Affirm Holdings. AFRM. Buy @ $139.5. Times recommended: 4. First recommended: $109. Last recommended: $134. Lowest recommended: $105.5

As with Upstart I am returning to the subject of Affirm Holdings, partly because I believe it is a very exciting business but also to share with you my improving understanding of what makes this business tick.

In my earlier article I was very much focused on what Affirm can do to make life easier for consumers by offering a range of buy now pay later alternatives, often in partnership with some very large partners like Wal-Mart, Shopify, Amazon and most recently, Target, a large US supermarket chain.

I am increasingly seeing Affirm as having three elements to its operations, each of which is important and requires sophisticated technology to make it work effectively. There is the service it provides to consumers, the service it provides to merchants and the sophisticated techniques it is developing to source the capital to fund its operations.

The company needs a rapidly growing research and development budget to finance progress on all these fronts which are highly complimentary. They also help explain why even such innovative businesses as Shopify and Amazon are turning to Affirm as a partner to help them with these complex services, which are not easy to develop. They further explain why Affirm does not see itself as some kind of 21st century bank but rather as as a full-on engineering and product development business.

CEO and founder, Max Levchin, whose full name comes straight out of War & Peace, is a Ukrainian-American software engineer who studied computer science at the University of Illonois and co-founded PayPal with Peter Thiel when he was just 23 years old. He is a techie, not a banker but also incredibly ambitious. Affirm is the fourth technology company Levchin has founded but this one, I suspect, will be fourth time lucky and who knows may even end up bigger than PayPal which has a current market value of $305bn.

In the previous article on Affirm I talked about its services to consumers culminating in the newly launched Affirm Debit Plus card, which it seems to me has the potential to be a huge success. Not only does it have appealing functionality so you can both buy stuff with it and choose how you want to pay after you have made the purchase. But also the powerful partnerships that Affirm has been announcing with some of the biggest retailers and merchant platforms in America suggest it could grow very rapidly indeed and become a massive driver of GMV (gross merchandising volume) across the Affirm platform and revenue in the business.

This, in itself, then leads to a powerful network effect. The more customers that are attracted to the Affirm platform the more appealing it is to merchants which attracts even more merchants. The more the whole operation scales up the bigger its capital raising operations become which may well lead to better terms which in turn funds even better deals for consumers, especially on the interest-related option of its BNPL operations. Constant innovation makes this flywheel effect turn even faster.

There is a key comment in the latest quarterly report. “Around 10 years ago, we founded Affirm with a simple mission: To deliver honest financial products that improve lives. We started by reinventing payments to make them transparent, simpler, smarter, and more delightful.”

These guys ‘started’ by reinventing payments but that is just the beginning. They clearly plan to do more, probably much more. Part of this is developing more services for merchants. Here is what Levchin says about merchants.

“Our consistent results, a culture of engineering excellence, focused on intelligent risk management, depth of capital markets execution, and relentless search for opportunities to delight our shared consumers have earned the trust and partnership of some of the world’s largest commerce platforms. These businesses depend on having the best technology to support their needs and that is why they overwhelmingly choose Affirm.

Our technology enables superior experiences, provides unrivaled flexibility and customization, and can address the most complex requirements, and we’re constantly adding to those services. In fact, Affirm’s roadmap for new merchant services is very long. We see natural product expansion opportunities wherever access to capital, risk, or complex engineering requirements prevent merchants from delighting their consumers. Our acquisition of Returnly and its unique returns management capabilities is a great example of one such idea.

Returnly is indeed a great example of what Levchin has in mind. “On the merchant side, our recent acquisition of Returnly has meaningfully expanded our addressable market. Not only does Returnly solve one of the merchants’ most critical pain points, it also provides us with another unique offering for higher velocity merchants, especially in categories such as fashion and apparel, where returns are quite frequent.”

Quite frequent is the word. In 2020 $428bn in merchandise was returned in North America. How merchants handle this is a key factor in building customer loyalty. I bought something the other day. It was the wrong size. Nearly two weeks later I rang customer services. They said don’t worry about the two weeks and they even posted me the correct label to put on the returned item. I returned it and the next day a full refund appeared in my account.

Returnly takes that great level of service even one step further. You can choose a replacement item before the old item has returned to the shop. This is clever use of technology to really delight the customer, which is just what every merchant wants to do.

The main way in which Affirm appeals to merchants and thus attracts all those great partners and many more is by using technology to develop solutions which delight the customer. If it does that it will have loads of customers and attract many great partners, ultimately not just in the US but all over the world.

Another service Affirm offers merchants is its merchant marketplace.

“Another is the merchant marketplace built directly into the Affirm app and website. Purchases originating on these Affirm-owned and operated services amounted to nearly one-third of transactions we facilitated in the fiscal year 2021. And these transactions are particularly valuable to our merchant partners. Merchants love our marketplace because the reach can be highly targeted, and effective in driving conversion.

In this use case, Affirm is both the provider of purchasing power to the consumer and the demand generation platform for merchants. We expect to continue to find many more opportunities like these to build and buy and offer these high-value services for our merchant partners.“

And then there are the even smaller items on consumers’ buying lists. “The next frontier of unbundled payment is daily spend, groceries, restaurants, incidental purchases.” This is where the Affirm Debit Plus card will have a role to play. Back in the day there were companies like Provident Financial in the UK which would lend you money at eye-watering rates of interest which were collected weekly by door to door payment collectors. Now with Affirm you can put these purchases on your card and defer the payments over the next several weeks with no interest charges at all.

People can no doubt still get in a mess but they are in far better hands with Affirm that they were with these old-style money lenders.

As Levchin says:- “As we speed into our fiscal year ’22, I believe Affirm is strongly positioned to capture much more of the vast opportunity in front of us. We will do that by remaining obsessively focused on our two constituents: the merchant and the consumer, and by leveraging our core strengths to continue building products that delight both sides of our network.”

I am becoming very excited about Affirm and the prospects for this amazing business. And they are also applying technology to another equally important part of the operation which is effectively sourcing the capital which funds the loans.

Here is what chief finance officer, Michael Linford, had to say about Affirm’s funding operations.

“Total platform portfolio, which we define as the unpaid principal balance outstanding for all loans facilitated through our platform, including those loans owned by third-party, increased $2.2bn from June 30, 2020 to $4.7bn at the end of the fourth quarter. Half of the $2.2bn increase was funded on a nonconsolidated basis through a combination of forward flow and our first unconsolidated securitization transaction. The rest was funded through consolidation, securitization, and warehouse facility. In terms of our overall funding mix, warehouse financing continued to shrink from $1.0bn to $0.7bn at June 30, 2021.

We expect to fund future growth primarily through a combination of loan sales and securitization transactions, which continue to garner strong demand in the ABS [asset backed security] market from a diverse array of large institutional investors. As alluded to previously, during the quarter, we successfully closed 2021-Z1, our first unconsolidated securitization transaction. In addition, we recently issued our six ABS transaction 2021-B, at a very attractive financing term, resulting in minimal equity capital required by Affirm. By establishing ourselves as a programmatic ABS issuer, the securitization, in conjunction with our committed forward flow agreements and warehouse facilities, provided us with the financial flexibility to support our GMV growth aspirations by creating meaningful capacity to efficiently fund billions of dollars of loan with negligible incremental equity capital requirements.

A material noteworthy result of our approach to funding optimization across these channels is the reduction of equity capital we use to fund our business. Equity capital required declined by 19pc in the year-ago quarter, from $221m to $178m, despite growing our loans and the balance sheet by $1bn. Accordingly, as a percentage of the total platform portfolio, equity capital required fell to below 4pc from 9pc in the year-ago quarter.“

I include this quote not because I totally understand their operations but to demonstrate (a) that they do and (b) that efficiently raising capital is a critical element in their operations and one which is likely to prove another barrier to entry as they grow in scale.

The group remains on the front foot in terms of technology.

“We plan to deliver an exciting slate of consumer and merchant product offerings in the fiscal year 2022, as well as over the next several years. To drive the success of these initiatives, we are investing in engineering and product talent here in the United States, and deploying a new engineering centre in Poland. As a result, we have significant investment in technology and data analytics in the fiscal year ’22. We are also increasing our spending and marketing to drive consumer awareness and adoption.”

We also know that the group has international ambitions because in December 2020 they acquired Paybright, one of Canada’s leading buy now pay later operations, for C$340m. It makes obvious sense for Affirm to go global because this will reinforce the network effects driving growth In the business. The more customers they can acquire and delight the more attractive they become to merchants and the more merchants there are on the platform the more customers they can attract.

This is why not only can Affirm become a very large business but it is a key part of their game plan to do that and probably to do it quickly.

There will be some headwinds in 2022 such as slowing growth at Peloton which was such an important growth driver in 2020 particularly. Nevertheless there are many exciting things happening to suggest that 2022 will be another banner year for the business.

Affirm shares have run up strongly in the last three months so turbulence could set in any time but I see loads of potential for Affirm to become a very large business. I even suspect, as suggested earlier, that the valuation could start to catch up on PayPal. Affirm is moving so fast to develop exciting technology, to build relationships with some of the world’s most powerful retailers and merchant platforms and to attract consumers to its platform that it is fast emerging as a real force in online commerce.

Max Levchin is a huge talent and an impressively articulate individual with a clear road map for where he is going. Not only is he formidable in his own right but this is going to attract serious talent to join with him in taking Affirm forwards. CFO, Michael Linford, also comes across as as an impressively able individual and Levchin, in his comments at the investment forum paid tribute to the talents of the team helping him drive the company forward. The sky really does look to be the limit for this business.

I even forgot to mention that the group has already launched a high yield savings product for its consumer customers. And this has an intriguing feature because the deposits are held at Cross River Bank, the very same bank responsible for doing so much business with Upstart Holdings.

I should also remind you of the fantastic momentum in this business.

“During the fourth quarter, we increased the number of merchants on our platform by more than fivefold, more than doubled gross merchandise volume and grew active consumers by 97pc year over year.”

And their ambition matches their performance.

“We remain focused on extending our leadership position with our core products, while capitalizing on our vast opportunities to empower more people with the new ones we continue to launch.”

In the investment forum, which was an event held on 28 September, the CFO came up with some long term growth forecasts but later in the question and answer session he dropped strong hints that at least in the next two financial years (to 30 June 2023) the group expects to do much better and after that they don’t really know what is going to happen.

There are so many exciting new initiatives taking place at this company, things like the launch of the Affirm Debit Plus card and the coming on board of powerful partners like Amazon and Target that it would be absurd for the group to come up with detailed forecasts so any forecasts they do make are going to be very cautious.

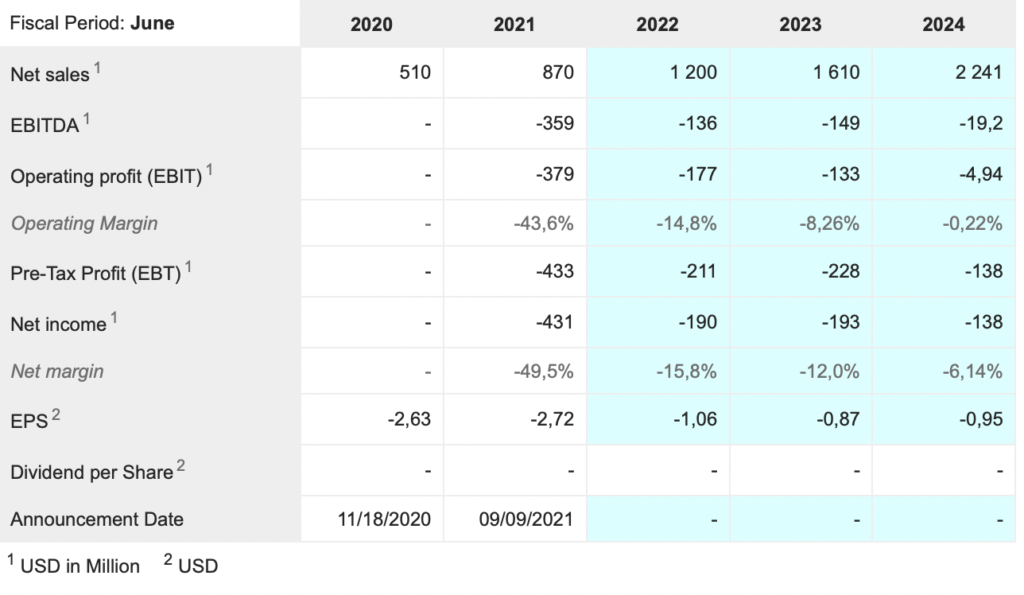

The forecasts below look pretty exciting, $510m to $2,241m in four years is hardly slow going but I suspect they are very cautious and are going to be handsomely beaten. My best guess for the year to 30 June 2024 would be $3bn plus in turnover for a sales over revenue multiple fast approaching 10 which would be phenomenal value for a business growing as fast as Affirm and which by then will surely have begun to go seriously global as well as developing who knows what additional exciting products.

If you think I am being too aggressive I would just refer you to the quote above about merchants on the platform growing more than fivefold in a year. Affirm is in an explosive phase of growth, which is what happens with small to medium sized businesses that are going to end up becoming very large indeed.

A subscriber has contacted me saying she is worried about the markets which feel to her a bit fragile. They do too me too. When I go through the table the number of shares that look worth buying is the lowest it has been for quite a while. Is this a sign? I don’t really know.

As a private investor you have the option of selling everything and starting again. This is actually not a bad idea sometimes because you will refresh your portfolio and rebuild it around new stars. You may not make more money than just by buying and holding, especially if shares turn around and head strongly higher but it can make sense if you are feeling nervous.

What I sometimes do is batten down the hatches around the shares I really feel passionate about.