Covid connection – shares in seven companies helping battle the pandemic

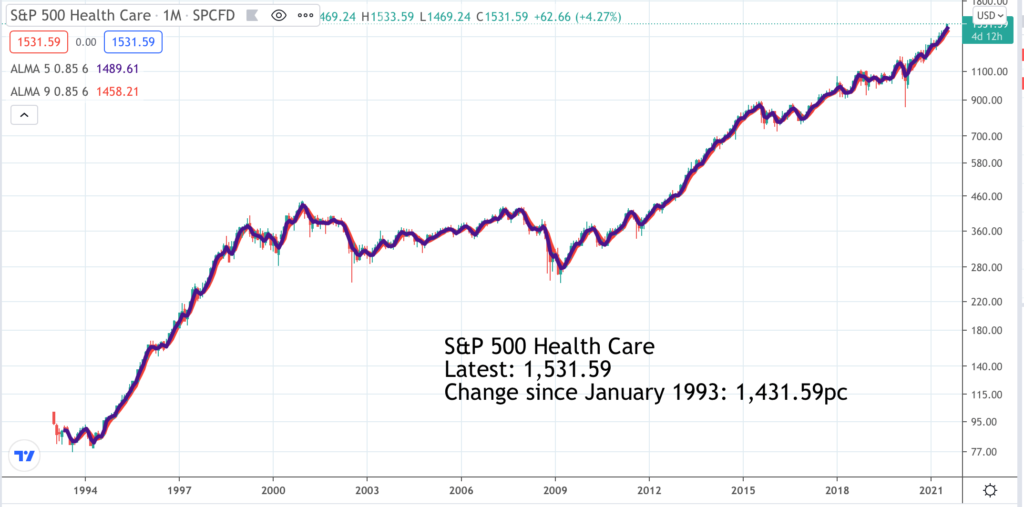

It’s most likely that none of the seven shares alerted below is in the S&P 500 Health Care index so the chart is just to give the flavour of how health care shares generally are trending. The long-term performance is positive after a slow period between 1999 and 2011 as share markets generally digested the excessive enthusiasm for growth and technology shares that characterised the closing years of the last millennium.

The current trend looks to be strongly higher driven by globalisation which is spreading diseases more widely, by advancing technology which is helping the industry come up with better solutions, by longer life spans and greater affluence which is boosting spending on health care and latterly by the impact of the battle to control Covid-19 which has turbocharged the sector.

Big pharmas like Pfizer and Astra-Zeneca are the front line of the vaccine effort but behind the scenes are many exciting smaller health care businesses playing a critical role and in the process advancing technologies with wide health care applications that should help them grow even when the Covid battle is finally won – if that happy day ever comes.

Four are already in the QV for Shares portfolio and three are newcomers. All except BioNTech and Moderna were doing very well before Covid-19 was even heard of while the latter two have seized the opportunity to validate the MRNA technology with which Moderna is so strongly identified that its stock market code is MRNA.

BioNTech. BNTX. Buy @ $284. MV: $68bn. Next figures: 9 August. New entry

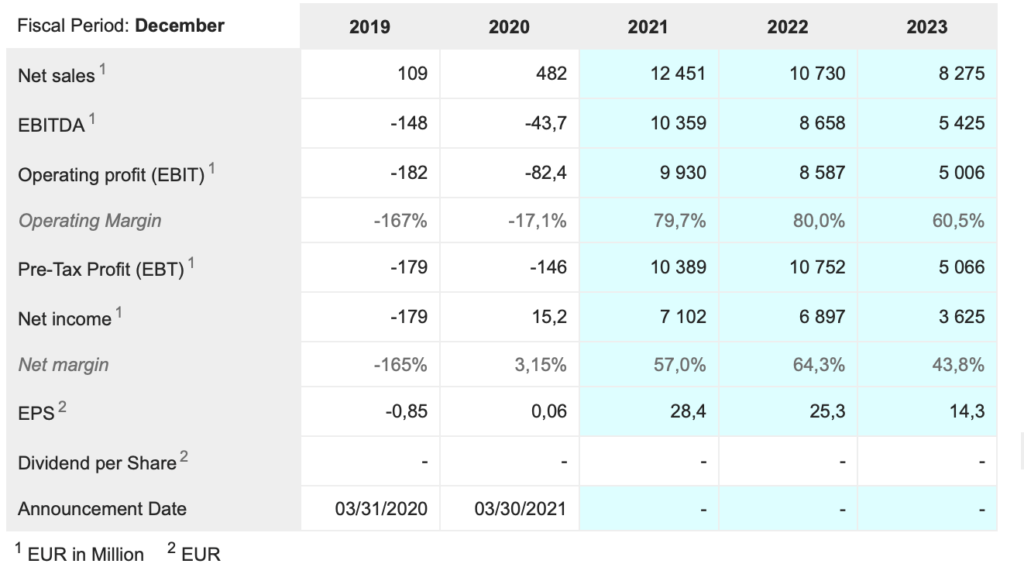

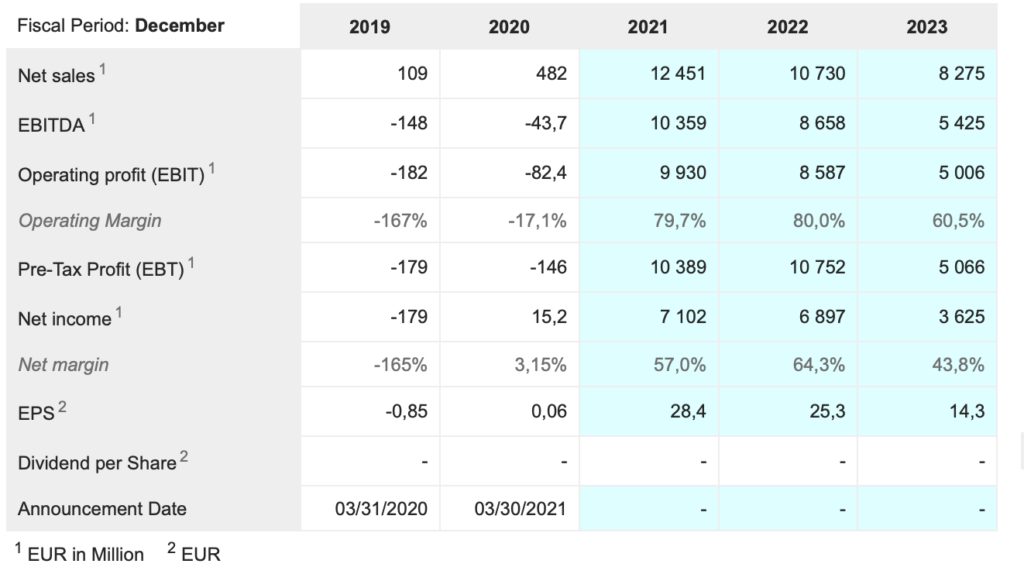

BioNTech is the partner to Pfizer in its vaccine rollout, so much so that the vaccine is called the Pfizer-BioNTech Covid-19 vaccine. In 2020, BioNTech, partnering with Pfizer for testing and logistics, developed the RNA vaccine BNT162b2 for preventing Covid-19 infections, which offers a 95pc efficacy in preventing confirmed COVID-19 occurring at least 7 days after the second dose of vaccine. On 2 December 2020, temporary HMR authorization was granted by the United Kingdom government for BNT162b2 vaccinations within the UK. It was the first mRNA vaccine ever authorized. Some days later the vaccine also got an emergency approval in the United States, Canada,and Switzerland. On 21 December 2020, the European Commission approved BioNTech/Pfizer’s coronavirus vaccine in accordance with the positive recommendation of the European Medicines Agency (EMA)

The speed of development was incredible.

“Project Lightspeed”, the project to develop a novel mRNA technology for a COVID-19 vaccine, began in mid-January 2020 just days after the SARS-Cov-2 genetic sequence was first made public. The company is partnered on this project with Pfizer and Fosun. The production of the vaccine was followed by clinical trials, the success of which was a prerequisite for the commencement of marketing. On 9 November 2020, BioNTech and Pfizer announced that 43,500 people in 6 countries had received a test vaccine against COVID-19 with more than 90 percent effectiveness. On the basis of successful testing, they asked for the right to distribute vaccines in the United States, as well as in the European Union, the United Kingdom and Japan.”

The result of all this, in the words of co-founder and CEO, Ugur Sahin, is that “2020 has literally transformed BioNTech.”

The company is building scale at warp speed.

“During the fourth quarter of 2020, we recognized our first commercial product sales. This is a major milestone given the considerable investment in research and development which we have made over the past 13 years. We are now a fully integrated biopharmaceutic company. We have built a sales force in Germany, and we have built global commercial-scale manufacturing capacity.

We expect to be able to produce up to 1 billion doses of our vaccine in 2021 in BioNTech’s own manufacturing network. Our Marburg facility has made remarkable progress since we acquired it and will be ramping up production in the second quarter. Despite COVID-19 being the spotlight last year, we made progress in advancing our oncology pipelines. We now have 13 oncology product candidates in 14 ongoing trials across four different drug classes.“

The extraordinary thing happening to BioNTech and also Moderna (see below) is that the virus is driving a tsunami of cash into the business which can be used to fund its ongoing efforts to apply MRNA technology in other areas of unmet medical needs from oncology (cancer) to autoimmune diseases, diabetes and heart disease. They are able to build global r&d networks, state of the art manufacturing facilities and all the capabilities of a global bippharama business.

As a result Moderna says it is increasingly dispensing with partnerships and going it alone in the development of its pipeline, a process which is normally far too expensive for fledgling biopharma companies.

In layman’s terms, this ignorant layman’s terms so hardly the last word, biopharmas find products that work in the lab, test them on animals with human characteristics like mice to gain more insight into efficacy and then put them through an obstacle course of staged trials, (phases 1, 2 and 3) which give ever more information on efficacy, toxicity and side effects generally. Finally they come out of this very expensive process (costing an average $1.5bn) hopefully with the Holy Grail of FDA approval and they can start selling the drug, which, in turn requires costly manufacturing and distribution capabilities.

All of this is being paid for by the huge profits rolling in from Covid-19 and what is also very exciting is that these two companies, BioNTech and Moderna, are at the cutting edge of a new disruptive approach to treating a whole range of previously hard-to-treat or untreatable conditions using technology based on MRNA. Not only that but MRNA is presently giving a devastating demonstration of its efficacy by playing a key role in helping the world fight Covid-19. Two of the most widely used vaccines, Pfizer-BionTech’s vaccine and Moderna’s vaccine are based on MRNA..

This provides an insight into why shares in BioNTech and Moderna are so strong. It is.not just because their finances have been transformed by their role in supplying Covid vaccines but also because of the way it has validated their whole MRNA-based approach to disease in general.

“I want to highlight some key takeaways for us as we reflect on 2020. First, it became clear that our mRNA pharmaceuticals have a great potential to address major health challenges. While the first generation of our mRNA vaccine technology has already proven to be powerful, we are working on rapid iterations to further improve this new class of products. Our mRNA approach is not based on a simple technology.

Our way of developing our technologies is not based on the idea of a single-trick pony. Rather, our goal from the very beginning was to build a novel industrial approach for precision pharmaceuticals that can address medical need in multiple disease areas. We did more than a decade-long research to develop a broad toolbox of mRNA technology platforms. Each of these technology platforms is tailored and optimized for potency and immunological precision to enable the development of best-in-class product candidates for various disease areas.

Second, we believe that mRNA will revolutionize the field of immunology, and BioNTech is well placed to continue to lead the revolution given our broad technology base, robust IP portfolio and deep know-how in the field. We intend to increase further our investment in the space given the tremendous opportunity we see. In addition, we learned from our COVID-19 experience that product development can be faster. We intend to apply the capabilities and learnings we developed during the Project Lightspeed to rapidly advance our pipeline products toward the market.

And finally, we learned that our collaboration model works. Our focus on innovation and our strategic partnership with powerful collaborators like Pfizer has helped us not only develop product in record time but establish an early market-leading position. We intend to continue to leverage our strategic partnerships by building our own capabilities in long term. As depicted on slide eight, we see a great opportunity ahead.”

The company certainly can’t be faulted for lack of ambition. “Our long-term goal remains to build a 21st century global immunotherapy powerhouse developing products for multiple disease areas.”

Bio-Rad Laboratories. BIO Buy @ $693. MV: $20.5bn Next figures: 29 July. New entry

The company recently reported a strong quarter. “Net sales for the first quarter of 2021 were $726.8m, which is a 27.1pc increase on a reported basis versus $571.6m in Q1 of 2020.” This included a significant boost from Covid. “We estimate that COVID-19-related sales were about $94m in the quarter. Sales of the Life Science Group in the first quarter of 2021 were $366.5m compared to $227.2m in Q1 of 2020, which is a 61.3pc increase on a reported basis, and a 56.9pc increase on a currency-neutral basis. The year-over-year growth in the first quarter was driven by the continued strength of COVID-19-related qPCR products.”

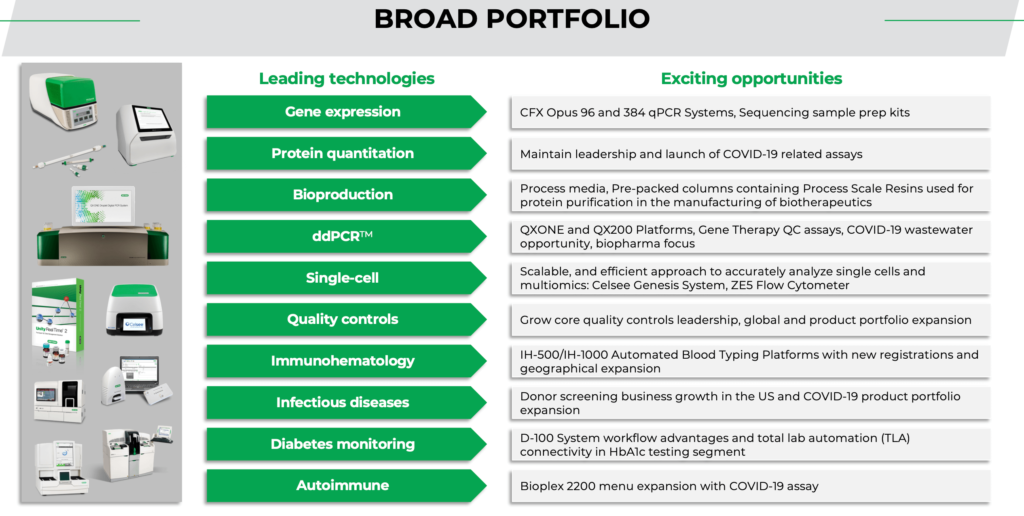

On the basis of the activities represented below Bio-Rad seems rather similar as a business to Bio-Techne.

The group explains its role in the battle against Covid. “For our part, the pandemic product focus has largely been around instruments and reagents needed to detect the virus either in a clinical or a community setting. Our core products are instruments used for detection of the virus by a method called polymerase chain reaction, or PCR. This is a very accurate and sensitive method and today is considered the gold standard for molecular testing. We are well known for our products in this area and, as a result, were able to exponentially increase production to meet the unanticipated demand, not only for instruments, but also for some of the associated reagents.”

As with other companies Covid has also spurred innovation. “Finally, adding to our roster of products being used in the battle against COVID-19, in early 2021 we introduced Bio-Plex Pro Human IgG SARS-CoV-2 Serology Assays, for research use only. This qualitative multiplex immunoassay kit detects IgG antibodies against four SARS-CoV-2 antigens, helping vaccine developers determine therapeutic efficacy, from development through all clinical evaluation phases. Our Reliance SARS-CoV-2/FluA/FluB RT-PCR and Reliance SARS-CoV-2 RT-PCR Assay Kits were also granted Emergency Use Authorization by the FDA in 2021, providing labs with access to sensitive and reliable qPCR tests to help guide patient treatment decisions.”

Bio-Rad is a quality business delivering steady growth in revenue and rising profitability based on constant innovation. “At the end of 2020, we communicated our outlook for the next three years, which projects further growth and margin expansion going forward. We are well positioned in the growing markets of life science and healthcare. Our broad portfolio of products and technologies provides us with innumerable opportunities to introduce new, innovative products. We also see opportunity to continue to improve our operating margins through several targeted operational initiatives.”

See below for the importance of Bio-Rad’s 37pc stake in Sartorius Stedim Biotech in valuing the business.

Bio-Techne Corp. TECH. Buy @ $472. MV: $18.5bn. Next figures: 5 August. Times recommended: 10 First recommended: $279.50 Last recommended: $445. Lowest recommended: $252

Bio-Techne Corp. has been quite a performer since the shares first IPO’d in 1989. They have risen around 1,000 times since then and remain in a strong uptrend. The group is a classic example of the old aphorism that in a gold rush you should buy shares in the company that makes the packs and shovels because they will certainly be a winner. The group makes the tools that help industry and academia carry out their experiments. It is vertically integrated and controls the entire process from constantly developing new tools to manufacture, testing, packaging and delivery from a global network of sites. This enables it to ensure the quality of goods and services that make it a trusted partner for so many organisations worldwide.

I am not going to try and go into too much detail about Bio-Techne which as a result of organic growth and acquisitions has around 250,000 products. The end markets they cater to include proteomic research reagents, proteomic analytic tools, cell culture and gene therapy, tissue technology, liquid biopsy and diagnostic kits (genetic/ oncology).

A key point about Bio-Techne’s business is that 82pc of its output is consumables giving it a high level of recurring revenue driving predictable growth. Around half sales go to the Americas, with the balance roughly divided between Europe and Asia. It estimates its addressable markets at around $18bn with growth rates between mid single digits and over 20pc.

Its market penetration ranges between one and around 10pc leaving it with ample headroom to sustain growth and win market share. The group, which had sales of $739m and operating income of $246m in FY 2020 is targeting sales and operating income of $1.5bn and $0.6bn respectively for 2020.

Charles Kummeth has been CEO since 1 April 2013 since when the shares have climbed sevenfold.

Latest results were impressive. “Our year-over-year organic growth accelerated to 22pc for the quarter as we continue to build on momentum from the first half of our fiscal year. This growth was the best organic growth the company has delivered over 25 years, both year-over-year as well as on a two-year CAGR basis. As it has been all year, the growth in Q3 was broad-based across our segments and geographies as penetration into biopharma remained very strong and continued improvement in academia drove the year-over-year and sequential acceleration in our business. The growth between our product categories was also broad-based with most accelerating sequentially from Q2 and continued by leadership from our Simple Plex, Simple Western, cell and gene therapy and genomics platforms.”

The group’s protein sciences division is heavily involved in vaccine development. “Now let’s discuss the performance of our growth platform, starting with the Protein Sciences segment, where growth accelerated to 24pc organically in the quarter. Our core proteomic research reagent portfolio had another strong quarter, with research use only proteins growing nearly 10pc and antibodies growing in the mid-teens. Our newest proteins are more frequently being used in mRNA research and production. Given the recent success and growing interest in mRNA-based vaccines, these could be a sustainable growth driver for this product line going forward.”

There is more evidence of the key role played by the company in the battle against the Covid-19 virus. “Our leadership in antibodies has also not gone unnoticed in our industry, with Bio-Techne’s R&D Systems and Novus brands recently named winners of the side — COVID-19 Innovation Award. This award celebrates innovative solutions or products that help shape the life sciences sector’s understanding of or resilience to COVID-19. The COVID-19 Innovation Award reflects Bio-Techne’s quick and impactful response to the COVID-19 pandemic, developing and commercializing new antibodies to support research as well as COVID-19 testing initiatives. This represents the fifth consecutive year of Bio-Techne’s antibody innovation efforts have been recognized with the CiteAb Award, and we are very proud of our antibody team.”

Covid is helping Bio-Techne grow but ultimately is only a small part of the growth at a business which describes itself as firing on all cylinders. “Since the start of the pandemic, Bio-Techne’s reagents and instruments have enabled insights into the virus, including ACD probes, to detect the virus in tissue, sales of bulk diagnostic reagents used in COVID testing applications as well as pathogen specific by antibodies and proteins to known variance of the COVID virus. COVID was an estimated 3pc tailwind to our business in Q3, including initial revenue from sales of the Kantaro IgG antibody serology kit. We expect the COVID research and diagnostics will be around for many years, particularly as new viral strands continue to emerge, making this tailwind as sustaining new layer of our product portfolio going forward.”

It is no wonder that Kummuth says “I believe Bio-Techne is in the best position ever, or at least since I’ve been with the company, to deliver on our long-term revenue and profitability aspirations, which keep getting bigger every year.”

Croda International. CRDA Buy @ 8300p. MV: £11.0bn. Next figures: 27 July Times recommended: 13 First recommended: 4599p. Last recommended: 7704p

Croda has been much recommended included recently when I discussed the company’s partnership with Pfizer in the roll-out of the latter’s Covid-19 vaccine so I am not going to say much more here. The company will be reporting its half year results tomorrow, which will update us on how things are going but the big picture looks very positive. CEO, Steve Foots said alongside the full year 2020 results that the company was working alongside 60 companies its developing Covid vaccines. The big one was Pfizer and winning that contract meant the group expected Pfizer vaccine-related sales around $125m in 2021.

Helped by an acquisition the group’s sales into the Chinese market have doubled and altogether prospects look exciting from a group which is reinventing itself as a business focussed on personal and health care with a growing footprint in drug delivery.

The interim results reported on 27 July were significantly ahead of expectations helping the shares climb and inspiring a strong outlook statements from CEO, Steve Foots. ““I am excited by Croda’s increasing opportunities in emerging technology platforms and faster growth markets, where demand for sustainable solutions will drive our progress going forward. We are investing in organic and inorganic expansion, continuing our relentless innovation and focusing on sustainability across everything we do. This is creating new avenues for future growth, delivering significant value for our shareholders.”

Lonza. LONN. Buy @ Swfr680. MV: Swfr52.4bn (£41.4bn) Next figures: 27 July. New entry

Lonza is a highly profitable Swiss company with two divisions, Lonza pharma, biotech and nutrition (LPBN) and Lonza specialty ingredients (LSI) making it somewhat resemble Croda, especially given the increasing health care emphasis of the latter company. The company is heavily involved in the battle against Covid.

“Both segments of our business have worked tirelessly in the fight against the COVID-19 pandemic. Our LPBN segment has continued to develop and manufacture a large number of life-saving treatments. These enable our customers to protect their most vulnerable patients, whose needs have never been greater. Meanwhile, the LSI segment has continued to focus on delivering microbial control solutions, which have played a significant role in containing the spread of the virus.

As well as establishing our position as a provider of essential products and services, our colleagues in LPBN have also worked with customers to deliver a direct contribution to controlling the COVID-19 pandemic. Our partnership with Moderna on the COVID-19 Vaccine has placed us in the global spotlight as a company at the forefront of efforts to control the pandemic. Alongside this critical program, we are also working to support a broad range of customers developing treatments and therapies related to COVID-19, including AstraZeneca, Altimmune and Humanigen. Our colleagues in LSI have been similarly industrious in the efforts to control the spread of the virus, with 16 Lonza disinfectant ingredients securing EPA approval for hard surface use against COVID-19.”

LPBN is the faster growing and more profitable business with sales growth in 2020 of 12.2pc and ebitda margins of 32.1pc v 3.4pc and 20.3pc respectively for the LSI business. In February 2021 Lonza agreed to sell the LSI business for Swfr4.2bn to concentrate on the faster growing health care and nutrition related business.

There is a lot going on in the LPBN business. “Our ambitious strategic growth plans have also continued to maintain momentum with a number of new investments approved, and a wide range of new facilities either ramping up or coming on line. We have commenced landmark work in developing mRNA facilities in Portsmouth (USA) and Visp (CH). We have expanded our Drug Product Services activity and are ramping up a Fill and Finish site in Stein (CH). We have expanded our capsule manufacturing capacity by 10 billion capsules annually and opened a new facility for antibody-drug conjugates payload manufacturing in Visp. We expanded our highly potent drug product development and manufacturing capabilities in Tampa, USA as well as our particle engineering and drug product capabilities in Bend, USA. We qualified the Cocoon® Platform towards clinical and commercial readiness and saw the first patient treated with an autologous CAR-T therapy, manufactured using the Cocoon® Platform. Inevitably this list only provides a snapshot of activities, and many other important developments and expansion plans are in development or on the horizon.”

Over the long term the group has ambitious plans for the healthcare focused company. “Looking to the longer term, we reconfirm our 2023 mid-term guidance at double-digit sales growth per year driven by Biologics, Small Molecules and Cell & Gene Technologies. We anticipate a CORE EBITDA margin of around 33pc to 35pc, accompanied by double-digit ROIC driven by growth and margin expansion.”

The group has recently appointed a new CEO, Pierre Alain Ruffieux and, in addition to the Swfr4.2bn raised by the sale of LSI, which is expected to close in 2H 2021 it also recently raised Swfr150m and €500m from bond issues so should be strongly placed for its aggressive Capex programme and also for acquisitions.

Moderna. MRNA. Buy @ $322. MV: $130bn. Next figures: 5 August Times recommended: 1. First recommended: $298

“The MRNA vaccine field is developing extremely rapidly; a large body of preclinical data has accumulated over the past several years, and multiple human clinical trials have been initiated. In this Review, we discuss current mRNA vaccine approaches, summarize the latest findings, highlight challenges and recent successes, and offer perspectives on the future of mRNA vaccines. The data suggest that mRNA vaccines have the potential to solve many of the challenges in vaccine development for both infectious diseases and cancer.”

The above appeared in a paper published in January 2018 and since then, not least because of Covid-19, further dramatic progress has been made with Moderna a leader in making this progress. In the early days Moderna CEO, Stephane Bancel, said the company was focused on developing the platform rather than trying to generate early returns from products as some investors wanted. The reason why, as Bancel said was because of the company’s belief that – “This platform can become gigantic.“

The company has passed a number of milestones on its way to its present valuation.

In 2011, Noubar Afevan, the largest shareholder of Moderna, hired Stephane Bancel, previously an executive at BioMerieux and and Eli Lilleyas CEO. Within 2 years of its founding, the company reached a unicorn ($1bn plus) valuation.

In March 2013, Moderna and AstraZeneca signed a five-year exclusive option agreement to discover, develop, and commercialize mRNA for treatments in the therapeutic areas of cardiovascular, metabolic, and renal diseases, and selected targets for cancer. The agreement included a $240m upfront payment to Moderna, a payment which was “one of the largest ever initial payments in a pharmaceutical industry licensing deal that does not involve a drug already being tested in clinical trials”,

In December 2018, Moderna became a public company via the largest biotech initial public offering in history, raising $621m (27 million shares at $23 per share).

The superlatives have continued from there to the point where observers expect the group to rack up sales of as much as $100bn over the next five or six years. The Covid results may be in the price on a market value around $130bn but Covid may be just the beginning of the journey for MRNA, which has applications for other viruses, for cancer and for auto-immune diseases.

An idea of the opportunities is that Bancel believes the company will eventually have 1000s of vaccines. It has nine right now and many more on the way. Listening to him describe the advances he believes will come in years rather than decades to treat people who have had heart attacks, to make cancer a treatable disease so that even if it cannot be cured people will live to an old age with a high quality of life it is clearly possible (a) that Moderna is going to be a major disruptor in the biopharma industry and (b) is going to become a very large company indeed.

Sartorius Stedim Bio. DIM. Buy @ €463. MV: €42.6bn (US$50.3bn). Next figures: 19 October. Times recommended: 1 First recommended: €359

Sartorius is an ambitious German-based company supplying research services to the global biopharma industry. They love setting long term goals as referenced in the 2018 annual report when they said they planned to double sales by 2025 to €4bn and increase ebitda margins to 28pc. Two-thirds of this growth was expect be organic with one third from acquisitions. Staff numbers were expected to double to 8,000.

Another intriguing feature of Sartorius is that Bio-Rad Laboratories owns 37pc of the company worth $18.6bn, which is fast approaching Bio-Rad’s valuation meaning that Sartorius is increasingly becoming the tail wagging the Bio-Rad dog. This explains why the Bio-Rad share price chart looks so like the Sartorius one.

Sartorius is a business on fire.

“In the first six months of the year, we have seen unabated high demand for innovative technologies used in the production of biopharmaceuticals. Orders from customers who manufacture coronavirus vaccines have played an additional important, though not dominant, role in this respect. The acquisitions closed in 2020 also are performing well and have added positive momentum. Our most recent acquisition of a majority stake in CellGenix, a leading global supplier of GMP grade cell culture components, enables us to provide our customers with even more comprehensive support in moving their drug candidates quickly and efficiently through the various steps of drug development so that innovative therapies reach patients faster. Due to the ongoing expansion of our production facilities worldwide, we are well prepared to respond to the continued high demand, and recruitment of additional employees is continuing at full speed. As communicated at the beginning of July, we significantly raised our sales and earnings forecast for the full year yet again though forecasts are currently subject to above-average uncertainty due to the various pandemic-related effects.”

The numbers are as impressive as the statement. For the first six months of 2021 sales grew 60.1pc to €1.35bn. Underlying ebitda rose 85.8pc to €487.4m. Order intake rose 87.4pc to €1.89bn and employee numbers increased 30.7pc to 8,746.

So what is going on. “The majority of this growth was generated through strong organic expansion in all regions and is based on unabated high demand for innovative technologies used in the development and production of biopharmaceuticals, both in the area of classic monoclonal antibodies and in the emerging fields of cell and gene therapies. In addition to solid performance by its core business, Sartorius Stedim Biotech benefited from the ramp-up in coronavirus vaccine production by many manufacturers.”

Covid has had a significant impact on companies like Sartorius. “Sales revenue growth of providers of technologies for the development and production of biopharmaceuticals was especially buoyant in 2020. This was attributable to the continuing good performance of the core business and strong additional demand fueled by the ramp-up of production capacity for coronavirus vaccines and Covid-19 therapeutics. Given the large investment of resources and considerable governmental and private sector cooperation, many drug candidates progressed through the various phases of development at a record pace. This has since then resulted in the market approval of more than 30 vaccines and anti-coronavirus compounds. The demand associated with the research activities and expanding commercial production again resulted in very positive business performance for providers of bioprocess technology in the first half of 2021.”

Even as this tails off there will still be strong growth drivers for the business as demand picks up for the health care revolution being driven by cell and gene technology. “The growth of the biopharma market fundamentally depends more on medium-to long-term trends than on short-term economic developments. In addition to the market launch of innovative biopharmaceuticals, significant impetus is provided by the world’s rising demand for medications as well as the expanded range of indications for approved medicines and their further market penetration. A growing number of active substances manufactured using biotech production methods is being approved for the treatment of rare illnesses that have been incurable so far. In the process, the pharmaceutical industry is increasingly concentrating on advanced therapies, such as gene and cell therapies and biotechnologically processed tissue products. The approval process for new medications relies on the performance of clinical studies. In 2020, over 1,000 clinical studies had to be suspended or their scheduled start delayed as a result of the coronavirus pandemic. A similarly high number of studies was again suspended in the first half of 2021. This development could lead to the delayed approval of new drugs in the future.”

The group is also benefiting from its international scale. “Sales in the EMEA region surged by 71.3pc in constant currencies (reported: +70.5pc) to €580.1m, particularly benefitting from additional demand from coronavirus vaccine manufacturers. This region accounted for the largest share of group sales of about 43pc. With a rise of 66.1pc in constant currencies to €352.0m (reported: +62.8pc), sales in the Asia Pacific also rose strongly, increasing the region’s share of group sales revenue slightly to 26pc. The Americas region accounted for around 31pc of group sales and registered growth of 46.1pc in constant currencies to €419.8m (reported: +34.3pc).

Investors understandably worry that companies benefiting from the global roll out of Covid-19 vaccines will suffer once victory over the virus has been achieved. However it looks as though this victory will be contingent on continuing vaccine programmes and booster shots to deal with new variants. Equally important is the effect of the roll out in validating vaccines based on MRNA technology, which has the potential to be applied to many other areas of medicine.