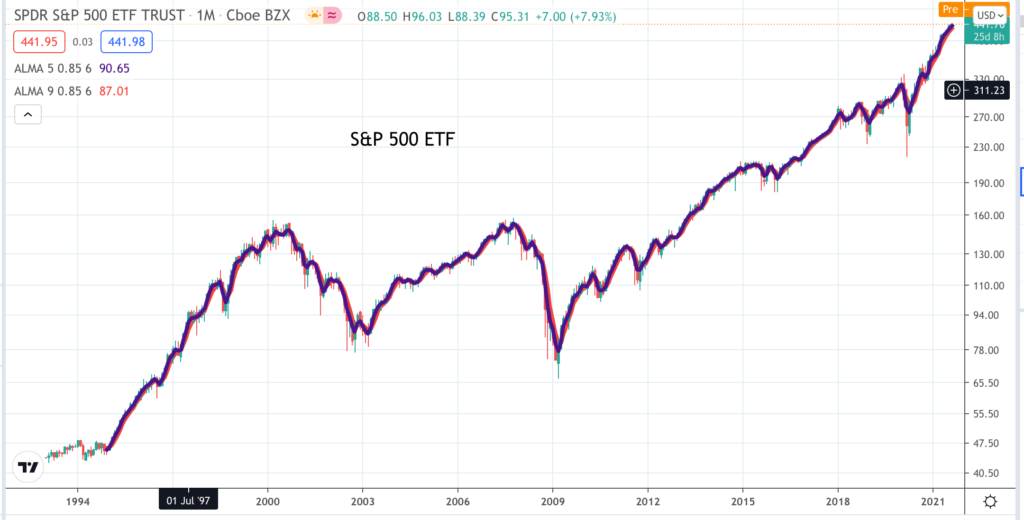

The S&P 500 ETF, charted above, is the biggest and oldest US-listed ETF with assets under management of $382bn. It has been doing very well, especially since 2009. The recently floated US trading platform, Robinhood Markets, described the US stock market in their prospectus as the greatest wealth-creating machine in history. It is doing an amazing job at making Americans and many people across the planet wealthier. It seems that holding US stocks, especially well chosen ones leading the growth charge, is a good idea. The performance of many of the ETFs listed below reflects the strong performance by the US indices.

ATT. Allianz Technology Trust. Buy @ 298.5p

IBB IShares Biotechnology. Buy @ $173

QQQ3. Wisdomtree Nasdaq 100 3x daily leveraged. Buy @ $198.74

2MCL. Wisdomtree FTSE 250 2x daily leveraged. Buy @ 28725p

3USL Wisdomtree S&P 500 3x daily leveraged. Buy @ $1555

SPXL Direxion Daily S&P 500 3x daily leveraged. Buy @ $116.5

SOXL. Direxion Daily Semiconductor Bull 3x leveraged. Buy @ $46.56

TECL Direxion Technology Bull 3x Buy @ $63.53

DIA. SPDR Dow Jones Industrials. Buy @ $351

HACK ETFMG Prime Cyber Security. Buy @ $61.85

FXH. First Trust Health Care Alphadex. Buy @ $121.9

QQEW. First Trust Nasdaq 100 Equal Weighted Buy @ $114.90

SHE SPDR Gender Diversity. Buy @ $104.6

CLOU Global X Cloud Computing. Buy @ $29.35

FINX Global X Fintech. Buy @ $48.50

AIQ Global X Artificial Intelligence. Buy @ $30.87

SNSR Global X Internet of Things. Buy @ $37.34

MILN. Global X Millennial Consumer. Buy @ $43.99

PDP. Invesco DWA Momentum. Buy @ $93.04

MTUM IShares MSCI USA Momentum. Buy @ $179.70

RBOT IShares Auto & Robotics. Buy @ $13.5

IYW. IShares US Technology. Buy @ $104.60

IWMO. IShares World Momentum Buy @ $65.46

MIDD IShares FTSE 250. Buy @ 2218.5p

IGM. IShares Expanded Tech. Buy @ $417

IGV. IShares Expanded Tech Software. Buy @ $409.50

IETC IShares Evolved Technology Buy @ $57.46

IWF IShares Russell 1000 Growth. Buy @ $283

IWY ISHares Russell Top 200 Growth. Buy @ $157.85

IWV. IShares Russell 3000 Buy @ $262.50

IUSA IShares S&P 500. Buy @ $37.50

IHI. IShares US Medical Devices. Buy @ $63.50

ISPY. L&G Cyber Security. Buy @ €21.645

LUXE. EMLES Luxury Goods Buy @ $31.86

JRS JP Morgan Russian Securities. Buy @ 760p

MTE Montenara European Smaller Companies Buy @ 2020p

PTF. Invesco Technology Momentum. Buy @ $154

PSI Invesco Dynamic Semiconductors. Buy @ $131

QQQ. Invesco QQQ. Buy @ $368

SOXX IShares Semiconductor. Buy @ $465

PCT. Polar Capital Technology. Buy @ 2480p

TQQQ. ProShares UltraPro QQQ Buy @ $136

XHE S&P Health Care Equipment. Buy @ $128.5

XLV. SPDR Health Care. Buy @ $132.50

SPY. SPDR S&P 500 Buy @ $442

XSD. SPDR S&P Semiconductor. Buy @ $198

XLC Communication Services. Buy @ $82.5

XLK SPDR Technology. Buy @ $154.5

SMH. Vance Vectors Semiconductor. Buy @ $268.5

MGK. Vangard Mega Cap Growth. Buy @ $241.5

VONG. Vanguard Russell 1000 Growth Buy @ $72.5

VOOG. Vanguard S&P 500 Growth. Buy @ $274.5

VUG. Vanguard Growth. Buy @ $298.50

VCR. Vanguard Consumer Discretionary. Buy @ $316.5

WCLD Wisdomtree Cloud Computing. Buy @ $58.5

WUGI. Esoterica NextG Economy. Buy @ $57

Buying the green is my simple strategy for declaring a buy signal when a completed month’s trading ends with a green candlestick. The idea is that these are all shares in secular uptrends so buy on the green should produce good results. You can either use the signal to open a new position or to add to a position.

The striking omission from this list is any ETF connected with China. As well as apparently experiencing new struggles with Covid-19 Chinese stocks have experienced a black swan event in the from of a sharp and unexpected clampdown by the Chinese authorities. I am somewhat baffled by what is going on. You would imagine that in a China combining a one party state with a vibrant economy they would want Chinese companies to be successful, especially the quoted ones.

For whatever reason it appears they don’t see it like that and appear to regard a vigorous private sector as a threat. This has knocked the stuffing out of Chinese shares and is likely to have a permanent effect on confidence. Even so it seems to me that the basic logic still applies. China has a huge market with a middle class growing in both numbers and spending power. This is not going into reverse so will surely give rise to large, powerful companies to cater for its requirements. However it is certainly proving a bumpy ride and the charts for all China-related ETFs are presently in free fall.

This leaves US growth and technology shares looking more attractive than ever as the ‘greatest wealth creating engine on the planet’. No surprise that investors all over the world are seeing US shares as a good place to invest.

Subscribers will see that there is considerable duplication. There is no need to hold more than one ETF invested in the S&P 500 or the semiconductor sector. ETFs are one area where concentrated portfolios can work very well. If you decide to just buy say SPY and QQQ that would be both reasonable and low risk given the diversification built into these ETFs. Either of them is like buying a stake in corporate America and through them in the global economy.

ETFs are also very suitable for buying on buy signal strategies like buying on the green or any other kind of buy signal. The advantage of using buy signals is that you avoid adding to positions in ETFs like the China-related ones when they experience a severe sell-off.

As I have noted frequently in the past leveraged ETFs are also valid long-term investments. They should do very well over the long haul but it can be a very bumpy ride so be prepared.