Covid virus refuses to die and digital transformation proceeds apace

Investing in the stock market is never straightforward because indices and even individual shares climb a wall of worry. If it looks like a sure thing it is probably a trap. Yet amid all this uncertainty indices, especially in the US and many individual stocks make incredible progress over time. Investors find it difficult because this process does not happen in a straight line but in bursts of strength interspersed with periods of weakness. All the time there is a chorus in the media and by self-proclaimed experts and other commentators with wildly differing views on what is going to happen next. It can become very hard to see the wood for the trees.

At the present time some indices and some important stocks are making powerful upward progress but many stocks are struggling including many stocks which were particularly strong in 2020 but which are finding it hard to make substantial progress in 2021. Meanwhile the stocks like those in travel, events and hospitality which suffered most from lockdown are recovering on successes like the vaccination roll out and then relapsing because Covid cases fall away and then start climbing again. Covid is like some infernal monster which keeps resurrecting no matter hw many times you plunge a dagger into its heart. It seems at times that we will never recapture the easy mobility and social gatherings of the pre-Covid era, when there is a new variant around every corner.

My belief is that digital transformation and the accelerating progress of the technology programme is the most important thing happening in the world and will be for the foreseeable future. This is changing the way businesses and individuals operate and relate to each other. It is driving a productivity revolution which means that inflation may bubble up sometimes but will never again be the threat it posed in the past and it is marching hand in hand with and facilitating an incredible process of globalisation.

Companies go from start up to disrupting their local market to going global with unprecedented speed. We can see this with the success of Revolut which is already much used by my children. The company was founded by a guy with a Russian name in 2015 because he was fed up with being ripped off by the banking system on currency exchanges, was valued around $5bn a year ago and has just done a further funding round as a private company which valued it at $33bn.

If it floated with a good story, as it presumably would, a buying frenzy might easily drive that valuation to $100bn – in barely more than five years! This is exciting but also scary. It is understandable that investors might look at the progress if this were to happen and have two thoughts (a) this is a phenomenally exciting business and (b) the valuation is wildly overcooked. The shares then become very volatile and may fall back dramatically from that $100bn as investors take stock and overreact on the downside until they find a level from which further progress can be made.

This process may well be happening in many areas of the stock market. Shopify is a wonderful business. It was founded in 2006 as a way to help businesses get online quickly, easily and cheaply. It now has over 1.7m business customers to whom it offers a widening range of services and is in partnership with other giant concerns like Facebook and Wal-Mart. There is little doubt that it has an exciting future with sales projected to reach $8bn by 2023 v $1bn in 2018.

Every time I read about what they are doing and their plans for the future I come away as excited as they must be. The problem is to determine what all this excitement is worth. Even on the projections the PER in 2023 will be 364. The present market value of $179bn is 40 times projected sales for calendar 2021. These valuations are uncharted territory for investors used to the days when great growth stocks were valued at 20 times earnings, not 40 times sales. But then again never before have we had these incredible growth rates sustained for decades.

Amazon. Alphabet, Apple, Microsoft and now Facebook have shown the way by climbing to trillion dollar valuations within the lifespans of the individuals who founded these businesses and in some cases are still young. It is no wonder that investors don’t know whether the shares are still incredibly cheap as Shopify scales to a size which might well justify a trillion dollar plus valuation sometime later this decade or incredibly dear as growth eventually slows and investors take stock.

I’m with the bulls but I can understand why sentiment and the share price veer up and down as investors struggle to find a happy medium which balances all the possibilities in a fast-moving world. In 2016 you could have bought Shopify shares for $16. The latest price is $1,442. It takes a huge amount of fresh investor interest to keep the shares climbing when there are so many investors sitting on huge profits ready to jump ship on signs of weakness.

The usual response is a prolonged period of backing and filling as investors take profits while new investors climb on board. Eventually the selling is exhausted and as long as the story remains intact the shares will be able to move ahead. Before then there may be a number of false starts as the shares head higher, look promising but then the price is hauled back by yet more profit-taking.

My guess is that this is what is happening now with Shopify and a number of other exciting enterprise software names. They needed to pause for breath sometime and maybe that time is now. For Shopify I believe it is indeed a wonderful business, that eventually the profit taking will dry up and the price will move meaningfully higher. I even think that one day Shopify will be worth $1 trillion or more so for long term investors buy, hold and buy more on fresh buy signals is the way to go but it can be a bumpy ride.

Big tech offers more obvious value

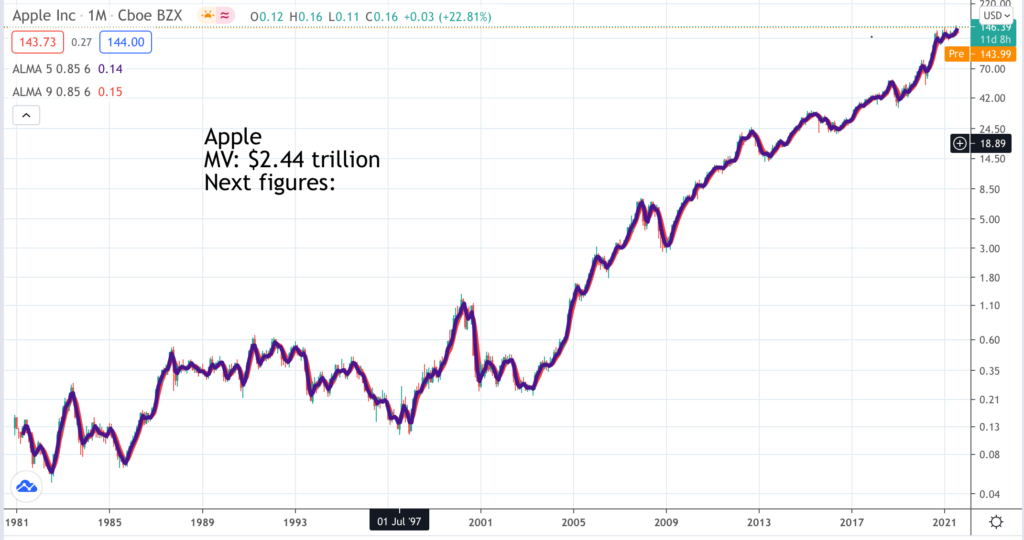

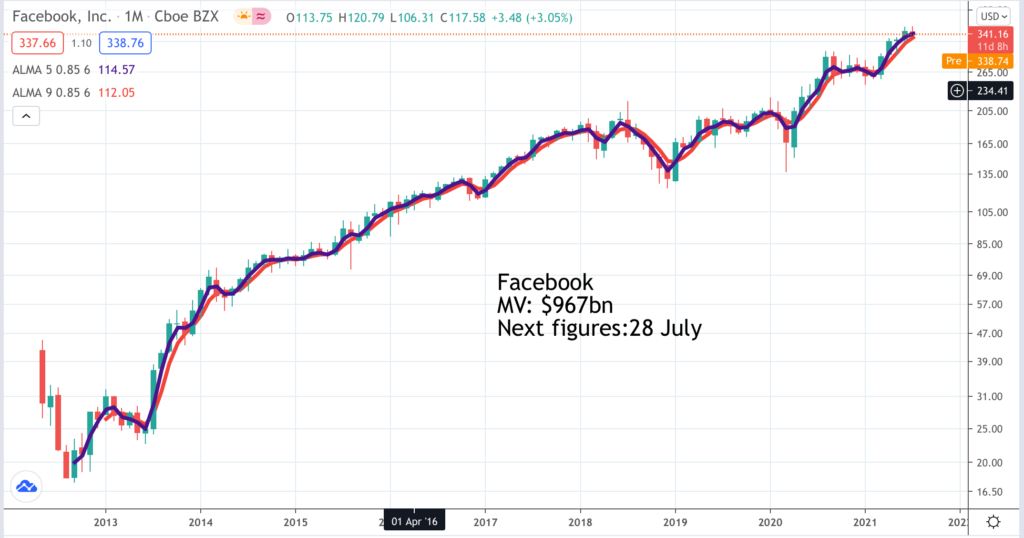

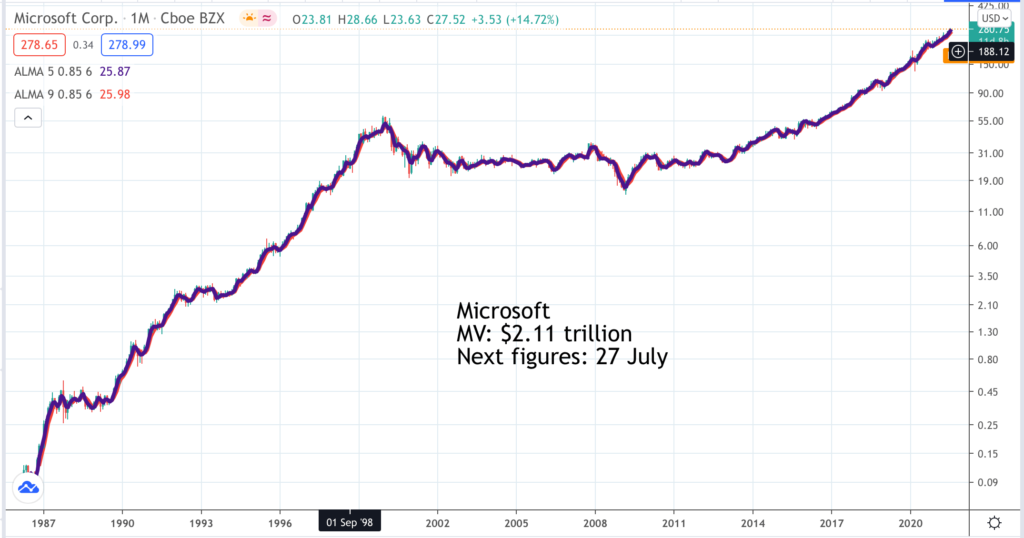

Some of the best looking charts in the stock market are those of the shares of the technology giants. I have been saying for ages that the charts of Apple and Amazon look very promising . Recently both have punched higher out of lengthy periods of consolidation. Other big techs like Alphabet, Microsoft, Facebook, Nvidia, Adobe and Netflix all have strong charts.

These companies have matured to the stage where growth is slower but still impressive while valuations are much less demanding. They are also typically generating cash in staggering quantities. Apple is expected to have free cash flow this year of approaching $100bn. This means it is able to fund dividends and massive share buybacks giving the shares a strong upward bias.

Other companies are doing the same. Just as a reminder share buybacks mean fewer shares in issue raising earnings per share and making each remaining share more valuable. Companies like Mettler-Toledo, which makes devices like pipettes for laboratories, have delivered extraordinary results for shares holders by recycling free cash flow into share buybacks over many years. It is a very powerful way of rewarding loyal shareholders and an increasingly significant factor driving the whole US stock market higher.

Technology is also popping up all over the place to create winning shares and sectors. One group doing very well is IT consultancies like Accenture, Epam Systems, Globant and ServiceNow. it makes sense. The consultancies are great launching pads for a career in IT/ business so attract top quality graduates. Demand in an era of digital transformation is insatiable and their charge-out rates deliver high margins and profits. Accenture is approaching a $200bn valuation with no sign of any loss of momentum.

Another attractive group in a world where huge pools of savings are looking for a home is the companies that supply the infrastructure of the stock market and other areas like the booming ETF market. This involves companies like Morningstar, MSCI, Nasdaq Inc. and S&P Global, whose shares have been storming higher for years. It included London Stock Exchange Group until they warned that their recent chunky acquisition of US data provider, Refinitiv, was going to add to costs and be a short term negative to profits. Most likely this effect will be temporary and the shares will resume their climb.

What I have noticed from building the QV for Shares portfolio over the four years since mid-2017 is that an amazing number of shares do recover after periods of decline and high volatility. Hopefully this reflects an effective selection process. I am looking for shares which are 3G (great chart, great growth, great story) with some extra magic and ideally new and important developments coming through to further boost progress.

Business is always an obstacle course so they cannot be hitting the ball out of the park all the time but as long as the overall progress is impressive, which it mostly is, the shares will make progress.

This has led to the development of QV as an ecosystem with different publications profiling exciting stocks, looking for chart breakouts (the job of Great Charts) and alerting on stocks that look timely to buy, which are new to the portfolio or have an exceptional story driving their growth. This will often include something new. When the something new is big enough it can have a massive impact on share price performance over a long period. Moderna is benefiting from its role in supplying vaccines against Covid 19 but it is also seeing great share price outperformance because its success against Covid has validated the mRNA technology on which it has bet so heavily. It suddenly found itself in the right place at the right time and has moved brilliantly to take advantage.

The core of the QV approach is good stock selection to build a portfolio of recommended shares that are all quality growth with huge potential. If the stock market was a Formula I event the vast majority of quoted shares are not even participating. Every stock in the QV portfolio is Formula 1 or at least that is the plan.

This in turn has given rise to my never sell approach. If the shares are that good the best way to make long term gains is to do what the owners do and never sell (albeit they may trickle shares out over time to fund their other ventures). Buy and hold is another axiom at the heart of the QV approach.

I also like to re-recommend shares on subsequent buy signals. This is partly a process of pyramiding to concentrate funds in the best performers. It is also a way of taking advantage of periods of general market weakness. One of my golden rules is that macro weakness driving the whole stock market down always generates buying opportunities for quality stocks. However I never try to catch a falling knife. Hence my mantra of waiting for buy signals.

Something I am looking at is the idea that the absence of a buy signal is a sell signal. Instead of just holding a stock you would buy and sell continually based on successive signals. But my gut feeling is that overall it does not work. It will produce some great results where a stock flies high and then crashes to earth but if stocks are just pausing for breath it just seems to involve much sound and fury signifying nothing so my preference is very much buy and hold or accumulate and hold for more cautious investors. If the stock selections are good either approach or a mixture of the two will work very well.

The game changer for a strategy of slow accumulation is the rise of share dealing platforms that provide zero or very low commission on dealing and permit fractional investing. Instead of buying Amazon shares in traditional units of at least one share (costing $3,500 plus) fractional investing means you choose how much you want to invest which can be any amount.

In the past choosing a low amount would have been uneconomic because of the need to pay high minimum commissions. Zero commission means the only issue is the spread between the offer price (for buyers) and the bid price (for sellers) and this is typically minimal, especially on most US shares and has to be paid however much you are investing.

Zero commissions, fractional investing and the availability of so much free information about companies on the Internet has levelled the playing field between retail and propfessional investors, which is attracting an army of diy investors into global stock markets. This in turn is contributing to volatility, fads and other investment phenomena but overall seems to me like an exciting development.

The charts in this issue focus on the big stocks, mostly US-quoted. keeping the indices climbing. I also throw in some smaller names (not charted) which look exciting.

Accenture. ACN. Buy @ $308

Adobe ADBE. Buy @ $601

Alphabet. GOOGL Buy @ $2498

Amazon AMZN Buy @ $3527

Apple AAPL Buy @ $143

ASML. ASML. Buy @ $674

Facebook. FB. Buy @ $336

Intuit. INTU. Buy @ $496

Intuitive Surgical. ISRG. Buy @ $934

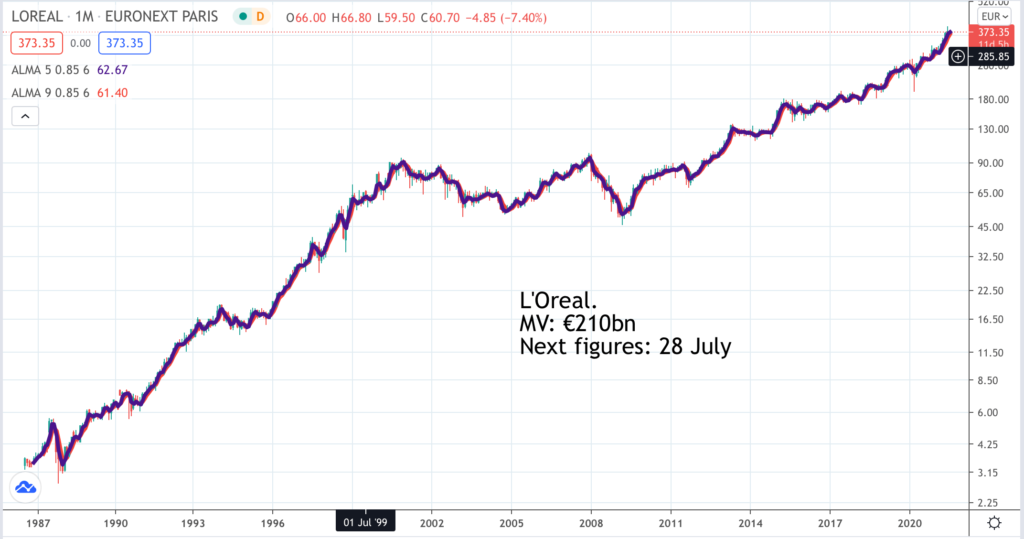

L’Oreal OR. Buy @ €371

LVMH LVMH. Buy @ €640

Microsoft MSFT. Buy @ $278

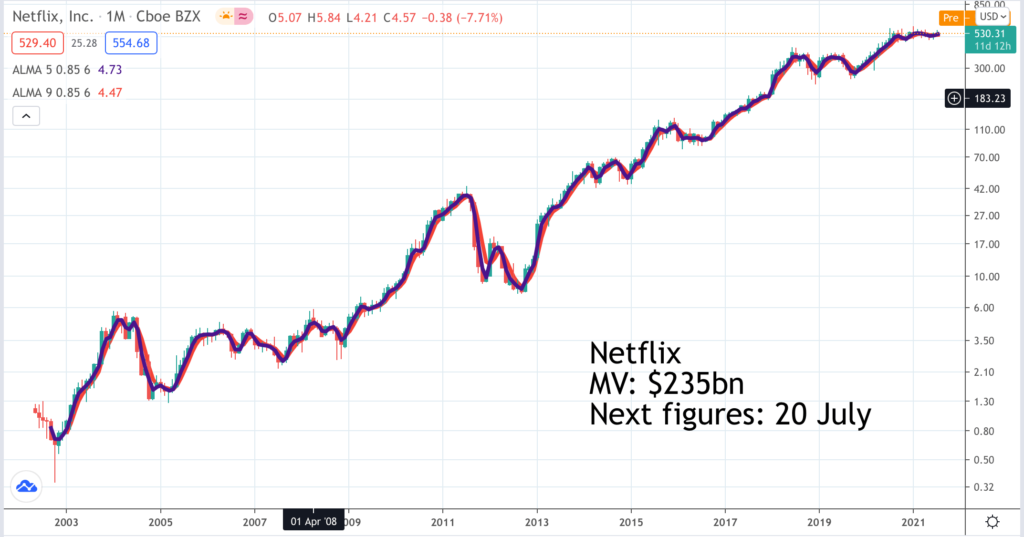

Netflix NFLX. buy @ $525

Nike NKE. Buy @ $158

Nvidia. NVDA. Buy @ $725

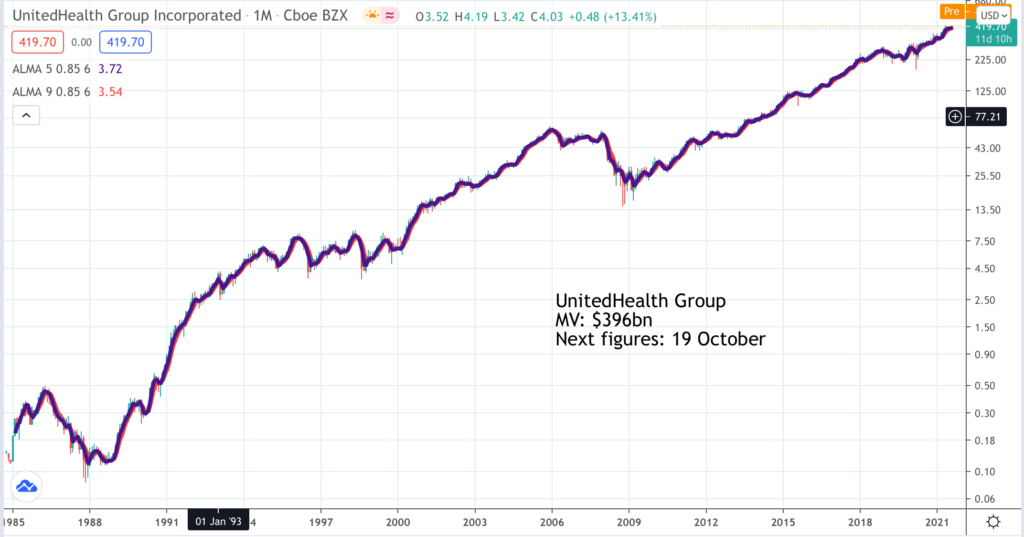

UnitedHealth Group. UNH. Buy @ $418

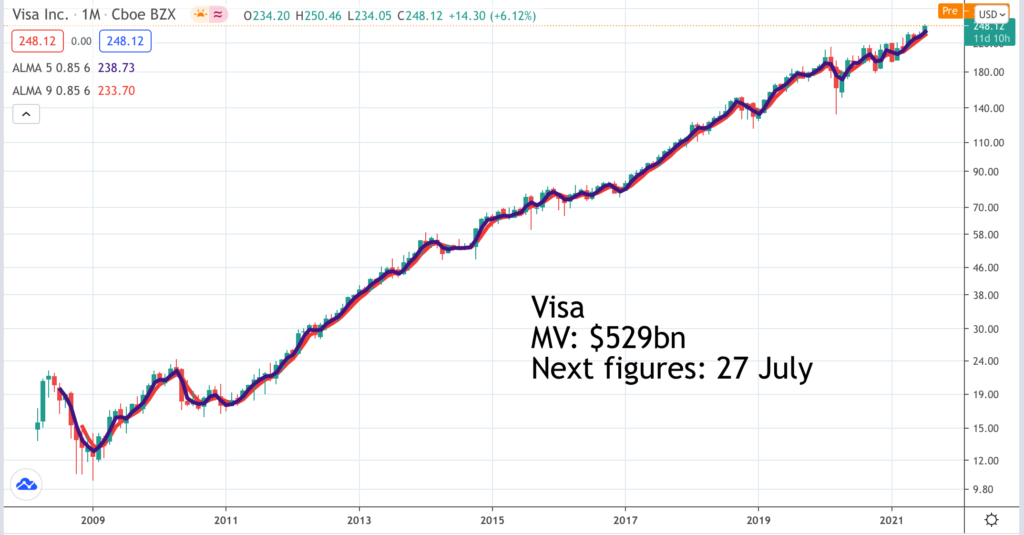

Visa. V. Buy @ $240

Other recommendations (see last page)

Accenture. ACN. Buy @ $308. Next figures: 24 September

Accenture is a giant IT consultancy which is riding a wave of global digital transformation. “We had a record 20 clients with bookings over $100m and a total of $15.4bn in bookings. We delivered 16pc revenue growth in local currency, 3pc above the top of our guided range with outstanding profitability and free cash flow. We estimate that we continue to take significant market share. Our growth was broad-based across geographic markets and industries with 11 out of 13 industries growing double-digits this quarter and reflects our ability to bring together our unmatched breadth of services from strategy and consulting to interactive technology and operations to create the solutions, which achieve the value at speed that makes a difference to our clients.” The growth for such a large business is staggering. “We continue to meet our clients’ strong demand adding a net 32,000 talented people this quarter alone.” Nor is it just organic. “We now expect to invest about $4bn in strategic acquisitions this fiscal year with 39 acquisitions closed or announced year-to-date. This includes announcing this quarter two acquisitions with purchase prices over $1bn each.” As they say. “We invest in acquisitions to scale in areas where we see a big market opportunity to add skills and new capabilities and to further deepen our industry and functional expertise, all to drive continued innovation in the next waves of growth.”

Adobe. ADBE. Buy @ $601. Next figures: 21 September

These giant companies say it all in their reports. “Adobe had another outstanding quarter as the shift to a digital-first world continues to accelerate. From students to creative professionals to small businesses to the world’s largest global enterprises, digital is transforming how we work, learn and play. Adobe’s mission to change the world through digital experiences has never been more relevant. Our strategy to unleash creativity for all, accelerate document productivity and power digital businesses is working. Fueled by our ground-breaking innovation, proven capability to create and lead categories and our expansive global customer base, our opportunity and momentum has never been greater.” The growth being delivered for such a large business is extraordinary. “In Q2, Adobe achieved $3.84bn in revenue, representing 23pc year-over-year growth.” The opportunity is immense. “Adobe is the leader in core creative categories such as imaging, design, video and illustration, and we are expanding our leadership in exciting new media types, including screen design and prototyping, 3D and AR.” Adobe is all about using technology to unleash creativity and store the results in its even faster growing (+30pc) document cloud business. Like all the companies charted in this issue if it it not already a trillion dollar business it will be.

Alphabet. GOOGL. Buy @ $2498. Next figures: 27 July

On top of its outstanding ad-driven Google Search and You Tube businesses, Alphabet saw its cloud revenues grow by 46pc in the latest quarter. The growth across the business was staggering. “For the first quarter, our consolidated revenues were $55.3bn, up 34pc, or up 32pc in constant currency, reflecting elevated consumer activity online and broad-based increases in advertiser spending within Google Services, as well as ongoing strength in Google Cloud….Operating income was $16.4bn, up 106pc. And our operating margin in the quarter was 30pc” This is leading to almost unprecedented balance sheet strength and free cash flow metrics. “Operating cash flow was $19.3bn, with free cash flow of $13.3bn in the quarter and $50.7bn for the trailing 12 months. We ended the first quarter with $135 billion in cash and marketable securities.” Not surprisingly the group says – “We still intend to invest aggressively to support the extraordinary opportunities we see.” These formidable financial metrics are enabling the group to be generous with shares holders while investing in growth. “Finally, with respect to capital allocation, our primary use of capital continues to be to support organic growth in our businesses, followed by retaining flexibility for acquisitions and investments. We complement these growth drivers with a return of capital. As we indicated in our press release today, our Board has authorized the repurchase of up to an additional $50bn of our Class C stock.”

Amazon. AMZN. Buy @ $3527. Next figures: 29 July

Amazon is yet another Internet giant with a valuation fast approaching $2 trillion, which is still managing to grow at an extraordinary rate. “In the first quarter, AWS [Amazon Web Services – the cloud infrastucture and services business] revenue growth accelerated across a broad range of customers. During COVID, we’ve seen many enterprises decide that they no longer want to manage their own technology infrastructure. They see that partnering with AWS and moving to the cloud gives them better cost, better capability and better speed of innovation. We expect this trend to continue as we move into the post pandemic recovery. There’s significant momentum around the world, including broad and deep engagement across major industries.” Meanwhile the consumer business is also growing fast. “Turning to the consumer business, we continue to see strong customer demand globally in the first quarter. Revenue growth in our international segment grew 50pc on an FX-neutral basis year over year in Q1 as restrictive regional and national lockdowns were in place throughout the quarter, particularly in the UK and Europe. In North America, revenue growth of 39pc largely reflects the continuation of demand trends that we have seen since the early months of the pandemic. Third-party sellers were largely comprised of small and medium-sized businesses, continue to see strong sales and serve more customers.” Prime is also booming. “Over the past 12 months, Prime Video streaming hours were up over 70pc year over year.”

Apple. AAPL. Buy @ $143. Next figures: 27 July

Apple is another giant growing at an astonishing rate. “Apple is proud to report another strong quarter, one where we set new March quarter records for both revenue and earnings, besting our year ago revenue performance by 54pc.” It’s obvious that millions, even billions of people, like my family, use Apple products for everything – iPhones, MacBooks, iPads, AirPods, apps and services like iTunes. If they ever did launch an Apple car I am sure it would be greeted with huge enthusiasm by their massive global fan club. None of my family yet has an Apple Watch but many people do. “It was a quarter of sustained strength for wearables, home and accessories, which grew by 25pc year over year. Apple Watch is a global success story, and the category set March quarter records in each geographic segment, thanks to strong performance from both Apple Watch Series 6 and Apple Watch SE. It’s an exciting and busy period ahead for wearables, home and accessories with the launch of the next-generation Apple TV 4K and our newest accessory, AirTag. AirTag builds on the powerful and incredibly useful Find My experience, helping users privately and securely keep track of the items that matter most to them.” The scale at which Apple is operating s also staggering. “Over the next five years, we will invest $430 billion, creating 20,000 jobs in the process. The investments will support American innovation and drive economic benefits in every state, including a new North Carolina campus and job creating investments in innovative fields like silicon engineering and 5G technology.”

ASML. ASML. Buy @ $674. Next figures: 21 July

ASML is the king of machines to make printed circuit boards. “The photolithography machines manufactured by ASML are used in the production of computer chips. In these machines, patterns are optically imaged onto a silicon wafer that is covered with a film of light-sensitive material. This procedure is repeated dozens of times on a single wafer. The photoresist is then further processed to create the actual electronic circuits on the silicon. The optical imaging that ASML’s machines deal with is used in the fabrication of nearly all integrated circuits, and as of 2010, ASML has 67 percent of the worldwide sales of lithography machines.” Business is going well, not surprisingly given widespread reports of shortages of semiconductors. “We are seeing a significant increase in demand from our customers across all market segments and all nodes, mature and advanced, compared to 3 months ago and we expect another very strong year with demand across our entire product portfolio.” You can see what is happening. “Last quarter we expected revenue from Logic in 2021 to be up 10pc year-on-year. However, we now expect Logic to be up around 30pc this year. In Memory, the applications that are driving the strong Logic demand are also fueling demand for Memory. As we mentioned in earlier calls, the Memory recovery started last year and continues to strengthen as customers’ plans to increase capacity are driving significant demand for our systems in the second half of the year. Compared to last quarter where we expected revenue from Memory in 2021 to be up 20pc year-on-year, we now expect Memory revenue to be up around 50pc this year.” Long term looks good too. “For the industry as a whole, the long-term demand drivers only increase our confidence in our future growth outlook towards 2025.”

Facebook. FB. Buy @ $336. Next figures: 28 July

The sheer scale of Facebook is amazing. “This was another strong quarter. More than 2.7bn people now use one or more of our apps each day, and more than 200m businesses use our tools to reach customers.” Facebook is playing a long game. “Over the past couple of quarters, our business has been performing better than we expected. And this has given us the confidence to increase our investments meaningfully and in a few key areas that have the potential to change the trajectory of the company over the long term. So on today’s call, I’m going to talk about the opportunities that we’re pursuing in augmented and virtual reality and around commerce, business messaging, and creators. So first, let’s talk about building the next computing platform. I believe that augmented and virtual reality are going to enable a deeper sense of presence in social connection than any existing platform. They’re going to be an important part of how we will interact with computers in the future. So we’re going to keep investing heavily in building out the best experience this year, and this accounts for a major part of our overall R&D budget growth. Quest 2 (wireless Oculus Quest virtual reality headset) is doing better than we expected, even after the holiday season.” Facebook is using its massive financial firepower on developments which will literally change the world. “Over time, I expect augmented and virtual reality to unlock a massive amount of value, both in people’s lives and the economy overall. There’s still a long way to go here, and most of our investments to make this work are ahead of us.” The company is also moving strongly into e-commerce.

Intuit. INTU. Buy @ $496. Next figures: 26 August

Intuit, which specialises in accountancy software for SMEs (small and medium sized enterprises) and individuals is another large US based business enjoying strong trading. “We had a very strong third quarter. Small Business and Self-Employed Group revenue accelerated to 20pc this quarter, and Credit Karma [sourcing affordable loans] performed very well with revenue at an all-time high for the quarter. Our tax results through the May 17 IRS tax filing deadline reflect another strong season. As a result, we are raising our revenue, operating income, and earnings per share guidance for fiscal year 2021.” In newer categories of business growth is especially strong. “Within the do-it-yourself category, we continued to double down on underpenetrated segments, including LatinX, Self-Employed, and investors. We saw a significant acceleration in investor customer growth this season, and expect it to more than triple over last year. We expect the base of customers paying us nothing to grow 6pc this season. Within transforming the assisted category, we continue to make progress connecting people to experts with TurboTax Live. We expect customers to grow more than 90pc this season, compared to 70pc growth last year, and TurboTax Live customers new to Intuit to be up more than 100pc.” The long term opportunity is summed up by the companies five big bets. “More broadly, our AI-driven expert platform strategy and five Big Bets are driving strong momentum and accelerating innovation across the Company. These Big Bets are focused on the largest problems our customers face, and represent durable growth opportunities for Intuit. As a reminder, these bets are revolutionize speed to benefit, connect people to experts, unlock smart money decisions, be the center of small business growth, and disrupt the small business mid-market.”

Intuitive Surgical. ISRG. Buy @ $934. Next figures: 22 July

Unlike most of the companies in this issue Intuitive Surgical’s business has been seriously impact by the pandemic with normal surgical operations being crowed out by Covid-19 but the group has weathered the storm and is seeing recovery. “Our first quarter of 2021 was a step in the right direction. In the quarter, we saw a healthy recovery of surgery and use of our products. Strong capital placements continued in Q1 2021, and utilization of installed systems increased through the quarter, indicating a need by our customers to return to surgery. We’re in the early innings of commercialization of two new platforms for Intuitive while advancing digital enablement of our ecosystem. Our teams are making good progress in all three areas. Overall, we’re seeing some pandemic recovery, but improvement has been uneven with significant regional variation. Our experience shows that our business rebounds as COVID drops.” ISRG is also strong in China. “Growth in our second-largest market, China, continued to be strong with multiple specialties contributing.” ISRG is a razors and razor blades-type business with installed equipment driving recurring income from consumables so it is important to see a strong trend in equipment sales. “On the capital side, new system placements continue to exceed our expectations with the United States, China, France, and the U.K. standing out in the quarter. We know that new system placements are closely tied to anticipated procedure volumes and system utilization in mature markets. System utilization grew in the quarter on average with significant regional variance due to pandemic differences. Overall, capital strength indicates anticipation of future procedure opportunity by our customers.”

L’Oreal. OR. Buy @ €371. Next figures: 28 July

L’Oreal is in amazing shape with all areas trading well except for Covid affected Europe and especial strength in Asia, mainland China and e-commerce. “L’Oréal has started the year with very strong growth at +10.2pc like-for-like in the first quarter, significantly outperforming the market. The group is therefore continuing its acceleration, initiated in the third quarter of 2020, and is increasing by +5.0pc like-for-like compared to the first quarter of 2019. The performance of the Professional Products, L’Oréal Luxe and Active Cosmetics Divisions is remarkable, all showing double-digit growth. The Professional Products division is posting significant growth all over the world. The growth of L’Oréal Luxe is driven by the success of its skincare brands, particularly Lancôme, Kiehl’s and Helena Rubinstein. Active Cosmetics continues to build on the strong momentum already seen in 2020. The consumer products division is stable, still held back by its high exposure to the makeup category which remains lacklustre. All geographic zones are growing, with the exception of Western Europe still impacted by the measures associated with the health crisis. North America is performing well both online and offline. All zones in the new markets are growing above 10pc, especially the Asia Pacific zone which is returning to the extremely dynamic pre-pandemic growth rates, driven most notably by a fast-growing mainland China. E-commerce growth is at +47.2pc and accounts for 26.8pc of sales.“

LVMH. LVMH. Buy @ €640. Next figures: 25 July

LVMH is an amazing group of businesses. “LVMH, the world’s leading luxury products group, gathers 75 prestigious brands, with €44.7bn revenue in 2020 and a retail network of over 5,000 stores worldwide.” Even though it is already so large it is capable of extraordinarily rapid growth. “LVMH Moët Hennessy Louis Vuitton recorded revenue of €14bn for the first quarter of 2021, up 32pc compared to the same period in 2020 and up 30pc on an organic basis. The quarter marks a return to growth after several quarters of decline during 2020, a year that was severely disrupted by the global pandemic. Organic revenue grew 8pc compared to the first quarter of 2019.” The geographical pattern is similar to that seen at L’Oreal. “Fashion & Leather Goods, in particular, had an excellent start to the year and achieved record levels of revenue. The United States and Asia enjoyed strong growth, while Europe is still affected by the crisis due to the impact of store closures across several countries and the suspension of tourism.” Like its products LVMH is a class act. “LVMH is well-equipped to build upon the hoped-for recovery in 2021 and regain growth momentum for all its businesses. The group will continue to pursue its strategy focused on the development of its brands, driven by strong innovation and investment as well as by a constant quest for quality in their products and their distribution. “

Microsoft. MRST. Buy @ $278. Next figures: 27 July

Microsoft is on a roll with global digital transformation as evidenced by its latest quarterly results. “It was a record quarter powered by the continued strength of our commercial cloud. Over a year into the pandemic, digital adoption curves aren’t slowing down. In fact, they’re accelerating and it’s just the beginning. Digital technology will be the foundation for resilience and growth over the next decade. We are innovating and building the cloud stack to accelerate the digital capability of every organisation on the planet.” Strong innovation is driving growth. “Azure [the cloud infrastructure and services business] has always been hybrid by design, and we are accelerating our innovation to meet customers where they are. Azure Arc extends the Azure control plane across on-premise, multi-cloud, and the edge and going further with Arc-enabled machine learning and Arc-enabled Kubernetes.” Parts of the business are seeing explosive growth. “Customers continue to choose Azure for their relational database workloads with SQL Server on Azure VMs use up 129pc year over year. And Cosmos DB is the database of choice for cloud-native app development at any scale. Transaction volume increased 170pc year over year.” Application software is also growing strongly. “Dynamics 365 had a breakthrough quarter as companies turn to intelligent business applications to adapt and grow. Revenue increased 45pc as we continue to take share from competition.” LinkedIn is booming. “We once again saw record engagement as LinkedIn’s 756m members use the network to connect, learn, create content, and find jobs. Conversations increased 43pc, content share was up 29pc, and the hours on LinkedIn increased by 80pc.” It’s no surprise the shares are strong.

Netflix NFLX. Buy @ $525. Next figures: 20 July

Netflix’s share price tends to react dramatically to the latest set of subscriber numbers. A beat makes the shares soar, a hint of slowing and they tumble but as co-CEO, Reed Hastings, keeps saying the big trend is a massive shift to streaming form linear TV and Netflix is one of the clear winners in this process. “Revenue grew 24pc year over year and was in line with our beginning of quarter forecast, while operating profit and margin reached all-time highs. We finished Q1’21 with 208m paid memberships, up 14pc year over year, but below our guidance forecast of 210m paid memberships. We believe paid membership growth slowed due to the big Covid-19 pull forward in 2020 and a lighter content slate in the first half of this year, due to Covid-19 production delays. We continue to anticipate a strong second half with the return of new seasons of some of our biggest hits and an exciting film lineup. In the short-term, there is some uncertainty from Covid-19; in the long-term, the rise of streaming to replace linear TV around the world is the clear trend in entertainment.” Netflix is a classic example of a brilliantly managed company enjoying a virtuous circle of growth. Better content attracts more subscribers which funds the creation of even more great content ad infinitum. The product is excellent value (a month’s viewing for less than the price of a single cinema seat) and the membership is well short of the number of households worldwide, even excluding China, which could become subscribers. As Hastings says – “We are optimistic about the future and believe we are still in the early days of the adoption of internet entertainment, which should provide us with many years of growth ahead.”

Nike NKE. Buy @ $158. Next figures: 28 September

Nike is the global sports giant best known for its iconic sports footwear. In January 2020 John Donahoe become CEO. He is a man with a CV to die for having risen to become president and CEO of the management consultancy, Bain & Co, before going on to be CEO of Ebay and then Service Now, a fast growing digital transformation service business, before leaving to head Nike. He had a baptism of fire as Covid struck shortly after his arrival but Nike is coming through in style. “Our relentless focus on our objectives is clear and our strategy is working. We’re excited by the momentum we continue to see. In Q4, we saw growth of over 95pc, which translates to 19pc growth for the fiscal year. This full-year growth was led by our owned digital business, which is now more than double versus fiscal ’19, prior to the pandemic.” Prospects look outstanding. “As we look ahead to fiscal ’22, the opportunity ahead of us is significant. We remain very confident in our long-term strategy and our growth outlook. The structural tailwinds we discussed before, including the return to sport and permanent shifts in consumer behavior toward digital and health and wellness continue to create energy for us. And we remain focused on our largest growth drivers, including our women’s business, apparel, Jordan and international.” The scale of the group’s ambitions is stunning. “As the world’s largest athletic, footwear and apparel brand we take seriously our leadership position to promote sport participation and an active lifestyle through inspiration and innovation. Our goal isn’t merely to take market share. Our goal is also to grow the entire market.”

Nvidia. NVDA. Buy @ $725. Next figures: 12 August

Nvidia is the company which invented the GPU semiconductor (graphical processing unit) and has used this as a base to become a key player across many of the fastest growing areas of technology. “Q1 was exceptionally strong with revenue of $5.66bn and year-on-year growth accelerating to 84pc. We set a record in total revenue in Gaming, Data Centre and Professional Visualisation, driven by our best ever product lineups and structural tailwinds across our businesses.” There is so much going on at Nvidia it is hard to see the wood for the trees. As one example there is their Omniverse product. “At GTC we announced the upcoming general availability of NVIDIA Omniverse Enterprise, the world’s first technology platform that enables global 3D design teams to collaborate in real time in a shared space, working across multiple software speeds. This incredible technology builds on NVIDIA’s entire body of work and is supported by a large, rapidly growing ecosystem. Early adopters include sophisticated design teams at some of the world’s leading companies such as BMW Group, Foster and Partners and WPP. Over 400 companies have been evaluating Omniverse and nearly 17,000 users have downloaded the open beta. Omniverse is offered as a software subscription on a per-user and a per-server basis. As the world becomes more digital, virtual and collaborative, we see a significant revenue opportunity for Omniverse.” Re its proposed acquisition of Cambridge based Arm from SoftBank the company said. “On our Arm acquisition, we are making steady progress in working with the regulators across key regions. We remain on track to close the transaction within our original timeframe of early 2022. Arm’s IP is widely used, but the company needs a partner that can help it achieve new heights. NVIDIA is uniquely positioned to enhance Arm’s capabilities, and we are committed to invest in developing the Arm ecosystem, enhancing R&D, adding IP and turbocharging its development to grow into new markets in the data center, IoT and embedded devices; areas where it only has a light footprint, or in some cases, none at all.”

UnitedHealth Group UNH. Buy @ $418. Next figures: 19 October

UnitedHealth Group is the gigantic US healthcare insurance business that is using its growing financial power to reinvent the provision of healthcare. “As we discuss our enterprise today, I hope you sense its growing momentum as we advance on our path of improving the quality, cost and experience of healthcare for everyone we serve. Both Optum and UnitedHealthcare grew and delivered on our long-standing strategy. And we’ve increased our outlook for the year to a range of $18.30 to $18.80 per share. We continue to prioritize three key themes that we believe will underpin the next era of growth for our enterprise. First, unlock the collaborative opportunities within and between Optum and UnitedHealthcare. Second, increasingly apply technology to improve patient care and experience and to help the system run better. And third, strengthen our consumer focus, capabilities and value.” Optum is the jewel in the UNH crown. “In 2011, UnitedHealth Group formed Optum by merging its existing pharmacy and care delivery services into the single Optum brand, comprising three main businesses: OptumHealth, OptumInsight and OptumRx. In 2017, Optum accounted for 44pc of UnitedHealth Group’s profits and as of 2019, Optum’s revenues have surpassed $100bn. Optum will contribute more than 50pc of UnitedHealth’s 2020 earnings, making Optum UnitedHealth’s fastest-growing unit.” The group is making great strides in making healthcare more efficient. “OptumRx continues to improve access and affordability of home delivery for patients, leading to significant improvements in continuity of care and having already reduced the cost to process and dispense prescriptions by nearly 20pc in just the past two years.”

Visa. V. Buy @ $240. Next figures: 27 July

Part of the whole process of digital transformation has been a global shift from using cash to pay for stuff to paying electronically. Visa stands at the heart of this process which has been driving sustained growth in revenue and profits, albeit with a slight hiccup as Covid shut down large chunks of the global economy. “We believe we’re at the beginning of the end of the pandemic and the recovery is well under way, at least in a number of markets. First, Q2 results, revenue declined 2pc year over year but would be slightly positive at 20 basis points if service revenues were recognized on current-quarter payment volume. When looking at volumes and transactions growth, keep in mind that we’re now lapping the start of the pandemic. As growth rates are now less indicative of performance in the business trajectory, we’re going to also provide some metrics compared to 2019 on a constant-dollar basis. So payments volume grew 11pc, improving 7 points from Q1 and reached 116pc of 2019, which is up 3 points from Q1. Cross-border volume, excluding intra-Europe, declined 21pc, but improved 12 points from Q1 and is 75pc of 2019 levels, 3 points better than Q1. Process transactions growth of 8pc improved 4 points from Q1 and represented 116pc of 2019, which is consistent with the first quarter.” Like other giant multinationals Visa is making exciting progress on multiple fronts across the globe. “In the next year, we plan to more than double our clients in Europe and Central Europe, Middle East, and Africa. So while the pandemic has disrupted the world, it has not changed our strategy. In fact, it has reinforced our belief that our three areas of focus will deliver robust growth for years to come.” The three areas are consumer payments, new flows and value added services.

Five companies looking exciting but where there is no space to show their charts are Crocs Inc.,/ CROX @ $112, Fortinet/ FTNT @ $258, Genscript Bio/ 1548 @ HK$41.95, Modern/ MRNA @ $286 and Waste Management/ WM @ $145. Crocs makes the eponymous shoes, increased Q1 revenues by 64pc and sees tremendous momentum in the business. Cyber security specialist, Fortinet, increased Q1 revenue by 23pc and says – “We continue to see momentum and adoption of our SD-WAN, SASE and Zero Trust Network Access Solution among the world’s largest service providers.” Genscript Bio reported sales up 42.9pc partly attributable to “success in answering global demands for COVID-19 related services, including the launch of cPass™ sVNT Kit – the world’s first reagent kit able to detect functional neutralizing antibodies quickly and effectively.” There is much more happening at this exciting company. Modern is one of the key players in the development of Covid-19 vaccinations based on mRNA. Growth is staggering. “In the first quarter alone, 102m doses have been shipped and many tens of millions of people have been fully vaccinated or received their first dose. 12 months ago, in Q1 2020, Moderna had never ran a Phase 3 clinical study, never gotten a product authorized by a regulator and never made 100m doses in a single quarter, not even 10m, not even 1m doses.” Waste Management is the leading US waste management business and a great company. The shares are up 100-fold since 1990 and the business is changing. “As digital transformation sweeps across nearly every industry in the wake of the pandemic, we’re making strides in differentiating our customers’ experience through end-to-end digital transformation.”