Connected TV and audio offer huge opportunities for The Trade Desk

Before talking about The Trade Desk I want to say a little about the way I use charts.

You should all be familiar with my 3G idea – great story, great growth, great chart. Absent these characteristics I never recommend a share.

Indices can also be 3G and an excellent example is the US NASDAQ 100 index, which I rate as the world’s most exciting index. You can buy shares in ETFs (exchange traded funds) to track this index (QQQ) and even shares that offer three times leverage (QQQ3). Both these trackers have been recommended numerous times in QV’s sister publication, Quentinvest for ETFs and they are doing very well.

What you can expect to see, when a share or index is in a massive secular uptrend, is strongly rising prices interspersed with periods of reaction/ consolidation and that is exactly what we see here. I have marked some of the more notable consolidations. They don’t happen all that often so it is important to take active advantage when we see breakouts from these consolidations – like right now.

In the latest period of consolidation there were two buy signals. The first came when the shorter (green) moving average crossed up through a rising longer (blue) moving average. I use five and nine months and the shorter average is a slightly weird one calculated according to an incomprehensible formula to make it more sensitive. I find the combination works very well. A full on buy signal (golden cross) occurs when after a period in which one or both averages was falling they turn higher and the shorter one rises up through the longer one. But sometimes you have to play it by ear.

The second buy signal was a breakout to a new high. Rising moving averages, a chart breakout from a lengthy period of consolidation and a new all-time high is about as good as it gets in the stock market. If that doesn’t get your juices flowing I don’t know what will.

Sometimes a period of consolidation ends up forming a top and a severe reaction/ bear phase follows. There was one in 2009, shown early in the chart. If I see a major chart breakout to the downside I am out, no doubt bloodied but hopefully unbowed and ready to fight another day. There is no sign of a bear market on the horizon currently; quite the contrary and major breakdowns are rare.

My guess is that the two ferocious sell-offs earlier in the millennium gave investors such a fright that irrational exuberance such as we saw in the late 1990s Internet bubble is not a problem. There are some highly rated shares, including The Trade Desk, see story below but their growth and opportunity means that anything less than a high valuation would be ridiculous.

At the epicentre of the global boom is America and within that California. Not only is California the world’s fourth biggest economy, ahead of the UK in fifth place (excluding the USA) but there are 12 US states in the 32 largest global economies. (It makes you wonder why so many governments including the one planned by our recent would-be glorious leader, Jeremy Corbyn, are so horrified by the US model and apparently find alternatives like Venezuela vastly superior. The problem with Corbyn as sussed by so many former Labour voters is not his half-arsed ideology or his lack of patriotism but the fact that the man is an idiot.)

Back to business. The message from both charts and fundamentals and, I would say, common sense is that a fabulous global boom is underway led by the USA with more than a little help from China and its exploding in size and increasingly wealthy middle class. My guess is that beneath the communist veneer, China is doing its best, with considerable success, to turn into America. No wonder people are talking about an unprecedented era of wealth creation lying ahead. You might not guess it from reading the papers, watching the BBC or tuning into social media but these are exciting times!

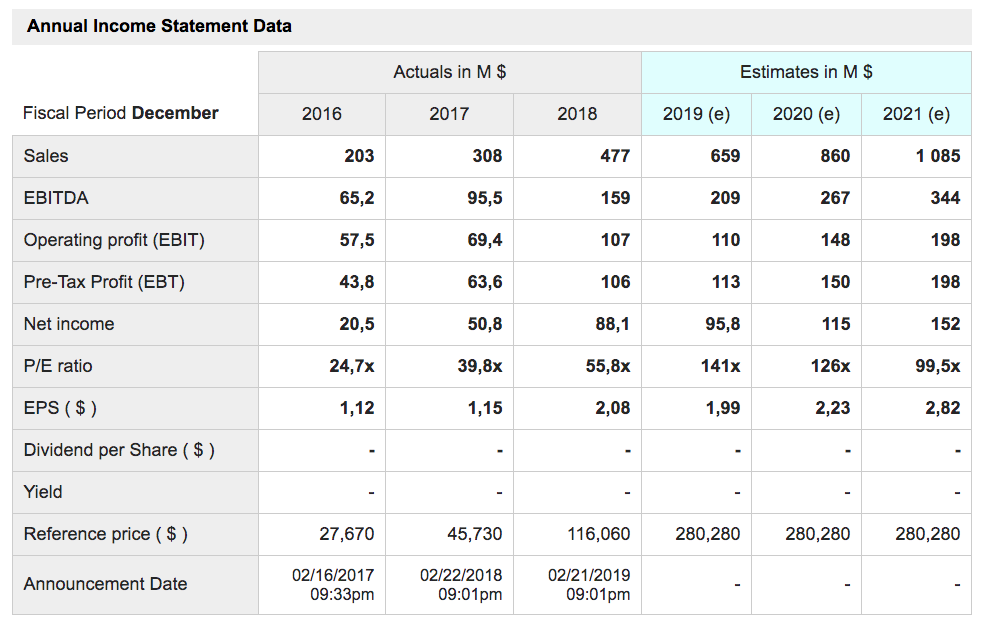

The Trade Desk. TTD . Latest $285 . MV: $12.9bn . Employees: 944 Next figures due: 20 February

This is my fourth alert for shares in TTD, which have already more than doubled on my first recommendation. So I am delighted to see that other people, who are much more knowledgeable about the business than I am, share my enthusiasm.

“In a recent note, Needham analyst Laura Martin called The Trade Desk the firm’s top stock pick for 2020 thanks to three big tailwinds: improving digital ad market dynamics, continued robust adoption of programmatic advertising and out-sized growth in the “open internet” thanks to big tech titans like Facebook, Amazon and Alphabet being distracted by regulatory issues.

Most trends support the notion that The Trade Desk will have a great 2020.

First, ad spend trends globally will re-accelerate in 2020 as companies across the globe up their ad budgets against an improving economic backdrop. Second, U.S. ad spends trends will get a double boost from this economic rebound, and from upped political ad spend in an election year. Third, the digital consumption shift will accelerate, thanks to the mainstream roll-out of 5G, the introduction of multiple new streaming services, and the launch of cloud gaming platforms. This will lead to digital ad spend acceleration, because ad dollars always chase consumption. Fourth, automation technology will continue to gain mainstream traction, and as it does, programmatic advertising adoption uptake rates will remain robust.

On top of all that, the “open internet” will continue to gain momentum in 2020. Sustained regulatory pressures on Big Tech will force many of these companies to open up their walled gardens. Part of this opening will be in the digital ad world, where they will be forced to relinquish complete control of the ad transaction process. Amazon has already done this in part, allowing for third-party demand side platforms to buy and sell ads in its ecosystem. Facebook and Alphabet will likely follow suit, leading to healthy growth in ad spend through third-party demand side platforms.

Connecting all the dots, 2020 looks like a great year to be invested in U.S.-focused, third-party demand side platforms in the programmatic digital ad world. In that category, who reigns supreme? You guessed it. The Trade Desk.

As such, The Trade Desk’s underlying fundamentals should materially improve in 2020. As they do, The Trade Desk stock should move higher.

The long-term profit growth potential of The Trade Desk implies that the stock is positioned to run above $300 in 2020. At present, this is a 30pc-plus revenue growth company in a ~20pc growth global digital ad market. The global digital ad market will continue to grow at a double-digit rate over the next several years, thanks to sustained digital consumption shifts in verticals like streaming TV, cloud gaming and mobile. At the same time, programmatic advertising and open internet tailwinds imply that The Trade Desk will gain share in the digital ad market. Therefore, the company should grow revenues at a 20pc-plus rate over the next few years.

Gross margins at the company are up near 80pc, and stable. That leaves plenty of room for 20pc-plus revenue growth to drive positive operating leverage. That’s exactly what will happen. Expense growth rates will moderate as the company gains share and leverages size and reputation (not marketing spend) to win over more clients. Revenue growth rates won’t moderate. That combination will drive healthy margin expansion.

Assuming 20pc-plus revenue growth on top of steady margin expansion, my modelling puts The Trade Desk’s earnings-per-share potential at $12.50 by fiscal 2025. Based on a 35-times forward earnings multiple, which is average for application software stocks with low capital spending rates, that equates to a 2024 price target for the stock of nearly $440. Discounted back by 10pc per year, that yields a 2020 price target of almost $300.

As we all know, stocks that are firing on all cylinders often tend to trade above their fair value. In 2020, The Trade Desk will be firing on all cylinders. Thus, by the end of the year, I fully expect to see its stock trading at prices well above $300, and probably closer to $325.

Digital ad fundamentals will improve in 2020. Programmatic ad fundamentals will improve in 2020. Open internet fundamentals will improve in 2020.

The Trade Desk is at the convergence of all three of those industries. Consequently, the company is in a great position to report strong numbers over the next twelve months. As they do, the stock should continue to climb, up to and potentially even above the $300 level.”

The above makes a solid case for investing in TTD shares but it could be better that that; indeed I am sure if TTD CEO and co-founder, Jeff Green, was part of the above discussion he would be painting a much more gung-ho picture on prospects and looking at what is happening in the worlds of connected TV and audio he might just be right.

The problem for advertisers is that eyeballs are shifting massively from old-style TV to the Internet generally. At the same time ad-funded TV has increasingly been replaced by subscription models like Netflix and Disney, while YouTube is also offering a ad-free subscription service. The same goes for music delivered by such as Spotify, iTunes, Amazon Prime and the like, which are also focused on subscription models.

The result of all this has been incredible demand for ads in the walled garden environments of Google, Facebook and Amazon. Jeff Green thinks two things are going to happen in response to this. First the walled gardens are crumbling.

This what he said about what is happening in the Q3 earnings meeting on 7 November 2019.

“As content providers create and launch their streaming services, almost all of them are working with us to figure out how to optimise for programmatic demand. Since we last reported earnings, we announced the details of a private marketplace agreement with Amazon. This deal is a game changer for the industry, and represents another tea leaf offering. We are now one of the preferred DSPs for third-party premium content in their FireTV marketplace (a DSP is a demand side platform, which allows buyers of digital advertising inventory to manage multiple ad exchange and data exchange accounts through one interface). We have access to all their premium content inventory, not the remnants. And as Amazon publisher services, APS, stated when we announced this deal, they are coming to us in order to maximise demand to ensure fee transparency for the advertisers they are trying to attract and to improve ad frequency for consumers. As you may have heard, we have also started to work with Disney as a preferred partner as they start to stream more of their premium costs.

Let me just pause a moment and reiterate these content providers are not our direct customers, they are our partners. More and more, they are asking to work with us. It’s not just Amazon and Disney, [but] other major global providers worldwide including Channel 4 in England, ProSieben in Germany, TF1 in France, and pretty much every other significant network and content provider. They are coming to us because they want to make sure that everything is right so the advertisers kind of flight data-driven strategies to their content.”

And this is what he said about why this is happening.

“I believe we are well positioned to take advantage of significant shifts in the advertising industry, which makes us as competitive as anyone for the next advertising dollar. Nowhere is this more apparent than Connected TV (TV streamed over the Internet). As we have discussed in the past, the nature of TV viewing and TV advertising is changing right before our eyes. This is significant because in many ways TV is the most important frontier in digital advertising.

For many of our customers, such as major CPGs (consumer packaged goods), retailers, and automakers, TV represents the largest piece of their massive ad campaigns. Until now they have only been able to run those TV campaigns based on the very broad demos (demographics) on linear TV, and they’ve had very little detailed feedback on how these campaigns perform. Connected TV is changing all of that as more viewers access TV content via connected devices and smart TVs, and as more content providers build and launch new streaming platforms, advertisers can apply data into their TV campaigns for the first time. It’s a game changer.

And as I said, two years ago, companies like Hulu, AT&T, and Spotify were pioneers in this ad-funded streaming revolution. I said that they were what I call tea leaf companies If you watch what they do, you can predict and know what others are going to do. They developed new TV and audio revenue models. They took strong positions on ad supported options. In some cases they offer premium offerings with no ads, and in others they offered a discounted offering with targeted ads. These tea leaf companies proved to the model, and most consumers chose the ad-funded models. As a result, most of those companies ultimately laid out strategies that went all in on programmatic ads.

Whether any individual tea leaf company executes well is less important. Some will execute, and some will not. What’s undeniable is that these companies have changed the game and streaming content and programmatic advertising there were the pioneers, but now it’s a movement. AT&T’s HBO Max is planning an ad-funded tier. When NBC launches its Peacock service next year, there are reports that it will be entirely ad funded. When Disney launches its Disney plus subscription service soon, it will sit alongside their ad-funded options for properties such as ESPN, ABC, National Geographic, and FX . Disney also owns Hulu, which of course has an ad-funded tier and has been leading the fusion of programmatic ads and CTV. These companies and others are giving consumers various ways to pay for the access to their content and in doing so, are maximisng their revenue potential.

I believe 2019 is the year that CTV proves that its future will mostly be ad-funded. Given the current economics, and the current state of competition in the TV industry, all providers will have to explore ad-funded CTV models. On the linear side, figures from Lichtman Research Group show that the entire traditional linear TV industry lost about 1.53m subscribers in Q2 of 2019. Linear broadcasters are fighting for fewer viewers, while content costs are going up. That’s a ticking time bomb. For advertisers, that means their ad-to-viewer ratio is worse than ever. Until recently, there has been a sense that they have nowhere else to go.

Now they do, but as more provider ship content to streaming platforms, competition among them is becoming more intense. As we have seen, platforms such as Netflix are fighting tooth and nail for subscriber growth while having to issue new debt just to keep pace in the war for premium content. There is only so much subscription demand, and there are new competitors every month with massive established content libraries. It all points to growth in ad-funded models, and I firmly believe that even Netflix will start to experiment with ad-supported services in the future. I believe they’ll eventually adopt what others have, giving consumers the choice to pay more and avoid all ads, or pay less and see a few, highly relevant ads.”

The reason why this is exciting is that the programmatic ads business for connected TV is growing explosively.

“Spend on our platform in Connected TV was up 145pc from Q3 of last year. We’ve seen strong growth in available CTV inventory, especially in live events. We are especially excited about the upside potential for live events in 2020, including major sporting events and the US elections. After multiple years of triple and even quadruple-digit growth in CTV, Q3 year-over-year growth of 145pc is definitely one of the biggest bright spots in our business.

CTV is the most strategically important focus of our business going into 2020. We invested early in our CTV infrastructure and in the supplier ecosystem, and we’re seeing the pay-off of those investments accelerate. I’ll say more about this a bit later, but the growth is not just in CTV. IO spend was up a stunning 162pc year-over-year (IO stands for insertion order – An insertion order is the final step in the ad proposal process; when an insertion order is signed, it represents a commitment from an advertiser (or their agency) to run a campaign on a publisher’s site(s)). Like CTV, audio is a large and growing market, about $3bn according to PwC digital radio estimates. In terms of pure percentage growth, it continues to be one of our fastest-growing channels. Audio is highly attractive to our customers because it regularly delivers high-performance metrics, such as completion rates (One important metric is completion rate. As the name implies, completion rate lets you know what percentage of your video your target audiences watch. From that number, you can also gauge how many of your intended viewers watched significant portions of your video ad or viewed it in full). We continue to integrate new sources of audio inventory worldwide, and expect to see broader adoption of this channel by advertisers in the years to come.

Music dominates audio today, but I’m just as bullish on other nascent audio opportunities such as podcasting in our future. If you believe as I do that CTV and audio are two of the most effective forms of advertising, because of high audience engagement, this means the TTD is growing fastest in the forms of advertising [growing fastest] into 2020.”

My conclusion from all the above is that The Trade Desk looks poised to continue to be an exciting investment in 2020 and beyond. Its classic 3G and both fundamentals and chart suggest that now is a good time to add to holdings or make an initial purchase.

I view The Trade Desk (TTD) as a much smaller but highly successful competitor to Google and Facebook. If I am right this is an exciting company playing for high stakes in a very large marketplace. There are risks with any share on such a demanding valuation but great growth stocks almost always look expensive when they are at an early stage of growth. Shares like Microsoft, Google (Alphabet). Amazon and Facebook all looked phenomenally expensive in the early days. If an explosively growing business looks cheap that is usually a major warning sign. TTD frightens off buyers by being expensive but that implies that if and as it grows into its valuation the buyers will keep coming. On these growth rates TTD could still be a phenomenally expensive share in 2024.