Tesla TSLA. Buy @ $199

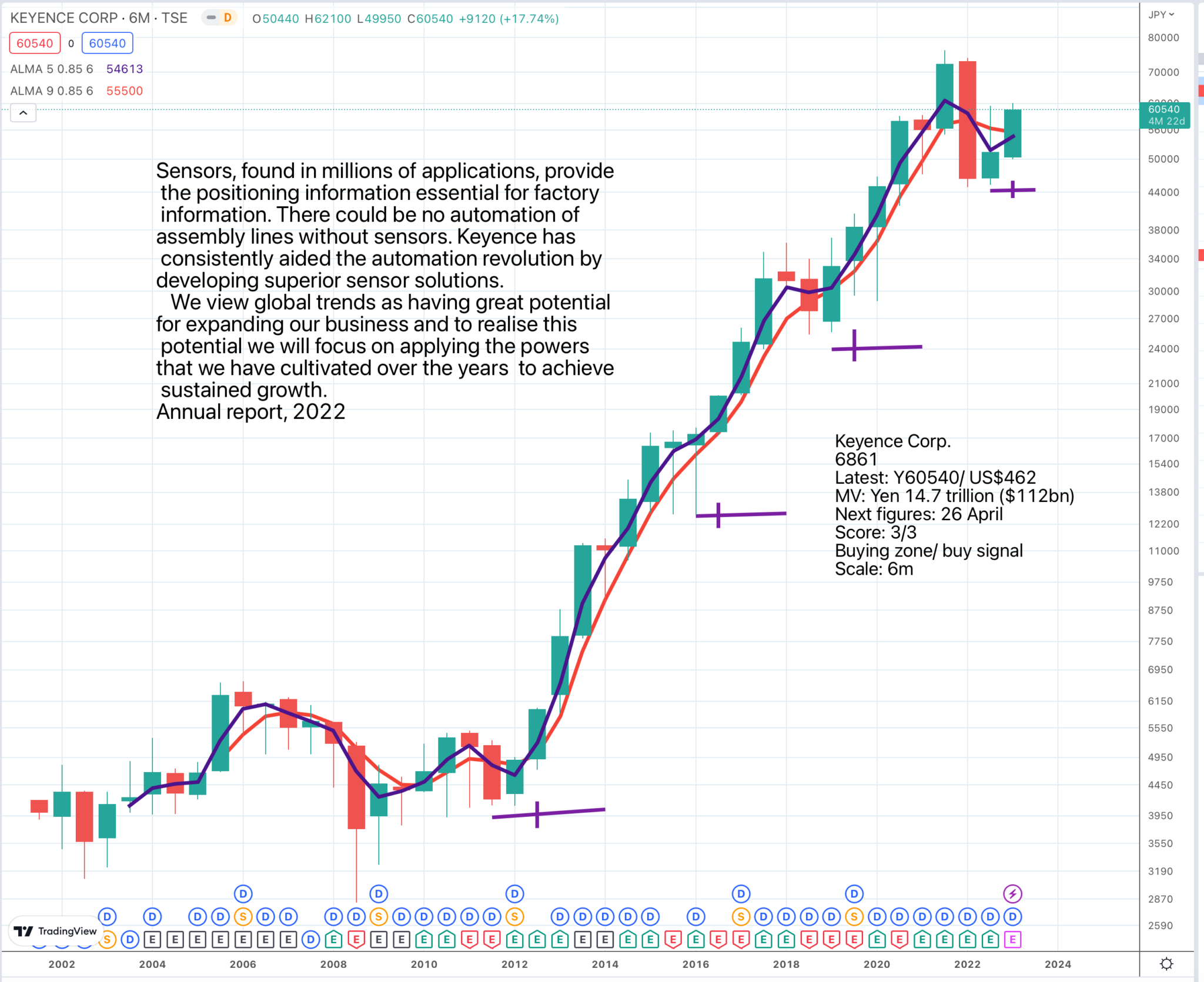

Keyence. 6861. Buy @ Yen60540/ US$462

Hermes. RMS Buy @ Eur1694

Brunello Cucinelli. BC. Buy @ Eur79.65

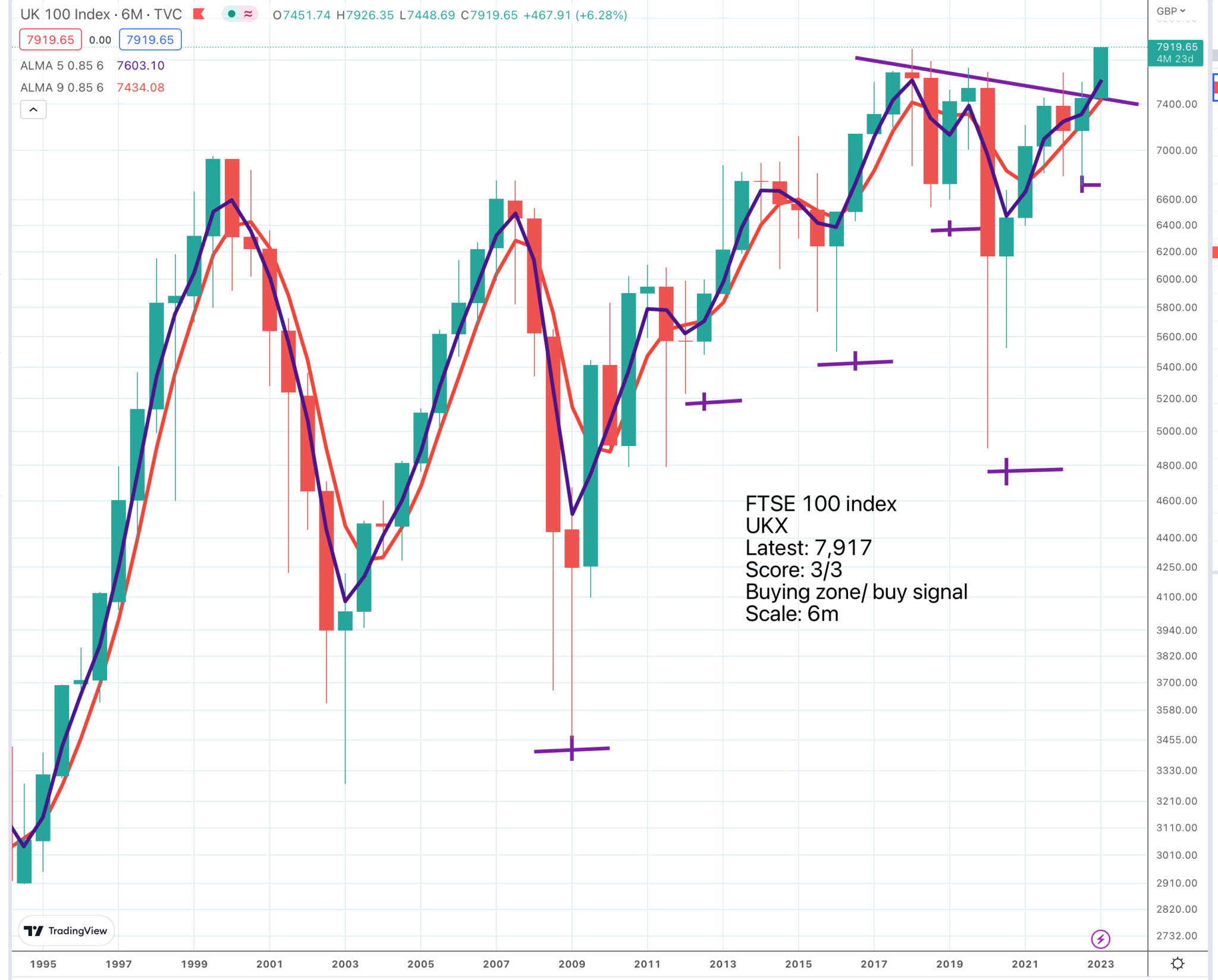

You may be wondering why I am illustrating yet another story about QQQ3 with a chart of the FTSE 100. The reason for the chart is that it is a strong one showing a breakout to a new all-time high by the FTSE 100. The newspapers are full of doom and gloom which fits perfectly with the chart. Investors love staring over the abyss because after that, not always, in Germany in the 1930s things looked bad and then came the Nazis and even they were good for the economy, just not for people, but generally at max doom and gloom shares start to climb in anticipation of better times ahead.

The chart of the FTSE fits in with my recent alerts for four UK growth shares which on the full scoring system would all be 10/10 with support from a strong index and strong ETFs. It’s just that QQQ3 is such a fantastic performer that you need a good reason to buy a share other than QQQ3. Since December 2012 QQQ3 has climbed 26 times from $3 to $78, having been as high as $273.

How many shares in individual companies can match that performance? Microsoft has been an exceptional performer rising 10 times from $27 to $270. You would be delighted if you held them for that performance but it is not as good as QQQ3.

Tesla smashes it

What about Tesla? They did manage to beat QQQ3 with a rise from $2.25 to $197, that is plus 87.5 times but that is just about the best performing share in the world and it is an important constituent of QQQ3. I don’t know how much but probably around four per cent. Tesla is a classic example of a share to buy which could beat QQQ3. It is run by the greatest entrepreneur of the 21st century so far; it has the potential to become the Apple of the car industry which implies that when it has enough devices (cars and trucks) out there it will be able to build a fast-growing services business around them (insurance, for example). This company is the very definition of something new (cars, solar panels, robots), whatever the fertile mind of Musk and his team can come up with, similar technology, loads of applications.

The chart is strong, no question about that; we had a pattern breakdown and a sharp fall but against the long term trend. My guess is that Tesla is forming a new big consolidation from which it will eventually break higher. It is incredible how many Teslas there are in Kensington; more than Range Rovers which used to be the ubiquitous vehicle and symptomatic of the money that is sloshing around.

Yesterday I walked up a street that practically intersects with mine and spotted a group of four cars, a white Rolls-Royce SUV, a Rolls-Royce Convertible, a Mercedes-Benz G-wagon (think £200,000 plus) and a Bentley Convertible. I said to the impossibly glamorous woman who I saw getting into the Bentley that it seemed the street was moving up in the world. She just said ‘humph’, amazed that a member of the proletariat had dared to speak to her, as I bowed and backed away.

I think you get the picture. Whenever you find a share to buy you must ask yourself if you would rather hold that one in a bull market or QQQ3. The decision is a little easier for me because I buy QQQ3 in a share account but shares in individual companies in a spread betting account with five times leverage.

The importance of something new

This is putting huge emphasis on something new, which again puts emphasis on the chart. Imagine that something new and incredible is happening at a company. Let’s say for example that Tesla or maybe somebody else like Alphabet, Apple or Keyence (see chart below), an incredible Japanese robotics related business, is testing a robot which is blowing their minds and looks set to take the market by storm. Outsiders are not going to be the first to know about this but the news will trickle out and that will affect the shares.

This is why time and again exciting developments at a company are anticipated by a strong share price and very often a massive chart breakout. Just look at Tesla, consolidate, explode, consolidate, explode and maybe now consolidate again or maybe not, maybe a new explosion is beginning. At the moment I am looking for the next Coppock buy signal for Tesla coming in June but if the shares race higher that could be brought forward.

Back to the something new. The typical sequence is strong chart, news of an important something new and then if the something new is important enough a huge share price move. So I have realised that I am really on the hunt for strong charts plus ‘something new’ at Quentinvest to give me 10+ rockets with the potential to beat QQQ3.

Strategy

Just as a completely random aside my list of liked songs on Spotify is up to 2,742. The amount of musical talent out there is incredible especially if you can choose from all the music of a lifetime. My life is like a musical and I love it. I even stepped up my sound equipment so I have a Bose sound mixer and a Focusrite audio interface. Thank goodness my daughter’s father in law is a sound engineer because I was totally baffled when it came to putting it all together with the software you need for everything these days. If I wanted I could blow the roof of this building and I can use my kit to make sound bites and podcasts so we will be working on more of them.

The way I think of portfolios now is consisting of focused ETFs to capture the performance of exciting sectors, leveraged ETFs, which for the moment means QQQ3 because of the patronising know-alls in Brussels, classy shares because I am always going to want a few of those to add diversity to my investments and some really sexy ‘something new’ shares with 10+ zero to hero potential.

My idea is to play this portfolio game in a bull market using my indicators and common sense to tell me where we are in the cycle. I believe we are presently in transition from bear to bull with many shares, ETFs, cryptos and indices in the buy zone if they have not already given 3/3 buy signals. My long term plan but hopefully that is well into the future is to spot the moment when we need to take profits and raise liquidity.

This will be tricky because the reasoning will be different. The last bull market was killed by a burst of inflation and rising interest rates. The next bull market may end in different circumstances. We always need an open mind. I will be looking to my benchmarks to help with this.

People point to quantitative easing and super low interest rates as the cause of our present problems by setting the scene for the present interest rate shock but I don’t think it is that simple. We live in a globalised high technology economy with research and development budgets and manufacturing technology that would have been unimaginable to earlier generations. So what happens if you flood such an economy with money; maybe you get blast off and spectacular advances in productivity with asset prices going through the roof. Is that so bad? Sounds cool to me as long as it doesn’t get totally out of hand, which is maybe what was happening in 2021.

This is why I have a suspicion that this bull market could come back bigger and badder than ever. Interest rates have rocketed and they are hurting but luxury goods demand has never been stronger. People want good stuff and they are prepared to pay for it. There are restaurants everywhere now with new ones opening in Kensington almost daily and they are packed even at eye-watering prices.

Hermes is on fire

Sales and profits have exploded at uber-luxury goods group, Hermes, since 2020’s downturn. It is part bounce back but it is more than that and the group is expanding production at an amazing rate for a business which follows the classic luxury goods strategy of keeping the customers hungry. This business has never had a sale and never will.

The chart is perfect and it seems that Hermes doesn’t need a ‘something new’ to boom, unless the something new is globalisation and a wealth explosion in the Far East.

Brunello Cucinelli hits it out of the park for Italy

Brunello Cucinelli falls into the category – if you have to ask the price you can’t afford it. But if you can their stuff is fabulous and guaranteed to make you feel a million dollars which is why the shares are flying. I am not speaking from experience here, just imagining what it must be like.

I love this quote

We believe that the main driving force for the entire market is the intensity of the desire for luxury products in all regions of the world, and we believe that products with the highest craftsmanship are particularly attractive at this time. The focus on sustainability has further accelerated the search for a “well-made” product, created according to ethical criteria and intended to last over time.

Half year 30 June 2022

I think there is a something new going on here and it is demand for luxury goods which applies to all sorts of things. The reclaimed York stone for the patios at my house in Saffron Walden is costing me two and a half times what my first house cost. I think I may have mentioned this before but it seems so evocative of what is happening in the world. When I suggested paying half up front and the rest on delivery they guy said no, he could sell the whole lot for cash in a heart beat. I ended up buying the stone before I got planning permission; thank goodness I love to gamble.

The morale of the tale is that something is happening in the world that is very favourable for purveyors of high end luxury and the sector is booming.