Four of my favourite fintechs – Afterpay, PayPal, Square and Upstart

What is fintech?

Initially, fintech referred to technology that was applied to the back-end systems of banks or other financial institutions – but has since grown to encompass a plethora of other applications that are more consumer-focused. In 2020, it is possible to manage funds, trade stocks, pay for food or manage insurance through this technology (and often on your smartphone).

For the estimated near 2bn people worldwide without bank accounts, fintech provides a nimble option to participate in financial services without the need for bricks-and-mortar. And, to a large extent, that is precisely what fintech has been developed to do – give consumers direct access to their financial lives through easy-to-use technology.

What is clear is that fintech is disrupting the global financial services industry. Think of any old school way of doing things from banking to stockbroking to insurance and there are companies using technology and increasingly artificial intelligence to disrupt these old industries and give us better, simpler, cheaper ways of carrying out tasks that are a vital part of our lives.

These are huge industries with trillions of dollars at stake. It is still early days in this transformation but it is already creating businesses that I believe are going to become behemoths in the future. I look at four examples below which are already in the QV portfolio but where I think the best is still to come.

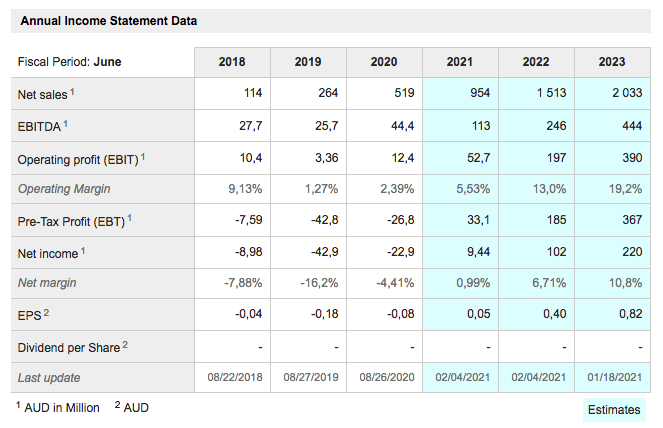

Afterpay APT Buy @ A$151.3 Employees: 665 MV: A$41.1bn (US$31.4bn/ £22.8bn) Next figures: 3 March Times recommended: 12 First recommended: A$51.52 Last recommended: A$140

Afterpay is an Australian buy now pay later business (BNPL), founded by Anthony Eisen and Nick Molnay, which dominates the ANZ market, is growing rapidly in North America and the UK (trading as Clearpay in the UK) and has clearly signalled ambitions to expand into continental Europe and South East Asia.

It is also growing from offering its services online to offering them in-store (i.e. in shops) and intends to use BNPL as a spring board for offering other financial services like banking, initially in partnership with actual banks.

Customers love Afterpay. They buy stuff but get to pay in four interest free equal instalments. It’s very convenient and makes stuff more affordable for cash-strapped consumers, which is most of the millennials and Gen Z, who make up the bulk of Afterpay’s customer base.

Afterpay charges capped and also interest free late fees to customers who don’t pay on time but the main penalty is not being able to use Afterpay until your account is back in balance. Customers who pay on time get rewards and larger lines of credit albeit that the service is not intended for larger items like cars but smaller purchases like fashion and beauty, dentistry and airline tickets.

What is increasingly happening is that consumers go onto the Afterpay platform because they only want to shop with BNPL making it important for retailers to be on the platform and enabling Afterpay to generate millions of leads for those merchants. Over time customers use the platform more and more so that early cohorts are using Afterpay 25 times a year or more.

The fees that support the whole operation are paid by the merchants. It’s not a huge amount, several per cent but the benefit to them is more customers closing deals and average spending amounts growing larger. The merchants like it so much that they are flocking to join the platform and global merchants are a big factor in encouraging Afterpay to go global.

The shares collapsed in March because investors imagined that nobody would pay during lockdown and Afterpay, which has to fund the loans, would experience difficulties. This was a complete non-event. Customers paid and the shift online meant Afterpay grew faster than ever. Chinese internet giant, Tencent, use the setback to invest in Afterpay and may now help the group to expand in Asia.

This is a highly competitive space as we will see when we look at Paypal but it is also a big space, plenty of room for more than one company to become big. There will be winners and losers. Business is about execution as well as great ideas. I think Afterpay is brilliant at execution ad will be one of the winners, even able to go head to head with a giant like Paypal.

The business is growing at an incredible rate with customer and merchant numbers soaring and revenues doubling annually. I really think the sky is the limit for these guys.

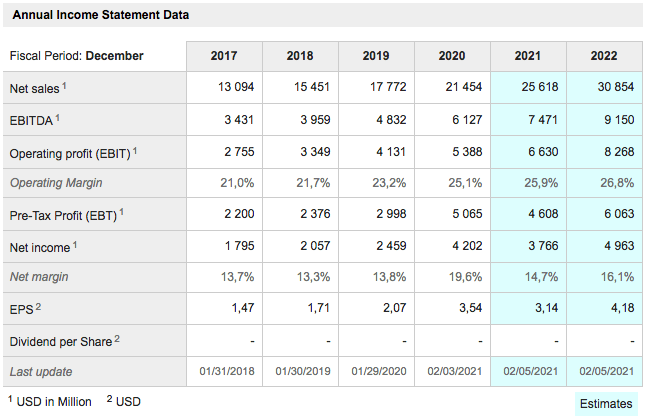

Paypal PYPL Buy @ $267 MV: $317bn Employees: 23,200 Next figures: 28 April Times recommended: 20 First recommended: $70.97 Last recommended: $243

When I talk about these companies becoming huge you might think that PayPal is already pretty big with a market value approaching a third of a trillion dollars. I still think it is going to become much bigger and so does CEO, Dan Schulman. “We intend to shape that future, and in doing so, become one of the world’s leading digital payments, financial services, and commerce platforms. I look forward to expanding on this vision during our investor day next week.”

That is the kind of ambition I love to see with a business and with Paypal it doesn’t sound like hype. They are definitely walking the talk.

PayPal recently reported its results for Q4 2020, which handsomely beat expectations.

“The pandemic has accelerated a digital wave of change across almost every industry by three to five years, unleashing a profound and permanent structural transformation. Our results in Q4 highlight these strengths. In the quarter, we added 16m net new active customers, including an incremental 1.4m new merchants. For the year, we delivered a record 73m net new actives, ending the year with 377m active accounts, up 24pc.

We now have over 29m merchants interacting with nearly 350m consumers. In 2021, we expect to add another 50m net new active accounts. Equally important, our daily active users remain elevated versus a year ago, up 29pc from Q4 of 2019. Our expanding scale and increasing engagement drove a record 4.4bn transactions in the quarter, up 27pc.

Our total payment volumes in Q4 were $277bn, up 36pc on an FXN [FX neutral] basis. Our TPV [total payments volume], excluding eBay, was up a record 40pc percent as we continue to gain market share. eBay TPV grew at 1pc and exited the year at just under 6pc of our total volume. For the full year, our TPV was up 31pc to $936bn.

In Q2 of 2020, our quarterly revenue surpassed $5bn for the first time. In Q4, we surpassed $6bn for the first time with our quarterly revenues growing by 23pc to $6.116bn. For the year, our revenues grew by a record 22pc on an FX-neutral basis to $21.45bn. Our non-GAAP EPS grew a record 31pc to $3.88, and our free cash flow increased by 48pc of to $5bn.

Venmo continued its strong performance with Q4 TPV of $47bn, up 60pc year over year. Venmo’s customer base grew by 32pc in 2020, ending just shy of 70m active accounts. This continued momentum reinforces our conviction that revenues will approach $900m in 2021. In early January, eligible customers were able to cash their stimulus checks within the Venmo app for the first time.”

This business is absolutely smoking but that is what you need if you are going to become one of the world’s largest businesses, which is surely PayPal’s destiny. There is loads more going on at PayPal including their successful launch of the BNPL business but the key point is this is a great business with a massive opportunity. They are also becoming increasingly involved with bitcoin.

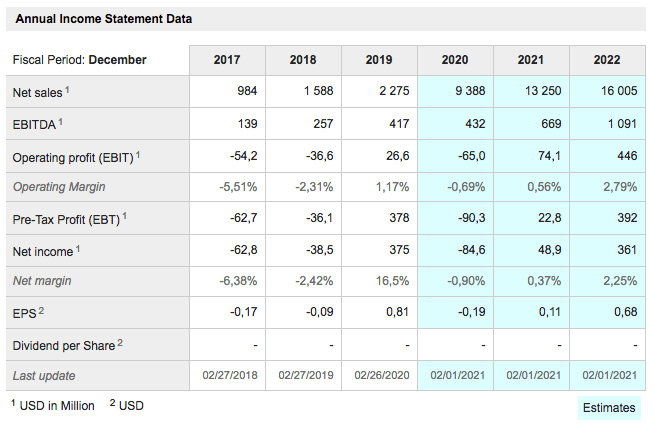

Square SQ Buy @ $238 MV: $106bn Employees: 3,635 Next figures: 23 February Times recommended: 16 First recommended: $39.51 Last recommended: $227.50

A striking feature about Square is that it is already a third of Paypal’s size by market value but only has around 15pc of the number of employees. The implication is that Square is even more technology focused than Paypal though for the foreseeable future it is nothing like as profitable. If it can continue to grow while keeping its employee numbers tight it should do very well one day.

By any standards Square, of which the CEO and co-founder is Jack Dorsey, also of Twitter, is a very fast growing business. It was only founded in 2009 and yet is already valued at over $100bn. It is safe to safe that Dorsey is one of the world’s great tech entrepreneurs.

Square’s mission, not dissimilar to others in the fintech space, is to use technology to make life easier for merchants, what it calls the Seller business and use its other ecosystem, CashApp, to do the same for individuals. In recent years CashApp has grown even faster than Seller, which means very fast indeed.

There is a great deal to do because frankly the services provided by traditional banks are rubbish. I like my bank manager but Barclays are a joke and I am looking very seriously at making the transition into the fintech world. Goodbye Barclays, hello Square, Revolut or whatever.

Square began by helping small businesses take card payments. I see their little white square card readers all over the place in local street markets but they are also expanding into a rapidly growing range of services. Examples include Square Card, a business debit card and Square Payroll about which Square says.

“In the third quarter, we launched two new features for Square Payroll: Instant Payments and On-Demand Pay. Instant Payments allows Square Payroll merchants to pay employees using earned funds the next business day with Direct Deposit or instantly when employees use Cash App.

On-Demand Pay gives employees a way to get their compensation faster by transferring up to $200 of earned wages per pay period into their Cash App accounts. This strengthens the integration between our seller and Cash App ecosystems and is a great example of what we can do when we connect the two ecosystems together. We continue to believe our ecosystem is a key differentiator for sellers and see an opportunity to educate businesses who are looking to adapt.”

What is very noticeable is that every time Square introduces new features into its growing ecosystem of merchants and individuals that adoption is very rapid. Integration between the two platforms is likely to make this process even faster.

The figures below for sales growth are a bit misleading. Square is growing fast but not that fast. It is being disorted by things like stockbroking and the move into bitcoin of which Dorsey is such a fan that Square recently invested $50m. He talks about this in the Q3 report. “The second was a $50m investment into Bitcoin, which we believe will be the native currency of the Internet and help people around the world better participate and thrive in the economy.”

Square is dramatically stepping up its spending on marketing. “During the quarter, we also ran our largest brand awareness campaign to date, with a focus on how our offerings can help sellers globally through the COVID-19 pandemic. We expect to reach more than 50m people in the U.S. through our campaigns in the second half of 2020.”

CashApp arguably looks even more exciting. “We have seen strong adoption across the Cash App ecosystem, including our stock brokerage products, which have seen the fastest adoption of any product to date. Since launching it less than a year ago, more than 2.5m customers have bought stocks using Cash App, and billions of dollars have been traded by the end of the third quarter. With the stock products, we’re focused on expanding access to investing for more customers, many of whom likely have never purchased stocks before. This quarter, we launched Auto Invest, which allows for dollar-cost averaging from recurring daily or weekly purchase of Bitcoin or stocks.”

No wonder Dorsey says “we have scaled not one but two ecosystems focused on expanding access to financial services for sellers and individuals. We intend to continue looking for opportunities within each ecosystem and to expand into new adjacencies beyond seller, and so we’re investing for the long term and we’re energized by what’s possible.”

I just think Square is a fantastic business.

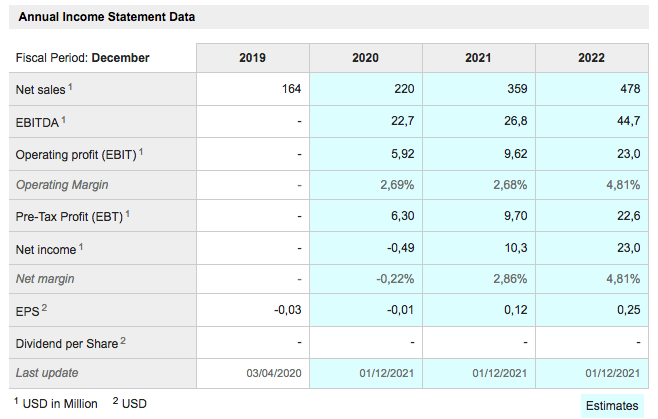

Upstart UPST Buy @ $78 MV: $5.6bn Employees: 429 Next figures: 3 March Times recommended: 3 First recommended: $62.50 Last recommended: $75.50

One of the things that makes Upstart exciting as an investment is that this is a very young business. The business was launched in 2012 and then effectively relaunched in 2014. The founders were a talented bunch including Dave Girouard, former President of Enterprise Google, Paul Gu, a Thiel Fellow, and Anna Counselman, former Manager of Global Enterprise Customer Programs and Gmail Consumer Operations at Google. In 2019 it had sales of just $164m, enough for proof of concept but tiny in US business terms, especially for a company that is planning to disrupt a multi trillion dollar industry.

There is something about Americans. They are just so unbelievably gung-ho, literally sitting around a table making plans to change the world and then going out and doing it.

Upstart is so new that it has yet to report as a public company. For someone who has been endlessly frustrated by how stupid and cautious traditional banks can be, unless your planning large scale fraud, when they will greet you with open arms, I love Upstart’s mission statement.

“Upstart’s mission is to enable effortless credit based on true risk. We are a leading artificial intelligence (AI) lending platform designed to improve access to affordable credit while reducing the risk and costs of lending for our bank partners. Our platform uses sophisticated machine learning models to more accurately identify risk and approve more applicants than traditional, credit-score based lending models.”

What is also amazing about these companies is how easy they make it look. Why couldn’t banks do what they do but they don’t and won’t move without a massive kick up the backside from companies like Upstart and its free-thinking founders.

Upstart is an unusual disrupter because it is not planning to supplant banks as PayPal and Square are likely to do but to work alongside them, using its platform to help banks make better and faster loan decisions. This means news flow is likely to be a key stock price driver for Upstart as they sign up banking customers. Since floating the group has already announced two new sign-ups, Oriental Bank and most recently KEMBA Financial Credit Union, the Columbus, Ohio based credit union, which has expanded its personal loan program with Upstart to better serve its community.

If things go according to plan there are going to be many more such announcements. Another big part of the excitement with companies like Upstart is where they go with the technology. Square started with a card reader and look at them now. I imagine something similar will happen with Upstart. As the group has noted the present financial system, especially in relation to the way credit is advanced to individuals, is in their words ‘broken’. There is much to do and Upstart is determined to do it.

In a nutshell, they have tasked themselves with using artificial intelligence to improve decision making in one of the world’s largest and most important activities – borrowing and lending money. As they say “the potential economic wins from AI are dramatic.” If Upstart plays any sort of significant role in this the business is going to become hugely more valuable. As so often, it is all about execution. Have they got the right stuff? They’ve progressed this far which strongly suggests that they do.

One of the problems for value investors is that when an industry is being disrupted shares in the companies doing the disrupting become very expensive, while shares in the companies being disrupted start to look very cheap. A famous example is Tesla being valued at more than the whole of the world’s fossil fuel car industry. It looks insane but usually it is correct. Netflix looked crazily expensive, when it began to disrupt the DVD rental industry but it was bricks and mortar giant, Blockbuster, which went bust.

Prsesently Barclays is valued at some $35bn v $5.6bn for Upstart. What are the odds (a) that one day Upstart will be worth more than Barclays and (b) that, if and when it is, it will still be a fraction of the British bank’s size.

Dinosaurs were huge, mammals were tiny but who survived the meteor impact and came to dominate the planet? Exactly!

I really like the four stocks featured above. Obviously they get riskier as you go from PayPal to Upstart but I see them all as potential worldbeaters.