OGIG is the ETF I describe as the Quentinvest ETF because its portfolio has so many shares in common with the Quentinvest portfolio.

We have just had a massive correction in the US stock market which is the heart of the action for technology shares. That correction is now over and in my view a new bull market has begun, which was signalled by my Coppock indicators in February/ March 2023 and has been picking up steam ever since.

The motor for this bull market is the accelerating technology revolution, which, overwhelmingly is being driven by the innovation taking place in the US, especially at a handful of increasingly massive mega caps, which I believe are going to become even more gigantic, emerging as the giga corporations of the 21st century.

As investors we need to consider what actions we wish to take to reap maximum advantage from what I believe is an incredible investment opportunity. One we are free to take, because unlike with the Labour government in the 1960s and 1970s, there is free movement of capital. We take this for granted but it is a freedom which was introduced by prime minister, Margaret Thatcher.

Table of Contents

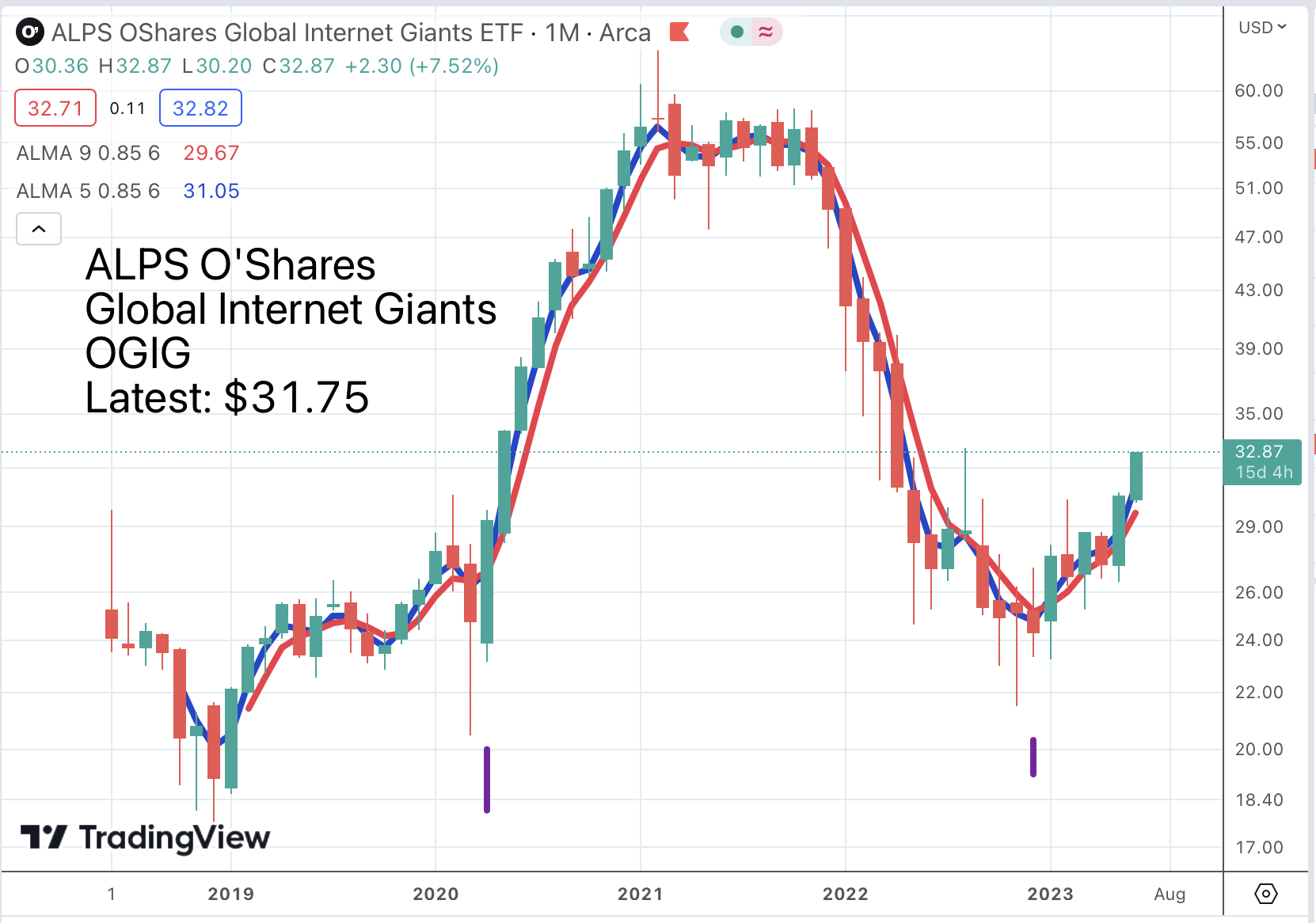

OGIG Has Built an Extremely Promising Chart Pattern

Subscribers will notice that there are significant areas of consolidation on this chart, the original base pattern formed during 2019 into 2020, the top area formed through 2021 and the new base pattern which has been forming over the last year since May 2022.

Both Coppock and the moving averages gave us early warning of the likely direction for the breakouts. Coppock signalled in December 2022 and the moving averages in January 2023. This latest pattern looks to me like a reversed head and shoulders which is normally a reliable pattern. The neckline is around $30 and the shares are on their way with little serious resistance below $50.

The breakout by OGIG is not only good news for their shares but for the whole US stock market. OGIG is handy because it is a quick way of buying an instant, very appealing, US technology portfolio.

This list (including the holdings not shown) is a broad cross section of US technology shares and full of shares likely to do well in the new bull market. Buy OGIG shares and you have instant exposure to all of them.

Strategy – Space Up Your Purchase With Some Leverage

You can just buy the shares, in the traditional way and that is not a bad idea. They are likely to do much better than cash or bonds over the short and long term and buying now, after a sharp fall, I think they are relatively low risk.

But you can also buy them in a CFD or spread betting account with two, three, four, even five times, leverage, which is what I would do.

I have to say that I am intrigued that two of my favourite shares, Nvidia and Tesla, do not feature in the list but I guess the clue lies in the name, ALPS O’Leary Global Internet Giants. This means no semiconductor shares and no electric vehicle shares.

Intense Focus on Apple and Microsoft

If you want to get a different sort of exposure, an excellent ETF is SPDR Technology, XLK, which has been racing ahead in 2023.

I Love XLK’s Portfolio

This fund is amazingly concentrated with nearly 50pc in Apple and Microsoft. I had a look at the rest of their portfolio and it is a really good one.

I love this ETF. What a portfolio! Just now I think I would rather have these than OGIG.

Share Recommendations

ALPS O’Leary Global Internet Giants OGIG Buy @ $32.94

SPDR Sector Select Technology. XLK. Buy @ $174.47