FCSS/ Fidelity China Special Situations – a brilliant way to invest in the growth of the Chinese economy

Fidelity China Special Situations FCSS Latest: 373p New entry

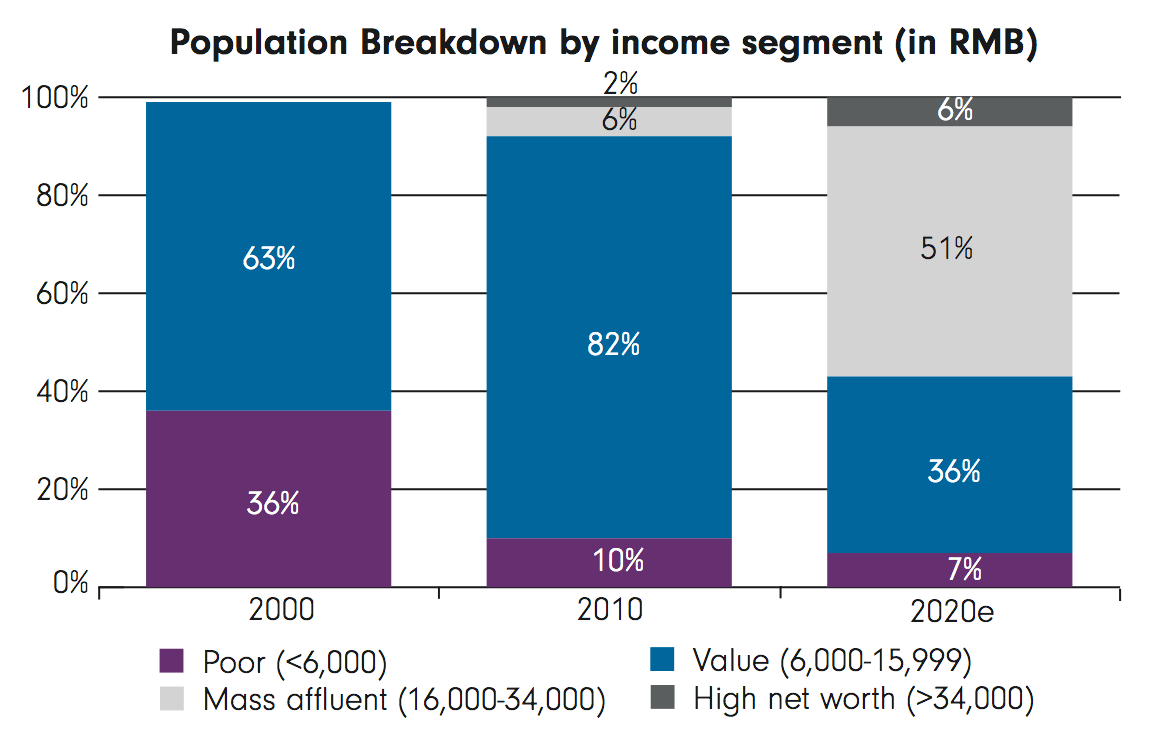

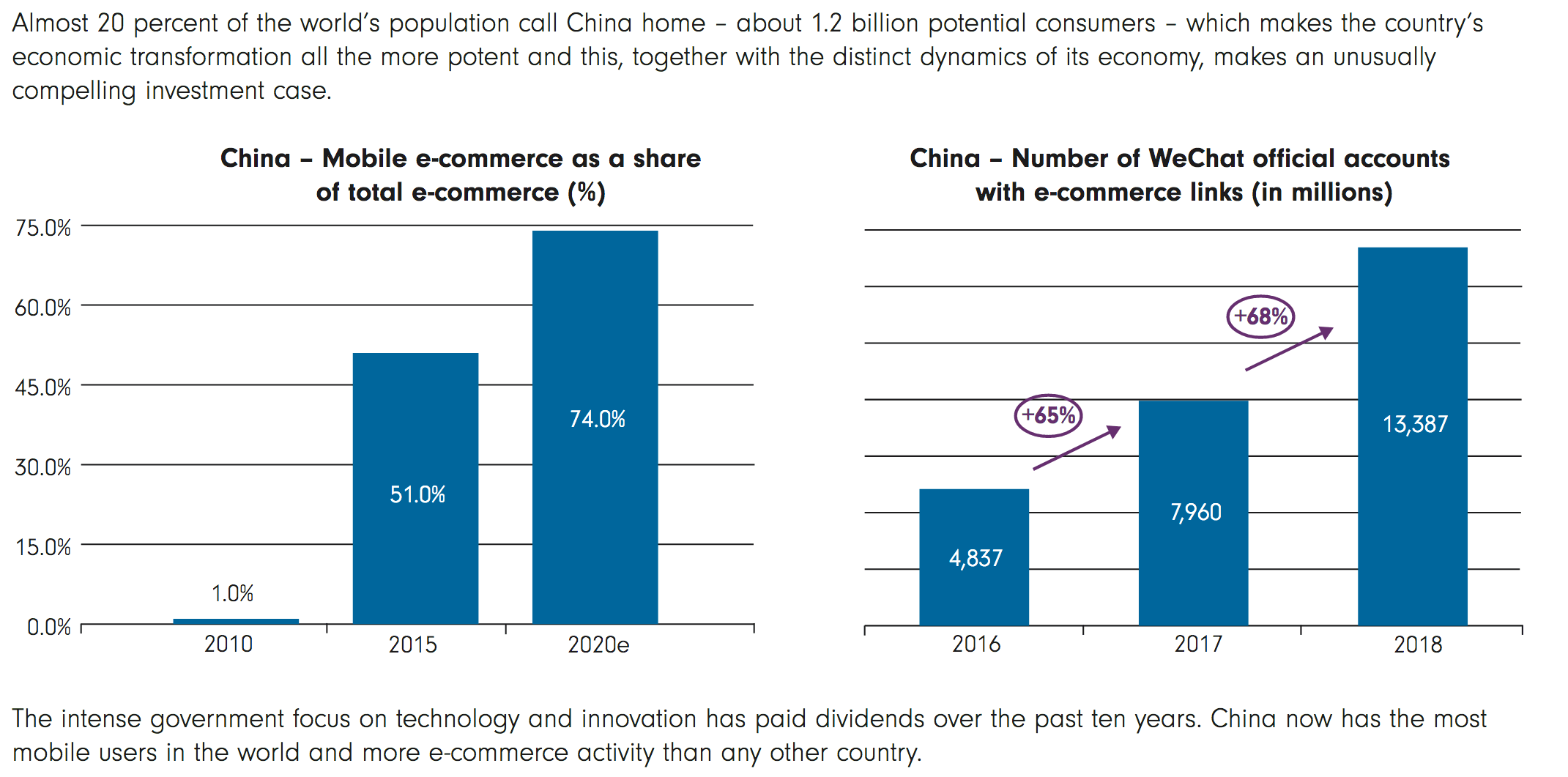

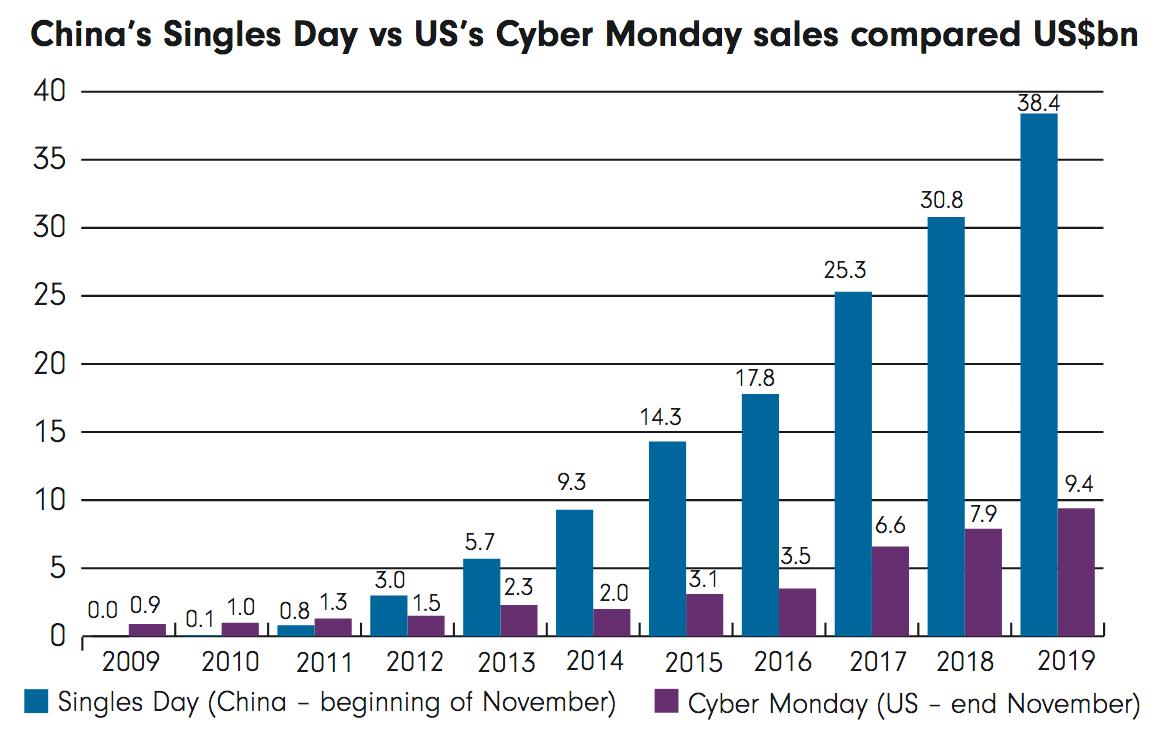

The charts below are taken from the 31 March 2020 annual report for FCSS. They paint a vivid picture of the incredible transformation of the Chinese economy, which has taken place over the last 20 years. Even in the last decade the change has been dramatic with the number of mass affluent rising from six per cent of the population to 51pc and high net worth individuals rising from two per cent to six per cent. It’s like the transformation of wealth that took place in Victorian England in the 19th century but instead of taking a century it has happened in one or two decades.

FCSS’s strategy is focused on this transformation. They buy shares in companies that benefit from rising domestic consumption and advancing technology, precisely the developments highlighed by these charts.

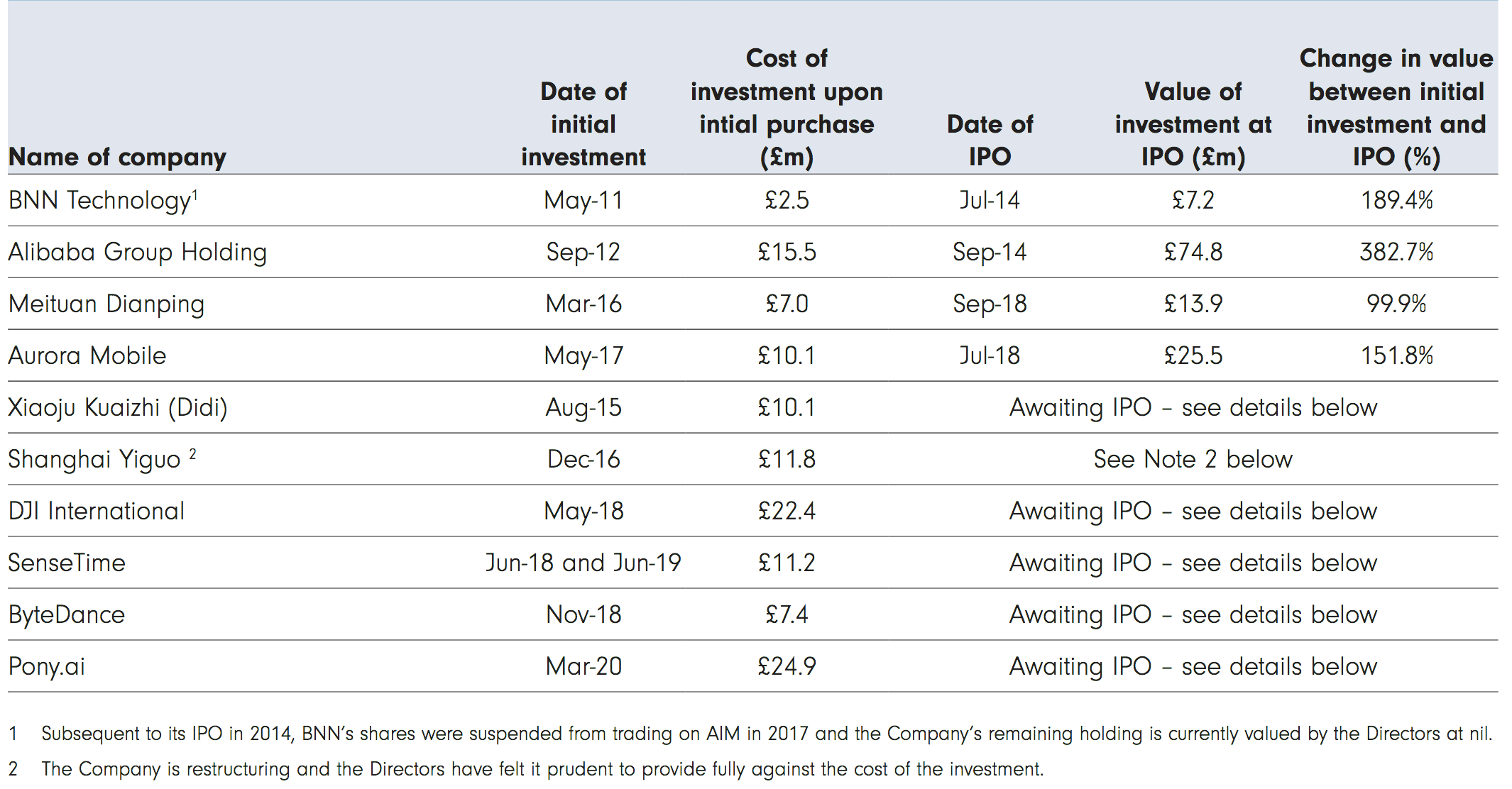

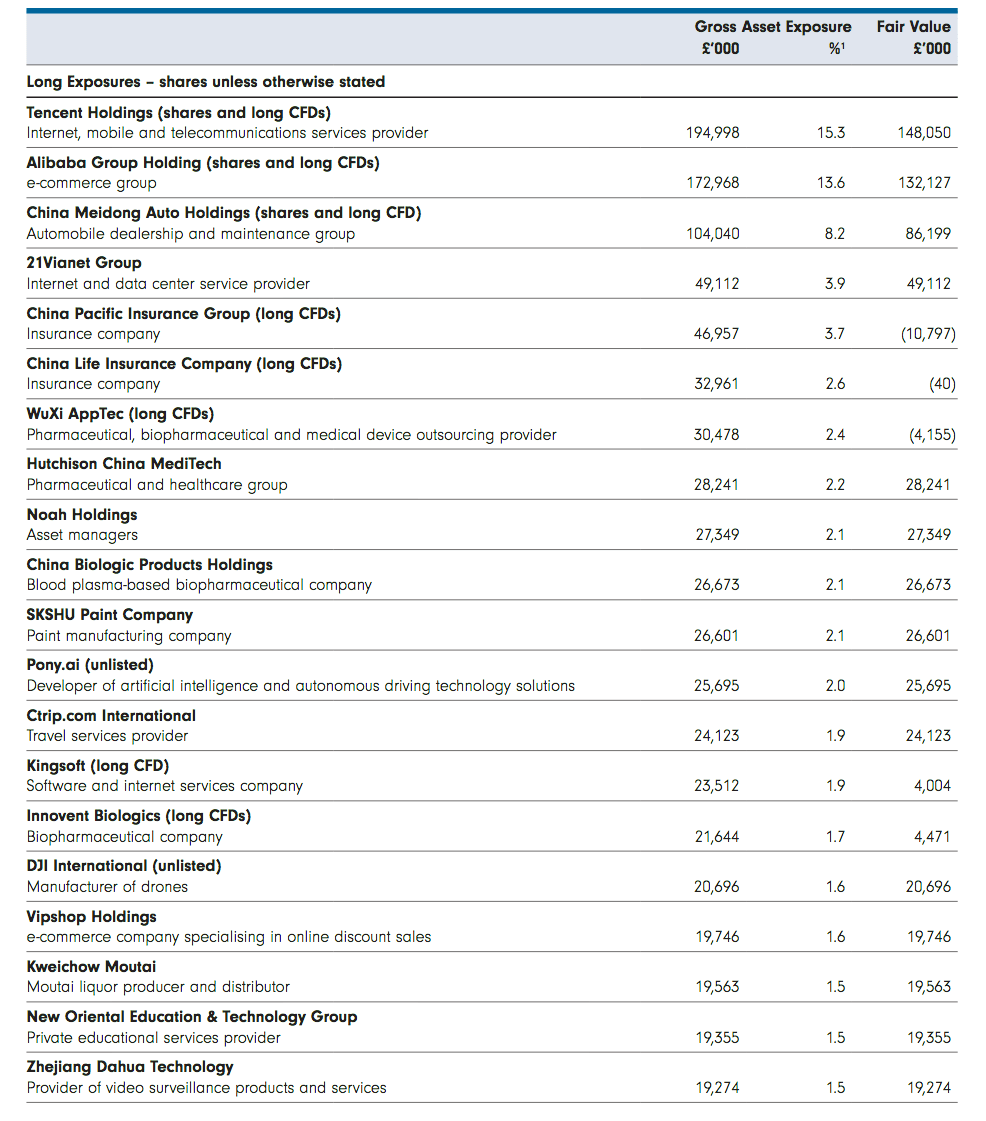

The investment trust uses leverage (currently around 25pc with a permitted ceiling of 30pc) to enhance returns and also invests up to 10pc of the portfolio in unlisted shares. A successful past investment was now-quoted Alibaba and some of the current unlisted investments offering exposure to social media, artificial intelligence and autonomous driving technology look very exciting.

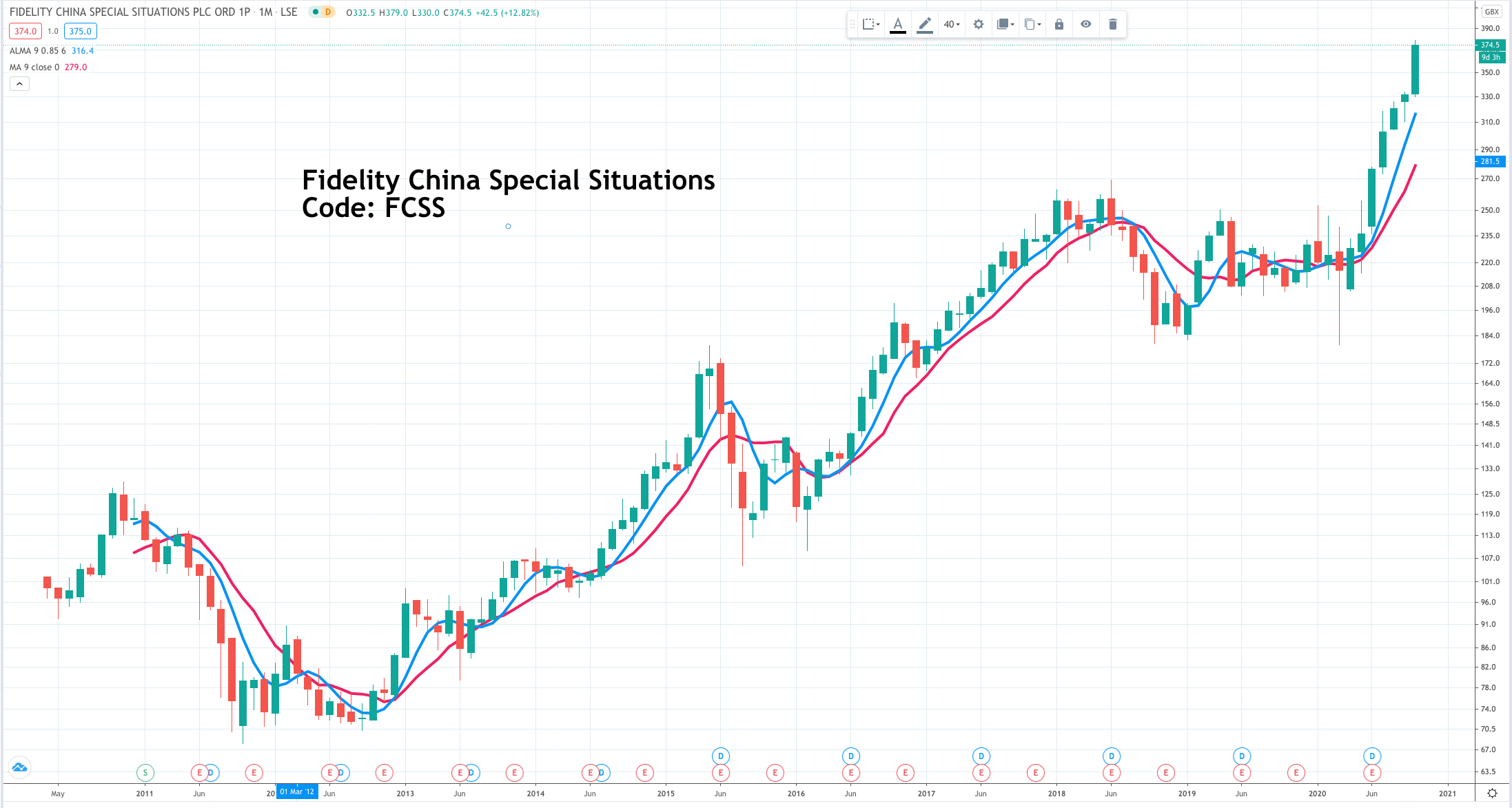

The trust has done well in the past as can be seen from the share price and given the outlook for the Chinese economy, especially domestically, the outlook remains positive.

FCSS is an investment trust, not an ETF so it is actively managed by a team led by Dale Nicholls, who has been in charge since 2014. He is very optimistic on prospects, which is encouraging given what he has achieved over the past six and a half years.

Investment trusts often trade at a discount to underlying net asset value. FCSS is committed to keeping this discount around eight per cent and regularly buys back shares if the discount starts to widen. This reduces the number of shares in issue boosting net asset value for those which remain so is another factor driving the shares higher over time.

Last but not least the company pays dividends and has raised the dividend ever year in its 10 years of existence.

I think it is a good one, well worth investing in and offering a direct way of benefiting from the growth of the vast Chinese economy.

The shares have been particularly strong recently with net asset value rising 50.2pc in the 12 months to 31 August 2020 helped by a very strong performance by Meidong Auto, a high conviction holding in the portfolio. Meidong Auto sells luxury cars like Porsche, BMW and Lexus into the domestic Chinese economy. It has been growing rapidly helped by adding more outlets both from greenfield and by acquisition and by raising profit margins as it boosts sales across the network. I had a look at the company, which has this ferocious focus on efficiency, which is what is delivering its powerful growth.

It is the likelihood that there will be more successful investments like Meidong Auto in the future that adds to the case for buying FCSS shares. One of their unlisted investments about which they are clearly excited is Pony.ai, which was founded in 2016 by two former developers at Baidu, is based in California and is making amazing progress with autonomous driving technology. If they can take that into the mainstream it could be huge.

Even before I came across FCSS my interest had been growing in Chinese investments. The Chinese economy seems to have dealt with Covid-19 very well, seems to charge on regardless of the state of relations with the US and the performance of the domestic economy is one of the wonders of the world, probably explaining while there is so little criticism of the authoritarian regime.

The Chinese economy overtook the USA in absolute terms in 2017 but in terms of income per capita it is still way behind. US incomes, adjusted for domestic prices are still over three times Chinese incomes. China remains behind countries like Brazil but it is growing faster.

My guess is that eventually it will catch up with the US. Even if that is too aggressive an expectation there is still huge scope for Chinese domestic consumption to grow dramatically, which underpins the investment case for FCSS.

While we are having issues with the website this copy is being posted on the web site and sent via Mailchimp.