Many of the stocks that excited us so much in the last bull market have suffered because of a revaluation, devaluation if you prefer, and are still exciting businesses with years of strong growth ahead of them. Despite a growing number of Coppock buy signals including for the main indices investors are still approaching the stock market with great care.

These Coppock buy signals will work in the end and when we watch the stock market on a day to day basis as I do it can seem that the turnaround is not happening but it will. It is a case of up, down, up, down, up, down but slowly but surely progress is made. Below I look at four stocks with outstanding fundamentals which have all just given valid Coppock buy signals.

Table of Contents

Crowdstrike is one of the sexiest companies out there

I am a fan of George Kurtz, co-founder and CEO of cyber security group and he is as positive as ever.

We believe this is best showcased by the fourth quarters record net new ARR [annual recurring revenue] of $222m, record net new customers of 1,873, strong retention rates, record operating income, record free cash flow of $209m, and a rule of 81 [don’t know but sounds good] on a free cash flow basis. Second, the dual mandate of high efficacy and low total cost of ownership [TCO] plays to CrowdStrike strength as a leading consolidator. CrowdStrike’s growing market share showcases the Falcon platform’s advanced AI and technology leadership that drives better security outcomes, automation, and lower TCO for customers. And third, our conviction in CrowdStrike’s expansive opportunity continues to grow.

We see a massive opportunity to leverage our AI-driven “collect data once, reuse many times” platform to expand share across our markets. As Burt will discuss, we are continuing our thoughtful and balanced approach to investing to drive both top-line and bottom-line growth. We remain steadfast in our vision to grow ending ARR to $5bn by the end of fiscal year 2026 and to reach our target operating model sometime within fiscal year 2025. The key to our success in the fourth quarter was execution and strong market demand for the Falcon platform.

Q4 2023, 7 March 2023

The fall in Crowdstrike’s share price (see chart below) seems to be entirely accounted for by a more cautious attitude to valuations in a world of soaring interest rates. One way of valuing shares like Crowdstrike is to take expected sales and/ or profits in several years time and discount them back to the present by the prevailing rate of interest. Warren Buffett is said to be a fan of this technique though partner Charlie Munger joked once that he had never seen him do it. If interest rates rise 10-fold or more as they have done obviously the shares will take a hit.

The valuation has dropped from 54 times (market valuation over sales) for the year to end January 2021 to around 10 times for the year to 31 January 2024 and nearer six time for the year to January 2026. My rule of thumb is to multiply the MV/ sales ratio by five to get an approximate PE ratio so Crowdstrike could be on a PE of 30 for 2025-26 earnings. This may not happen in practice if the company is still investing heavily in growth and is not screamingly cheap but it certainly suggests that the shares are finding a floor and could head higher in a more boisterous market.

Crowdstrike is one of the sexiest shares out there. I doubt if there is anything to match it on the UK stock market which is why, when investors are in the mood, it tends to become very expensive, like Hermes handbags.

Cloudflare in 2022 – 400,000 applicants for 1,300 positions

Internet infrastructure and cyber security business, Cloudflare, is still barrelling along at a healthy rate.

We had another strong quarter in spite of continued challenging macroeconomic conditions. We generated $274.7m of revenue, up 42pc year over year.

We achieved a record operating profit of $16.8m, representing an operating margin over 6pc. While we continue to invest to capture the huge market ahead of us, we believe that during economic slowdowns like the one we’re in the midst of it’s important to show discipline and optimize for efficiency. We have our hands on the leverage of our business and are adjusting them based on the macroeconomic conditions. Our free cash flow in the quarter was $34m, representing a free cash flow margin of 12pc and allowing us to generate $29m of free cash flow in the second half of 2022.

Q4 2022, 9 February 2023

What a class act this company is.

We still see a clear path to a dollar-based net retention over 130pc as we ramp seat-based products like Zero Trust and storage-based products like R2, and we won’t be satisfied until we get there. We added 134 large customers, those that pay us over $100,000 per year and now have 2,042 large customers, including 33pc of the Fortune 500. Revenue from large customers grew 56pc year over year, and they now contribute 63pc of our total revenue. We were fortunate that given our visibility into the overall Internet traffic and the e-commerce trends, we started to see a slowdown in the economy all the way back in December of 2021.

Q4 2022, 9 February 2023

A dollar-based net retention rate of 130pc means that sales grow 30pc in the year even before you have added new customers. And what a talent pool this company is able to draw on.

Based on that [early warning of a slowing economy], around this time last year, we began slowing our pace of hiring to ensure we didn’t get over our skis. That’s paid off and kept us from having to take more drastic actions like many of our peers. It’s also given us the ability to sensibly invest in our team as amazing talent comes on the market. To give you some sense, in 2022, we had over 400,000 people apply for approximately 1,300 positions at Cloudflare.

Q4 2022, 9 February 2023

Talk about feeling like one of the chosen ones. It’s like being in the corridor with over 300 people and you get the job. And this leads straight to an exciting ‘something new’ which is happening at Cloudflare

We’re seeing incredible people from the leading sales team in the world apply to work at Cloudflare. We aim for nothing less than to build one of the leading sales organizations in the world. That’s all exciting. And while I believe there is a substantial opportunity for us to improve our go-to-market engine, I’m also cognizant that these efforts can take time.

Q4 2022, 9 February 2023

The company recently won Federal accreditation for contracts and this has produced immediate results.

We were awarded the contract because of our modern infrastructure, technical prowess, relentless innovation, and proven ability to defend against the largest cyber-attacks. Every email sent to the White House, every agency’s web page, and most of the other ways the U.S. government connects to the Internet, now depend on Cloudflare and our network. We’re proud to have won this business, but the public sector space is only 3pc of our revenue today, so we believe it’s only the beginning of what we’ll be doing in the future.

Q4 2022, 9 February 2023

The Trade Desk’s Jeff Green could not be more excited

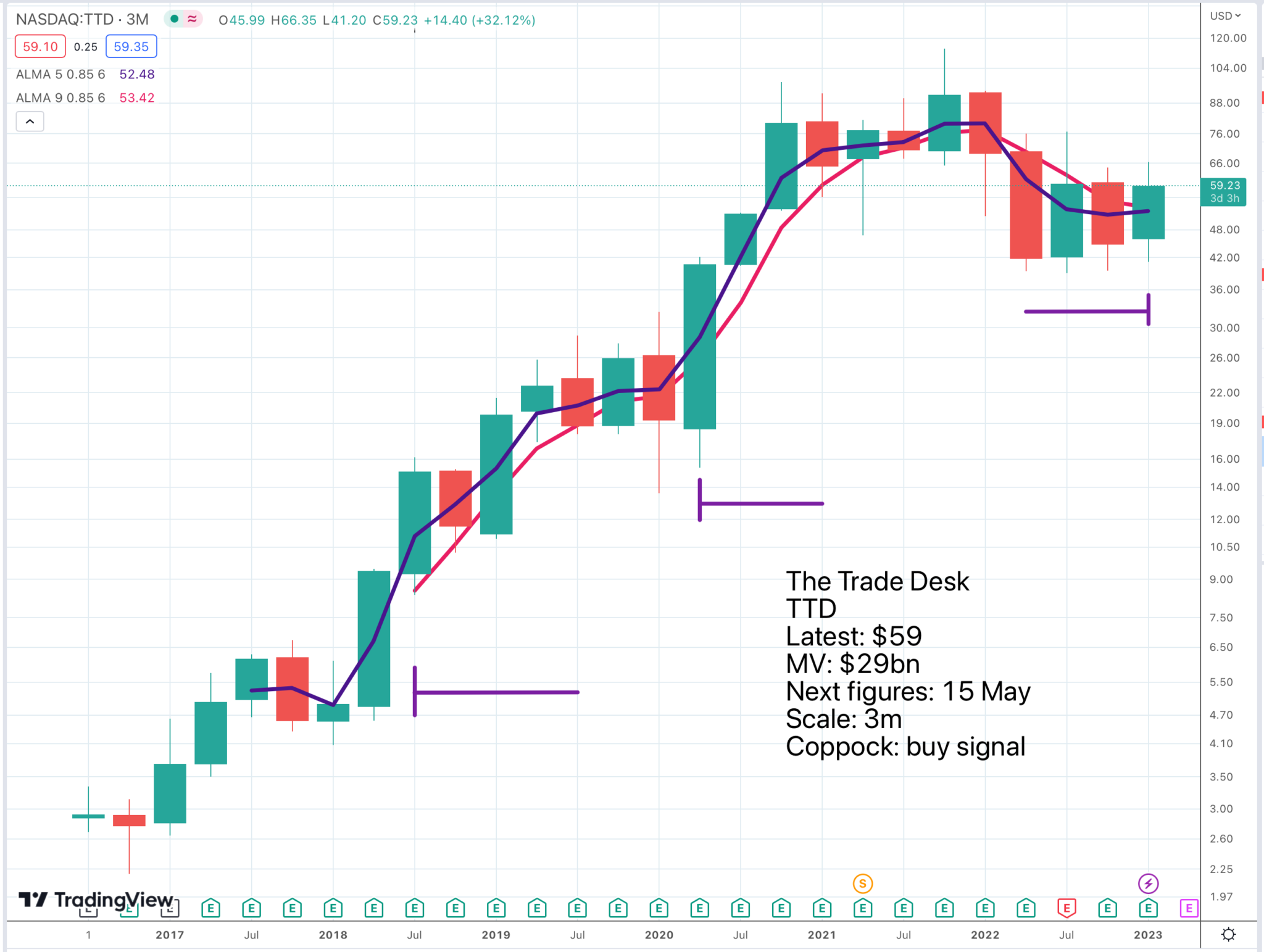

The Trade Desk is another class act, where I think the shares have bottomed out. I think of them as a David taking on the ‘walled garden’ Goliaths like Google and Facebook.

Specifically, in the last six months of 2022, The Trade Desk started to separate from much of the digital advertising market in terms of relative outperformance. In the third quarter, we reported 31% growth, while our competitors were either in retreat or posting single-digit growth. That same trend continued into the fourth quarter as we grew 24pc, and most of our large competitors were posting between negative 9pc and negative 2pc growth. I don’t think we’ve ever had the level of industry outperformance in our six years or so as a public company as we did in 2022.

And it means that we can be very confident that we’re gaining share and that our platform continues to gain traction with advertisers. I remain convinced that in times of uncertainty as marketers look to do more with less, they are continuing to prioritize decisioned media on the open internet. With The Trade Desk and the open internet, marketers can measure ROI and value with more objectivity, and that means they’ll prioritize us over the limitations of walled gardens. With that in mind, Insider Intelligence reported a couple of weeks ago that 2022 represented the first year in a decade that Mata and Google did not account for more than half of the digital advertising market between them.

Q4 2022, 15 February 2023

Jeff Green, the founder and CEO of The Trade Desk, is not a shrinking violet. He is the kind of guy who never says focused but always laser-focused. He makes Salesforce.com’s ebullient co-founder and CEO, Marc Benioff, look low key but it doesn’t matter because he walks the talk.

To be clear, this is not us versus Google [ed: not sure about that]. It’s the value and opportunity of the open internet versus the limitations of walled gardens. We have been winning for years in an unfair market with some systemic obstructions working against us. Imagine what we can do as the market becomes more fair, which we predict it will, one way or another.

I could not be more excited about the direction we are heading in and the value that our advertising clients are realizing on the open internet because of all the progress we’ve talked about today. Our focus on profitability ensures that we will remain at the cutting edge of our industry. Compared to many others in our industry over the last three years, we did not overextend ourselves in terms of hiring. We have been deliberate and prudent, keeping it laser-focused on the long-term opportunities in front of us.

As a result, we are one of a few high-growth technology companies that consistently generates strong adjusted EBITDA and free cash flow. As you may have seen in our press release, our strong profitability and cash flow enabled us to return capital to shareholders with a $700m share repurchase program. While I generally don’t like to comment on competitors’ performance, it is worth noting again that in an environment where many of our competitors contracted, our revenue grew 24pc in the fourth quarter. I believe that level of relative outperformance, which was evident throughout 2022, is indicative of the value we are delivering to our clients, even in a challenging environment.

We continue to sign JBPs with brands and their agencies at a very strong pace, with billions of dollars transacted through these agreements last year. I believe 2023 will be a tipping point year in many ways. And I expect that advertisers will emerge more empowered than ever to drive data-driven precision. As a result, we will continue to gain share.

Q4 2022, 15 February 2023

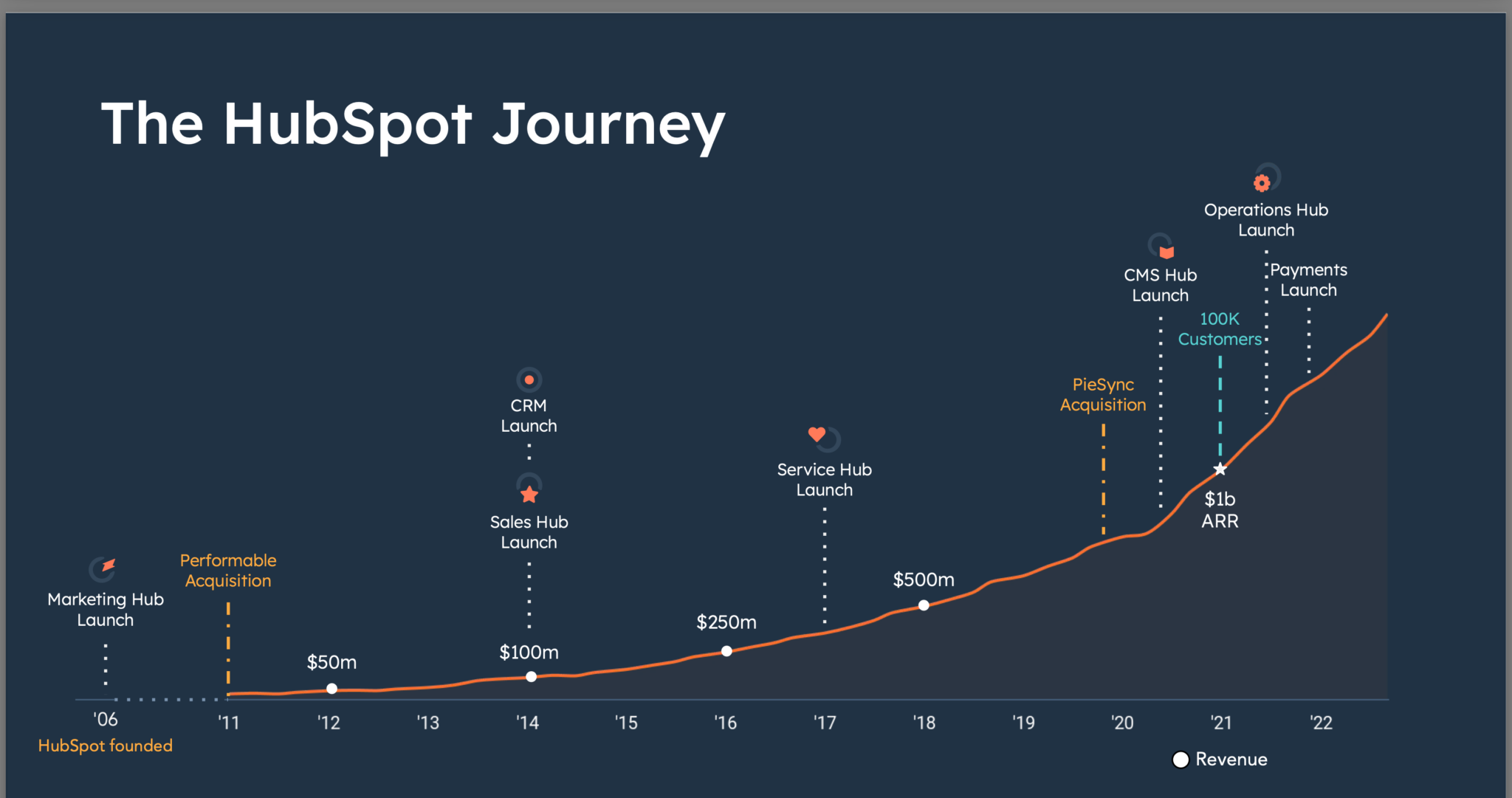

Still early days in the Hubspot journey

The graphic of the Hubspot journey makes it immediately clear that this is an exciting business. If say the UK’s Barclays produced a similar graphic just imagine how different it would look. For a start it would be flat if not pointing down, whereas Hubspot has gone in 16 years from zero sales to sales running at over $2bn a year.

What is rather extraordinary is that a company reporting such impressive results for its fourth quarter should accompany this announcement with news of lay-offs. This is part of a marked trend in the technology sector to prioritising profits and cash flow over sales growth at all costs.

Before we get started, I want to acknowledge the restructuring announcement we just made 2 weeks ago, where we decided to part ways with approximately 500 HubSpotters. This was the most difficult decision in HubSpot’s history and not one we took lightly but one we believe is in the best interest of the company over the long term.

Now on to our results. Q4 revenue grew 35pc year-over-year in constant currency, and full year 2022 revenue grew 39pc in constant currency. Our operating profit margin was 14pc in Q4 and 10pc for the full year. Total customers grew 24pc to over 167,000 globally.

Q4 2022, 16 February 2023

There are reasons why the business continues to do well.

SMBs [small and medium sized businesses] are doubling down on digital. Their businesses are now built on digital compared to pre-pandemic. They’re not turning back. But instead of operating in a “buy first, understand value later” mode, they’re now in a “understand value deeply buy cautiously” mode. HubSpot has always resonated with customers because we deliver easy-to-buy, easy-to-use and easy-to-manage solutions. Now in this environment, we’re focused on helping our customers drive innovation and efficiency with a quick time to value with customers taking under 8 weeks on average to activate and see value.

Q4 2022, 16 February 2023

The company is bursting with ambition with what was a single software programme increasingly becoming a platform offering a comprehensive suite of services to its customers.

While the environment may be uncertain, we operate in massive markets and are confidently pursuing our goal of becoming the #1 CRM platform for scaling companies.

Our next objective is to continue on our journey to transform B2B commerce. We launched HubSpot Payments a little over a year ago, and early customer interest have been strong despite the macro environment. This year, as we continue to ramp, we’ll be focused on driving greater awareness of our commerce capabilities and increase customer adoption while adding key functionality like native invoices, flexible billing and flexible payment processing that our customers need.

Third, we will double down on our bimodal strategy. Our strategy of focusing on volume of customer adds at the low end while expanding the value of customers at the upper end is working. We launched CMS Free, introduced self-guided demos, moved automation down to our starter edition and optimized sign-ups. These initiatives drove results, and we added over 30,000 net new customers last year with the majority landing on the starter CRM [customer relationship management] suite and expanding beyond. We will continue to find creative ways to make it even easier for customers to get started with HubSpot and get value out of our platform quickly.

Q4 2022, 16 February 2023

Financial strategy

Warren Buffett says he likes bear markets because it is sale time for shares and there are bargains to be found. That is what these four selections are all about. They were spectacular performers in the bull phase, especially since 2017 and during lockdown as interest rates disappeared as a factor in financial decisions.

Back to normal with interest rates has meant back to normal in valuations and the heady multiples that characterised shares in exciting companies in 2021 have been violently reversed leading to plummeting share prices in 2022, especially for the hot momentum plays that had been so popular.

When a share price is falling various things start to happen. Investor psychology changes and once loved shares become hated enemies. Since these shares are often bought with borrowed money so margin calls abound adding to the selling pressure. Finally, there is that uneasy feeling that something must be wrong.

Just as share prices overshoot on the way up they have a tendency to overshoot on the way down and I think that has happened with the four shares being alerted above. They are wonderful businesses with great leadership, ambitious plans for the future and talent pools to die for. Human beings are resourceful creatures. They react to challenging circumstances by adapting and becoming stronger and fitter than ever.

So what do we want to do with these shares. I leave analysis to the analysts who can wrack their brains over the short term outlook. I prefer that to be good but what I really want is for the business to be amazing. If it is everything else will fall into place.

On the chart front I want to see fading downwards momentum and the beginnings of a new uptrend and that is what I see here. Even if we are jumping the gun a little bit here these four look like classic win in the end stocks to me.

Share recommendations

Crowdstrike. CRWD. Buy @ $128.5

Cloudflare. NET. Buy @ $56.5

The Trade Desk. TTD. Buy @ $58

Hubspot. HUBS. Buy @ $403