you know that, unlike individual shares, they will never go bust, unless a meteor hits the planet, when we will all be gone anyhow.

I have noticed two things about the leveraged ETFs that I have been recommending in QV for ETFs. First, the performance is incredible. This is because we are in a bull market but that is the whole point. We are in a long-running bull market, driven by a wave of new technology. There is no sign of any end in sight. If anything change is accelerating.

Secondly, the volatility is actually an advantage if you use it properly. Buffett has said the same about shares, where you can use volatility to make cheap purchases as we have done also on QV for Shares.

If you look at the stocks featured above you will see examples, where the lowest purchase price is well below both the initial purchase price and the latest price; that is the advantage of volatility.

When the whole market takes a dive dragging prices lower I start looking for buying opportunities and alerting my subscribers accordingly.

Some of the performances are insanely good. QQQ3, the 3x leveraged Nasdaq 100 tracker, has risen 50 times since 2013! How many individual shares can match that performance. It’s incredible and obviously well worth buying into.

You can do something similar by buying any ETFs in a leveraged CFD account. You could buy QQQ, the unleveraged Nasdaq 100 tracker, with five times leverage as a CFD; that’s not a bad idea too but you will experience extreme volatility on the way to making a fortune. So be prepared (a) to stomach that and (b) to exploit it by adding to your holdings on the dips.

Shares in small cap companies are more sensitive to the state of the economy and often play catch up to their bigger counterparts. They move later in the cycle. Currently they have much to look forward to because the recovery since 2009 has been running a long time and also has been interrupted by the Covid crisis so they have massive bounce back potential ahead.

S&P Small cap 600 Growth. IJT. Buy @ $133.50. New entry

Janus Henderson Small Cap Growth Alpha. JSML. Buy @ $73. Times recommended: 1 First recommended: $55

Montenaro European Smaller Companies MTE. Buy @ 1685p. Times recommended: 5. First recommended: 1045p. Last recommended: 1460p

RBB Fund MFAM Small Cap Growth. MFMS. Buy @ $44.20. Times recommended: 1 First recommended: $36

Vanguard Russell 2000 Growth. VTWG. Buy @ $242.98. Times recommended: 1. First recommended: $183

The rise in US indices since 2009 has been led by giant stocks like Apple, Alphabet. Amazon, Microsoft, Netflix and Nvidia but digital transformation is turning into a wave lifting all the boats. There could be a time in the sun ahead for small caps too.

The Russell 2000 index is part of the Russell 3000. The Russell 1000 is the biggest stocks by market value. The Russell 2000 is the ones not in the 1000.

There will always be room for exciting newcomers in the QV for ETFs portfolio. I look at two below.

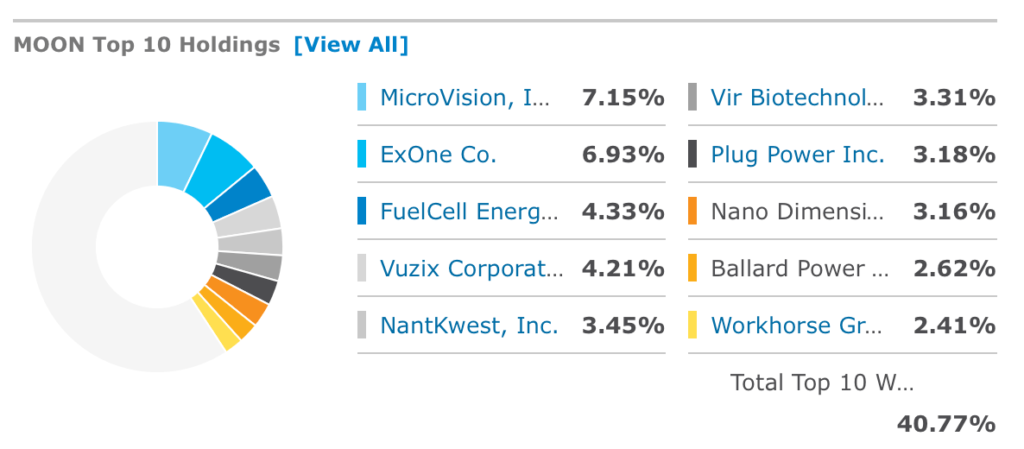

Direxion Moonshoot Innovators. MOON Buy @ $49.97 New entry

MOON targets US companies that pursue innovative and disruptive technologies, or ‘moonshot innovators’. The selection universe is drawn from companies in the S&P Kensho New Economy indices, or from the wireless telecommunication or internet industries. To construct the portfolio, the index picks the top 50 companies with the highest “early-stage composite innovation scores”. This score is based on a natural language processing (NLP) algorithm used for keyword searches relating to the theme and on the companies’ research and development expense ratio to revenue. While MOON may include stocks of all capitalizations in its portfolio, the fund aims to focus on mid- and small-cap stocks and exclude mega-cap stocks. Furthermore, the index applies modified equal-weighting—stocks are first equal-weighted, and then adjusted to meet liquidity, industry group, and diversification constraints. The index is rebalanced quarterly and reconstituted semi-annually.

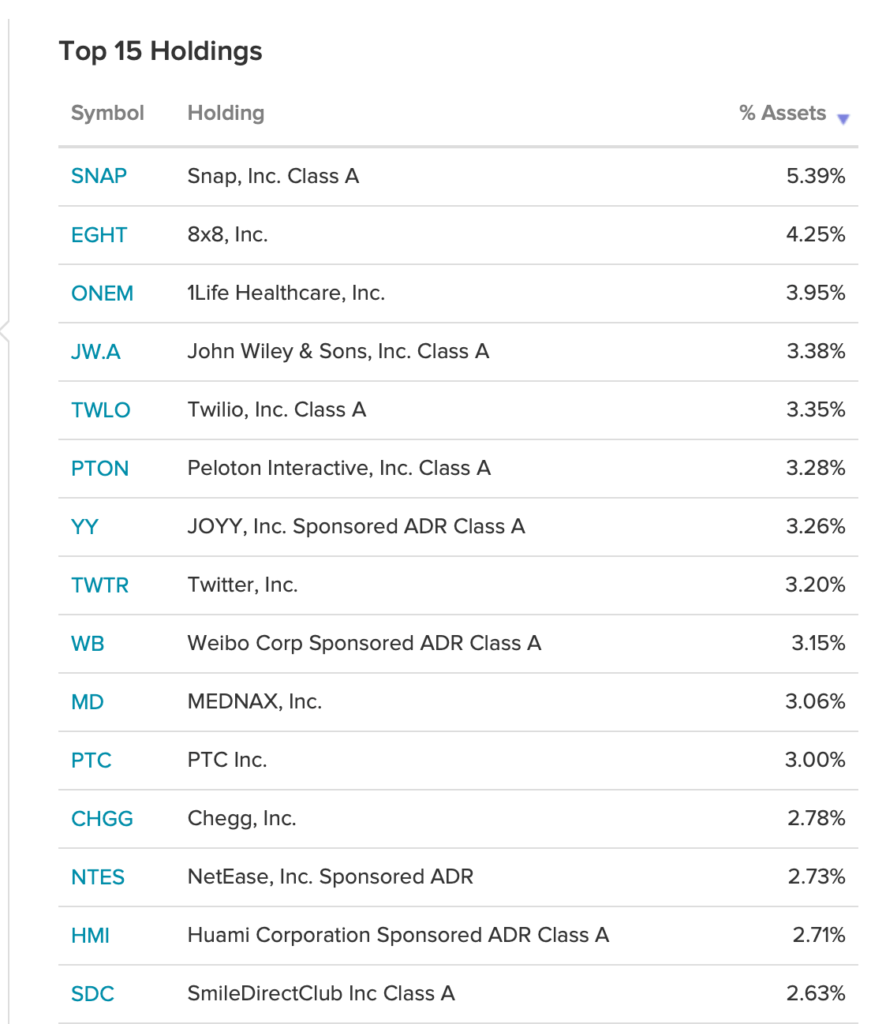

Direxion Connected Consumer. CCON. Buy @ $70.72. New entry

The Direxion Connected Consumer ETF offers exposure to companies across four technology pillars, allowing investors to capture those companies that stand to benefit from consumers connecting to products and services in new ways, especially virtual ones. The four pillars include home entertainment, online education, remote health and well-being, and virtual and digital social interaction. Companies are selected for inclusion in the index by ARTIS, a proprietary natural language processing algorithm, which uses key words to evaluate large volumes of publicly available information, such as annual reports, business descriptions and financial news.

- Uses advanced techniques to identify the 40 stocks accelerating worldwide shifts from offline to online activities

- Gain access to four pillars, across established and emerging technologies, that power the ability of consumers to connect virtually

- May be considered a satellite holding to complement other broader positions within a portfolio

Shares in the connected consumer portfolio are more familiar (five of them are in the QV for Shares portfolio). I hardly know any of the companies in the moonshot innovators. I had a look at a couple and I can see that their shares are surging higher. Obviously there are stories behind what is going on. Plug Power describes itself as “the innovator that has taken hydrogen and fuel cell technology from concept to commercialisation”. Microvision says “We expect MicroVision’s Long Range Lidar Sensor, (LRL Sensor) which has been in development for over two years, to meet or exceed requirements established by OEMs [original equipment manufacturers] for autonomous safety and autonomous driving features.” I guess the idea is that these are long shots that could succeed in a big way.

The more I learn about ETFs the more impressed I am with their effectiveness as investment vehicles. The performance has been amazing and as I study them I can see why. I thought initially that they would be an unexciting alternative to investing directly in shares. This is not at all the case. It is perfectly possible to make a fortune from investing solely in ETFs as its being demonstrated by the selection above.

Note that it is slightly misleading to say I have only recommended an S&P 500 tracker four times in Quentinvest because there are two such funds in the portfolio. Between the two identical funds I have made 10 recommendations. They are never going to be the best performing ETFs but they are great for investors who like to sleep soundly at night knowing that they have invested broadly in the might of the US economy.