Building a List portfolio more practical than you may think as biopharma stocks boom

I recently published as a Quentinvest Alert what I called The List. This is a list of stocks drawn from the QV for Shares portfolio that I believe should be in your portfolio now. It will change over time but hopefully not too rapidly

There are 200 stocks in the list which may seem an impractically large number. It would have been in the past unless you had substantial funds at your disposal because of issues like minimum commission and high priced stocks such as Alphabet (recent price $2,694) and Amazon (recent price $3327) which are both in the list. Technology has changed all that. We now have trading platforms where you can trade US shares commission free and all shares very cheaply and which offer fractional investing so you can choose to invest any amount in a share independent of the share price.

This means you could build a portfolio investing around £100 in each share so a 200-share portfolio would cost you £20,000. If you were following the QV for Shares strategy you could then add to holdings on subsequent buy signals (with Quentinvest you will be alerted monthly or even more frequently when new buy signals occur) so over time you can build a valuable portfolio with great potential to deliver impressive long term capital gains.

Even if you did not make the additional purchases I would hope that you would do well over time and with Quentinvest there are many strategies open to you. You could buy/ make additions when the shares are featured in either or both of Great Chart and Great Stocks. You could make additions monthly or quarterly which should certainly work well with ETFs.

The main thing is to focus your strategy on well-chosen stocks and choosing them is what Quentinvest is all about. Do that and almost any patient, long-term approach will deliver good results.

Covid kick starts biopharma related stocks

The Covid pandemic is having a dramatic effect on biopharma stocks. This is partly because the global rollout of the vaccine is effectively the biggest drug programme in history generating a tidal wave of revenues for a number of stocks, some of which are in the QV portfolio. It is also because the named vaccine providers like Pfizer-BioNTech, Moderna and Astra-Zeneca are not acting alone but have many suppliers and partners among other quoted stocks, which are often also in QV.

It is also because of a vital health care technology platform called mRNA, with which Moderna is so involved that this is the company’s stock market code.

“mRNA stands for messenger ribonucleic acid. They’re single-stranded molecules that carry genetic code from DNA in a cell’s nucleus to ribosomes, which make protein in the cells. These molecules are called messenger RNA because they carry instructions for producing proteins from one part of the cell to another.”

How does it work in the Covid vaccine?

“Scientists engineered a synthetic mRNA that codes for the spike protein on the coronavirus. This is the part of the virus that helps it enter human cells. The spikes are what you see on illustrations of the SARS-CoV-2 viral particle.

This synthetic mRNA instructs cells in the human body to make their own viral spike protein. This triggers the immune system to make antibodies to fight the virus. Once the immune system knows how to make these antibodies, it can do it again when exposed to the spike protein.

You can think of an mRNA vaccine as sending instructions into the body on how to fight COVID-19. Once the body makes the viral proteins, the immune system learns how to destroy them. This gives your body the tools to defend against SARS-CoV-2 if you’re exposed.”

What is exciting is that mRNA could have many other applications. The companies that have been involved in developing the technology over the last 10-20 years say the implications for fighting all kinds of diseases could be “gigantic”. There may also be a job to do dealing with further Covid variants over the years, with new ones appearing all the time.

We have also seen how fast the industry can move to develop a vaccine when a crisis strikes and the impact of huge private and public funding in helping to make things happen. The effect is that Covid-19 has turbocharged the whole sector.

Avantor AVTR Buy @ $37.50 – “We expect the momentum in our base business to continue.”

Bio-Rad Laboratories. BIO. Buy @ $726 – “One of the benefits of the pandemic is that government have poured a lot of funding into translational medicine, infectious disease, vaccine development.”

Sartorius Stedim Bio. DIIM Buy @ €477.- “Demand for Sartorius products is growing rapidly.”

Edwards Lifesciences. EW. Buy @ $112 – “We remain as optimistic as ever about the long-term growth opportunity.”

Illumina. ILMN. Buy @ $491 – “[Pandemic] has established a new baseline of awareness and infrastructure build-out that will support sustained activity.”

InMode INMD. Buy @ $113 – “This platform [Empower] is expected to become the gold standard in women’s health and wellness.”

Monolithic Power Systems. MPWR. Buy @ $449 – “New product acceptance on this scale [37pc of revenues] has paved the way for accelerated growth.

Rapid7. RPD. Buy @ $113.50 – “Rest of world saw continued strong growth of 40pc year over year,”

Veeva Systems. VEEV. Buy @ $330 – “Many downsides to Covid 19 but it is spurring innovation.”

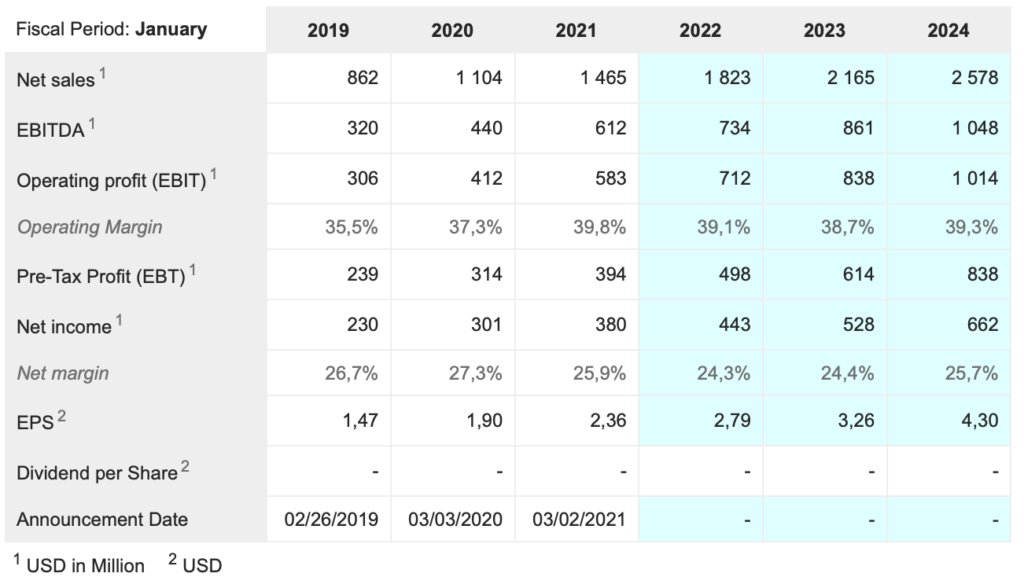

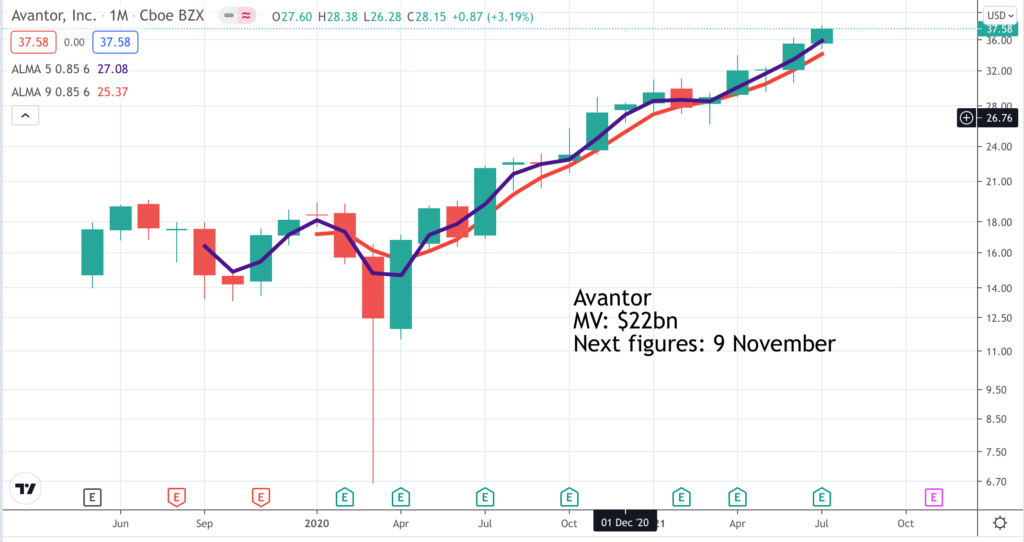

Avantor AVTR. Buy @ $37.50. New entry

Avantor supplies vital goods and services to a booming global biopharma industry

Although floated quite recently Avantor is a large business that has been around for a long time. It was founded in 1904 to bring extra purity to lab ingredients and then acquired another company creating chemicals for use in labs and gold mining creating the present business.

Going public can be a way of cashing in your chips but more usually it signals a new era of growth for a business and that certainly seems to be the case for Avantor which recently reported a stellar set of quarterly figures including boosting earnings per share by 80pc.

“In the second quarter, we achieved 20.5pc organic revenue growth and our core growth rate improved for the fourth consecutive quarter to 18.5pc COVID tailwinds contributed approximately 2pc to growth driven largely by sales of raw materials and single use solutions for COVID vaccine production. In addition to delivering exceptional top-line results, we expanded EBITDA margins approximately 125 basis points, grew our adjusted EPS more than 80pc to $0.35, and more than tripled free cash flow.”

What seems to be happening is that Covid-19 has unleashed a tsunami of funding into the biopharma industry and this in turn is leading to stepped up spending on goods and services from suppliers like Avantor.

The fact that the company has been around such a long time creates great barriers to entry from factors like the global distribution infrastructure it has created.

“One of our greatest strengths comes from having a global infrastructure that is strategically located to support the needs of our customers. Our global footprint enables us to serve more than 225,000 customer locations and gives us extensive access to research laboratories and scientists in more than 180 countries.”

The company is also benefiting from people living longer and becoming more affluent. This is driving huge populations in emerging markets to aspire to levels of health care available in more advanced economies at the same time as those countries or themselves making further progress.

“Avantor’s differentiated and highly resilient business model positions the company to deliver results across market segments. We are progressing a long-term growth strategy based on product innovation, expansion in emerging markets and targeted M&A.”

Acquisitions are playing an important role.

“In mid-June, we completed the acquisition of Ritter, which adds high precision proprietary consumables to our portfolio. And we recently launched Ritter’s products under the J.T. Baker brand name through our differentiated customer channel. We also closed on RIM Bio, a China based manufacturer of single use solutions to support our bioprocessing platform. This acquisition extends our single use manufacturing footprint to China and adds critical technology to our portfolio.”

The business is in great shape.

“Looking ahead, we expect the momentum in our base business to continue driven by strong fundamentals across all of our end markets. Revenues in July have kept pace with first half results and our order book for long cycle proprietary materials continues to grow. We are again raising our 2021 full year guidance.”

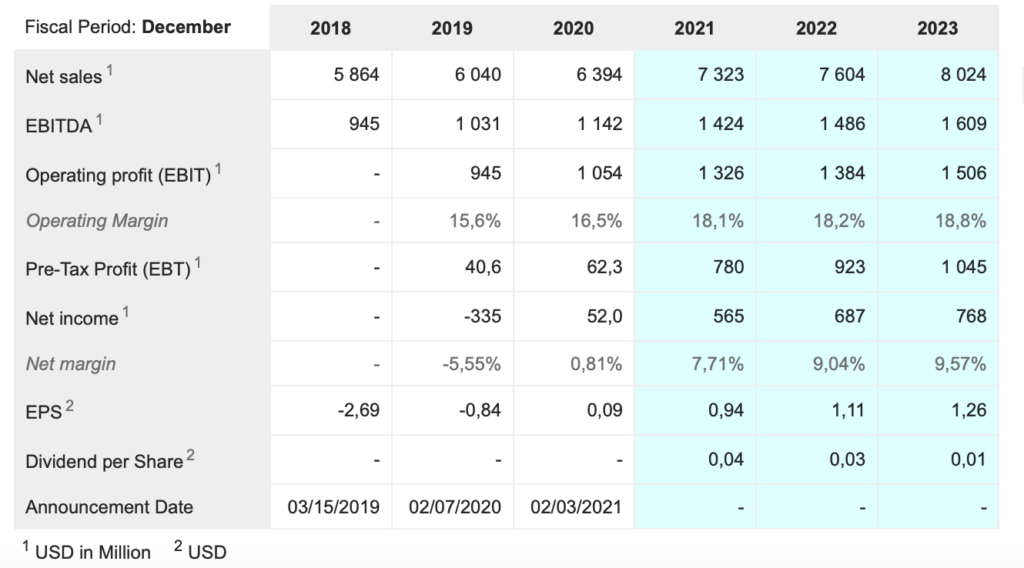

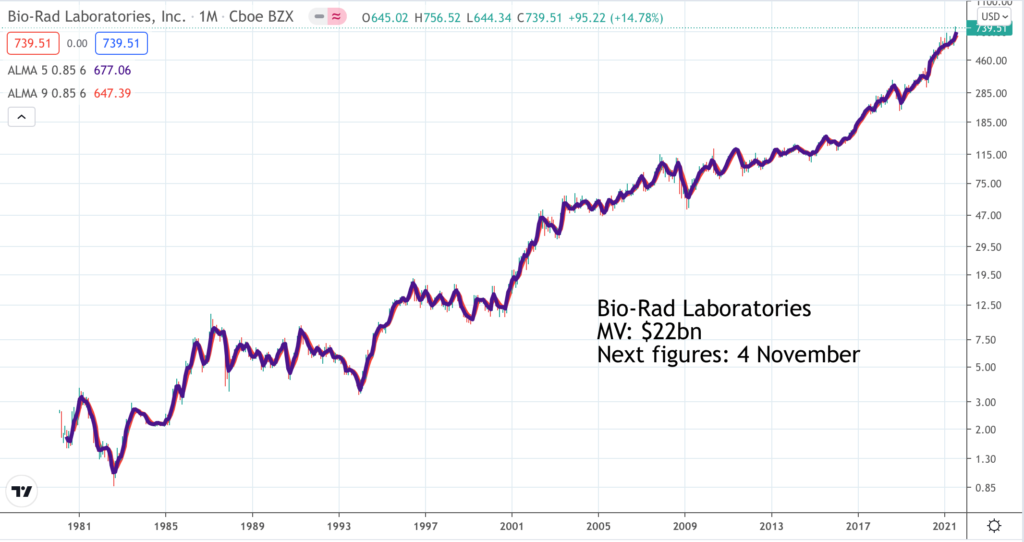

Bio-Rad Laboratories. BIO Buy @ $726. Times recommended: 1 First recommended: $693

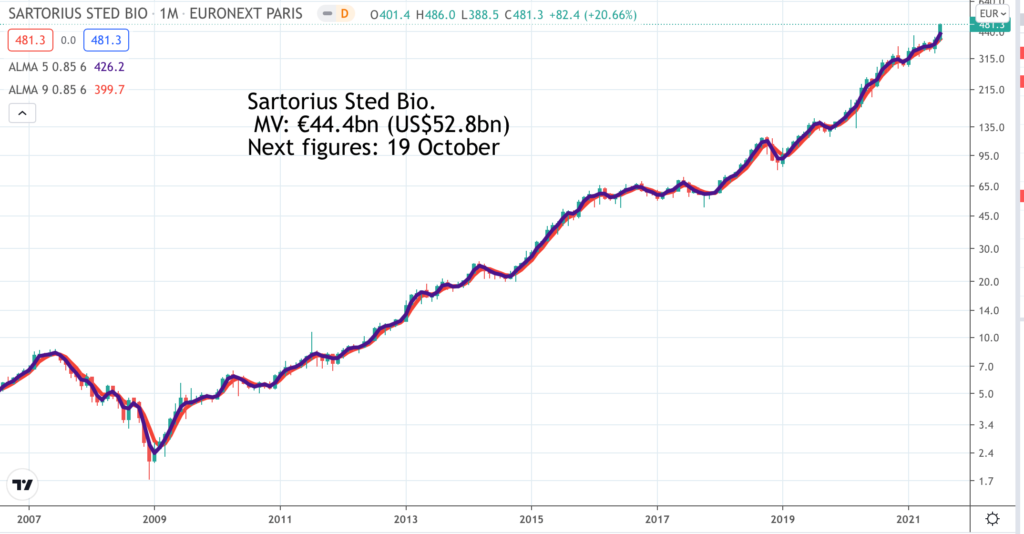

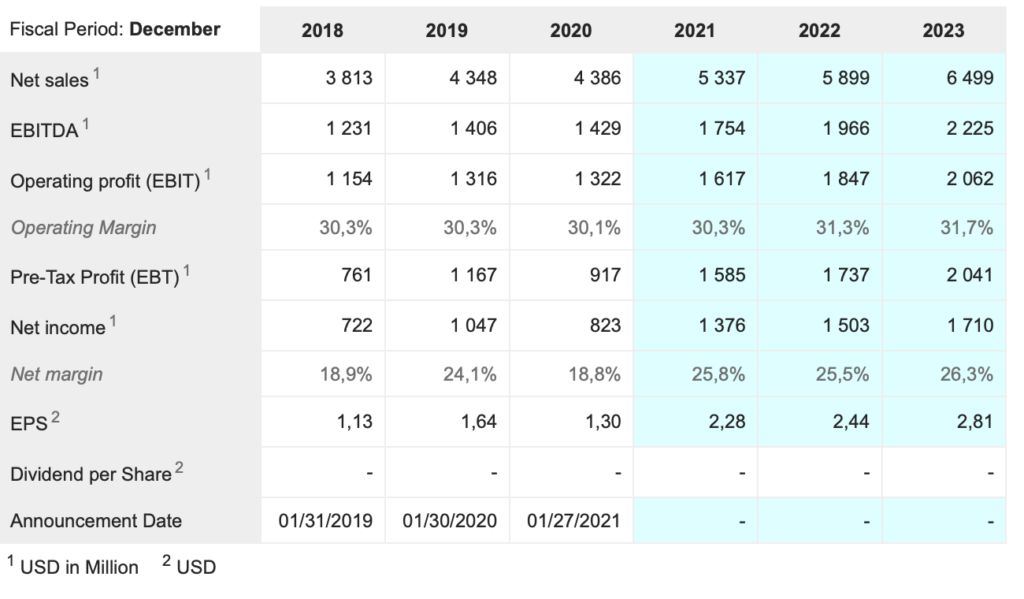

Sartorius Stedim Bio. DIM. Buy @ €477. Times recommended: 2. First recommended: €359. Last recommended: €463

Bio-Rad trading strongly and owns 37pc of high flying Swiss-based Sartorius, a stake worth almost as much as Bio-Rad’s market value

As you can see from the chart Sartorius Setdim Biotech has been an incredible performer over the years. The price has climbed from €2 in 2009 to around €480 recently. The company supplies products to the biopharma industry. Organic growth has been in double digits annually over many years and this is supplemented by acquisitions.

The Swiss-based company has been around a long time.

“Spotlights from 150 years trace how we evolved from a precision mechanical workshop into a leading international life science group. Both then and today, our innovative tools have been helping researchers make scientific discoveries. Yet today we are entirely focusing on serving the biopharma sector – an industry that did not even exist 150 years ago.”

The business is on fire.

“Based on constant currencies, group sales revenue rose 60.1pc to around 1,629m euros (reported: +54.2pc). The majority of this growth was generated based on the strong organic expansion of the core businesses of both divisions in all regions. Acquisitions added a good 8 percentage points to the increase in sales revenue, and the growth related to the development and production of vaccines and coronavirus test kits was about 22pc points. Order intake1grew even more dynamically, rising to 2,179m euros (+82.4pc in constant currencies of which around 27 percentage points were attributable to the coronavirus pandemic and around 10 percentage points to acquisitions; reported: +75.0pc).”

If you look on their web site thee is an incredible amount going on to sustain growth with new innovations, factory expansions and acquisitions. DIM is a very dynamic operation.

Bio-Rad Laboratories, a US quoted business, which also supplies research labs and biopharmas is less dynamic but still growing very healthily.

“Net sales for the second quarter of 2021 were $715.9m, which is a 33.4pc increase on a reported basis versus $536.9m in Q2 of 2020.”

The reason why I am including both these companies in the same story is because Bio-Rad owns a 37pc stake in Sartorius worth $19.5bn. Since the whole of Bio-Rad is capitalised at $22bn this is obviously a hugely important factory in evaluating the shares.

On the face of it Bio-Rad looks cheap. You are paying $3bn for a business expected to have sales and profits in 2021 of $2.5bn and $486m respectively. It doesn’t always work out according to logic. Sometimes companies end up being valued at a discount to large single investments.

Eventually it should trigger some action. by the companies to realise the value. Bio-Rad could sell its stake in Sartorius although it is hard to imagine where it could reinvest the money more successfully. A better idea might be for Sartorius to buy Bio-Rad but that could be expensive.

Whatever happens both shares seem well placed to head higher so it makes sense to invest in both. to capitalise on the growth and be positioned for any corporate activity that might eventually occur.

Edwards Life Sciences EW Buy @ $112. Times recommended: 3. First recommended: $96. Last recommended: $102.50. Times recommended: $103

Heart specialist, Edwards Lifesciences, sees Covid bounce and long term opportunity as procedures recover

Edwards Lifesciences is the global leader in patient-focused medical innovations for structural heart disease, as well as critical care and surgical monitoring. Unlike many other medical stocks Edwards’ performance was hit by Covid, especially initially as procedures were delayed. Now it is seeing a strong recovery.

“Last year, we noted that we’re in the midst of the onset of this tragic global pandemic. There were more than 20,000 patients around the world who were treated with our SAPIEN valves in that second quarter. This quarter, more than 30,000 patients were treated with SAPIEN valves, an indication that more patients are benefiting from our life changing technologies than ever before.”

This is driving strong financial performance.

“We are pleased to report better than expected second quarter sales of $1.4bn, up 44pc on a constant currency basis from a year ago period. All four product groups delivered large increases in sales led by TAVR. Total company sales increased sequentially versus Q1. And importantly, sales grew 11pc on a two year compounded annual basis, compared to the strong pre-pandemic second quarter of 2019.”

Another business going well is TAVR (transcatheter aortic valve replacement).

“In TAVR, second quarter global sales were $902m, up 48pc on an underlying basis versus the year ago period or 14pc on a two year compounded annual basis. We estimate global TAVR procedure growth was comparable with Edwards’ growth in the second quarter. Globally, our average selling price remains stable as we continue to exercise price discipline. We continue to be optimistic about the long-term potential of TAVR because of its transformational impact on the many patients suffering from aortic stenosis and because many remain untreated.”

This potential is very considerable.

“In a recent article in the American Journal of Cardiology reported, it reported on the survival of severe AS [aortic stenosis] patients since the introduction of TAVR in 2008. The analysis included clinical data on 4,000 patients obtained at the mass general and concluded that in the TAVR era overall survival of patients with severe AS has doubled. The long-term potential, along with the rebound in procedures reinforces our view that this global TAVR opportunity will exceed $7bn by 2024, up from more than $5bn today. And beyond 2024, bolstered by two pivotal trials currently being enrolled, we believe the impact of treating this deadly disease before symptoms and before the disease becomes severe has the potential to transform the lives of even more patients.”

The group also sees a significant international opportunity.

“Long-term goal, we see excellent opportunities for OUS growth as we believe international adoption of TAVR therapy remains quite low. TAVR procedure and Edwards’ growth in Europe, also rebounded significantly on a year-over-year basis. Edwards’ growth was driven by the continued strong adoption of our SAPIEN platform and was broad based across all countries.”

Solid growth looks sustainable in the long term as the Covid bounce works through.

“n summary, given the strength of our year-to-date performance, we are raising our full year Surgical Structure Heart guidance, we now expect underlying sales growth in the mid-teens versus our previous expectation of high-single-digit growth. We continue to believe the current $1.8bn Surgical Structure Heart market will grow in the mid-single-digits through 2026.…. As patients and clinicians increasingly recognize the significant benefits of transcatheter-based technologies, supported by the substantial body of compelling evidence, we remain optimistic about the long-term growth opportunity. “

Illumina ILMN. Buy @ $ 491. New entry

Illumina leads world in DNA sequencing to detect and fight disease

America is a treasure trove of great companies, which is why for a long time it was hard to persuade Americans to invest outside their own stock market. Illumina, a new entry to the Quentinvest ecosystem is a case in point. The group is a global leader in DNA sequencing and array-based technologies, fuelling advancements in life sciences, oncology, reproductive health, genetic disease, agriculture, microbiology, and other emerging segments to quote their web site.

The group is trading strongly.

“Illumina had a very strong start to 2021 with the first billion-dollar quarter in Illumina’s history. We achieved first quarter revenue of $1.093bn, growing 27pc compared to the prior year and 15pc from last quarter. Sequencing revenue was especially strong, up 29pc compared to the prior year, driven primarily by accelerating growth in our core business, with both clinical and research customers exceeding pre-COVID activity levels. In addition, we’re seeing global investment in the creation of a genomic epidemiology infrastructure to combat COVID-19, as well as monitor for future pathogen outbreaks.”

It’s business is in all the most exciting areas of medical progress..

‘Illumina develops, manufactures, and markets integrated systems for the analysis of genetic variation and biological function. The company provides a line of products and services that serves the sequencing, genotyping, gene expression and proteomics markets. Illumina’s technology had purportedly by 2014 reduced the cost of sequencing a human genome to US$1,000, down from a price of $1 million in 2007. Customers include genomic research centres, pharmaceutical companies, academic institutions, clinical research organizations, and biotechnology companies.’

Their gene sequencing products have many applications.

“One interesting customer example is BlueNalu, a start-up using our technology in the development of cell-cultured seafood to support sustainability and oceanic diversity. Additionally, these instruments play a critical role in catalyzing localized COVID surveillance programs across the globe.”

Consumables are a big part of the business.

“Total sequencing consumables revenue of $695 m was up 26pc year-over-year, demonstrating strong demand for sequencing across both clinical and research segments. More than 44pc of our sequencing consumable shipments in the first quarter of 2021 were to clinical customers. Clinical testing showed significant growth with consumables up 35pc year-over-year. These results do not include COVID surveillance, which is reported in our Research and Academic segment. Oncology testing exceeded our overall clinical growth rate and is our largest and fastest growing clinical segment.”

Covid is having a significant impact.

“The pandemic and emerging variants of concern have raised awareness within governments around the world about the essential role that genomic, pathogen surveillance plays in the fight against infectious disease. We are seeing investment globally in the creation of a pathogen surveillance infrastructure to manage outbreaks and improve health outcomes, including sequencing capabilities to determine the spread of pathogens, the emergence of variant strains, and emerging drug or vaccine resistance.”

They conclude.

“While the pandemic has certainly fueled demand for our sequencing, we also believe it has established a new baseline of awareness and infrastructure build-out that will support sustained activity.”

The group is also in the middle of a planned acquisition of GRAIL, a company using blood tests for early detection of cancer. The acquisition is being examined by anti-trust bodies in the US and Europe.

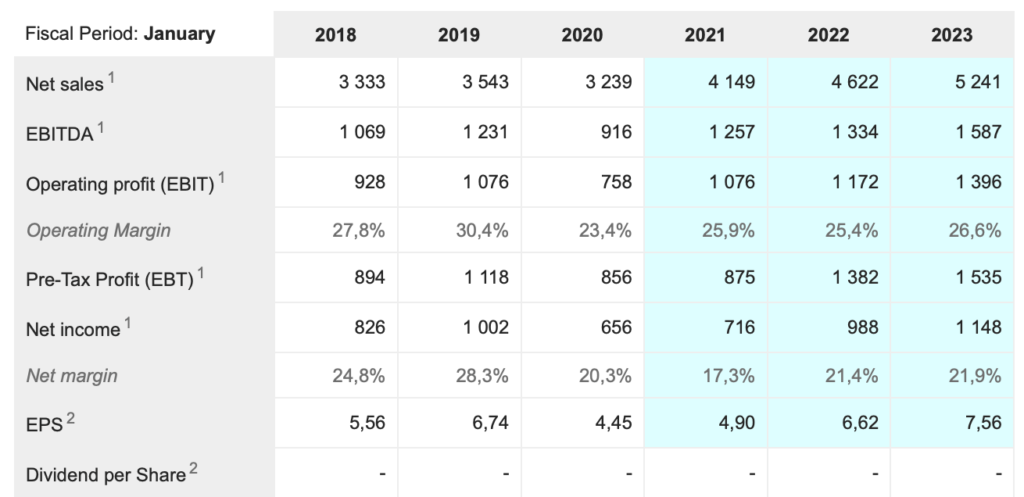

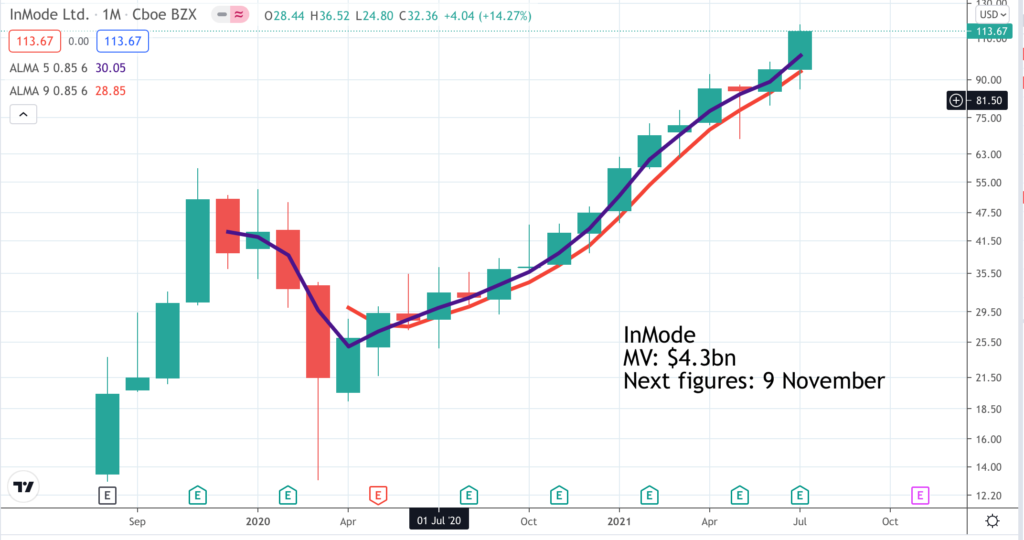

InMode. INMD. Buy @ $113. Times recommended: 2 First recommended: $87.6. Last recommended: $97.46

InMode’s painless but effective approach to cosmetic surgery drives explosive growth

InMode is a provider of minimal and non-invasive radio-frequency technology. Its innovative technology strives to improve surgical procedures. Its products are used by plastic surgeons, gynaecologists, dermatologists, and others. They are made for a variety of purposes including liposuction, permanent hair reduction, facial skin rejuvenation, wrinkle reduction, cellulite treatment, skin appearance and texture, and superficial benign vascular and pigmented lesions. The group operates in the U.S. and internationally. It was founded in 2008 and is headquartered in Yokneam, Israel, a country which punches way above its weight in creating new technology-based businesses.

The company is growing fast generally and skyrocketing outside America. Q1 eps of $0.69 beat expectations by $0.11 and revenue of $65.5M, which grew 62pc year-over-year, beat expectations by $9.3M. 2021 guidance was also raised. Asia and Europe revenue increased by 273pc and 63pc year-over-year, respectively. As a percentage of total revenue, international revenue is now 33pc compared to 24pc one quarter ago and 27pc for the full year 2020.

I think we can safely say that InMode is 3G. This is not surprising. People want to look better and they want any procedures that help them to do that to be as painless as possible.

Consumables, which generate recurring revenue, are still only a small proportion of sales, 12pc in the last quarterly report but growing fast. According to the most recent earnings call, INMD more than doubled the number of consumables sold in the last 4 quarters overall and more than tripled consumables sales in regards to North America.

The company is also looking to use its technology to expand into health care as well as beauty. One of these platforms is called Empower, which they expect to launch in the third quarter of 2021. Empower will be the gold standard in women’s health and wellness, and has earned FDA approval for all of its applicators.

“We’re also expanding our verticals beyond aesthetic. As our R&D pipeline include over a dozen projects for other medical areas such as gynecology, ophthalmology, ENT, urology and several others. As part of our strategy, we expect to launch 2 new platforms this year in which our advanced bipolar RF technology will provide significant quality of life improvement.”

Latest quarterly revenues for Q2 2021 grew 184pc and held great promise for the future.

“It is with considerable optimism that we are launching Empower, a new platform focused on women’s health, on 15 August. Empower will significantly increase our business in women’s health and mark our major expansion into the gynecology market, which is three times the size of the aesthetics market. InMode will market this medically oriented platform to OB/GYN doctors, further diversifying our client base and verticals,” commented Dr. Michael Kreindel, CTO and co-founder of InMode.

Yair Malca, CFO of InMode, added, “Recent business expansions in key markets contributed to InMode reporting record numbers. Operations outside the U.S. represented 34pc of the business in H1 2021, compared to 23pc in H1 2020. Asia and Europe were the biggest regions supporting InMode’s growth outside the U.S. this quarter. As the market demand in the U.S. and globally increases, we believe that our profitable growth will continue, especially in light of our ever-expanding pipeline.”

InMode’s business is in very good shape.

“We are happy to report another strong quarter and share the successful results of our growth strategy. We’ve seen advancements in key areas of our business and our minimally invasive technologies are becoming the gold standard,” said Moshe Mizrahy, CEO of InMode. “Consumable and service revenues have continued to experience high growth, increasing 22pc from last quarter. This indicates that physicians are successfully adopting our procedures as well as keep increasing the use of each InMode system, which leads to a growing contribution of consumables to our overall revenues.”

The rate at which this business is growing is incredible – from $23.1m for 2016 to $206.1m for 2020. There presentations also include before and after pictures which seem very impressive.If that is what they can do without pain no wonder the business is exploding.

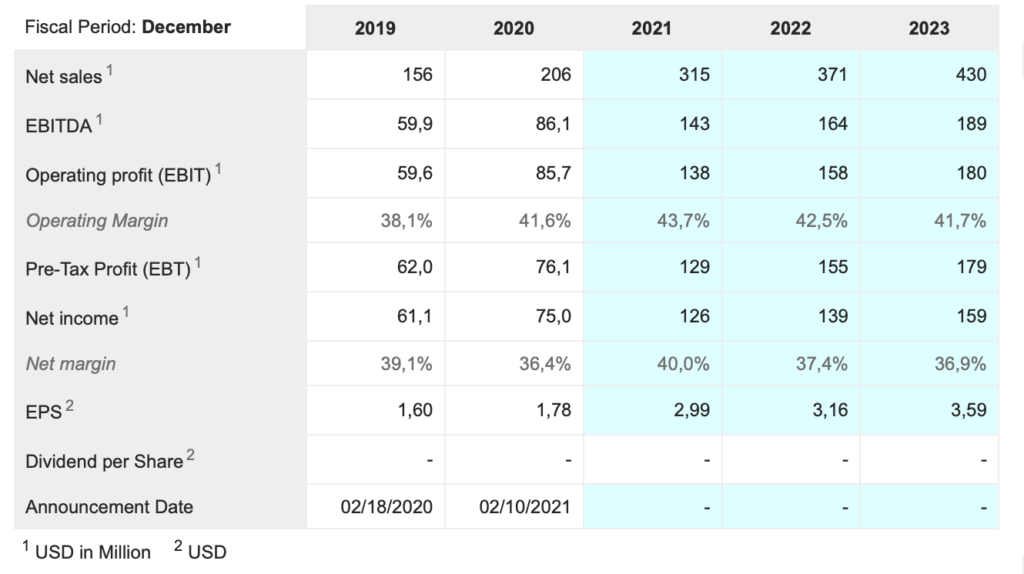

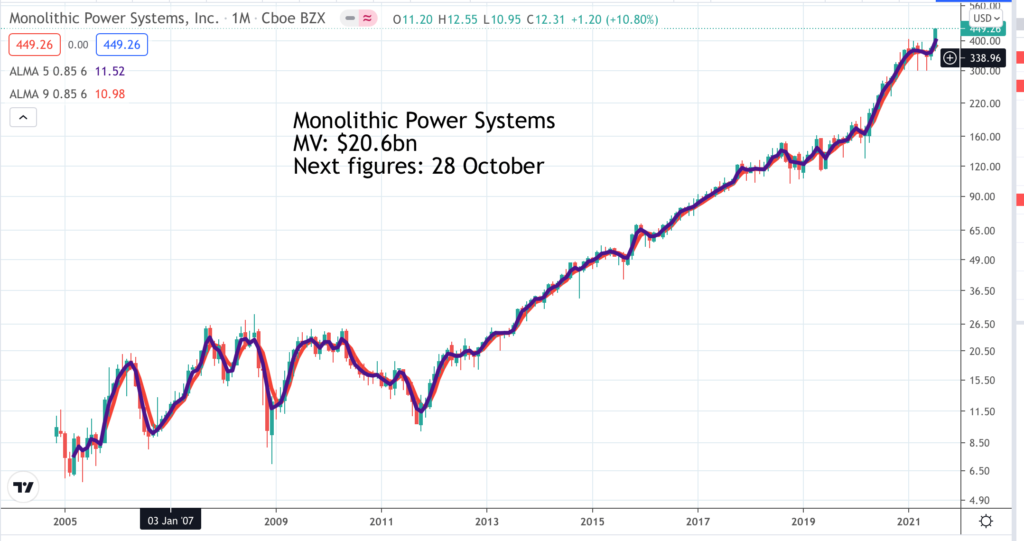

Monolithic Power Systems MPWR. Buy @ $449. Times recommended: 6 First recommended: $225. Last recommended: $374. Highest: $385

MPWR is a US-based, Chinese led, semiconductor company that manufactures and sells mostly in fast-growing Asian markets

This is what a recent commentator said about Monolithic Power Systems (MPWR).

“MPWR, a leading semiconductor company specializing in power management solutions, has experienced outstanding growth across all segments due to strong profitability being driven by incrementally outsourced manufacturing to China and other operational efficiencies. These expanding margins permitted heavy investments in R&D, creating new and innovative technologies necessary to maintain its leadership position. This success is seen throughout its financials as evidenced by the continuous revenue, profit and margin growth, cash-heavy and near debt-free balance sheet, and strong cash flow generation. Monolithic’s success is powered by its strong relationship with China, accounting for ~60pc+ of the revenue with the U.S. near the bottom at around 3pc. With 5G continuing to roll out, IoT, AI, and automation becoming more prevalent, MPWR is positioned to continue the long-term financial success albeit by banking on China, not the United States.”

They also thought the shares were a little overvalued but fortunately that is not something we worry about on Quentinvest where our approach is very long term.

The company’s products are closely aligned with where the world is going.

“Automotive segment growth is attributable to more electric vehicles which require battery management systems, and ever-evolving infotainment systems. The company is primed to continue strong growth here as its products are a key component in cars’ ADAS, which is fancy jargon for Autonomous Driving. It produces sensors and other bits necessary for creating a sophisticated yet safe driving experience. As for Industrial, growth has been driven by companies’ desire to cut costs through automation and robotics whereby MPWR produces scanning sensors for machines and power management chips for Unmanned Aerial Vehicles (UAVs), among other purposes. Monolithic’s third largest segment is now communications, which has been driven by technology for 4G, yet the company is a key beneficiary of 5G with its technology being used in the wireless network infrastructure.”

In some ways MPWR is quite a strange company. Many of the top management include the CEO and founder, Michael Hsing, are Chinese. The bulk of sales go to China, Taiwan, Korea, Japan and other parts of Asia with minimal sales into the US. Manufacturing is largely outsourced to China and Taiwan but much r&d is done in the US and the company feels like an American company.

There is no arguing with the performance though which has been outstanding for many years. The company is also highly innovative. It has r&d facilities in the USA, Chia and Europe and is steadily repositioning itself to capitalise on many of the most exciting trends of the 21st century.

Latest sales growth was 57.5pc. Even with this strong performance, CEO, Hsing, said – “In conclusion, with our planned capacity expansion in place and as we release more parts into production, we are well-positioned to accelerate our future revenue growth.”

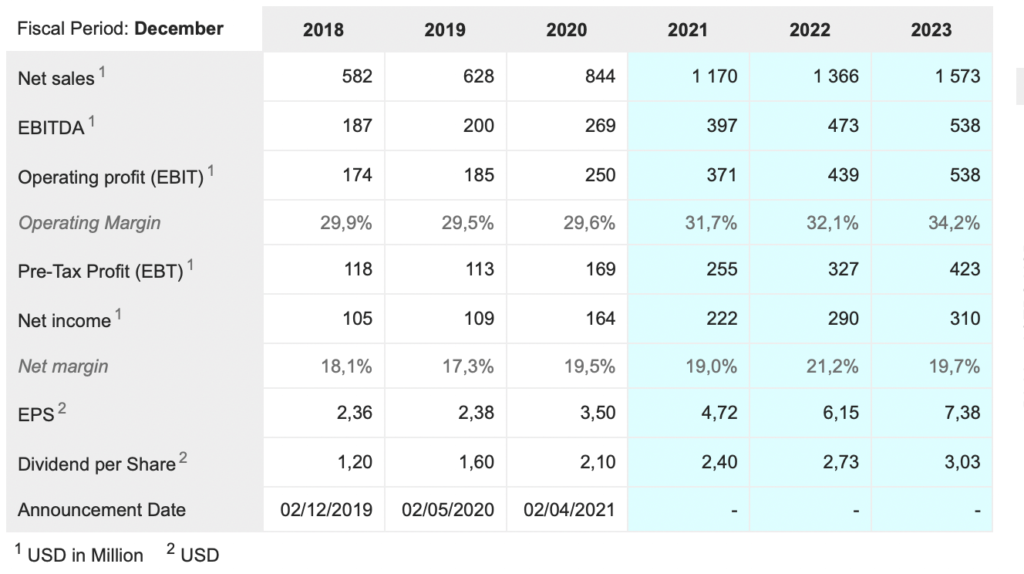

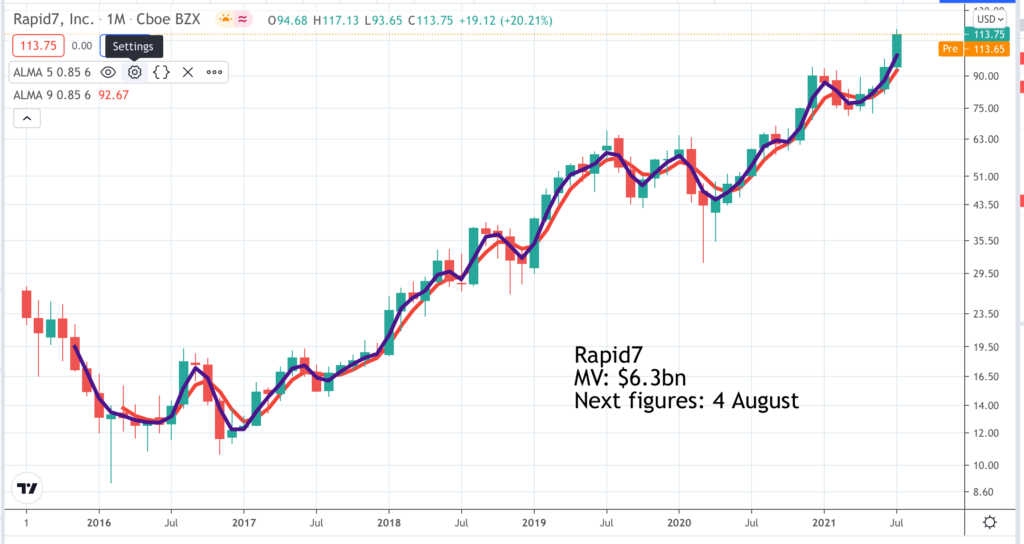

Rapid7. RPD. Buy @ $113.50. Times recommended: 2 First recommended: $95 Last recommended: $96.5

Cyber security specialist Rapid7 drives strong growth with its powerful land and expand business model

Enterprise software companies talk a lot about their land and expand business models. The idea is that your sales and marketing team helps you land your customer and your r&d team kicks in with new innovations and products to expand the business you do with those customers.

You can see this process in action with Rapid&’s first quarter results. “Our customer base grew 14pc year over year in the first quarter as we experienced continued wallet share gains and ARR per customer increased to $38,900, a year-over-year increase of 15pc.”

Put these two numbers together and you have total revenue growth of 29pc. Most of the group’s business is recurring and recurring revenues grew 31pc.It turns out I was looking at the numbers for Q1 2020, not Q1 2021 but I hardly need to change them. Performance at Rapid7 is so consistent that the Q1 2021 numbers are very similar. The difference is that customer growth was 11pc to 8,900 and ARR per customer increased 17pc to over $51,000.

Some of the scope for the business is that as well as having a huge opportunity to add more customers the group sees an ultimate target for revenue per customer of $420,000.

I don’t pretend to understand how Rapid7’s technology works and in a way it doesn’t matter. They do and it is their expertise in cyber security that makes the company so successful. What is important to me is that their performance validates their claims as well as high rankings with Gartners Magic Quadrant and other accolades. They are signing up multiple large customers, 80pc of all their customers spend $100,000 or more with Rapid7 and they see a huge opportunity.

The international opportunity looks spectacular. US sales, which represent 82pc of the total grew 22pc in Q1 while the rest of the world grew 38pc. The company is also using acquisitions to fill gaps in its technology and bring more talent to the team. Their TAM (total addressable market) is in the 10s of billions and they speak of having a ‘massive opportunity’.

As they say “The dynamic nature of today’s cyber risk landscape has once again put security investments squarely back in focus for boards and leadership teams.”

Veeva Systems. VEEV Buy @ $330 Times recommended: 15 First recommended: $100.75. Last recommended: $320. Highest recommended: $357

Veeva’s vision of helping the biopharma world to use digital trials for speed and efficiency promises sustained growth

Veeva Systems provides software services from the cloud (SaaS) or software as a service on subscription and is delivering strong growth with latest results well ahead of expectations. “We had an outstanding Q1 with results well ahead of guidance due to significant outperformance in development cloud and continued strength in commercial cloud. Total revenue in the quarter was $434m, up 29pc year over year, with subscription revenue up 26pc to $341m. Non-GAAP operating income was $181m or 42pc of total revenue.”

Veeva is all about using software to help life sciences and biopharma companies operate more effectively. This is driving sustained growth at the business.

“Our level of partnership with the industry is noticeably increasing, and there are multiple reasons for this. With every quarter of customer success and reliable delivery, Veeva becomes a more trusted partner. Our expanding product footprint, with products such as CDMS, Safety, MyVeeva, and Data Cloud, also makes Veeva a more strategic partner. The move to a digital-first way of working is also making technology and data more strategic overall to our customers. And finally, our move to operating as a public benefit corporation is encouraging to our customers as they look to us for long-term partnership.”

The company is helped by its total focus on life sciences and biopharma. They give an example to show how this plays out.

“We are also very encouraged by the progress of Veeva Link. Link provides real-time customer intelligence on key healthcare providers worldwide. Life sciences professionals in sales, medical, clinical, and research use Link to understand and follow key people. The Link data feed is also used by data science teams to identify trends and provide analytics to help power solutions like medical insights and next best action.

We started with Link in oncology and, in June, will expand to 11 new therapeutic areas. Over time, Link coverage will include deep profiles for roughly one million of the most important healthcare providers across all therapeutic areas. We added four new Link customers in the quarter and are advancing strategic discussions with a number of large enterprises.

Having this suite of data products has also helped us grow Veeva Business Consulting, which has roughly doubled in the last 12 months.”

Another division called. Veeva Vault is also growing fast. “In R&D, we are making great strides to help the industry streamline drug development by unifying clinical, quality, regulatory, and safety with Veeva Development Cloud. This is driving increased momentum across all areas of Development Cloud. For instance, Vault Quality had a record number of new customer additions in the quarter, including our sixth Vault QMS win with a top 20 pharma.”

The company. has ambitious plans. “Our overall vision for clinical is to move the industry to digital trials that are patient-centric and paperless. Digital trials have the potential to be a game changer for patients, the industry, and for Veeva. We believe this move will increase the speed of trial execution by 25pc and cut costs by 25pc.“