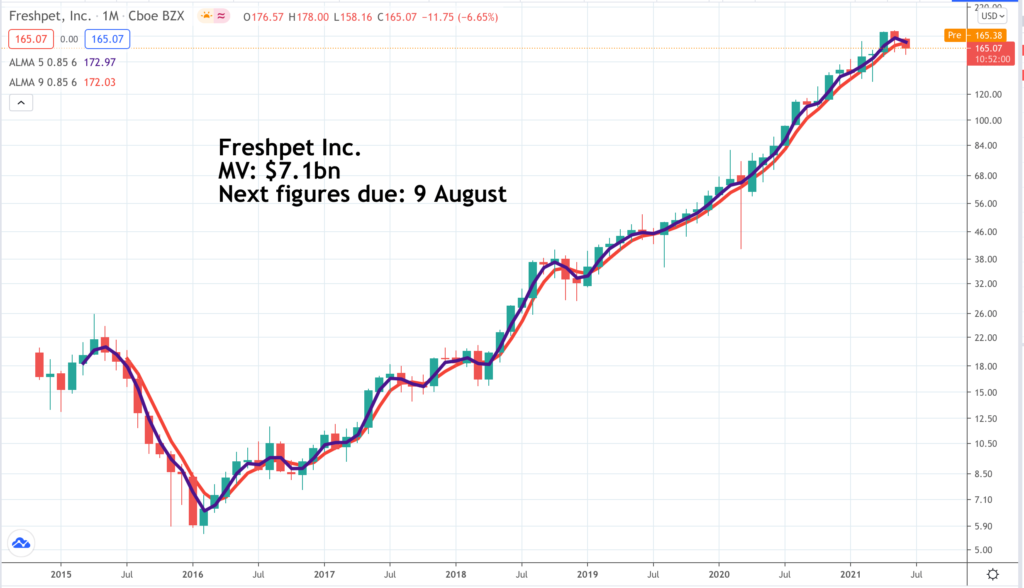

I am showing the Freshpet chart just to warn you that it is not looking that great at the moment. I have just published my list of nearly 200 stocks from the portfolio giving buy signals and Freshpet was not in it. However I love the sector and so I am including it as a recommendation in this piece about the four/ five pet-related stocks in the QV portfolio. Something amazing is happening in the world of pets and domesticated animals generally and it is creating some huge stock market winners.

One striking thing that is changing with pets is the cost of acquiring them. My daughter wanted me to buy a dog and found a Bedlington Terrier puppy. I wasn’t really thinking about it. Dogs are lovely but also a big responsibility, especially in London but anyhow she told me the price – £1,750. What! I thought puppies cost maybe £200. Not any more. The next day the dog was sold.

I have always kind of thought of dogs as members of the family and now it seems that is what everybody thinks. They are treated much like all the other family members, children, husband (if I can still say that) with the best food, the best medical treatment, insurance policies to protect against some of the rising costs of having dogs and companies doing much the same research into innovative treatments for animals as we see for their human counterparts.

When you watch wild life programmes you see that these standards of care are even being extended into the natural world to animals who have not come near an insurance plan.

“Pet parents increasingly view pets as part of the family and are willing to spend more on higher-quality goods and services for those family members. According to the American Pet Products Association (the “APPA”) 2020 Packaged Facts report (“Packaged Facts”), more than 90pc of pet owners in 2020 considered their pets to be a part of their family. Furthermore, according to Packaged Facts, 73pc of pet parents are willing to spend more on high quality foods that are viewed as healthier for their pets.”

This is not a small change. It is a transformation and it is helping a group of companies, including those featured here, to grow very rapidly indeed. I have realised while writing this that you could talk about five pet related stocks because Lemonade, a company disrupting the insurance industry is doing booming business in pet insurance or even six, since I have found a new one (see below).

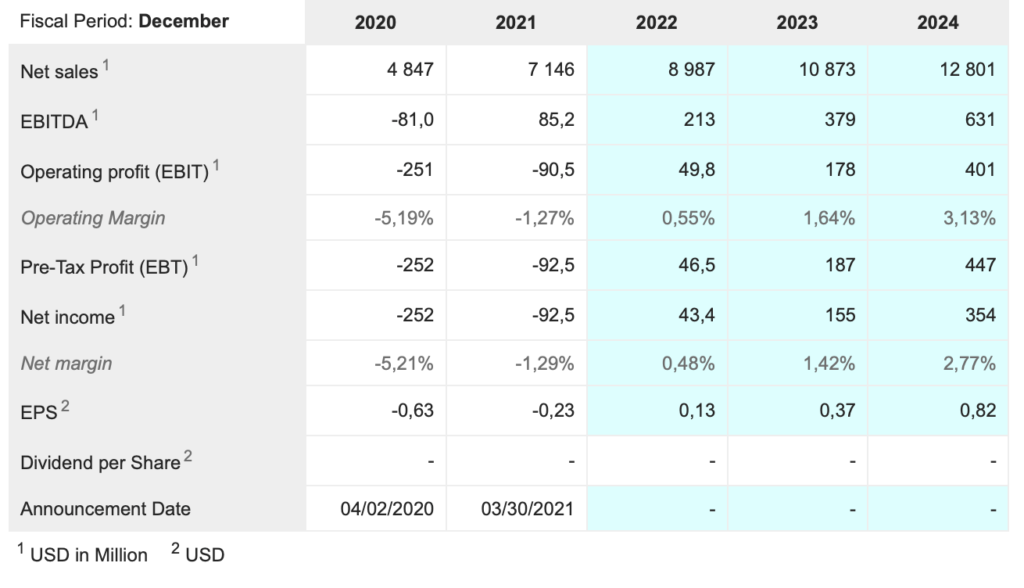

Chewy CHWY. Buy @ $80.50. MV: $34.0bn. Next figures: 21 September. Times recommended: 2. First recommended: $82. Last recommended: $83 Highest recommended:$105.2

Chewy is Amazon for pets. The company’s founder and first CEO, Ryan Cohen, stated that he used Jeff Bezos’s 1997 letter to shareholders as a roadmap for how to grow Chewy by using Amazon’s guidelines on the convenience of shopping online and customer service. It started as a platform for selling food and treats. Pets eat much the same stuff all the time so the next option was to sell customers recurring orders on subscription. More recently still the group has been using its large and growing customer base to sell them other things like pharmaceutical products for pets and veterinary services under the umbrella Chewy Health.

As Sumit Singh, CEO since 2018 and COO (chief operating officer) before that noted in the latest quarterly report. “In 2018, we were mostly a provider of food and treats. Today, just 3 years later, we are delivering a multidimensional customer experience that spans food, treats, personalized accessories, health care and most recently services.”

Singh is a star performer. He led the company through a successful IPO, grew Chewy to a market capitalisation of $40bn at one point and was named in 2020 to the Bloomberg 50 and Comparably’s Best CEOs list.

Key to the success of the company has been the growth in the customer base. This has risen from 10.6m in 2018 to 13.5m for 2019, 19.2m in 2020 and has climbed further to 19.8m in Q1 2021.

The growing customer base not only grows sales in its own right but is a powerful driver of future growth because customers increase their spending with the group over time, especially given the new products and services being added. “The weighted average tenure of our active customer base is just under 2 years. For context, our customers historically spend over $400 with us in their second year compared to approximately $700 in their fifth year and almost $900 in their 9th year.”

Another way of looking at this is that most customers to Chewy become subscribers, much like Amazon Prime customers. This delivers recurring and rising income as their average spend per head rises. “First quarter net sales per active customer, or NSPAC, increased $31 or 8.7pc to reach $388, a meaningful acceleration over our 2020 growth rate.”

This all adds up to the strong sales growth we can see in the table, both reported and expected. The problem investors have with Chewy is that in many respects it looks like a sexy software company with strong growth, high recurring income, increasing customer numbers and rising spending per customer but with one key difference. Software companies have 20pc plus operating margins. Chewy is more like a supermarket with operating margins around three per cent.

This can still lead to dramatic growth in net income and earnings per share and the total addressable market is massive. “According to Packaged Facts, spending on the overall pet market has grown from $73bn in 2014 to an estimated $98bn in 2020, or at a 5pc compounded annual growth rate (“CAGR”) over that time. Packaged Facts projects the overall pet market to continue growing at a CAGR of over 6pc through 2024, with retail pet food and treats projected to grow at a CAGR of over 5pc annually over that time.“

The market is also moving online. “Packaged Facts reports that online shopping grew from 4pc of U.S. pet product sales in 2014 to an estimated 27pc in 2020 with over $10bn of pet food and treats sold online. This represents an over 40pc CAGR for online pet retail over that time frame. Packaged Facts estimates the e-commerce channel to rapidly increase to over 34pc of the total pet food market by 2024, up from pre-pandemic estimates of 24pc while all other channels are projected to remain flat or decline.”

Covid-19 has accelerated this shift and it is fear that future comparisons will be less favourable that has helped the shares react in recent weeks. Overall though the prospects look outstanding for a business which has built an outstanding platform (pun intended) for sustained future growth

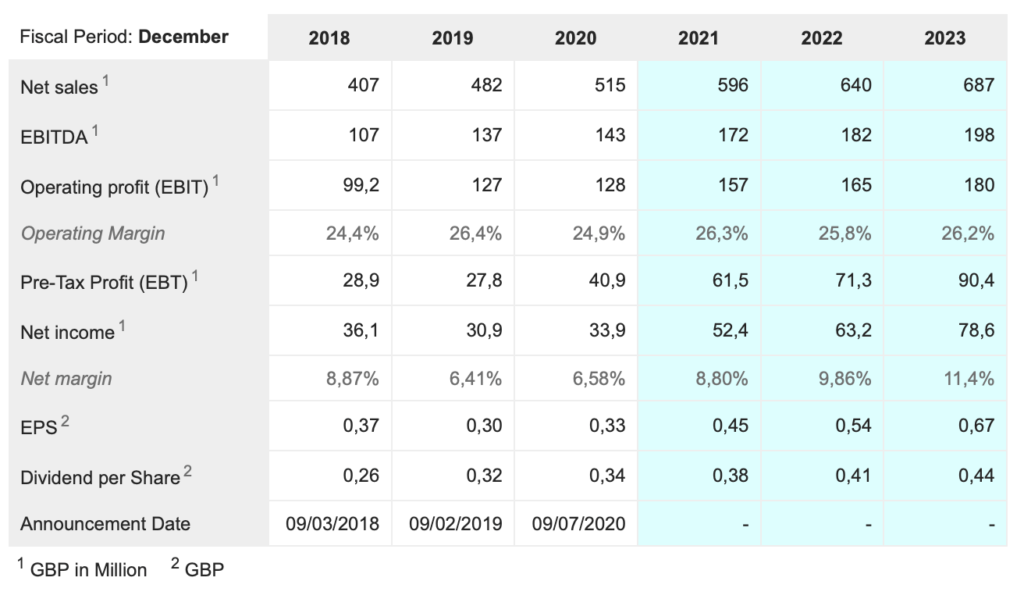

Dechra Pharmaceuticals. DPH. Buy @ 4408p. MV: £4.7bn. Next figures: 6 September. Times recommended: 3 First recommended: 3892p. Last recommended: 4303p

Dechra Pharmaceuticals is a pharmaceutical company for pets and also increasingly for horses and farm animals. Until quite recently people would have been stunned that such a company could exist and have sales expected to approach around £600m in 2021. It is part of a huge change in attitudes. If our pets get sick now we expect to do as much for them as we would for any other member of the family. The difference is that the NHS does not treat pets, not yet anyhow, so this is all private sector creating big opportunities for the companies catering for this growing need.

Dechra is not only a specialised pharmaceutical business with global distribution, research and development pipelines and all the other attributes of a modern pharmaceutical company, it is also an acquisition machine. It is this latter characteristic that explains much of the inexorable share price performance. At the start of the millennium the price was closer to 100p v over 4300p now. Dechra is Halma for pets.

Dechra already has a large global footprint but they describe geographical expansion as one of their key growth drivers. This was apparent from the three acquisitions made between August 2019 and July 2020, which added new products but also deepened the group’s exposure to world markets. The acquisitions cost a total $207.6m, like me the guys at Dechra think mainly in dollars, they were also the 18th, 19th and 20th acquisitions in Dechra’s history.

Product development in farm and companion animals is cheaper and faster than with humans because trials are carried out directly on the animals themselves. There are fewer blockbusters, just a wide range of treatments, many of which are becoming part of Dechra as a result of their acquisitions and their pipeline.

According to fairly recent data, around the end of 2019 Dechra had a 1.27 per cent share of the global veterinary pharmaceuticals market. IDEXX Laboratories (see below) had a 4.90pc share and the big boy on the block Zoetis had 13.4pc. I have just looked at Zoetis and they are classic 3G so I will be adding their shares to the portfolio though you probably don’t need to own shares in all three given the overlap.

What is apparent is that shares in companies specialising in veterinary pharmaceuticals seem to be delivering more consistent growth than their human-focused counterparts.

Dechra notes two factors driving growth for the whole sector. The first is the changing attitudes to pets. “We have seen growth in the companion animal market for many years due to veterinarians’ capabilities, improved nutrition, increased longevity of pets and the owner’s willingness to continue to increase spending on pets. This trend has historically been in Western Europe, North America and other selected markets. However, in the developing world we are now seeing the status of pets increase, creating new markets.”

The second is a growing and increasingly affluent global population needing better nutrition. “With the global increase in population and the improvement in developing countries’ economies, there is a huge increase in demand for high quality animal protein and dairy products.”

Another factor is that there is so much going on of which most of us are unaware. Governemnts are bearing down on the use of antibiotics for animals, which is driving the search for better management of antibiotic use and better solutions in general. There is also a growing requirement for pain control in areas like pig castration and tail docking for sheep. Vaccines are the biggest growth area for animals as they may well now be for humans.

I am not going to go into much more detail about Dechra except to say that they are a perfect example of the mantra – it is not what you do but how you do it that is really important or as other people say, there are three things that make a successful business, execution, execution and execution. This is a superbly managed business in a strongly growing area with a highly effective acquisition programme. They deserve their high valuation and I expect their growth to continue for years into the future.

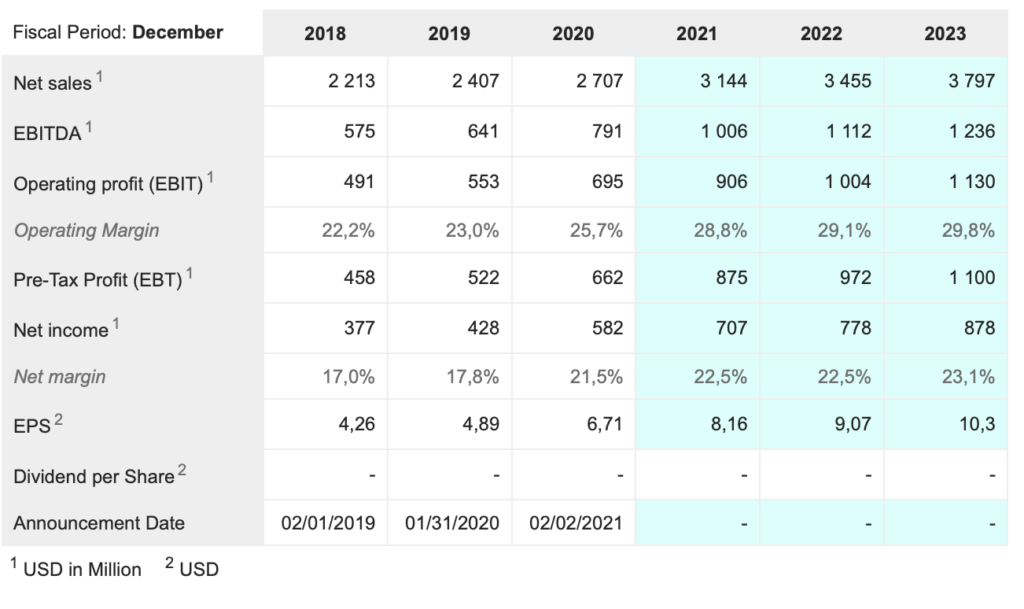

Freshpet. FRPT. Buy @ $160.50. MV: $7bn. Next figures: 9 August. Times recommended: 5. First recommended: $144. Last recommended: $169

I have just been reading an article by an analyst who says he cannot understand Freshpet’s valuation. He thinks it is being valued like a technology company rather than a pet food manufacturing company. I think he makes some interesting points but he is missing the real reason why Freshpet is valued so highly.

Freshpet is what the Americans call a category killer. Other examples would be Starbucks and Macdonalds and look what they have achieved. Coca-Cola is also a kind of category killer in the carbonated soft drinks category. Freshpet’s category is the pet food category and it is targeting it by doing what the successful veterinary pharmaceutical companies are doing – treating pets like human beings, just as growing numbers of pet owners do.

Pet owners speak to their pets. The pets don’t answer back but like toddlers who can’t speak it is amazing how much they get of what is going on. Personally, I totally approve of treating pets like human beings because we are all animals on this planet together and we need to look out for each other. So even if their are some silly aspects to it like putting pets in shoes and nappies most of the improvement in standards of pet care is long overdue and an exciting trend.

Freshpet is at the heart of it and although still small one of the key companies making it happen. They choose great ingredients for their food, fresh meat and vegetables and the like. They prepare it carefully to maintain the nutritional value. They distribute it via a refrigerated food chain just like the cold chain Marks & Spencers uses to bring iceberg lettuces from Israel to the chilled counter in their shops. Then they sell it via Freshpet refrigerators.

This is exciting for investors because they can measure growth by the number of Freshpet refrigerators/ stores out there. In 2013 there were 10,826. In 2020 there were 22,371 and the company expects to reach 30,000 in time referencing mainly the North American market. The international opportunity comes on top. The company also upgrades fridges by adding a smaller fridge alongside the main fridge or a second fridge. So between Q2 2020 and Q2 2021 the number of upgraded fridges went from 1,890 to 2,940 and the number od second fridges went from 1,585 to 2,953.

In general, I don’t pay much attention to targets and limits to growth because invariably when companies hit their targets they don’t fold their tents and go home. They set new targets, bring on new products and the growth just keeps on steaming ahead. Ten years later it turns out the market was 10 times the size they first started talking about.

Another way Freshpet measures growth is by households served. In February 2019 the group was serving 3m households and aspired to 8m households by 2025. It has since raised this target to 11m households by 2025 but that is out of 85m pet owning households in the USA alone so there is a big opportunity out there.

I can see parallels with Tesla in what Freshpet is doing. They are disrupting a category. They have their own unique approach to distribution and they spend much of their time with investors and analysts talking about the amazing new factories they are building.

As always with all these businesses it is easy to overanalyse. They are disrupting the pet food market. They have an impressive record of achievement. They are gung ho about the opportunity. They are expanding at a great rate with the second Freshpet Kitchen ramping up in 2021 and Kitchen 3.0, all featuring improvements on earlier facilities, scheduled to come on stream in 2022, all in the USA.

Their e-commerce sales are also growing rapidly, albeit still being a single figure percentage of total sales. This may change since they have recently signed a partnership with Chewy (see above).

I think Freshpet is a fabulous business with a great future and the shares are well worth buying.

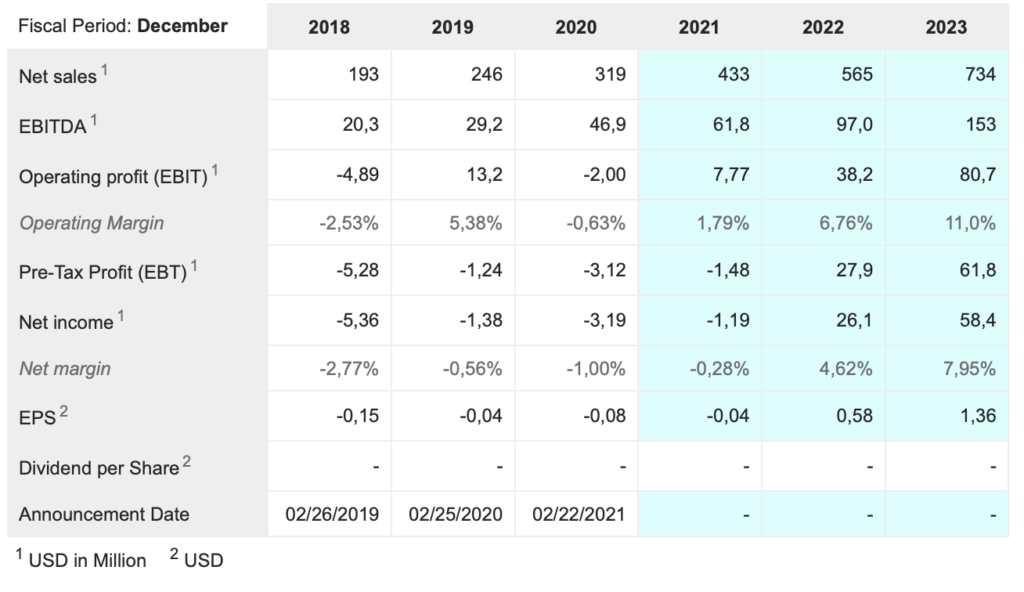

IDEXX Laboratories. IDXX. Buy @ $643. MV: $54.3bn Next figures: 4 August. Times recommended: 9. First recommended: $320. Last recommended: $631

It is tempting to think of IDEXX Laboratories as a bigger US version of Dechra Pharmaceuticals but although both companies chiefly target the CAG (companion animal group) market they are very different. Dechra is more like a collection of treatments, growing by acquisition and with global distribution. IDEXX has proprietary diagnostic technology, often based on blood and urine testing and grows by having a larger installed base of its hardware, which in turns drives growing recurring income from sales of consumables. In this respect, IDEXX is more like Intuitive Surgical, another long time QV favourite.

Various trends are driving strong growth in Idexx’s business. One is the changing attitudes to pets. Owners are prepared to spend more on their well-being, perhaps even in line with the sharply rising cost of acquiring them. Vets are responding to this by being more receptive to testing animals to provide better and earlier diagnosis of health problems.

IDEXX was founded 38 years ago so has had many years to prepare for this moment when it seems that all the signs are aligned to drive accelerating growth. An idea of the opportunity is given by this third party estimate of the growth in the addressable market. “Looking ahead, opportunities to expand the international market are seen as representing a long-growth runway. By 2044, estimated total worldwide companion animal diagnostics spending is expected to climb towards $31bn as an addressable market compared to $4.1bn in 2019 led by a higher growth rate internationally. IDEXX is likely to capture a significant portion of that expansion.”

The fact that IDEXX is a great business with a great opportunity is not a secret and the shares are highly valued on a forward PE ratio of 78. This may make for some volatility but long-term the shares long an outstanding buy, OK to buy right now and perfect for a programmatic approach.

Lemonade. LMND. Buy @ $109. Next figures: 11 August Times recommended: 6 First recommended: $80. Last recommended: $110.5. Highest recommended: $167

It is a bit of a stretch to include Lemonade in a group of stocks whose success is based on catering to the needs of companion animals but pet insurance has proved an exciting opportunity for the company. The company is on a roll generally as indicated by latest quarterly results. “As compared to the first quarter of 2020, our top line, which is in force premium, grew 89pc to $252m, representing an accelerated rate of growth compared to the prior quarter. Premium per customer also increased at an accelerated rate to 25pc year on year as recent product launches continued to bolster our economics.”

One of those new products is pet insurance. Another new product is life insurance and the group has just announced plans to move into the massive car insurance market so pet insurance is hardly going to be the main driver of sales and profits in the longer run. Just now it is playing an important role. Co-founder and chief operating officer, Shai Wininger, said – “We are happy with the rate in which our non-renters products are growing, with homeowners, pet and life representing roughly half of our new business in the last quarter, up from roughly a third a year ago. This diversification is strategically important to us.”

This company is amazing. It seems no time since much of the growth and diversification was all about pet insurance but already huge new opportunities are opening up for a company, which is taking on some massive competitors in its efforts to disrupt a market which looks long overdue for a new technology makeover.

I love this business and the energy and enthusiasm of the founders but the shares have become a byword for volatility. Just in 2021 alone the shares have been as high as $188 and as low as $56. My advice is hang in there, have faith and keep watching for QV buy signals to turn that volatility into a way of buying cheap shares.

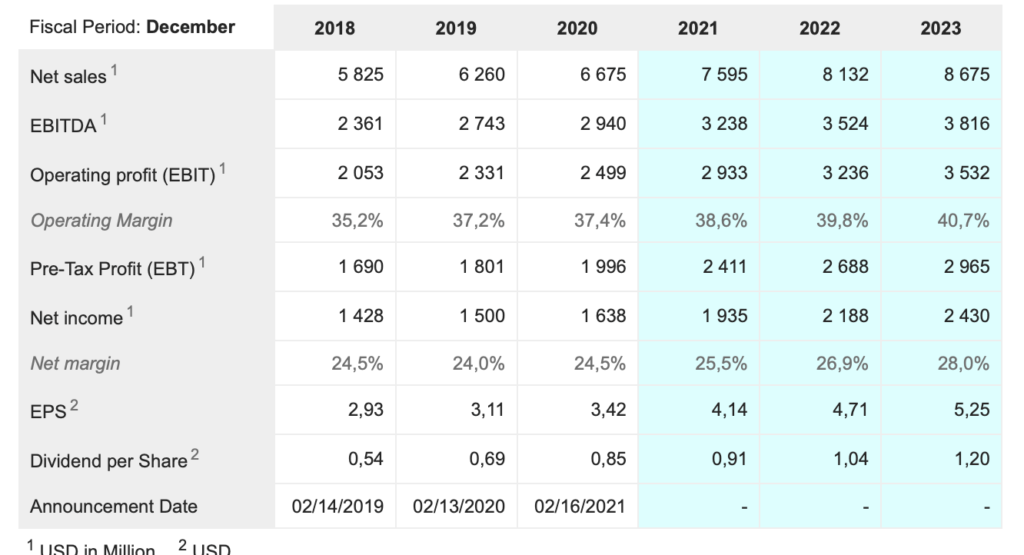

Zoetis ZTS. Buy @ $191. MV: $90bn Next figures: 5 August. New entry

“Zoetis discovers, develops, manufactures and commercialises veterinary medicines, vaccines and diagnostic products, which are complemented by biodevices, genetic tests and precision livestock farming.” They say they are the world’s leading animal health company and with a market value fast approaching $100bn I believe them. Until I started researching this story I had no idea animal health was such big business.

Apparently animals in zoos like gorillas are getting Covid-19. Zoetis has developed a vaccine and vaccines are being rolled out for zoo animals at risk like tigers, bears, chimps, ferrets and even fruit bats. I thought they were the ones who gave us these diseases.

It is amazing what is going on. “One of the company’s goals within its Driven to Care long-term sustainability initiative is to combat diseases that pose the greatest risk to animals and humans. Through its Centre for transboundary and emerging diseases (CTED), Zoetis has developed vaccines for high-impact emerging diseases around the world including Avian Influenza, Porcine Epidemic Diarrhea Virus, Schmallenberg Virus, Hendra Virus and Canine Influenza. The Centre continues to work on vaccines for Foot and Mouth Disease and African Swine Fever.”

It’s like some TV series where superheroes work ceaselessly to protect humanity and the animal kingdom from threats of which most of us are barely aware.

Until yesterday I had never heard of Zoetis but they look like a classic 3G company. The chart looks amazing, the table below shows strong growth and the story is what I am working on here but is shaping up very well. Latest results for Q1 2021 were stunning for such an already large business. “The company reported revenue of $1.9bn for the first quarter of 2021, an increase of 22pc compared with the first quarter of 2020. Net income for the first quarter of 2021 was $559m, or $1.17 per diluted share, an increase of 32pc and 33pc, respectively, on a reported basis.”

At first sight Zoetis looks like a bigger version of IDEXX. “We are off to a very strong start in 2021 — our best quarter ever — with 21pc operational revenue growth and 34pc growth in adjusted net income, as we continue to build on our innovative petcare portfolio, expand in key markets outside the U.S., and accelerate sales of diagnostics products,” said Kristin Peck, Chief Executive Officer of Zoetis.“Looking ahead, we are raising guidance for operational growth in full-year revenue to the range of 10.5pc to 12pc. The fundamental growth drivers for our industry continue to show strong and sustainable momentum, and we remain confident that our diverse portfolio across species and geographies, our pipeline of innovative new products and lifecycle innovations, and the agility and commitment of our colleagues will continue driving our success in 2021 and beyond.”

Discussing the growth the company especially referenced growth in parasiticides products. “Sales of companion animal products increased 32pc driven by growth in the parasiticides portfolio including the recently launched Simparica Trio® brand, the new triple combination parasiticide for dogs. Also contributing to growth was the company’s diagnostic franchise, resulting from increased sales of point-of-care consumables, and the key dermatology portfolio across both the Apoquel® and Cytopoint® brands.”

Sales are split roughly evenly between the US and international with the latter growing 27pc v 19pc for US sales.

“Sales of livestock products grew 17pc on both a reported and operational basis. Sales of swine products grew as a result of the continuing expansion of herd production and increased biosecurity measures in key accounts in the wake of African Swine Fever in China. Sales of cattle products grew due to promotional activities, key account penetration and favorable export market conditions in Brazil and other emerging markets around the world. Growth in the company’s fish portfolio was primarily the result of increased vaccine sales in key salmon markets, including favorable timing of vaccination programs. The recent acquisition of Fish Vet Group also contributed to growth in the quarter.”

This highlights what is clearly another growth driver for the group which is the need to feed a growing and increasingly affluent global population which is upgrading its diet to include more protein. This means more animals in close proximity and all the disease transmission that is happening with the increasingly crowded human population. As standards of care also rise and worries grow about transmission of disease between animals and from animals to humans this is creating a strong tailwind for Zoetis and the whole sector.

Excitingly Zoetis is a big player in China. “In China, Zoetis’ second largest market in terms of revenue, the company received approvals for several of its leading products. On the livestock side, Fostera® PCV MH, a one-shot vaccine for pigs that offers long-lasting combined protection against porcine circovirus type 2 (PCV2) and Mycoplasma hyopneumoniae infections, was approved, along with Excenel® RTU EZ (ceftiofur hydrochloride), a key anti-infective for cattle and swine. For companion animals, Zoetis expanded the reach of its parasiticide offering for cats with the approval of Revolution® Plus (selamectin and sarolaner topical solution).”

Zoetis is on a forward looking PE ratio in the mid-40s which would have stunned earlier generations of investors but earlier generations did not have an ongoing r&d driven technology revolution, the global victory of capitalism and the vast global markets that modern multinationals can access so it really is a whole new ball game.

Way back in the day a US investor and speculator called Jesse Livermore advised investors that a share became a much stronger buy when another share in a company in the same industry was also doing well. It signalled that something big was happening. Shares involved with pets and livestock are a case in point. They are all steaming higher. Indeed I realise that I could have written about Genus and its breeding and semen technology but I didn’t and now I have to move on to other things.

The big picture is that we are seeing the application of technology to looking after our companion animals and making farm animals healthier and more productive. Its probably a bit like another agricultural revolution and certainly a sea change in our attitudes to pets.