Inflation is not all bad for everybody. If you can pass prices on inflation boosts revenue and if you can maintain your profit margins that means more profit, higher earnings per share and a higher share price. It is not for nothing that equities are often described as inflation hedges.

I have a sweet tooth. I like fruit and granola, I like honeycombs for honey on toast, I like chocolate brownies, I like baklava, I like rice pudding, Turkish delight, hot chocolate and many days, much to my wife’s horror I have all of those things. I suppose I should fight it but then I just think why. My size seems to stay much the same so why not follow my general rule in life – I can resist everything except temptation.

It seems that I am not alone. The consumption of sweet and salty treats is going up rapidly and with a little turbo charging from price inflation the market leaders in this space look well placed, especially if they have a strong new management team who know exactly what they need to do to make the most of the opportunity.

Table of Contents

New CEO, since 2017, puts a rocket under Hershey

I have heard of Hershey bars because they are a very American phenomenon but I am a little vague as to what they are. So let us have a little background.

Hershey chocolate bars had their origin in Milton Hershey‘s first successful confectionery business, Lancaster Caramel Company, which was founded in 1886. After seeing German chocolate manufacturing machinery at the World’s Columbian Exposition of 1893 in Chicago, Hershey decided to go into the chocolate making business.[2] After purchasing the chocolate processing machinery, Hershey began by applying chocolate coatings to the caramels. The next year, 1894, Hershey founded the Hershey Chocolate Company and incorporated it as a subsidiary of the Lancaster Caramel Company. The Hershey Chocolate Company developed its own line of chocolate products, marketed as “sweet chocolate novelties” to distinguish them from unsweetened baking chocolate.[3] After developing the Hershey process to mass-produce chocolate in 1899,[4] Hershey sold the Lancaster Caramel Company in August of the year 1900, and kept the chocolate manufacturing business.[5] In November of that same year, Hershey began to produce and sell the Hershey chocolate bar.[6]

Wikipedia

I am not quite sure how much of Hershey’s sales are Hershey’s Chocolate Bars but things have moved on since 1900 as the graphic below of The Hershey Company’s sales between 2006 and 2022 makes clear.

Two things stand out. First, it is a good performance. Not in his wildest dreams would Milton Hershey have imagined that the chocolate bar he created would be part of a company bearing the Hershey name with sales of over $10bn. Secondly, I am sure he would have been impressed by the acceleration in growth in the last two years.

There are always two possibilities when you see an acceleration like this for a company which has been around for a long time. It could be something internal to the company or something happening in the wider world which is working to their benefit. As so often, no doubt it is a bit of. both.

A lady called Michelle Buck became CEO of Hershey in March 2017 and seems to be an impressive leader with a clear vision of where she is taking Hershey and how she wants to get there.

The Hershey Company is a bit like Coco-Cola in that the precise formulation of Hershey bars is a trade secret and unique to the USA. Coca-Cola has gone global but because Hershey chocolate tastes different to European chocolate this doesn’t happen in either direction. Hershey chocolate has a tangy taste which Americans associate with chocolate.

This puts a powerful moat around the business and makes the Hershey confectionary business something of a cash cow which is being used to make acquisitions and drive growth in newer areas like non-chocolate sweets such as Gummy drops and salty products like popcorn and pretzels.

The company is making excellent progress.

We had a great start to the year as our increased investments in the business and strong execution delivered resilient consumer demand and drove double digit sales and earnings growth in the quarter. Net sales in the first quarter grew 12.1pc, driven by both price and volume gains across segments.

As we discussed in our recent Investor Day, expanding our presence in non-chocolate candy is a strategic priority for us given strong consumer demand, particularly in the gummy segment. Our investments in innovation and media in this space are paying dividends, with Q1 retail sales growth of almost 19pc for Twizzlers and over 15pc for our Jolly Rancher brands.

Within our North America Salty Snacks segment, high single digit volume gains and low double digit price realization drove overall net sales growth of over 19pc in the first quarter. SkinnyPop retail takeaway of over 23pc drove a 220-basis point share gain in the ready-to-eat popcorn category. Dot’s Pretzel’s performance also continued to shine, with retail sales growth of over 25pc in the quarter, resulting in a pretzel category share gain of 100 basis points.

Q1 2023, 26 April 2023

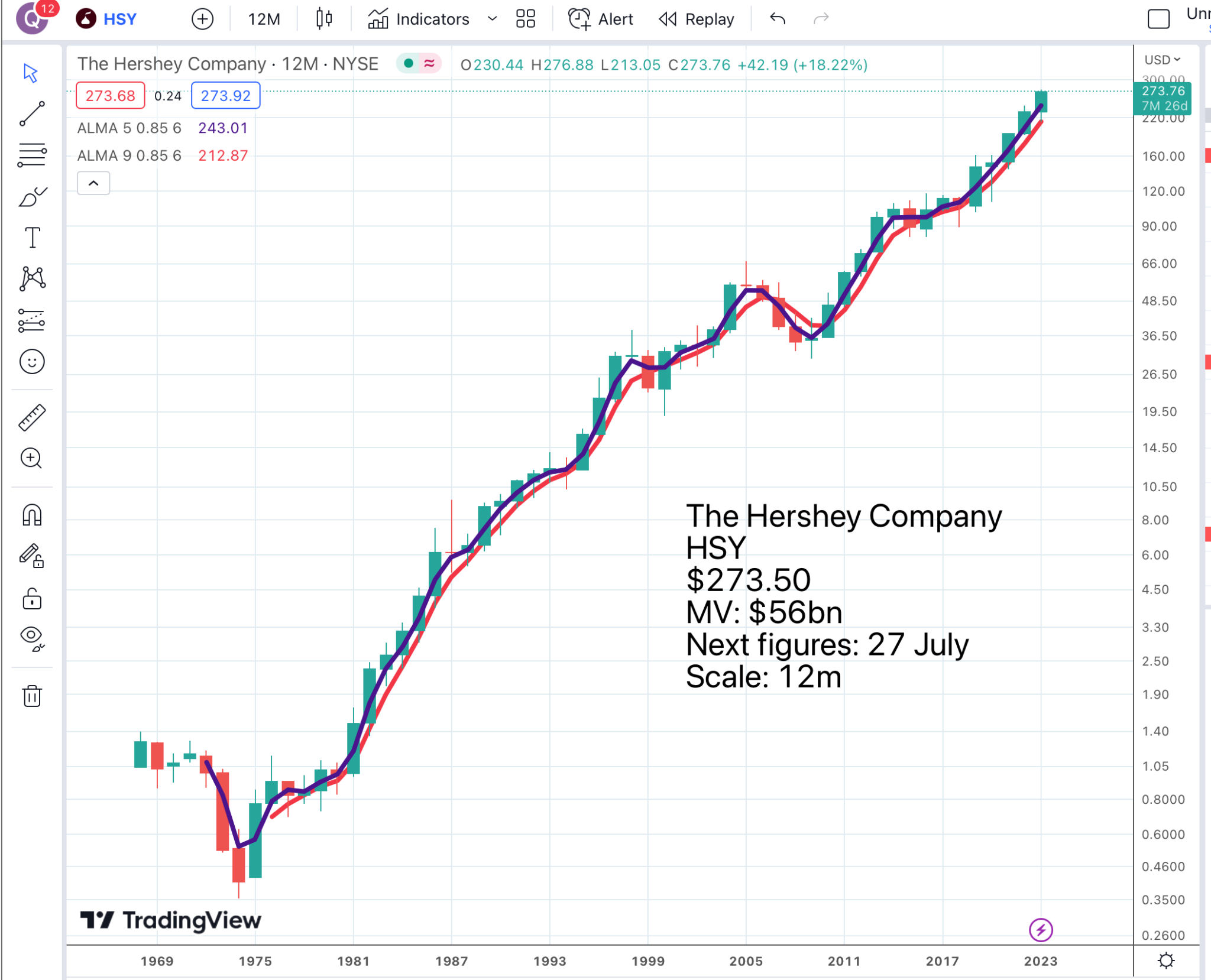

No surprise that with fundamentals like these the chart looks good, especially in the period since Michelle Buck arrived on the scene.

More snacking is a global phenomenon

I discovered this when looking at a company called Mondelez International, which makes things like Oreos.

Oreo is a brand of sandwich cookie consisting of two chocolate biscuits or cookie pieces with a sweet creme filling. It was introduced by Nabisco on March 6, 1912, and through a series of corporate acquisitions, mergers and splits both Nabisco and the Oreo brand have been owned by Mondelez International since 2012

Wikipedia

Just so you know I use Wikipedia quite a lot and I do make donations to show my appreciation. I am also a subscriber to Seeking Alpha which provides excellent independent research. Mondelez is almost twice the size of Hershey with a market value around $105bn.

Below is a picture from their web site which says a lot about what they do.

It turns out that Mondelez, of which I had never heard until I started researching The Hershey Company, is a serious player in a global snacks market showing accelerating growth.

It is interesting about snacks because this is a journey I am on myself. It started when I found that one of the hobbits in The Lord of The Rings was talking about ‘second breakfast’. I liked the idea and have since added third breakfast. Then I may have a light lunch, depending what time I had third breakfast. After that I have tea, dinner,, cheese and biscuits, pudding and then maybe some sort of sweet like almonds coated with sugar and dusted with cocoa powder.

It is an indulgent way to spend the day but I think a day should be full of pleasure and I am less and less interested in the sort of large meals , meat, potatoes, vegetables that used to dominate my day. If I am part of a global trend then I can see why companies like Hershey and Mondelez have strong following winds in their businesses.

We all love treats

People like treats, a bit like dogs whose lives seem to revolve around walks and treats, something which seems to be happening to me as well, so it is no surprise that companies catering to this growing enthusiasm are doing very well.

And I’m pleased to share that we are off to a record start in 2023 with very strong double-digit top line growth in the first quarter, driven by effective pricing and ongoing volume growth. We continue to execute on our long-term strategy and we see robust momentum across geographies and categories.

We delivered strong performance in both emerging and developed markets and we successfully implemented circa-80pc of our price increases in Europe. Our robust profit dollar growth was driven by volume leverage, cost discipline and pricing to offset cost inflation. Our strategic decision to focus our portfolio on the attractive categories of chocolate, biscuits and baked snacks continues to bear fruit, with consumers gravitating to those categories. We continue to invest in our brands, in our capabilities and our portfolio reshaping initiatives to accelerate and compound growth on both the top and bottom lines.

At 19.4pc growth, we delivered our best quarter ever, significantly ahead of our already strong 12pc in full-year 2022.

Q1 2023, 27 April 2023

Unsurprisingly Mondelez has another strong chart.

Pepsico completes trio of great snacking stocks

PepsiCo is the biggest beast in this sector with a market value of $265bn. I had a look and it is almost as big by market value as Coca-Cola, which must be a shock for the latter company.

The company has the usual collection of iconic brands.

PepsiCo products are enjoyed by consumers more than one billion times a day in more than 200 countries and territories around the world. PepsiCo generated $86bn in net revenue in 2022, driven by a complementary beverage and convenient foods portfolio that includes Lay’s, Doritos, Cheetos, Gatorade, Pepsi-Cola, Mountain Dew, Quaker, and SodaStream. PepsiCo’s product portfolio includes a wide range of enjoyable foods and beverages, including many iconic brands that generate more than $1bn each in estimated annual retail sales.

Website

Pepsico in its modern incarnation dates back to the merger with Frito-Lay in 1965.

In 1965, Frito-Lay Inc. merged with Pepsi-Cola to form PepsiCo. Today, Frito-Lay North America (FLNA) makes some of the most popular and high-quality snacks in the United States and Canada, including Lay’s and Ruffles potato chips, Doritos tortilla chips, Cheetos cheese-flavored snacks, Tostitos tortilla chips and branded dips, Santitas tortilla chips, Sun Chips multigrain chips, and Fritos corn chips. In addition, FLNA, through a joint venture with Strauss Group, makes, markets, distributes and sells Sabra refrigerated dips and spreads. Its emerging brands include Bare Snacks, Off The Eaten Path and Popcorners.

Website

Ten in 2001 Quaker Foods North America became part of the group.

The Quaker Oats Company merged with PepsiCo in 2001. Today, Quaker offers numerous products and choices including hot cereals, cold cereals, snack bars, rice snacks and more.

In addition to Quaker branded products, Quaker Foods North America also makes, markets, distributes and sells cereals, rice, pasta, dairy and products such as Cheetos Mac‘N Cheese, Pearl Milling Company pancake mixes and syrups, Cap’n Crunch cereal, Life cereal, Rice-A-Roni and Near East side dishes.

Website

Like the other two companies Pepsico is in strong growth mode.

We are very pleased with our performance for the first quarter as our business delivered 14.3 percent organic revenue growth and 18 percent core constant currency earnings per share growth.

Given the strength of our business performance, we now expect our full-year 2023 organic revenue to increase 8 percent (previously 6 percent) and our core constant currency earnings per share to increase 9 percent (previously 8 percent).

Our performance also gives us added confidence that our strategy to invest in becoming an even Faster, even Stronger, and even Better company is working as our growth and momentum remains robust across our categories and geographies.

Q1 2023, 25 April 2023

Faster, Stronger, Better is the kind of corporate-speak you get from these businesses but it seems to be working.

The chart is strong over a long period.

Strategy

The big question is why is snacking doing so well. Is the whole planet copying me or is there some bigger phenomenon at work? This graphic is a bit out of date but it gives you a flavour (pun intended) of how big is the snacking market.

It has changed a lot.

In an environment where consumer tastes are changing, the demand for snacks has only gone up, especially in the U.S. “The average number of snacks consumed per day in the U.S. more than doubled since the late 1970’s from 1 to 2.5 today. Moreover, 40pc of U.S. adults in the late ‘70’s didn’t snack at all on any given day! Now, 95pc of U.S. adults consume at least one snack daily,” analyst David Driscoll wrote in a note Wednesday.

Yahoo Finance, 25 May 2019

This reflects social changes.

“The rise in snacking occasions in the U.S. over the past 40 years has been driven largely in part to social and economic shifts, including consumers having busier, faster-paced lives, more women in the workforce, and smaller households. Consumers now need or want to eat more on the go, or cooking full sit-down meals is not as much as priority,”

Yahoo Finance, 25 May 2019

The opportunity remains huge.

Growth rates are strong, but the average consumer in an emerging market only spends about $38 a year on snacks, while the average consumer in a developed country spends about $328 annually. Thus, Driscoll argued that there is still a long journey for snack trends in emerging markets to catch up to developed markets. However, it remains an area of great opportunity.

Yahoo Finance, 25 May 2019

All three of these shares look like great investments.

Share recommendations

The Hershey Company HSY. Latest: $273

Mondolez International. MDLZ. Buy @ $77

Pepsico. PEP. Buy @ $913