After December we will no longer be posting dead tree products, print on paper, to subscribers. Instead Great Charts, like Great Stocks, will only be available on line. We think this is going to be a huge improvement. Yes, you will pay a little more but in return whatever you subscribe to now from January you will get EVERYTHING and that is way, way better. In fact if we add the separate value of all the various products, Great Stocks, Great Charts, Quentinvest for Shares (email alerts on our favourite shares) and Quentinvest for ETFs (email alerts on our favourite ETFs) the combined value is £668 but we are offering this for £249.50 a year or £24.99 a month.

Plus, if you are not sure about a product you have not been receiving you can have a three months free trial where you still get the printed copy (until December) and full access to the online service. Whatever you decide you will get a credit for your unused subscription to the print product. If you do come on board and we would love it if you do you will receive a service that has been leaving the FTSE 100 for dust when it comes to performance.

Please give us a try. I think you will love the online service which is all about building a portfolio of the world’s hottest growth stocks. And we even do cryptos. Bitcoin has been our single best performing investment since 2015 (+1,652pc) and cryptos were the subject of the last QV Alert to be published just days ago.

The real reason why you should never sell

Jeff Bezos, talking about Amazon, said he and his teams made mistakes all the time. He added that if you are not making mistakes you are not really trying. In effect the triumphs come from making lots of mistakes. It is a bit like the way some people seem to be very lucky. My impression is that people who get lucky are the sort of optimistic, energetic, have-a-go types who give luck a chance to happen.

My never sell rule for investing is a bit like that. At any given moment there can seem to be many compelling reasons for selling some shares or even all your shares. Yet, as the years pass, it is the people who never sell who make the most money. Why is this?

I think mainly because it gives miracles a chance to happen. Shares are volatile so if you sell on sell signals, whether technical (chart based), because of some blip in the fundamentals or most usually because of some macro issue that knocks the whole market sideways for a while you won’t give miracles a chance because miracles take time.

I envy people who start businesses because except within limits they can’t sell and mostly don’t even consider selling. They are absolutely in it for the long haul. But it is precisely this reluctance to sell which means that nearly all the world’s great fortunes belong to people who started businesses. Being a founder obviously helps but being a person who never sells is just as important.

If you never sell and you buy into a business which spends a decade growing dramatically you will make a huge return just on that one investment. This will be the case even though there may have been periods when your investment declined dramatically in value.

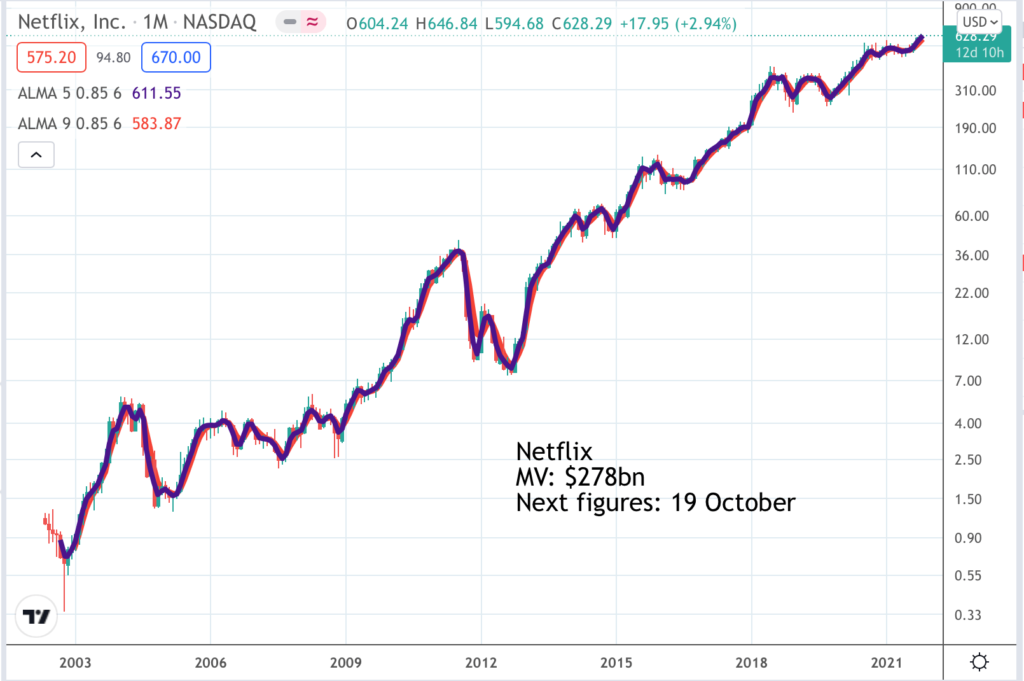

I could give you many examples just from the Quentinvest portfolio. In 2009 I recommended shares in Amazon and Alphabet and we all know what they have done since. In 2010 I recommended shares in Netflix, not once but twice at $9.43 and $13.57. The latest price is $628.29 and all these shares still look good to keep climbing. All three experienced periods when their prices fell sharply.

If you hang on to these great performers you can have quite a few duds in your portfolio and you will still do extremely well. And one type of sale I do advocate is getting rid of obvious duds. It is usually obvious when a share has completely lost the plot. Alphabet, Amazon and Netflix never have. On the contrary these shares have kept climbing because quarter after quarter after quarter these companies have exciting things to tell us about the progress they are making.

Never sell is a strategy that often feels wrong at the time but when you look back later you realise it is so right. If I look back at my own investment life if I had never sold anything I would be a zillionaire even though some of the companies in which I bought shares don’t even exist any more.

The alternative to never sell is to go to the opposite extreme and be ridiculously dynamic.

There is an alternative to never selling but it will not suit the vast majority of investors. This is to be extremely dynamic. This is more like what I do and I am almost certain that it is not as good a strategy as never selling because you waste a huge amount of energy selling and buying back the same shares.

I do it partly because I invest with maximum leverage so I am always getting margin calls and I am vulnerable to a total wipeout in the event of a market crash. Most of my subscribers, probably wisely, don’t like investing on margin but I have done it all my life and I am addicted. I cannot break the habit so I have had to devise strategies that enable me to cope.

The main thing I do with my dynamic approach is to always be invested only in shares that are trending strongly higher. If they start to flag I sell even when I know that the fundamentals are still outstanding. I can sell because I know that once the shares start trending higher again I will buy them back.

This means that I am an extraordinarily active investor. I trade most days. One reason why this works is that in the modern era commissions are very low and spreads on the mostly highly liquid shares in which I deal are very narrow (the spread is the difference between the price at which shares are offered to buy and the price which you will receive on a sale).

Because I am so trigger happy I am mostly selling for small losses so I am not creating tax problems for myself. Another thing I am doing is building larger holdings in my highest conviction stocks. Quentinvest subscribers will know which these are because they are recommended repeatedly. In these cases I am more reluctant to sell but I will if necessary but always with the proviso that if they resume trending higher I will buy them back.

Another thing I have started doing, which most subscribers will feel even more cautious about, is spread betting. I keep this for the bigger holdings. In spread betting you bet on a share’s performance. A one point bet is the same as holding 100 shares because for every one cent the price rises you make $1.

This means that a one point bet in Amazon shares is a big bet, equivalent to buying over $340,000 worth of shares. The smallest bet on IG is 0.24 but even that is an investment of around $85,000 in Amazon.

I make my bets for the longest available duration which is nine months or currently out to June 2022. If I am still holding next June the bet will automatically be rolled over and so on ad infinitum.

Alternatively you can make a daily funded bet which also rolls on for ever. You are paying IG interest to fund the bet but at a reasonable rate, similar to what you might pay on a mortgage.

Why have I switched my interest to spread bets? Because any gains are tax free. By the same token losses cannot be set against profits made elsewhere. The tax free status of spread betting means I am really giving miracles a chance and also I have the freedom to move in and out of positions without worrying about the tax implications.

Spread betting will not be for everybody but if you can get your head around it, it has considerable advantages. Its also just another way of investing. A spread better is as much a part owner of a business as any other shareholder. Some while back, Bernard Arnault of luxury goods giant, LVMH, tried to gain control of Hermes by building a large position in the company’s shares using derivatives, which is what CFDs (contracts for differences) and spread bets are.

Nevertheless I think for most subscribers never sell is the way to go perhaps with an annual portfolio spring clean to clear out obvious dead wood.

The case for technology shares

Ask most investors what is the biggest thing happening in the world of investment and I suspect their answer will be some variant on the theme of technological change. In my last editorial in Great Charts I talked about the growing importance of AI (artificial intelligence) in driving a new wave of exciting high growth shares.

The world is in process of digital transformation. Technology is extending into all our lives. There are 7.9bn people in the world of whom around 6.2bn own smart phones. This is an incredible number because I regard it as a proxy for people with discretionary spending power. People who, for example, are potential customers for services like Netflix.

You might think that Netflix shares have run their course with a rise of some 600-fold since 2003 but Netflix still has just 209m subscribers with a third of those in North America. Even allowing for the fact that many households have a single Netflix subscription there is ample scope for this number to grow and also for the price of a subscription to rise. In an increasingly technology driven world Netflix, like other technology giants, still has plenty of scope to grow even bigger.

Another extraordinary feature of the technology revolution is that dramatic as it already is there are many indications that the rate of change is still accelerating. When I look at technology companies one of the key items I look for is their spending on research and development. Time and again I will find that this figure is growing dramatically.

Take the example of an Australian based but Nasdaq quoted company called Atlassian which develops software so that groups of employees working in teams can work together in a more effective and productive way. In 2013 Atlassian spent $57m on research and development which is already a serious amount for a small but ambitious business. By 2020 this had grown to $763m and based on the spend for the latest quarter Atlassian will soon be spending over $1bn a year on r&d.

This pattern of dramatically growing r&d spend is being repeated across multiple companies not just in Australia and America but across the globe. It is one of the key phenomena of the 21st century and it is having amazing results.

One conclusion I draw from all this is that exciting as the first two decades of the 21st century have been things could get even more exciting as we move through the third decade. Another conclusion I draw, which I have mentioned before, is that there is a good case for making every single share in your portfolio in companies with cutting edge technology.

I have just had a look at my own portfolio and they are all primarily technology shares with high and growing r&d budgets. There was a time in the 1960s when an incredible mining boom was raging in Australia. For about two years the best performing shares in the world were Australian mining shares and for aggressive investors there was not much point holding shares in anything else.

It is a bit like that now except that the shares to own are technology shares and this boom is not going to last for two years. It may well run for decades, even centuries. I regard it as the biggest revolution in the life of Homo Sapiens since the change from a hunter gatherer lifestyle to a life in settlements and cities. It is huge and it is driving incredible investment opportunities. It really is a time to give miracles a chance.

Still a need to be selective

Not every technology share is going to be a winner. The ones I choose to be included in the QV ecosystem of recommended shares also have to be 3G, which means great chart, great growth and great story. I like if possible to choose the leading share in a sub-sector of technology. We have seen time and again the tendency for technology shares to display first mover advantage and winner takes all. Just look at Amazon. Who would have thought that the first company to start selling books online would become so dominant in ecommerce. One reason was because Amazon was one of the first companies to start selling anything online and because of a combination of constant innovation and network effects it went on to become the behemoth it is today.

Napoleon used to say of his grande armee that every soldier carried a field marshal’s baton in his rucksack. This is how investors have learned to think of technology shares which are disrupting industries. If they are growing fast, are early movers in their field and have talented leadership they may be the corporate equivalent of those soldiers who become field marshals as Amazon has done so impressively.

This is another reason why these companies are so hard to value. Do you use some old fashioned metric like a price to earnings ratio because then you miss out on all the businesses that have such great opportunities that they are spending every penny they can beg, borrow and steal on r&d and sales and marketing to win the critical battle for territory and claim that first mover advantage?

If they are loss making do you then value them on a multiple of market value to revenue because even that may not do justice to the opportunity they are trying to seize. In the modern era of rocket-fuelled loss making growth, share valuation has become a case of sticking a wet finger in the air to see how the wind is blowing.

Momentum is all

In this world momentum has become all-important, which is what 3G is all about. If a company is going to become very large it needs to grow very fast. If it is growing very fast it will have huge momentum and this will find expression in a sharply rising share price.

This is both exciting and scary because as high profits build over a short period the potential for dramatic bouts of profit taking also builds. As a result stock markets in recent years have been characterised by extraordinary volatility. It is nothing for a share to halve for no reason other than simple profit taking.

If there is a serious worry on the horizon like Covid-19 share prices generally can collapse and then recover as fast as they fell. It is not easy to be an investor in the 21st century. It is almost as though the price we pay for the supercharged gains we are seeing is super charged volatility.

Almost the supreme example of this phenomenon is cryptocurrencies. Nobody has the faintest idea what any given cryptocurrency is worth, if anything, so prices can be staggeringly volatile. Bitcoin can drop 20pc in a day and then carry on up as though nothing has happened. You either need nerves of steel or adopt my never sell mantra and when prices are falling fast go off and have a stiff gin and tonic and wait for the storm to pass.

Modern day companies are a bit like the early days of Christianity which started with a handful of believers scrawling fish graffiti on walls and ended with complete domination of the western world, most of the New World and large chunks of the developing world. If just one company in your portfolio becomes a world beater you will make a fortune. If more than one does it may be time to start looking for a football club to buy.

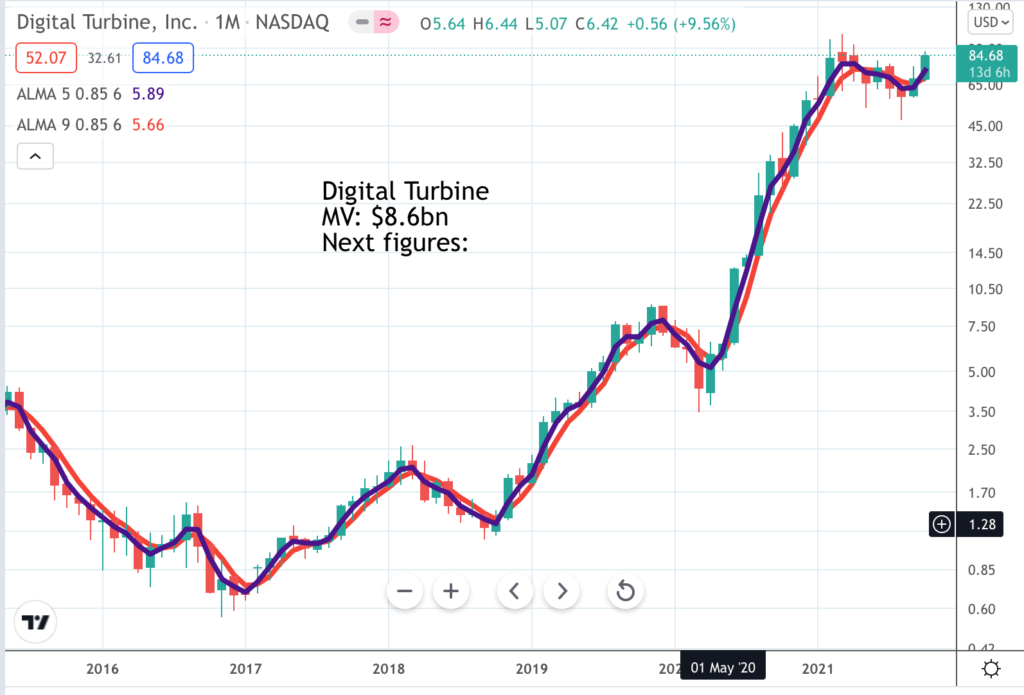

Digital Turbine APPS. Buy @ $86.50

Salesforce.com. CRM. Buy @ $291

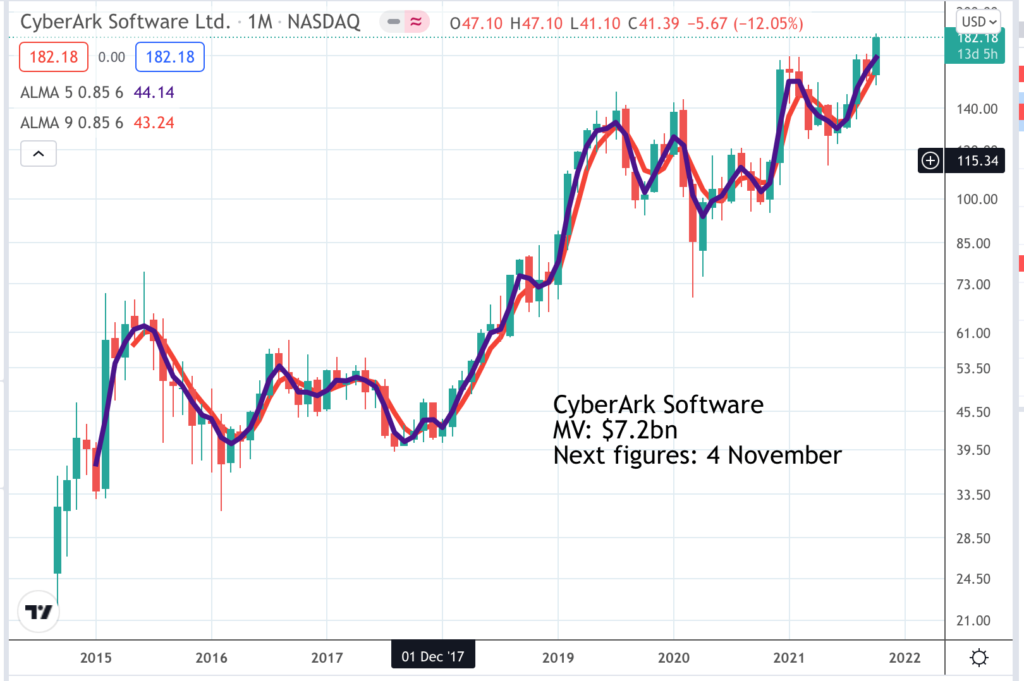

CyberArk Software Buy @$185

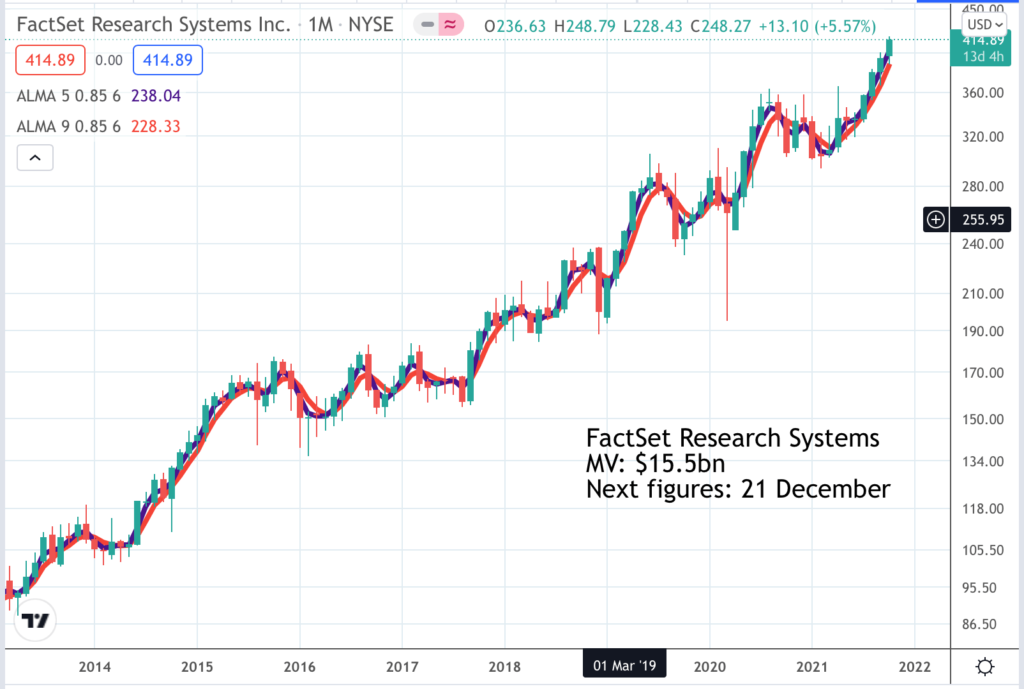

FactSet Research Systems. FDS. Buy @ $413

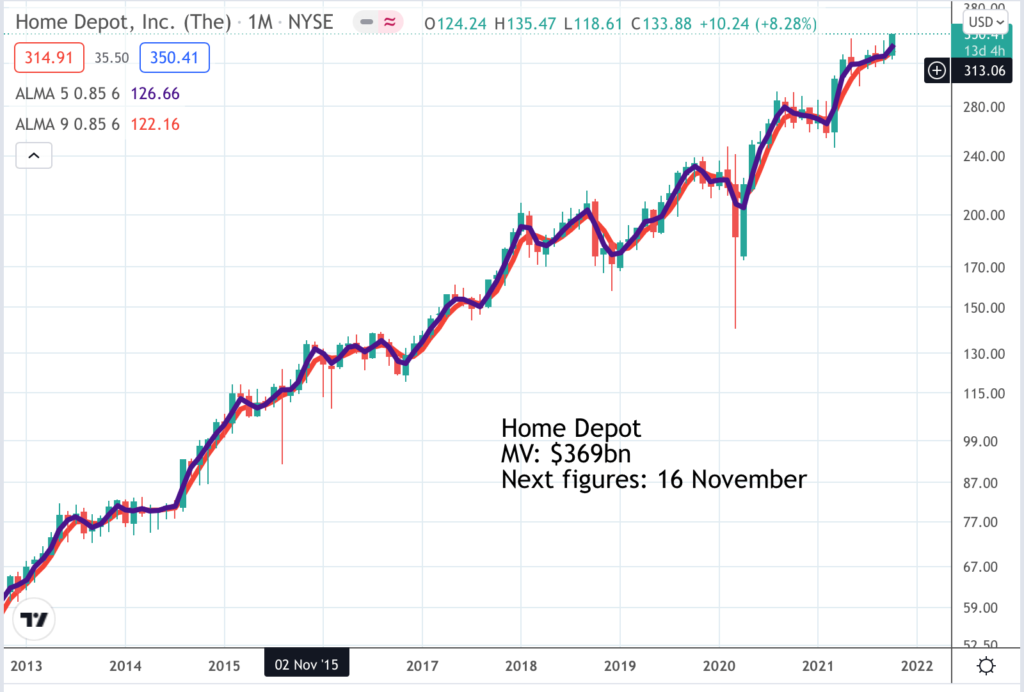

Home Depot. HD. Buy @ $354

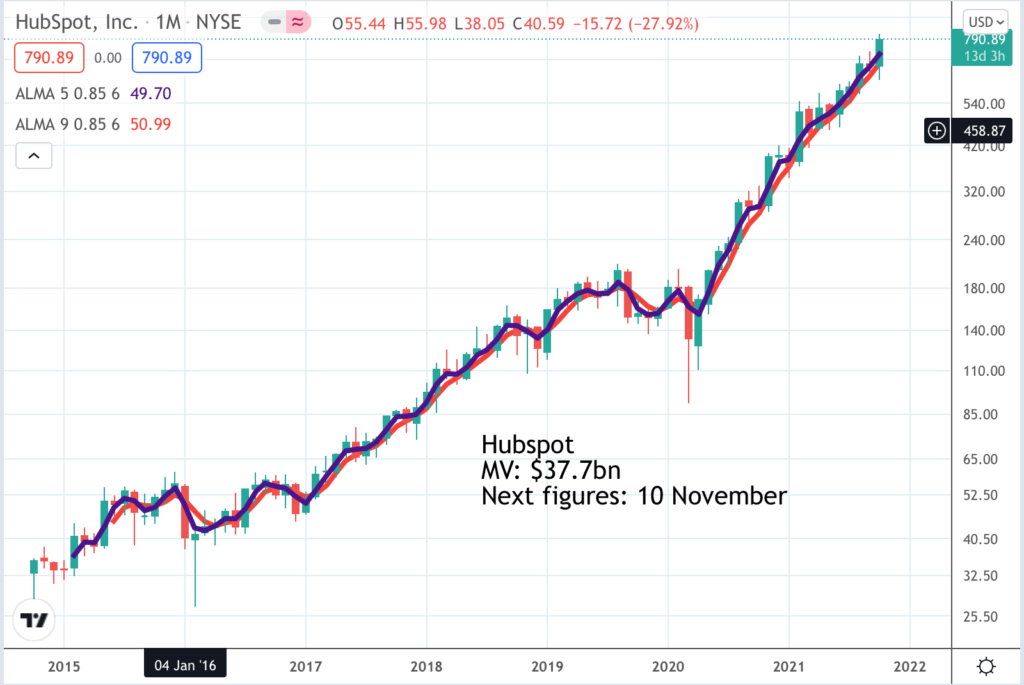

HubSpot. HUBS. Buy @ $795

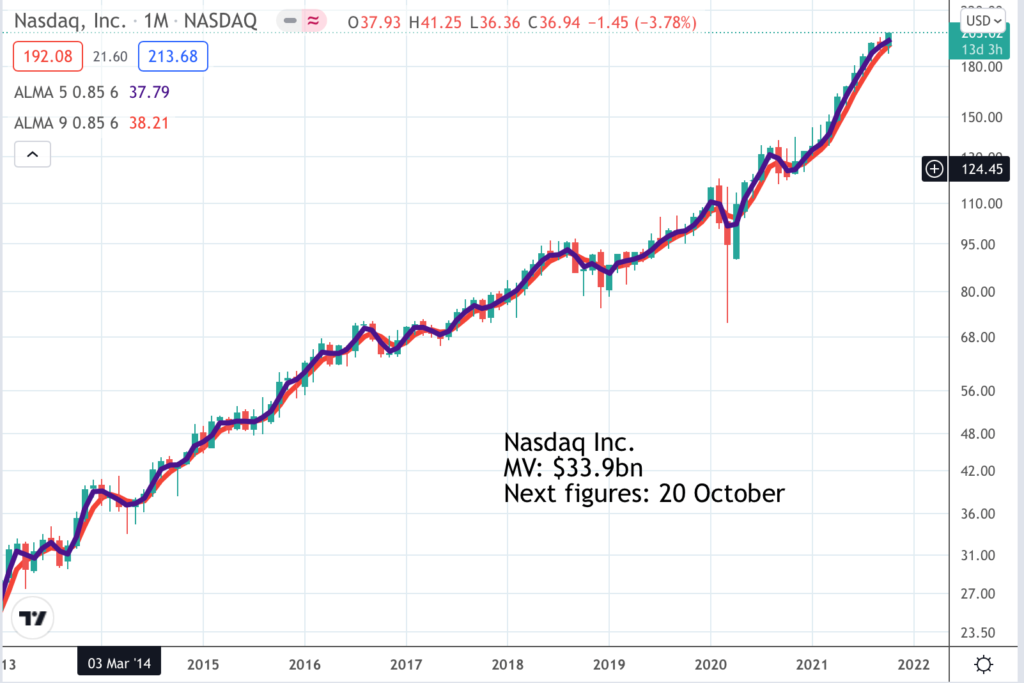

Nasdaq. NDAQ. Buy @$203

Novanta. NVTA. Buy @ $161

Netflix. NFLX. Buy @ $634

Palo Alto Networks. PANW. Buy @ $513

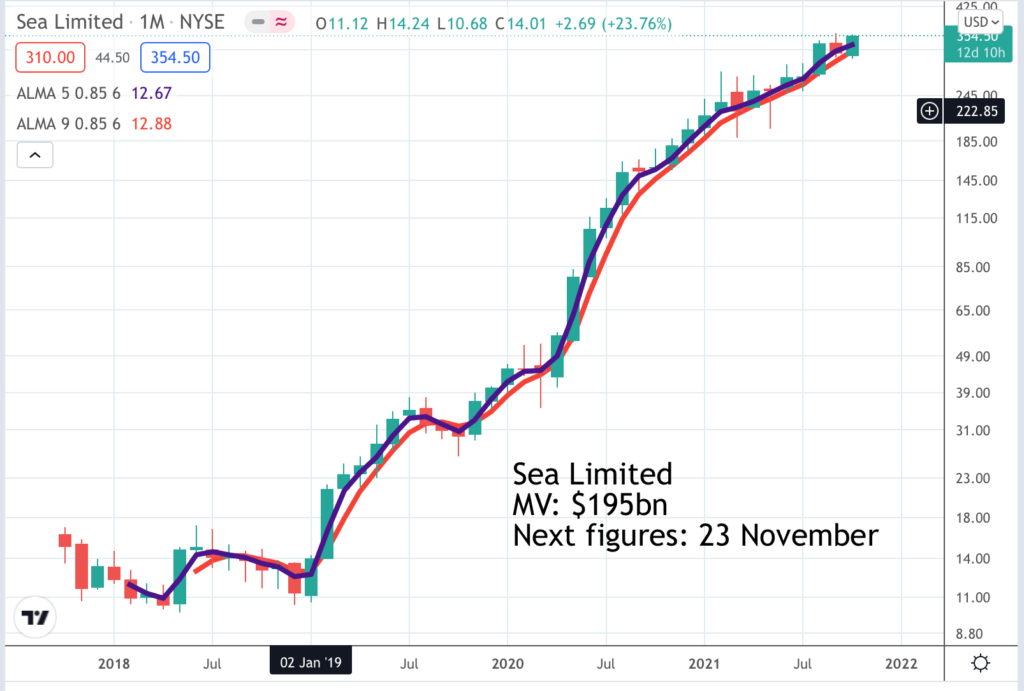

Sea Limited. SE. Buy @ $356

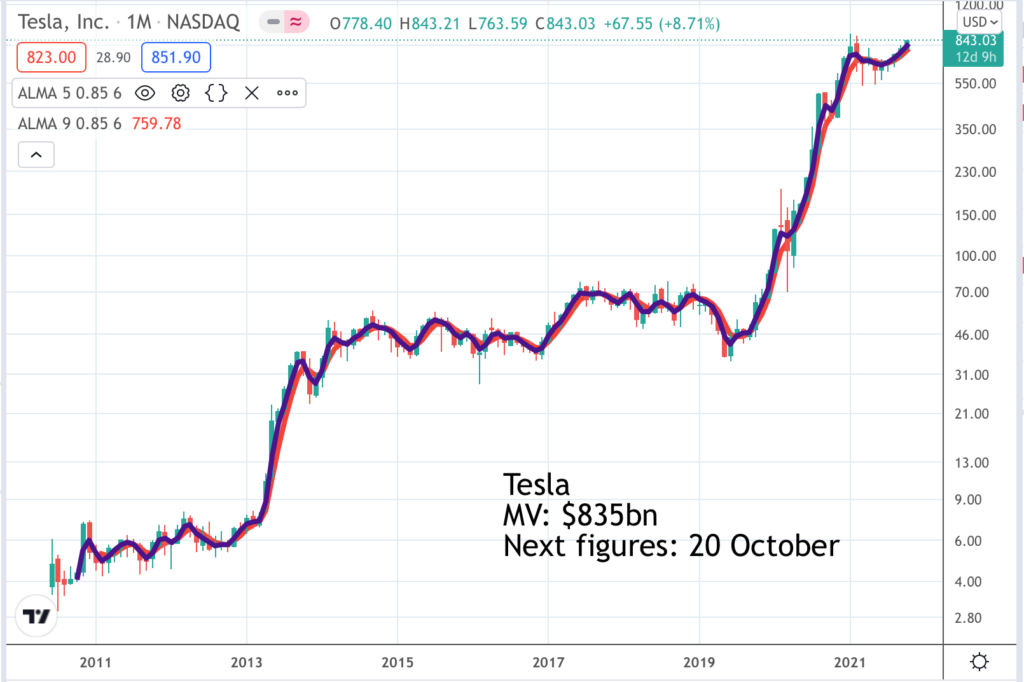

Tesla. TSLA. Buy @ $863

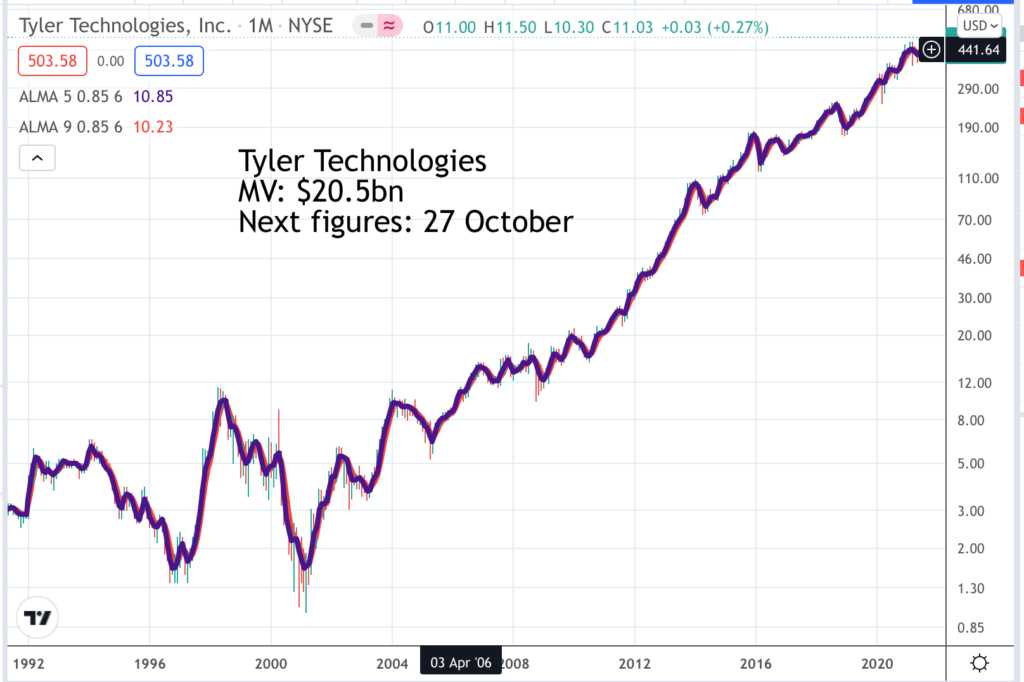

Tyler Technologies. TYL. Buy @ $509

Upstart Holdings UPST. Buy @ $374

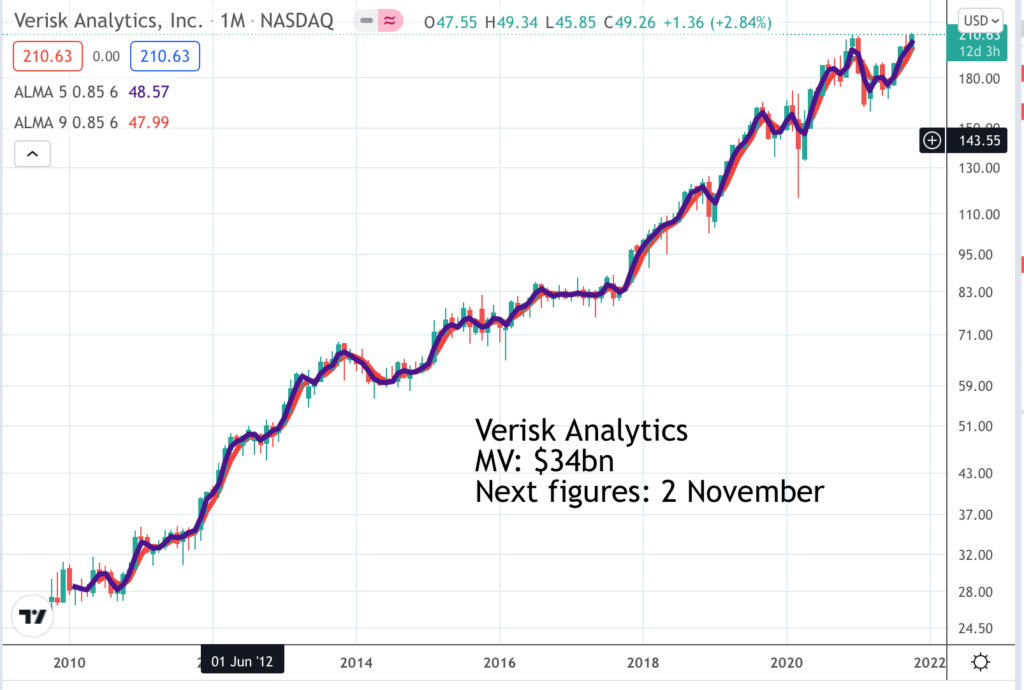

Verisk Analytics. VRSK. Buy @ $210

Waste Management WM. Buy @ $157

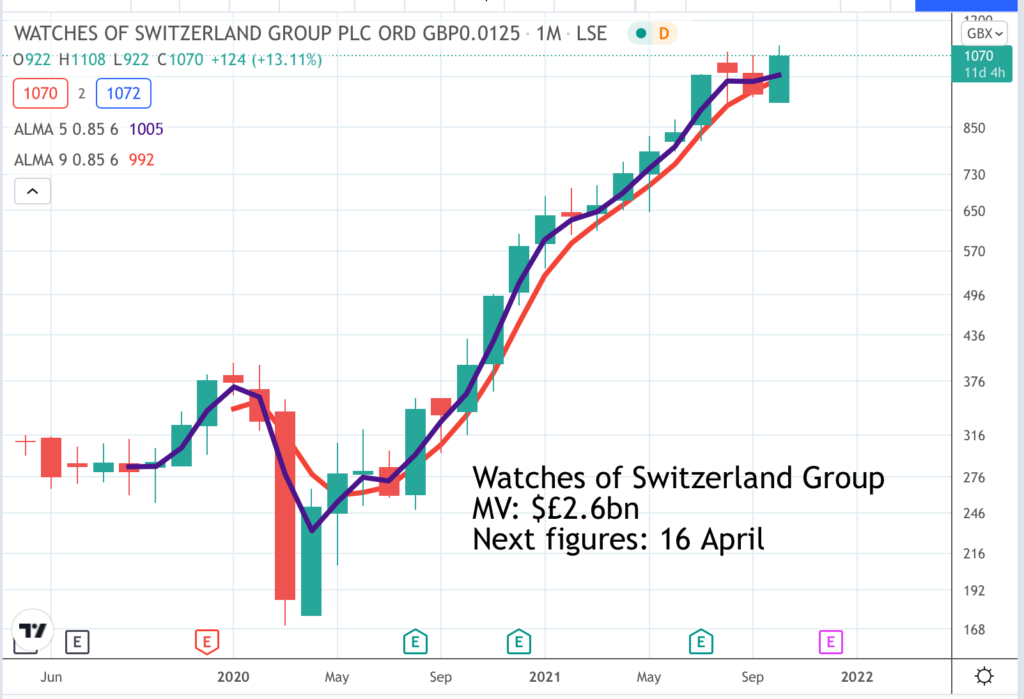

Watches of Switzerland Group. WOSG. Buy @ 1084p

Digital Turbine APPS. Buy @ $86.50

It is not surprising that shares in Digital Turbine have been pausing for breath after rising from 60 cents to over $100 between 2017 and 2021. But this is one incredibly fast growing business. Sales are forecast to grow from $104m for the year to 31 March 2019 to $2.2bn for the year to March 2024. On that basis the multiple of market value to sales will drop to less than four which looks undemanding. The company’s stock market code is APPS which points to their role in helping easy installation and positioning of apps on mobile phones which, in turn, leads to opportunities for advertisers. The company is both innovative and acquisitive which s helping to drive the strong growth. Latest results for Q1 2022 reflect a company delivering explosive growth. “Our top line and EBITDA growth were over 100pc and 200pc respectively on a pro forma basis, and our earnings per share growth was over 150pc.” And the opportunity looks massive. “We also believe it demonstrates how well we are now positioned with real scale to attack the $300bn plus mobile media market.” A big part of the growth is the company’s recently launched single tap product. “Our App Media business grew an impressive 81pc. In particular, we saw hyper-growth of nearly 600pc year-over-year with our SingleTap business. SingleTap was almost 20pc of our total On-Device Media revenues in the June quarter, compared to 4pc a year ago.”

Salesforce.com. CRM. Buy @ $291

Salesforce.com, famous for its customer relationship management software, is the grandaddy of the cloud computing, software as a service (SaaS) business and its shares have prospered accordingly. The shares are up around 100 fold since 2005 but still showing every sign of climbing higher. CEO and founder, Marc Benioff is the most bullishly exuberant CEO I have ever come across. In one passage in his opening words at the latest analyst meeting he used the word ‘phenomenal’ four times in a 33 word passage. Why not though when the business is going so well. “So, let’s take a look now at the second quarter because the numbers are incredible. And you can see we delivered our first $6bn quarter, about $6.3bn, and continue to maintain our very strong growth rate, our profitability, our cash flow, our margin growth, continue to execute our new operating margin model. And you can see right now, revenue and the growth in the quarter, you can see $6.34bn, up 23pc year over year.” And there is no sign of any slowdown. “So, we are really quite confident and remain on our path to generate $50bn in revenue by fiscal year ’26, which doesn’t seem very far away right now.”

CyberArk Software CYBR. Buy @ $185

CyberArk Software is a cyber security business, one of the hottest sectors of the stock market as a digitally transforming world provides ever more opportunity for cyber attacks. Founded in 1999 the group is still run by the founders and offers privileged account security with over 50pc of the Fortune 500 as customers. A more recent development has been the shift from selling software on license to a selling software as a service (SaaS) model which is driving strong growth in recurring revenue. “The underlying business significantly accelerated in the second quarter driven by record SaaS bookings and robust subscription demand. Due to our strong bookings, ARR [annualised recurring revenue] grew by 35pc to $315m as of June 30. Even more importantly, our subscription ARR grew faster than 125pc year-over-year. Recurring revenue reached $81m, an increase of 32pc compared to Q2 2020. Subscription mix, ARR and recurring revenue demonstrate the progress in the subscription transition, momentum in the business and the incredible demand trends we are seeing for our identity security platform, which is centred on PAM [privileged access management].” As they say:- “Identity Security is at the centre of digital transformation, Zero Trust and hacker innovation, three of the most important and intertwined trends in cyber security. With digital transformation and the move to the cloud, Privilege Access is everywhere and every identity across human users, applications and bots can be privileged under certain conditions.”

FactSet Research Systems. FDS. Buy @ $413

FactSet is proud to have delivered 40 years of revenue growth and 24 years of consecutive earnings growth which has been reflected in a strongly performing share price. All the signs are that growth is going to continue and in a world of digital transformation it may be poised to accelerate. They have just had a great year and a great quarter. “We ended the year with record organic ASV [annual sales value] plus professional services growth of $68m for the quarter, crossing the $100m annual ASV threshold for the first time and soundly beating the top end of our guidance. Our year-on-year organic ASV growth rate accelerated 200 basis points to over 7pc and we delivered annual revenue of $1.6bn and adjusted EPS of $11.20.” Business is going well. “FactSet’s goal to be the leading open content and analytics platform is resonating in the marketplace and increasing our wallet share with clients.” Prospects look good. “The need for more differentiated content and analytics is at an unprecedented high and we are perfectly positioned to capture this demand and poised to deliver best in class workflows and a hyper personalized experience for our clients.”

Home Depot. HD. Buy @ $354

Home Depot is a diy giant in North America. Helped by strong demand the group is delivering astonishing earnings per share growth for such a large business. “Sales for the second quarter were $41.1bn, up 8.1pc from last year. Comp sales were up 4.5pc from last year with U.S. comps of a positive 3.4pc. Diluted earnings per share were $4.53 in the second quarter, up from $4.02 in the second quarter last year. The strong underlying demand across the business continues.” Covid-19 has triggered a surge in diy activity from Americans stuck a home. “Over the last six quarters, we have grown the business by more than $34bn, a level unmatched in our market.” The group also sees a rosy future. “We believe that home price appreciation is a fundamental support of home improvement activity and demand. As your home becomes more valuable, you are more likely to spend more on it. We are at a point now where the housing stock of the United States is over 20pc more valuable than it was two years ago. And so, as we look forward, not only have we seen that home price appreciation, but the homeowner balance sheet is incredibly healthy.” There is another reason why HD shareholders do so well. “During the quarter, we paid approximately $1.75bn in dividends to our shareholders, and we returned approximately $3bn to shareholders in the form of share repurchases”

Hubspot. HUBS. Buy @ $795

Hubspot is a great business. Quentinvest is a customer. “HubSpot’s mission is to help millions of organizations grow better. Over 121,000 customers in more than 120 countries use HubSpot’s software, services, and support to transform the way they attract, engage, and delight customers.” The business is growing fast with sales expected to quadruple between calendar 2018 and 2023 from $513m to over $2bn. A trigger for the latest burst of strength in the shares has been a significant ‘something new’. “HubSpot, the customer relationship management (CRM) platform for scaling companies, announced today at INBOUND 2021 the launch of HubSpot Payments, an end-to-end payment solution built to deliver a more delightful and connected buyer experience. Built natively as part of the HubSpot CRM platform, HubSpot Payments enables companies to accept payments confidently and seamlessly in less time and with fewer tools.” Even before this launch the company was in great shape. “We continue to operate from a broad position of strength, with Q2 revenue growth accelerating to 47pc year-over-year in constant currency and total customers growing 20pc year-over-year to over 121,000. We’ve seen multi-product adoption grow to over half of our total customers. A great indicator that more companies are realizing the advantage of managing their entire front office on one platform, with one data model, one view of their customers, and one user interface that’s easy to use.”

Nasdaq Inc. NDAQ. Buy @ $203

Nasdaq Inc is the first global markets operator to have a woman CEO. Adena Friedman, currently 52 years old, became CEO in January 2017. My impression is that she is phenomenally able and a major factor in why the business is doing so well. Nasdaq Inc. operates the NASDAQ market so rising markets and strong IPO activity provide a great following wind for the business but there are also many exciting initiatives going on. “We announced our strategic investment in Puro.earth, a leading carbon removal marketplace, along with the launch of our new ESG [environmental,sustainable, governmental] Data Hub, these solutions further expand the ways that we can partner with our clients to support their unique sustainability efforts. And third, we announced yesterday that we are starting an exciting next chapter for the Nasdaq Private Market as part of our partnership with the group of leading banks in the private market space. It highlights both the success of the Private Market platform we developed at Nasdaq, and the growing interest in developing a robust ecosystem for private company liquidity.” Meanwhile business is strong. “Overall, Nasdaq delivered net revenues of $846m, an increase of $147m, or 21pc from the prior-year period, driven by 18pc organic revenue growth in our Solutions segments and 10pc organic growth in our Market Services businesses.” In conclusion she says:- “We’re leading Nasdaq into the second half of 2021 with incredible momentum.”

Novanta. NOVT. Buy @ $161

Novanta is a leading global supplier of core technology solutions that give medical and advanced industrial original equipment manufacturers (“OEMs”) a competitive advantage. This focus is delivering strong growth. “Novanta delivered fantastic results in the second quarter of 2021. We delivered above our expectations for revenue, profit and cash flow. We delivered new all-time highs for revenue and bookings and excellent operating performance with adjusted EBITDA growth of 20pc year-over-year. And on top of all of this, we were very excited to announce two upcoming acquisitions in the past month, both of which will be a great strategic fit for Novanta, and together, will contribute significantly to Novanta’s long-term growth and our presence in attractive high-growth application areas.” Growth is on an accelerating path. “We saw record bookings momentum in the second quarter with sequential bookings growth of 12pc versus an already strong first quarter and year-over-year bookings growth of 77pc versus second quarter of 2020.” There is plenty of innovation to drive future growth. “We continue to invest in our innovation pipeline with terrific results. Year-to-date, we launched 8 new products, and we are on track for 25 launches for the full year with multiple new products in the queue for the second half for 2021, with focus on industrial and surgical robotics, minimally invasive surgery, precision motion and diagnostics and industry 4.0.”

Palo Alto Networks PANW. Buy @ $513.

Palo Alto Networks is a bit like CyberArk Software, a cyber security business which enjoyed great success earlier in the millennium, then seemed to be lagging behind a new generation of cyber security super stocks but is now reinventing itself for the new era of cloud and AI. This was summed up by CEO, Nikesh Arora, in the Q4 2021 results. “The average ransom demand in the first half of this year grew from $5.3m, which is up 518pc year over year. What these attacks are highlighting is the constant shortcomings of enterprises and of government infrastructure. It’s against this backdrop that our platform approach is working. Three years ago we set out the strategy of the company on three fundamental tenets. One, that the network will transform with the introduction of the cloud. This is accelerated with the pandemic, with SASE and virtual firewalls leading the transformation. Not only that, we supplemented our firewall platform strategy with software capabilities like DLP, IoT, SaaS visibility, DNS security, and SD-WAN. Our second insight was the cloud is going to be big and it’s here to stay. We have now seven modules in our cloud security platform, which is being used by over 75 Fortune 100 companies. And our third insight was more AI and machine learning will be needed to support the automation of our security platforms and our security operating centers. Our Cortex platform validates that for us every single day. Underpinning this innovation strategy has been a flurry of product releases from Palo Alto Networks.” This is bearing fruit. “In the fourth quarter of 2021, we delivered billings of $1.87bn, up 34pc, and well ahead of our guided 22pc to 23pc growth. The size of the deals with our large strategic customers grew and our total customer count expanded, with over 2,500 customers added in the quarter.”

Netflix. NFLX. Buy @ $634.

Over the years there has been a torrent of analysis about Netflix with minute scrutiny of the latest subscriber numbers. The ones who don’t care much about them are Netflix themselves. Their simple comment is that the numbers will vary from quarter to quarter and people should not attach too much significance to any set of figures. More important is the long view set out in the investor relations section of their web site. “People love movies and TV shows, but they don’t love the linear TV experience, where channels present programs only at particular times on non-portable screens with complicated remote controls. Now streaming entertainment – which is on-demand, personalized, and available on any screen – is replacing linear TV. Changes of this magnitude are rare. Radio was the dominant home entertainment media for nearly 50 years until linear TV took over in the 1950’s and 1960’s. Linear video in the home was a huge advance over radio, and very large firms emerged to meet consumer desires over the last 60 years. The new era of streaming entertainment, which began in the mid-2000’s, is likely to be very big and enduring also, given the flexibility and ubiquity of the internet around the world. We hope to continue being one of the leading firms of the streaming entertainment era.” Netflix is the king of streaming TV. No surprise they are doing well and now they are investing in video games too to broaden their market even further.

Sea Limited. SE. Buy @ $356

Sea Limited is shaping up as one of the greatest investments of the 21st century. Since January 2019 the shares are up from $10 to over $350 and look as full of running as ever. The share price performance is supported by stunning fundamentals. Analysts are forecasting revenue growing from $1bn for 2018 to approaching $18bn for 2023 and when you look at the markets being addressed by Sea Limited and its position in those markets it is easy to see those sales growing dramatically further. Sea operates in South East Asia, hence the name and is led by an uber talented group of Stanford and Harvard educated alumni. It is far and away the regional market leader in three huge markets, video games, ecommerce and fintech. Growth is running white hot. “Our efforts to capture the long-term growth from the shift to digitalization across our markets continued to deliver clear and strong results. At the group level for the second quarter of 2021, we achieved GAAP revenue of $2.3bn. This represents 159pc year-on-year growth. Our gross profit was $931m, up 364pc year on year. Bookings for Garena [games] reached $1.2bn, growing 65pc compared to last year. Shopee [ecommerce] recorded 1.4bn gross orders, a 127pc year-on-year increase. And SeaMoney’s mobile wallet services registered total payment volume of over $4.1bn, up close to 150pc from last year.” The strong performance is a function of their mission. “We strongly believe that our business performance is closely linked with our ability to deliver on our mission of bettering lives through technology.”

Tesla. TSLA. Buy @ $863

Tesla has long been a controversial share. When I first started recommending them at a fraction of the current price one subscriber was so infuriated he nearly cancelled his subscription. The company is probably valued at more than the rest of the world’s car industry put together and is often cited as an example of wildly over excited stock markets. The mistake here may be to think of Tesla as a car company. Tesla describes its mission as to accelerate the world’s transition to sustainable energy, which does sound like something that could be worth $835bn or maybe much more. The way they are doing this at the moment is by making electric cars but they also make batteries, solar panels androadside chargers. They are developing software to make vehicles autonomous, are planning to launch cyber trucks and the latest idea floated by Elon Musk is to use ever improving computer technology to make humanoid looking robots. This last made everybody laugh but I am not at all sure that Musk is joking and he recently topped Bezos to become the world’s richest man. The company is certainly walking the talk. Analysts see sales growing from $21bn to $83bn between 2018 and 2023 and if we go further back to 2013 sales were just $413m. Latest news was of strong sales in China.

Tyler Technologies. TYL. Buy @ $509

Tyler Technologies provides technology solutions for the public sector and has built a long track record of strong growth. Recently Tyler acquired NIC, its largest acquisition to date, for $2.3bn. NIC is a leading provider of digital government solutions and payment processing that serves more than 7,100 federal, state and local government agencies across the nation. The enlarged company s trading well. “Our second quarter was very strong, reflecting the inclusion of the results of NIC from April 21 with both core Tyler and NIC operations exceeding expectations. Total revenues grew 49.1pc driven by the inclusion of NIC, as well as the acceleration of Tyler’s organic growth to 12.4pc. Recurring revenues comprised 79pc of our second quarter revenues and were led by 133pc growth in subscription revenues with the inclusion of NIC. Excluding NIC revenues, subscription revenue growth was robust at 24pc “The outlook also looks good. “Bookings in the second quarter grew 50pc to approximately $464m with the inclusion of NIC. Excluding NIC, bookings rose 17.5pc. We continue to see indications that our market is returning to normal, as many delayed procurement processes are moving forward and new processes are starting.”

Upstart Holdings. UPST. Buy @ $374

Much recommended in Quentinvest Upstart has been on an extraordinary run, up nearly 20 times on the December 2020 flotation price which, with hindsight, looks to have been set ludicrously low. The price is now being driven by the extraordinary results being reported by the company with revenues up some 500pc on the pre-Covid 2019 levels. CEO and co-founder, Dave Girouard, is adamant that Upstart is on course to become one of the world’s most important and largest fintech businesses and the company is recruiting accordingly. Alongside the latest results Girouard noted “June was our first month with more than 100,000 loans and more than $1bn in origination volume on our platform.” $1bn monthly equals $12bn annualised which would be 14.3pc of the total personal loans market. If Upstart could repeat that achievement in the auto loans market that would be 14.3pc of a total $719bn of loans or $103bn originated on the platform implying group revenue over $6bn. Such an achievement does not seem impossible given the consumer appeal of Upstart-powered loans, the presence of the company across most of America and the rapid growth of the recently acquired Prodigy auto sales software platform. One thing is clear. There could be plenty more strong growth ahead for Upstart.

Verisk Analytics. VRSK. Buy @ $210

Verisk Analytics, Inc. is an American multinational data analytics and risk assessment firm with customers in insurance, natural resources, financial services, government, and risk management sectors. The company uses proprietary data sets and industry expertise to provide predictive analytics and decision support consultations in areas including fraud prevention, actuarial science, insurance coverage, fire protection, catastrophe and weather risk, and data management. Covid-19 had a depressing effect on performance but the company managed to keep growing and growth is accelerating as conditions slowly return to normal. The company is also in process of transitioning from a software license based model to a cloud and subscriptions based model which. can depress growth in the short erm but lead to an acceleration over the longer term. More growth looks assured. “As our business recovers from the short-term impacts of the pandemic, we continue to actively study the signs of resilience, across the different parts of our company. Our dynamic capital process is designed to ensure that our capital is deployed into the highest-growth and highest-return opportunities.”

Waste Management WM. Buy @ $157

Rubbish disposal is good business in the 21st century as we can see from Waste Management’s latest quarterly report. “Our business produced tremendous growth in the second quarter as the economy continued to recover from the pandemic, and we made further progress on our integration of the Advanced Disposal operations. The acquisition of Advanced Disposal, the return of volumes from early pandemic levels, and our continued focus on cost control all contributed to financial outcomes that exceeded expectations. In the second quarter, as adjusted operating EBITDA grew 28pc, adjusted operating EBITDA margin expanded 50 basis points, and we generated more than $1bn of cash from operations. We continue to execute on our pricing programs and efficiently manage our costs as volumes return. As a result of our strong performance through the first half of 2021 and our confidence in the continued strength of our business model, we are increasing our full-year revenue, adjusted operating EBITDA, and free cash flow guidance. In addition, due to our robust cash generation, we are increasing our expectations for 2021 share repurchases up to our full authorization of $1.35bn.” Earnings quality is also improving. “We’ve made substantial progress in derisking our recycling business by shifting to a fee-for-service contract structure, which has lifted the floor for recycled returns and created an economically sustainable business model.”

Watches of Switzerland Group. WOSG. Buy @ 1084p

The annual report of Watches of Switzerland Group is stuffed with pictures relating to Rolex watches. I counted four before yo reached pictures of TagHeuer, Breitling and Cartier watches. One reason for this is that you can only buy a Rolex watch through an intermediary like Watches of Switzerland. Another is that Rolex is an incredible business. It is still family-controlled, private and data is hard to come buy. Nevertheless based on watch sale statistics that are available a good guess is that the business is worth at least €100bn. Watches of Switzerland is like their representative here on earth and especially in the UK and USA. Swiss watches are big business in the UK, less so in the US but they are catching the bug and this is helping drive strong growth at WOSG. It is incredibly hard for newcomers to build the sort of relationships that WOSG has with the leading Swiss brands and the company also benefits as for top names demand exceeds supply. Two thirds of sales are in the UK and one third in the USA. In the latest year sales grew 34.9pc overall including 38.5pc in the US where the group sees a great opportunity. WOSG is up there with the great French luxury goods businesses as a key long term growth investment.