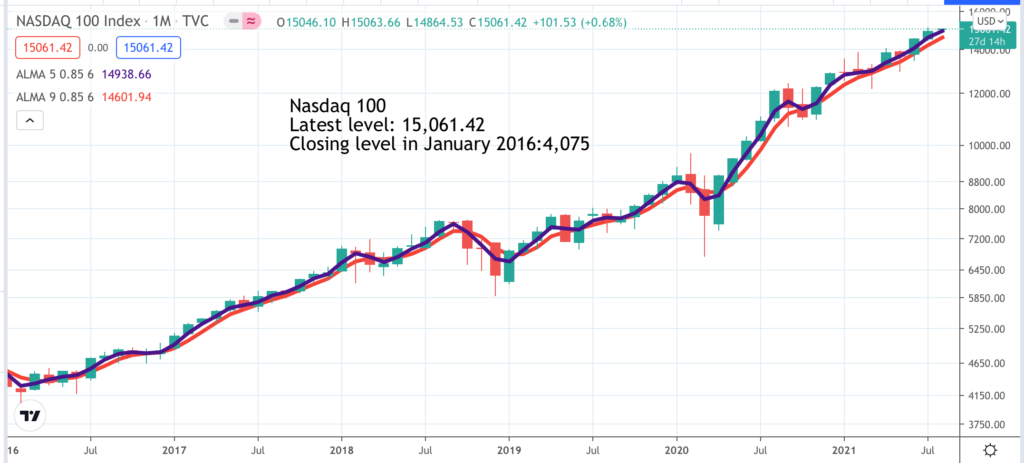

The chart above of the Nasdaq 100 is a candlestick chart. Invented by the Japanese, each period, in this case a month, is represented by a candle. The base of the solid part of the candle is the opening price on the month and the top of the solid part is the price at which the index or share closed the month. The lines at the top and bottom extend to the highest and lowest prices reached during the month. You can see at a glance that in March 2020 share prices plunged but quickly began a strong recovery.

A green candle means that shares closed the month higher. A red candle signifies that they closed lower. Buying the green is a simple strategy for adding to a position on every green candle. In effect, it means treating a green candle as a buy signal.

If you think about any particular share you have various options. You could just buy your entire position when you first decide it would make an attractive investment. You could buy on the green or on one of many other buy-signal-based strategies. Or, simplest of all, you could just add to your position every month as happens with traditional pound-cost averaging strategies.

The importance of stock selection is indicated by this chart. Because the Nasdaq 100 has risen 3.7 times over the period all of these strategies would have delivered a great result. If it had traded sideways or down it would be a different story. There are good reasons for adopting different strategies depending on your circumstances.

Older investors are often investing from a lump sum. This makes it more realistic to buy your whole position as soon as you decide a share is worth buying. As you can see from the performance of the index in many cases this will be the most profitable strategy.

Younger investors are typically under financial pressure to fund mortgages, school fees, holidays and all the other expenses younger couples and individuals have to deal with. They don’t have the option of investing from a capital sum. The option available to them is to invest a small amount each month.

Doing this on the Nasdaq 100 each month since January 2016 would have been highly profitable. Nor does it seem to make much difference whether you wait for buy signals or just buy each month regardless of whether the candle is green or red.

So the question is why bother to use buy signals. There is a reason. It helps to allocate your capital between different stocks. Unlike the index, which averages the performance of many stocks, individual stocks perform very differently. A strategy of only buying on buy signals allocates your capital to the best performers and helps you avoid shares which are in long term decline.

Buying the green is just a very simple way of doing this. Below is a list of shares from the QV portfolio which have given a ‘buying the green’ buy signal in July. There is no particular message about shares that have not given a buy signal. Many, even most of the shares which did not signal this month probably will do over the next three months since shares in secular uptrends rarely go much more than three months without giving a buy signal.

One of the reasons why I have adopted the buying the green strategy is because in the past, before Quentinvest existed and I only had my two print publications, Quantum Leap and Chart Breakout, I noticed that I often missed great buying opportunities for shares. Buying the green means this won’t happen.

For many people this is a move from famine to feast, not enough buy signals becomes too many. If you don’t have funds wait for a signal when you do. Green candle sticks are like buses. They often come in bunches (actually buses are much better now) and there will always be another one. If there isn’t that is definitely a share that you do not want to be buying.

I use a measure of discretion in choosing the buying the green stocks. If the candle is green but indecisive or the shares are consolidating and likely to give a stronger buy signal in the future I may well leave them out of the list, which is reported below in alphabetical order

One thing to always bear in mind is that these are buy signals for shares that have already established themselves as 3G + Magic. They are an elite like the SAS in the British army or Napoleon’s Imperial Guard. These are not trading buy signals but signals to make a permanent addition to your portfolio.

QV for Shares is based on a strategy of relentless accumulation of holdings in newly discovered exciting companies, exciting companies from the table that you do not yet hold and additions to positions that you already have. The idea is to start with a small portfolio, especially as you build familiarity and trust in the strategy and go from strength to strength.

The stock market being what it is there will be setbacks. All past evidence suggests that you should weather these setbacks and reinforce your portfolio by buying into the recovery which, again on past evidence, invariably follows. Since 2009 the move from peak to trough for stock market corrections has typically taken three months or less. Share prices may then back and fill for a while but eventually they will head higher again. As I say in my e-book. It pays to be an optimist.

Abbott Laboratories. ABT Buy @ $122

Accenture. ACN. Buy @ $318

Adobe. ADBE. Buy @ $621

Advanced Micro Devices. AMD. Buy @ $112.50

Afterpay. APT. Buy @ A$126.50

Align Technology. ALGN. BUY @ $701

Alphabet. GOOGL. Buy @ $2705

Anaplan. PLAN. Buy @ $56.40

Apple AAPL. Buy @ $147

Aptitude Software. APTD. Buy @ 610p

Argenx SE. ARGX. Buy @ €311.50

Argo Blockchain. ARB. Buy @ 130p

Arista Networks. ANET. Buy @ $379

ASML. ASML. Buy @ $779

Atlassian. TEAM. Buy @ $329

Autodesk ADSK. Buy @ $327

Automatic Data Processing. ADP. Buy @ $213

Avalara. AVLR. Buy @ $165.50

Avast. AVST. Buy @ 580p

Axon Enterprises. AXON. Buy @ $187

Baillie Gifford European Growth Trust. BGEU. Buy @ 161p

Berkshire Hathaway. BRK.B. Buy @ $281

Bill.com. BILL. Buy @ $207

BioNTech. BNTX. Buy @ $351

Bio-Rad Laboratories. BIO. Buy @ $745

Bio-Techne. TECH. Buy @ $481

Bitcoin. BTCUDS. Buy @ $37,865

Blackline. BL. Buy @ $114.50

Blue Prism. PRSM. Buy @ 879p

Brunello Cucinelli. BC. Buy @ €55.65

Cadence Design Systems CDNS. Buy @ $149.50

Carvana CVNA. Buy @ $332

Carl Zeiss Meditec. AFX. Buy @ €193.45

Charles River Laboratories. CRL. BUY @ $411

Chegg CHGG Buy @ $88

Chewy. CHWY. Buy @ $86.50

Chipotle Mexican Grill CMG Buy @ $1884

Cloudflare. NET. Buy @ $119.50

Corporate Travel Management. CTD. Buy @ A$21.22

Crocs. CROX. Buy @ $137

Croda International CRDA. Buy @ 8644p

Crowdstrike Holdings. CRWD. Buy @ $254

Cyber-Ark Software. CYBR. Buy @ $142.50

Datadog. DDOG. Buy @ $114.50

Dechra Pharmaceuticals. DPH. Buy @ 5040p

Delivery Hero DHER. Buy @ €130.90

Dexcom. DXCM. Buy @ $521

Diageo. DGE. Buy @ 3622p

Diploma. DPLM Buy @ 3016p

Docusign. DOCU. Buy @ $292.50

Domino’s Pizza DOM. Buy @ 430p

Domino’s Pizza Inc. DPZ. Buy @ $540

Domo. DOMO. Buy @ $89.50

Dropbox. DBX. Buy @ $31

Dynatrace. DT Buy @ $64.50

Edwards Lifesciences. EW. Buy @ $114.50

Enphase.Energy ENPH. Buy @ $195.50

Epam Systems. EPAM. Buy @ $571

Estee Lauder. EL. Buy @ $327

Ether. ETHD. Buy @ $2493

Everbridge EVBG. Buy @ $139.50

Experian EXPN. Buy @ 3231p

Facebook FB Buy @ $351

Five9. FIVN. Buy @ $199

Fortinet. FTNt. Buy @ $297

Frontier Developments. FDEV. Buy @ 2555p

Genscript Bio. 1548. HK$ 39.85

Genus. GNS. Buy @ 5730p

Getswift Technologies Buy @ A$1.35

Halma. HLMA Buy @ 2939p

Hermes. RMS. Buy @ €1329

Hubspot. HUBS. Buy @ $583

IDEXX Laboratories IDXX Buy @ $695

Illumina. ILMN Buy @ $498

Impax Environmental Markets IEM. Buy @ 490

inMode INMD. Buy @ $115

Imogen. INGN. Buy @ $78

Intuit. INTU. Buy @ $530

Intuitive Surgical. ISRG. Buy @ $999

iShares World Momentum. IWMO. Buy @ $65

JTC. JTC. Buy @ 683p

Kering KER. Buy @ €779

Keyence 6861 Buy @ Y61,900 ($567)

Keywords Studios. KWS. Buy @ 2794p

Learning Technologies. LTG Buy @ 208p

Li Auto. LI. Buy @ $32.50

Lightspeed POS. Buy @ $87

Liontrust Asset Management. LIO. Buy @ 2115p

Lonza LONN Buy @ Swfr721 ($796)

L’Oreal. OR. €396

Lululemon Athletica. LULU. Buy @ $407

LVMH. LVMH. Buy @ €696

Masimo. MASI. Buy @ $276

Maxcyte. MXCT. Buy @ 1080p

Mettler-Toledo-Toledo. MTD. Buy @ $1496

Microsoft. MSFt. Buy @ $287

Middleby Corp. MIDD. Buy @ $194

Moderna MRNA. Buy @ $386

Monolithic Power Systems. MPWR. Buy @ $456

MSCI Inc. MSCI. Buy @ $619

Nasdaq Inc. NDAQ. Buy @ $188

Nike NKE. Buy @ $171

O’Reilly Automotive. ORLY Buy @ $612

Palo Alto Networks. PANW. Buy @ $398

Paylocity. PCTY. Buy @ $203

Pepsico. PEP Buy @ $156.50

Polar Capital Technology Trust. PCT. Buy @ 2464p

Pool Corporation POOL Buy @ $480

Procore Technologies PCOR. buy @ $104

Prologis. PLD. Buy @ $129.5

QQQ QQQ Buy @ $366.50

Rapid7. RPD Buy @ $115

Repligen. RGEN Buy @ $249

Restore RST Buy @ 510p

Rightmove RMV Buy @ 733p

Robinhood Markets HOOD Buy @ $46.80 (new entry)

S4 Capital SFOR Buy @ 698p

S&P Global Inc. SPGI Buy @ $436

Sanne Group SNN Buy @ 910p

Sartorius Stedim Bio DIM Buy @ €490.50

Sea Limited SE. Buy @ $282.50

Servicenow NOW Buy @ $584

Shopify SHOP Buy @ $1522

Smartsheet SMAR Buy @ $71

Snap Inc. SNAP Buy @ $73

SPDR S&P 500 ETF. Buy @ $441

Spiral-Sarco Engineering SPX Buy @ 15370p

Square SQ Buy @ $269

Stamps.com Inc STMP Buy @ $327

Starbucks SBUX Buy @ $119

Stryker SYK Buy @ $268

Synopsys SNPS Buy @ $289

Team17 TM17 Buy @ 830p

The Trade Desk TTD Buy @ $83

Tyler Technologies TYL Buy @ $490

Upstart UPST Buy @ $128

Veeva Systems. VEEV Buy @ $338

Verisk Analytics VRSK Buy @ $188

Visa V Buy @ $237

Waste Connections WCN Buy @ $127.50

Waste Management. WM. Buy @ $149

Watches of Switzerland Group. WOSG. Buy @ 989p

Water Intelligence. WATR Buy @ 1150p

West Pharmaceutical Services. WST Buy @ $422

Wingstop WING Buy @ $172.50

WisdomTree Nasdaq 100 3x Daily Leveraged. QQQ3 Buy @ $196.5

Xilinx XLNX Buy @ $146

Yougov. YOU Buy @ 1275p

Yum! Brands Inc YUM Buy @ $133

Zebra Technologies ZBRA Buy @ $546

Zoetis. ZTS Buy @ $204

ZoomInfo Technologies ZI Buy @ $56.50

Zscaler ZS Buy @ $243

I recently introduced the concept of The List to subscribers – a table within a table of 200 shares that I thought could be used to form the basis of an exciting long-term portfolio. These buy the green buy signals are not quite the same because I have decided to apply them all the shares in the table. Getswift is not an obvious candidate to be in The List but is showing signs of recovery from a low base.

I am keen for subscribers to try to build their own 200-share or even more portfolios composed of a cross-section of the world’s fastest growing business. These are the companies that are shaping our world and attracting the most exciting talent from universities and elsewhere to help them do it.

They are superbly led and resourced so when a shock like Covid-19 comes along they adapt and often play a key role in solving the problems presented by a global pandemic.

It’s diversification with a difference. There is no attempt to diversify by sector, investment type or investment style. They are all growth shares and many of them are in the technology sector. What such a large portfolio does give you is great exposure to the way the world is changing and the companies and people making it happen. Some may not succeed but many will and as we have seen this can drive extraordinary increases in shareholder value.

I have been a little cheeky and introduced a new name into the list. Robinhood Markets has just floated. The company provides a platform for investors, mainly in the US. It makes it possible to trade commission free and buy shares in fractions so they can invest any amount they wish. It is growing explosively and is clearly 3G. It may well also have overshot in early dealings but who ever knows about these things.