I am looking at a chart of the Nasdaq Composite index, which measures the performance of the more important Nasdaq-quoted companies since launch at 100 in 1973. It has risen from 100 to 14,639, a rise of 146 times. The climb has been punctuated by three severe bear markets, in 1974, 2003 and 2008 respectively. The normal direction of travel is up and the forces pushing it higher seem to me to be becoming stronger all the time. I expect it to reach six figures within a decade although that is obviously pure guesswork.

My impression also is that bear markets have been replaced by volatility, which can be very extreme. Covid-19, for example, triggered a full scale bear market move compressed into two months as the index fell from 9,824 to 6,628. There have been further bouts of wild volatility since then and there will no doubt be more in the future. Volatility has become a fact of investing life, especially with the kind of high-growth, high-momentum stocks favoured by Quentinvest.

This is why as well as the focus on share selection, which has always been a feature of the Quentinvest approach I am also developing strategies for exploiting that volatility to add to holdings at favourable prices.

Every time the market has a wobble, what I describe as snakes in an endless game of snakes and ladders, people worry that an old-fashioned two year bear market is developing. It is always a possibility but I think unlikely. Since 2009 no reaction has lasted longer than three months. Part of the reason for this is that the toxic cocktail of higher inflation, rising interest rates, governments slamming on the brakes leading to recession doesn’t seem to be happening any more.

Why? I believe this is precisely because of technology and globalisation which have made the global production process dramatically more flexible and efficient with further improvement coming all the time. Strong demand, quantitative easing and fiscal expansion are being absorbed without causing a significant rise in inflation. Also central banks are on the watch and only have to breathe caution for everybody to calm down.

Labour shortages are emerging in some countries but will this lead to inflation or more investment in automation and robotics.

So I believe it makes sense to buy and hold, to add into strength after weakness and to expect most well chosen stocks, no matter how severe their sell-offs, to eventually rally to new peaks. As I say in my e-book on the golden rules of investing with Quentinvest (launching soon) – it pays to be an optimist.

It also pays to choose the right stocks which is where the QV focus on technology comes into play. Big share price moves come on the back of something big happening. The technology revolution is a massive something big driving huge share price moves and ones which run and run. I recently alerted yet again in Quentinvest all the big names in technology, Apple, Alphabet, Amazon and others, even though they have already been recommended countless times across the QV ecosystem. The Apple share price has been rising, with periodic interruptions, since 2003 and looks set to keep climbing for years to come.

This is not surprising given the role that Apple devices and services play in our lives. Stocks like Apple are the technology revolution so 10 years from now these companies, huge as they are could be dramatically bigger as could all the companies in the second, third and fourth tiers playing their exciting part in driving the revolution forwards.

Charles River Laboratories/ CRL Buy @ $374 – “The biotech funding environment has never been stronger.”

Croda International/ CRDA. Buy @ 7440p – “[using] the acquisition of adjacent technologies to build a broad drug delivery business of global scale.”

Domino’s Pizza Inc./ DPZ Buy @ $474 – “We still see so much opportunity for continued growth and share gain in that international business.”

Intuit/ INTU. Buy @ $497 – “Our AI-driven expert platform strategy and five Big Bets are driving strong momentum and accelerating innovation across the company.”

Liontrust Asset Management/ LIO. Buy @ 1912p – “The excellence of our active investment management, service and communications gives me great confidence that Liontrust will continue to grow as we emerge from the pandemic.”

The Joint Corp. JYNT Buy @ $83 – “Patients who visit a chiropractor first had 90pc decreased odds of early and long-term opioid use.”

Zebra Technologies. ZBRA. Buy @ $539 – “Encouraged by the broad-based robust demand we are seeing across virtually every dimension of our business.”

Charles River Laboratories. CRL. Buy @ $374. Times recommended: 7. First recommended: $268 Last recommended: $366

Business genius, Jim Foster, turns Charles River Labs from a niche business supplying ‘models’ for animal testing to a comprehensive outsourcing partner for global biopharma

Charles River Laboratories started life as a niche business providing ‘models’ (animals for drug testing). This is still an important business for the group and although it is hard to be enthusiastic about it somebody has to do it until we find another way to bring novel drugs from the lab into general use.

However the models business is increasingly a springboard for the creation of a much more comprehensive service provider to the global pharmaceutical research community. And these changes are taking place under the leadership of an inspirational guy called Jim Foster who has been CEO since 1992.

“As CEO, Mr. Foster has built Charles River from a niche research models and services business to a full service, early-stage drug research partner to more than 100 of the world’s largest biopharmaceutical companies and academic institutions, as well as thousands of emerging and established biotechnology companies. Today, the company offers a unique portfolio of products and services required to take a novel drug therapy from discovery through non-clinical development.”

Charles River is an outsourcing business taking on non-core roles for pharmaceutical companies and providing them as a service. This is increasingly the business model for even very small businesses who love the flexibility of focusing on what they can do best and leaving everything else to be provided as a service by third party specialists. CRL is already doing the hardest thing, providing test animals, so no surprise it is using that base and the customer relationships that spring from it to offer an ever widening range of services.

Think Square in fintech which started with card readers and now offers funding and much more for its growing client base. CRL is doing the same in the pharmaceutical world, which was growing fast anyhow but has been turbo charged by the Covid pandemic.

Much of this expansion of the portfolio is coming by acquisition. “Already this year, we have enhanced our scientific capabilities for advanced drug modalities through the acquisitions of Distributed Bio, Cognate BioServices and Retrogenix. Distributed Bio and Retrogenix strengthen our discovery portfolio. And the acquisition of Cognate, which was completed on March 29, provides an excellent growth opportunity by allowing us to offer CDMO (contract development and manufacturing organisation) services in the high-growth, high-science cell and gene therapy sector.”

The company has just reported an outstanding quarter. “Earnings per share were $2.53 in the first quarter, an increase of 37.5pc from $1.84 in the first quarter of last year. This outstanding earnings growth principally reflected the double-digit revenue growth and meaningful operating margin improvement.”

The relationship between CRL and its customers is changing. “Clients increasingly view Charles River as a premier scientific partner who can support their efforts to identify new drug targets and discover novel therapeutics.”

CRL is classic 3G and has all the characteristics in place to create a very large business as a key partner in the global pharmaceutical effort to develop new drugs, which is gaining speed at an astonishing rate. China alone is effectively trying to create an important pharmaceutical sector from scratch which is why there are three Chinese biopharmas in the QV for Shares portfolio.

As CRL noted in their latest report. “Research models business in China had an exceptional quarter even after normalizing for last year’s COVID-19 impact, driven by a resurgence in demand across all segments.”

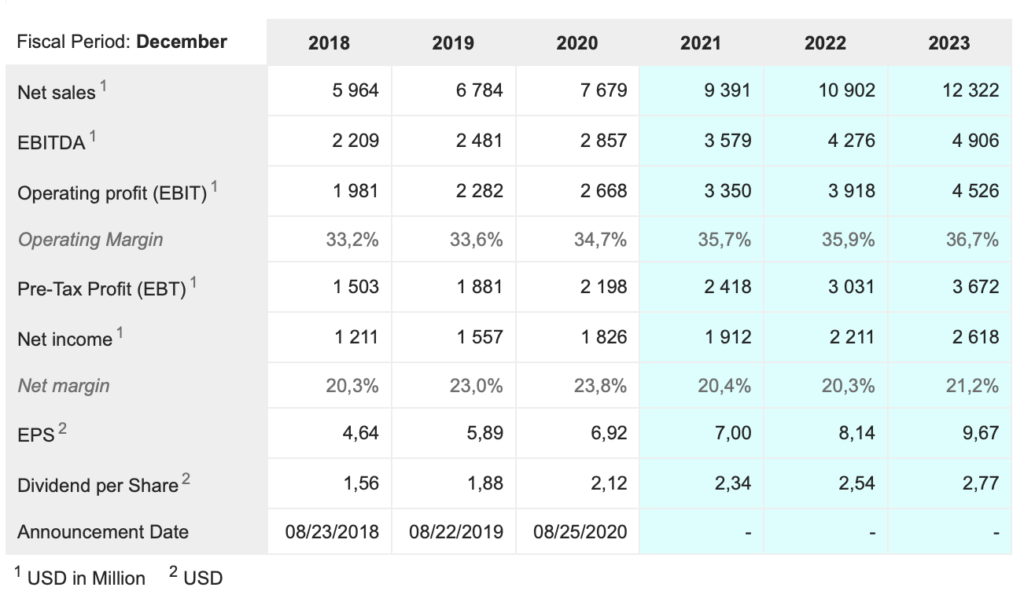

Croda International. CRDA. Buy @ 7424p. Next figures: 27 July. Times recommended: 11 First recommended: 4499p. Last recommended: 7308p

Croda looks to divest performance technologies and industrial divisions to focus on faster growing personal care and life sciences

Croda International is a specialty chemicals business with a long record of sustained growth. It consists of four divisions – customer care, life sciences, performance technologies and industrial chemicals. The first two generate 80pc of profits. The group recently announced a strategic review to consider whether the last two divisions should stay in the group or find a new home.

This is an important ‘something new’ which could drive significant share price growth. Funds raised from any divestment could be reinvested in the two faster growing businesses and the increased focus could have exciting consequences in terms of acquisitions and even a higher rating for a more exciting total business.

I already think of Croda as the company that provides the X factor in many skincare and beauty products, the bit that actually makes the product work. This enables it to achieve high operating margins in the mid-20s per cent. The review would only be taking the group faster in the direction it is already going.

“We invested over £120m [in 2020] in organic capital expansion, with a particular focus in growing Health Care and innovation, and over £850m in two acquisitions into key market adjacencies. Firstly, in support of our near-term priority to scale drug delivery, we acquired Avanti Polar Lipids, whose lipid-based technologies are key to new patient health applications including mRNA-based vaccines and drugs to fight COVID-19. Then, in November, we acquired Iberchem, a global flavours and fragrances business, in line with our priority to deliver fast growth in emerging markets, particularly China.”

The strategic review has in part been inspired by steadily improving trading which makes me think the next set of figures are going to be good, especially since Croda has been playing an important part in the battle against Covid. “Pfizer-BioNTech COVID-19 vaccine approved by regulators initially in the UK and USA; Croda/Avanti playing critical role in scale-up of the vaccine that has been achieved in unprecedented time and is now being delivered at pace.”

The company is also involved in the battle against climate change. “The need for sustainable solutions is disrupting markets, creating significant opportunities for Croda to create market-leading products whilst ensuring that we have a positive effect on the environment and society.”

There is just so much that is going on at Croda to drive faster sales growth in future. “China offers significant growth opportunities as part of our ‘fast grow’ strategy.” Another exciting area is drug delivery. “Drug delivery offers our strongest global opportunity for growth and we are investing in new manufacturing capacity to serve these patient health care markets.”

The real significance of the strategic review is not any possible divestments in themselves but the evidence that Croda is moving onto the front foot in driving future growth.

Like all great 21st century companies Croda is all about innovation. “Innovation – the lifeblood of our business, we seek to increase the proportion of New and Protected Products (NPP) that we sell and formulate into customers’ products.”

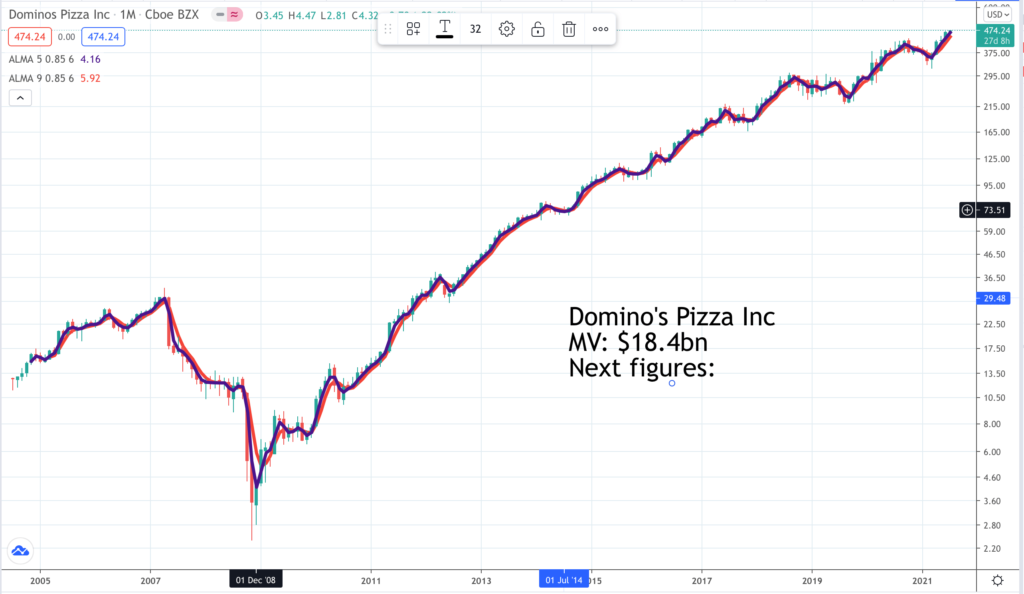

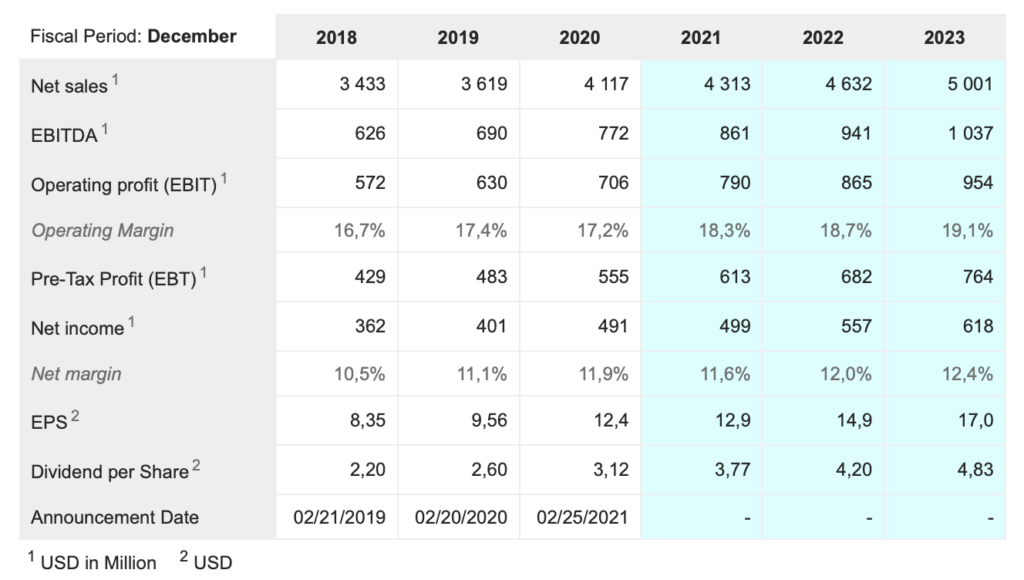

Domino’s Pizza Inc. DPZ. Buy @ $474. Times recommended: 5. First recommended: $355. Last recommended: $463

Runway for growth stretches endlessly into the future as Domino’s franchisees roll out stores across the globe

Domino’s Pizza Inc. is a business in the right place at the right time with Covid raging around the world and everybody looking for convenient home delivered food. However it is not just Covid. Domino’s has been growing for a long time.

“During Q1, we continued to lead the broader restaurant industry with 40 straight quarters of positive US comparable sales and 109 consecutive quarters of positive international comps. Same-store sales in the US grew 13.4pc in the quarter, lapping a prior year increase of 1.6pc. Same-store sales for our international business grew 11.8pc, rolling over a prior year increase of 1.5pc.”

Domino’s Pizza is increasingly seeing physical growth in the international side of the business. “We and our franchisees added 36 net stores in the US during the first quarter, consisting of 37 store openings and the closure of one of our corporate stores. Our international business added 139 net stores, comprised of 160 store openings and 21 closures.”

It is also mainly a franchise business with master franchisees in the UK, Australia and other locations who have expanded into their nearby geographies. in China and Asia generally it is growing with joint ventures and India with over 1,000 stores is the second biggest locations after the US. Revenue comes from franchise fees and royalties and the master franchisees look after advertising.

Domino’s is the kind of business where there are always factors at work to influence short-term performance and act as short term drivers of the share price. This is why I prefer to look at the whole concept. Home delivery was described by McDonald’s as the fastest growing areas of the fast food market even before Covid was ever heard of and is likely to receive a durable boost as work from home becomes a way of life for many people.

Part of Domino’s success comes from attracting high quality franchisees. “A single store closure in the quarter, on a base of over 6,000 units, demonstrates the elite economic proposition that we offer to our franchisees. And on that note, I’m thrilled to report yet another record-setting year of franchisee profitability, with our final 2020 estimated average EBITDA number for US franchise stores coming in at just over $177,000; the highest in our history. While this result was certainly aided by the Covid demand tailwind, it clearly demonstrates not only the power of the brand, but also the incredible work of our US franchisees and operators, and their relentless efforts throughout an incredibly busy 2020.”

The runway for growth for Domino’s capital light business model stretches seemingly endlessly into the future. “India, China, and Japan, once again, led our system in net unit growth. And I’d like to highlight another market, Guatemala, that also delivered terrific store growth. China, Japan, Turkey, Colombia, Germany, and France, all drove impressive retail sales growth during the quarter. So, once again, I am very proud of our master franchisees and their operators for a great start to 2021.”

It almost seems that having done the early groundwork Domino’s Pizza Inc. and its shareholders can increasingly sit back and reap the benefits while much of the heavy lifting is done by other people. Not that the master franchisees have any complaints. In cases where they are quoted their shares are doing pretty well too and as we have seen individual franchisees are laughing all the way to the bank.

Intuit. INTU. Buy @ $497. Times recommended: 13. First recommended: $210.50 Last recommended: $486

Intuit buys Credit Karma for $8.1bn to add impetus to one of its five big bets, helping its customer base take smart money decisions and access affordable loans

Intuit provides accounting services for SMEs (small and medium sized businesses) and individuals. It is an American business and the bulk of its revenues are still generated there though it is increasingly spreading its wings internationally. The original growth charge came from software packages. It then adapted to SaaS (software as a service) and reinvented itself as an online subscription business. Now it is spreading its wings again by adding new services to the basic package such as helping its customer base find affordable loans.

You can get a quick snapshot of the business from the annual report. “Our global products and platforms, including QuickBooks, TurboTax, Mint and Turbo, are designed to help our customers better manage their money, reduce their debt and file their taxes with ease so they can receive the maximum refund they deserve. For those customers who run small businesses, we are focused on helping them get paid faster, pay their employees, access capital, ensure their books are done right and find and keep customers. We serve more than 50m customers across our product offerings and platforms. We had revenue of $7.7bn in our fiscal year which ended July 31, 2020, with approximately 10,600 employees in offices in the United States, India, Canada, the United Kingdom, Israel, Australia, and other locations.”

The way in which Intuit operates is also changing. “The rise of Artificial Intelligence (AI) is fundamentally reshaping our world — and Intuit is taking advantage of this technological revolution to find new ways to deliver on our mission.” The use of artificial intelligence promises to bring about a transformation of the business as the company builds an AI-driven expert platform.

intuit is making what it calls five big bets to accelerate growth. One of these is to unlock smart money decisions and to jump start this bet it recently announced an important acquisition. It is buying Credit Karma, a free credit scoring business with 110m members for $8.1bn in a mixture of shares and cash. The aim of the deal is to help people and SMEs with their finances.

“We’re thrilled to begin our journey together to create a mobile, personal financial assistant for consumers to help solve their most pressing financial problems,” said Sasan Goodarzi, CEO of Intuit. “Together, we will help consumers achieve financial success with confidence by helping them find the right financial products, put more money in their pockets, and provide financial expertise and advice. I personally want to welcome Ken and the Credit Karma team to the Intuit family. We at Intuit have been fans of theirs for some time and are ready to start our journey together.”

This is a major ‘something new’ for Intuit to do this at scale and points to the aggressive ambitions of the business. Intriguingly Credit Karma has a close partnership with Upstart, another business using AI to disrupt the banking industry. Over half the loans made through Upstart’s platform come from referrals by Credit Karma. Some people, although not Upstart, see this as a risk factor for that business. It highlights what an exciting growth opportunity Credit Karma could be for Intuit.

The other big bets Intuit is making are revolutionise speed to benefit, connect people to experts, be the centre of small business growth and disrupt the small business mid-market. Most likely we can expect acquisitions in all these ares to add scale and boost growth.Meanwhile the company is in great shape with sales growth accelerating to 20pc in the latest quarter.

Liontrust Asset Management. LIO. Buy @ 1912p Times recommended: 10. First recommended: 1200p. Last recommended: 1848p Lowest recommended: 1030p

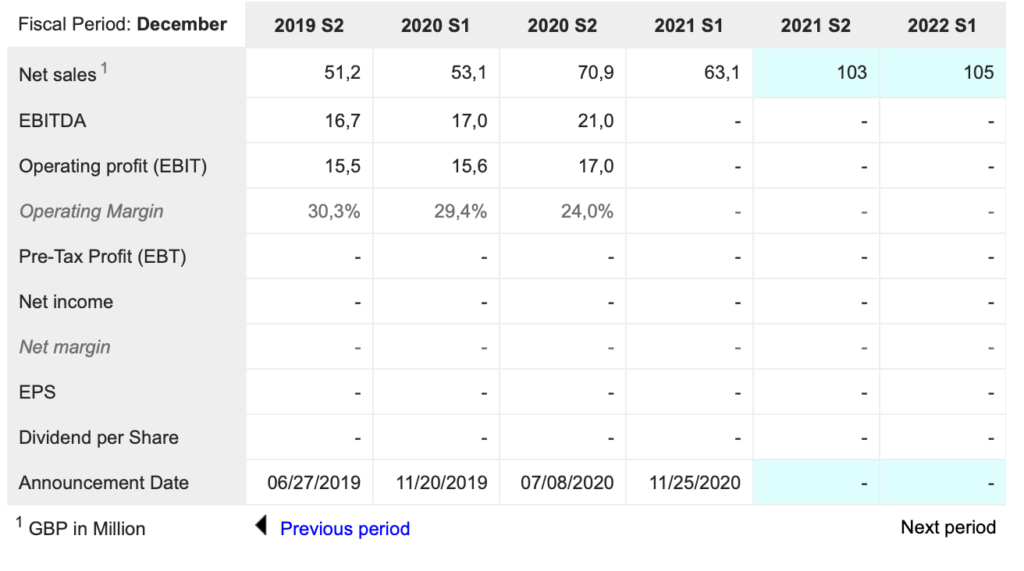

Liontrust grows managed funds strongly both organically and by acquisition and launches first investment trust into booming market for sustainable investments

Among the best investments in bull markets are fund managers. Strong markets make it easier to deliver a strong investment performance. They encourage more investors into the market so client numbers climb. Lastly funds under management grow without management doing anything because of rising values.

The icing on the cake is that it makes little difference to a fund manager whether he is managing a £10m fund or a £100m fund so costs rise more slowly than funds under management giving huge operational leverage to profits. This doesn’t necessarily mean profits will rise faster than sales because if the climate is very favourable it makes sense to invest those extra profits in marketing to bring in yet more clients and drive even faster growth in funds managed.

A major boost to the share price performance came on 20 May when the group announced that it was trading ahead of expectations. “Liontrust today announces that it expects revenues to be ahead and adjusted profit before tax to be significantly ahead of market expectations for the year ended 31 March 2021. Adjusted profit before tax will be not less than £63m, driven primarily by stronger than expected performance fee revenues during the period of £13.7m.

There is much more to the exciting performance of Liontrust Asset Management than a favourable stock market. The group gave a boost to assets under management with an acquisition when it acquired Archives investment business for £75m in November 2020 to add £5.7bn to funds managed.

The business is also very well led. John Ions became CEO in 2010 when the group was haemorrhaging assets and net assets were down to around £1bn. The timing was perfect in stock market terms but the growth since then has been impressive supported by excellent performance by the stable of managed funds.

A striking phenomenon of recent times has been the swelling numbers of retail investors investing directly in the stock market. This can take the form of investing directly in shares or just tracking down an excellent fund management business like Liontrust and investing in the funds. Many people are clearly doing this along side the business flows directed into the funds by financial advisers.

Another attraction of Liontrust as an investment is strong free cash flow and a generous dividend policy. For the year to 31 March 2021 the group reported earnings per share of 87.4p, up 54pc on the previous year. The total dividend paid for the year rose 42pc to 47p.

The group is also planning to launch its first investment trust as a quoted stock market vehicle. The Liontrust ESG Trust, a sustainable investments focused trust, was due for launch this Monday 5 July.

It is also expanding in continental Europe with a partnership with ABN AMRO Investment Solutions to launch a global impact fund. “In continental Europe, Liontrust has partnered with ABN AMRO Investment Solutions to launch a global impact fund which is being distributed in Italy, Luxembourg and Spain. Along with Sustainable Investment, we see great potential for our Global Fixed Income, Cashflow Solution and Economic Advantage strategies in Europe.”

There is plenty happening and with stock markets climbing on the back of rising economic activity the outlook remains highly positive.

The Joint Corp JYNT. Buy @ $83 Times recommended: 2. First recommended: $77.50. Last recommended: $82.50

The Joint Corp pioneers affordable back pain clinics across America and targets grow to 1800 clinics while sales per clinic also grow

Like Freshpet I think of The Joint Company (back pain, not marijuana) not so much as a disruptor as a category killer. They provide affordable, membership-based, easy-access chiropractic services via walk-in clinics and they are growing by rolling out these clinics across the USA. At a recent count they had 527 franchised clinics and 65 company owned clinics. In 2010, when the business was launched, they had 10 and numbers have grown rapidly ever since. They are targeting 1000 clinics by 2023 and are by far the market leader in the category.

You could say they invented the category. The medical doctor founders dreamed up the whole concept of providing easy access health care for bad backs. It clearly struck a nerve since the business has grown like topsy. It also does a great job in protecting Americans from another US epidemic, the surging US market for addictive opioids reminiscent of the Victorians and their passion for the highly addictive opium-based painkiller, laudanum.

The business model is simple. “The Joint is revolutionizing access to chiropractic care. Our core concept has remained steadfast. Located in convenient retail settings, we provide concierge-style membership-based services, without the need for insurance or appointment with attractive pricing and convenient hours. Our growth strategy is to build on our brand, increase awareness of the efficacy of chiropractic care, attract new patients and open more clinics.”

What is amazing is how the clinics have flourished even during lockdown. “Our clinics achieved new highs even during the pandemic. Of the 73 new clinics opened in 2020, 15 achieved Go Elite status, meaning that they acquired over 400 patients and recorded more than $30,000 in sales in the first two months of operation. In fact, 169 clinics achieved more than $550,000 in sales in 2020, up 19pc compared to 2019. That included nine Platinum clinics with over $1m in sales, up from four Platinum clinics the previous year. Our undisputed sales champion earned Diamond clinic status for the second year in a row with over $1.5m in annual sales.”

Evidently they have a formidable growth engine in place as more clinics open while all the clinics do more business each year. At the time of flotation in 2013 there were 215 clinics, all franchised either directly or through regional developers (RDs). The reason there are now 65 company owned clinics is that as regions reach maturity the group opportunistically buys back the RD rights so that they keep the sales commission and the three per cent royalty stream payable by franchisees to RDs. It is an easy way to turn free cash flow into higher recurring income while generating capital gains for RDs.

Marketing is principally directed to driving more patients through the system. “In March, we’re pleased to attract a record number of new patients in our system. This is 11pc greater than our previous system high which was in March of 2019. This is a significant development as the average number of new patients was the metric most negatively impacted by the pandemic, and is a key ingredient for growth of our membership model. Many factors are driving our momentum from easing of COVID related restrictions by local governments, to increases in local advertising spending by our franchisees, to continued success of our brand building efforts, to the growing market strength of our regional co-ops and the innovations in our marketing technology platforms.”

There is much else going on at The Joint Company including setting up a SugarCRM (customer relationship management) system across the network which should be a powerful driver of higher efficiency and patient recruitment.

The group says the goal is 1,800 clinics but I am sure they will think of new ideas to expand the network and offer new services to keep growth going once that target is reached. They compete on price very effectively with medical practitioners generally and co-payments on insured schemes. They are operating in a massive market. Americans spend $90bn on back pain, $16bn of that with chiropractors.

Zebra Technologies ZBRA Buy @ $539 Times recommended: 9 First recommended: $232. Last recommended: $530

Zebra Technologies is quite a complicated company to get your head around. It was born in the 1960s when it was known as Data Specialties inc. it invented numerous products that were involved with the bar code reading revolution in shops and in 2004 launched the first rugged RFID handheld and first enterprise digital assistant. RFID refers to a wireless system comprised of two components: tags and readers. The reader is a device that has one or more antennas that emit radio waves and receive signals back from the RFID tag. In 2014 it bought Motorola Enterprise Solutions bringing in $2.5bn of sales for an acquisition cost of $3.45bn funded in cash and debt.

At the time Zebra CEO, Anders Gustavsson said – “With 2013 pro-forma sales of approximately $2.5bn, Motorola Solutions’ Enterprise business is an industry leader in mobile computing and advanced data capture communications technologies that serve customers in retail, transportation & logistics, and manufacturing. The sale includes Motorola Solutions’ wireless local area network (WLAN), Rhomobile and MESH businesses.”

By current valuation standards it looks an amazing deal at 1.5 times sales. At the time Zebra described itself as making businesses as smart and connected as the world we live in. Zebra tracking and visibility solutions transform the physical to digital, creating the data streams businesses need in order to simplify operations, know more about their business, and empower their mobile workforce.

Given that description you can see why the group is flourishing in an era of digital transformation. Since 2014 both acquisitions and innovations have kept on coming to create the company that Zebra is today. A brief summary describes Zebra as a manufacturer of bar code scanners, RFID readers, mobile computers, and printers that capture real-time data. As data becomes an ever larger part of industry, it’s essential to capture more and more of it through devices made by Zebra. They sometimes describe what they do as Intelligent Edge solutions with the edge being the interface between a company and its customers.

One of the things their products do is enable intelligent automation. Their latest acquisition, announced on 1 July, was a company called Fetch Robotics which they describe as follows – “Fetch is a pioneer in on-demand automation. Fetch’s Autonomous Mobile Robots (AMRs) are used for optimized picking in fulfillment centers and distribution centers, just-in-time material delivery in manufacturing facilities and automating manual material movement in any facility.”

Explosive growth in e-commerce is creating strong demand for products which facilitate what they call the on-demand economy and Fetch has the largest portfolio of AMRs in the industry.You can see how they feel about Fetch because they paid $290m for a company with sales of $10m.

Zebra is a leader in many niches related to its core competency which offers many opportunities for acquisitions. It is well led, solves important problems for its customers and is operating in a large market.

One factor which could be an important following wind for Zebra’s business is widespread reports of labour shortages. This will only accelerate the tendency for enterprises to turn to Zebra and its range of automation solutions as the deal with all the issues of operating in a multichannel world.

The bear case is that Covid gave a one off pull-through boost to demand. More likely though is that lockdown has just accelerated a massive trend towards e-commerce and digital transformation and that Zebra’s role at the edge in collecting date, transforming it into digital form and using it to power greater automation and efficiency will be a lasting trend.