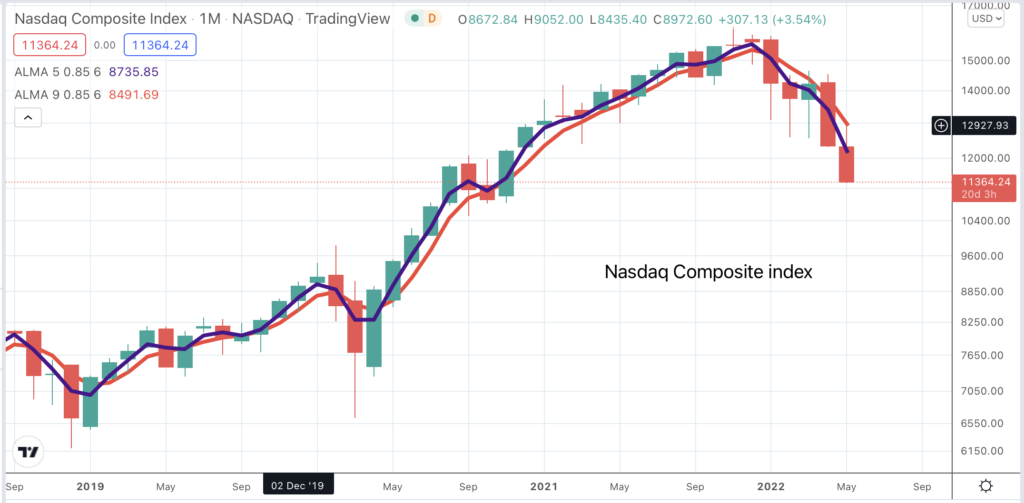

If you look at this chart of the Nasdaq Composite index the way I do you will see a breakdown, arguably even a head and shoulders top. The key point is the neckline which is around 12550. It has been broken, decisively which confirms the whole area as a top. Minimum target from the top is calculated by the depth of the top which means this index, currently 11,364, could be heading for 10,000 and that is just a minimum target.

Maybe charts are all mumbo jumbo but they have been very helpful so far in telling us what is happening to US shares. Nor is it just this chart which is telling us that more pain lies ahead. All my charts and indicators are negative. It is like a grand slam of negativity. At the very least it suggests that any plans to re-enter the stock market should wait for clear buy signals which are noticeably absent.

Another key point is the trend in inflation and interest rates. After decades being quiet inflation is back with a vengeance and interest rates are rising. I have no idea how high they are going to go but it may be higher than people presently expect which will put pressure on share values. The Nasdaq 100 topped out on 21 November 2021 having been building a top area since February 2021. US bond yields bottomed out at 0.334pc in March 2020 but only began rising in earnest in 2021 and really forced their way into investor consciousness in late 2021 when the bear market began. Current 10 year US bond yields are around 3.0pc.

My impression is that the monetary authorities are losing control of events. Joe Biden’s multi trillion dollar stimulation of the US economy is likely to be perceived as yet another disastrous decision by a guy who was just trying to win an election with little idea what to do with power when he got it. Maggie Thatcher, he ain’t. Just when he needed to calm things down he poured gallons of paraffin on the fire which is now blazing out of control.

Whether they like it or not the authorities in the US are going to have to make a priority of the battle against inflation, no matter how painful that becomes in terms of higher interest rates. It is this perception which has sent US shares into free fall and is also proving devastating for cryptocurrencies.

Higher interest rates are normally a negative for property prices but I am not sure what the effect will be here because property is a good in short supply, like used cars, where prices are going through the roof. The explosive rise in building costs also makes already built properties more valuable.

It may be instructive to look at bitcoin in terms of what has been happening to 10 year US interest rates. The last time US bond yields were over 3pc was in November 2018. In that month bitcoin fell heavily reaching a low of $3,168 in December 2018. Over the next 16 months US bond yields fell sharply to 0.334pc triggering a massive bull market in bitcoin which peaked at $68,958 in March 2021. Significantly US bond yields rose above 1pc in January 2021 and are now back at 3pc and bitcoin is falling again.

It seems that interest rates are a, maybe the, key driver of cryptocurrency prices and have a dramatic effect on share prices too. This is not new. Interest rates have always been the key driver of bull and bear markets. It is is just that interest rates have been falling for such a long time that maybe we forgot to make the connection.

The whole thing has also been massively complicated by Covid which had the effect of flooding the system with cash and driving interest rates to unsustainably low levels, even negative levels in some countries.

With hindsight we can now see that the combination of Covid and super low interest rates created a bubble in stocks which is now bursting. Another problem with sharply falling stock markets is that they become their own justification as they start to impact directly on demand, especially business to business spending, which tends to be more volatile. Consumers are usually more resilient although they suffer from inflation as necessities like utility bills and fuel take a bigger chunk of incomes.

In the later stages of bear markets businesses that became over-extended in the preceding boom start to go bust which focuses investor attention on balance sheets. Companies with high levels of borrowings can struggle. which may explain why Netflix, with net debt over $9bn is seeing such ferocious pressure on its shares, down from $700 to $165 in just seven months. In an increasingly competitive market Netflix needs to spend heavily on content for which it needs to borrow; with subscriber growth faltering and interest rates rising this spending may be hard to sustain and a virtuous circle of growth may become a vicious circle of decline. Markets can be very cruel.

These considerations may also be weighing on shares in Disney, Amazon and Roku.

Another worry for markets may be share buybacks. Many companies have been buying back their own shares. Even Netflix had begun buying back its own shares in anticipation of being cash flow positive in 2022. Apple has been buying back its own shares in staggering quantities. It spent $81bn on share buybacks in 2021, easy to do when long term interest rates for star corporate borrowers are below one per cent. Maybe not so easy now if we are heading into a period when cash is king.

We could even see a perfect storm where companies severely curtail share buybacks while private investors are forced sellers as they struggle to reduce a near $1 trillion mountain of margin debt. The good news is that if these scary prognostications come to pass shares are going to become very cheap and the opportunities when my indicators turn positive are going to be exciting.

There is something to which to look forward but we are not there yet. Share prices remain under severe pressure and the charts could hardly look more negative.

This is a market to watch and wait. You could try short selling but that is incredibly high risk and not something I advise or do. I have put together a list of around 160 shares from the QV table, which I believe have great fundamentals. At the moment, these shares are falling almost across the board but that will change and when it does I will be watching and my subscribers will be the first to know. Until then extreme caution must be the watchword.