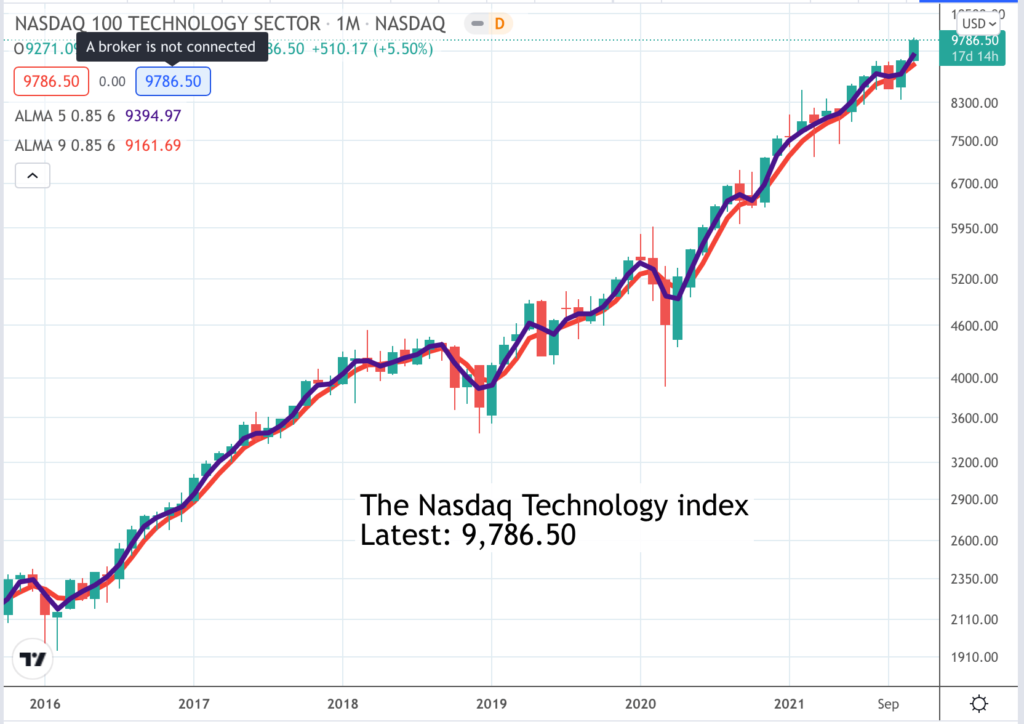

There is a beautiful breakout on the Nasdaq 100 Technology index. Apart from an even greater emphasis on technology than the more familiar Nasdaq 100 index the former differs in being equal weighted so not skewed to the performance of tech giants like Apple and Alphabet. A breakout by this index is obviously an encouraging development suggesting that a good period lies ahead for technology shares and probably the whole market given the growing importance of the technology sector.

Somebody, it may have been Warren Buffett, once said it was important to buy shares in a company which could be led by monkeys because one day it will be. This may apply to businesses that have been around for a long time with many changes of leadership but for many businesses, small and large, the man or woman in charge can make a crucial difference.

I have noticed that many of the most successful and fastest growing businesses are led by charismatic, inspirational and gifted leaders, many of whom but not all are also the founders of the company.

Anyone who doubts that great leaders can make a difference should look at the impact of Julius Caesar on the Roman republic, Genghis Khan on the Mongol hordes, Napoleon on revolutionary France and Steve Jobs on a floundering Apple when he returned as CEO in 1997. Between then and his death in 2011 the company was transformed into the Apple we know today and the shares rose around 150-fold in value. It turns out that having a genius in charge is very good for business.

The outstanding example of a company led by a man many regard as a genius in the current era is Tesla. Elon Musk has many attributes of genius including being decidedly odd. Personally I think he is a very special individual and a major reason why Tesla is having such an impact on the car industry and even the planet.

Is he good for business? My goodness, yes. Since 2011 Tesla shares are up from around $3.50 to over $1,000, having been as high as $1,243. Much of that performance has been captured by Great Charts for Quentinvest which, in its old guise as Chart Breakout, first recommended shares in Tesla at $15.83 in May 2013.

It turns out that many of the companies with the best performing shares have an inspirational individual, often a founder, in charge. In this respect Apple is a bit like the Roman Empire where many of the best emperors were former generals chosen by the legions. In Apple’s case, after the tragically early death of the great creator, Steve Jobs, he was replaced by the brilliant chief operating officer, Tim Cook, who had played a decisive role in helping Jobs to the early triumphs and has proved a superb leader in the subsequent period. Since Cook took charge in 2013 Apple shares are up approaching 10-fold and the company is the world’s largest by market value.

As with Apple superstar leadership doesn’t only have to come from the founder. Alphabet/ Google has been a phenomenal performer under Sundar Pichai. He took charge of Alphabet in succession to cofounder, Larry Page, in 2015 when he was just 43 years old. Since then Alphabet shares are up from $640 to around $3,000 and the market cap is fast approaching $2 trillion.

Something similar has happened at Microsoft where current CEO, Satya Nadella, took charge in February 2014 when the shares were around $38. The current price is $336.

It will be interesting to see what happens at Amazon where superstar CEO and founder, Jeff Bezos, has stepped down, or maybe up since he is now executive chairman, to be replaced by Andy Jassy in July 2021. Amazon shares have been trading sideways for 16 months and have formed a pattern known to chartists as a line. Breakouts from lines can lead to huge moves. The odds favour an eventual move higher since lines are typically continuation patterns.

In this issue I have referenced in the copy about individual shares the importance of charismatic leadership. This is especially true in the current era where so much importance is attached (a) to getting the company’s message over and (b) attracting top talent to come and work at the company. Max Levchin at Affirm attributes much of his company’s success, a $40bn plus market value for a company founded in 2012 which only really started trading in 2016, to what he calls the greatest collection of fintech talent on the planet.

I am not joking when I say that a portfolio build entirely around shares in companies with inspirational leaders could do incredibly well. Great portfolio performance is often driven by a handful of really exceptional performers, the kind of shares described by famed Wall Street investor, Peter Lynch, as 10-baggers (i.e. up 10 times). It is amazing how often these 10-baggers are led by very special individuals.

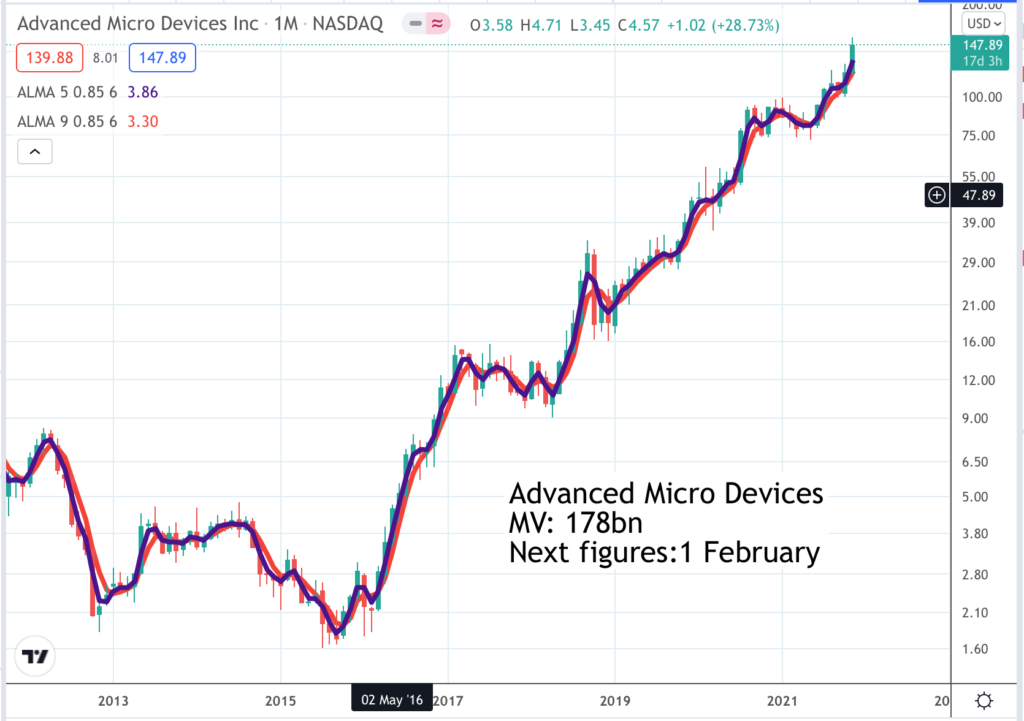

I can give you a flavour of what I am talking about by naming some of the key figures behind the performance of the QV for shares portfolio, some of which are featured in this issue of Great Charts. At Advanced Micro Devices there is Lisa Su, who has been CEO since 2014. At Affirm there is Max Levchin (founder of Affirm and before that a co-founder of PayPal). At Arista Networks there is Jayshree Ullal, who has been in charge for over a decade. At Ambarella there is Fermit Wang who co-founded the business. At Atlassian there are the two Australians, Mike Cannon-Brookes and Scott Farquhar, who lead and co-founded the business and that’s just some from companies with names starting with ‘A’.

I am going to stop there because I realise that a huge number of the shares in the QV portfolio have charismatic leaders in charge. It almost seems to go with the territory. Many of them too, from the standpoint of an Englishman born in the Home Counties, have decidedly exotic names and looks. American capitalism really does draw on a global talent pool and is greatly invigorated as a result.

Shortages driving technological change

We live in a world where everything seems to be in short supply, even people, despite the soaring global population. My daughter has just told me that we cannot have the tiles we ordered for our pool in the New Forest because they are not available. Shortages are taking over from lockdowns as the latest drivers of digital transformation. If you want to do more things with fewer people you need automation and that means technology. It also helps with more efficient supply chains, more efficient production, better use of raw materials and many other things.

The latest buzz word in technology to which I devoted a whole issue of Great Charts recently is artificial intelligence (AI) which shades into another buzz phrase, machine learning (ML). More and more companies are using AI to capitalise on the vast quantities of data being collected in the modern world. This is a fascinating process because it means that the software being created by us humans then constantly improves seemingly without human intervention.

Where this is all going to lead I have no idea but it is an exciting journey and means that the world belongs increasingly to a new breed of innovation centred businesses. Businesses like Atlassian which out of expected turnover for the year to 30 June 2022 of $2.6bn is expecting to spend around $1bn on research and development. Or Affirm which in the three years to June 2021 has increased spending on what it calls technology and data analytics from $76m for fiscal 2019 to $122m for fiscal 2020 and $256m for fiscal 2021. Nor is there any sign that this spending explosion is slowing down. For Q1 2022 Affirm spent $78m on technology and data analytics versus $33.8m for Q1 2021.

This is intriguing on two counts. First is the huge human effort being put by Affirm into innovating on its growing range of products. Second is the thought that this human effort is being supercharged by machine learning and artificial intelligence.

The implications for the pace of technological change worldwide given the growing number of companies like Affirm driving innovation forward at an accelerating rate are mind-blowing. Legacy businesses and traditional ways of doing things are being swept away, reinvented and disrupted at an accelerating rate.

This is why there are so many businesses in the world growing at such a spectacular rate and investing so furiously in driving further growth. It is the single most important reason why the US stock market especially, where so many of these exciting companies are found, is rising so strongly and it probably also means that any increase in inflation will be short-lived.

On top of that and part of the whole World Wide Web phenomenon we live in an increasingly connected, globalised and prosperous world. This means that companies with exciting, disruptive technology can grow at phenomenal speed. In little more than two decades Alphabet/ Google has gone from an algorithm dreamed up by two Stanford students to a business with expected 2021 sales of $250bn. Not only that but the latest quarter delivered a 41pc increase in revenues. People can get blasé about these things but the truth is that it is stunning what is happening.

I don’t believe there has ever been a more exciting time to be an equity investor. Quentinvest is all about helping our subscribers capitalise on this exciting time which is why we are having our own digital transformation. At the end of December Great Stocks and Great Charts will no longer be available in printed (dead trees) format but will be delivered wholly online as part of the QV growth share discovery ecosystem. Print subscribers are going to have to pay a little more but in return they will receive so much more. Please join me on this exciting journey.

Adventures in the Metaverse

I am struggling to figure out what the Metaverse is but Mark Zuckerberg (another inspirational if sometimes controversial leader) thinks it is so important that Facebook has become Meta Platforms, the new name for the parent company of Facebook, What’s App and Instagram. This is what Zuckerberg says about Meta’s new strategy.

“3D spaces in the metaverse will let you socialize, learn, collaborate and play in ways that go beyond what we can imagine. The metaverse is the next evolution of social connection. Our company’s vision is to help bring the metaverse to life, so we are changing our name to reflect our commitment to this future.”

Meta Platforms isn’t the only company with plans for the Metaverse. One of the companies featured in this issue, Roblox, is already actively creating and promoting this virtual world with its subscribers adopting avatars to interact with each other. Co-founded in 2004 by another inspirational CEO, Dave Baszucki, Roblox began to grow rapidly in the second half of the 2010s, and this growth has been accelerated by the Covid-19 epidemic. Roblox is free-to-play, with in-game purchases available through a virtual currency called “Robux”. As of August 2020, Roblox had over 164m monthly active users, with it being played by over half of all children aged under 16 in the United States.

Roblox is a platform that connects developers with consumers allowing the former to make money from providing the latter with extraordinary experiences. This is a three way process – Roblox, developers and consumers.

“CTO [chief technology officer] Daniel Sturman shared several updates about the platform and highlighted the advancements the company made throughout the year to give developers the tools and resources they need to build the next generation of experiences on the Roblox platform. Shortly after RDC [the annual Roblox developer conference], we launched the Layered Clothing Studio Beta, which enables developers to apply any combination of clothing to the avatars in their own experiences and opens the door to greater possibilities for self-expression.

Our developer community builds the content that powers our global platform, and sharing this time with them is invaluable. We believe that their ability to continue creating ever more engaging experiences for the nearly 50m daily users on Roblox is a significant driver of the results we are sharing with you today.

The strength of our unique developer community is reflected in the healthy year-over-year growth we experienced in Q3 2021, particularly as these results are compared to the extraordinary growth we saw in 2020. It’s clear that even as users revert back to pre-pandemic routines and behaviours, Roblox remains an important part of their day.”

The great results keep coming. “During the quarter, developers and creators earned $130m in developer exchange fees, up 52pc from Q3 2020. We remain on track to exceed our goal of delivering half a billion dollars to developers in 2021.”

Yet again the focus on innovation could not be more striking. “As of 30 September, 2021, we had 1,435 employees, up 66pc from 865 employees at this time last year. Engineering and product talent still comprise approximately 80pc of our employee base.”

In financial terms Roblox is storming ahead. “Revenue in Q3 2021 was $509.3m, an increase of 102pc over Q3 2020. Cost of revenue totalled $130.0m, up 98pc year over year.”

Volatility is the price of growth

Another phenomenon of soaring markets with substantial retail investor participation and excited chatrooms amplifying and distorting what is happening is volatility. Shares in Affirm have been driven sharply higher, as in trebled in three months, by news of their growing involvement with ecommerce behemoth, Amazon. Ahead of the latest quarterly report nervous investors took profits and in two days the shares fell from $178 to $133.

The company then reported fantastic results with merchants on the platform increasing from 6,500 to 102,000 in a year even before the partnership with Amazon has had time to kick in. In thin after market trading the shares rocketed back up to $176, which then attracted more waves of profit-taking as official dealings resumed the following day.

The shares have been all over the place but disregarding all that the business is doing incredibly well and CEO, Max Levchin, could not be more excited about prospects. The only way to make sense of this is to focus on the fundamentals, buy and hold the shares for the long term and leave the wild short-term moves to wash through the system

One reason why so many fast growing shares are vulnerable to waves of heavy profit taking is that high valuations contrast with realised losses. Many investors seem not to understand that the losses are the price of growth. Some fast growing companies are spending all or more of their revenue on research and development and sales and marketing. Inevitably this means they are losing money.

Why spend to the point where you keep making losses? Because there is a battle raging out there which I call the battle for territory. The bigger you become the greater the network effects you enjoy and the stronger the moat you can build around your business. In this world it makes sense for companies to really go for it and they do. It doesn’t mean they are intrinsically unprofitable. Gross margins, sales less variable costs, are often as much as 80pc or more. It is only when the discretionary fixed costs kick in that losses are reported.

So increasingly these companies are valued on revenue not earnings. This makes them look very expensive but actually they are not because as we are seeing with companies like Amazon, Netflix and Tesla when they become big enough to make profits while still spending heavily on r&d and sales and marketing profits can grow very rapidly indeed. Netflix is projected to grow ebitda (earnings before interest, tax, depreciation and amortisation) from $2bn to well over $10bn between 2018 and 2023. Tesla is set to grow ebitda from $2.2bn to over $21bn over a similar period.

So my advice is hold your nerve, keep holding and keep buying. This bull market ain’t over yet, not by a long chalk.

Advanced Micro Devices. AMD. Buy @ $147.5

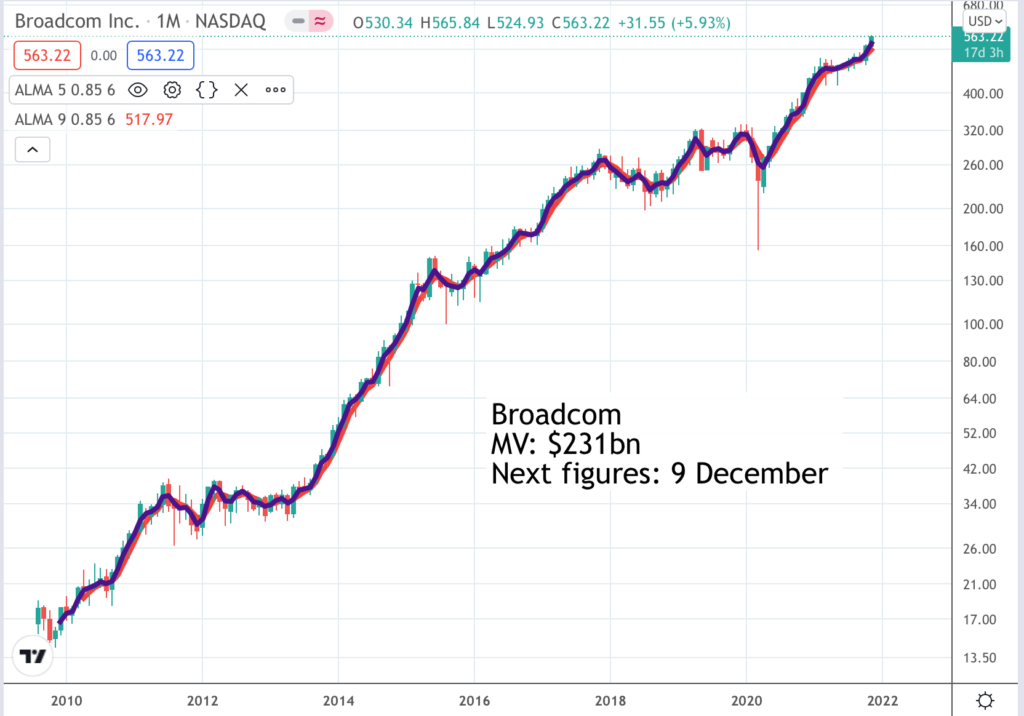

Broadcom. AVGO. Buy @ $563

Brunello Cucinelli. BC. Buy @ €62.75

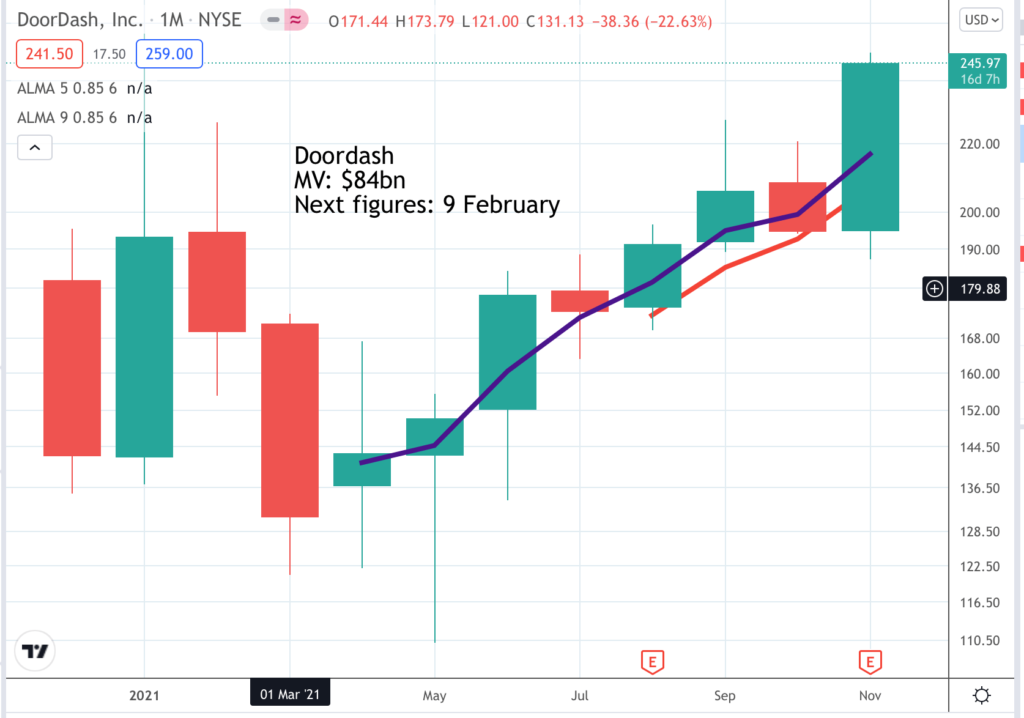

DoorDash. DASH. Buy @ $245

Enphase Energy. ENPH. Buy @ $251

Globant. GLOB. Buy @ $323

Hermes. RMS. Buy @ €1498

JTC. JTC. Buy @ 876p

L’Oreal. OR. Buy @ €424

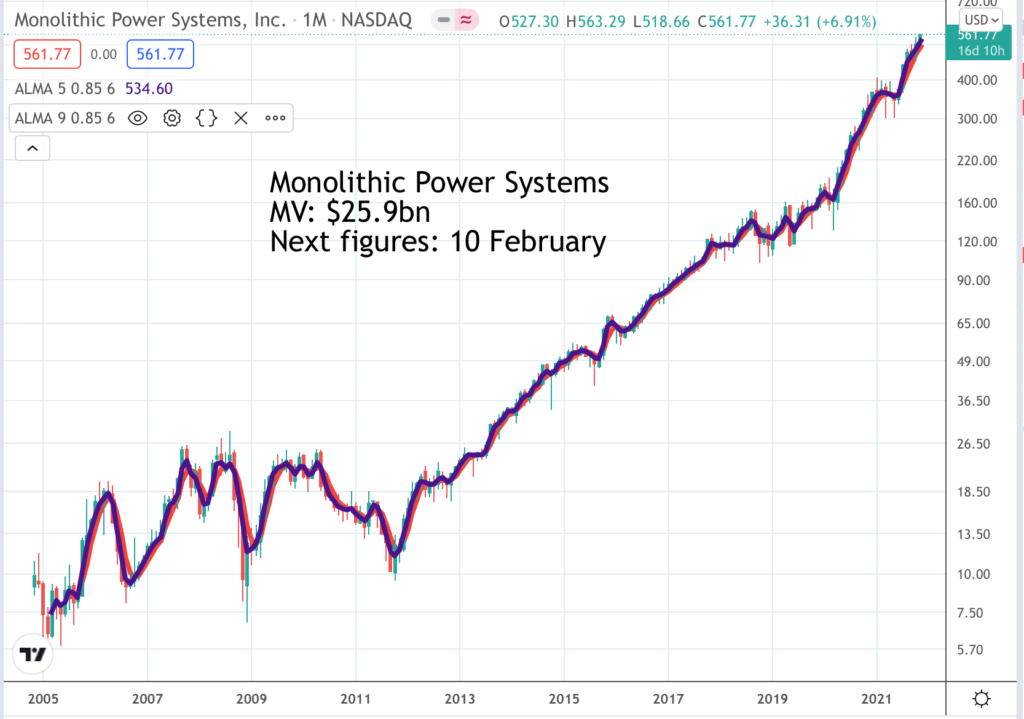

Monolithic Power Systems MPWR. Buy @ $561

Rapid7. RPD. Buy @ $133

Roblox. RBLX. Buy @ $107.50

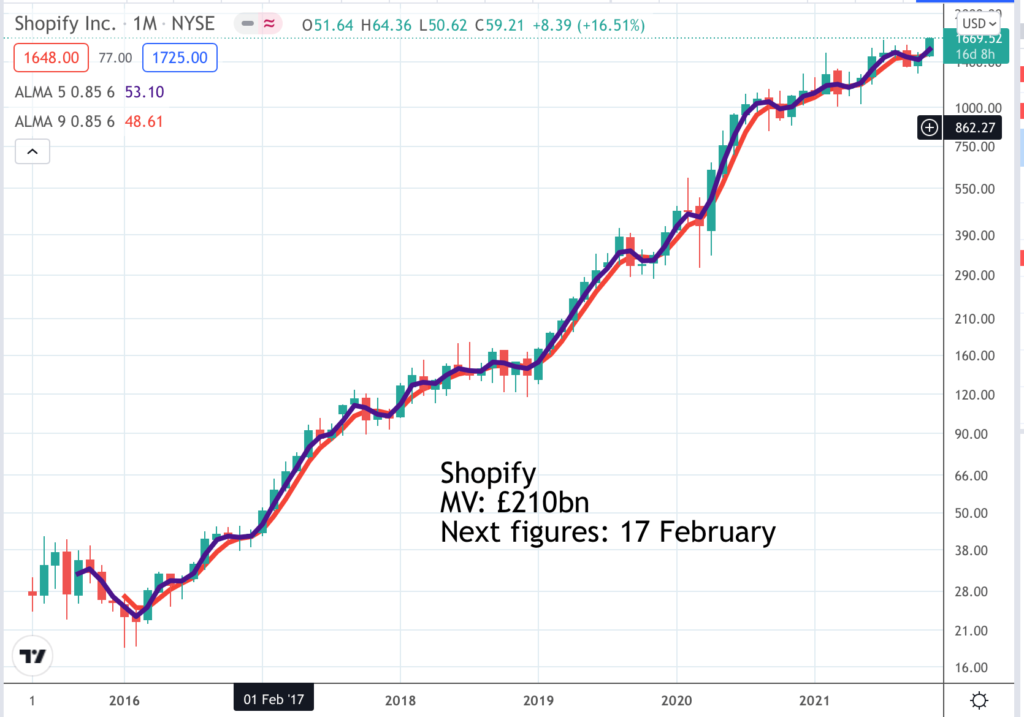

Shopify. SHOP Buy @ $1669

Snowflake. SNOW. Buy @ $386

Synopsys. SNPS. Buy @ $347

The Trade Desk. TTD. Buy @ $100

Unity Software. U. Buy @ $196.50

Advanced Micro Devices AMD. Buy @ $147.5

Latest quarterly results from AMD showed why the shares are climbing so strongly. “Our business performed extremely well in the third quarter as our leadership product portfolio and strong execution drove record quarterly revenue, operating income, net income, and earnings per share. We delivered our fifth straight quarter of greater than 50pc year-over-year revenue growth, with each of our businesses growing significantly year over year and data centre sales more than doubling. Third-quarter revenue grew 54pc to $4.3bn…. In closing, our record third-quarter results and the significant acceleration of our business in 2021 demonstrate that we have the right products and strategies to drive best-in-class growth and significant shareholder returns.” Here is another reason why AMD shares are flying. “Facebook’s parent company, Meta, is on a mission to bring people to the metaverse – a virtual space that brings people together to do real-time activities, such as watching movies, showing a presentation, or gaming, in their 3D avatars. But that would require a colossal infrastructure, including advanced processors and data servers. Chip-making company AMD (Advanced Micro Devices) announced Meta is a customer of its data centre chips – a move that will cement the company’s position as a major rival of Intel.”

Broadcom. AVGO. Buy @ $563

Broadcom is a leader in the technology space but it is a complicated business which has been built since 2009 by a string of acquisitions, many of them large ones that give the group a history going back to the glory days of AT&T and its famed research centre, Bell Labs. The pace really stepped up from the middle of the last decade with the purchases of LSI Logic, Broadcom itself, Brocade, CA Technologies and Symantec Enterprise Security. Before the Broadcom purchase which led to a change of name the company was Avago, hence the stock market code. Since 2014 both sales and r&d spending have exploded with sales up 16x since 2009 and r&d spending u p 25x over the same period. Operating profits have risen 84 times. Well judged acquisitions can have a formidable effect on accelerating growth. Broadcom now has an impressive 25 category leading franchises relating to semiconductors and technology. This is powering strong growth. “In Q3, semiconductor solutions revenue grew 19pc year on year to $5bn, with infrastructure software revenue growing 10pc year on year to $1.8bn. Consolidated net revenue was $6.8bn or up 16pc year on year.” Another attraction of Broadcom is its dividend performance. “Broadcom has been one of the best stocks for dividend growth investors over the last 5 years. The dividend has a 5-year growth rate of 49.32pc, growing from $4.08 per share to $14.40 a share.”

Brunello Cucinelli. BC. Buy @ €62.75

It is a strange experience for me to read the interim report for luxury goods company Brunello Cucinelli because the language seems so overwrought and pretentious but the bottom line is that the clothes are wonderful and they are flying off the shelves. “We have already delivered the first restocking orders of the Fall/Winter 2021 collections, providing us with extremely useful information on which models are most popular with end customers. In recent weeks we launched the sales campaign for the Spring/Summer 2022 collection: the comments, and even more important the orders received so far, are very, very positive…. With regard to revenues, we saw very positive results in both the retail and wholesale channels. Specifically, the direct channel showed a strong acceleration in the sales of men’s collections, recovering faster than women’s purchases.” They certainly aim high. “We would like the timeless style of our garments to allow them to live beyond the seasons and even be left as a legacy.” The bottom line of all this is that sales are growing very strongly. The half year to 30 June 2021 was up 53pc year on year while a loss has rebounded to healthy profits. Based on the quotes above we can assume that the outlook is for continued buoyant trading. There is also an impression that tastes and spending patterns are developing in a way very favourable to the timeless elegance of the Brunello Cucinelli brand.

DoorDash. DASH. Buy @ $245

Delivery service DoorDash continued to grow strongly in Q3 2021 with sales up 45pc against strong comparisons for the previous year. “Our MAU [monthly average users] grew to a record high in Q3. Average order frequency in Q3 remained consistent with the all-time high reached in Q2 and increased by a double digit percentage versus Q3 2020. Improvements to our service, along with growing awareness of it, are also visible in new consumer metrics. The consumers we acquired in Q3 demonstrated initial order rates that were largely consistent with recent quarters, and well above levels from 2019 and prior. The number of new consumers acquired in Q3 was down versus peak levels in 2020, but remained well above levels in 2019 and prior year periods.” A newer area of growth is non-restaurants. “Our goal for merchants in non-restaurant categories is the same as it is in restaurants; drive incremental demand and provide world class services that help merchants build and manage their omni-channel businesses. In Q3, we added meaningful new partnerships that span both our Marketplace and Platform Services, including: Total Wine & More, Weis Markets, Cardenas Markets, and Bed Bath & Beyond. Exiting Q3, our Marketplace included over 40,000 non-restaurant stores.” DASH is also acquiring Wolt in a €7bn all-stock transaction to drive international expansion and take it into 22 countries where it does not currently have a presence. Both companies feel:- “We’ve been on an incredible journey so far but believe we are only getting started. We have one chance to build a leading global platform for local commerce.”

Enphase Energy ENPH. Buy @ $251

Enphase Energy is a fantastic growth story in a hugely fashionable industry. As they say:- “Today, if you see a home with solar panels on it, there’s a good chance it’s an Enphase home. We have installed more than 39m microinverters on more than 1.7m homes in over 130 countries, helping millions of people gain access to clean, affordable, and reliable energy while creating good jobs and a more carbon-free future for everyone. Enphase is putting people and their power at the centre of our shared energy future.” This has powered phenomenal growth in Enphase revenues and a staggering rise in the share price from the low points of 2017 when full year sales dropped below $300m and there were fears the company might go bankrupt. The company is seeing very strong demand. “We reported record revenue of $351.5m, shipped approximately 2.6m microinverters and 65 megawatt hours of Enphase storage systems, achieved non-GAAP gross margin of 40.8pc and generated strong free cash flow of $100.7m.” The company also outlined its strategic vision. “Enphase is rapidly evolving from being the world’s leading supplier of microinverters to becoming the world’s leading home energy management systems provider.” The company is investing heavily to increase supply and to improve the product. “Along with our existing capacity in China, we expect to easily achieve our target global capacity of 5m microinverters per quarter by the end of the year.”

Globant. GLOB. Buy @ $323

Globant is an IT consultancy based in South America but quoted on Nasdaq which is led by Martin Migoya, who co-founded the company. It is growing at an incredible rate. “We closed the quarter with $305.3m in revenue. This represents 67.1pc year-over-year growth and breaks last quarter’s record as our strongest year-over-year growth as a public company. We are now a team of 20,000 Globers working all over the world. It took us 16 years to reach 10,000 employees. Today, just two years later, we have doubled our team.”Again they have a formidable mission. “Every person, business and even nature itself face a need for reinvention. The need to evolve and to become better versions of themselves and to navigate through constant challenges. It is our vision to seek reinvention in everything we do. We apply this concept to our clients as we help them create a way forward into a sustainable future. We don’t just supply technology for the short term. We design profound transformations to go beyond digital. And we apply it to ourselves as we provide our Globers with the tools to augment their work, to develop new skills and to build and transform their own career paths.” And the opportunity keeps growing. “Last month marked the seventh anniversary of our IPO, and I still feel like we are just getting started as the market opportunity keeps increasing. According to IDC, the numbers of companies that embrace a digital transformation strategy is up 43pc since 2019….Similarly, artificial intelligence adoption continues to expand, and the AI market is expected to grow by $76bn by 2025. We’re confident that these trends together with the growth of our market will allow us to grow fast.”

Hermes. RMS. Buy @ €1498

Luxury goods group, Hermes International, is on fire. “Third-quarter revenues to the end of September 2021 grew by 31pc to reach €2.37bn (£2bn) and have risen by 40pc over two years. Net profit for the first six months of the financial year stood at €1.17bn (£989m), up from €335m (£282m) in 2020 and €754m (£635m) in 2019.” Hermès benefited from an upturn in sales in Europe, an acceleration in America and sustained demand in Asia. All geographical regions recorded double-digit growth in the third quarter compared with 2019. Axel Dumas, executive chairman of Hermès, said in a typically understated way: “The performance of the third quarter reflects an atypical year, during which we continue our strategic investments and accelerate job creations.” Untypical was the element of rebound from a Covid-affected 2020 but the two year growth from an unaffected 2019 is also very impressive. Attempts to quantify what Hermes shares should be worth invariably show the company as very expensive but maybe it should be given the desirability of its products, the global exposure including a massive chunk of revenue from Asia Pacific and incredible consistency of the growth. Long term investors have never regretted buying the shares.

JTC. JTC. Buy @ 876p

JTC shares have taken off in the last four months rising by more than a third. As so often there is a key figure involved with Nigel Le Quesne having been CEO since 1991. They say “In 2019, our shared ownership story and culture was made the subject of a Harvard Business School MBA case study.” JTC is an outsourcing business in the area of wealth management. Helped by acquisitions, where it has been extremely active, the group has a global network of offices enabling it to access wealthy clients all over the world. It is a revelation to read the timeline of acquisitions on the group’s web site. It is no wonder this company has put together decades of unbroken growth. They have been phenomenally active even before listing in London in 2018. The strong share price behaviour since listing is just a continuation of that growth. The group now has around 1,200 employees, around $180bn assets under administration, so a very efficient use of manpower and a global presence. It is obvious that the earnings enhancing acquisitions are just going to keep coming, maybe even at an accelerating rate. Latest results show all systems go. “Revenue grew by 24.8pc compared to the same period last year to stand at £67m as of 30 June. Underlying profit was up 22.6pc to £21.9m year-on-year, whilst annualised new business wins totalled a record £10.3m, representing an increase of 19.8pc compared to the first half of 2020. The company also revealed that it won its largest ever mandate during the period, an engagement worth c. £2.5m per year to provide services to a major global financial institution.”

L’Oreal OR. Buy @ €420

What a wonderful long term investment shares in beauty products group, L’Oreal, have proved to be. What is it about the French that they are so good at creating great fashion and beauty companies? Maybe it is the feeling that buying French products is buying a slice of Parisian glamour, a piece of that wonderful chicness that French women possess in such abundance. Since 1986 the shares have appreciated around 125-fold and are presently climbing as strongly as ever. This is what CEO, Nicolas Hieronimus, had to say about the latest results. “The group’s sales increased by +9.3pc like-for-like over two years, compared with the first nine months of 2019, with a remarkable acceleration in the third quarter. All divisions increased their growth over two years quarter after quarter.” The acceleration was indeed remarkable. “Growth acceleration over two years: +14.9pc like-for-like in the third quarter compared with 2019. Balanced growth: North America at +23.1pc, North Asia at +22.6pc Powerful e-commerce, +29.7pc.” The group is confident going forward. “Since the start of the pandemic, L’Oréal has been constantly gaining strength and is ideally positioned to continue to grow at its pre-crisis pace. We are more confident than ever in this growth momentum. In an environment which remains uncertain, our performance in the third quarter strengthens our ambition to outperform the market and achieve a year of growth in both sales and profits.”

Monolithic Power Systems MPWR. Buy @ $561

As happens year after year semiconductor business, MPS, continues to trade strongly. “MPS achieved record third quarter revenue of $323.5m, 10.3pc higher than revenue in the second quarter of 2021 and 24.7pc higher than the comparable quarter in 2020.” This is how they describe themselves. “Monolithic Power Systems, Inc. is a global company that provides high-performance, semiconductor-based power electronics solutions. The company’s mission is to reduce energy and material consumption to improve all aspects of quality of life. Formed in 1997 by CEO, Michael Hsing, the company has three core strengths: deep system-level knowledge, strong semiconductor design expertise, and innovative proprietary semiconductor process and system integration technologies. These combined advantages enable MPS to provide customers with reliable, compact, monolithic solutions that offer highly energy efficient, cost-effective products, as well as provide a consistent return on investment to our shareholders.” Products are designed by globally based engineering teams. “We have assembled a qualified team of engineers primarily in China, Spain, Taiwan and the United States, with core competencies in analog and mixed-signal design.” Fabrication is outsourced to third parties to manufacture and assemble their ICs [integrated circuits]. They have a 60,000 square-foot manufacturing facility located in Chengdu, China for wafer sort and final testing. They keep a low profile but they do say. “We believe that we differentiate ourselves by offering solutions that are more highly integrated, smaller in size, more energy-efficient, more accurate with respect to performance specifications and, consequently, more cost-effective than many competing solutions. We plan to continue to introduce new products within our existing product families, as well as in new innovative product categories.”

Rapid7. RPD. Buy @ $133

Cyber security group, Rapid7, has delivered yet another strong quarter. “I’m thrilled to report that Rapid7 delivered a milestone quarter exceeding $500m in ARR [annual recurring revenue] for the first time. Accelerated demand for our security transformation solutions, coupled with sustained growth of our revenue management and our recent Insight acquisition drove Q3 ending ARR to $550m, growth of 38pc over the prior year and growth of over 30pc organically driven by strong contribution from both our land and expand interest in the quarter.” Rapid7 its prospering by catering to its customers’ needs. “Many customers we engage are seeking a more holistic approach to monitoring the threat and vulnerability in their environment as well as detecting and responding to attacks across their internal and external digital footprints. As I shared at our Investor Day in March, Rapid7 is leading a charge by delivering some of the most advanced capabilities around security, analytics and automation, unified on an integrated platform that is also accessible to a wider audience of enterprise and mid-market organisations. This is how we’re disrupting the market by enabling customers to marry advanced capabilities, high efficacy and productivity to achieve better security outcomes for their stakeholders.” What do they do. “The core of what Rapid7 does is collect fragmented data across the technology environment, endpoint data, deep cloud data, vulnerability data, API, logs, network data, fast data, all collected and aggregated natively on our Insight platform. This allows us to look at risk more holistically across the environment to not just detect the text, but to perform the forensics and analysis across the environment and ultimately drive remediation with our automation framework.” Demand is strong because “organisations across the world are undergoing significant digital transformation and meeting an escalating cyber threat landscape.”

Roblox. RBLX. Buy @ $107.50

Roblox allows players to create their own games using its proprietary engine, Roblox Studio, which can then be played by other users. Users are able to create purchasable content through one-time purchases, known as “game passes”, as well as micro transactions which can be purchased more than once, known as “developer products” or “products”. Revenue from purchases is split between the developer and the Roblox Corporation 30–70, in favor of Roblox Corp. The majority of games produced using Roblox Studio are developed by minors, and a total of 20m games a year are produced using it. During the 2017 Roblox Developers Conference, the company said that creators on the game platform, of which there were about 1.7m as of 2017, collectively earned at least $30m in 2017. The iOS version of Roblox passed $1bn of lifetime revenue in November 2019, $1.5bn in June 2020 and $2bn in October 2020, making it the iOS app with the second-highest revenue. Several individual games on Roblox have accumulated revenues of over $10m, while developers as a whole on the platform were collectively projected to have earned around $250m over the course of 2020 and are on track to receive over $0.5bn in 2021. The group is also attracting older users. “As of 30 September, 2021, 28pc of the top 1,000 experiences qualified as “aged up (defined as majority of users aged 13+),” a significant increase from 10pc of the top 1,000 experiences last year.” APAC is also growing in importance. “User growth in Q3 2021 was highest in the Asia Pacific region, growing 75pc over last year. APAC users now represent 20pc of DAUs [daily active users].”

Shopify. SHOP Buy @ $1669

I haven’t been able to find out exactly why Shopify shares soared last week although interest on investor social platforms has reportedly exploded. The company continues to grow fast as reported in late October. Shopify’s third-quarter revenue rocketed 46pc year over year to $1.1bn. More than 1.7m merchants conducted a whopping $41.8bn worth of retail sales on its platform during the quarter. That represented a 35pc jump from the prior-year quarter. “Our results show that Shopify is executing well, giving our merchants the tools they need to compete in differentiated ways in a growing number of markets,” chief financial officer, Amy Shapero, said in the company’s earnings release. Several notable partnerships are helping to fuel Shopify’s growth. Deals with Meta Platforms (formerly known as Facebook) and Walmart are making it easier for Shopify’s merchant customers to sell their wares on Facebook’s rebranded platform and Walmart.com. An agreement with TikTok gave Shopify’s merchants the opportunity to create mini-storefronts on the fast-growing social media app. And a partnership with “buy now, pay later” leader Affirm gave merchants the ability to offer increasingly popular installment-payment options to their customers. Prospects look as good as ever. “We are still in the early innings of omnichannel commerce, which has plenty of runway ahead, and Shopify’s flywheel is just taking off. Merchants around the world are joining Shopify to grow their businesses.”

Snowflake. SNOW. Buy @ $386

Data warehousing business, Snowflake, is an amazing growth story. “We saw continued momentum in Q2 with 103pc year-on-year growth to $255m of product revenues, reflecting strength in Snowflake consumption. The remaining performance obligations grew to $1.5bn, indicating strength in sales. For the first half of fiscal ’22, total revenues were $501m, up 107pc year on year. As the net revenue retention rate reached 169pc, we also saw non-GAAP product gross margin and operating margin efficiency improved to 73.6pc from negative 8pc, respectively.” No sign of fading momentum. “As we approach the $1bn mark in annual revenues, we continue to add customers at a robust pace, adding 458 net new customers, up from 397 in Q2 of last year with a focus on the largest organizations of Fortune 500, current total of 212, increasing by 18 in the quarter. We are addressing the largest enterprises globally with a vertical industry approach. We see these investments yield strong results. In Q2, financial services customer product revenue grew more than 100pc year on year, representing the largest contribution, while healthcare customer product revenue grew nearly 200pc.” Particularly explosive is the growth outside the US. “We are pleased with our geographical expansion outside of the United States for product revenue from EMEA and the Asia-Pacific, outstripping the company’s growth as a whole, growing 185pc and 170pc year on year, respectively.” What makes Snowflake special? “Strategically, Snowflake is emerging as a highly secure, compliant, global, and efficient data network in the infrastructure across the major public cloud domains. The combination of world-class data workload execution with cloud application development, cross-cloud operations, data, and data application marketplaces, as well as planned monetization is what makes Snowflake stand out.”

Synopsys. SNPS. Buy @ $347

“Synopsys technology is at the heart of innovations that are changing the way people work and play. Self-driving cars. Machines that learn. Lightning-fast communication across billions of devices in the datasphere. These breakthroughs are ushering in the era of Smart Everything―where devices are getting smarter and connected, and security is an important consideration. Powering this new era of digital innovation are high-performance silicon chips and exponentially growing amounts of software content. Synopsys is at the forefront of Smart Everything with the world’s most advanced technologies for chip design, verification, IP integration, and software security and quality testing. We help our customers innovate from silicon to software so they can bring Smart Everything to life.” Synopsys sounds like a wonderful company and performs like one. “Third-quarter results, including record revenue and non-GAAP earnings reflect strong momentum across the company. For the full year, we are on track to deliver mid-teens revenue growth. An increase in non-GAAP operating margin of more than 200 basis points, non-GAAP earnings-per-share growth of more than 20pc, and approximately $1.35bn in operating cash flow. The combination of the dynamic markets we serve, the powerful impact of our products and solutions on customer results and our history of strong execution is the basis for our setting the goal of crossing $5bn in revenue by 2023.” One analysts says:-“Given Synopsys is arguably the chip industry’s leading EDA [electronic design automation] provider, the company is quite likely to grow faster than the projected 8.7-9.2pc CAGR [compound annual growth rate] referenced above, perhaps as much as a 13-15pc CAGR.

The Trade Desk. TTD. Buy @ $100

I am forgetting to call these out but TTD has a super charismatic CEO and founder in Jeff Green and he is driving the building of an incredible business. “Revenue was $301m, a 39pc increase from a year ago, once again, exceeding our own expectations. Excluding political spend related to the U.S. elections in Q3 of last year, our growth was about 47pc from a year ago. This performance builds on our momentum year to date.” The latest quarterly statement refers to five developments which are driving growth. Video, excluding connected TV (streaming), is now 40pc of the business. International growth is outpacing domestic US growth. The Walmart Dollar DSC (Dollar Shave Club) has been launched. TTD says this is built on the Tribe platform, that some of the largest brands in the world are trying out test budgets on the platform and that these budgets are incremental. Fourth, Unified ID continued its strong industrywide momentum and is reaching critical scale in the market. Unified ID is a new approach to identify for an open Internet. And fifth, our mobile business continues to be resilient. As we predicted, the most recent iOS changes have had no material impact on our business, and we expect that to remain the case. All of this adds up to a massive opportunity for TTD. “I get asked every day about where this market is heading because the pandemic has changed everything because it has massively adjusted the media and tech landscape. It has accelerated the shift to CTV. It forced brand marketers to embrace data and has driven a higher focus on real-time agility for everyone in our industry.I think this is an important backdrop to why we’re doing so well and why our prospects are so bright for the future and why I’m so optimistic about the future of the open Internet.”

Unity Software. U. Buy @ $196.50

Unity Software’s latest results show the business storming ahead. “We are really happy with our third quarter results, and we have great news to share. We reported another strong quarter with results well above our expectations. We delivered 43pc revenue growth as revenue had a record $286m in the quarter.” They also refer to what they describe as even more exciting news. “We’ve entered into a definitive agreement to acquire Weta Digital, specifically its award-winning engineering talent, artist pipeline, tools and technologies. Weta Digital will become part of Unity Create Solutions led by Marc Whitten and we’ll focus on bringing dozens of artist tools inside of Weta to a much broader world of VFX [visual effects] artists across many companies to the gaming industry and the users across many industries. The Academy award-winning VFX teams of Weta Digital will continue as a stand-alone entity called WetaFX and is expected to become Unity’s largest customer in the media and entertainment space. We are thrilled to democratize Weta’s industry-leading tools and bring the genius of Peter Jackson and Weta’s amazing engineering talent to life for artists everywhere. By combining the power of Unity and Weta Digital, the tools and technologies that built characters and scenes from the world’s most iconic films such as Avatar, Lord of The Rings, and Wonder Woman. We will be able to enable an entirely new generation of creators to build, transform and distribute stunning real-time 3D content.” Unity is the world’s leading platform for creating and operating interactive, real-time 3D (RT3D) content. “Whatever the word metaverse means, it’s going to be built by millions of content creators, and we’re on a mission to give them the easy to use and high performance tools that will bring their visions to life. Weta Digital accelerates this mission by years, bringing an incredible team to join ours.”