Blue Prism. PRSM . Latest 1682p . MV: £1.3bn . Employees: n/a Next figures due: 18 June

Blue Prism shares have been a bumpy ride. So much is this the case that even after a strong recovery, three of my seven alerts are still showing losses. However there is no question that on its current showing the shares are classic 3G. They have an exciting story to tell, the growth rate remains exponential and the chart is pointing higher after a golden cross buy signal from the moving averages.

The trigger for the latest surge in the shares was the full year 2019 results showing explosive growth continuing. Investors were worried because a larger private rival to Blue Prism, UiPath, has been laying off 100s of workers suggesting problems with adoption of RPA (robotic process automation) but the results make it clear this is not the case.

Indeed, if anything the mood at Blue Prism is becoming even more positive on prospects.

Jason Kingdon, had previously left the company but has recently returned as executive chairman and this is what he has to say.

“We think that the future is going to push towards an organisation that looks something like 1/3 people, 1/3 core IT and 1/3 digital workers. We see digital workers as being very, very different from core IT. Digital workers operate and interoperate with the core infrastructure, they orchestrate that infrastructure. And they provide fulfilment across that infrastructure. Very different from what core IT does and distinct from what people will do in the future as well. We think people will be involved with the design of work, the design of services, the kind of ideas in terms of how they scale the business, what kind of services that they’re trying to bring alive to their clients.

And so if we take this and we say, okay, all right, well, if these are the characteristics, what does that look like when it kind of hits the real world. And this takes on to something that’s happened over the last four years. This is a product category that didn’t even exist five years ago. I just trotted through some of the characteristics associated with the technology and what it is that it does. And I think you would kind of say, wow, these are really big claims you guys are making. If anything, that you’re saying there is true, it will be very interesting to see what kind of impact that’s had on the real world. Well, here it is. And the last four years, we’ve gone from an organisation that did something like £6m in revenue 4 years ago to over £100m in revenue that we’re reporting this year. [Ed: also incredible is that three years ago Blue Prism had 75 customers, now it has 1,677 and the bulk of revenue growth comes from selling more to those customers].

And we believe that we’re at the very beginning of this. We think that the journey is only just getting underway. We don’t think it’s necessarily a technology that’s fully understood yet. We don’t think that there’s necessarily people out there that are explaining it to the depth that they could be. But we are starting to see signs. We are certainly seeing signs in our early adopter advanced customers who are really starting to see how you use this technology, how you use it at scale and how it is that you start to disrupt the way that you do business within your own context.”

Another exciting development is that following the acquisition of Thoughtonomy last year, Blue Prism is now offering its software not just as a license but also as SaaS (software on subscription from the cloud), the strategy that has powered soaring share prices for many enterprise software businesses in the USA.

Blue Prism claims that its digital worker software lies at the heart of the digital transformation revolution and that it is addressing a huge market opportunity. The quote below is not from them but is highly relevant.

“Robot Process Automation was originally rules-based software that simply automated back-office functions and administrative processes. But now RPA is morphing into an ecosystem for artificial intelligence. For instance, using RPA, a chatbot will interact with customers on its own. If the software can’t solve the problem, then an employee will be notified. Right now, the market for Robotic Process Automation is quite small, approximately $1.5bn in 2018. Forrester estimates it will reach $2.9bn by 2021. However, RPA is at the centre of a disruptive wave that is predicted to have a larger economic impact than self-driving cars, or even the Internet of Things. McKinsey and Company predicts that automation of knowledge work will affect $6.7 trillion worth of the economy by 2025. If you have a white-collar job in the next decade, virtual robots will probably be working with you.”

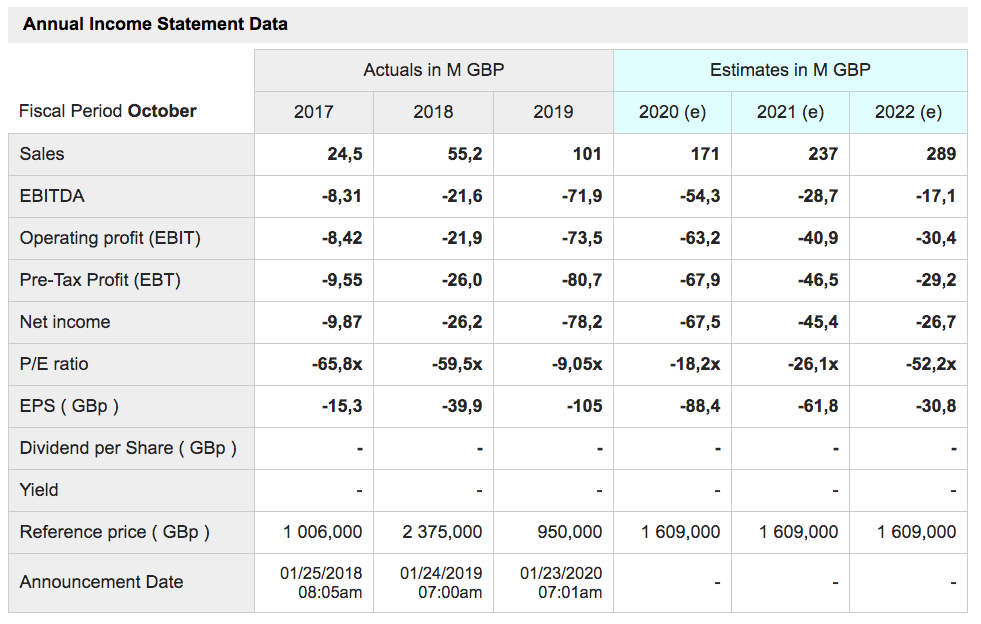

In summary, Blue Prism has a great story and an amazing opportunity. It is walking the talk by delivering explosive growth in sales and customer numbers and with investment spending set to fall away after a spike in 2019 there is even the hope that by second half 2020 free cash flow could turn positive. No profits on the horizon yet but that is normal for a company growing so rapidly. It is more important to seize the opportunity than to report a profit; that comes later.

Last but not least we now have a chart buy signal. One of my simple ideas in a world of uncertainty is to hold shares while the moving averages are rising and consider stepping aside, while they are falling. Blue Prism has put together a substantial consolidation (around two years) and may now be starting the second leg of its upward journey. It certainly scores highly for excitement and is a rare example of an enterprise software investment opportunity on the UK stock market.

Blue Prism shares fell after being savaged by the Lex column in the FT as ludicrously over-valued. We shall see who has the last laugh on that one. Many of the great and the good in the US investment world have been similarly dismissive of shares in companies like Amazon, Netflix and Tesla and may now be reconsidering their views on those stocks. Great businesses start small and address huge opportunities. Whenever it looks as though they might be successful their shares understandably climb to huge valuations; that’s investment for you. Stocks that look cheap usually do so for a reason.

I expect your wondering about the effect of the Chinese coronavirus on the global economy and stock markets. It’s what investors call a ‘black swan’ event coming out of nowhere as a new threat. The news coverage is disturbing but the best guess is that it will come to be seen as another macro influence that will peter out in its effect even if the news from China stays scary for a while. If we did end up with a global pandemic and millions of deaths as happened after the first world war that would be different but there seems no reason to expect such a disaster. We are much more skilled at dealing with flu epidemics these days. My advice is to soldier through it; what really matters is how companies are doing and many of them are delivering exciting results. These are good times for good businesses.