On 6 December I sent out a QV for Shares alert headed “Time to circle the wagons’. My worry was that although charts of the indices may still be in an uptrend many individual shares showed serious breakdowns. Markets have been volatile since then but mostly down and remain fragile. Well that was then. In the last few days there has been another amazing turnaround and share prices have been shooting higher although many individual charts still look wobbly.

Share prices are very susceptible to factors like sentiment. One view is that share prices are 20pc bedrock reality, whatever exactly that is and 80pc sentiment. This means a change in sentiment can have a big effect and that seems to be what we are seeing now in some parts of the market though certainly not all.

The fundamentals still look good. Many companies are reporting stellar results and huge opportunities ahead. A possible problem is that they have been reporting great results and great opportunities for years now and each time they do their shares move higher. Maybe they just climbed too high.

If true this would create a double problem. First there are some stunning valuations out there. I love Snowflake as a business. These guys are the kings of data and the data market is exploding, doubling in the last two years and set to keep growing at an exponential rate. Snowflake is growing even faster, more than doubling sales year on year in the last quarter. What a business!

But also what a valuation. Snowflake is presently valued at over 80 times expected sales for the year to end January 2022, 50 times expected sales for the following year and 32 times expected sales for the year to end January 2024. The excitement about the IPO was wild. The shares were originally going to have an IPO price of $75. This was raised to $120. They opened at $245 and four months later peaked at $425. Since then there have been bouts of profit-taking and the shares are building what looks like a wide-ranging consolidation, ranging between a low of $186 and a recent peak of $405.

As it happens I think they are worth the high prices based on what they are trying to do. CEO, Frank Slootman, a highly experienced manager who was formerly CEO of ServiceNow and came out of retirement to lead Snowflake, said this on 1 December when reporting sensational Q3 results.

“Data is becoming the beating heart of the modern enterprise. So, the race is on to lay the foundation for a digital data-driven infrastructure. Snowflake is and will be a critical enabler of this journey.”

If they do that and they are well on their way what will this business be worth – telephone numbers but meanwhile in a jittery market they are an easy sell just on the basis of that stunning valuation; ditto for many other super-exciting shares.

The second problem for many shares is the huge accumulated profits. Many shares are up 10, 20 and even 50 fold since the bull run began in 2009. If investors see some of those profits starting to melt away they will rush to sell.

Doesn’t mean it is a mistake to hang in there. Great fundamentals will out in the end and when shares turn after a sell-off the recovery can be very swift. As we are seeing with Amazon though when shares reach a peak after a massive bull run the consolidation that follows can be surprisingly extended. Amazon shares have been trading sideways now for 17 months. The odds favour an eventual breakout higher but when that will happen is anyone’s guess.

One way of rationalising what is happening is to think of share prices not as valuations of what is happening now or in the recent past but as bets on an uncertain future. First of all we have to guess what the future will hold. Will Snowflake grow at 100pc, 50pc, 30pc or maybe growth will even accelerate if Slootman is right about a tipping point lying ahead? Who knows?

Then, even if we did know, at what rate will investors discount that future growth to find a present day value – three per cent, five per cent, 10pc. Again, who knows although the discount rate will be influenced by the general structure of interest rates. If they go up as many people expect to happen at some point then the discount rate will go up as well and present day values will be reduced pro rata. This explains why high growth shares are vulnerable to what is happening to interest rates and bond yields and have climbed so high in an era of super-low interest rates.

Although I have to tell you in relation to this a joke about Warren Buffett. He and others often talk about valuing shares using this discounted future cash flow model but Buffett’s long time partner, Charlie Munger, once pointed out that he had never seen Buffett performing any of these calculations so it was a mystery how he knew what these present values were.

This is where charts can come in handy. They make not work in any precise sense or it would be too easy to make money from shares – buy on a breakout, sell on a breakdown ad infinitum. They can be helpful in a more generalised sense. Lots of breakdowns is alarming; lots of breakouts is exciting. Right now we are seeing lots of breakdowns; hence my caution but equally that can change surprisingly quickly.

Mega-caps rule

There is one group of shares which is not breaking down, the mega-caps, shares in companies like Apple, Alphabet and Amazon. This explains why a capitalisation-weighted index like the Nasdaq 100 is holding up relatively well. it reflects what is happening to shares in its largest constituents.

It is instructive to look at an ETF like OGIG, O’Shares Global Internet Giants. Despite the name OGIG has a portfolio containing a broad portfolio of shares in exciting fast-growing technology companies. It is much more broadly based than the Nasdaq 100 and its shares are suffering. They peaked in February at $64.26 and are currently $49.77,with a chart that looks as though it is trending lower.

There is a special factor at work with OGIG because it has a high exposure to some of the Chinese technology shares which have been slammed as they are caught up in the cross-fire of tensions between the US and Chinese governments. On my reading of charts OGIG is in a downtrend and the shares could have further to fall which is another warning sign for stock markets generally.

The mega-caps are holding up better because their businesses are still growing fast but their valuations are less demanding and they are using their free cash flow to buy back shares which supports prices directly and adds value by increasing earnings per share for any given level of profits. The numbers are staggering. Apple spent something like $20bn on share buybacks in its latest quarter. This is in addition to dividends.

Listen to this comment on Apple made by one analyst.

“Over the last eight years, Apple has bought back shares worth $421bn, reducing its share count by 35pc. However, the company still has net cash of more than $80bn. Apple will likely produce more than $100bn of free cash flow every year going forward. Therefore, Apple’s buyback program is virtually an infinite pump.”

This contrasts sharply with smaller, faster growing businesses like Snowflake which are consuming large quantities of cash in their dash to grow in what I call the battle for territory. This strategy makes great sense. If you are a disruptor and your business has network effects (the bigger the business grows the more valuable it becomes for new customers and the bigger the moat against rivals). If Snowflake becomes the global data platform that will be so valuable it could even become a mega cap itself. But in the short-term this strategy is expensive. In the first nine months of its 2022 fiscal year, ending 31 January 2022, Snowflake lost $546m on turnover of $836m.

This is not as disastrous as it may sound. Snowflake’s recent IPO left it with $3.9bn in cash and short term investments, rising to $5.1bn if long-term investments are included and as it grows there is scope for a rapid improvement in its operating performance. In fact the group expects to generate eight per cent positive free cash flow for the current year and since big acquisitions look unlikely for such a focused business it is not unreasonable to expect the group to reach profitability without raising more equity just as Amazon has done despite years of losses.

There is a famous expression – ‘Beauty lies in the eye of the beholder’. Many exciting US growth shares fall exactly into this category. A value-oriented investor looks at a share like Snowflake, MongoDB, Datadog, Cloudflare, Shopify, Zscaler, Hubspot and many more and sees share prices that have wildly outpaced their fundamentals. A growth-oriented investor like me sees companies growing at spectacular rates and with huge opportunities to become dominant players in the markets they are addressing.

When the latter camp are in charge the shares rise. When there is more emphasis on the views of the value group shares fall and there is room for a huge amount of volatility between these camps.

Snowflake has said it is targeting revenues of $10bn by fiscal 2028 (effectively 2027 given its January year end). At its current 100x revenues valuation this would take the company’s value to $1 trillion by then. You could also argue that $10bn revenue by 2027-8 is quite a cautious target. At the current growth rate the group would have sales around $77bn by then and everybody is agreed that the data market is exploding.

For the value investors it is possible that even by 2027-8 Snowflake may still not be making profits. In Q3 Snowflake spent a combined $306m on r&d and sales and marketing. This annualises at $1.22bn and is a major factor in why the company is growing so fast but if this keeps growing pro-rata as the company seeks to capitalise on its opportunity to become the world’s global data sharing platform it won’t be making profits for a good while yet allowing the value bears to wonder if it ever will.

So these are the stock markets we are dealing with – incredible growth, incredible valuations, incredible volatility and for the moment at least as many charts pointing down as those pointing up.

A brave new digital world

This is the last print copy I will ever produce of my publications. From now it will be all digital. Great Charts and Great Stocks, the former Chart Breakout and Quantum Leap, will be published monthly online. Initially the format will be much the same but as the whole Quentinvest growth share ecosystem of online publications develops that may change. I urge you to join this brave new world. It is way better than the old print and snail mail approach from the point of view of both subscribers and publisher.

Just one instance of the opportunities presented by the all-digital approach is my recently launched Rule of 10/ Operation CFD strategy. The idea is that each month I publish a list of ETFs and shares to buy. It should be fun, more like playing a game than old-style investing. This means you don’t bet the ranch on the strategy.

There are two ways of doing this. One is to sign up to a platform that allows for commission-free and fractional investing. This way you can invest small amounts in each share – £10, £50, £100, £1,000, whatever seems small to you.

I am an action junkey so I do it differently. I use CFDs, which allow me to leverage my investments. Specifically I put $3,000 (£2,267) in cash into my CFD account each time I buy a tranche of stocks. I gear to the max which means I buy $15,000 worth of shares or roughly $1,500 in each share if I am buying 10 shares. In practice it doesn’t work out that neatly so the first tranche of buys was eight shares.

I hit another problem too, the usual investor’s version of Murphy’s law. The minute I launched the new strategy the stock market hit a severe bout of turbulence and the portfolio fell rapidly into the red. IG has three levels of reaction when it makes margin calls. Step one is please add funds, step two is more funds urgently needed, step three, if your equity falls below 50pc of your margin requirement, is that they start selling without asking you.

I paid no attention to the add funds but when the funds urgently required message came I capitulated and added money to bring the account back into balance. I have decided that I won’t recommend another tranche of stocks until I move into profit. I always like to build from a winning position and we have plenty of time. I have the stocks and ETFs in mind that I want to buy in the second tranche so as soon as my account moves into the black I will send out an alert.

There is a special feature to this Rule of 10/ Operation CFD approach which I hope will be a game changer for me and other leveraged investors. Normally if my account moves into profit I start to invest the profits in more purchases of exciting shares. This means I am always leveraged to the max and vulnerable when Mr Market goes into correction mode. It basically makes investing for me exciting but also a kind of suicide mission. I do incredibly well in rising markets and get smashed in corrections – and corrections always come out of the blue.

I am not going to do that this time, at least with this account. All purchases will be funded through cash money. If I want to buy $15,000 worth of shares I will have to inject $3,000 into the account. Profits will sit there, hopefully accumulating but NEVER used as funds to support further investments.

This should have two effects if the strategy goes according to plan. One is that leverage on the account will become less over time. If the account goes very well this effect can be dramatic. If the value of the portfolio rises 10pc the value of my equity rises 50pc and so on. The second effect is that you can draw money off the account to spend on whatever, going on a cruise, home improvements, a new car without incurring any tax liability because effectively you are borrowing against your profits. I love that kind of thing because it makes whatever you are buying free.

It could be a really cool investment strategy even though it is off to a bumpy start. Markets always feel awful when they are falling but they never fall for ever and can be back to onwards or upwards with surprising speed when sentiment changes direction. So I am just going to hang in there and wait.

It is easy to forget at moments like this but the world is in the throes of the most dramatic revolution in history as technology advances at an accelerating rate. This plus globalisation is what has been driving the bull market in US shares and it is still happening. There is no way this great bull market is over but it is in pause mode right now.

If you are following the R10 strategy or want to but without leverage then you can just sit it out and wait for the next tranche of recommendations. If and when we do move solidly into profit I won’t have to wait for a market improvement to send the account into the blue; it should always be in profit. Once that happens I will be able to recommend additions on a monthly basis.

Abbott Laboratories. ABT Buy @ $139

Abbvie. ABBV. Buy @ $133

Accenture. ACXN. Buy @ $403

Arista Networks. ANET. Buy @ $141.50

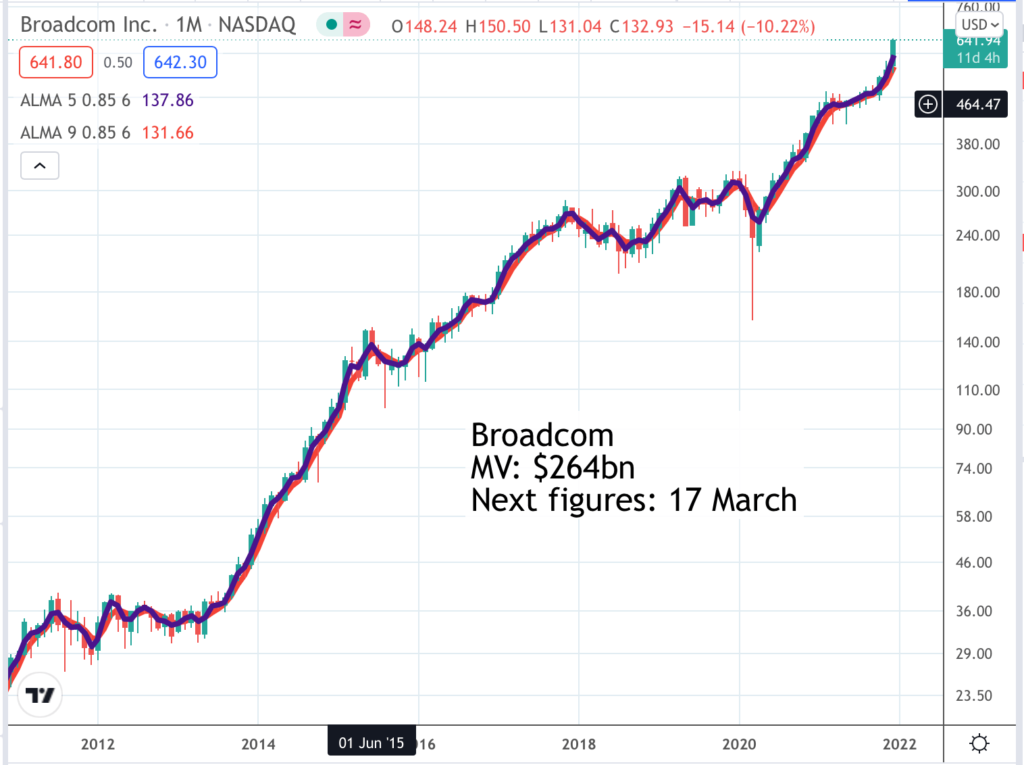

Broadcom. AVGO. Buy @ $664

Diageo. DGE. Buy @ 4015p

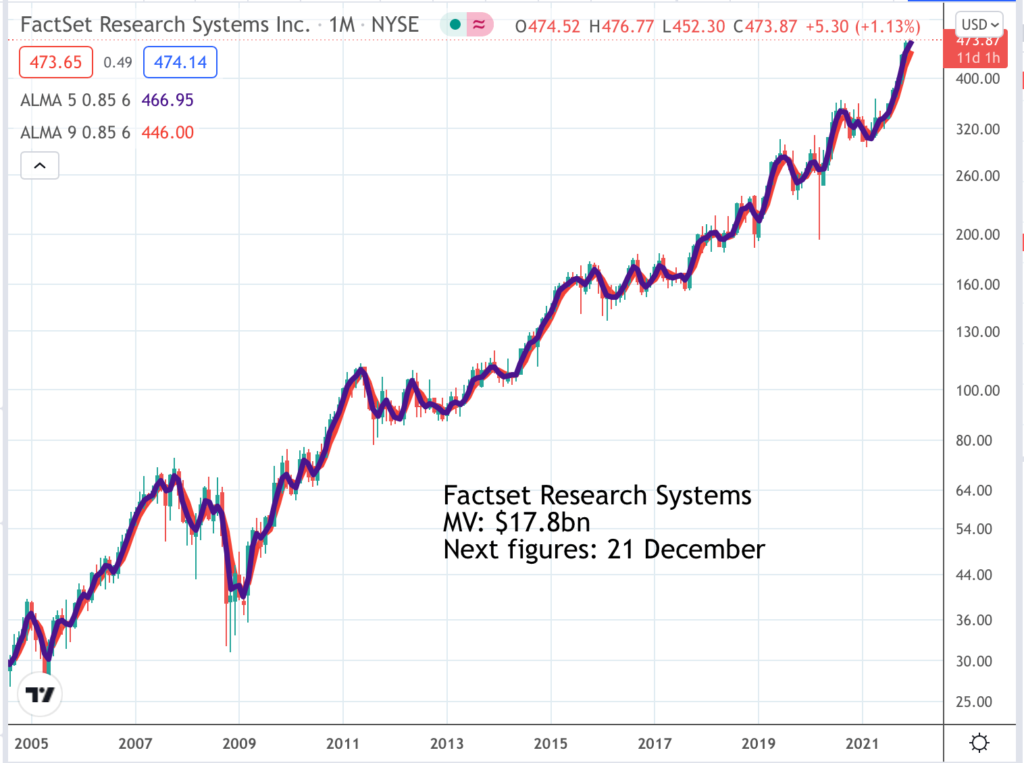

Factset Research Systems FDS Buy @ $479.5

Keyence Corp. 6861. Buy @ Yen74090 ($640)

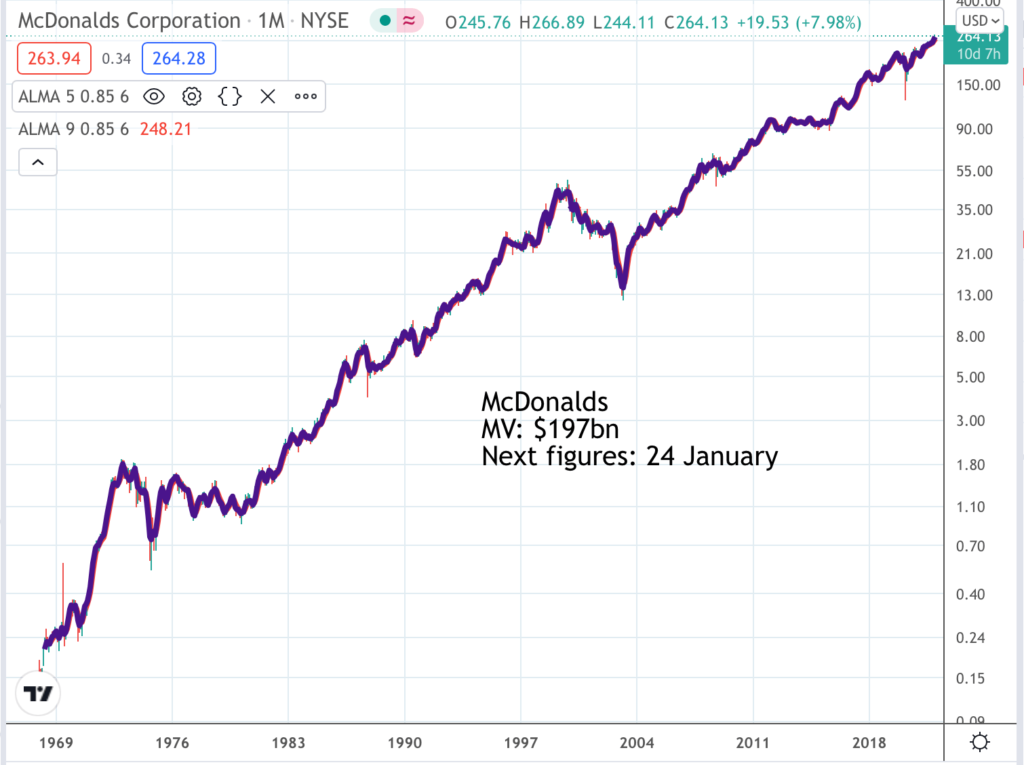

McDonalds. MCD. Buy @ $265.50

Mettler-Toledo. MTD. Buy @ $1626

O’Reilly Automotive. ORLY. Buy @ $679

Palo Alto Networks. PANW. Buy @ $561.50

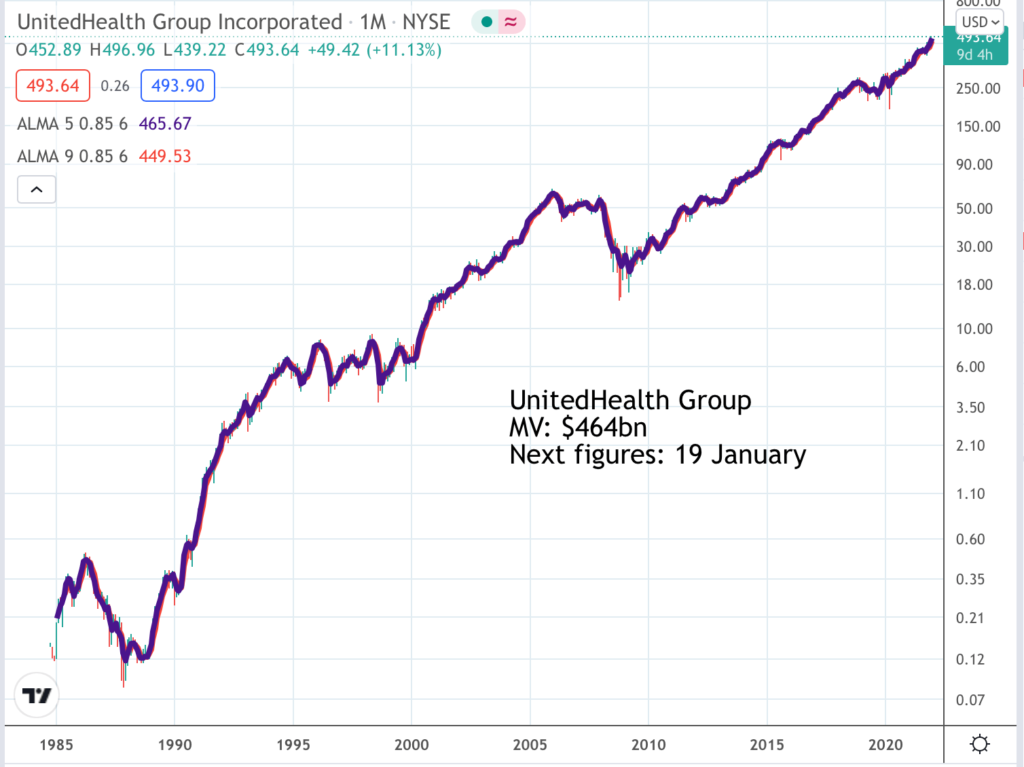

UnitedHealth. UNH. Buy @ $495

Victoria Carpets. VCP Buy @ 1190p

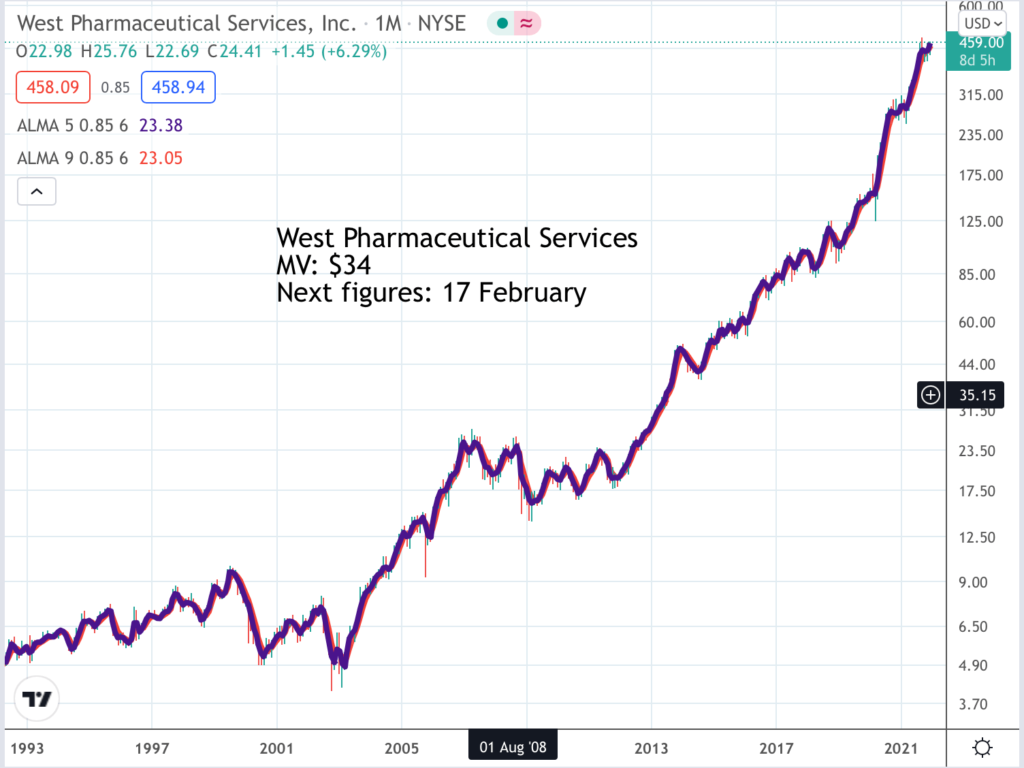

West Pharmaceutical Services. WST. Buy @ $459.50

Wisetech Global. WTC. Buy @ A$59.5 (£31.62)

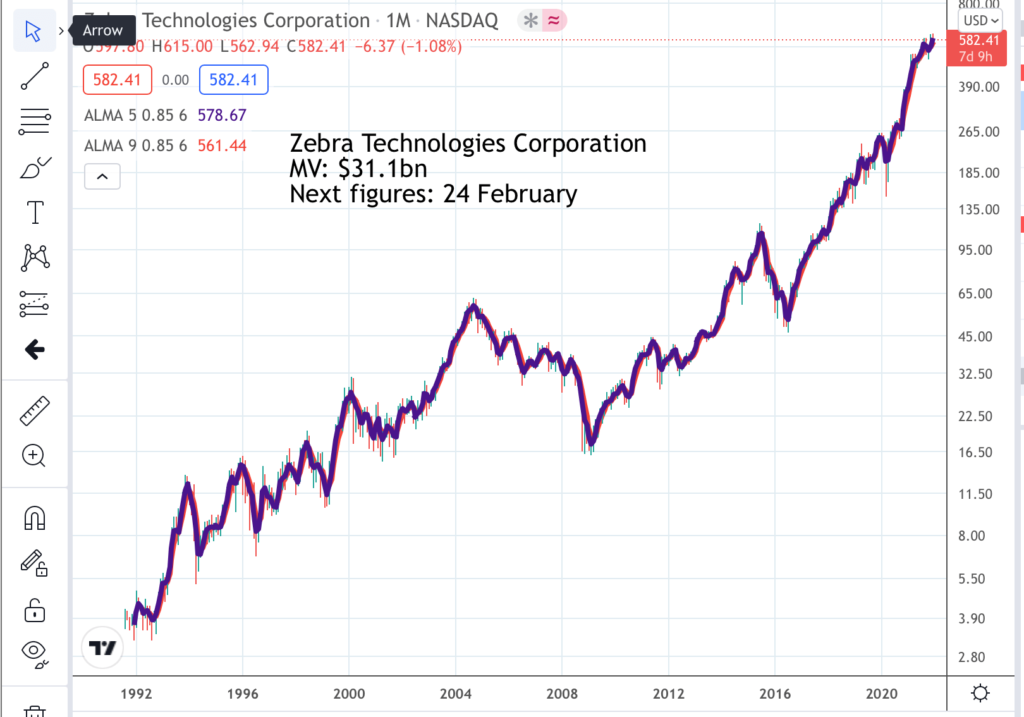

Zebra Technologies. ZBRA. Buy @ $582

Zoetis. ZTS. Buy @ $242.50

Abbott Laboratories. ABT. Buy @ $139

Abbott Laboratories business is going gangbusters. “Today, we reported results of another very strong quarter. Ongoing earnings per share were $1.40, reflecting nearly 45pc growth compared to last year and sales increased more than 22pc on an organic basis. Excluding COVID testing-related sales, which totalled $1.9bn in the quarter, organic sales increased 12pc versus last year. As we’ve seen since the start of the pandemic, our diversified mix of healthcare businesses continues to prove highly resilient. Even as COVID case rates surged in the US and other geographies during the third quarter, strong growth in our more consumer-facing businesses, nutritionals, established pharmaceuticals and diabetes care, mitigated the modest impacts we saw from the surges in certain areas of our hospital base businesses.” Abbott ips very strong in Covid testing. “Over the of last several months, we’ve learned that COVID vaccines, while a powerful tool, are not the lone solution needed in our global fight against this virus. Testing, particularly rapid testing, which is fast, affordable, and easy to use, is an important companion to vaccines and therapeutics. Abbott has established a global leadership position in rapid testing, including a supply capacity of more than 100m tests per month.” The outlook for such a large company is amazing. “And based on the strength of our performance and outlook, we’re raising our EPS guidance for the year, which now reflects growth of nearly 40pc compared to last year.”

Abbvie ABBV. Buy @ $133

Abbott Laboratories (see above) has been one of the great US growth stocks and Abbvie is a testament to that. In 2013 Abbott Labs split itself into the parent company focused on devices and nutrition and the biopharma arm, Abbvie, which has also been a great success. Latest results showed the group firing on all fronts with revenues up 10.3pc and earnings per share rising 17.7pc. Among a string of drugs Abbvie now owns Botox as a result of the $63bn acquisition of Botox-owner, Allergen,in 2019. This contributed to double-digit growth in Abbvie’s aesthetics division, which is expected to deliver high single digit growth through the end of the decade. Abbvie’s leading drug is a treatment for Psoriasis called Humira. “Global Humira sales were more than $5.4bnn, up 5.2pc on an operational basis with 10.1pc revenue growth in the U.S., offset by biosimilar competition across the international markets, where revenues were down 16.7pc on an operational basis.” It also owns Skyrizi, another psoriasis treatment which has nearly 20pc of the US market after Humira and is being prepared for its international launch. Abbvie is a complicated and impressive business with a great deal going on. “This has been a very productive year thus far for our R&D organization and we anticipate several additional milestones in the coming months. We expect this momentum to continue into next year, which is looking to be a milestone-filled year for AbbVie as well.”

Accenture. ACN. Buy @ $403

Accenture is the huge, US-based, IT consultancy led so successfully by Julie Sweet, CEO since September 2019. Latest results from the business were outstanding. “We added 15 new Diamond clients, bringing the total to 244. Diamond clients are our largest relationships and to give some context, we added 13 Diamonds in all of FY’21. We also had record bookings of $16.8bnn, 30pc growth year-over-year with 20 clients with bookings over $100mn, and we expanded operating margin 20 basis points in Q1, with adjusted EPS growth of 28pc, while we continue to invest in our business and people, including $1.7bn in acquisitions and in just the first quarter, we invested $215m in learning for our people with 8.6 million training hours for approximately 14 hours per person.” Sweet says “The extraordinary demand we see in the market reflects the imperative of digital transformation.” It really is extraordinary. The business scaling at a dramatic rate “with the focus on growing our people through learning, allowing us to rapidly reskill with an unwavering commitment to inclusion and diversity and the quality and caring for our people professionally and personally, making us a talent magnet in a tight labor market, adding 50,000 talented individuals in Q1.” This takes the total staffing to 624,000. The shift to cloud computing has been a powerful tailwind for Accenture. “And when the pandemic hit, we were ready with capabilities at scale reflected in 70pc of our revenue at that time, being from digital cloud and security with strong relationships with the world’s leading technology companies, which in some cases go back decades.”

Arista Networks. ANET. Buy @ $141.50

Arista Networks is a networking company, led by Jayshree Ullal, who after a 15 year career at Cisco Networks left in 2008n to become CEO of Arista Networks, where she has been a phenomenal success enabling the company to take a big chunk of Cisco’s market share of the networking market. They gave a flavour of what is happening in the industry with their latest results. “The continued industrywide impact of COVID on global supply chain output, combined with an increase in demand for electronics across all segments, is expected to remain for the foreseeable future. Component lead times are the highest we’ve seen and have roughly doubled from pre-pandemic norms. Most notable are semiconductor lead times, which have extended in the range of 40-60 weeks. Factories are operating near full capacity, limiting flexibility for changes in demand. Therefore, we expect extended lead times and escalating product costs due to expedites and elevated component increases in 2021 and 2022.” Against this background Arista is trading well. “Our enterprise customer momentum has never been stronger.” The business is in great shape. “We see 2021 as the first year of inflection for higher speeds, ranging from 100 to 200 to 400 gigabit after 18 months of trials. We have now shipped more than 2.5 million ports of high-performance port in the first half of 2021, according to analysts; placing us also at No. 1 leadership in the combined 100 gig, 200 gig, and 400 gig of an ethernet high-performance cloud switching. In summary, Arista is well-positioned for the next phase of our growth in cloud and data-driven networking.”

Broadcom AVGO. Buy @ $664

Broadcom is a business that designs, develops and supplies semiconductor and infrastructure software solutions, It has been built by acquisition over the years and has just signalled its confidence in the future by announcing a $10bn share repurchase scheme. This is another large cap company growing at an impressive rate. “So, in the environment we have today, enterprise demand rebounded sharply over 30pc year on year. Hyper-cloud and service provider demand continued to be strong, and strong wireless growth in Q4 was driven by the seasonal launch of next-generation smartphones by our North American OEM. Meanwhile, our core software business continues to be steady with a focus on strategic customers. On the supply side, our lead times remain extended and stable. Inventory in our channels and at our customers remains very lean. Accordingly, in Q4, semiconductor solutions revenue grew 17pc year on year to $5.6bn, and with infrastructure software revenue growing 8pc year on year to $1.8bn. Consolidated net revenue was a record $7.4bn, up 15pc year on year.” The company is equally confident on prospects. “Turning to Q1. Semiconductor revenue, excluding wireless, is expected to be up 28% year on year. Wireless is expected to grow flat to low single-digit percentage compared to the peak of a year ago. So, semiconductor revenue in total is expected to grow 17% year on year again, and consolidated revenue is expected to grow 14% year on year. Sequentially, this will drive revenue to grow from $7.4 billion in Q4 to $7.6 billion in Q1. We are very well positioned in every one of our franchise markets in fiscal ’22 and beyond. We continue to significantly out-invest anyone else across our platforms, in switching and routing, offload compute, silicon photonics, and wireless connectivity to accelerate our next-generation road maps as we continue to gain market share.“

Diageo. DGE. Buy @ 4015p

Diageo is a luxury spirits company. In fact it is the world’s leading spirits company with a four per cent share of the total beverage alcohol market. It also has a stated intention of increasing this share to six per cent by 2030 which would drive sustained growth. Helping them in this strategy is a marked global tendency, especially by younger generations, to drink less but better. All Diageo’s brands are premium brands. Think Johnny Walker and Talisker whisky, Smirnoff Vodka, Captain Morgan rum, Bailey’s liquors and many, many more. The group is a treasure house of the world’s best know drinks brands and I haven’t even mentioned Guinness. They have also demonstrated a great ability to turn this portfolio into strong shareholder returns with the dividend being increased for 20 years in succession and a £4.5bn share buyback programme by 2024 which has been about one third completed. These are the factors they cite as driving growth. “The growth in the total beverage alcohol market is underpinned by strong consumer fundamentals in both developed and emerging markets. The first is population, with an additional 550m consumers coming of age this decade. The relentless rise of the middle class continues, enabling a further 700 million consumers to access our brands. In India alone we anticipate 100m new potential consumers in the next five years. The second is penetration, across the world our iconic global giants recruit over 40m new consumers each year to our brands. Even in our largest market the United States there is still significant headroom as only ~50pc of households purchase spirits every year. The pandemic disrupted consumer behaviours creating an exciting opportunity for spirits with a significant rise in the ‘at home cocktail’ occasion. The third is premiumisation, purchasing power has remained resilient, with the premium end of house-hold staples continuing to gain share as consumers look for affordable luxuries.”

Factset Research Systems. FDS. Buy @ $479.50

ASV is an acronym which stands for all subscription revenues expected from clients over the next 12 months. It is an important number for Factset Research Systems which is all about data. For over 40 years the group has delivered data and analytics to power investment workflows. Over 160,000 asset managers and owners, bankers, wealth managers, corporate firms, private equity and venture capital firms have used their personalised solutions to gain competitive advantage and they are really coming into their own now as the world becomes increasingly data centric. “We ended the year with record organic ASV plus professional services growth of $68m for the quarter, crossing the $100m annual ASV threshold for the first time and soundly beating the top end of our guidance. Our year-on-year organic ASV growth rate accelerated 200 basis points to over 7pc and we delivered annual revenue of $1.6bn and adjusted EPS of $11.20. Our outperformance was driven by two years of planned accelerated investments in content and technology, which is paying dividends. FactSet’s goal to be the leading open content and analytics platform is resonating in the marketplace and increasing our wallet share with clients. Our targeted investment in new content sets was a significant ASV driver in fiscal ’21 and fueled our workstation growth. The continued development of our deep sector coverage improved sell side retention and expansion with our largest banking clients and help secure a new business.” They have ambitious plans. “As we look ahead to 2022 and beyond, we remain focused on three things: scaling up our content refinery to provide the most comprehensive and connected set of industry, proprietary and third-party data for the financial markets; two, enhancing the clients’ experience by delivering hyper personalized solutions, so clients can discover meaningful insights faster; and third, driving next generation workflow specific solutions for asset managers, asset owners, sell side wealth management and corporate clients.”

Keyence Corp. 6861. Buy @ Yen74090 ($640)

Keyence Corp is a Japanese company which specialises in automation and robotics. The Japanese are brilliant at precision engineering so no surprise that this business is hugely successful. Since the 2008 low point the shares are up 25-fold. This is what they do, taken from their annual report. The company’s speciality is sensors. “There could be no automation of assembly lines without sensors. Keyence has consistently aided the automation revolution by developing superior sensor solutions.” After a sustained rise since 2010 sales and profits fell in 2019 and 2020. During this period the company has continued to develop new products. The latest figures for the six months to 21 September 2021 show growth resuming very strongly. Sales rose from Yen 2.28 to Yen3.34 and profits from Yen804m (or billion, I lose track with these huge numbers) to Yen1.29bn (or trillion). Keyence is not the easiest business to research but part of their secret sauce is a global direct sales and support organisation. Once you get into bed with Keyence it’s hard to get out even if you wanted to though given their constant innovation you are probably very happy. The company has consistently been ranked by Forbes as one of the world’s most innovative companies and in a world where everything, including labour, is in short supply automation is the way to go.

McDonalds. MCD. Buy @ $265.50

As you can see from the chart fast food giant, McDonalds, has been a sensational performer over the years. I don’t think Warren Buffett has shares in Big Mac but it is just the sort of all-conquering American brand, like Apple, in which he loves to invest. CEO, Chris Kempczinski, sums up why McDonalds is so successful. “As the largest restaurant business in the world our size and scale are competitive advantage that we’ve built and nurtured for over six decades. Our 40,000 restaurants in over 100 countries are predominantly run by local owner operators, connecting the business to the 40,000 communities in which we operate. These local connections and better level of agility that complements our size and scale, enabling local teams to adapt and adjust to operating conditions that vary by country, community and even restaurant in real time.” The new mantras of the business in a Covid-ridden world are the 3Ds, digital, delivery and drive-thru to guide the business. Latest results show continuing recovery. “Our third quarter topline results represent a continuation of our broad-based business momentum around the world with global comp sales, up nearly 13pc or 10pc on a two-year basis. Our International Operated Markets have continued to recover accelerating two-year comp trends in the third quarter to nearly 9pc% as most markets operated with fewer government restrictions.” Prospects look good. “Going forward, we’re confident that our operating performance will continue to fuel growth in our already strong free cash flow profile. As a result, we’re committed to our historical capital allocation priorities: first, to invest in new restaurants, existing restaurants and opportunities to grow the business. Then we expect to return all free cash flow to shareholders through a combination of dividends and share repurchases over time.”

Mettler-Toledo. MTD. Buy @ $1626

Mettler-Toledo makes precision instruments for laboratory, industrial and food retailing applications. It started life in Switzerland and has a strong Swiss connection even though it is quoted in the US. As is evident from the chart the shares have been astounding performers, rising over 100-fold since 1998. One of the reasons for this amazing performance is that Mettler-Toledo has never paid a dividend. Instead it uses its strong cash generation to buy back its own shares, reducing the share count and raising earnings per share for any given level of profits.If you have strong free cash flow and keep doing this year after year the cumulative effect becomes large. It is similar to the patient accumulation based on endless compounding that has made Warren Buffett such a wealthy man. Also helping is that Mettler-Toledo is no slouch when it comes to growth. In the latest quarter sales grew 16pc even though like so many businesses MTD is having to deal with supply challenges. It remains all systems go. “With our strong sales growth and good execution, we achieved a 19pc growth in adjusted operating income and a 24pc increase in adjusted EPS. Cash flow generation was very strong in the quarter. Our end markets remain favourable, and our strategic initiatives are very effective at capturing growth. We believe we are ideally positioned to gain market share. With proven strategies, good demand in our end markets and continued focused execution on our growth and margin initiatives, we believe we are in an excellent position to deliver strong results in 2021 and 2022.”

O’Reilly Automotive. ORLY. Buy @ $679

O’Reilly Automotive is a multi-channel retailer supplying everything you need for your car from a far-flung empire of stores across the United States. They pioneered the idea of clustering stores together to make it even harder for competitors to break in. New stores cannibalised sales from old stores but the net effect was more sales overall. The difficulty in securing supplies, especially of semiconductors, is leading to a dramatic lengthening of timelines for buying new cars which is pushing up used car values which is creating a tailwind for O’Reilly’s business. Despite difficult comps from a supercharged performance this time last year the group continues to deliver solid growth. “The highlights of our third quarter results include a 6.7pc increase in comparable store sales on top of an impressive 16.9pc increase in the third quarter of last year and a 14pc increase in diluted earnings per share, which is all the more impressive considering we grew EPS 39pc in the third quarter last year.” Growth continues. “This top line sales strength [seen in the quarter ending 30 September] has continued thus far in October and we continue to be pleased with the durable nature of the strong sales volumes we’ve been able to achieve.” The company is also able to pass on rising prices. “Our third quarter average ticket increase was aided by an increase in same SKU [stock keeping unit] selling prices of approximately 5.5pc as acquisition cost increases were passed along in selling prices. The stability of demand in our business is very encouraging and reflects the continued willingness for consumers to invest in repairing and maintaining their vehicles in the face of an overall shortage of new and used vehicles.”

Palo Alto Networks. PANW. Buy @ $561.5

Like other cyber security businesses, Palo Alto Networks is operating with a strong tail wind. “Earlier in the year, Gartner updated its forecast for spending in information security and risk management technology and services, calling for growth of 12pc year-over-year in 2021. We see this backdrop as sustainable beyond this year, as customers, not only grappled with familiar events like ransomware and data breaches, but also new threats coming to light as they adopt cloud services and also try to hire enough qualified security professionals to keep their environment safe. All in all, I think demand is strong, attention for cybersecurity is high and there is a long-term positive secular trend in place, which gives us great comfort towards the three-year plan we highlighted for you.” PANW’s business is doing even better. “We were extremely happy with our Q1 performance, which was ahead of our guidance on all measures. We saw revenues grow 32pc year-over-year, our fastest Q1 in five years, coming on the back of a strong Q4, our billings grew 28pc year-over-year.”

UnitedHealth. UNH. Buy @ $495

I think of UnitedHealth as the US equivalent of the NHS. However if the NHS was a quoted company I rather doubt that the shares would be doing as well as UNH. British people tend to think NHS brilliant, US health care brutally expensive but UNH shares would not be performing like they are if the company was not doing a great job for its customers. These are the three key strategic objectives for UNH. “First, unlocking the collaborative potential within Optum and UnitedHealthcare for the benefit of all. Second, further developing our technology and data science platform to aid patient care and experience and to help the system run better. Third, strengthening our consumer experience, capabilities and value.” The following quote gives the flavour of how the group operates operates. “Our broad home-based clinical care initiatives at Optum and UnitedHealthcare are central to improving near and longer-term health outcomes for people with medical, behavioral and social needs. These efforts include Optum at Home, which delivers high-quality primary care services in the convenience of the home setting and support recovery after hospitalizations. Seniors served by our home and community offering experienced a 14pc lower rate of hospital admissions and about a 4pc higher rate of physician encounters. In addition to caring for people in their homes, we continue to expand capabilities in other optimal sites of care, including via digital means.” Initiatives like this are driving steady strong growth. “This morning, we reported third quarter and year-to-date revenues of $72m and $214m, respectively, growth of 11pc and 12pc over last year. This growth was led by OptumHealth, primarily our care businesses. In the third quarter, the Optum platform comprised 54pc of enterprise operating earnings and continues to show strong growth momentum.”

Victoria Carpets. VCP. Buy @ 1190p

Investment banker and acquisition specialist, Geoff Wilding, became executive chairman and a major shareholder in Victoria Carpets on October 2012. Look at the chart and you can see broadly what has happened since he arrived. A share price in pennies has topped £11. Total return has been even better. “£1 invested in VCP on the day Geoff Wilding was appointed Chairman (3 October 2012) would today be worth £73.59 assuming dividends reinvested.What’s unusual about Victoria Carpets is there is not of the usual guff about stakeholders and the community. Their mission statement is unequivocal. “The group’s strategy is designed to create wealth for its shareholders by constantly increasing earnings per share via acquisitions and sustainable organic growth.“And the acquisitions have been coming thick and fast. In just the last half year there have been four acquisitions, sales rose 60pc to £489m and operating profits rose 107.8pc to £27.7m. In the statement Wilding said:- “Outlook remains very positive, along with a healthy pipeline of acquisition opportunities.” The report also included this extraordinary quote. “Since no one has privileged access to the future, forecasting the market is a waste of time… In the post-war period the US stock market has gone up in around 70pc of the years because the US economy grows most of the time. Odds much less favorable than that have made casino owners very rich, yet most investors try to guess the 30pc of the time stocks decline, or even worse spend time trying to surf, to no avail, the quarterly up and down waves in the market. Most of the returns in stocks are concentrated in sharp bursts beginning in periods of great pessimism or fear, as we saw most recently in the 2020 pandemic decline. We believe time, not timing, is key to building wealth in the stock market.” Victoria is a cool share to own.

West Pharmaceutical Services. WST. Buy @ $459.50

West Pharmaceutical Services is a health care company in a strong growth phase. “Our team delivered an incredibly strong third quarter. Our proven market-led strategy delivered double-digit growth across all three market units and geographies. And excluding positive impact from sales related to the pandemic, we delivered double-digit growth in our base business with continued strong adoption of our high-value products, coupled with solid execution and leveraging our global operating model, it has led to robust margin expansion and EPS growth for the quarter.” It’s party Covid, partly other things. “Our key drivers of growth in Q3 are being fueled by COVID-19 customers that are used in our stoppers and seals including the highest level of NovaPure and FluroTec. Biologic customers that are shifting preference from FluroTec to our premium platform, NovaPure, to achieve the highest quality and tightest specifications for their newly approved biologic drugs. And pharma and generic customers, there are increasing orders as their demand grows for non-COVID-19 vaccines and injectable drugs. Shifting to our device portfolio and our long-standing partnership with Daikyo Seiko, we continue to see adoption and uptick of customer interest for new pipeline drugs with Crystal Zenith syringes, cartridges, and vials.” Prospects look great too. “Since the onset of the pandemic, we have expanded capacity at 13 existing sites with 30 major facility modifications, dedicated over $300 million of capital, and added over 400 incremental pieces of equipment, all while keeping pace with a growing base demand and moving our operations to 24/7. As our book of committed orders continues to surge, we will continue to make further strategic investments to meet demand.”

Wisetech Global. WTC. Buy @ A$59.5 (£31.62)

“We bring meaningful, continual improvement to the world’s supply chains. Replacing ageing, legacy, proprietary and domestic systems with efficient, highly automated and integrated global capabilities. Our breakthrough software solutions are renowned for their powerful productivity, extensive functionality, comprehensive integration, deep compliance capabilities and truly global reach. Our people and teams around the world are aligned in our strong vision to be the operating system for global logistics. We are evolving rapidly. Expanding into more products, deeper functionality, more geographies and adjacencies, driving our long-term growth and market position with each new innovation and acquisition.” That says it all really. WTC has been highly acquisitive in the past but they are slowing the deal flow to focus on cost cutting. This is already having a dramatic effect. “Total Revenue of $238.7m, up 16pc on 1H20. EBITDA of $89.2 million up 43% and EBITDA Margin up 7pp – reflecting continued revenue growth and cost reduction initiatives. Underlying NPAT[net profit after tax] of $43.6m up 61pc.” The group is also investing in the future. “WiseTech’s investment in R&D increased 13pc from $73.3m in 1H20 to $83.0m in 1H21.” The company describes the strategy going forward. “Having completed 39 acquisitions since IPO in 2016, we have now assembled significant resources and development capability to fuel our CargoWise technology pipeline and therefore intend to slow our acquisition activity in the near term. Our focus going forward is on expanding the CargoWise ecosystem and extracting efficiencies across our business to maximise our operational leverage.”

Zebra Technologies. ZBRA. Buy @ $582

Like all the companies featured in Great Charts Zebra Technologies is trading strongly. “Our team delivered exceptional third quarter results that exceeded our outlook, supported by robust broad-based demand for our solutions. For the quarter, we realized adjusted net sales growth of 27pc or 23pc on an organic basis, an adjusted EBITDA margin of 21.7pc and a 140 basis point year-over-year improvement. Non-GAAP diluted earnings per share of $4.55, a 39pc increase from the prior year. And strong free cash flow. Our customers are prioritizing investment in our solutions to digitize and automate their workflows in an increasingly on-demand global economy. We realized double-digit sales growth across all four regions, with particularly strong growth in EMEA. Favorable business mix and higher service and software margins enabled us to expand our gross profit margin despite escalating freight costs.” Zebra is a perfect business for a global economy where labour is scarce. “By transforming workflows Zebra’s customers can address complex operational challenges to achieve higher levels of performance. By closely collaborating with our partners and customers, we help businesses across a variety of end markets to implement solutions that maximize their return on investment. Human labor is a scarce resource. Our innovative solutions empower their workforce to do their jobs more effectively by navigating constant change in near real time, utilizing insights driven by advanced software capabilities such as machine vision, prescriptive analytics and artificial intelligence. In October, we acquired Antuit for approximately $145m to further advance our Enterprise Asset Intelligence vision. This high-margin Software as a Service business generated sales of approximately $27m in 2020, nearly doubling over a three-year period.”

Zoetis. ZTS. Buy @ $242.50

Back in the day when Old Shep’s time had come Elvis took him into the back yard and shot him. Things have moved on a bit since then as you can see from pet health specialist, Zoetis. “We delivered strong results again this quarter with 10% operational growth in both revenue and adjusted net income, driven by our innovative portfolio of petcare parasiticides and dermatology products. Our US business grew revenue 7pc operationally, while international grew revenue 14pc operationally. In terms of species, our Companion Animal portfolio generated 19pc operational revenue growth in the quarter with great performance in markets around the world. Our latest innovation in parasiticides, the triple combination Simparica Trio is increasing its global adoption. Our groundbreaking dermatology products, Apoquel and Cytopoint, continue to redefine and expand the category. And we completed the first full quarter of sales for both of our new monoclonal antibody therapies for osteoarthritis pain in dogs and cats, Librela and Solensia. These new products are exceeding expectations and receiving very positive feedback from veterinarians and pet owners in European markets, where they’ve been launched.” The business has a bright future. “Increased spending on pet wellness and treatment will be sustainable well beyond the pandemic. We remain on track for a record setting year with updated guidance for operational revenue growth in the range of 14pc to 14.5pc and adjusted net income growth in the range of 16.5pc to 18pc for 2021. Our strength in petcare has an incredibly strong foundation across parasiticide, dermatology and vaccine. To the first nine months of 2021, our Companion Animal portfolio has grown 29pc operationally. We also remain very excited about the long-term blockbuster potential of our new monoclonal antibody franchises in pain, Librela and Solensia, as they grow in Europe and we make progress on approvals in the US.“