Preparing for the shift from print to online as jittery markets consolidate

After some 36 years of continuous publication in print format Great Stocks and Great Charts (formerly Quantum Leap and Chart Breakout) are preparing to join the 21st century and become a fully-fledged part of the digital era. The print format will continue for another three months (October, November, December) but after that they will no longer be printed and posted to subscribers and will transfer entirely to being available online.

This has great advantages for both recipients and publishers. You receive a publication the minute it is published (no waiting for printers and snail mail). There is more flexibility in the writing and best of all it becomes easier and more obvious to integrate the material with everything else in the Quentinvest ecosystem.

Here is the best bit. When you switch from offline to online you get everything. So if you previously received either of Great Stocks or Great Charts you will now receive both of these publications and all the Quentinvest Alerts which focus on timing and individual stock selections. These three bought separately would cost £568.50. We are also consolidating Quentinvest for ETFs into the all-in Quentinvest subscription so subscribers get everything we do. This adds another £99.50 of value taking the cost of the total package to £668.

However we are offering the whole package for £249.50 a year or £24.99 a month. Plus, in line with the enclosed flyer, subscribers to either of the print publications will have a free trial period when they receiver everything online plus three months of the printed versions. Only then do you have to decide whether to subscribe to the online package and we will be looking at ways to take into account any unused subscriptions to the printed versions.

Last but certainly not least is the performance. The whole Quentinvest ecosystem is dedicated to the search for what I call 3G stocks (great chart, great growth, great story). Only stocks with these characteristics are selected to go into the Quentinvest portfolio – a table of all the stocks ever recommended. As you can see from the web site the performance is excellent. The shares we pick tend to go up, often a lot and compared to the UK stock market we are not in the same race or if we are, UK plc is walking and we are riding a Harley-Davidson.

The core idea of Quentinvest is very simple. I want my subscribers to build a portfolio based on Quentinvest stocks which are a who’s who of the most exciting quoted companies in the world, the businesses shaping the 21st century.

I encourage my subscribers to think long term, to think like an owner because that is what you become when you buy shares in a company. Warren Buffett buys such big chunks of stock and is so famously long term that he is often invited to sit on the board. This probably won’t happen to us but we will be part owners just as much as he is and can actually look through the accounts to see how much of the group’s sales belong to us (total sales divided by number of shares in issue times shares we own). This is an exciting thing to do with companies growing at 50pc plus a year as many QV stocks are. You may not seem to own much now but look out 10 years and you could be the owner of a sizeable, even life-changing little business still growing very rapidly.

My impression is that we are living with uncertain markets presently. Shares have good days and bad days. This is understandable after the brilliant period we have had since March 2020, let alone the huge rise since March 2009. Since March 2020 the Nasdaq 100 has climbed 134pc, trough to peak. In the process many shares have been rerated and an exciting future is priced in so it is harder to make dramatic further progress. However you could have said something similar for years now. Great stocks nearly always look expensive.

Progress there will be because the future is so exciting, driven by an unfolding and arguably accelerating technology revolution, certainly if expanding r&d budgets have anything to do with it, and the spreading impact of globalisation. When I started looking seriously at shares, long, long ago it would have been ridiculous for most businesses to talk about global markets. The world was fragmented and huge areas were sealed off completely, sometimes literally by walls.

This has changed dramatically. We now have companies barely 10 years old not only targeting or even making sales of $1bn plus a year but also explicitly making and even rolling out global strategies to address a market which has become almost unimaginably huge. I think of addressable markets as the number of people who own smart phones. In September 2021 there were 3.88bn smart phone users in the world rising to 4.88bn if we add in feature phones.

No wonder companies, even those with sales in the low billions of dollars keep saying they are just scratching the surface of their ultimate opportunity. This is a very exciting time to be an investor.

Affirm Holdings AFRM Buy @ $116.- “Even at our blistering pace of growth, the opportunity before us is fast.”

Atlassian. TEAM. Buy @ $389 – “… the opportunities in front of Atlassian have never been greater.”

FactSet Research Systems. FDS Buy @ $394 – “The need for more differentiated content and analytics is at an unprecedented high.”

Inmode. INMD. buy @ $78.50 – “This ongoing demand reflect how the minimal invasive aesthetic surgical space is growing.“

MongoDB. MDB. Buy @ $474 – “As proud as I am of the amazing journey we’ve had, I’m even more optimistic today about our opportunities ahead.”

Netflix. NFLX. Buy @ $611.- “It’s still early days in pretty much every market around the world.“

Repligen. RGEN. Buy @ $281. – “…strong momentum with orders up approximately 140pc in the first half of this year compared to 2020.“

Workiva. WK Buy @ $142 – “It continues to be an exciting time for Workiva.”

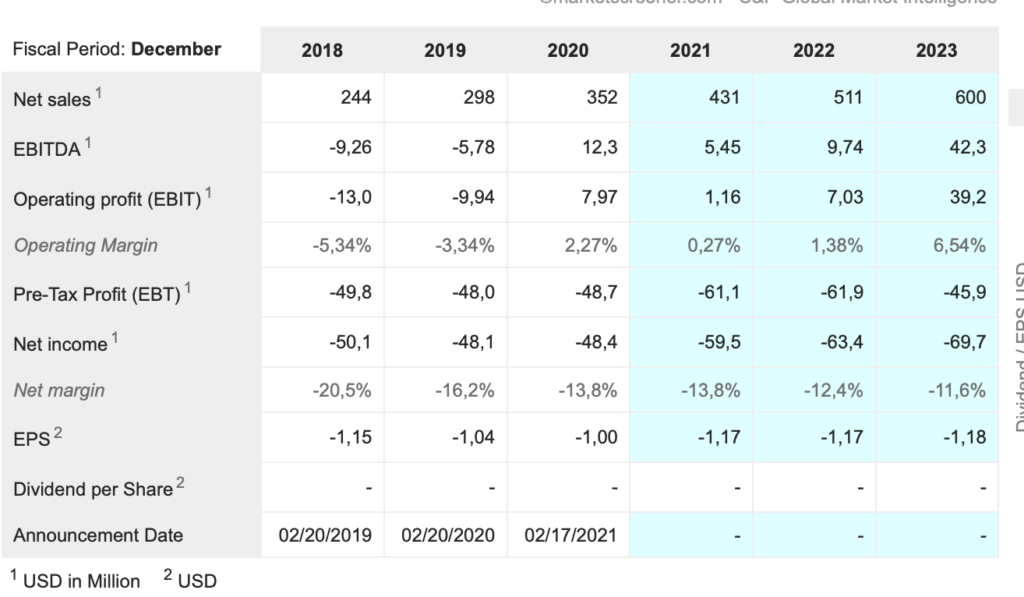

Affirm Holdings. AFRM. Buy @ $116 Times recommended: 2 First recommended: $109 Last recommended: $105.5

BNPL specialist, Affirm, adds partnerships, rolls out exciting innovations, targets world conquest

Affirm is forecast to have sales of $1.2bn in the year to 30 June 2022. It currently has 1,641 employees or did recently. The number will no doubt have climbed since. It is not quite the case but the number is not so far from $1m of sales per employee. On paper the group is reporting losses but it is obvious that a business with sales of nearly $1m per employee must be fundamentally hugely profitable.

They are making losses precisely because they are growing so fast. This becomes clear if you look at their latest profit and loss statement. In Q4 2021, ending 30 June 2021, Affirm had sales of $262m and spent a combined $134.7m on technology and data analytics (another name for r&d) and sales and marketing. All of this spend is an investment in growth. In Q4 2020 when they slowed this spending dramatically they moved into significant profit.

Most companies when I began investing spent nothing on r&d which was considered wasted money and not a lot on sales and marketing because without the r&d they didn’t have a very exciting story to pitch to potential customers. The reason why so many companies like Affirm are growing so fast is because they do have an exciting story to tell, they are making a real difference to their customers’ lives and businesses and so it is worthwhile for them to invest so much. In the jargon the lifetime value of the customers they can acquire exceeds the cost of acquiring them, often by a large margin.

This is what makes 21st century stock markets such exciting places and Affirm Holdings is a prime example. They are having a massively disruptive effect on the way consumers buy stuff and the way merchants sell and, in the time honoured phrase, they are just getting started.

Their latest quarterly report is packed with exciting innovations and developments. They have just partnered with Amazon to enable buyers and merchants on Amazon to use their buy now pay later services. This follows earlier deals with Shopify and Wal-Mart. They are launching a new kind of debit card, Debit+, which consumers will be able to use to decide how they want to pay for stuff, up front, over short periods in interest free instalments or over longer periods with interest charge but in a completely transparent way with no nasties hidden in the small print.

Affirm is a great example of explosive growth. CEO, Max Levchin, co-founded the company in 2021 and it is expected to report sales in the current financial year of around $1.2bn. This ties into another reason why the business is growing so rapidly. It is a platform so it is infinitely scaleable. It is just software, proprietary software. It doesn’t need to spend a penny if customer numbers double – no new factories and in these days of work from home maybe not even any new offices.

There is nothing to stop Affirm from having revenues of $10bn, even $100bn and if you talked to Levchin after a couple of beers in a relaxed moment he might well tell you that the company has exactly such ambitious targets. The sky really is the limit for businesses like Affirm, which is why it is so exciting to become a part owner.

You might think that a business which depends on some computer code, some intellectual property is vulnerable to competition. Think again. One of the world’s great consumer businesses, Coca-Cola, is an IP business. They own the formula to coke and various other beverages. The bottling and distribution is done by other companies and Coke just collects royalties. Similarly Microsoft shares rose from 10 cents to $68 ibetween September 1986 and January 2000, all based on software – the Windows operating system and the Office suite of application software. Software can be very valuable. It is often the guys selling the hardware who struggle.

Just like Microsoft Affirm is using its base with one single launch product to build a much broader offering. This means it grows not only by adding new customers but also by having more services to sell to each of those customers. It is a powerful formula, especially in an era when rapid technological advance is enabling fleet-footed companies to disrupt old ways of doing things on a global basis.

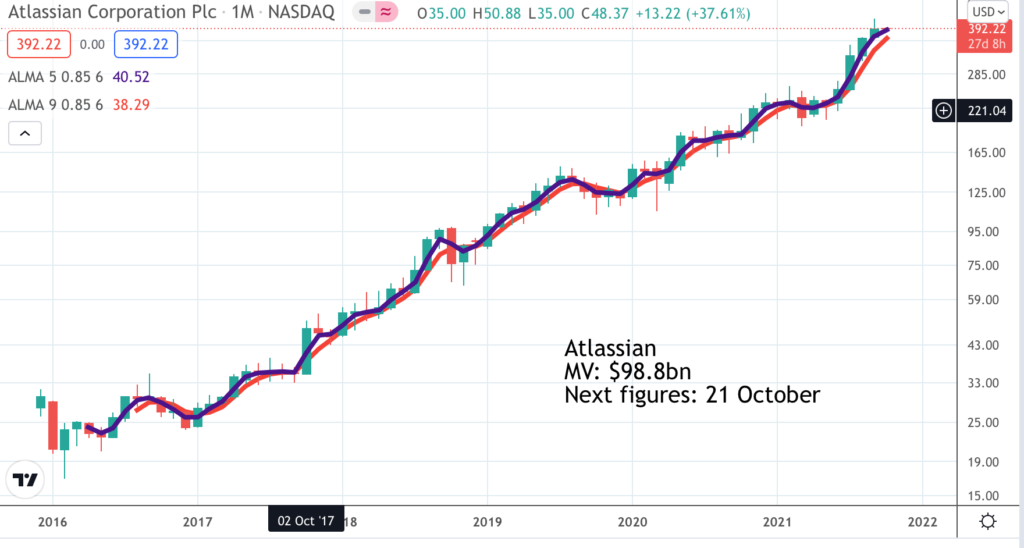

Atlassian. TEAM. Buy @ $389. Times recommended: 18 First recommended: $110 Last recommended: $390

Atlassian shifts its teams software to the cloud and majors on r&d to offer unbeatable value

Atlassian is another software based business. It has been around longer than Affirm, having been launched in 2002 by the two founders who are still the co-CEOs and as full of ambition as ever. Another difference is that Afirm’s revenue is primarily transaction related. They charge a fee to the merchants for the business taking place using their platform so, in theory, no transactions no revenue. Atlassian charges a subscription to use its platform and all its customers are businesses and organisations. This generates recurring revenue which is especially highly prized by investors.

There are two other things that make Atlassian unusual. The first is that because the business started life in 2002 it began selling by selling software licenses and has only more recently begun switching its business model to subscription sales (SaaS or software as a service) sold from the cloud. The second feature is a lower reliance on sales and marketing to promote its business.

Atlassian spends an incredible amount on r&d and relies on offering richly featured software at a very good value price to generate sales, often by word of mouth. You can see why this would be an attractive strategy from the point of view of the customer because he knows he is getting a good deal. It also makes it very hard to compete with Atlassian because the deal is so good.

You can see all these aspects of Atlassian’s business illustrated in its latest quarterly report (Q4 to end June 2021). Sales overall grew 30pc to $580m. Within that subscription (SaaS) sales grew 50pc to $386m showing how well the cloud strategy is working. R&D spend for the quarter was a stoncking $245m, which means it is running at close to $1bn a year, which buys a lot of innovation. How many rivals could live with that!

Incidentally Atlassian’s code is TEAM which tells you a great deal about what they do. In an increasingly developer dominated world employees work in teams and one of the critical factors for corporate success is to enable those teams to work effectively together. Atlassian’s software makes that happen.

They are starting to spend more heavily on sales and marketing and that may be a function of the growing importance of their subscription revenues which really justify heavy spending to land new customers. If that is true we may see strong growth continuing in coming years as the group’s total investment in growth goes higher.

Part of what I love about these software companies is the attitude. Listen to co-CEO, Mike Cannon-Brookes, talking about their latest quarter.

“Those accomplishments include surpassing 200,000 customers and $2bn in revenue, adding over 1,500 new Atlassians to the team, and building five new products on top of our rapidly advancing cloud platform. Plus, we’re launching into FY22 equipped with a full ladder of cloud editions – Free, Standard, Premium, and Enterprise – designed to meet the needs of virtually any customer. There’s a lot to celebrate, but we won’t pause to party. Our sleeves are rolled up and we’re keen to keep putting in the hard yards to seize the massive opportunities in front of us.”

Like many exciting 21st century companies Atlassian is on a hugely ambitious mission.

“As we reimagine the future of work in our three core markets – agile development, ITSM (IT service management) and work management for all – we’re growing an entire ecosystem that advances our mission.”

Atlassian shares are not cheap with the business valued at close to $100bn but then they never have been and that has not stopped them becoming more valuable. It takes an effort of imagination to see just how big these businesses can become. Who ever thought, when they floated in 2015, that six years later the business would be worth so much, still be growing so fast and have such a huge opportunity in front of it.

FactSet Research Systems. Buy @ $394. New entry

FactSet may be a tortoise but shares up nearly 100-fold in 25 years ain’t bad

FactSet Research Systems is more of a tortoise than a hare compared to companies like Affirm and Atlassian but has other attractions to make it a valuable addition to a portfolio. This is how they start their web site. “We’re proud of our 40 consecutive years of revenue growth and 24 consecutive years of adjusted earnings growth as a public company.” They are right to be proud. It is a great achievement and has helped the shares rise nearly 100-fold since the IPO in July 1996.

Despite this considerable achievement all the signs are that FactSet’s future will be even more exciting than its past.

“We enter fiscal 2021 with a sense of excitement. We are in a period of accelerated innovation within our industry as clients look to differentiate themselves and be ever more efficient. There’s a great opportunity for us to work in new ways and create new products to improve the experience of both our clients and FactSetters around the globe.”

I am seeing this with companies in so many areas. The pace of innovation is growing faster and faster and leading to new ways of doing everything.

As the name implies FactSet is an increasingly sophisticated provider of information, much of it finance-based and often being supplied to finance professionals like the 15,000 wealth management professionals across Merrill Lynch. It has grown its information sources by acquisitions of data bases such as Thomsons and has increasingly used the power of the Internet and the cloud to supply information to clients in the fastest and most convenient way.

Most recently, in another sign of the times, it has begun using AI (artificial intelligence) to shape its offerings. “In 2020, FactSet acquired Truvalue Labs, a pioneer in AI-driven environmental, social, and governance (ESG) data. Truvalue Labs applies AI-driven technology to over 100,000 unstructured text sources in 13 languages, including news, trade journals, and nongovernmental organizations and industry reports, to provide daily signals that identify positive and negative ESG behavior. Its coverage spans over 20,000 public and private companies and generates short-term, long-term, and momentum scores derived from hundreds of signals.”

Subscribers will be aware that ESG has become a huge buzz word across the whole wealth management industry so providing AI-derived signals to help is clients manage their portfolios sustainably is going to be much sought after.

They have an important mission which should drive strong growth well into the future.

“:With everyone at FactSet—over 10,000 people strong—dedicated to our digital transformation and a global team of experts who each play an important role in putting our purpose into practice, we are accelerating our efforts to capture additional market share and be the partner of choice for all existing and prospective clients. We want to be the provider of mission-critical data that guides the investment community to think more strategically about their long-term prospects across the entire investment workflow, which will drive continued long-term shareholder value for FactSet.”

FactSet’s growth in any one period may never be that amazing. They have just reported Q4 2021. “Our year-on-year organic ASV growth rate accelerated 200 basis points to over 7pc and we delivered annual revenue of $1.6pc and adjusted EPS of $11.20.”

But they have exciting plans. “As we look ahead to 2022 and beyond, we remain focused on three things: scaling up our content refinery to provide the most comprehensive and connected set of industry, proprietary and third-party data for the financial markets; two, enhancing the clients’ experience by delivering hyper personalized solutions, so clients can discover meaningful insights faster; and third, driving next generation workflow specific solutions for asset managers, asset owners, sell side wealth management and corporate clients.”

As CEO, Philip Snow says:- “The need for more differentiated content and analytics is at an unprecedented high and we are perfectly positioned to capture this demand and poised to deliver best in class workflows and a hyper personalized experience for our clients.”

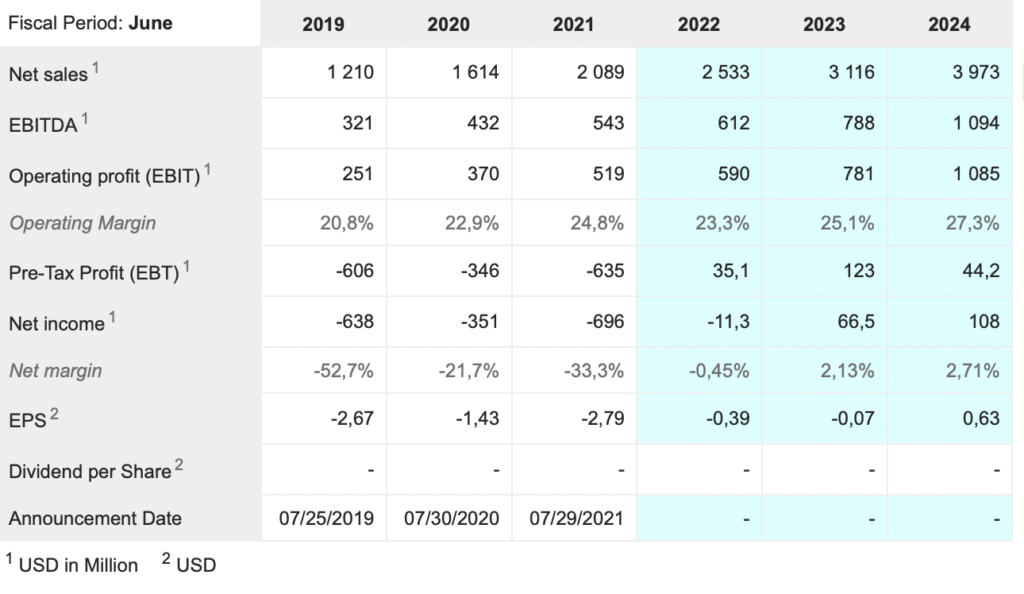

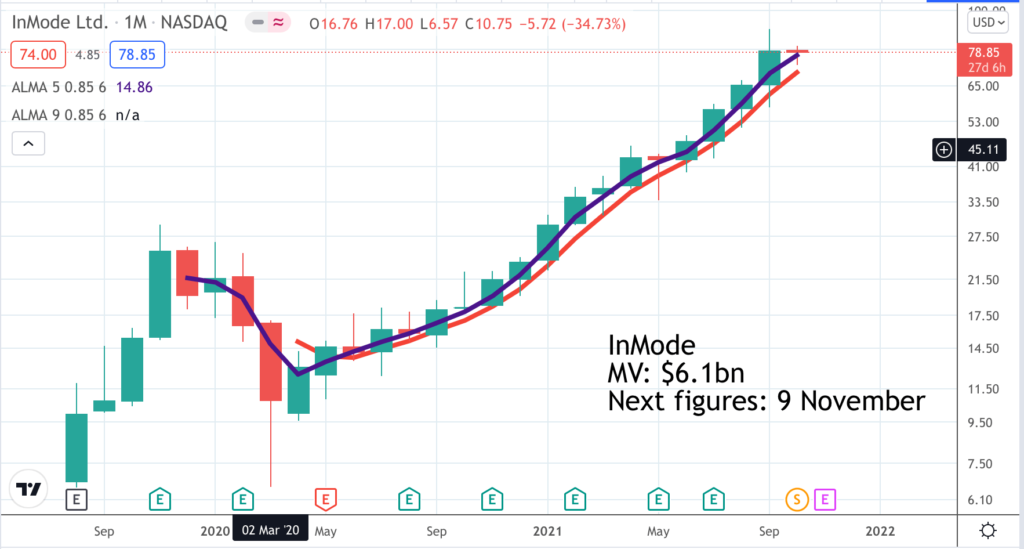

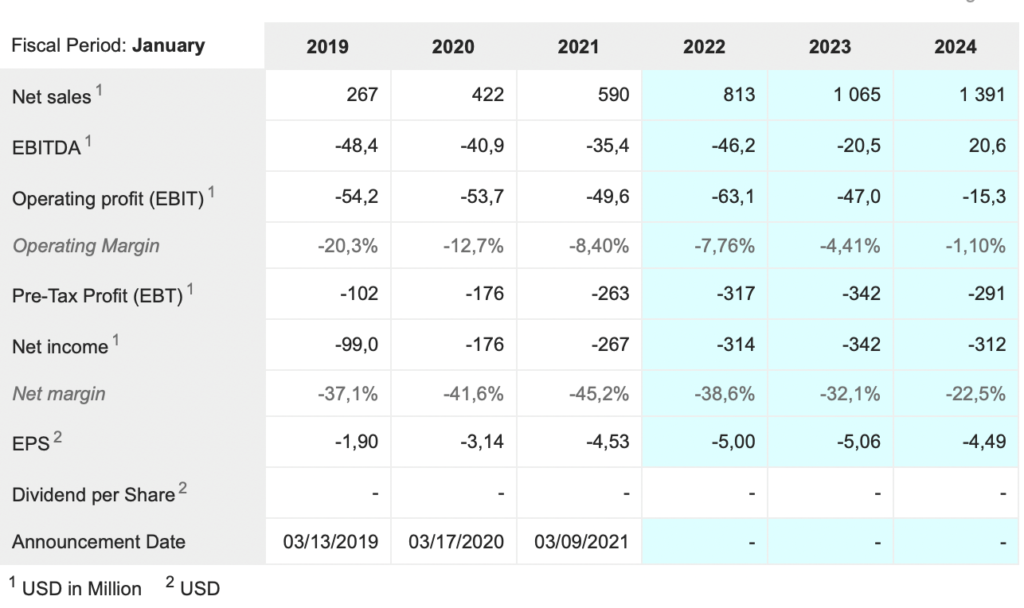

Inmode. INMD. buy @ $78.50. Times recommended: 6 First recommended: $43.8 Last recommended: $63.5

InMode’s non invasive body shaping, anti-aging technologies delivering explosive growth

InMode’s business is a mystery to me. Their technology helps reshape people’s faces and bodies. It has never occurred to me to use technology to do that. I prefer the old fashioned route of good diet and exercise and find it works very well but clearly millions of people have a different approach, especially if such instant results can be achieved in a non-invasive way.

It seems to be a very American thing – a world of movie stars, celebrities, fashion journalists and influencers who find it as natural to use interventions to reshape their bodies as the rest of us do when something more specifically medical needs fixing. Because they all do it, it has become a mass market thing which is driving very rapid growth at InMode.

“The U.S. continued to be the biggest contributor to our top line with total sales reaching $56.4m compared to $24.1m in the same quarter last year. As part of our growth strategy and following our success in the United States market, we keep expanding globally. We continue to expand our sales network in all geographic markets. This quarter, Asia and Europe were top contributors. Total sales outside U.S. were $30.9m, more than triple what we reported during the same period last year. This represents 35pc of our total revenue compared with 22pc of our total revenue in Q2 2020. Currently, we operate in 68 countries and we expect these numbers to grow.”

This is what InMode does. “InMode has leveraged its medically-accepted RF technologies to offer a comprehensive line of platforms that will enable us to capitalize on a multi-billion dollar market opportunity across several categories of surgical specialty such as plastic surgery, gynecology, dermatology, ENT’s and ophthalmologists.”

What they do certainly sound amazing. “Morpheus8 is the first and only device to mold the fat subdermally in order to morph the aging facial features into a more youthful appearance.” Maybe I am not tempted because I already have a reasonably youthful face for my age. If I had more lines or a sagging chin then a machine that fixes that in a painless way would have appeal. Who doesn’t want to look younger and more vigorous?

So perhaps it is not surprising that their business is growing at such a rate. The business is still small so well short of any kind of maturity. They can grow in their core markets. They can grow in new geographies. And they can grow by expanding into new verticals and developing new products.

“Presently, InMode’s R&D pipeline is comprised of dozens of projects in our traditional area of activity in aesthetic surgery, as well as in gynecology, ophthalmology, and ENT [ear, nose and throat], and more. Our newest platform, the Empower will be launch on 15 August. This platform is expected to become the gold standard in women’s health and wellness. The Empower will expand our business and mark a major step for InMode into the gynecology market.”

The share price performance has been distorted by the onset of Covid-19 which will initially have looked like a strong negative for such a discretionary and hands-on business. The negative affect was short lived and now the growth is being supercharged by an element of recovery. However if we net that out by comparing 2021 to 2019 this business is growing rapidly and there even seems to be an element of take-off in what is happening as word spreads about what their technology can achieve. It is reminiscent of the strong performance of another QV stock, Align Technologies, with its Invisalign procedure for straightening the teeth and even realigning the jaws of teenage girls preparing for a world of selfies.

Most recently the shares have been all over the place because of a 2:1 share split which has seen momentum investors and day traders plunging in and out of the shares. If you treat that as noise the overall pattern is strongly higher as looks very much justified by the impressive fundamentals.

I suppose the bottom line is whether it is all smoke and mirrors or whether InMode really can make a globally ageing population look younger without enduring painful procedures. Their web site is full of before and after pictures suggesting they can but then so is that of any plastic surgeon’s reception area. What we can see is how the business is doing. They claim that sales of consumables are a strong positive indicator. “Quarter by quarter, over the past year, InMode consistently posted sales of a record numbers of consumable. From Q2 2020 until today, sales of consumable have more than doubled. This indicates that physicians are successfully adapting our system with a greater frequency, paving the way for this segment to continue even more to contribute to our revenue. This ongoing demand reflect how the minimal invasive aesthetic surgical space is growing.”

This is what one analyst has to say. “Their profitability has been amazing due to their products’ technological superiority and brand recognition. These two provide a great economic moat. Also, EBITDA margin has been steadily improving over the past 5 years (3.56pc in 2016 to 44.31pc in 2021). These profit margins illustrate the high product reputation and customer satisfaction that they maintain, as well as the strength of their marketing team. I believe the profitability will remain high in the foreseeable future, as they enjoy a deep economic moat.”

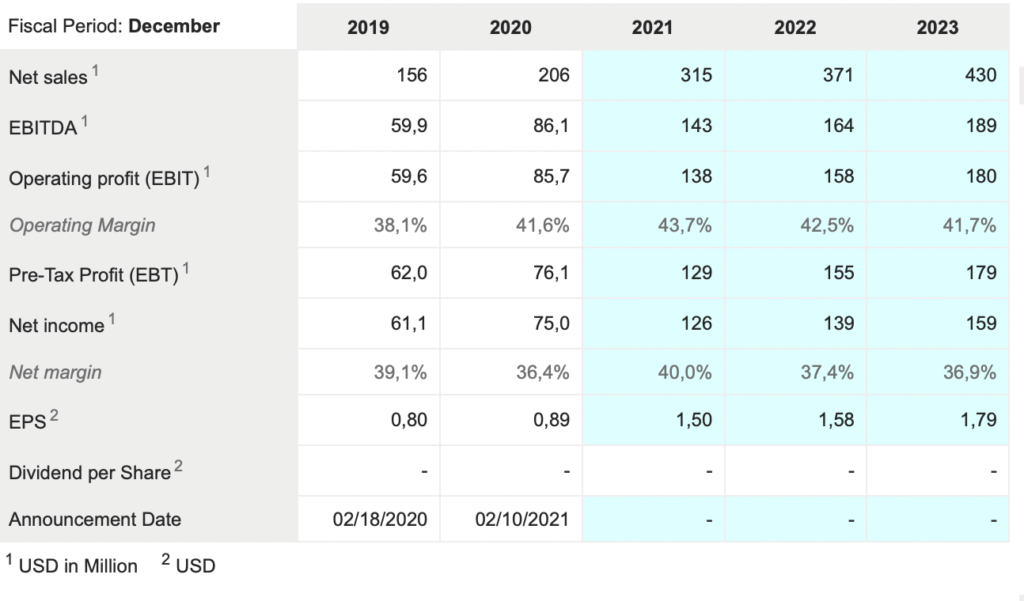

MongoDB. MDB. Buy @ $474 Times recommended: 19 First recommended: $74 Last recommended: $485

Database superstar, MongoDB, sees a wealth of worlds to conquer

MongoDB has been a long-time favourite of Quentinvest and has delivered an impressive performance. The DB stands for database and the company is doing so well because of a document-centred approach to data base management which has great appeal to developers. In effect, they are disrupting the database management market originally çreated by Oracle and having great success from so doing. Since it is a large and growing market, which has moved centre stage in importance in a world of digital transformation there are powerful following winds helping the business to grow.

One should also give a nod to an impressive management team led by Dev Ittycheria. “Before diving in [to the Q2 2021 results], I want to share that today marks my seventh anniversary at MongoDB. I’m incredibly proud of how much progress we’ve made over the past seven years. We went from being a small private company with an interesting technology to disrupting one of the largest markets in all of software. Along the way, we changed how open source software is licensed, we introduced the new cloud service that required us to both partner and compete with the largest cloud providers, and we grew revenues 20-fold with a compound annual growth rate of over 50pc.”

In typical gang-ho American fashion he ends by saying. “As proud as I am of the amazing journey we’ve had, I’m even more optimistic today about our opportunities ahead.” Given what has already been achieved, the strength of the latest results and the sense of energy and innovation pulsating through the business, who would say for a second that his optimism is not justified.

“Looking quickly at our second-quarter financial results, we generated revenue of $199m, a 44pc year-over-year increase and above the high-end of our guidance. We grew subscription revenue 44pc year over year. Atlas revenue grew 83pc year over year and now represents 56pc of our revenue, and we had another strong quarter of customer growth, ending the quarter with over 29,000 customers. Businesses across nearly every industry have realised that in today’s highly dynamic global markets, speed of development is a meaningful competitive advantage.”

The company regards this ability to help its customers digitally transform faster as a key attraction of their products.

“Fundamentally, MongoDB’s application data platform offers three intrinsic advantages.

First, MongoDB’s document model is designed around how developers think and code unlike legacy data technologies. This enables developers to be far more productive and build applications faster as compared to any other technology. Second, MongoDB’s document model is a superset of other data models. Tabular, key value, time series, graph, and other kinds of data relationships can be easily created using documents. The document model enables MongoDB to address a wide range of use cases and reduces the need for customers to use niche technologies that only serve a single purpose. Third, MongoDB is designed for performance and scale. With MongoDB’s sophisticated capabilities to replicate, manage and distribute data at massive scale, organizations increasingly choose MongoDB to address the most demanding requirements. Legacy technologies are fundamentally not designed for today’s scale and performance expectations, requiring developers to spend an enormous amount of time working around their architectural limitations.“

MongoDB is a classic enterprise software business pouring money into r&d and sales and marketing to drive fast growth which is increasingly going global. Total revenue for Q2 2021 was $199m. Against that the company spent $182m on sales and marketing and research and development. This is a company driving flat out to win the battle for territory but you can also imagine how rapidly profitability would grow if these costs grew more slowly than sales which will happen eventually as the company matures.

Like other enterprise software businesses the utility of MongoDB’s software to its customers is great in relation to its cost so there is no great pricing pressure so the company is potentially highly profitable like other mature software businesses such as Microsoft.

Meanwhile the company sees a multiplicity of worlds to conquer.

“Our second-quarter results give us even more conviction to continue investing in both our product portfolio and our go-to-market initiatives. Starting with go-to-market. Our field sales team is increasingly being pulled into higher-level strategic conversations at the C-suite of the largest companies in the world, and we are adjusting our approach to more effectively serve that audience. Last year, we expanded with increasing our focus on our most promising customers.

Our hypothesis was that by going deep into an account with more resources, it would position us more strategically and allow us to penetrate the account more quickly. Those investments produced excellent returns and those accounts that ran this experiment grew faster than we expected. This is giving us confidence to expand this deeper coverage model to more accounts this year while also focusing on expanding our field sales capacity in all regions.”

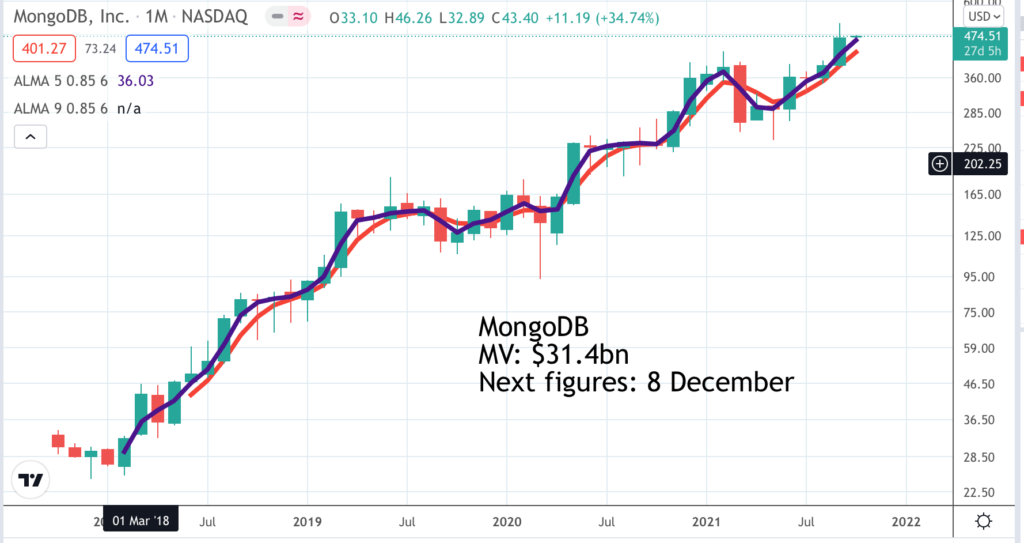

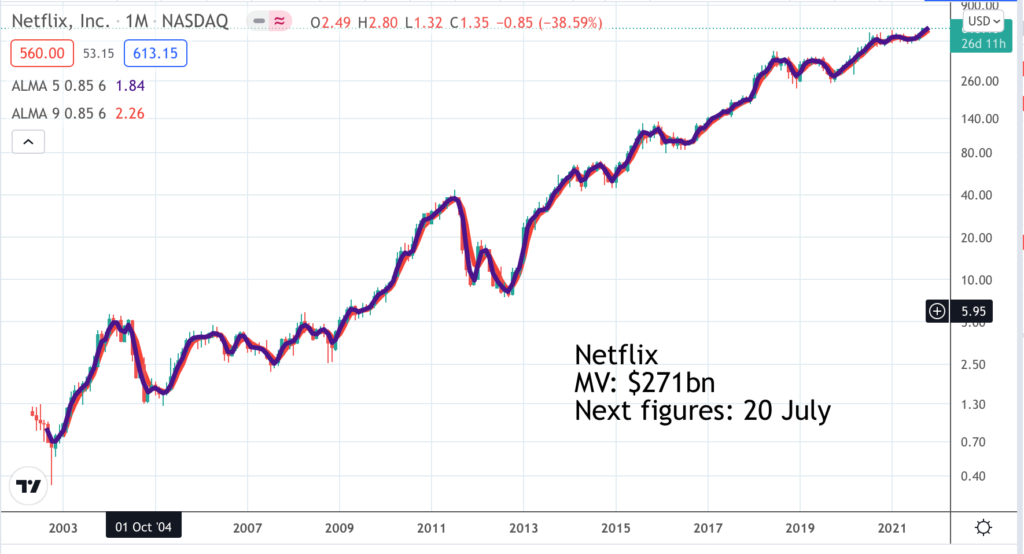

Netflix. NFLX. Buy @ $611. Times recommended: 23 First recommended: $174.13 Last recommended: $525

Netflix adds video games to its ever-improving slate of content on the way to a trillion dollar valuation

Netflix is one of the wonders of American capitalism in the 21st century. Since the shares were floated in April 2002 the price has risen from $1.17 or thereabouts to over $600. All you had to do with this one was not to sell and you would have made great profits; and they are not done yet.

When you look at a company like Netflix you have to give the management, led by joint CEOs, Reed Hastings and Ted Sarandos, the benefit of the doubt in any new initiatives they may undertake. There is overwhelming evidence that these guys know exactly what they are doing and any missteps are quickly corrected.

The big picture of why they can continue to do well is twofold. Their current subscriber numbers are well short of where they could be and those subscribers will be happy to pay more for the service over the years. Imagine the day when they have 1bn subscribers and they raise the price by $1 a month to reflect the ever more amazing content they are putting on the platform. This would generate another $12bn a year in revenue with no associated increase in costs; that is phenomenal operating leverage.

Recently they had 209m subscribers paying a wide range of subscriptions. For example my family pays £13.99 a month to watch on four devices at a time although my impression is that we can actually watch on five. Nobody would bat an eyelid if the price went up by £1 a month because it is so obviously such good value. Between us we have Disney, Amazon Prime (two subscriptions) and Netflix and all together we are spending less than £40 a month for an incredible stream of great content plus free next day delivery on loads of stuff we buy. When you think that a BBC TV licence is £159 a year and you don’t even get Jeremy Clarkson any more you realise what great value streamers are – less than the cost of two tickets to the opera at Covent Garden.

Netflix is part of a bizarre ritual with investors. The company predicts how many subscribers they are going to add in the next quarter. If they beat it the shares go up. If they miss it the shares go down. Then Reed Hastings points out in his regular letters to shareholders that the company is just guessing, that the quarterly figures are pretty meaningless and they are playing a long term gain in which streaming will progressively replace linear TV with great benefits for Netflix, as one of the main players and indeed the first mover in this field.

My guess is that for future generations Netflix will become a text book example of a business success story. They started with DVDs online, like Amazon with books, putting many of the bricks and mortar guys out of business. Then they reinvented the wheel by shifting to streaming. They then began to generate their own content on which they expect to spend $17bn in 2021.

They are also expanding into new types of content like documentaries, unscripted, animation and most recently video games and an incredibly impressive slate of foreign sourced content like the Korean horror series, Squid Games, which is shaping up as the most successful Netflix show ever.

Video games are being added at no extra cost to the viewer but they are surely playing a long game. All this extra content will justify higher prices and attract more subscribers in the future.

There is still plenty of room for growth. As Reed Hastings says in his latest letter. “We are still very much in the early days of the transition from linear to on-demand consumption of entertainment. Streaming represents just 27pc of US TV screen time, compared with 63pc for linear television, according to Nielsen. Based on this same study, Nielsen estimates that we are just 7pc of US TV screen time. Considering that we are less mature in other countries and that this excludes mobile screens (where we believe our share of engagement is even lower), we are confident that we have a long runway for growth. As we improve our service, our goal is to continue to increase our share of screen time in the US and around the world..”

An area where exciting progress is being made is operating profit margins which have risen from 4.13pc in 2016 to 20pc in 2021 and are forecast to continue to climb steadily higher.

“We continue to target a 20pc operating margin for the full year 2021 vs. 18pc in 2020. After our big global launch in January 2016, we committed to steadily growing our operating margin thereafter at an average rate of three percentage points per year over any few-year period. Some years we’ll be a little over (like in 2020), some years a little under (like in 2021). Assuming we achieve our margin target this year, we will have quintupled our operating margin in the last five years and are tracking ahead of this average annual three percentage point pace.”

Amazingly after all the progress already made Netflix looks as exciting an investment as ever. One analyst recently wrote a piece describing the company’s path to a trillion dollar valuation equal to $2,300 a share. They don’t have to do anything particularly new, just more of the same to grab an ever larger share of a huge global market.

Two key elements pointing to future success are first the creativity they are unleashing. “Last week, Netflix series and specials received 129 Emmy nominations.” Second is that they no longer need outside funding. “We believe we no longer have a need to raise external financing to fund our day-to-day operations.” And their conclusion. “Our belief is that as we steadily improve our service to better please our members, this will lead to continued growth in our membership base, ARM, revenue, operating margin and profit dollars.”

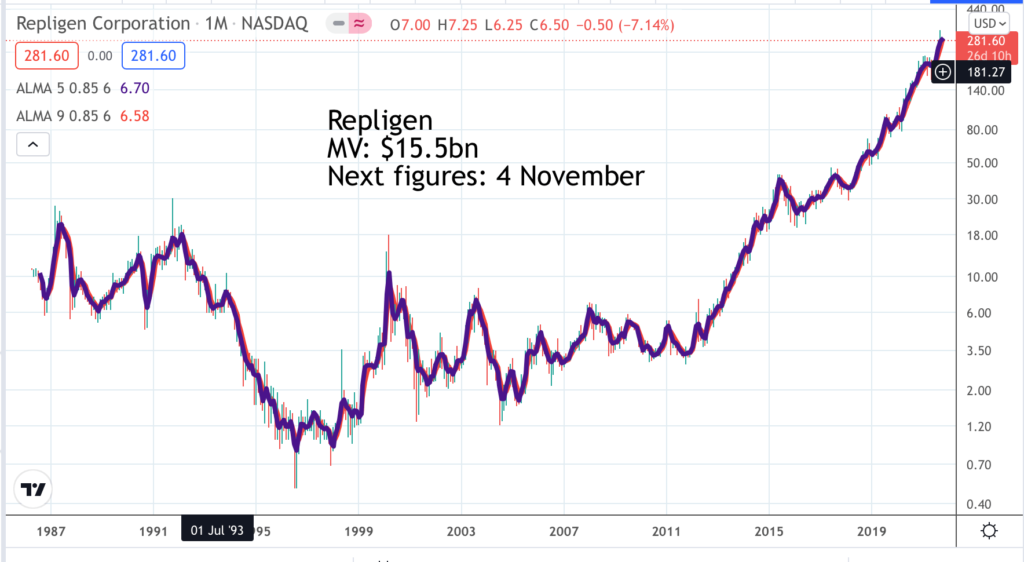

Repligen. RGEN. Buy @ $281. Times recommended: 11 First recommended: $116.45 Last recommended: $285

Tony Hunt, CEO from 2015, leads Repligen’s transformation from commodity protein supplier to a handful of OEMs to high tech supplier to multiple biopharmas

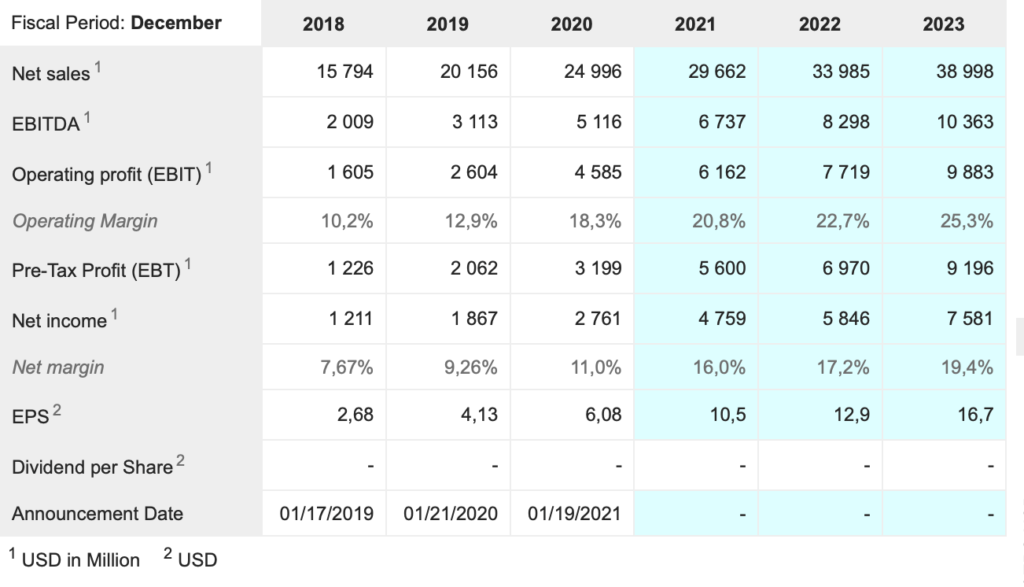

Repligen is a medical technology company which is on a tear with latest Q2 sales up 86pc to $168m. This breaks down into 69pc organic growth with the balance from acquisitions and within that 35pc from the core business and the balance from Covid-related sales which accounted for 27pc of total revenue.

Investors have a tendency to regard Covid sales as exceptional but we may well find that Covid and its many variants are with us in some form or other for a long time. There is also a growing awareness that the battle to contain the pandemic has given a huge boost to medical technology and the battle against disease generally.

As so often with highly successful companies it has much to do with an inspirational CEO, Tony Hunt, who took charge in 2014 and has piloted Repligen’s transformation from a commodity supplier of raw materials to two or three OEMs [original equipment manufacturers] to a direct supplier of unique biological products and technology to a wide range of biopharmaceutical developers.

This process has been aided by a string of acquisitions. In the words of one analyst – “He’s been a phenomenal CEO,” said Jefferies analyst Brandon Couillard. Hunt “came in and had a really clear strategic vision around M&A, where he wanted to take Repligen and the specific areas of the market where he thought they could have an advantage with technology.”.

This new focus for the company left them perfectly prepared when Covid-19 came along. “We’re now on a journey of helping companies develop vaccines and treatments for Covid-19 in addition to our normal work.I think this is very new for everyone, and we are adapting to this unexpected situation.”

The deals keep coming. The group has just announced the acquisition of Avitide for $150m, half cash and half stock. Hunt says:- “The addition of Avitide is a major step forward in building out our Proteins business and in particular our affinity ligand discovery engine”, which sounds good though I don’t pretend to know what it means.

Shortly before that he says:- “We also executed on our M&A strategy adding an important player in hollow fiber technology to our fast-growing filtration franchise.” M&A has been a powerful driver of past growth so it is good to see plenty of activity continuing.

There is huge momentum in the business.

“We continue to be encouraged by the sustained strength in our non-COVID business for all our franchises continued to perform above our expectations led by our filtration franchise, which was more than doubled through the first six months of 2021. On the orders front, we continue to see strong momentum with orders up approximately 140pc in the first half of this year compared to 2020 as customers continue to fill out the order book for the second half of 2021 and first half of 2022. In the quarter COVID orders represented 28pc of the order book. Given the strength in orders and overall first half revenue performance, we now expect 2021 to finish between $625m and $645m with COVID revenue coming in between $170m and $180m. Our base business growth should be north of 30pc reflecting the strong adoption of our core technologies and bioprocessing.”

Another exciting indicator is their aggressive building programme to expand capacity. As they say:- “As noted in May, our number one priority continues to be building our capacity to support accelerating demand across all of our businesses.”

In summary Hunt says: “We are especially encouraged for our base business growth, which we anticipate will be north of 30pc this year. With additional capacity coming online new products continue to hit the market, excellent performance by our recent M&As, the future is bright. And we continue to execute on our long-term growth targets, which we are now revising, with the goal of surpassing $1 billion in revenue in 2024.”

Workiva. WK Buy @ $142. New entry

Workiva is a wonderful company that specializes in helping coordinate regulatory and financial reporting become ‘the world’s leading platform for simplifying complex work‘.

What Workiva’s software does is automatically update values from validated sources to the final reports, and track who made modifications and if they have the required permissions. By doing so companies can have reports more quickly and with fewer errors.

Developing this specialized software has been a good business for Workiva, which is now moving its software solutions to a new cloud platform, and already over 90pc of the customer annual contract value (ACV) has been upgraded to their new platform. This makes the online collaboration of remote workers easier, and speeds the digitization of the office of the CFO.

Despite the amazing growth Workiva has had, it believes it has just scratched the surface of its total addressable market. There are more than 108,000 companies with over 250 employees in the U.S., E.U. and Canada according to public records, and that is not even counting potential government clients. Based on the normal $150 annual contract value per customer, the TAM for Workiva would be $16.2bn.

Latest results for Q2 2021 show the strong growth continuing. “We target being a low to mid 20pc growth company. And for the first half of 2021 we delivered total revenue growth of 23.7pc. Other highlights of the quarter included posting strong operating cash flow, our third highest in company history, achieving our highest revenue retention rate in 2.5 years and continuing to grow the percentage of customers with an annual contract value of over $100,000 and $150,000.”

The company also sees big opportunities in Europe. “The EMEA [Europe, Middle East & Africa] team continued to build a strong new local pipeline with a focus on ESEF [European Electronic Single Format] and other use cases. We are pleased with our incremental performance in the ESEF market. We believe it is still early days and that the market has a long tail. We remain optimistic about the opportunity and are expanding our selling organization to capture the market as it reopens.”

The company has a fully worked out growth strategy. “All four tenets of our company strategy are now fully in motion. We expect fit-for-purpose solutions, along with our modern platform, marketplace, and partner ecosystem to drive our growth.”

Prospects look better than ever.

“It continues to be an exciting time for Workiva. The world is changing at a rapid pace and we believe we are well positioned to capitalize on the increasing opportunities to power transparent reporting for a better world.”