I am keen on technology as subscribers may have noticed. This reflects partly what I see happening in the stock market but also my belief that the world is at an early stage of an accelerating technology revolution which may even end with the machines taking over, merging with humans or who knows what.

In the meantime I don’t want you all to think that Quentinvest is only about technology shares. There are other businesses out there doing very well, a quartet of which I discuss below, of which one probably is a tech share.

Table of Contents

Lululemon targets international opportunity

A stock which has been a long-time favourite of Quentinvest is Lululemon Athletic. It started by riding the yoga boom but is now spreading out into all kinds of fitness activities. It is also a premium product and I believe the world is making a massive shift from quantity to quality. I am doing it myself and am trying to school myself to only buying the best; not hard because I have always leaned in that direction. The only difference is that now my idea of the best is eye-waveringly expensive, which doesn’t mean I now rival Elon Musk for wealth but just means I have not been shopping for a while.

Of course, if I could learn to follow my own advice, I would be off to Bond Street tomorrow so that is my new resolution.

Lululemon has had a number of CEOs but I really like the look of the current one, Calvin Macdonald, who was born in London, Canada. He is around 50, a tri-athelete and he has exciting plans for the group.

Following the unveiling of our Power of Three ×2 growth plan this spring, I wanted to spotlight each of our strategic pillars – Product Innovation, Guest Experience, and International Expansion – and share my perspective on the role an intentional growth strategy can have in accelerating innovation and driving value creation within an organization.

Earlier this month, we shared our plans to launch lululemon in Spain. It is incredibly exciting to introduce our brand to new communities and continue growing our collective around the world, as we work towards our goal of quadrupling our international business and driving double-digit growth in North America by 2026.

Linked In, 19 July 2022

The new growth strategy seems to be working.

Our adjusted quarter four results came in ahead of our January guidance update and our adjusted full year results represent a very solid start to our Power of Three x2 growth plan. I’m also excited that we continue to see strength and momentum across the business so far in quarter one.

Our momentum continued in quarter four, with revenue increasing 30pc versus last year and 26pc on a three-year CAGR basis. We managed the business very well through an environment that was highly promotional and our markdowns were only up a modest 40 basis points versus 2019. I am pleased that as we progressed out of the holidays and began to transition to new spring merchandise, regular price sales returned to our normal levels.

Our business continues to be well balanced across product category, channel and region. Revenue increased in quarter four on a three-year CAGR [compound annual growth rate] basis as follows. Women’s was up 23pc. Our men’s business was up 26pc. And accessories was up 44pc. We saw a 10pc increase in company-operated stores and our e-commerce grew 46pc. And by region, North America grew 24pc and international increased 39pc. When looking at adjusted earnings per share, we continue to deliver strong gains as well, with quarter four EPS increasing 31pc versus last year and 25pc on a three-year CAGR basis.

Q4 2022, 30 March 2023

The company is bursting with new ideas.

2022 was a strong year for product newness and innovation. We continue to expand our core categories with the launch of SenseKnit fabric technology and cold weather run styles. We grew our play categories with our golf, tennis and height capsules, and we entered a new category with the launch of footwear. Looking forward into 2023, I continue to be incredibly excited by the pipeline of innovation developed by our product teams. Several of our ideas this year include franchise growth, category expansions and building upon the success of some recently launched collections. First, in the coming weeks, we will launch our campaign, featuring our popular and versatile Align franchise. As you know, Align began with a single style, a legging, which we grew to be our #1 performing bottom.

Q4 2022, 30 March 2023

The company has a classic luxury goods approach with almost all sales at full price.

One thing to add is that we do not drive our client growth through discounts or promotions, and we have no intentions to do so. We run a full-price business with markdown strategically used to clear seasonal and other select product, and this will remain our approach in the future.

Q4 2022, 30 March 2023

The international opportunity is particularly big both across the world and in Asia.

While COVID-19 impacted revenue in December, we had a strong finish to the quarter and have seen momentum accelerate in quarter one. We have a solid foundation in the region across our brick-and-mortar and digital channels and this is supported by exceptional talent on which we continue to build. We recently opened our largest store in Asia Pacific, the Kerry Center in Shanghai. It’s an incredible expression of our brand, reflecting our commitment to the market, and it now brings our store count in China to nearly a 100 locations. It’s clear our growth strategies are on track, and we remain early in our journey across our international markets.

Q4 2022, 30 March 2023

As you would expect with all this excitement the chart looks encouraging. There is a Coppock buy signal and these have worked well in the past. There is also a golden cross on the moving averages on this chart where every candlestick represents three months. Again, these buy signals have worked well in the past.

It’s simple really, great company, strong performance, bullish chart equals buy.

Ulta Beauty looking good

Ulta Beauty, Inc. is the largest beauty retailer in the United States selling both mass and prestige cosmetics, fragrances, skin care and hair care products, in addition to offering salon services. With over 25,000 products available at more than 1,250 stores and at ulta.com, the possibilities are beautiful.

Website

The company is trading strongly.

“Ulta Beauty’s strong fourth quarter results punctuate an exceptional year with record sales, profitability, and member growth, reflecting robust demand and best-in-class execution,” said Dave Kimbell, chief executive officer. “For the first time in our 33-year history, Ulta Beauty’s annual revenue surpassed ten billion dollars, our annual net income exceeded one billion dollars, and we exceeded 40 million Ultamate Rewards members. These milestone achievements demonstrate the power of Ulta Beauty’s highly differentiated model, the health of the growing beauty category, and our winning culture and outstanding teams.”

Full year 2022, 9 March 2023

I have to admit, reading about it, that Ulta Beauty is a world of mystery to me. The nearest I get to a beauty routine is cleaning my teeth in the morning so the staggering range of products that women especially need in order to face the world is baffling. I am also a bit of a sceptic about the efficacy of a lot of this stuff but there we go. What I have grasped over the years is that women especially but also metrosexual men or whatever we call these caring trendsetters these days are ready to spend incredible amounts on hair, skin care, nails, lips and so on.

I have two daughters. One is a dream customer for all this stuff and evidently a true believer. The other soldiers on successfully without it. Fortunately for Ulta Beauty there are plenty like my eldest daughter, the big spending one. She looks good but I suspect she would anyway and now she has three children and is breaking the bank to make them look good too.

I sort of agree that what is money for but to be poured away on fripperies and I suppose whether it works or not it is all terrific fun. I guess also that Ulta which offers products across a range of price points is benefiting from the move up market in many product areas and the obsession with celebrity. Every singer and actress you have ever heard of seems to have either a clothing or a beauty brand these days.

And Ulta’s net is cast wide with over 1400 stores across the USA and a thriving e-commerce business. The company is positive on prospects.

As we look to 2023, I am optimistic about our opportunities to expand our market leadership and drive profitable growth. We are leaders in a culturally relevant growing category with a strong proven business model and a winning culture with outstanding associates who are passionate about caring for our guests and each other.

Q4 2022, 9 March 2023

I think that second sentence may be key. In a world of video phones, Zoom, work from home with guest appearances at the office people are spending more on how they look and Ulta has got the biggest net to capture a big chunk of that spending growth. I guess it is a similar phenomenon which has made Align Technology (invisible teeth straightening) such a successful business,

I was writing about smiling the other day. People used not to smile partly because nearly everybody had bad teeth. Now everybody smiles all the time and gleaming white teeth are practically a given so glossy hair, perfect skin, beautifully made up eyes, glistening nails are all part of that package and all good because it is true that the streets are full of wonderfully pretty girls these days.

I know we are not allowed to look let alone say or do anything to suggest you are impressed but when you inadvertently catch a glimpse of these goddesses it is a pleasure.

The company is seriously outperforming.

Results for the quarter were well ahead of our expectations, primarily driven by strong holiday sales and robust guest demand, which accelerated post holiday. Sales growth across both physical and digital channels were stronger than expected, resulting in less gross margin deleverage than planned and greater SG&A [selling, general and administrative expenses] leverage. As a result, operating margin increased to 13.9pc for the quarter. Net sales for the quarter increased 18.2pc, driven by 15.6pc growth in comp sales and strong new store performance.

We remain confident we can deliver comp sales growth between 3pc to 5pc but now believe we can maintain operating margins between 14pc to 15pc of sales over the next few years. We believe the outlook for the beauty category is bright, and we are confident our strategic framework and strong financial foundation will enable us to drive long-term growth and shareholder returns.

Q4 2022, 9 March 2023

I can’t find a ‘something new’ but I suspect that is because there is a ‘something new’ but it is external to the company. There is a global boom in beauty and skin care products similar to what is happening in luxury goods markets. Maybe the jobs market is more favourable to women as manufacturing jobs start to fade into history and work from home is brilliant for women with young children like my daughter.

The chart looks strong.

Phones are ancient history at booming Motorola Solutions

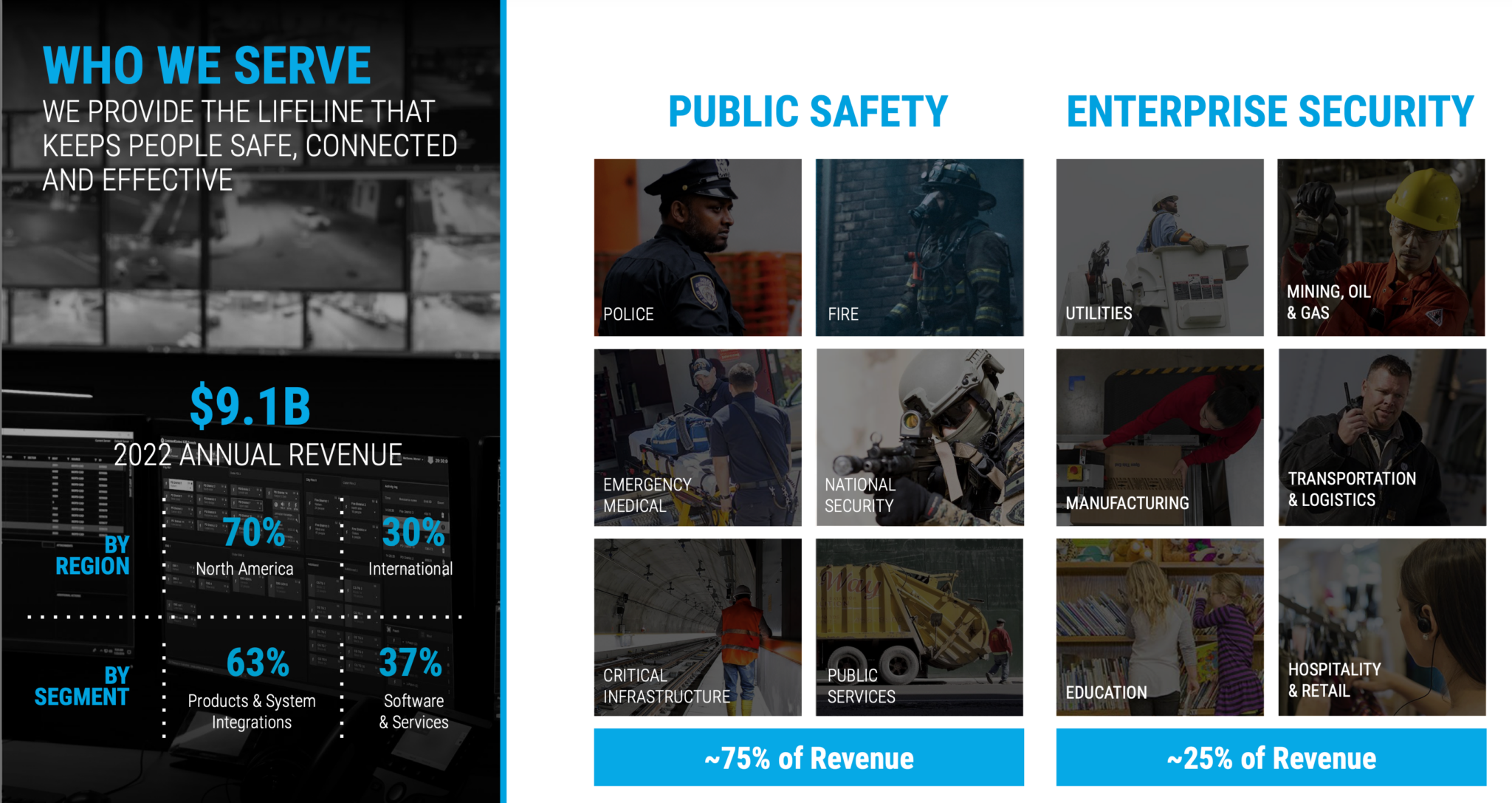

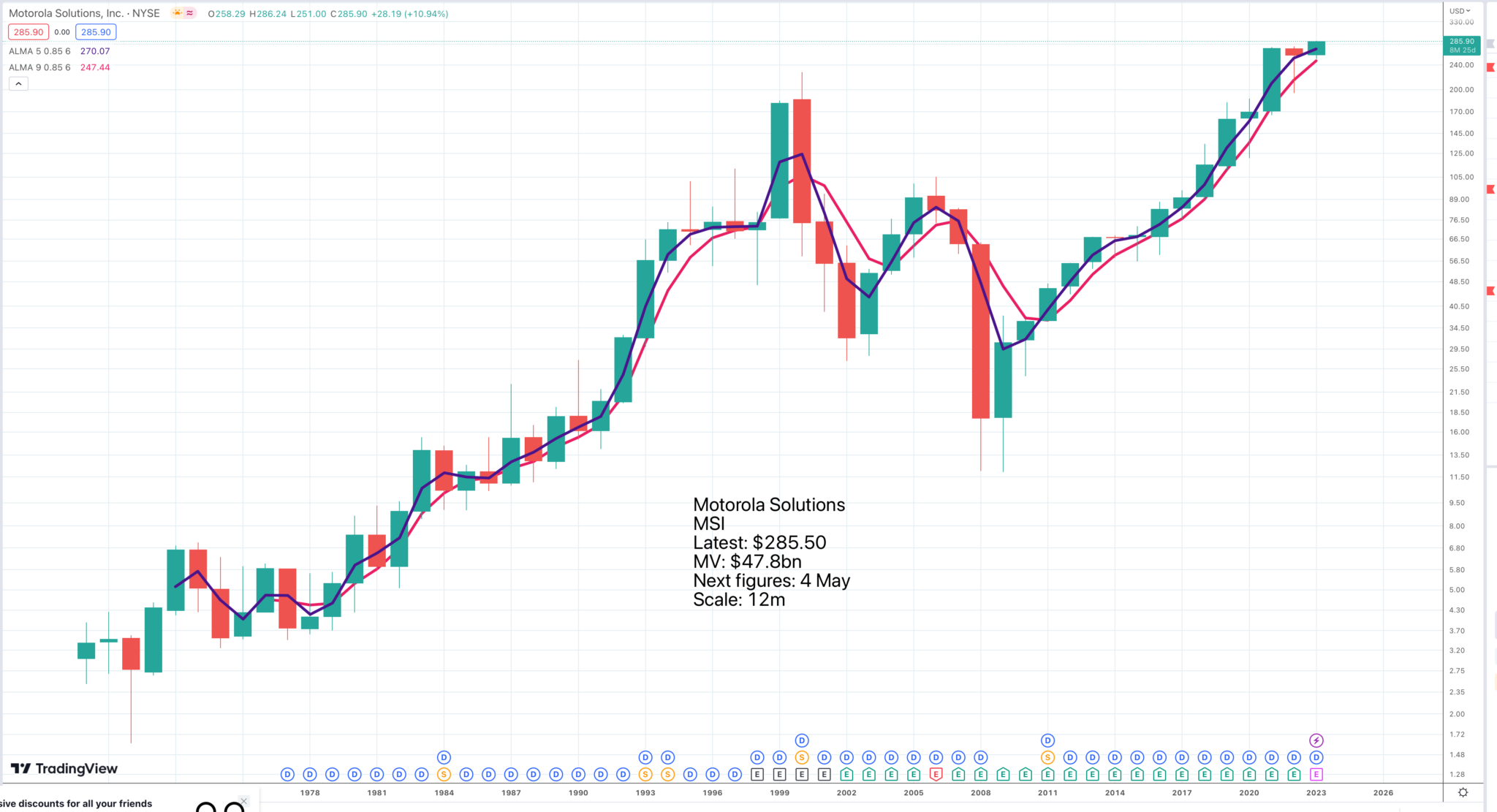

The graphic below gives an idea of what Motorola Solutions does, the phones are long gone, and the size of the markets which it’s addressing is growing fast. Another striking fact about Motorola is that since 2011 it has reduced the share price count by 51pc, which is a brilliant use of spare capital, when you have a share price in a strong secular uptrend. In effect, they are doing exactly the kind of $-cost averaging programme that I recommend to my subscribers.

Below is an excellent breakdown of their markets by geography and sector showing what a widely diversified business this is.

The business is in great shape.

First, our record Q4 results highlight the continued robust demand we’re seeing for our Public Safety and enterprise security solutions. During the quarter we grew revenue 17pc, earnings per share 26pc, expanded operating margins by 150 basis points and generated a record $1.3bn of operating cash flow. Additionally, orders remained strong which led to record ending backlog of $14.3bn, up $800m versus last year.

Second, 2022 was an outstanding year across-the-board. In our Products and Systems Integration segment we grew revenue 14pc, driven by strong growth in both LMR [land mobile radio] and video security and we ended the year with a record backlog up 22pc versus last year. We also expanded operating margins in the segment by 110 basis points despite higher costs related to semiconductors. In Software and Services revenue was up 8pc and 12% when normalized for FX [foreign exchange] headwinds highlighted by double-digit growth in both video security and command center.

And finally, as I look to 2023, our record backlog position coupled with a robust funding environment positions us well for another year of strong revenue and earnings growth.

Q4 2022, 8 February 2023

Acquisitions are playing an important role in growth.

Since 2015, we’ve invested almost $6bn in acquiring companies that have helped us create a broad set of public safety and enterprise security solutions. These assets have helped accelerate our revenue growth, diversify the composition of our revenue streams and more than quadrupled our addressable market to what we now estimate to be $60bn.

Q4 2022, 8 February 2023

The outlook statement could hardly be better.

And finally, as I look ahead, the momentum of our business remains strong. The funding environment for Public Safety and enterprise security remains exceptional. Our investments in APX NEXT device portfolio are driving a refresh cycle that is still in the very early days, with less than 10pc of customers’ installed base upgraded to date. Our AI and cloud solutions continue to help drive market share gains in video security and command centre software and we will continue to navigate the ongoing supply chain challenges. I’m extremely pleased with how we’re positioned as we enter this year, and I expect it to be another year of strong revenue and earnings growth for the company.

Q4 2022, 8 February 2023

Last but not least the chart looks good.

The Progressive Corporation – a stunning long-term performer

This company has an amazing ultra long term chart with the price even without dividends, rising 26,677 times from the 1974 low point. A hundred dollars invested then would now be worth $2.67m. The shares have been split numerous times over the years.

The chart is strong both short term and long. The only slight blemish is that the Coppock indicator is just in process of turning down. This does not in itself stop the shares from going up but it is something to watch if other chart indicators turn negative.

I have been having a look at Progressive which is an insurance company providing things like car insurance for cars and trucks. It is very technology focused. For example you can have a device fitted to your vehicle in return for a discount on your insurance which operates like a smart meter. It monitors your driving behaviour and when you next come to renew your insurance it adjusts the price accordingly rewarding good behaviour with a discount and bad behaviour with a premium which helps to drive riskier drivers away.

It also has an accident response system which reports the accident, calls police and ambulances as necessary and immediately files an insurance claim. No wonder they call themselves The Progressive Corporation.

Part of the reason for the company’s success is that is extremely competitive.

Based on public rate filings, we know that our competitors are raising rates to address their own profitability concerns. And as they have done so, we’ve seen our relative competitiveness improve, which has resulted in improving retention, strong quote growth, and high conversion. We’ve now actually seen some competitors surpass our post-COVID rate take, which should help us sustain those improvement trends. As a result, we finished 2022 with the best fourth quarter for personal auto new application volume in our history, which contributed to growing our personal auto PIFs 3pc in 2022 while also running a lower acquisition expense ratio than 2021.

Q4 2022, 28 February 2023

Usage based insurance (UBI) is an extraordinary product.

We have had a UBI offering since 1996 when we launched our first product called Autograph. This first effort was limited by the technology of the time and required a professional mechanic to install equipment in the customer’s car at a considerable expense.

That first attempt evolved to TripSense in 2004, which was our first self-install option, and then in 2008, we launched MyRate, which is where we first employed cellular technology to upload data to our systems. And then, in 2010, we launched Snapshot, which we consider the start of our modern UBI program. We moved from our discount-only model to one that included the possibility of a surcharge in 2014. And in 2016, we launched the Snapshot app, which allowed the customer to use a mobile phone app instead of the plug-in device.

Our most recent addition is continuous monitoring, which began its rollout in the summer of 2022. In parallel to our efforts in personal lines, we were developing UBI for commercial auto products. This culminated in our first broad commercial offering of Smart Haul in 2018, which allows us to provide usage-based insurance to truckers in partnership with providers of electronic logging devices. We also expanded the Snapshot program for commercial auto with Snapshot ProView in 2020, which includes fleet monitoring services to small businesses.

Throughout our history of usage-based insurance, we have collected billions of miles of data and invested in a process of continuous improvement in our UBI products. Today, UBI is our most predictive rating variable, and it provides unparalleled rate accuracy to our customers. Through this, we have continuously educated our customers where, today, UBI adoption is at near historical highs

Q4 2022, 28 February 2023

Telematics is becoming increasingly key to the experience of insuring with The Progressive Corporation and the company freely admits that it is hard so the fact that they have made so much progress is building a valuable moat around the business and offers great opportunities for the future.

We’ve got a great start to our telematics journey. We’ve got a significant benefit from the experience and investments our colleagues in personal auto have made, and I’m really excited about how we’ll continue to use telematics to drive competitive advantage going forward.

Q4 2022, 28 February 2023

Strategy

It is intriguing to look at GDP per head for various locations. The UK is around $45,000. Uruguay, where my wife comes from is around $17,000, the USA is around $70,000 and California alone, where so many of the technology companies are based is $93,000. No wonder California is such a magnet for people from all over the world and they even have great weather but the sea is cold so you need a swimming pool.

This last statistic makes you realise why technology companies can improve their profitability so dramatically by laying off staff and shedding properties, which are their two main fixed cost items. You could say this has been another great pivot where the technology industry has switched from headlong pursuit of growth to a more targeted pursuit of growth, free cash flow and profitability.

The four companies alerted above are all classic examples of Great American Growth Companies, dominant in the sectors where they operate, always seeking improvement in everything they do, addressing large domestic markets and in some cases using that as a base to expand globally and always growing. They are superb businesses and as a result make excellent long term investments.

The danger as has been pointed out by Warren Buffett is that sometimes these great companies can become overvalued and that is when caution is needed although even then the long term record suggests that all will come right in the end. Presently, after a sharp deterioration in investor sentiment in 2022 it is unlikely that they are significantly overvalued and now should be a good time to buy.

Four categories of investments

I think of the shares being selected by Quentinvest as falling into four categories. There are the regular portfolio stocks like all the four above. There are the stocks that seem to have super stock potential like Nvidia with its dominant position in the explosively growing field of AI, artificial intelligence and its more recent iteration, generative artificial intelligence. There are the regular ETFs like QQQ and SMH. Finally there are the leveraged ETFs of which only one, QQQ3, is presently available for UK-based investors to buy and which offers dramatic performance, up in bull markets and down in bear markets.

Not included in the above because they are not shares but I also comment on cryptocurrencies which are clearly an exciting, if controversial asset class.

There are different ways of using the above information.

At this stage of the market cycle, after a sharp correction, I think it is a good time to be building a portfolio which could be quite large. If you have 50-100 high quality growth shares in your portfolio, which is perfectly possible given the great selection of such companies quoted in the USA you should do very well and have an interesting time with lots of news about shares you hold.

A handful of well chosen ETFs can also give you good exposure to the indices and certain key sectors like technology, healthcare and cyber security, for example.

For out and out excitement you can buy QQQ3, which is an electrifying investment. It may have done especially well during the period between 2012 and 2021 when shares like Apple, Amazon, Microsoft and Alphabet were in a golden period of growth but I still expect great things of this ETF over the next decade as the technology revolution continues to accelerate,

If you want to be really safe and solid you can use $-cost averaging with individual shares, ETFs, index ETFs and QQQ3 or like me you can mix and match a hodge podge of everything.

Share recommendations

Lululemon Athletica. LULU. Buy @ $364.50

Ulta Beauty. ULTA. Buy @ $534

Motorola Solutions. MSI. Buy @ $286

The Progressive Corporation. PGR. Buy @ $146