Great Charts prioritises chart breakouts, which means leaning into strength

I am starting to become more excited about the immediate stock market outlook. There willl be more to say about that below but first I want to talk about what I see as the primary role for Great Charts in the Quentinvest ecosystem.

Great Charts for Quentinvest is the new name for Chart Breakout, which gives you a strong clue to what the publication is mainly about. I am looking for stocks with 3G characteristics, that requirement will never change, which are making chart breakouts.

Beauty is in the eye of the beholder. Your idea of a chart breakout may be different to mine. In Great Charts you get to see my selections.

Great Charts has become a part of what I am starting to think of as the Quentinvest ecosystem. This also includes Great Stocks, QV Share Alerts and for subscribers who take the full package QV for ETFs alerts.

Within that I have also broken QV Share Alerts and QV for ETFs into alerts for shares and groups of shares that I like for whatever reason including being new additions to the portfolio, which I am continually refreshing with new ideas.

It also includes buy signals based on my programmatic strategies and what I call buying the green. Programmatic buy signals are primarily based on moving averages. I look for golden crosses where monthly or weekly moving averages cross higher after a period wen they were falling.

Buying the green involves monitoring candle stick charts and issuing buy alerts when a green candle follows a red one.

If this all sounds impossibly complicated the good news is it works for me and there is no need for subscribers to become bogged down in the details. The whole strategy could be summed up as (a) selecting shares to go into the portfolio and (b) monitoring the price action to identify subsequent timely moments to buy the shares. This could be either adding to an existing holding, sometimes called pyramiding or opening a position for the first time, which I sometimes call climbing aboard.

As I keep saying the strategy works in part because of its one decision core. We only buy. We almost never sell. I see sell signals on the charts all the time. These could be programmatic, when the moving averages turn down or selling the red, when a red candlestick follows a green one. Sometimes the signals work very well but overall my judgement is that they lead to a trading mindset and in the long run that does not work.

The Quentinvest strategy is totally pragmatic. Investors who never sell do better, I believe much better, than those who do. The underpinning for this is good stock selection but that I believe is the forte of Quentinvest and the best thing I can do for my subscribers. I pick most of the shares that over time go up a lot, the Amazons and the Netflixes and most of the stocks I pick go up. Allied to a never sell approach and where possible a policy of adding to holdings on subsequent buy signals it is a powerful strategy for building a portfolio that over time delivers large capital gains and often works well on the income front as well.

So, back to Great Charts. As subscribers know I have various tables of past recommendations, which form the heart of the QV strategy and enable me to monitor performance. I use my tables to tell me that I am doing a good job for my subscribers and don’t need to retire yet. I even have a master table to which I add shares in companies that look to have 3G characteristics but have not yet been recommended. These so often end up being recommended at a higher price that I am considering having a section in the QV eco system for new entries to the table.

When I am about to write Great Charts I go through the master table looking for chart breakouts. I am influenced by what already I know about the shares in the table. For example, the most recent issue of QV for Shares featured 10 of the world’s biggest technology companies. My impression is that they are still full of running like the technology revolution they are spearheading and I expect their shares to keep climbing.

I also suspect that they are like an early alert system telling us that technology shares generally may be about to head higher. This is exciting because technology shares form the heart of the QV portfolio, which is stuffed with fast-growing technology companies. It is amazing how many of these companies are delivering supercharged growth in some key metric, often as high as 100pc or even more. Indeed, I am also running a series in QV for Shares looking at some of these explosively growing businesses, which are exciting for their founders, their managers, their investors and their employees. There is a horde of super-exciting companies quoted on global and especially North American stock markets but also elsewhere. I want subscribers to own as many of them as possible.

These shares are volatile. Early investors have huge profits. They benefited from lockdown which sent digital transformation into overdrive. Profits are deferred into a distant future so they are vulnerable to rising discount rates when interest rates rise and investors are always scared that even a slowing in growth or a cautious statement will make the shares collapse.

Investors should remember that these are classic ‘win in the end and win big’ stocks. You have to hang in there, have faith and ideally use that volatility to add to your holdings. However I never advocate buying into weakness because you never know when a business is losing the plot. I prefer always to buy on buy signals, what I sometimes call leaning into strength.

This is important because Quentinvest is all about backing winners and allowing losers to fade into obscurity. It is a form of capital allocation rather like what we see in the broader economy. I always want my money to go where the action is even if this upsets my subscribers.

A lady cancelled her subscription the other day partly on grounds of age but also because she didn’t like the fact that I recommend so many US shares. This is a perennial complaint and one with which I have very little patience. Come on guys, which would you rather hold, Netflix, up 1,500 times in the 21st century or Barclays, down by 66pc on its level in 2000. The answer is surely so obvious that no-brainer hardly does it justice.

Enterprise software stocks breaking higher

I have been saying for a while and especially vociferously since 2017 that the enterprise software sector is the most exciting sector in the world. I broadly still subscribe to this view although I am impressed by the incredible growth and prospects of a growing number of Chinese focused digital transformation, electric car, e-commerce, social gaming and other super exciting businesses. The global pool of fast-growing quoted stocks is itself growing at an accelerating rate which is an exciting prospect for aggressive growth share investors like my subscribers.

I would say that at the moment I find at least one incredibly exciting must-own stock a week, albeit that some of them, like say Stripe, are not yet quoted.

Enterprise software stocks bore the brunt of the wave of profit taking that hit stock markets in May. I know that if you look on a chart of the Nasdaq 100 it looks like the merest blip but it was surprisingly painful at the time, especially for a leveraged to the eyeballs investor like me. Many of what I consider the most exciting shares, fell in a matter of days by a third or a half.

This has two effects. First it shakes out all the momentum, algorithm-driven, over-leveraged guys who have to run for cover on the first signs of significant weakness. Secondly, many investors are influenced by share price weakness to think that something must be wrong and that shakes out another cohort of low-conviction investors. People who only bought the shares in the first place because they were going up and so have no core of belief in the company’s strategy to keep them committed when others turn tail.

Sometimes they are right and a falling share price is a sign of trouble ahead but most of the time there is an astonishing level of disconnect between what the shares are doing and how the company is doing. I look at loads of reports from companies. In the US they report quarterly and many UK companies give regular updates on trading. There is very little sign of a slowdown. The world is undergoing a major shift in the way we do things, much of it involving digitalisation and the Internet and that is proceeding at least as fast as ever.

My impression is that as and when normal types of interaction are able to resume in a more Covid-free world that this won’t involve a return to a pre-Covid pattern of doing things but an even more accelerated advance to an omni-channel way of life. There are still going to be huge opportunities for the businesses making all this happen.

In this month’s issue of Great Charts as promised I am focused on 3G shares making chart breakouts. There are 41 shares in the list. Some of the breakouts are illustrated by charts. Some are just listed here. The charts are all much the same. They look strong and the shares are breaking higher from some kind of consolidation. They are ALL stocks I would be delighted to have in my portfolio and many of them I do own. They are absolutely a cross-section of some of the world’s most exciting quoted businesses with shares behaving in a way that suggests that they are timely to buy right now.

The list doesn’t pretend to be comprehensive. Sometimes I will not include a stock because it has just been recommended and I don’t want to duplicate what I am saying. There is always a choice between buying your intended full holding straight away or adding to holdings in an incremental way. Personally I do a mixture of both although with the market looking this promising I am more inclined to pile in straight away. These are just such fabulous businesses I can’t wait to own a decent stake.

This is in line with yet another of Warren Buffett’s many aphorisms about the stock market. He tells us we should find a great business at a reasonable price and then buy a meaningful stake. I can see the logic. He wants investors to have the courage of their convictions before they buy which will make it easier for them to hold through any subsequent volatility. Either approach is fine. Pile in now or buy your intended stake in tranches.

What is impressing me is the way that a good number of the shares that sold off strongly are starting to rebound as strongly as they fell and the number of companies reporting who are as gung-ho on prospects as they have ever been. One analyst made a great point about this. As well as noting that exciting shares nearly always look over-priced he said that when their shares fall they become good value very quickly because the valuation is dropping rapidly while the growth is continuing fast. At the extreme if a company doubles sales while its shares halve it has become four times as cheap or four times less expensive.

It just reminds me yet again of how important it is for investors to be patient and give the shares they buy a real chance to show why you bought them.

Not recommended here but if you want a quick proxy for the performance of shares that I like look at how ETFs like OGIG and ARKK are doing. Their portfolios are stuffed with exciting, fast-growing technology shares and they took a hit in May but are now rebounding. Also keep an eye on behemoths like Apple and Amazon which have built major consolidations but have not yet broken decisively higher. Breakouts on these stocks would be exciting developments given their massive weighting in many indices.

Shares recommended but not charted are Bio-Techne (TECH) @ $439; Charles River Laboratories (CRL) @ $360; Cochlear @ A$245; Dechra Pharmaceuticals @ 4306p; Domino’s Pizza Inc.@ $461; Dynatrace (DT) @ $58.43; Edwards Lifesciences (EW) @ $103; Epam Systems (EPAM) @ $519; Figs (FIGS) @ $41; IDEXX Laboratories (IDXX) @ $607; Intuitive Surgical (ISRG) @ $898; Kering (KER) @ Euro759; Mettler-Toledo (MTD) @ $1374; Microsoft (MSFT) @ $262; MSCI Inc. @ $514; Li Auto (LI) @ $30; Rapid7 (RPD) @ $95; Sea Limited (SE) @ $279; Shift4 (FOUR) @ $99; Shopify @ $1528; Smartsheet (SMAR) @ $71.50; Synopsys @ $265; Volex (VLX) @ 373p; West Pharmaceutical Services (WST) @ $357; Yougov (YOU @ 1170p; Xalando (ZAL) @ Eur99.50 and Zscaler (ZS) @ $216.

High-powered chart breakouts

Adobe Inc. ADBE. $565

Atlassian. TEAM. $267

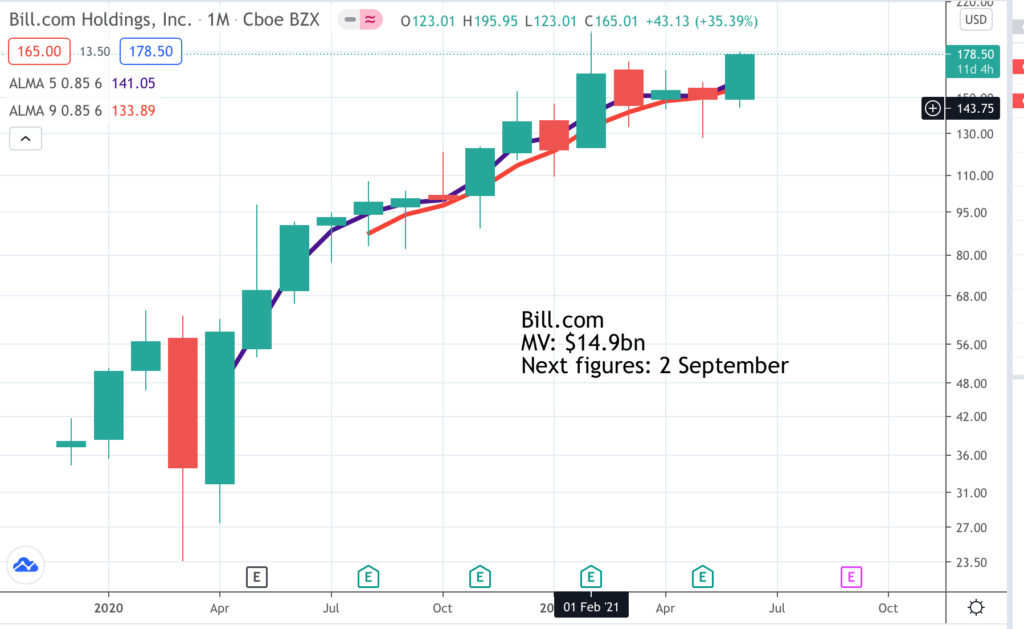

Bill.com. BILL. $181

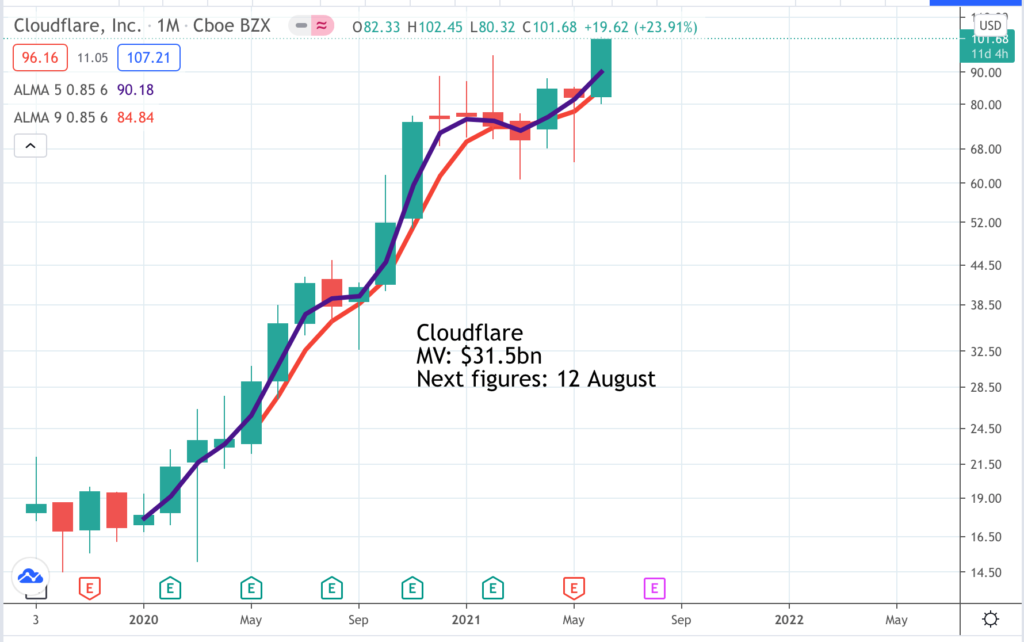

Cloudflare. NRT. $100

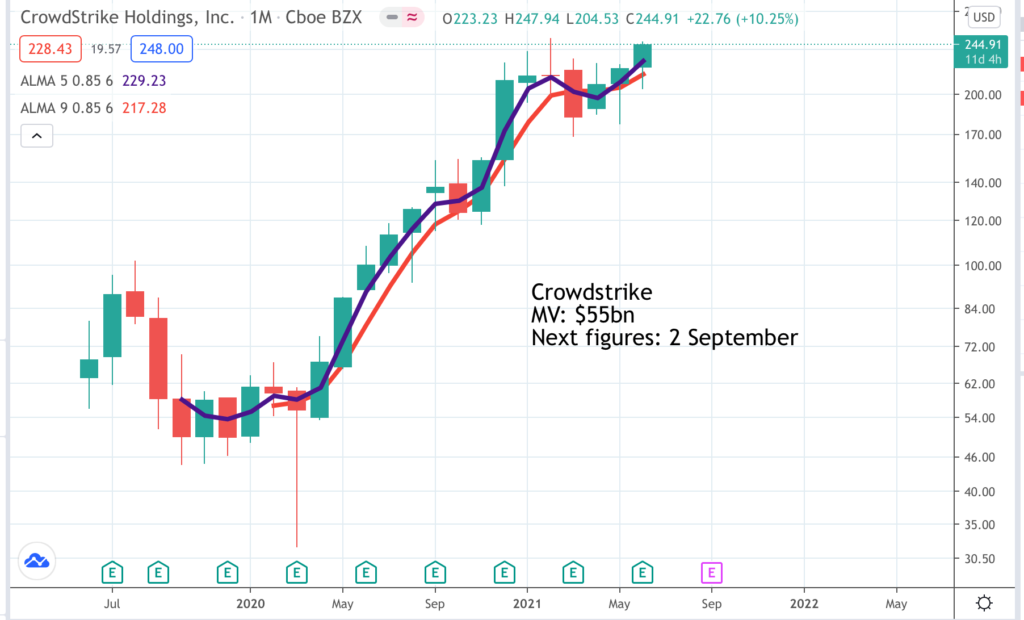

Crowdstrike CRWD. $237

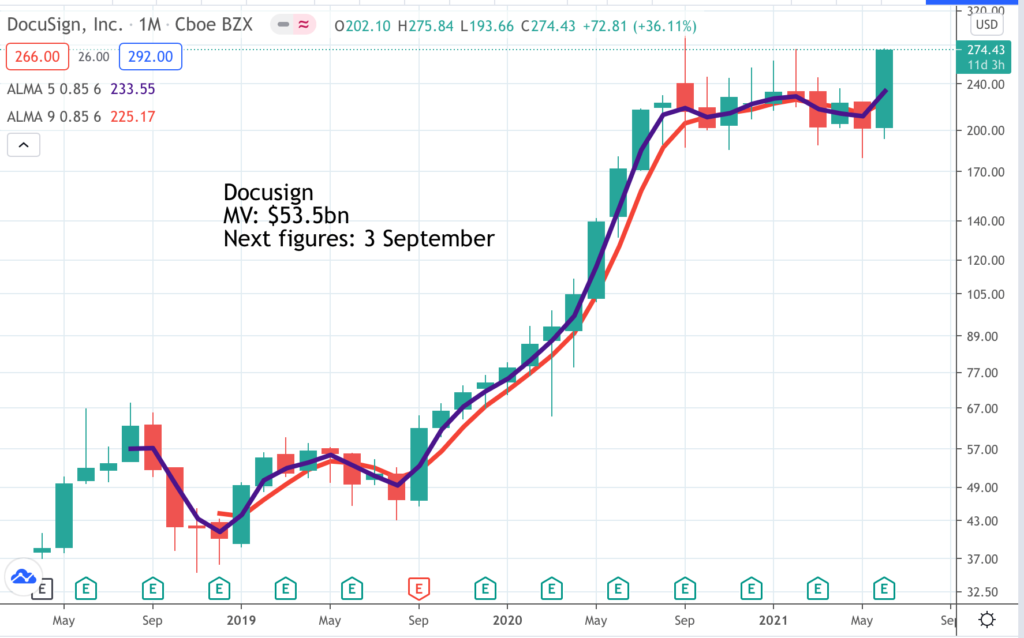

Docusign DOCU. $272

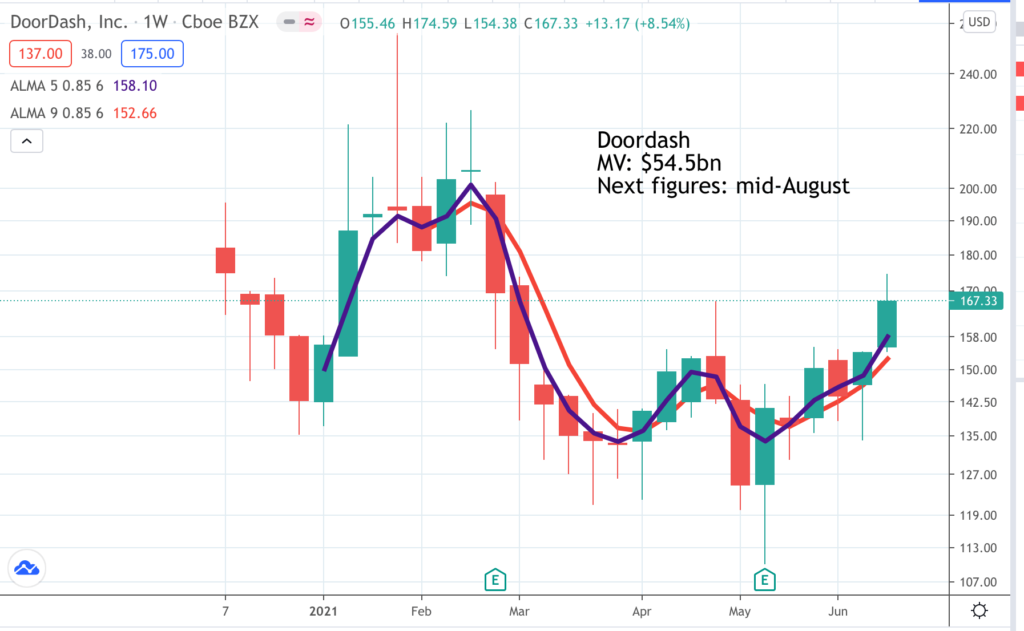

Doordash. DASH. $176

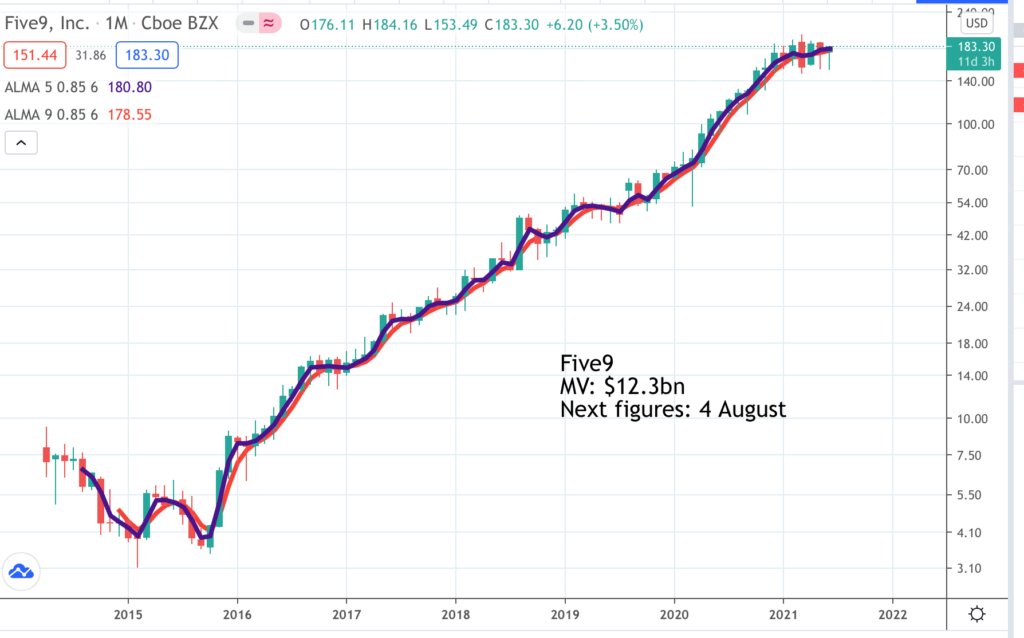

Five9 FIVN. $183

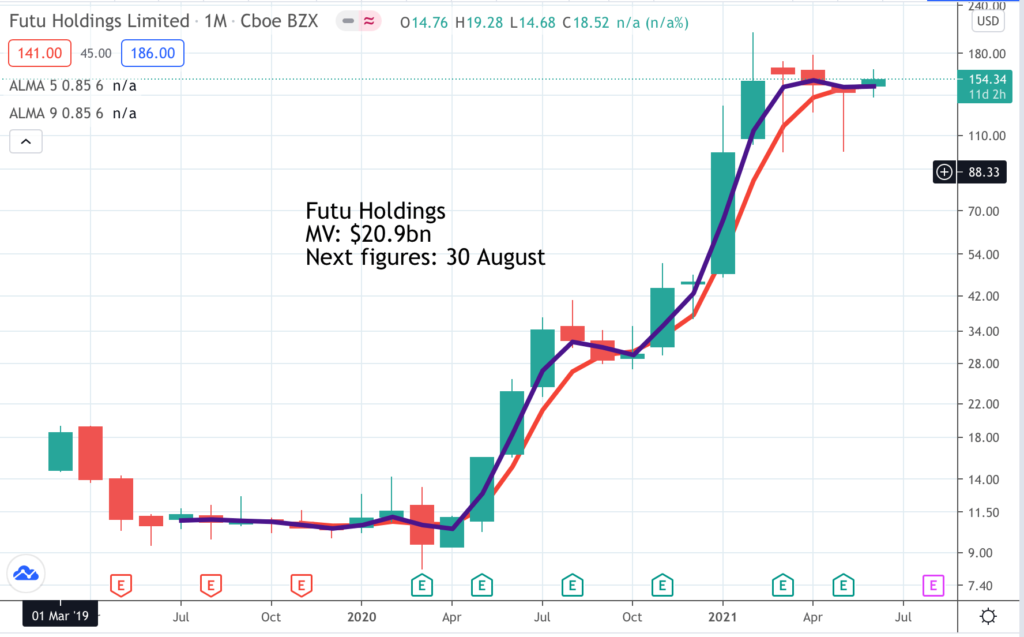

Futu Holdings FUTU. Buy @ $148.50

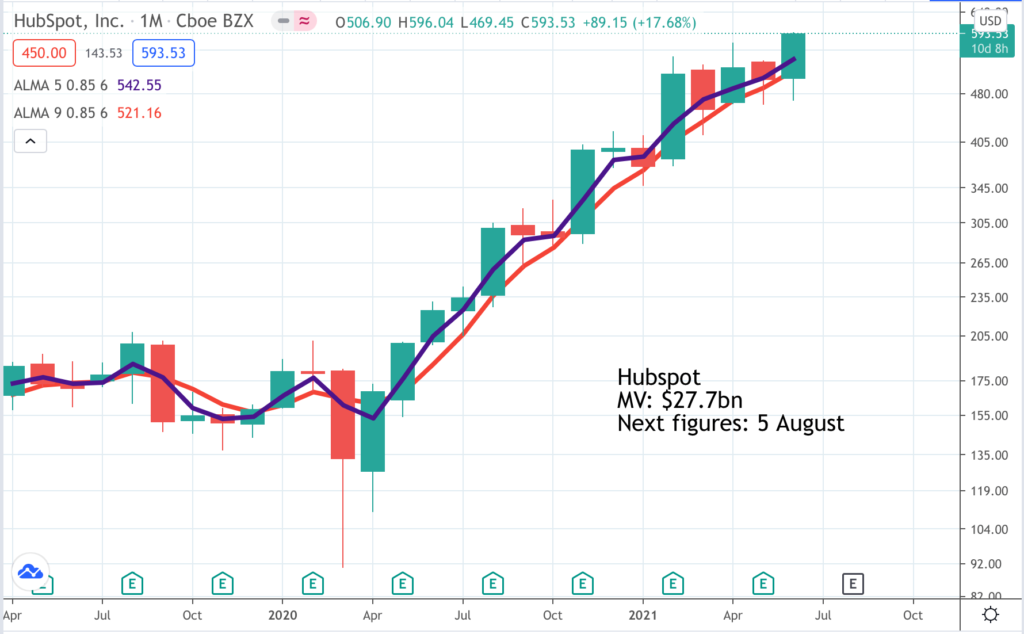

Hubspot. HUBS $577

Intuit. INTU. $479

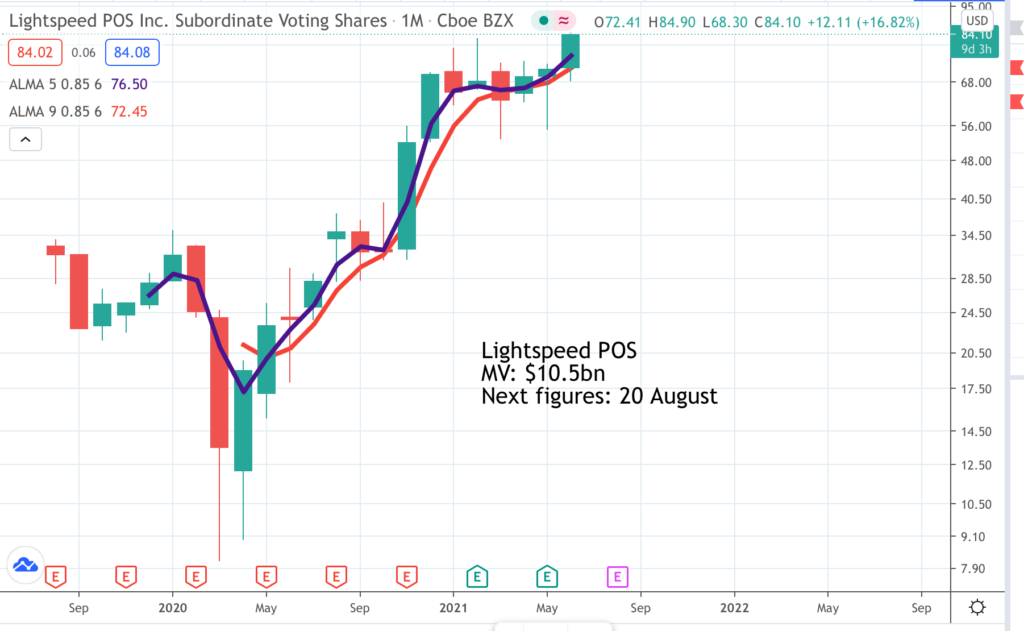

Lightspeed POS LSPD. $84

Monday.com MNDY. $217

Procore Technologies. PCOR. $91.50

The Joint Corp. JYNT. $77.50

Veeva Systems. VEEV. $311

Xero XRO. A$140.9

Adobe Buy @ $565. Next figures: 21 September

Adobe majors In software for creatives. The big shift in recent times has been from selling software packages for cash upfront to selling software as a service (SaaS), which is an easier sell and means customers always have the latest version but also defers revenue so there was a painful period when costs rose faster than revenue. This is now long past and the shares have been off to the races ever since as the group spends heavily on improving its offerings. Back in the day Apple used to be all about creatives but now we all use its products. Adobe is moving in the same direction. At the same time global digital transformation is redefining what we think of as big. Adobe had sales in 2020 of $12.9bn but it still managed to grow its just-reported Q2 2021 sales by 23pc to $3.84bn. “Adobe is the leader in core creative categories such as imaging, design, video and illustration, and we are expanding our leadership in exciting new media types, including screen design and prototyping, 3D and AR.” This is so obviously a good place to be in a world undergoing digital transformation that the real surprise would be if the company was not growing fast.

Atlassian. Buy @ $267. Next figures: 29 July

Atlassian is an Australian founded, Nasdaq quoted business which creates software to enable teams to work together more effectively, hence the stock market code. A key element in their approach is high spending on research and development to make sure their product is just so good you have to have it. In 2020 the company had revenues of $1.61bn and spent $763m on r&d. Normally SaaS companies like Atlassian spend a great deal on r&d and then even more on sales and marketing. Atlassian is different. In 2020, it spent $300m on sales and marketing, still a lot but much less than the r&d spend. Atlassian is mainly about creating technology products for people like developers. This creates a powerful following winds for the group to grow. Estimates suggest that at the start of 2019 there were around 20m active software developers in the world and the number is growing by around 20pc a year. Atlassian has been around long enough that it needs to make the transition from traditional software license sales to being a cloud first company. In the latest quarter cloud first revenue grew 35pc and subscription revenue grew by 43pc.

Bill.com Buy @ $181. Next figures: 2 September

Bill.com is an enterprise software business which supplies software on subscription to enable its customers to automate their back office operations, improving efficiency and driving out cost. Latest results showed how strongly the group is performing. “We delivered record results and accelerated growth in our core revenue, transaction fees and total payment volume. In the fiscal third quarter, core revenue increased 62pc year-over-year. Transaction fees increased 112pc year-over-year, and TPV [total payment volume] increased 44pc year-over-year.” I often talk in QV about the critical importance of the battle for territory. Bill.com is doing well. “We ended the third quarter with over 115,000 customers, more than 2.5m network members and an annualized run rate of $140bn in TPV. We believe we are the leading digital B2B payments platform for SMBs and operate one of the largest B2B networks in the United States.” The company is understandably optimistic on prospects. “We believe that we are at the beginning of a multiyear digital transformation wave that has been accelerated by the COVID pandemic.” Bill.com has recently announced an acquisition in the same space. “To give you an idea of their scale, exiting the March 2021 quarter, Divvy’s annualized recurring revenue run rate was approximately $100m, which was up more than 100pc from their March 2020 run rate. I’ve watched Divvy since they launched their product three years ago and have always been impressed with the team, their solution and their mission to help SMBs.” The consideration was $2.5bn mainly in shares.

Cloudflare. Buy @ $100. Next figures: 12 August

Cloudflare is another uber-exciting enterprise software business. Latest results showed the company roaring ahead. “We had an outstanding quarter. In Q1, we achieved revenue of $138m, up 51pc year-over-year. Two factors drove our accelerating revenue: First, we had notable success adding new customers. Overall, our total customer count crossed $4m in Q1. In particular, we added a record 117 large customers, those that spend more than $100,000 per year with us. Our large customer count was up 70pc year-over-year. And as expected, revenue for our customers now accounts for more than half of our total revenue. The second factor driving our outstanding performance in the quarter was the adoption of new products by our existing customers. As we shared in February during our Investor Day, 88pc of our contracted customers now use four or more Cloudflare products, up significantly from 18 months ago when we went public”. Cloudflare has the code NET because its products, sold on subscription, help the Internet to function better. As they say – “The growth in Internet traffic has been unprecedented. Across our platform, when Covid first struck we saw as much growth in traffic in 12 weeks as we have seen in the previous 12 months. The flexibility of our platform, where every server in every city can run every Cloudflare service, has allowed us to continue to spread load and serve all our customers.” Cloudflare is one of those companies that gives value investors a heart attack. It is currently on over 50 times forecast 2021 sales. and $31bn buys less than 2,000 employees. Worth every penny in my view.

Crowdstrike. Buy @ $237. Next figures: 2 September

Crowdstrike is another sensational fast-growing enterprise software business. “We delivered an outstanding first quarter, and fiscal year 2022 is off to a record start for CrowdStrike. Building on last year’s milestone performance, we started and finished the first quarter with strong momentum and results exceeding our expectations. We saw strength in multiple areas of the business, added $143.8m in net new ARR, and grew ending ARR 74pc to exceed $1.19bn.” Enterprise software just means they sell to enterprises, not to you and I, which puts them firmly at the heart of digital transformation. Crowdstrike is a fabulous company operating with very strong tailwinds. “Our growing brand has become the cybersecurity gold standard translating into a broad customer base that is scaling rapidly, deeper penetration within verticals, and our strong financial success. And third, the demand environment is robust, driven by strong secular trends, including digital and security transformation, cloud adoption, and an ongoing heightened threat environment. This includes the massive influx of ransomware and the operational impact of these attacks that have been seen over the past two years.” Crowdstrike is in the same valuation neighbourhood as Cloudflare but history shows that expensive stocks which deliver end up as the best investments.

Docusign Buy @ $272. Next figures: 3 September

Docusign is another exciting enterprise software business delivering barnstorming growth with a huge opportunity. Latest sales grew 58pc to $460m and the company says. “Since the start of the pandemic, DocuSign has helped accelerate access to healthcare, government, education, small business lending, and many other services around the world. What began as an urgent need has now transformed into a strategic priority. And as a result, DocuSign has become an indispensable part of many organizations’ business processes. Put another way, once businesses digitally transform their agreement processes, they simply don’t go back. We believe this trend will only accelerate as the anywhere economy continues to emerge. In fact, just a few weeks ago, we were excited to welcome DocuSign’s 1 millionth customer in this platform. And this move to digital has manifested itself in a great start to the year with Docusign. We saw strong performance on all fronts, delivering a balance of growth and profitability at scale.” Docusign has a net expansion rate (NER) of 125pc. A high NER is a feature of all these companies as customers at the start of the year increase spending and take on new modules during the year. The result is 25pc sales growth before a single new customer is added.

Doordash Buy @ $176. Next figures: mid-August

It’s extraordinary how a market value around $50bn is just a medium-sized company in the US these days. Albeit that Doordash is rapidly becoming less small with sales projected to grow from $885m for calendar 2019 to $6.67bn for 2023. Doordash is a recent IPO and has had the usual bumpy ride we often see with high growth, high valuation shares in the US. The IPO was priced at $102 and the shares rocketed before falling back almost to the IPO price and then heading higher again. There are people who argue that the success of food and convenience store delivery specialist Doordash with its millions of ‘Dashers’ making the deliveries is a lockdown phenomenon which will fade post lockdown. Unsurprisingly Doordash CEO, Tony Xu, doesn’t agree. Revenue trebled in the latest quarter but still with many lockdowns in place. The company also grew its non-restaurant business. “Grew orders from non-restaurant categories by over 40pc quarter-over-quarter (“Q/Q”) to over 7pc of total orders.” Doordash management obviously expect a slowdown as the US emerges from lockdowns but they now expect this affect to be less marked than previously anticipated and have become more optimistic on full year prospects. They say – “Our goal is for all our consumers to find value beyond restaurants, which suggests we have substantial room to raise awareness, improve our offerings, and earn order volume from a much larger portion of our consumers.”

Five9. Buy @ $183. Next figures: 4 August

Five9 is back to the theme of fast-growing enterprise software businesses. “Our first quarter revenue was a record $138m accelerating to 45pc year-over-year growth, an all-time record growth rate. The acceleration in revenue growth continues to be driven by our enterprise business, as demonstrated by LTM (last 12 months) enterprise subscription revenue, which also grew 45pc year-over-year.” Five9 started with virtual call centres. “Delivered on-demand, the solution enables clients to quickly deploy agent seats in any geographic location with only a computer, headset and broadband Internet connection, and rapidly adjust the number of contact center agent seats in response to changing business requirements.” Since then progress has come from constantly improving the solution helping the company win ever bigger orders. “This success is best demonstrated by the fact that in the first quarter, we closed another two exceptionally large multiyear global deals. We anticipate that these two deals will generate over $14m and $6m in ARR [annual recurring revenue], respectively. These two deals follow the fourth quarter $12m ARR win with a leading European insurance company.” Innovation means the company. believes it is exceptionally strongly placed. “Last quarter, I put a stake in the ground and said that after two years of focus and an increased investment, we had reached a critical milestone in delivering a hyper scale architecture.”

Futu Holdings. Buy @ $148.50. Next figures: 30 August

Futu is a share trading and wealth management platform quoted in Honk Kong and catering for local and mainland Chinese investors. It has been delivering explosive growth. A few statistics give the flavour of what is happening. “Total number of paying clients increased 231.0pc year-over-year to 789,652. Total client assets increased 367.6pc year-over-year to HK$462.2bn. Margin financing and securities lending balances increased 469.5pc year-over-year to HK$27.4bn.” The growth is staggering but in a way unsurprising giving the vast size of the markets being addressed by the group. It is easy to imagine that they are barely scratching the surface of the long-term opportunity as China’s increasingly affluent middle classes discover investing in the same way as they have discovered luxury goods and other sought after developed country products and activities. The opportunities look staggering. “We are encouraged by what we have achieved in Singapore so far and are convinced that Singapore and the broader Southeast Asian market offer huge runway for growth.” In April the group raised $1.4bn capitalising on the sharp rise in the share price. The group is backed by Chinese Internet giant, Tencent.

Hubspot. Buy @ $577. Next figures: 5 August

Hubspot is yet another enterprise software company reporting strong, even accelerating growth. “Both revenue and customer growth accelerated from Q4. This has been driven in part by a significant demand for digital transformation. More and more companies are shifting to a digitally powered, if not digital-first, customer experience. It just so happens that we’ve been evangelizing this transformation since our founding nearly 15 years ago.” It’s all about being in the right place at the right time. “We’ve seen an acceleration in companies adapting to doing business online. This has made CRM not just important but indispensable. Digital first can’t happen in one part of your customer journey and not another, and a strong comprehensive CRM platform is the thing that ties it all together.” Prospects look great. “I’m really excited about the progress we’ve made in the past year. But I’m even more excited about the path ahead.” Current trading is impressive. “We’ve continued to see tremendous performance across the business with an acceleration of Q1 revenue growth to 37pc year-over-year in constant currency and customer growth of 45pc year-over-year. “

Intuit. Buy @ $479. Next figures: 26 August

Intuit provides accounting services for SMBs (small and medium sized businesses) mainly in North America but also internationally. UK businesses may know them as QuickBooks. Like Adobe the group made the transition from software licenses and upgrades to software as a service sold on subscription years ago and has seen accelerating growth ever since. It is now starting to broaden the range of services offered while growing the core business. “We had a very strong third quarter. Small Business and Self-Employed Group revenue accelerated to 20pc this quarter, and Credit Karma performed very well with revenue at an all-time high for the quarter.” The group has a clear growth strategy. “More broadly, our AI-driven expert platform strategy and five Big Bets are driving strong momentum and accelerating innovation across the Company. These Big Bets are focused on the largest problems our customers face, and represent durable growth opportunities for Intuit. As a reminder, these bets are revolutionize speed to benefit, connect people to experts, unlock smart money decisions, be the centre of small business growth, and disrupt the small business mid-market.” Credit Karma looks an exciting addition. “Since the acquisition closed, TurboTax customers and migrating Turbo users accounted for 40pc of new Credit Karma members, significantly accelerating new member growth.”

Lightspeed POS. Buy @ $84. Next figures: 20 August

Lightspeed is a point of sale and e-commerce software provider based in Quebec. It was founded in 2005 by Dax da Silva who also serves as the CEO of the company. It has offices in Montreal, New York, Olympia, Ottawa, Santa Cruz, Ghent and Amsterdam and offers its services to 100,000+ retail, restaurant, and hospitality businesses, across 100 countries. It is a new entry to Quentinvest with classic 3G credentials. The group has been busy. “Despite a global pandemic that was particularly hard on our customer base of small and medium-sized businesses, Lightspeed managed to deliver some of the strongest performance in the company’s history, undertake three landmark acquisitions, which greatly improved our presence in the key U.S. markets, list on the New York Stock Exchange, released a series of new offerings including Lightspeed Capital, curbside pickup, e-commerce for restaurant, Order Ahead, Subscriptions, and launched two major strategic initiatives with supplier network and our recently announced global partnership with Google.” The group is delivering exceptional performance. “Never has our goal of arming our customers with the technologies they need to operate and scale their business felt so relevant…We grew revenue 127pc year over year with organic software and transaction-based revenue growth of 48pc…. Lightspeed is benefiting from economies reopening globally. We maintain strong footprints in the U.S., U.K., and Australia, all of which are in advanced stages of their current recovery. But even in regions where lockdowns are still present like Central Europe, we are seeing signs that our customers are beginning to prepare for an eventual reopening.”

Monday.com. Buy @ $217. Next figures: n/a

Monday.com is another newcomer to Quentinvest. Monday.com is a customizable web and mobile work management platform. It is designed to help teams and organisations increase operational efficiency by tracking projects and workflows, visualising data, and team collaboration. The company is growing at a ferocious rate but making large losses while doing it which in some recent trading periods have even exceeded turnover. Investors understandably worry about this but in the battle for territory it can make sense for companies like Monday.com at a very early stage of their growth path to buy sales in this way. The object is to become the big beast in their neighbourhood of the software market and once that is achieved it will be time to focus on cash flow and ultimately profitability. Significantly Salesforce.com and Zoom Video both made significant investments at the placing price so they are impressed. The group says their mission is to democratise the power of software so companies can easily build applications that suit their needs. Growth has been explosive with sales growth from minimal levels in Q2 2017 to an annual run rate of $236m based on Q1 2021 numbers.

Procore Technologies. Buy @ $91.50. Next figures: n/a

‘Procore is a leading provider of construction management software. Our mission is to connect everyone in construction on a global platform. Over 1 million projects and more than $1 trillion USD in construction volume have run on our platform. The Procore platform connects every project stakeholder to solutions we’ve built specifically for the construction industry—for the owner, the general contractor, and the specialty contractor.‘ The company, which is another newcomer to Quentinvest, is growing fast. Customer numbers have increased from 6,095 for 2018 to 10,166 for 2020 with revenues growing from $186m to over $400m. Like many other fast-growing enterprise software businesses the spend on sales and marketing and research and development is high – $189m and $125m respectively in 2020. It may seem crazy to spend at this rate but again it is all about the battle for territory. If you have a product that customers love you need to spend as fast as possible (a) to recruit more customers and (b) to keep improving your product to boost sales with existing customers and make sure nobody can eat your lunch. The company says they are “helping transform one of the oldest, largest, and least digitised industries in the world.” The opportunity looks huge. “A June 2020 McKinsey report estimates that construction industry spending on software and infrastructure could double as the construction industry starts to catch up with the manufacturing industry in terms of IT spending as a share of revenue.”

The Joint Corp. Buy @ $77.50. Next figures: 6 August

‘The Joint Chiropractic is revolutionizing access to chiropractic care via a model which makes ongoing treatment affordable, accessible and approachable. Eighty percent of Americans experience back pain at some time in their lives. Our highly trained doctors of chiropractic develop personalized treatment plans to relieve our patients’ pain and deliver ongoing preventative care. Our affordable membership plans eliminate the need for insurance. Our no-appointments policy, convenient locations and appealing, non-clinical environment make care more accessible and approachable. The Joint has 500+ clinics open across 33 states and is actively seeking new investors and franchise owners.’ The company is charging along. “During the first quarter, we continue to execute our plan to accelerate growth and deliver strong results. In April, we celebrate our 600th clinic opening, and we continue to strive to reach our goal of 1,000 clinics in operation by the end of 2023. Let me be perfectly clear, this is just one of many milestones, and just the beginning of our long-term growth blueprint.” Sales rose 29pc in Q1 21 and ebitda more than doubled to $3.5m as the group opened 73 new clinics in 2020.

Veeva Systems. Buy @ $311. Next figures:

Like Procore Veeva Systems is an enterprise software company specialising with great success in a particular vertical. They describe themselves as the industry cloud for life sciences. Part of their success is because they operate like management consultants for the industry. If any company finds a clever new way of doing something Veeva becomes the medium by which that spreads across the sector. This is why they talk about “becoming part of a powerful community of over 1,000 customers”. Like all the companies featured in Quentinvest the business is growing fast. “We had an outstanding Q1 with results well ahead of guidance due to significant outperformance in Development Cloud and continued strength in Commercial Cloud. Total revenue in the quarter was $434m, up 29pc year over year, with subscription revenue up 26pc to $341m. Non-GAAP operating income was $181m, or 42pc of total revenue.” As an example of how Veeva is changing things. “Our overall vision for clinical is to move the industry to digital trials that are patient-centric and paperless. Digital trials have the potential to be a game changer for patients, the industry, and for Veeva. We believe this move will increase the speed of trial execution by 25pc and cut costs by 25pc.Key to realizing our clinical vision is bringing sponsors, clinical research sites, and patients together in the Veeva Clinical Network. This is a large global effort with no short cuts or quick wins. We are playing the long game, striving for fundamental change, and off to a good start with more than 1,000 active sites on SiteVault Free and our first patients using MyVeeva for electronic consent.”

Xero. Buy @ A$140.96 Next figures:

Xero has a great deal in common with Intuit, featured earlier in this issue. Xero also serves SMEs (small and medium sized enterprises) and came up with the idea of linking accounting software with bank accounts and providing the services via subscriptions, which was then copied by Intuit. There were early hopes that Xero would take the US by storm but Intuit adapted quickly and had the advantage of a large base of existing customers. Even so Xero is doing well in the US, dominates its home base in ANZ and has been growing rapidly in the UK. Full year results for fiscal 2021 showed sales growing 18pc to $849m and subscriber numbers up 456,000 to 2.74m. Covid-19 presented many challenges for Xero’s customer base but the company is still excited about its long term strategy and ended fiscal 2021 and going into 2022 strongly. As they say “Looking ahead we believe small businesses will be a major driver of economic recovery in a post-pandemic world.” The group has also made a series of acquisitions to strengthen its offering in helping companies gain access to working capital, in helping companies with workforce management and with e-invoicing. Newer areas of strong geographical growth were South Africa and Singapore as the group grows its global presence.