A dynamic alternative to buying and holding great growth shares for very active investors

There is more than one path to investment success. We all need to find the strategy which works for us. However observation suggests that for many people the best results come from a one decision buy and hold strategy which focuses all the attention on good stock selection. Pick winning stocks and not only will this deliver substantial gains over time to patient investors who never sell but it can also offer opportunities to use stock market volatility to add to those gains.

Part of the argument here is that very often when share prices fall sharply it is for macroeconomic reasons like the effect of Covid-19 inspired lockdowns. Investors behave like a herd of wildebeest rushing into the jaws of the waiting crocodiles and all panic together. But companies don’t change because of these panics. If they were good businesses before they will still be good businesses so buying once there are signs of recovery is a good idea. Buying into the weakness is more problematic because you never know how far shares will fall before they recover.

I have a particular problem when I invest because I always buy on margin and typically keep buying until I am at full margin. In a rising market this can deliver dramatic gains but it also leaves me dangerously exposed when the inevitable correction arrives. This is why I think of investing as a game of snakes and ladders. I have a lovely time climbing the ladder but sooner or later I will land on a snake.

I have learned from experience that when there are signs of panic I need to panic too and I do. Where I differ from many investors is that I panic very decisively. Once I am sure there is a problem I will typically go 100pc liquid to make sure that I survive to fight another day. Panics are unselective. All shares fall, especially those that have risen the most in the preceding ladder.

Because my initial aggressive portfolio building delivers such large gains I usually manage to do all this and still come out with a good profit but I invariably forfeit a considerable chunk of my gains. Hence my endless search for a better way.

So let me tell you what I am doing now and how I am experimenting with adding a new element of dynamism into my strategy.

First of all, I am really focused on building a large portfolio. In a recent Quentinvest alert I talked about The List. This was a list of 200 shares (the round number was a coincidence) which I believed could form the core of a great growth stock portfolio. My ambition is to end up with a 200+ share portfolio, large based on The List but the latter is a moving target. Shares will drop out and other shares will come in and The List will likely grow over time.

Secondly, I am investing roughly equal amounts in each share. I have decided that this is so important that I recently trimmed the larger holdings in my portfolio so that holdings were roughly equal. This was where I had made bigger bets, not shares that had appreciated strongly after purchase. I never take profits so if and when some shares do better than others this will not trigger selling.

Thirdly, I am focused on shares which as well as being 3G+M (great chart, great growth, great story plus magic) are trending higher. This is where the element of dynamism comes in. If a share I hold shows signs of losing momentum, even though this is likely to be a short-term phenomenon, I will sell it and reinvest in another List stock which is still trending strongly higher.

The effect is that I have added another rule to the management of my portfolio. I will only hold shares which are trending higher. This is why I call this a dynamic approach because it means that the composition of my portfolio will be constantly changing. I even thought of calling this approach trigger-happy investing except that sounds like a criticism.

The dynamic element means that the portfolio is constantly reinventing itself around the latest market trends.

I use IG to deal and this strategy is made possible because dealing costs are low. There is no stamp duty on CFDs so only commission to pay. Minimum commissions are $15 on CFDs for US shares and £10 for UK shares, which makes them insignificant on a per holding basis unless you are dealing in very small parcels when you are better off with a platform that offers zero commission dealing on US shares and low commissions on other shares. Most of the shares I buy are in businesses valued in the billions so liquidity is good and spreads are narrow reinforcing the ease of dealing in and out.

Last but not least because I am always selling under-perfomers and running my winners I don’t usually encounter tax problems from all this activity.

I anticipate two effects from this dynamic strategy. One is that my portfolio will be continually rebuilding itself around the best performers. I am already seeing this effect in action although I am also selling shares that bounce back after being sold. If this happens I usually buy them back again. I don’t think in terms of profits and losses on a per share basis. This is all about managing the portfolio for the best overall outcome.

The second effect is that if the whole market turns lower I will swiftly be forced out of many if not all my holdings. This is not quite the panacea it may sound because typically when stock markets go into panic mode it happens very quickly, which is why investors, me included, struggle to react and why for many investors the best strategy is to weather the storm. Since 2009 even the sharpest corrections have never lasted longer than three months before recovery begins so patience is rewarded quite quickly.

I regard this new dynamic strategy as totally compatible with buy and hold because I expect to be continually buying and selling from the same group of stocks. It won’t be exactly the same because there are new names being added all the time but the broad picture is right. It also solves the problem of should I sell or not when a stock starts to fall sharply because the answer will usually be yes. You sell because they are falling, not because there is necessarily anything wrong.

It is important to get the balance right on this. You don’t sell because the share has a couple of down days or even because of a violent bout of profit taking after a great set of figures. You sell because through all the daily ups and downs there are signs that momentum is fading. Another way of putting it is that a stock shows signs of behaving badly. Moving averages are useful in determine whether this is happening because they smooth out the effect of the daily ups and downs.

Stocks behaving badly

When I created The List I realised that this also focused attention on the shares that were not included. Why not? Sometimes this was because of an obvious deterioration in the fundamentals but often the shares that did not make the cut were still 3G, as far as I could tell but the share price was behaving badly. So I decided to make another list of shares of all the shares behaving badly. There was also a third list of shares that were neither one thing nor the other but marking time.

A share price behaving badly can be part of a normal correction which will end with a buying opportunity or it can be the first sign of a deterioration in the fundamentals. Unfortunately, it is difficult to distinguish which of the two is happening. Subscribers sometimes contact me and ask whether they should sell a stock which is behaving badly. They want to know if there is anything wrong and usually I don’t know because there is no visible evidence of problems beyond a deteriorating share price.

Shares fall because there are always people with inside information. People who work at the company, who deal with the company, their advisers and others who have an inside track. This doesn’t mean anything illegal is going on but it does start to affect supply and demand for the shares and thus the price. But so do other factors unrelated to what is happening at the company like stockbroker’s reports which may send a share sharply higher or lower sometimes without justification. Or the shares may have climbed too far too fast on wonderful fundamentals and hit a bout of profit-taking – a simple two steps forward and one step back.

Bottom line – you never can tell from a falling share price whether a company has problems or not and usually it doesn’t. It is just part of the normal ebb and flow, the way a share price dances around any given set of corporate fundamentals.

The beauty of my dynamic strategy is that you don’t have to know whether the shares are falling for a good or a bad reason. You sell simply because they are falling and reinvest in other 3G+M shares that are still trending higher. Most likely the share you sold will eventually be one of the ones trending higher and you will buy them again.

Ideally the effect will be that you hold any given share while it is climbing, step aside when it is falling and go back in when it is rising again. Like so many things in the stock market this is easier to describe in theory than it is to operate in practice but I am going to give it a go and to start subscribers on the process I am going to list shares which I identify as behaving badly when I do my regular runs through my tables.

Below are the behaving badly names from my latest run. I am including them in two groups because I want to focus on Chinese stocks where there seems to be a particular problem affecting the whole group.

The Chinese names are Alibaba, Beigene, BiliBili, Fidelity China Special Situations (and any other ETFs specialising in China), Futu Holdings, I-Mab, JD.com, Meituan, Netease, Pinduoduo, Taiwan Semiconductor Manufacturing (Taiwan rather than mainland China but still seemingly being affected), TAL Education, Tencent, Up Fintech Holdings, and Zai Laboratories.

Other than Alibaba, about which I have long had mixed feelings, until recently I would have described this as a phenomenally exciting list of stocks up there with the best fast-growing US technology stars. And then came the most extraordinary black swan (out of nowhere) event as the Chinese government seems to have declared war on its entire quoted sector.

In the most extreme example Chinese leader, Xi Jinping, said he didn’t believe that Chinese students should use online tutors to help them pass exams but should rely on schools. Online tutoring companies were forbidden to charge for their services. Tal Education, which was until very recently a very fast growing company making full use of modern technology to deliver a great experience to the rapidly growing number of students using its services, has seen its shares totally collapse. In February they peaked at $90.96. The latest price is $5.13 and they have been lower.

Three days ago China’s Ministry of Information said that 43 apps including Tencent’s WeChat were found to have illegally transferred data. This follows other issues between Tencent and the Chinese authorities. In the last six months Tencent shares have dropped from a peak $775.6 to $425.4. Fidelity China Special Situations, an ETF specialising in Chinese shares, has seen its shares drop from $503 to $335 over the same time scale. The weakness is across the board and has made the actions of the Chinese government a major risk factor in assessing Chinese shares.

Other governments also have issues with companies on privacy, use of data, where they pay taxes and other factors but unlike in China they can’t just wade in by fiat but have to deal with elected parliaments, congress, courts, voters and all the checks and balances of a modern democracy. As a result wheels grind more slowly and shareholders are more fairly treated.

It is hard to judge exactly what is going on given that the Chinese government is so secretive. Has some anti-capitalist faction gained more power in China? Do the Chinese authorities have a problem with the whole first mover advantage, winners take all tendency in the technology industry which tends to create very large companies? Were there real problems on privacy and use of data which the government is belatedly sorting out? It is hard to say but it is alarming that the crackdown on China’s burgeoning quoted sector follows a crackdown removing many liberties in Hong Kong.

I don’t know whether this is a wonderful opportunity to buy Chinese shares or a last opportunity to sell before they collapse completely but it seems to make sense not to hold these shares or buy them until they start behaving like the exciting 3G businesses they were until recently.

In terms of dynamic portfolio management when so many exciting shares are behaving well why take risks with these shares that are behaving badly. Most of them have been behaving badly for some time so would have been sold a few months ago using my dynamic approach.

There are also some non-Chinese shares behaving badly including Alteryx, Bandwidth, Best of the Best, BioExcel Therapeutics, Booking Holdings, Boston Beer, Bumble, C3.AI, Coupa Software, Digital Turbine, Fastly, FreshPet, GrowGeneration, Guardant Health, HydroFarm, Lemonade, Logitech, Naspers, Nikola, Par Technology, Pinterest, Pliant Therapeutics, Shift4 Payments, Spotify, Teledoc Health, Vuzix, Wandisco, WD-40, Wix Holdings, Zendesk and Zillow Group.

Shares behaving badly stand out more in an overall stock market that is doing well. The list of shares trending higher from the QV for Shares table is much longer than the list of shares behaving badly and many of the names in the BB list are not mainstream selections that have been the subject of repeated recommendations.

It is going to be interesting to see what the Chinese companies say when they next report. Futu Holdings is a case in point. The shares have more than halved in five months yet in May the group reported its Q1 2021 figures and the growth was stunning. Client numbers increased 231pc, client assets increased 367.7pc and following a recent expansion into Singapore the business appeared to be on fire.

“We are encouraged by what we have achieved in Singapore so far and are convinced that Singapore and the broader Southeast Asian market offer huge runway for growth. Despite rapid client base expansion, our quarterly paying client churn rate remained below 2pc.”

Futu is due to report next towards the end of August. Most likely it will still be growing very strongly.

Is it bad for China and its burgeoning middle class that Futu is doing so well? It is hard to see why so it will be interesting to gain a better understanding of what is happening at what seems to be a wonderful business with an incredible future. Meanwhile though you can see the advantages if you can find a way to participate in most of the spectacular share price rise that has taken place at Futu, a rise from $8 to $204 in a year from March 2020, while stepping aside when there are periods of weakness.

I should caution also that although I have high hopes for my dynamic investing strategy there will be false signals. Futu shares gave a buy signal in June, which I alerted to subscribers and acted upon because of my enthusiasm for the blistering fundamentals. It was a false signal and the shares agin resumed their steep decline. It is complications like this that make successful investing challenging but fortunately it can still be very rewarding.

You can look at dynamic investing as a kind of insurance policy. Because you sell on fading momentum and buy on what appears to be resumed momentum you will make some mistakes and this may reduce the gains that would come from a buy and hold strategy but it also takes away a big chunk of risk because you will only rarely be caught holding a plummeting share because you will already have sold.

It also makes the decision process much easier. If it is clear that a share is behaving badly it’s a sell. There is no need to agonise about the fundamentals. This approach is especially relevant for me because of my use of margin trading. If you are not a leveraged investor a broadly based growth portfolio of growth shares share and a strategy of never selling should work well.

You can also approach the problem in a different way by building your portfolio over time with repeated smaller purchases. This way your entry price on all the shares you hold should be low and you should again do well. Under performers effectively sell themselves because you don’t buy more of them.

I am applying this approach to my portfolio of leveraged ETFs, where I make regular small purchases based on buy signals and sit it out when the shares are falling.

Last but not least you could mix and match. Have a buy and hold approach for your main portfolio and a dynamically managed portfolio which could be applied to some of the same shares and where you might even feel leveraged approach is worth trying.

Asana ASAN. Buy @ $77

American Tower Corporation AWK Buy @ $288

Apple. AAPL. Buy @ $149.50

Basler AG DWWS. Buy @ €129.50

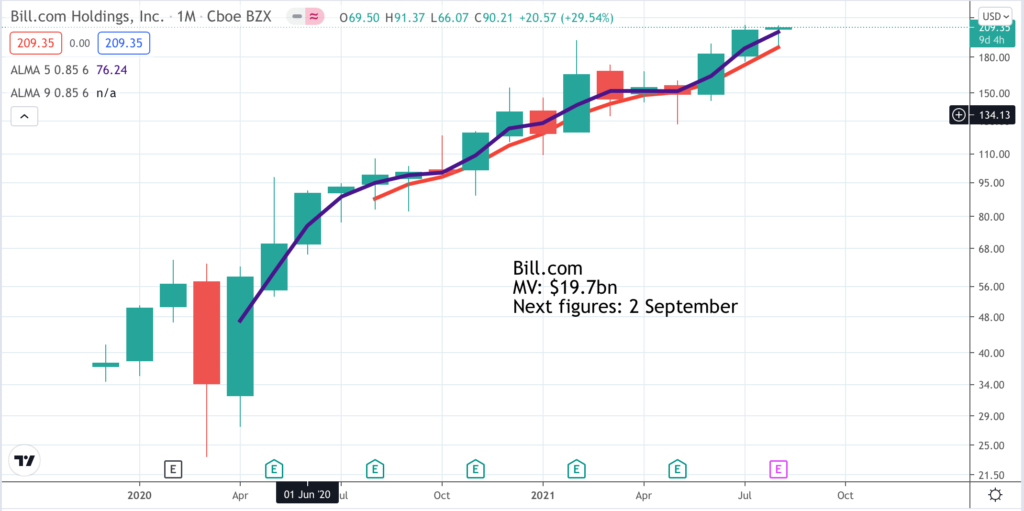

Bill.com. BILL Buy @ $217

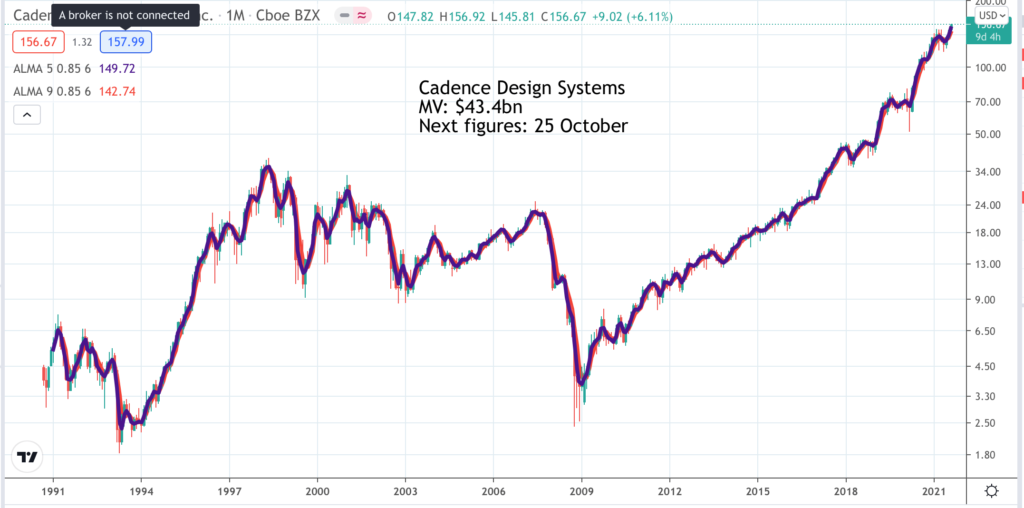

Cadence Design Systems. CDNS. Buy @ $158

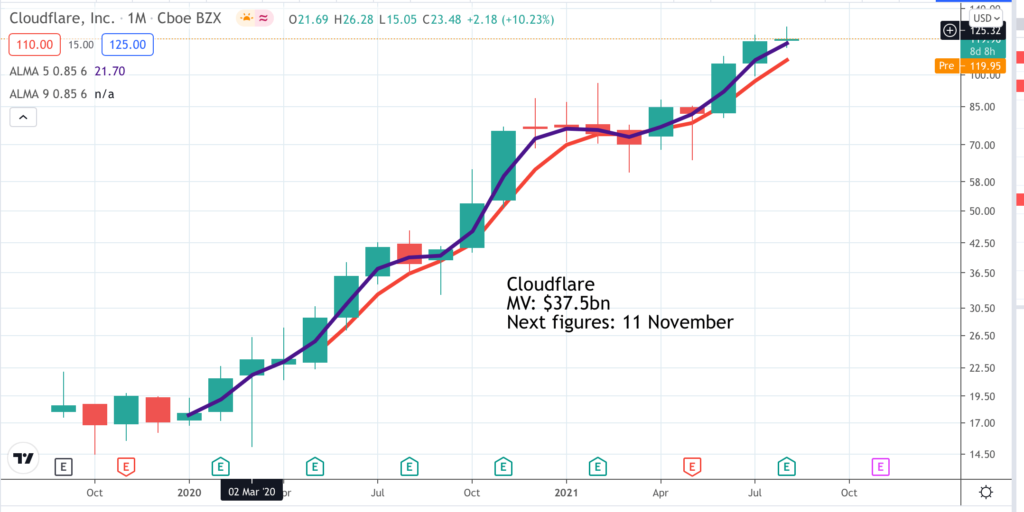

Cloudflare. NET. Buy @ $124

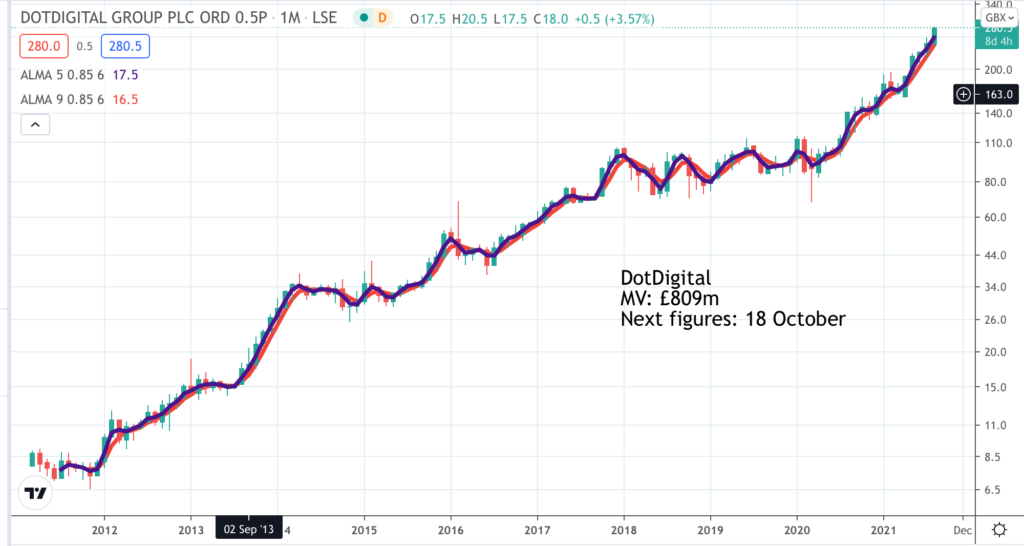

DotDigital. DOTD. Buy @ 279.50p

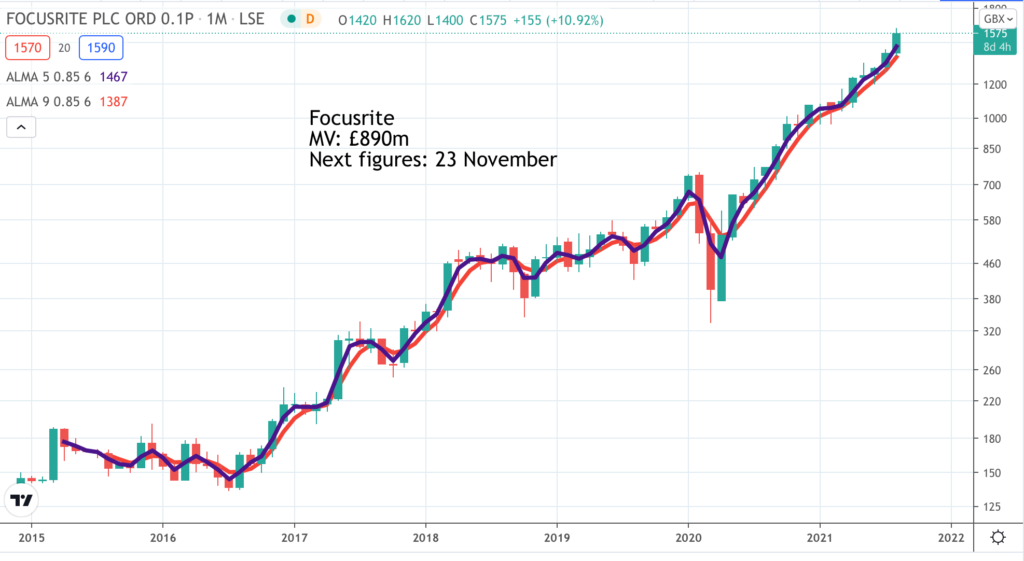

Focusrite. TUNE. Buy @ 1590p

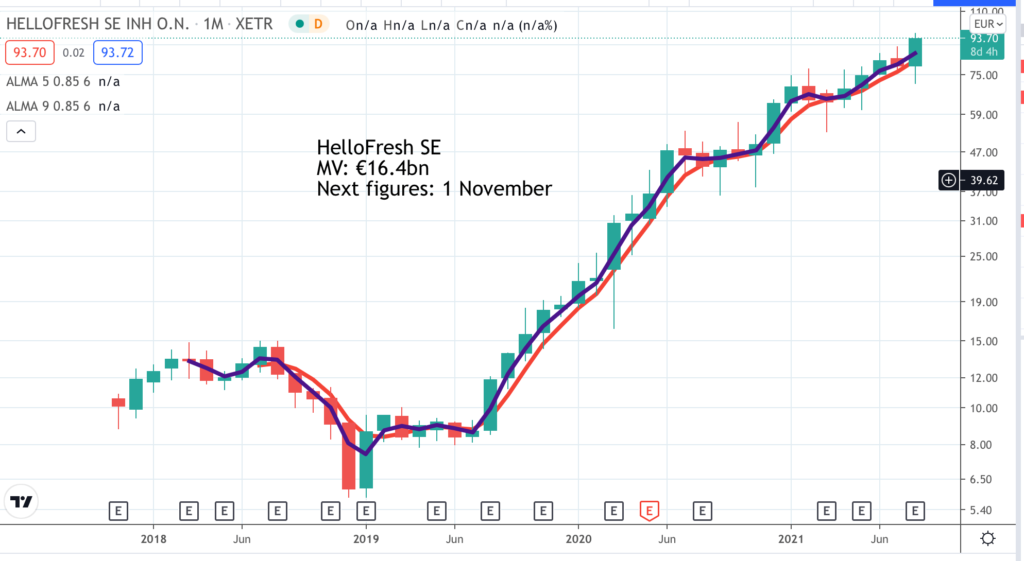

HelloFresh SE. HFG. Buy @ €95

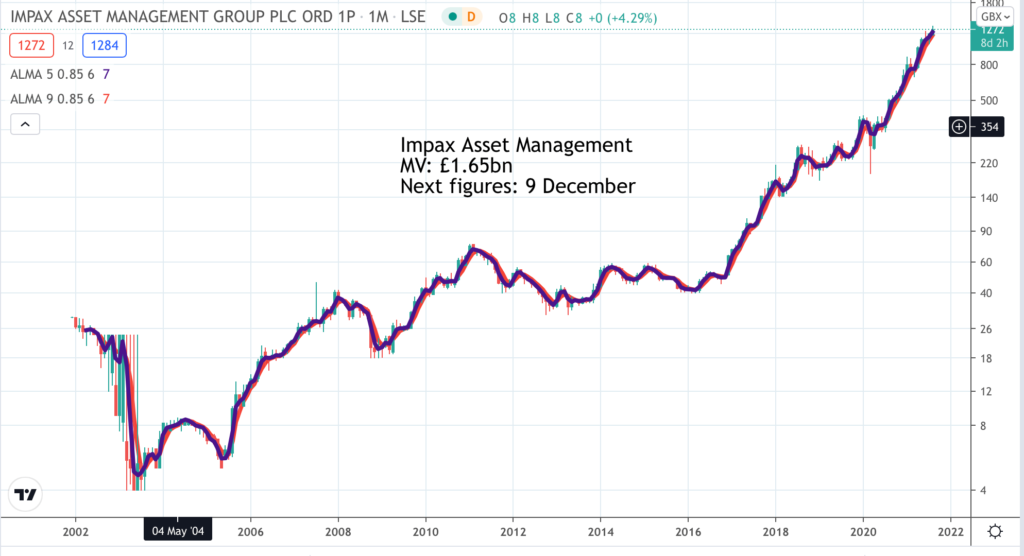

Impax Asset Management. IPX. Buy @ 1292p

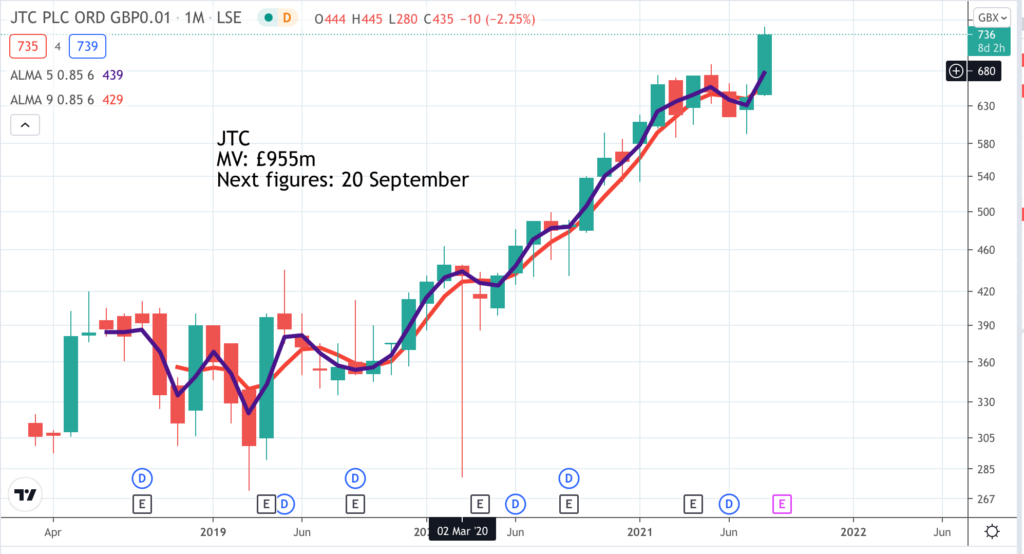

JTC. JTC. Buy @ 748p

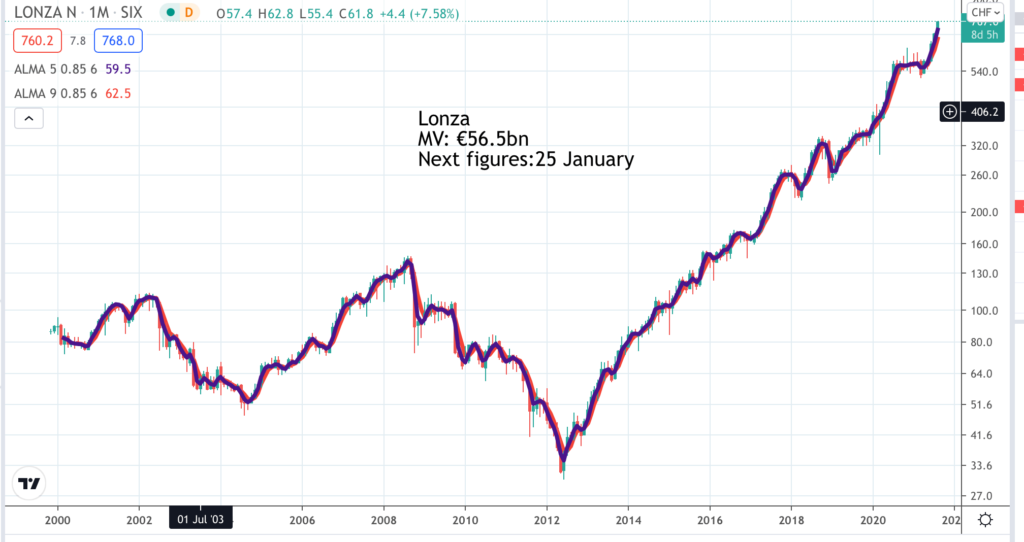

Lonza LONN. Buy @ 771

Microsoft. MSFT. Buy @ $304

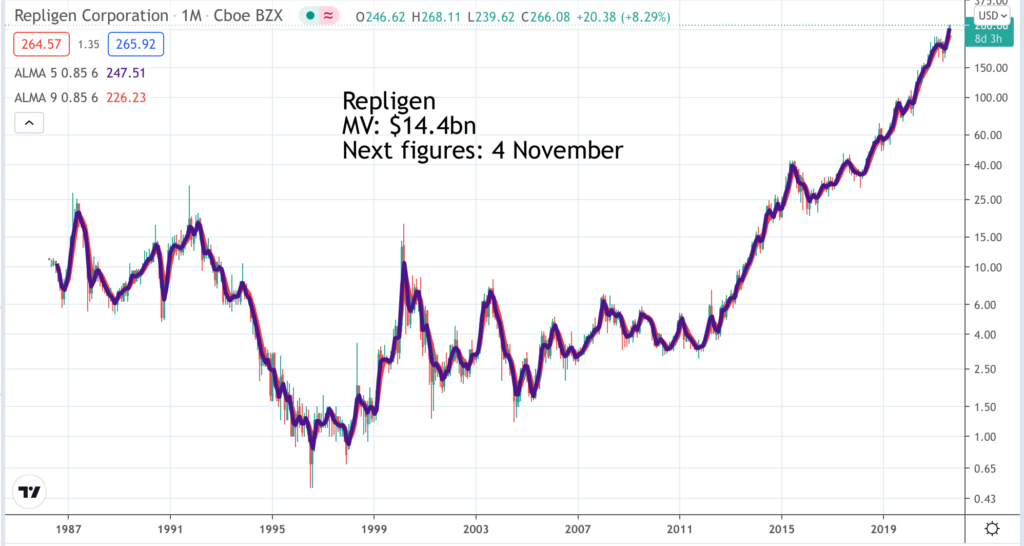

Repligen. RGEN. Buy @ $266

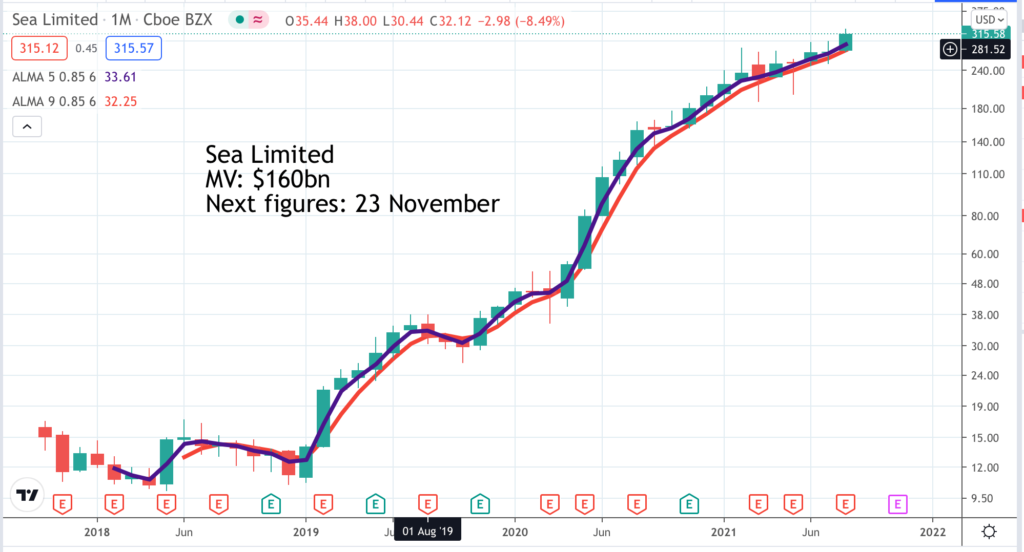

Sea Limited SE. Buy @ $315

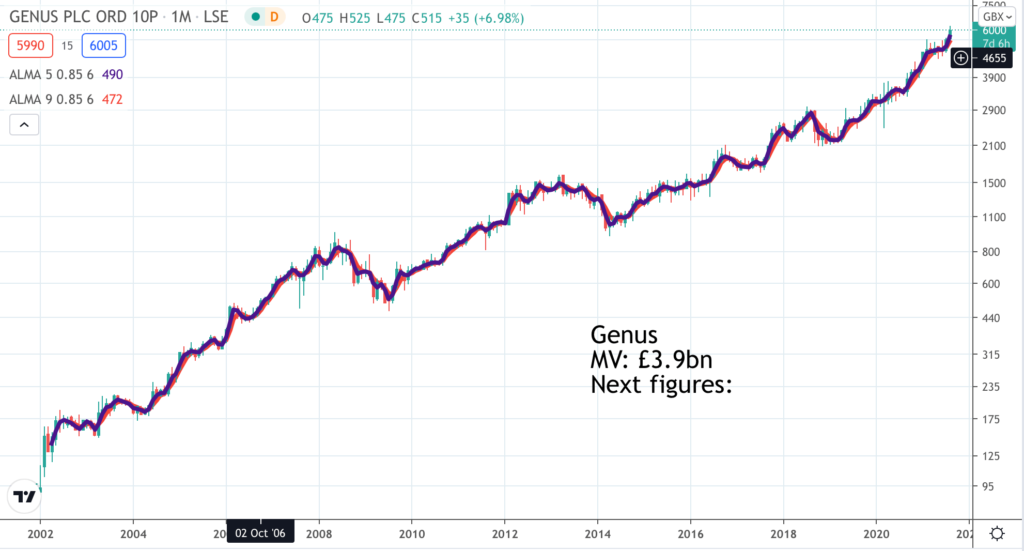

Genus. GNS. Buy @ 5950p

Asana. ASAN. Buy @ $77 (new entry)

Asana (Sanskrit for yoga pose) sounds like another company I love called Atlassian which develops software to help teams works more effectively together. Since company structures are now much flatter and more team based than the old hierarchical structures of the past such software is urgently needed. As they say at Asana:- “Building a system that enables the world’s teams to work together effortlessly represents an extraordinary leverage point on all other opportunities to drive progress in the world. Because delivering on that value proposition is also a great business opportunity, it creates a financial engine that enables us to continuously reinvest in our mission.” The founders, Dustin Moskovitz and Justin Rosenstein, left Facebook of which Moskovitz was a co-founder, to launch their new company in 2008. Asana is a classic software as a service enterprise software business selling subscriptions from the cloud. The business is on fire. “We had a remarkable first quarter and continue to see the business accelerate across revenues, paying customers and customer expansions. Revenues grew 61pc year-over-year, with growth accelerating for the second quarter in a row. We added over 7,000 net new paying customers in Q1, up from 4,000 added in the previous quarter. And growth in the number of paying customers accelerated for the third quarter in a row to 30pc year-over-year. Also, dollar-based net retention rates continue to be strong. For customers overall, it was over 115pc; for customers spending $5,000 and over, it was 123pc. And for customers spending $50,000 or more, it was over 140pc.”

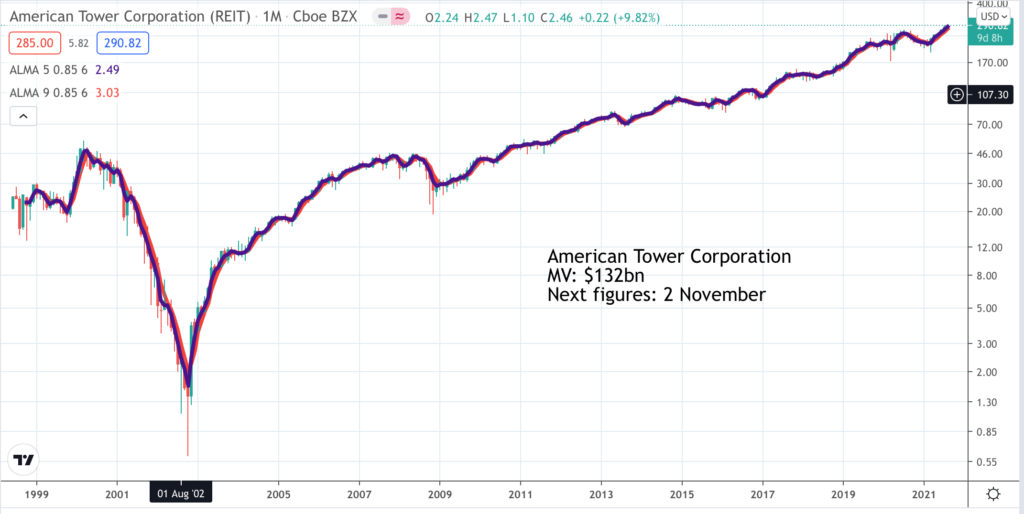

American Tower Corporation AMT. Buy @ $288 (new entry)

American Tower owns and operates communications towers across the globe. It is already a big operation but expects to become much bigger. “Our global portfolio of more than 214,000 sites is composed of towers in advanced, evolving and developing wireless markets, in various stages of wireless network deployment. We have selectively expanded internationally to complement our core U.S. operations, as we believe that the network development trajectory we have seen in the U.S. will ultimately be replicated overseas.” Because it has many characteristics of a property company AMT is a real estate investment trust (REIT), which means the company is legally obliged to distribute all its earnings in the form of dividends. Between 2018 and 2023 the dividend is expect to climb from $3.15 to $6.86 which would put the shares on a yield of 2.36pc; not bad in a world of near zero interest rates. Thanks to its global strategy AMT says:- “Markets outside the United States have made meaningful contributions to our long track record of generating strong organic growth, while delivering double digit annual consolidated AFFO [adjusted funds from operations] per share growth and attractive returns on invested capital.” The company has ambitious plans:- “Further on sites, we’ve constructed ourselves internationally across all vintages, the NOI [net operating income] yield as of the end of the second quarter was 25pc, demonstrating the tremendous return potential of our new build program. Finally, it’s important to note that just as we’ve done in the past, we expect to focus on constructing sites for high-quality, primarily investment grade tenants, as we drive toward our goal of 40,000 to 50,000 new builds worldwide, over the next five years.”

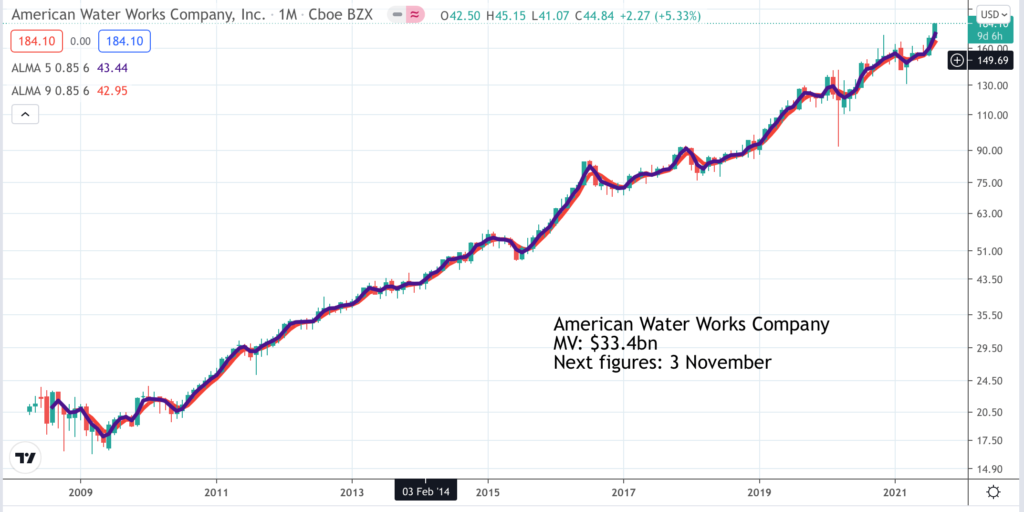

American Water Works Company. AWK. Buy @ $182. New entry

American Water Works (AWK) is a utility focused on supplying water. It sounds rather humdrum but the share price performance has been extraordinary. Part of the answer may be that AWK ticks a lot of boxes in a world of ESG (environmental, sustainable, governmental) investment. The company is included in Bloomberg’s gender equality index. It has been named one of the world’s top 10 most sustainable organisations and described by Newsweek as one of America’s most responsible corporations. AWK is a great dividend payer. The payout is on course to climb from $1.82 for 2018 to $2.82 for 2023. It is also capable of a surprising turn of speed when it comes to growth. Q2 2021 earnings per share rose by 17.5pc. The group, which is already the largest water utility in the US, also adds customers by a steady trickle of acquisitions. “We’ve added approximately 11,200 customer connections to date through closed acquisitions and organic growth and look forward to welcoming an additional 86,900 customer connections through pending acquisitions.” Much of its operations are regulated but this not necessarily a negative because there is a close link between investment and returns. “The foundation of our earnings growth continues to be the capital investment we make in our regulated operations. We plan to spend $1.9bn in 2021 and about $10.4bn over the next five years. The continued investment is critical to improving and maintaining distribution and treatment infrastructure, including improving water quality, fixing leaks and providing water for fire hydrants.” This gives great predictability to results. “With a strong first half of 2021 and continued execution of our strategies, we’re affirming today our 2021 earnings guidance range of $4.18 to $4.28 per share. We’re also affirming our long-term EPS compound annual growth rate range of 7pc to 10pc.”

Apple AAPL Buy @ $149.5

The Apple story is amazing making it one of the investment phenomena of the 21st century. The shares have appreciated since the bear market low of 2003 by some 740-fold and Apple jostles with Amazon for the title of world’s most valuable brand. I am in the Apple eco system and I just cannot imagine leaving it with a house littered with Apple devices. Thanks to my millennial daughter I am getting with the programme. Two years ago my phone was a museum piece. Now my wife and I both have Apple 11xr phones and I work on a one year old Apple MacBook Air (linked to a 27 inch LG screen). It seems many others are doing the same. The growth still being delivered by this gigantic business is just ridiculous. “Today, Apple is reporting a very strong quarter with double-digit revenue growth across our product and services categories and in every geographic segment. We set a new June quarter revenue record of $81.4bn, up 36pc from last year, and the vast majority of markets we track grew double digits, with especially strong growth in emerging markets, including India, Latin America, and Vietnam.” An army of analysts tracks every move the company makes but I prefer to look at the big picture. Like Amazon much of Apple’s quarterly report is dedicated not to financial performance but all the incredible innovations the group is bringing to the world. And the company makes sure that shareholders feel the benefits with $29bn returned to shareholders via dividends and share buybacks in the last quarter alone. A $2.45 trillion market value seems a lot but Apple is a key player driving the technology revolution across the planet.

Basler AG. DWWS. Buy @ €129.5

Basler is an internationally leading manufacturer of high-quality cameras and accessories for applications in factory automation, medicine, traffic and a variety of other markets. The Basler Group is home to approximately 800 employees at its headquarters in Ahrensburg, Germany, and at other locations in Europe, Asia and North America. No surprise the shares are climbing because the company is growing rapidly. “Compared to the reference period 2020, sales increased by 30pc to Euro 115.2m (previous year: Euro 88.9 million). Incoming orders increased by 65pc to Euro 152.4m (previous year: Euro 92.3m). Incoming orders increased significantly in the second quarter and more than doubled compared to the previous year.” The group plays a key role in semiconductor production. “The group closed the first six months of the current financial year 2021 very successfully above expectations and started with a very positive ratio between incoming orders and sales into the third quarter of 2021. The positive trend of demand for image processing components in applications for semiconductor and electronics as well as logistics typically weakens in the second half-year due to seasonal reasons. However, due to the bottlenecks for semiconductor and electronics components and the increasing demand in the automation and medical sectors, management expects the seasonal fluctuation to be milder until the end of this year.” Basler’s products are used in a variety of markets and applications, including factory automation, medical, logistics, retail, and robotics.

Bill.com. BILL Buy @ $217

Bill.com has an interesting business. “Our platform helps business simplify their back-office financial operations, connect with suppliers and customers and make payments. We ended the third quarter with over 115,000 customers, more than 2.5m network members and an annualized run rate of $140bn in TPV [total payment volume]. We believe we are the leading digital B2B payments platform for SMBs and operate one of the largest B2B networks in the United States.” It is growing rapidly. “We delivered record results and accelerated growth in our core revenue, transaction fees and total payment volume. In the fiscal third quarter, core revenue increased 62pc year-over-year. Transaction fees increased 112pc year-over-year, and TPV increased 44pc year-over-year.” The technology is special. “New customers are able to sign up and actively use the platform to manage documents, create invoices, make payments and collaborate with coworkers all in the same day. This ease-of-use is one of the reasons that in February, Bill.com was named a G2 Best Software Winner for the second year in a row.” The group is gung-ho on prospects. “We believe that we are at the beginning of a multiyear digital transformation wave that has been accelerated by the COVID pandemic.” The group has also recently acquired Divvy for $2.5bn, much of it in stock. Divvy is a cloud based spend management solution which doubled annualised revenues to $100m between Q1 2020 and Q1 2021. The deal looks almost a game changer for the business, greatly expanding its addressable market and creating multiple cross-selling opportunities.

Cadence Design Systems. CDNS. Buy @ $156

As can be seen from the chart everything started to happen for Cadence Design Systems (CDNS) in 2009. What also happened that year was that a talented Malaysian born venture capitalist, Lip-Bu Tan, became CEO. He has just now stepped up to become executive chairman with Aniruhd Devgan becoming president and CEO. “Tan, 61, became CEO in January 2009 and reinvented the company, driving a fundamental cultural transformation that was rooted in leapfrog innovation and a relentless focus on delighting customers. Under his stewardship, Cadence successfully launched highly innovative products, made strategic acquisitions and forged deep and trusted partnerships with market-shaping customers and ecosystem players. On his watch, revenue grew from less than $1bn to almost $3bn, operating margins expanded to more than 35pc, and the stock price appreciated by more than 3,200pc.” Devgan looks like an exciting appointment. “Devgan, 51, has served as president of Cadence since 2017 and oversees all the research and development, sales and field engineering as well as corporate strategy, marketing and business development groups, including mergers and acquisitions. Devgan drove the technology and product roadmap and was the architect of several breakthrough innovations behind our current industry-leading solutions. He also spearheaded the development of our Intelligent System Design™ strategy, which leverages our computational software heritage to expand beyond the company’s core electronic design automation business into the broader systems space, thereby tripling our total addressable market to $30bn.”

Cloudflare. NET Buy @ $124

Cloudflare is another of those enterpise software businesses that I can study for an hour and then five minutes later have forgotten what they do. Founded in 2009 it came to prominence in 2014 when it mitigated a massive DNS (denial of service) attack on an unnamed customer. By 2020 the group had over 100,000 customers for its DNS services. As of September 2020, the company claimed to block “an average of 72bn threats per day, including some of the largest DDoS attacks in history”. They describe themselves on their web site as follows:- “Cloudflare is a global cloud services provider that delivers a broad range of services to businesses of all sizes and in all geographies—making them more secure, enhancing the performance of their business-critical applications, and eliminating the cost and complexity of managing individual network hardware.” What I like about them is the rapid growth. “In Q2, we achieved revenue of $152m, up 53pc year-over-year. Our revenue growth continue to accelerate as we saw strength across all customer segments. In particular, we added a record of 143 large customers those that pay out more than $100,000 per year and ended the quarter with 1088 large customers, 19pc of the Fortune 1000 are now paying by their customers and we continue to see particular strength across our enterprise business.” The net expansion rate is also impressive. “Our expansion rate also improved over Q1 with dollar based net retention reaching 124pc in Q2, even stronger revenue and customer growth and our gross margin improved to 78pc, up 120 basis points year-over-year. If there were a theme for the quarter, it was Cloudflare winning the business of the largest and most sophisticated companies and organisations in the world.”

DotDigital. DOTD. Buy @ 279.5p

DotDigital started life in 2009 as a web design and development business called Elipsis Media and was soon renamed DotMailer after building a product, initially for the BBC, which was then offered to the mass market. Subsequent key landmarks included the appointment of Milan Patel as CEO in 2016, the acquisition of Comapi in 2017 and the subsequent renaming as DotDigital. Under Patel’s leadership the shares have risen sevenfold as the company has pursued a strategy of international expansion and constant innovation around the central theme of digital marketing. Partnerships are a key element in the group strategy. “We already partner with many of the leading ecommerce and CRM platforms, including Magento [part of Adobe], Microsoft Dynamics 365, Salesforce and Shopify – but we’re still not satisfied. With the mutual revenue possible and excited about what the future has in store”. As is international expansion. “Strengthening relationships with partners will be vital in growing our position in North America, as will the expansion of dedicated sales teams across the North America, APAC [Asia Pacific] and EMEA [Europe, Middle East and Africa]. Singapore, Vietnam, and Hong Kong are just some of the APAC markets we will be dedicating our efforts in, as will France and Germany in the EMEA region.” Over the last decade DOTD has delivered a 21 annual growth in engagement cloud revenues and 24pc growth in ebitda and sees AI as the next frontier for the business.

Focusrite. TUNE Buy @ 1590p

Focusrite has grow by acquisition to become a family of eight brands supporting musicians with an increasing global footprint. In the annual report for 2020 the group summarised the effect of both these strategies. “All major geographic regions grew: North America was up by 39.9pc; Europe, Middle East and Africa by 65.9pc; and the Rest of World by 59.7pc. This includes the benefit of a full year of ADAM Audio trading, eight months of Martin Audio trading and increased demand due to widespread lockdowns.” As an example of how the group is using digital technology to transform the music creation process “Ampify was set up in a separate UK location to develop what has become some of the most downloaded and recognised music creation apps in the world.” Covid has had a big impact on the group. “The use of Focusrite audio interfaces has expanded with the growth of podcasting and the use of Zoom and other platforms for creative applications in music, as well as film and TV dubbing and radio entertainment where actors voice productions from home.” If 2020 was a good year 2021 looks like being a barnstormer with interim results showing sales up 90.9pc and ebitda up 219.9pc. The company sees challenges but also strong prospects. “We believe the customer base has materially grown, with more people utilising these solutions for music creation, podcasting, social media broadcasts and other streaming workflows. The digitisation of almost every facet of modern life continues unabated, and audio is no exception.” The only business seeing reduced demand is the one catering for live events and that will surely recover strongly as the vaccination rollout continues.

HelloFresh SE HFG. Buy @ €95

HelloFresh is a business delivering ingredients to prepare healthy meals at home so no surprise that Covid-19 inspired lockdowns have been a game changer for the business. As they say in their latest annual report the demand for online food offerings has increased immensely such that four or five years of growth have been concentrated into one year. The group coped by doubling capital expenditure between 2019 and 2020 so that it was able to deliver over 600m healthy and easy to prepare meals. Strong growth has continued in the first half of 2021 with sales increasing by 87.2pc and customer numbers rising from 4.18m to 7.68m. The group strategy is to expand into new geographies, add more customers and increase the number of products it can supply to its customers on the way to becoming what it calls an integrated food solutions group. In 2021 it plans to expand into two or three new geographies and has acquired a US business call Factor75, which supplies prepared meals. The group has big ambitions. “With the acquisition of Factor late last year and with Youfoodz in Australia in early Q3, we are firmly committed to also becoming a leading player in the ready-to-eat market. With the launch of the HelloFresh market in Benelux and the U.S., we have further broadened our suite of products and increased our relevance to consumers, so that we’re on a clear trajectory to actually becoming the world’s leading food solutions group as outlined in our vision.”

Impax Asset Management IPX. Buy @ 1292p. (new entry)

Impax has pioneered investment in the transition to a more sustainable global economy and today is one of the largest investment managers dedicated to this area. As I have frequently observed asset managers do well in bull markets and Impax is no exception. It is also benefiting from its tight focus on the increasingly fashionable themes of ESG (environmental, social, governmental) investing. Latest results showed assets under management, the key driver of performance at asset management groups, rising almost 50pc to over £30bn helped by £6.8bn of net inflows and rising markets. Because asset management businesses are so scaleable (more funds under management do not lead directly to more managers) operating profits rose even more strongly. “Adjusted operating profit almost doubled versus H1 2020 to £20.7m (H1 2020: £10.5m, H2 2020: £12.7m) as a result of the growth in revenue. Run rate annualised and adjusted operating profit also grew strongly to £51.7m at the end of the Period. This resulted in the adjusted operating profit margin increasing to 34pc (H1 2020: 25%, H2 2020: 28pc).” Unlike other companies asset managers’ profits are unpredictable but the broad thrust looks positive. “Over the next few years we expect the companies that we invest in to continue to benefit from the secular trend of expanding investment into the transition to a more sustainable economy.”

JTC. JTC. Buy @ 748p

JTC was established in Jersey in 1987 to provide fund management services to clients. After buying Merrill Lynch’s international trust and wealth structuring business in May 2017, the company was the subject of an IPO on the London Stock Exchange in March 2018. The company made two major acquisitions in 2020: it bought Sanne Group’s private client business in March 2020. and then bought NES Financial for $40m in April 2020. It is based in Jersey but also has offices in Guernsey and Luxembourg: it employs some 650 staff globally. They say. “The combination of consistent organic growth and highly visible recurring revenue creates a compounding effect that drives the future value of the business. We are skilled and disciplined at finding acquisitions that complement and expand our core business. We extract value through proven integration methods and seamless transfer to the JTC platform.” Acquisitions play a key part in the growth with 23 made since 2010. Latest results for 2020 showed revenue up 15.9pc, ebitda up 9.4pc, new business won up 20.1pc, a new business pipeline up 49.7pc and in a sign of confidence for the future the dividend in creased by 27.4pc. The group has now delivered 33 consecutive years of growth.

Lonza. LONN Buy @ €771

Lonza is a highly successful Swiss company which reported 12pc sales growth in 2020. It has such a great portfolio of businesses that it has even divested its specialty ingredients business which most companies would love to own in order to focus on its core pharmacy, biotech and nutrition business (LPBN) which delivers a 32.1pc ebitda operating margin. Some idea of the momentum in the business is that they say “We invested around 20pc of sales in CAPEX in 2020 to continue to expand the asset footprint supporting our double-digit sales growth and ROIC [return on invested capital] increase for the future.” Alongside the sale of the specialty ingredients business the group has raised funds from a €500m bond issue and a Swf150m bond issue. The group has been playing a critical role in the battle to control Covid-19 including a partnership with Moderna which was recently expanded to a new drug substance production line at a Lonza site in the Netherlands to produce 300m doses a year with operations expected to begin by the end of 2021. The sale of the specialty ingredients business is expected to complete in H2 2021 and raise Swf.4.2bn (US$4.6bn). The result is that the LPBN division will become the future Lonza and the strong balance sheet will enable the company to invest aggressively in its growth. The annual report discusses just some of the many initiatives being taken to accelerate growth and paints an exciting picture of prospects.

Microsoft. MSFT. Buy @ $304.

One of the impressive things about Microsoft is the number of exiting companies in the Quentinvest portfolio which talk about important partnerships with Microsoft. It is as though they operate a gigantic global technology platform which is a key enabler for other exciting companies to make progress towards their goals. It is no surprise that after Apple they are the most valuable business in the world and have been able to sustain that sort of position for so many years. As happens with many companies there was a period of extraordinary growth under founder, Bill Gates, then a pause for breath and then a new growth charge with the appointment of Satya Nadella as CEO in February 2014. It highlights the importance of having a CEO who has a strong vision for the business. Nadella came out of the cloud where he headed that division and that is where he has taken the business with the cloud related activities growing apace, capitalising on the tailwind of a world undergoing a massive digital transformation. Unlike many of the new wave of cloud software businesses that are very focused in their approach Microsoft has productivity software (where it started with operating systems and Office), it has Azure and the cloud business, it has the gaming related operations, it has LinkedIn (social media and recruitment for professionals) and much else besides. Analysts forecast strong growth out to June 2024 but I suspect this is based on regression analysis as much as a detailed analysis of such a far flung business. You get the flavour from Nadella’s comments. “We continue to grow new franchises for Microsoft in large and growing markets. In the past three years alone, gaming, security, and now LinkedIn, have all surpassed $10bn in annual revenue. Now, I’ll highlight our innovation and our expanding opportunity across the tech stack starting with infrastructure.”

Repligen. RGEN. Buy @ $266

Repligen manufactures key components for biopharma companies including for Covid from facilities in the USA and Sweden. Partly but not only because of Covid sales are growing rapidly. “Our reported organic revenue growth of 69pc year-over-year along with significant margin expansion reflects the outstanding efforts by our entire team as we focus on capacity expansion and capital project programs to meet accelerating demand, on fast tracking the hiring of more than 300 people, completing the next phase implementation of SAP while delivering critical products to our expanding customer base.” There is plenty going on. “We also executed on our M&A strategy, adding an important player in hollow fiber technology to our fast growing filtration franchise. As noted in prior quarters, we continue to see very positive performance in our non-COVID base business, which was up 35pc, accounting for 66pc of revenue and 31 points of total growth. We had another strong COVID quarter, which represented 27pc of our revenue or 42 points of our total growth. Finally, revenue from acquisitions we made in 2020, namely ARTeSYN, EMT and NMS, represented 7pc of our revenue and 13 points of growth. We continue to be encouraged by the sustained strength in our non-COVID business where all our franchise continued to perform above our expectations, led by our filtration franchise, which was more than doubled through the first 6 months of 2021.” Prospects are also strong. “On the orders front, we continue to see strong momentum with orders up approximately 140pc in the first half of this year compared to 2020.”

Sea Limited SE. Buy @ $315

Sea Limited is the South East Asian stock market superstar with fast-growing businesses in video gaming, e-commerce and e-payments. It is led by the usual group of Stanford and Harvard educated alumni, who run the business in a very American fashion while being ethnic to the countries where they are doing business. Covid has helped a business with such a strong online focus but they were growing fast before anyone ever heard of Covid and seem likely to come out of of any ending of lockdown still in very strong shape and still with massive opportunities. On reporting Q1 2021 CEO and co-founder, Forrest Li, noted “At the group level, for the first quarter of 2021, we’re happy to report GAAP revenue of $1.8bn, which represents 147pc year-on-year growth. We’ve recorded particularly strong growth in gross profits, which reached $645.4m, up 212pc year on year, while adjusted EBITDA was $88.1m, compared to a loss of $69.9m a year ago.” Their blockbuster video game, Free Fire goes from strength to strength. “Free Fire remains the highest-grossing mobile game in Latin America, Southeast Asia, and India for the quarter according to App Annie, maintaining its top rank for Latin America and the Southeast Asia for seven consecutive quarters and achieving the same in India for two consecutive quarters.” The ecommerce business Shopee continued to race ahead. “Shopee reported 1.1bn gross orders, up 153pc year on year, and a GMV of $12.6bn, increase of 103pc year on year. GAAP revenue grew 250pc year on year to $922.3m.” Payments are also on fire. “SeaMoney’s mobile wallet services reported a total payment volume of $3.4bn, which more than tripled compared to $1.1bn a year ago. Quarterly paying users surpassed 26.1m in the quarter. We are pleased that ShopeePay continues to gain traction as the quick and the convenient online and contactless payment option. Indeed, according to Snapcart Indonesia survey in March, ShopeePay was the most used, the most remembered, and the most liked mobile wallet by Indonesian consumers during the fourth quarter.”

Genus GNS. Buy @ 5950p

Genus plc is a British-based business selling elite genetics and other products manufactured using biotechnology to cattle and pig farmers. This company always makes me think of the King of Siam in the musical The King and I who was obsessed with a scientific approach. He would surely have approved of Genus which applies scientific methods to the otherwise hit and miss business of breeding livestock. This has become an important global business. At their capital markets day in June 2021 the company talked about genomic selection, bio systems engineering, gene editing and reproductive biology. As I have discovered from watching Clarkson’s Farm on Amazon it is vital for farmers to use every possible trick to maximise returns and Genus helps them to do that by making sure they have the highest quality livestock. It is a big market because despite the vegetarianism craze there is also a trend for affluent customers in the Far East and the developing world to switch to meat-rich western diets. Livestock markets are big – 19bn chickens, 1.5bn cattle, 1bn sheep and 1bn pigs worldwide. Genus’s mission is to drive constant genetic improvement in the world population of dairy and beef cattle and pigs. The results are striking. Since 1970 food conversion in pigs has improved so that where 380kgs of feed turned into 100kgs of pig now 253kgs of feed becomes 115kgs of pig. In the US, over a similar period 13pc fewer cows now produce 76pc more milk. The group also sees a huge opportunity in China where African Swine Fever has decimated herds and there is an urgent need for improved breeding stock. Genus is building a strong China team to deliver PRRS (porcine reproductive and respiratory system) resistant pigs.