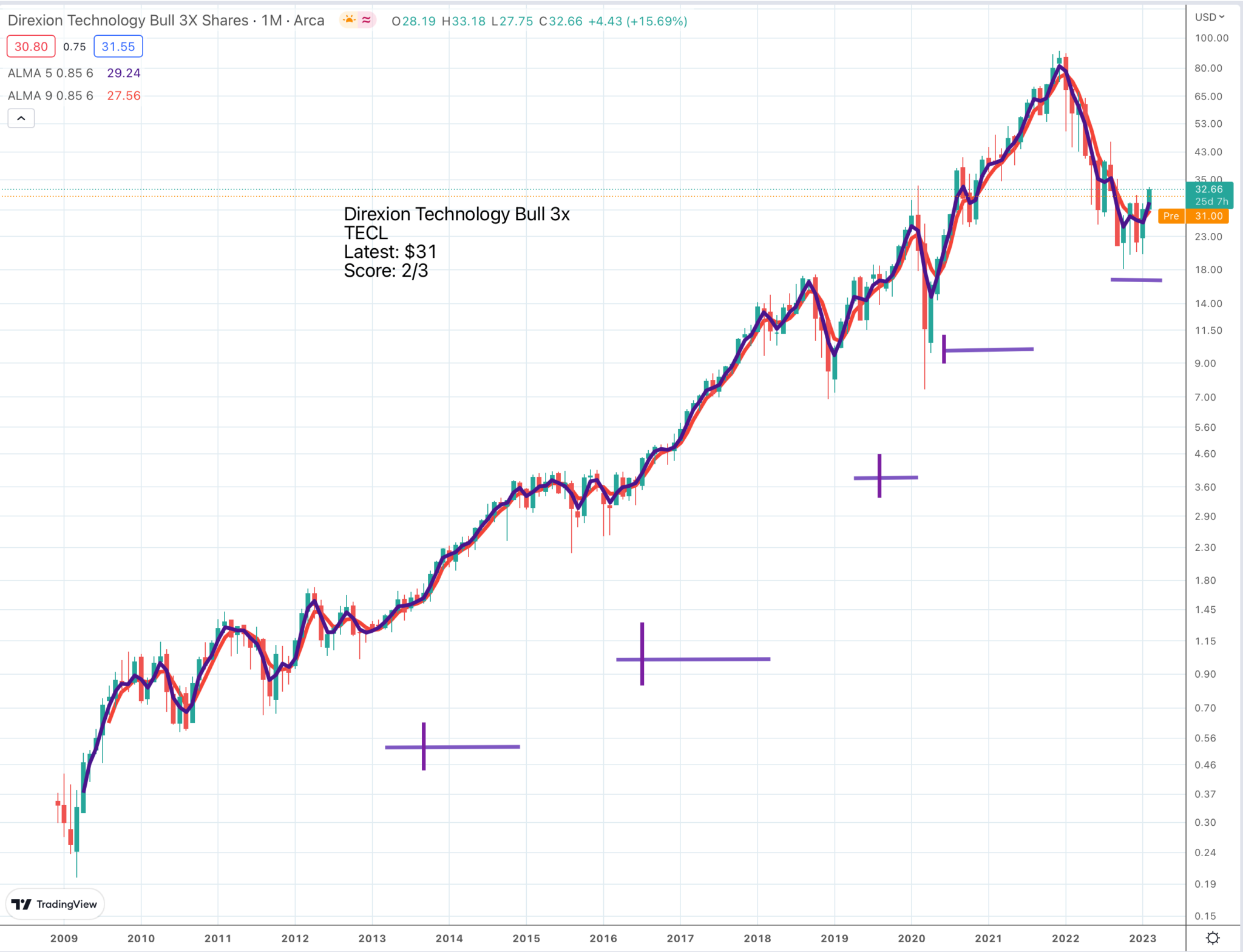

Latest prices. QQQ3 Buy @ $75. SOXL. Buy @ $17. SPXL. Buy @ $77. TECL. Buy @ $31.50. FNGU. Buy @ $90 (not currently available for purchase on IG)

My favourite ETFs are bubbling. If you are thinking of buying this is definitely a case of if not now when.

Just to recap on how these ETFs work. QQQ3 is designed broadly to track QQQ times 3 and QQQ tracks the Nasdaq 100 index. So far, so straightforward but then there is a huge extra twist. The Nasdaq 100 and so QQQ is rebalanced once a year. QQQ3 is rebalanced daily and this has the effect of turbocharging performance. QQQ3 and the other leveraged investments are like wild, crazy, wow investments designed to deliver maximum excitement and they do!

Just look at this chart. Trough to peak QQQ3 rose 90 times in less than a decade. It takes a remarkable individual share to deliver a performance that explosive; hence my contention that QQQ3 is one of the most exciting shares out there. It’s volatile which is where my indicators come into play. Based on Coppock the purple horizontal lines represent what I call the buying zone; the time scale over which you should be buying these shares. The vertical line reflects where Coppock gave a specific buy signal. Broadly speaking they seem to work well and we have a buy signal right now, this February.

The other point about this way of annotating the chart is that if you are not in the buy zone, the period represented by the horizontal purple line, you are entering the sell zone. Once in the sell zone we look at my other indicators (dead cross on the moving averages, broken uptrend line) to tell us when to sell. Very roughly the aim is to be in the shares while Coppock is rising, the purple line and out for much of the rest of the time.

Three more leveraged ETFs to set the blood racing

I have a confession to make. On these charts I am marking in a Coppock buy signal for February 2023. We won’t know for sure that we will have these buy signals until the end of the month but I am very sure we will. We also have the other indicators looking bullish and more and more shares in individual companies with strong charts and rising Coppocks.

If you are wondering if I am getting exciting about this market, I am. It is looking very promising and I am rapidly building my bullish exposure buying into the shares I have been writing about in 2023. I like these leveraged ETFs because they multiply my gains. A garden designer once said to me that you must design your garden as though you mean it; don’t be afraid to be bold. I try to invest like that which is not hard because if I don’t I get bored. It’s bet the ranch or nothing with me, except that I don’t ever actually bet the ranch but what I do I do foot flat to the floor.

The magic of leverage

What I like about leverage is that in a rising market a portfolio becomes self-financing. You buy shares, they go up, that’s the plan, doesn’t always happen, and that creates spare equity which can be invested, times five, in new shares or more of the same share. This is fast-track investing with a vengeance and it’s what I do. I use an IG spread betting account to do it, so I can switch investments and sell without worrying about tax and if I win big it is all tax free.

Just for clarity you can’t buy leveraged ETFs in a spread betting account. They have to be bought in a share account.

People have all sorts of preconceptions about spread betting which sounds like pure gambling but it needn’t be. I am not a day trader. My aim is to build a strong portfolio of classy 3G shares and ETFs and hold them until it is time to sell. I think of myself as a long-term investor although I do always end up selling. It is in recognition of that that I have developed a way of timing my sales so that I choose when to sell rather than being forced out by a collapsing stock market; that is the plan.

I have around 20 shares in my portfolio at the moment and may well end up with 100 or more if all goes according to plan. This will include all the leveraged ETFs mentioned here and others like OGIG and ARKF. I would have bought ARKK but IG is not allowing new positions to be opened in that one at the moment.

The other thing I will do is, if I become very excited by individual shares I will try to take them to the next level and build a significant stake. I love making big bets on what I perceive as really hot shares.

You will notice that with this approach much if not most of my growing portfolio is funded by profits. I don’t mind betting the ranch if I am betting with other people’s money. I am keen for subscribers to learn what I do and do it themselves, even if only on a small scale. It can be incredible fun and very profitable.

My wife says I do best when I am forced to sell shares to pay big bills like refurbishment costs on a property. There is something in what she says but now I hope to be more scientific in my approach and use my indicators to decide when to sell.

The S&P 500 is more staid than the Nasdaq 100 but attractive because it really does capture corporate America and if that doesn’t do well we are all f****d. Since the low point in 2009 the S&P 500 is up 6.3 times which is not a bad performance but pales against what is delivered by its three times leveraged, daily rebalanced counterpart, SPXL. Over the same time scale SPXL is up 68 times. It seems almost unbelievable. If SPXL did that again the price would reach $5,168 which may seem unlikely but then think about bitcoin. Who ever imagined in 2013 when bitcoin was less than $100 that a decade later it would be $23,341. We live in an era when investments or speculations if that is what you want to call them, can move an incredibly long way.

The four leveraged ETFs listed above are my core choices but there are others like FNGU, which holds a virtual 10pc in 10 of the largest tech companies. I don’t make too much of this one because although it looks exciting IG won’t let you buy them at the moment. Sometimes it does and sometimes it doesn’t. Of course, if you do manage to buy them you will always be allowed to close your position.

It is an exciting looking chart. I would buy them if I could. The odds are excellent that February is going to produce a Coppock buy signal.

Strategy

There is a Catch 22 in my investing life. I need to feel bullish in order to buy but when ever I feel bullish the next thing shares do is fall. It happens so often I could use it as another indicator, like my brother’s idea that when it feels really gloomy that is the time to buy and vice versa. Unlike me he practises what he preaches so his life is a little less stressful than mine.

Apparently the reason why shares are expected to open sharply lower today, Friday, is because of one of those developments that seem so counter intuitive, a strong jobs report. We don’t like those because they raise the threat of more inflation and higher interest rates in this mad hatter world in which we live. We want recession and unemployment to cool things down but not too much of that either or it’s a full-blown recession and we don’t like them.

It’s back to Goldilocks, not too hot, not too cold but at the end of the day whatever the economy throws at us shares will end up climbing so it becomes endless sound and fury signifying nothing or as my producer friend from Shakespeare in Love put it – ‘It’s a mystery’.

The good news is that the passage of time is making the charts turn bullish and they are looking more encouraging every day.