Carvana. CVNA. Buy @ $357. MV: $62bn. Next figures: 29 October Times recommended: 15. First recommended: $28.85. Last recommended: $332

Carvana sells used cars. Not only that but the father of the CEO, who provided much of the initial finance for the business, was convicted of fraud and served time in prison. These circumstances may explain why Wall Street has been so sceptical of this business despite the CEO’s conviction that his business was going to be a huge success and the explosive growth being delivered.

The CEO is called Ernie Garcia 111 and he took some time with the latest quarterly report to celebrate the group’s achievements to date. As he says eight years ago they had a dream to change the way people buy cars and they have made a lot of progress. They have indeed!

In 2013, the group’s first year of trading, they had $4m of revenue. Five years ago they sold 18,000 cars in a year. They have just reported Q2 2021. They sold over 100,000 cars in the quarter and had revenue of $3.3bn. Not only that but the much enlarged business is still delivering explosive growth. Total revenue increased by 198pc from a year earlier.

Another key number is gross profit per car sold or GPU. Five years ago total GPU was $1,000 and the company dreamed of reaching $4,000 GPU. The latest figure is $5,120 and the company reported its first ever profit.

The superlatives keep coming. “It was the first quarter we hit $100m EBITDA, and it was our first quarter of positive net earnings. It was also the first quarter we made the Fortune 500 list. And to top it all off, we’re now one of the four fastest companies to ever make the list organically along with Amazon, Google and Facebook.”

This is a wonderful business with an amazing management team, most of whom are alumni from Stanford, Harvard and other top US universities. And they don’t think they are anywhere near finished yet.

As Garcia says:-“Customer preferences will always change, and technology will always evolve. As a result, there will always be opportunity. We’re nowhere near realizing the opportunity — the potential that we saw from the beginning and additional potential reveals itself all the time. We’ll keep chasing it. And as long as we keep our eyes open wide enough, we’ll never catch it.”

Analysts are starting to get the message. By FY2026, the company’s sales are expected to reach $38.57bn. If, as seems very possible, Carvana is poised to become the Amazon of the highly fragmented US used car industry, the opportunity looks huge. The shares could still rise 10 times from here, especially if, like many other successful companies, they start diverting free cash flow into share buy backs.

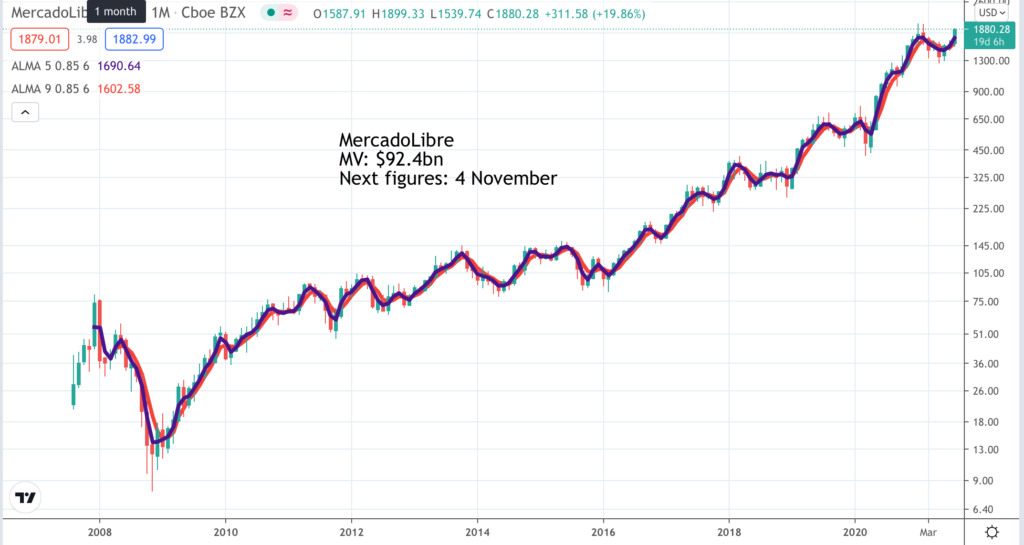

MercadoLibre. MELI. Buy @ $1836 MV: $92.4bn. Next figures: 4 November. Times recommended: 16. First recommended: $316.17. Last recommended: $1570. Highest recommended: $1925

MercadoLibre is an e-commerce and electronic payments business that could reasonably claim to be leading the digital transformation of south and Central America. This helps explain how, with a massive boost from Covid-19, it has been able to grow so big so fast and why it is still growing at an explosive rate.

The company was founded in 1999 by Marcos Galperin, who is still the CEO and studied, like the founders of so many technology success stories, at Stanford University. Again the board is stuffed with people who studied at Stanford or graduated from the famous US Wharton School of Business.

MercadoLibre has two businesses, e-commerce and e-payments with the latter growing even faster than the former. CEO, Galperin, has cautioned that the explosive triple figure growth associated with the lockdown is likely to revert to more like 30pc as conditions normalise, whenever that may happen.

The group looks well short of its likely size a decade or so into the future while being so far ahead of any competitors that it is unlikely to be caught now. On the basis that MELI is the dominant player in a continent with a population of 366m it seems to have an excellent chance of becoming a trillion dollar behemoth one day.

Sea Limited SE. Buy @ $304. MV: $155bn. Next figures: 17 August Times recommended: 14 First recommended: $79.80 Last recommended: $282.50

Sea Limited, the video games, e-commerce and fintech star of SE Asia is yet another fast-growing technology business run by graduates of top US universities like Stanford. When you consider that the population of SE Asia is 655m but Sea Limited is far and away the dominant operator in each of these fields it almost becomes unsurprising that the business is on such an explosive growth path. Sales are projected to grow from around $1bn for calendar 2018 to around $16bn for 2023.

In the latest quarter, reported in May, sales grew 147pc, gross profits grew 212pc and ebitda went from a loss of $69.9m to a profit of $88.1m. Covid may be influencing this but the company clearly expects strong growth to continue even in a post-Covid environment.

The games business, Garena, had a staggering quarter.

“Garena delivered another quarter of outstanding performance. Bookings were $1.1bn, up 117pc year on year, while adjusted EBITDA reached $717.3m, up 140pc year on year. In the quarter, quarterly active users reached 648.8m, up 61pc year on year, while quarterly paying users hit 79.8m, up 124pc year on year.

Our paying user ratio goes to reach 12.3pc, compared to 8.9pc a year ago, showing that we can grow our user base while also deepening monetization. Once again, Free Fire had a standout quarter as our focus on building out the platform with more creative and engaging content, and the user engagement activities continue to resonate with gamers around the world. Indeed, Free Fire remained the highest-grossing mobile game in Latin America, Southeast Asia, and India for the quarter according to App Annie, maintaining its top rank for Latin America and the Southeast Asia for seven consecutive quarters and achieving the same in India for two consecutive quarters.”

There is also so much in the pipeline. “Looking ahead, we continue to plan for a deep pipeline of innovative content, fresh partnerships, and exciting e-sports activities to further and better engage with our ever-growing global communities of users. We are also working to ensure that our long-term gains for forming pipeline remains strong. A significant number of our more than 1,000 in-house developers globally are constantly working on new ideas while we continue to engage with third-party game studios for collaboration on promising and complementary game development and the publishing opportunities.”

As they say FreeFire is much than just a game. It is becoming a platform.

Meanwhile the e-commerce business Shopee is also delivering supercharged results. “Shopee delivered exceptional results for the fourth quarter, building on stellar performance in 2020 as this continues to gain momentum and attract more buyers and sellers. In the first quarter, Shopee reported 1.1bn gross orders, up 153pc year on year, and a GMV of $12.6bn, increase of 103 year on year. GAAP revenue grew 250pc year on year to $922.3m.”

Despite this amazing performance CEO and co-founder, Forrest Li, says:- “We believe that e-commerce penetration remains low in our total market despite the change in digitalization since the onset of the pandemic.”

Last but not least is the phenomenal growth of the fintech business, SeaMoney. “Building upon its excellent performance last year, for the first quarter, SeaMoney’s mobile wallet services reported a total payment volume of $3.4bn, which more than tripled compared to $1.1bn a year ago. Quarterly paying users surpassed 26.1m in the quarter. We are pleased that ShopeePay continues to gain traction as the quick and the convenient online and contactless payment option. Indeed, according to Snapcart Indonesia survey in March, ShopeePay was the most used, the most remembered, and the most liked mobile wallet by Indonesian consumers during the fourth quarter.”

It is hard to imagine a more exciting business than Sea Limited as it grows explosively in South East Asia and plants footprints in Latin America and India. It is surely going to become a huge business with a market value in the trillions one day.

Upstart Holdings UPST. Buy @ $179.85. MV: $13.8b. Next figures: 10 November. Times recommended: 10. First recommended: $62.50. Last recommended: $128. Highest recommended: $179.50

Like Carvana, Upstart shares have been incredibly volatile since the company had its IPO in December 2020 at $20 per share. But this has been around a strongly rising trend with the shares up roughly ninefold since the IPO.

The company’s strategy is to use AI [artificial intelligence] to disrupt credit markets. This is an ambitious goal, to put it mildly and CEO and co-founder, Dave Girouard, says that by pursuing this strategy he expects Upstart to have a huge impact.

“They [the Q2 results] also demonstrate why Upstart has an opportunity to become one of the world’s largest and most impactful fintechs in the years to come. Lending is the centre beam of revenue and profits in financial services, and artificial intelligence may be the most transformational change to come to this industry in its 5,000-year history. It’s our view that AI-led disruption targeting dramatic inefficiency in one of the largest segments of our economy is worthy of your attention.”

This is just such a massive ambition it is almost hard to take it in but it is not just talk. Upstart is growing at a phenomenal rate. “Our Q2 revenues grew to $194m, up 60pc compared to the prior quarter. June was our first month with more than 100,000 loans and more than $1bn in origination volume on our platform. And we achieved this growth while also delivering record profits with adjusted EBITDA of $59.5m and GAAP net income of $37.3m. We’re also happy to report that more than 97pc of our revenue came in the form of fees from banks or loan servicing with 0 credit exposure or demands on our balance sheet.”

Note that this is not revenue growing 60pc year on year but 60pc from the previous quarter. Year on year the figures are ridiculous. As the finance director noted. “Revenues in Q2 came in at $194m, up 60pc quarter over quarter from Q1 of this year. As a side note, we will omit references to year-over-year growth rates for our P&L this quarter as they are all well above 1,000pc due to the lapping of last year’s pandemic impact.”

Upstart uses artificial intelligence to help banks to offer personal loans more efficiently. Its software looks at a lot of data, including the traditional FICO scores and uses this not just to offer loans more efficiently (to people who otherwise might not have qualified and at better rates) but to learn from the data to become even more efficient in the future.

Unlike Upstart, banks who use Upstart’s software and pay them fees are risking their capital so it is understandable that they are on a slow learning curve, However it is happening. One bank has recently taken the important decision not to make the FICO score a hurdle when using Upstart’s software to make loans. As and when more banks do this that could have a significant impact on the group’s growth and credibility.

Personal loans are a huge market but the group is already ramping up to address an even bigger one, auto loans. These are different because, unlike personal loans, auto loans are secured against a car. But Upstart says there are still massive inefficiencies and ample scope for AI to deliver better outcomes.

As usual with would-be disruptors like Upstart this is all about the battle for territory. They are moving fast because they want to stake out the territory and make the fullest possible use of their first mover advantage.

Again the management team is extremely impressive. Paul Girouard was formerly president of Google Enterprise. Another co-founder, Paul Gu, was a Thiel Fellow (as in Peter Thiel, one of the founders of PayPal) which is a very special accolade. The third co-founder, Anna Counselman, was formerly head of premium services and customer programmes at Google.

The growth in the business has been staggering. Total revenue in calendar 2017 was $57m. Sales are expected to roughly treble this year and reach $1.12bn by 2023.

And these may be conservative estimates given the group’s plans to ramp up its auto lending operations.

“We started in January, offering our auto refinance product in a single state, then expanded to 14 states by the end of Q1 and have now expanded to 47 states, covering more than 95pc of the U.S. population. We’ve also improved our funnel conversion rate about 100pc since the beginning of the year despite expanding from states with minimal funnel friction to those with the most. This is critical because funnel efficiency is the primary way we’ll scale up auto loan originations, just as we’ve done historically with personal loans.

Upstart-powered banks have now originated more than 2,000 auto refinance loans in 40 different states. And these loans are beginning to provide the repayment data that is the fuel to our AI models. And lastly, we now have our first five banks and credit unions signed up for auto lending on our platform. We’ve also made fast progress on our automotive retail solution, today, known as Prodigy Software.

Since the beginning of the year, we have doubled the number of dealerships, aka rooftops, using Prodigy. And in Q2, more than $1bn in vehicles were sold through Prodigy. We expect the first Upstart-powered loan to be offered through this platform before the end of 2021.”

The company is also getting really serious in its recruitment strategies.

“In June, we announced that Upstart is moving to a digital-first model, where most Upstarters can live and work anywhere in the U.S. We came to this decision for a few reasons. First, we’ve shown we can work well remotely as a team. The arguments against remote work tend to be historical rather than backed by real facts or data.

Second, the tech world feels like it’s on a multiyear transition toward work-from-anywhere, and we want to be ahead of the curve. Third, we believe the benefits of in-office work can be captured in just a few well-considered days together each month. And fourth, given the scale of our ambitions and the talent we need to aggressively pursue our goals, we need to tap into talent across the entire country. The good news is Digital First has paid immediate dividends to our recruiting efforts.

Though we announced this plan just a couple of months ago, over a third of our job offers in the past few weeks have been to candidates outside our footprint. And we’ve seen an acceptance rate of 80pc to these offers, a dramatic improvement over what we’ve seen historically. Digital-first is not just a reaction to the last year and a half. It’s a sign that we intend to create one of the largest and most impactful fintechs in the world.

We’re building a company that will be distributed not just physically, but logically, able to pursue multiple markets and business opportunities at the same time. We need extraordinary talent and the leadership to do this right. And digital-first will enable us to find that talent wherever it may be. Digital-first may help us recruit talent wherever it resides, but it’s our culture and mission that will keep it here.

We aim to be the go-to employer for those driven to build the most modern of technologies, artificial intelligence, to solve one of the most intractable problems, financial inclusion. To do this, Upstart must be widely recognized as a destination company for those destined to have real impact on the world while experiencing unparalleled career growth. In this theme, we were recently honored to be included in the Gender Diversity Index by State Street Advisers, recognizing Upstart’s role as one of the top companies in the U.S. for women in leadership.“

Goodness knows what is the right price for the shares but Upstart seems to me a phenomenally exciting business and a must-own investment.

One of my simplest investment rules is that in order to become very large in a relatively short period of time a company must grow very fast. The four companies featured above embody that rule and given the size of the markets they are addressing and the incredible momentum in the businesses they could become very large indeed.