Subscribers will remember that I used to have a publication called Chart Breakout, back in the days of dead tree publishing. It came out once a month and had to be printed, stuffed in envelopes and posted by good old snail mail.

Now we send out alerts which means we are not limited to once a month and as soon as I have finished writing them I press publish and moments later subscribers can read my ‘golden’ words of wisdom.

This alert is a bit like an online version of the old Chart Breakout. Much like the print version I confine all my recommendations to shares in companies which I have already identified as 3G (great growth, great story, great chart). I am not interested in any other kind of share, which is why so many of my recommendations are US technology because that is where the growth is happening.

I increasingly find parallels between what is happening now and the Renaissance. Much of the action back then came from a handful of superstars based somewhere in Italy and as we now know they were not passing fancies but Gods walking the earth, guys like Leonardo da Vinci, MichaelAngelo, Raphael, Botticelli, Petrarch, Dante and company.

The Renaissance was an incredible period in art and culture and was greatly aided by the 15th century invention of the Guthenberg Press. Not coincidentally Bill Gates has compared the importance of generative AI to the invention of the printing press.

We are again in an incredible period but the counterpart to those great artistic studios and the city states of Renaissance Italy are US corporations which are centres of research and development with funding most universities can only dream of and which are driving innovation at a furious and accelerating pace.

Nvidia alone, just one company and by no means the biggest, will spend over $8bn on research and development in 2023 and they are already at the cutting edge of semiconductor development. Forget about the stock market. What is happening at Nvidia is moving the needle for Homo Sapiens as a species. It really is incredible what is going on at corporate America.

Table of Contents

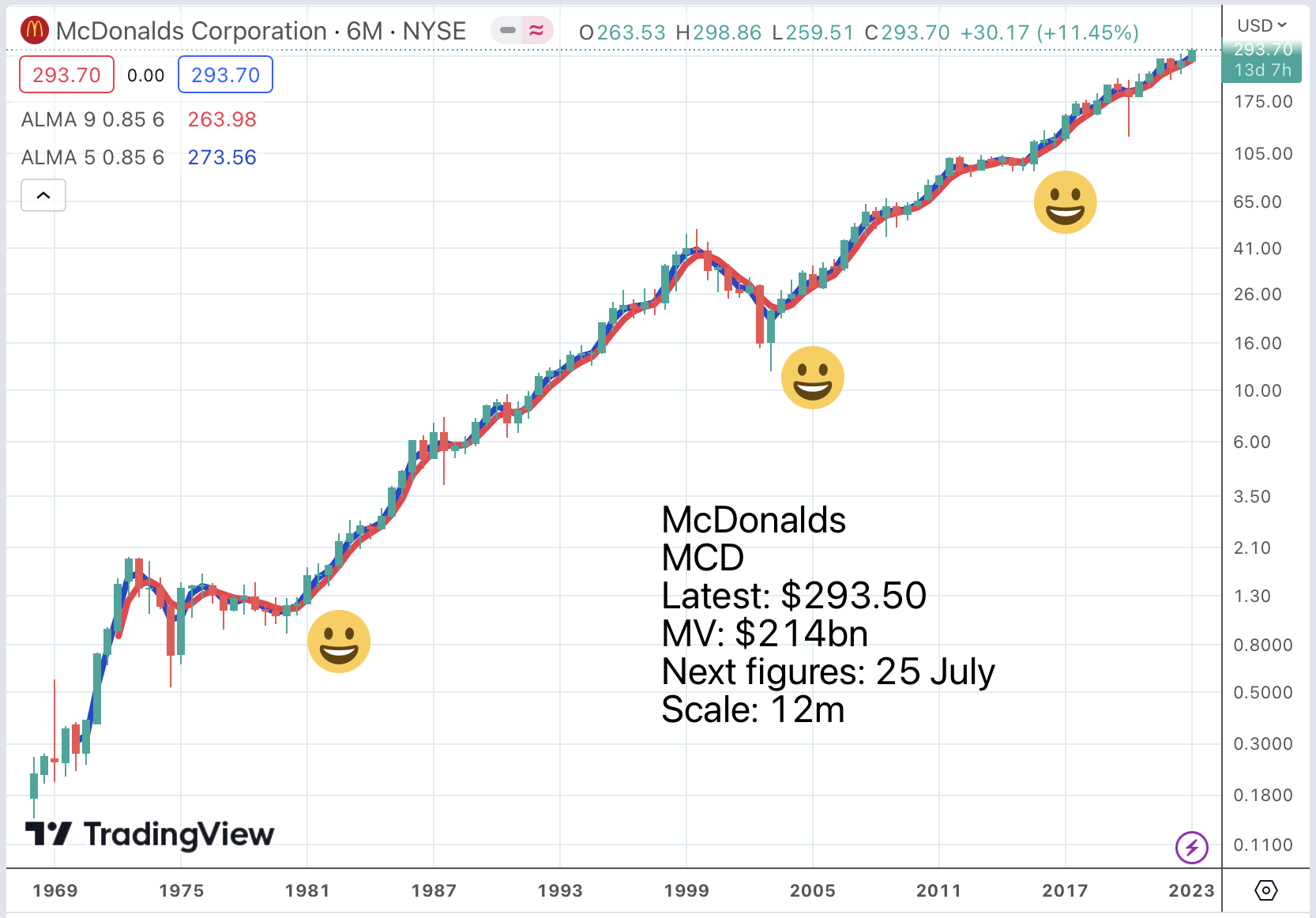

I am experimenting with a new chart layout where buy signals are indicated by yellow smileys and sell signals by red ones, if that is what they are called. I like them because they highlight a certain lack of precision, telling us that we are either in buying territory or in selling territory.

The Stronger the Chart the Better

I like strong charts, the stronger the better and, as I keep noting, I am not frightened of the obvious. Nvidia has an obviously strong chart and is the obvious play for the generative AI revolution. This puts many people off; they want the hidden gems, not the in-your-face ones but I just want the gems, the more brilliant the better.

In retrospect the obvious way to play the desktop computing revolution was with an investment in Microsoft, the company that made the software, the brains of the computers. Netflix was the obvious way to play the streaming boom; Amazon was the obvious way to play the e-commerce boom and then the cloud computing services boom. Google with its incredible search engine technology was one of the obvious way to play the move of advertising online; the other was Facebook with its gigantic social media networks. LVMH has been one of the obvious ways to play the global boom in luxury goods; another has been Hermes. McDonalds is the obvious way to play the fast food boom and as the chart below demonstrates, being obvious has not stopped the shares from being fantastic performers. Chipotle Mexican Grill is another fast-growing fast casual dining business, brilliantly managed and adapting rapidly to a fast-changing world.

And so if the outlook for you and Intel and AMD is accurate, then the second quarter will be the first quarter in the history of the data centre where NVIDIA’s data centre revenues will be greater than Intel and AMD combined. And I would argue that is proof of a tectonic shift in computing.

Mark Lipacis, London Investor Conference, 14 June 2023

There is another quote from the same conference that speaks to why investors are so excited about AI.

We are still in the early days of AI, although maybe here at an inflection point, there is a lot of work in terms of to scale up or scale out in terms of that data centre. But more importantly, outside of just CUDA [CUDA is a parallel computing platform and programming model created by NVIDIA] is the stacks of additional software from SDKs [software development kits]to full libraries, helping industry by industry move to accelerated computing and helping them move to AI as we better understand the applications that they use within that industry and realigning it to GPU [graphics processor unit] use versus just the standard CPU [central processing unit]. A lot of this is work with our engineers working end-to-end with our customers.

We have, of course, a very large hardware engineering team solely focused in terms of not only our GPU, but also our networking through our acquisition that we did with Mellanox. These are important pieces, but let’s not forget that we have engineers, almost equal size in terms of software engineers that are focused in terms of building out so much of the work that we have done over this time.

Colette Kress, London Investor Conference, 14 June 2023

There is another important ‘something new’ happening at Nvidia and that is the growing importance of software revenue which is typically highly valued by investors.

We have taken an approach of selling software separately. As you know, many of our systems right now incorporate a significant amount of software that is not really sold separately, but it is included in the full price of some of the systems that we create. But there is another opportunity for us to create software to help many of our enterprises and many different industries move towards AI. So, let’s talk about the three largest pieces of it. The first one is NVIDIA AIE. NVIDIA AIE is essentially a full package of the essentials of an operating system to do overall AI. Important for the enterprises who want to get started that can really leverage this for keeping everything straight within their data centre, keeping a close watch on all of their compute as they have got a full stack to both begin building what they need in terms of a new model and/or tracking in terms of the progress and how efficiently the data centre is running.

All this is available. Enterprises want us. They want to make sure that we are helping and providing software that keeps their risk minimized and they can count on us completing that software. That’s one piece of that.

The second piece there is Omniverse. Omniverse is a platform solution software. This is allowing the future of the metaverses in many different ways such as the ability to create digital twins, the ability to create a 3D environment in the Internet. All of these are important pieces and how you can work with both individuals or teams within the enterprise as they look for Omniverse’s solution.

And then lastly important one is our automotive software. Our automotive software sits in addition to the hardware that would be inside of the car, fueling ADAS [advanced driver assistance systems] or fuelling Level 2, Level 3 and beyond type of software. That’s with many of our partners, particularly our Daimler agreement as well as our JLR [Jaguar Land Rover] agreement. That will again be an important ramping as we are sharing the software revenue between us and those partners. So, we are excited for that piece as we believe that our automotive pipeline going forward is about $14bn and a good portion of that is focused on the software revenue that we will have with these two partners and likely more going forward.

So, right now our software revenue, we have indicated is in the hundreds of millions of dollars and we believe it’s an important piece with the infrastructure purchases that software will likely be hand-in-hand for so many of the things that we see going forward.

Colette Kress, London Investor Conference, 14 June 2023

There is a lot about Nvidia partly because they are at the heart of the technology revolution which is gathering pace right now but also because Nvidia is one of my favourite shares and the benchmark against which I measure all other shares including those below.

The Microsoft Cloud delivered over $28bn in quarterly revenue, up 22pc and 25pc in constant currency, demonstrating our continued leadership across the tech stack. We continue to focus on three priorities. First, helping customers use the breadth and depth of the Microsoft Cloud to get the most value out of their digital spend. Second, investing to lead in the new AI wave across our solution areas and expanding our TAM [total addressable market]. And third, driving operating leverage, aligning our cost structure with our revenue growth.

Now I’ll highlight examples of our progress, starting with infrastructure. Azure took share as customers continue to choose our ubiquitous computing fabric from cloud to edge, especially as every application becomes AI-powered. We have the most powerful AI infrastructure and it’s being used by our partner, OpenAI, as well as NVIDIA and leading AI start-ups like Adept and Inflection to train large models.

Our Azure OpenAI Service brings together advanced models, including ChatGPT and GPT-4 with the enterprise capabilities of Azure. From Coursera and Grammarly to Mercedes-Benz and Shell, we now have more than 2,500 Azure OpenAI Service customers, up 10x quarter-over-quarter. Just last week, Epic Systems shared that it was using Azure OpenAI Service to integrate the next generation of AI with its industry-leading EHR software.

Azure also powers OpenAI API and we are pleased to see brands like Shopify and Snap use the API to integrate OpenAI’s models. More broadly, we continue to see the world’s largest enterprises migrate key workloads to our cloud. Unilever, for example, went all in on Azure this quarter in one of the largest ever cloud migrations in the consumer goods industry.

IKEA Retail, ING Bank, Rabobank, Telstra and Wolverine Worldwide, all use Azure Arc to run Azure services across on-premises, edge and multi-cloud environments. We now have more than 15,000 Azure Arc customers, up over 150pc year-over-year. And we are extending our infrastructure to 5G network edge with Azure for Operators. We are the cloud of choice for telcos, and at MWC last month, AT&T, Deutsche Telekom, Singtel and Telefonica all shared how they are using our infrastructure to modernize and monetize their networks.

Satya Nadella, CEO, Microsoft, Q3 2023, 25 April 2023

Just read that statement and you can see that Microsoft is a company at the heart of the technology action and a key player in the whole technology revolution.

It is interesting to know that there is an analyst out there who has identified three potential $10 trillion stocks and their names are Apple, Nvidia and Microsoft. This ties in with my concept that a group of giga corporations is emerging which will lead humanity into the space age.

We’re seeing strong engagement growth across our apps and good progress on monetization efficiency, which combine to drive good business results.

Reels continues to grow quickly on both Facebook and Instagram. Reels also continue to become more social with people resharing Reels more than 2bn times every day, doubling over the last six months. Reels are also increasing overall app engagement and we believe that we’re gaining share in short-form video too.

A key theme I want to discuss today is AI. I’ve emphasized for a number of these calls now that there are two major technological waves driving our roadmap — a huge AI wave today and a building metaverse wave for the future. Our AI work comes in two main areas: first, the massive recommendations and ranking infrastructure that powers all of our main products — from feeds to Reels to our ads system to our integrity systems and that we’ve been working on for many, many years — and, second, the new generative foundation models that are enabling entirely new classes of products and experiences.

Our investment in recommendations and ranking systems has driven a lot of the results that we’re seeing today across our discovery engine, Reels, and ads. Along with surfacing content from friends and family, now more than 20pc of content in your Facebook and Instagram feeds are recommended by AI from people, groups, or accounts that you don’t follow. Across all of Instagram, that’s about 40pc of the content that you see. Since we launched Reels, AI recommendations have driven a more than 24pc increase in time spent on Instagram.

Our AI work is also improving monetization. Reels monetization efficiency is up over 30pc on Instagram and over 40pc on Facebook quarter-over-quarter. Daily revenue from Advantage+ Shopping Campaigns is up 7x in the last six months.

Our work to build out business messaging as the next pillar of our business is making progress too. I shared last quarter that click-to-message ads reached a $10bn revenue run-rate. And since then, the number of businesses using our other business messaging service — paid messaging on WhatsApp — has grown by 40pc quarter-over-quarter.

Mark Zuckerberg, Meta Platform, Q1 2023, 26 April 2023

My hunch is that Meta Platforms is another share with giga corporation potential. Zuckerberg has proved himself to be a tough as well as an inspired CEO.

Generative AI design tools are revolutionizing chip and system development by delivering unprecedented optimization and productivity benefits. Customers have already been benefiting from our ground-breaking generative AI solutions in the digital, verification and systems areas, and with the recent introductions of Virtuoso Studio and Allegro X AI, we now have an unmatched chip to package to board to systems generative AI portfolio.

Leveraging 30 years of industry leadership, Virtuoso Studio accelerates heterogenous system design, and through AI-powered layout automation and optimization provides an average 3x productivity boost for designs in the notably complex analog domain. Several customers including MediaTek, Renesas, Analog Devices and TSMC provided testimonials for the launch.

Allegro X AI technology utilizes the latest innovations in generative AI to accelerate PCB design with more than a 10x reduction in turnaround time, and at the recent launch, it was endorsed by Schneider Electric and Kioxia.

All of these powerful engines are fueled by our unique, differentiated big data analytics JedAI platform that unifies massive amounts of design and verification data to carry forward learnings and insights to future designs. Our rapidly proliferative generative AI solutions are enabling customers to reap significant power, performance and area benefits through better optimized designs while greatly improving engineering productivity and accelerating design closure.

Along with AI, other generational trends such as hyperscale computing, 5G and the digital transformation across multiple verticals continue to propel thriving design activity across semi and systems companies, creating rich market opportunities for our differentiated end-to-end EDA [electronic design automation], IP [intellectual propoerty] and systems solutions.

Anirudh Devgan, Cadence Design Systems, Q1 2023, 24 April 2023

The transition to smart everything is well underway and will drive significant long-term growth for semiconductors and outsized contribution for us. Against this backdrop, we planned and are executing accordingly. Based on continued strong design activity in high confidence in our business, we are raising our full-year revenue guidance range to between $5.79bn, and $5.83bn. We are increasing our Year-over-Year non-GAAP ops margin improvement expectation, to 150 basis-points up approximately half a point versus the prior guidance. We are raising our full-year non-GAAP EPS range to between $10.77 and $10.84.

Aart Geus, Synopsis, Q2 2023, 17 May 2023

We finished the fourth quarter strong, and the coming year looks stronger. I believe that it is generally agreed that the overall market for enterprise AI now appears substantially larger and is growing at a much greater rate than most analysts and experts predicted.

We have been working since 2009 to develop product leadership and established thought leadership in enterprise AI, assisting private and popular sector enterprises to apply AI to improve operational processes. C3.ai has been at the vanguard of the enterprise AI market for over a decade. As the market has developed from its roots in IoT [Internet of Things] to supervised learning — unsupervised learning, NLP [natural language processing], deep learning, reinforcement learning, and now generative AI. In the past 14 years, we have developed and enhanced the C3.ai platform and now offer over 40 enterprise AI applications developed with that platform that allow our customers to rapidly take advantage of AI to improve their business processes.

We have been communicating for over a decade that we believe that the market for enterprise AI solutions would be quite large. And now, as we enter the summer of 2023, AI has become a dominant theme in technology discussions, government discussions, media reports, defence and intelligence imperatives, and government and business imperatives. I do not believe that it’s an overstatement to say that there is no technology leader, no business leader, and no government leader who is not thinking about AI daily. AI chip makers, like NVIDIA, are accelerating production to try to keep up with the demand that’s out there.

And all of this is getting accelerated by the advent of generative AI. The interest in AI and in applying AI to business and government processes has never been greater. Business inquiries are increasing. The opportunity pipeline is growing, demand is increasing.

And C3.ai is well positioned to serve that increasing demand with our tried, tested and proven AI platform, our applications, our global footprint, and our large global ecosystem. The world is coming to us. The interest in applying AI to business processes is greater than we have ever seen. In the fourth quarter, we increased our customer base, expanded our work with existing clients, and saw especially strong growth in our federal business.

Tom Siebel, C3.AI, Q4 2023, 1 June 2023

Investors have been very nervous of C3.AI, suspecting it was all hot air but Tom Siebel is not a man to write off lightly and nobody can say that these guys are not sitting at the heart of the AI revolution. The name is a clue although so far it is more talk than walk.

Use of our products grew strongly in the first quarter versus a year ago, helped by positive surgical trends and strong execution by our team. New capital installs were likewise strong as customers built their da Vinci and Ion system capability to meet demand. Revenue grew 14pc on the back of this continued adoption. Some manufacturing and supply challenges this quarter negatively impacted our product margins. This is an opportunity for sharper execution going forward.

In Q1, the installed base of da Vinci systems grew 12pc to almost 7,800 systems, driven primarily by demand for additional capacity given procedure growth. Average system utilization grew 13pc year-over-year, significantly above long-term trends driven by notable strength in procedure volumes in January and February, and by an increasing mix of shorter duration benign procedures in the U.S. While we do not expect this level of utilization growth to continue, we actively support our customers as they increase utilization of their da Vinci systems, which in turn lowers their per procedure costs.

Gary Guthart, Intuitive Surgical, Q1 2023, 18 April 2023

Intuitive Surgical has a razors and razor blades approach which makes the growth in the installed base important.

Monday.com is absolutely rocketing along as you can see from the quote below.

After a strong fiscal year of 2022, we are happy to say that we kept the momentum going with an exceptional Q1 in fiscal year 2023. Despite the persistent uncertainties in the macro environment, we continue to invest in our growth and profitability at scale, and we are seeing the results. Q1 revenue totaled 162.3m, an increase of 50pc year over year.

We generated a record 38.7m in free cash flow during the quarter and are well positioned in meeting our goal of positive free cash flow for the third straight year. Additionally, we are pleased to report that we are now guiding to positive non-GAAP operating profit for fiscal year 2023, two years ahead of expectations. Customer acquisition continued to be exceptionally strong, our fastest-growing customer segment remains the enterprise, where we grew customers by 75pc to 1,683 customers, marking a record number of quarterly net new enterprise customers.

Equally impressive has been the fast adoption and strong customer feedback of our Monday Sales CRM product. Customers love Monday Sales CRM as it’s more customised and easier to use than traditional CRM tools. In Q1, we opened our Monday Sales CRM to a selection of our existing customer base, and the response has been tremendous. Total sales in CRM accounts accelerated to 5,441 accounts, representing a record number of quarterly net new sales CRM accounts.

Roy Mann, Monday.com, Q1 2023, 15 May 2023

As you can see, once again, our teams have delivered a balanced quarter between our top- and bottom-line performance in the current macroeconomic environment. In Q3, our billings grew 26pc year over year and revenue grew 24pc, while RPO [remaining performance obligations] grew ahead of these at 35pc. Our Q3 non-GAAP operating income and our trailing 12-month adjusted free cash flow both grew about 60pc year over year, while we achieved our fourth consecutive quarter of profitability on a GAAP basis.

Our ARR [annual recurring revenue] is growing over 50pc. At scale, we have surpassed 4,200 customers in Q3. Our success has spread across all three major geographies, as highlighted by large deals in each of these territories in Q3.

Nikesh Aurora, CEO, Q3 2023, 23 May 2023

Palo Alto Networks is my favourite digital security business at the the moment.

We are changing the shape of Shopify significantly today. The decade we’re in shows the speed of change accelerating beyond what anyone has ever experienced.

The pace of change can never outpace our ability to adapt. So, today, we announced that we are reducing our head count and leaning into our partner model ecosystem, selling the majority of our logistics business to Flexport, who will become the preferred logistics partner for Shopify. For our team, this is an incredibly hard week. Shopify is a company that deeply values the talented builders that make it possible for Shopify to simplify operations that reduce friction and enable merchant success.

Shopify continues to be the engine powering millions of merchants around the world. Our platform continues to expand, giving our merchants more of the solutions they need to run their businesses online, offline, and everywhere in between. We have worked hard to earn our merchants’ trust as Shopify continues to solve the industry’s biggest problems to make commerce better for everyone.

Harvey Finkelstein, president, Q1 2023, 4 May 2023

I am a huge fan of Spotify and subscriber to their service. My list of liked songs is fast approaching 4,000. Even having music in the background most of the time in the soap opera which is my life, especially now that I have moved back to my Dickensian mansion in Saffron Walden, with a garden so big and overgrown that who knows what is lost or hiding there, it is going to take well over a month to play the whole list.

Other people obviously also find them great because business is booming.

As we open this call, I can’t help but feel a tremendous amount of excitement about the progress our team made this quarter, our strongest Q1, since going public. Over the last few months, we’ve celebrated some significant milestones, including surpassing over 0.5bn users and reaching more than 200m subscribers.

Our user growth exceeded our expectations by 15m and our subscriber numbers by 3m. And at our scale, it is pretty remarkable to see this level of reacceleration in our user growth, but it is a trend that’s been consistent now for over the last five quarters. The last two quarters saw the largest MAU [monthly active user] growth in our history. The outperformance was broad based, meaning growth was pretty evenly spread across every region without a single market dominating. We were able to accomplish this level of growth with lower marketing spend. We look at this as a promising sign. But it’s too early to draw any conclusions yet.

But don’t let all my talk about the importance of long-term investing allow you to believe that we are rethinking our commitment to driving efficiency. Last quarter and building on what we shared at last year’s Investor Day, I talked about shifting towards becoming a more efficient company. There’s no question that we’ve become leaner in the last six months, but this progress is still early in its reflection on our financials.

The actions we’ve taken coupled with other opportunities to reduce spending in areas like marketing and content production and real estate should lead to a steady progression of key metrics throughout the year, all of which makes me even more bullish about the remainder of 2023 and beyond.

Daniel Ek, CEO, Spotify, Q1 2023, 25 April 2023

What’s notable about this earnings call is McDonald’s consistency, consistency in the strength of our numbers, consistency in the powerful drivers of our business, and consistency in the excitement that exists across the system about the opportunities that lie in front of us. Let’s start with the numbers. At the top line, you only need to know one number, 12.6pc.

US comparable sales growth, 12.6pc, IOM comparable sales, 12.6pc, IDL comparable sales, 12.6pc, and global comparable sales, you guessed it, 12.6pc. These results reflects strong consumer demand for McDonald’s that we are seeing around the world despite a challenging operating environment and historically weak consumer sentiment in many markets.

Chris Kempczinski, CEO, McDonald’s, Q1 2023, 25 April 2023

Big as it is McDonald’s is planning to accelerate the pace of growth.

Back in January, we announced the evolution of Accelerating the Arches. We’re continuing to double down on our existing growth pillars while advancing two new initiatives. The first is accelerating restaurant development. Our strong performance has earned us the right to open new restaurants at a faster rate than we have historically. We’re focused this year on determining the best path forward to meet customer demand and look forward to sharing more at our Investor Day later this year.

The second newer element of our strategy is fundamentally rethinking how we as a company can work better together to become faster, more innovative, and more efficient. We’re calling this Accelerating the Organization.

Chris Kempczinski, CEO, McDonald’s, Q1 2023, 25 April 2023

I keep meaning to go and have a McDonalds. I want to see first hand what is going on and it is a very cheap way of getting what I suspect will prove a perfectly tasty meal. The group has 40,000 restaurants serving 70m people daily which is a big number but also raises the possibility that they could become much bigger since they have a formula that clearly works incredibly well.

Chipotle is in great shape judging by the latest quarterly results.

2023 is off to a great start with first quarter sales and margins ahead of our expectations. For the quarter, sales grew 17pc to reach $2.4bn, driven by a 10.9pc comp. In-store sales grew by 23pc over last year. Digital sales represented 39pc of sales. Restaurant level margin was 25.6pc, an increase of 490 basis points year-over-year. Diluted EPS was $10.50, representing 84pc growth over last year. And we opened 41 new restaurants, including 34 Chipotlanes.

These results demonstrate that our focus on running great restaurants with exceptional food and exceptional people is driving performance. Additionally, we benefited from exciting new menu innovations including Fajita Quesadilla and Chicken al Pastor. Transaction trends were positive throughout the quarter and the strength has continued into April.

Brian Niccol, CEO, Chipotle Mexican Grill, Q1 2023, 25 April 2023

The powerful ‘something new’ which is driving performance at CMG is the arrival of Brian Niccol as CEO. He took charge on 5 March 2018 and just look at what has happened to the shares since then. The golden smiley in 2019 ought to have his face on it.

Since taking the helm, Niccol has led Chipotle’s digital transformation. The chain hit 3,000 store locations this year; Niccol’s long-term goal for the company is 7,000 locations in North America.

Digital sales made up 9pc of total sales when Niccol joined. They now make up about 37pc of revenue from food-and-beverage sales.

The 500th Chipotlane, which allows customers to order online and pick up their food at a walk-up or drive-up window, opened in November. Chippy, a robot that makes tortilla chips, began serving guests in California in October.

BusinessInsider.com, December 2022

Snowflake’s product revenue grew 50pc in Q1 fiscal year 2024, totaling $590m. Our net revenue retention rate reached 151pc, and remaining performance obligations came in at $3.4bn, up 31pc year on year.

Non-GAAP adjusted free cash flow was $287m, up 58pc year over year. We are, however, operating in an unsettled demand environment, and we see this reflected in consumption patterns across the board. While enthusiasm for Snowflake is high, enterprises are preoccupied with costs in response to their own uncertainties. We proactively work with customers to optimize their environments.

This may well continue near term, but cycles like this eventually run their course. Our conviction in the long-term opportunity remains unchanged. Generative AI with its chat style of interaction has captured the imagination of society at large. It will bring disruption, productivity, as well as obsolescence to tasks and entire industries alike.

Generative AI is powered by data. That’s how models train and become progressively more interesting and relevant. Models have been primarily been trained with internet and public data, and we believe enterprises will benefit from customizing this technology with their own data. Snowflake manages a vast and growing universe of public and proprietary data.

The data cloud’s role in advancing this trend becomes pronounced. AI’s focused on large language models and textual data, both structured and unstructured, will lead to rapid proliferation of model types and specializations. Some models will be broadly capable but shallow in functions. Others will be deep, specialized, and impactful in their specific realm.

For years, we focused on the extensibility of our platform via Snowpark, making Snowflake ideally suited for rapid adoption of new and interesting language models as they become available. AI is also not limited to textual data, equally far reaching we’ll be seeing with audio, video, and other modalities. The Snowflake mission is to steadily demolish any and all limits to data users, workloads, applications, and new forms of intelligence. We will, therefore, continue to see us at evolve and expand our functions and feature sets.

Our goal is for all the world’s data to find its way to Snowflake and not encounter any limitations in terms of use and purpose. From our perspective, machine learning, data science, and the AI are workloads that we enable with increased capability, continuous performance, and efficiency improvements. Data has gravitational pull. And given the vast universe of data Snowflake already manages, it’s no surprise that interest in these capabilities is escalating while its users are still evolving.

Data science, machine learning, and AI use cases on Snowflake are growing every day. In Q1, more than 1,500 customers leverage Snowflake for one of these workloads, up 91pc year over year. A large U.S. financial institution uses Snowflake for model training, facing memory constraints with their prior solution.

Frank Slootman, CEO, Snowflake, Q1 2024, 24 May 2023

As you’ve seen from our press release, we are off to a very strong start in 2023. We reported first quarter revenue of $383m, representing growth of 21pc compared with last year, again exceeding our own expectations, and has been the case in the last few quarters. We continue to significantly outperform the digital advertising industry.

We are gaining market share as advertisers embrace the precision and relevance of data-driven advertising on the open Internet via our platform. Even as most brands and advertisers continue to deal with some level of uncertainty, they are increasingly shifting more of their campaign dollars to decision, data-driven opportunities, where they can have more confidence that those dollars are working as hard as possible. As a result, we are signing multiyear joint business plans, JBPs, with the leading agencies and brands, some of which represent spend projections that exceed $1bn

Jeff Green, CEO, The Trade Desk, Q1 2023, 10 May 2023

Strategy – Buy on Double Whammies, Sell When Charts Turn Negative

If you have the patience there are many shares which should never be sold. Looking at the charts above you buy and hold when the last emoji was a smiley one and sell when the emoji is red and frowning. You may not make money from this by the time you have sold and bought back again but it does give you peace of mind.

We can see how this might have worked with Google, now known as Alphabet.

We are not trying to make money from trading in and out of the stock but just standing aside during periods of extreme weakness. The real aim is to make sure to be in the stock when the last emoji was a golden smiley. It is a simple but effective decision system, which can be applied to any share in a strong uptrend.

It most likely would not work well with a share which was not in a strong uptrend but that is the whole point of my 3G approach. I am only interested in shares with strong upwards momentum when my indicators do work. As you can, see, with Google/ Alphabet my approach would work very well and you could even base it just on the Coppock indicators, which, to date, have given excellent signals.

Think Like a General Planning His Strategy

Imagine you are a general being interrogated by the joint chiefs of staff who want to know why you are doing what you are doing and what you are going to do next. You now have complete answers for everything.

Question – why did you buy that share?

Answer – because it is 3G, because there is some magic to the story, because there is an important ‘something new’ happening at or affecting the business and lastly but also important, because the last emoji was a golden smiley.

If the answer does not include all of these points they will question your decision and they will be right to do so. If the answer is clearly unsatisfactory, such as that the last smiley was red and frowning or the company and its shares are obviously not 3G, you may expect to lose at least one of your stars (and probably some money as well).

Share Recommendations

Nvidia. NVDA. Buy @ $426

Microsoft. MSFT Buy @ $342

Meta Platforms. META. Buy @ $281

Cadence Design Systems. CDNS. Buy $235

Synopsys. SNPS. Buy $441

C3.AI. AI. Buy @ $44

Intuitive Surgical. ISRG. Buy @ $329

Monday.com. MNDY. Buy @ $178.50

Palo Alto Networks. PANW. Buy @ $246

Shopify. SHOP. Buy @ $64.50

Spotify. SPOT. Buy @ $160

McDonalds. MCD Buy @ $293

Chipotle Mexican Grill. Buy @ $2032

Snowflake. SNOW. Buy @ $184

The Trade Desk. TTD. Buy @ $76

Alphabet GOOGL. Buy @ $123.50

Climbing Aboard

One of my ideas is that if you find an exciting growth share don’t worry about where it has one from even if it has already risen significantly. Just think of buying these shares as climbing aboard a train which still has a long way to go to reach its destination.

How you use a string of recommendations such as those in this alert depends on your strategy. If you have a portfolio approach by all means invest in all of them as part of building a large portfolio stuffed with exciting names.