Share prices may have been hit in 2022 but the technology space remains incredibly exciting as emphasised by the explosive emergence of ChatGPT, which promises to usher in a new wave of rapid and even accelerating change.

I am trying to get my head around this whole analog v digital divide because it is so germaine to an appraisal of Analog Devices as an investment.

Table of Contents

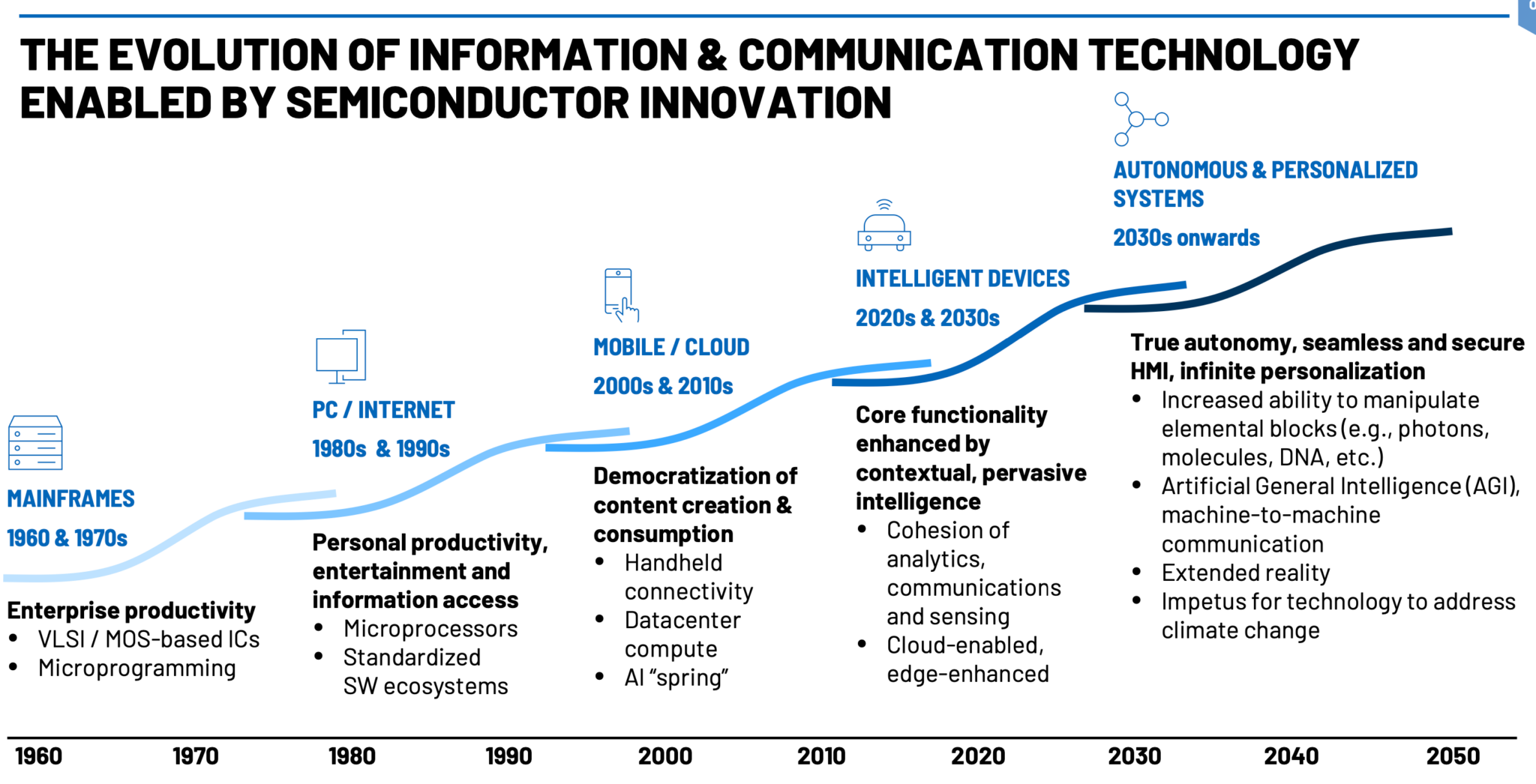

Analog Devices Ideally Placed for the Opportunity Ahead

I am not going to show you any more slides but this presentation about Analog Devices, what it does and the trends on which it is capitalising, leave me in no doubt that it is a very exciting business with an incredible story that places it at the heart of the technology revolution. The share price is strong as we can see from the chart below.

The company is trading strongly.

I’m very pleased to share that ADI continued to execute exceptionally well in the first quarter of fiscal 2023, despite continued macroeconomic uncertainty. Revenue was $3.25bn, up 21pc year-over-year, strength was broad based with all B2B [business to business] markets, up single-digits. Gross and operating margins were 74pc and 51pc respectively and adjusted EPS achieved another record at $2.75.

We play a long game and are excited about what the future holds for us to ensure that we capture the opportunity ahead. We’ve been steadily increasing investments in R&D, manufacturing capabilities and in partnerships that deepen our value to our customers now and over the long-term.

Q1 2023, 15 February 2023

And the future looks even more exciting than the past.

Today, we’re seeing the rise of new industrial applications that require more sophisticated and more complex architectures as machines become more intelligent and more sustainable. This is driving more semiconductor content per dollar of CapEx, unlocking new opportunities for our portfolio. While this transformation is benefiting all of our industrial applications, including healthcare and aerospace, let me share how we’re winning an industrial automation and instrumentation more specifically and discuss the burgeoning opportunity across the electrification ecosystem.

As an example, at a leading U.S. robotics manufacturer, we’ve won additional content across power sensing and GMSL connectivity. Our systems approach reduced our customers’ design time and increased our content per cobot by 4x. Also in the last quarter, our IO-Link solution was designed in at multiple leading industrial automation customers. These solutions are critical for delivering robust connectivity to the edge of the factory floor.

In our sustainable energy franchise, we’re leveraging our industry-leading automotive BMS solutions into energy storage systems for electrical grids and fast-charging infrastructure. We’ve won designs at leading EV infrastructure manufacturers in North America, Europe and Asia, putting us on a path to more than tripling this business in the coming years.

Q1 2023, 15 February 2023

There is tons of exciting stuff like the above going on at ADI, which is heavily involved in the more than $300bn of greenfield gigafactory projects essential to the production of batteries to proliferate the electrification system. The CEO is very optimistic on prospects and you can see why.

Lattice Semiconductor is Another Red-Hot AGI Investment

First of all, what do they do.

Lattice Semiconductor (NASDAQ: LSCC) is the low power programmable leader. We solve customer problems across the network, from the Edge to the Cloud, in the growing communications, computing, industrial, automotive, and consumer markets. Our technology, long-standing relationships, and commitment to world-class support lets our customers quickly and easily unleash their innovation to create a smart, secure and connected world.

LSCC website

This company is absolutely on a roll.

A big deal for Lattice is its involvement in FPGAs.

A Field Programmable Gate Array, or FPGA, is a type of integrated circuit (IC) that enables the development of custom logic for rapid prototyping and final system design. FPGAs are different than other custom or semi-custom ICs due to their inherent flexibility that allows it to be programmed and re-programmed via software download to adapt to the evolving needs of the larger system in which it is designed into. FPGAs are ideally suited for today’s fastest growing applications, like edge computing, artificial intelligence (AI), system security, 5G, factory automation, and robotics.

LSCC website

The company is on fire.

Annual revenue grew by 28pc driven by growth in our core strategic markets of industrial and automotive and communications and computing.

Full-year non-GAAP gross margin expanded by 590 basis points to a record 69.1pc and we delivered annual non-GAAP net income growth of 64pc year-over-year. We also continue to expand our product portfolio with multiple hardware and software product launches, including the successful launch of our new Lattice Avant mid-range FPGA platform, which doubles the addressable market of the company.

In summary, 2022 was another strong growth year for Lattice. We’re well positioned in long-term secular growth markets with a rapidly expanding product portfolio, accelerating customer momentum and consistent financial execution.

Q4 2022, 13 February 2023

Synopsys Sees Fabulous New Horizons

What they do:

Synopsys technology is at the heart of innovations that are changing the way people work and play. Self-driving cars. Machines that learn. Lightning-fast communication across billions of devices in the datasphere. These breakthroughs are ushering in the era of Smart Everything―where devices are getting smarter and connected, and security is an integral part of the design.

Powering this new era of innovation are high-performance silicon chips and exponentially growing amounts of software content. Synopsys is at the forefront of Smart Everything with the world’s most advanced technologies for chip design, verification, IP integration, and software security and quality testing. We help our customers innovate from silicon to software so they can bring amazing new products to life.

The future of Smart Everything depends on silicon chips running faster, scaling down to fit into smaller devices, integrating more capabilities, and processing massive amounts of data―all while consuming less power― reliably. A single chip the size of a nickel and no thicker than a fingernail can have 30 billion transistors across 100 different layers operating seamlessly. As complexity rises, companies also need chips customized for autonomous, AI, cloud, and 5G applications.

Advanced silicon chips with raw processing power have enabled a wave of software applications and data sharing never seen before. As the software supply chain changes, code quality is a growing concern. Using open-source code saves time and money, but it canintroduce security vulnerabilities and flaws. More than 80% of cyber attacks occur on the application laye and open source can comprise up to 90pc of a new application’s code.

In any given device, billions of transistors and millions of lines of code must all work together, securely. As the interdependency between hardware and software grows―and with the rise of safety-critical applications― the full benefits of autonomous vehicles, AI, the cloud, and 5G can only be realised if security is designed-in from silicon to software.

To deliver Smart Everything, companies need to start software development earlier, in tandem with hardware design, to properly simulate how a device will work, to verify that the chip won’t fail, and to ensure that the code can’t be hacked. That’s where we come in.

Synapsys web site

The company is changing

In the last few years, Synopsys has grown and evolved substantially. Commensurately, we are evolving our financial reporting. Starting in Q1, we are reporting our business in three segments: Design Automation, which includes design software, verification software and hardware and other EDA products. Design IP, a broad portfolio, including libraries, embedded memories, connectivity solutions, processor cores and security devices. And Software Integrity, which remains unchanged from previous reporting and deliver solutions to improve software quality and security.

To give you a relative sense of proportion, Design Automation is about 65pc of our revenue. Design IP is approximately 25pc and Software Integrity is about 10pc. While these numbers are approximate, the 65pc, 25pc, 10pc split is easy to remember and represents well how we think of our present business. We have leadership positions and excellent outlooks in all three segments. As the market leader in design automation, we see continued technical innovation towards still much, much more complex silicon and system designs.

Q1 2023, 15 February 2023

AGI is going to be a huge demand driver for Synopse.

Looking at the overall market picture, already 12 years ago, we identified the intersection of big data and machine learning as leading us into the age of Smart Everything. Today, smart everything is in full swing. You may have seen the fantastic new capabilities showcased recently by applications such as ChatGPT. It clearly shows how far Smart Everything has come and also how much further the opportunity space reaches. Indeed, this is playing out as every vertical market is now driving towards more and more sophisticated solutions with an unsatiable need for compute.

Q1 2023, 15 February 2023

One of the big things that is happening is that many companies are starting to design their own chips, companies like Apple and Tesla and they need the same sort of help as the traditional semiconductor companies.

And in IP, we see actually a very fertile horizon because with the increasing complexity that I mentioned earlier, there are a lot of companies that are coming into doing chips that have never done it before. And they have no history, no reason to start doing a lot of IP themselves. Actually, they move very quickly by acquiring IP and then taking it from there.

Q1 2023, 15 February 2023

Like others in the space the company is very excited on prospects.

And I think we have now a fabulous new horizon, which is going from one to multiple chips that are in very close proximity is actually a technology feat in itself. And we’re in the midst of that, and it is really exciting that a number of the top leaders in this field are doing production design with us already. And so this is active learning, and so I’m not worried that it’s going to get in the way on the contrary, I think. And I’m on record of having said many times now that a whole new age of systemic complexity has opened up and it retains one characteristic from the past, which is there’s unbelievable exponential ambition formulated by Gordon more many years ago.

Q1 2023, 15 February 2023

Financial Strategy

I had been thinking that we needed to be wary of technology companies for a while after the 2022 sell-off but the explosive emergence of AGI (general artificial intelligence or generative artificial intelligence) is changing all that and I am again feeling super bullish about technology but perhaps, for the moment at least, with a somewhat changed universe of names in which to invest. So here are three more companies that I really like to benefit from the AGI revolution and the world of smart everything that we are moving into.

Share Recommendations

Analog Devices ADI Buy @ $187

Lattice Semiconductor Corporation LSCC. Buy @ $92

Synopsys. SNPS. Buy @ $375