ARK Innovation ETF Code: ARKK Quoted: NYSE Latest price: $55.34 Annual expenses ratio: 0.75pc . Tracks: This ETF is very unusual; it is not a tracker so doesn’t aim to replicate the performance of a particular index; instead, it is actively managed like an investment trust with a focus on investing in companies which have innovative technology and are disrupting the markets in which they operate. UCITS: No

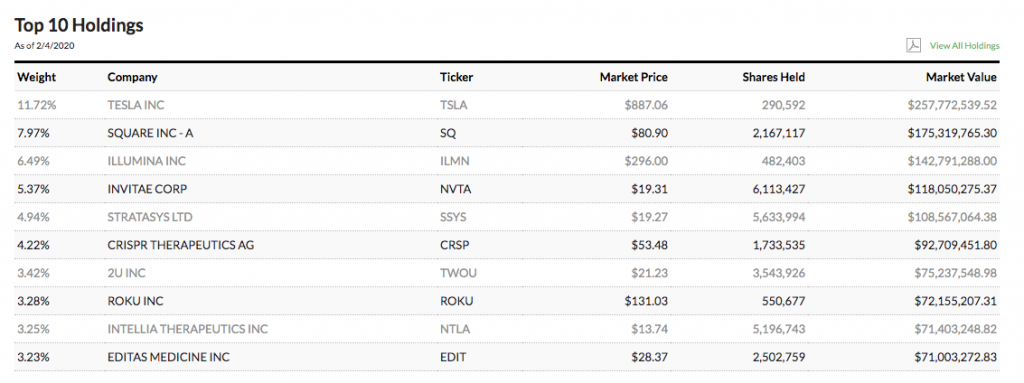

“ARK defines ‘‘disruptive innovation’’ as the introduction of a technologically enabled new product or service that potentially changes the way the world works. These are boldly managed ETFs not afraid of making big bets, as we shall see below but if you can live with that the performance is exceptional and if their biggest bets come off they could do very well indeed. The ETF is managed by a team led by a lady, Catherine Wood, who has very strong opinions on the stocks in which she invests. She is an exciting manager for an exciting time in markets. As you can see in the table below the fund’s biggest holding is Tesla, whose shares have exploded and then become super volatile in recent days following a strong quarterly report. The stock divides opinions on Wall Street and even now there are many analysts and observers, who think the stock is overpriced. Catherine Wood is not one of their number, to put it mildly.

Below is a report on her thoughts about Tesla.

“A little over a year ago, when Tesla CEO, Elon Musk, publicly flirted with the idea of taking his company private, one investor wrote to ask him to reconsider. According to research conducted by the investment firm, ARK Invest, “Tesla should be valued somewhere between $700 and $4,000 in five years,” wrote ARK’s chief investment officer, Catherine Wood. “Taking Tesla private today at $420 would undervalue it greatly.” But anyone who thought that was a bold call hasn’t seen anything yet. On Saturday, ARK published an update to its Tesla valuation model, saying it now expects the stock to be worth $7,000 by 2024 — and that’s the base case. In a bull case, Tesla shares would trade at, or above, $15,000. The bear case puts the stock at $1,500, or about 2.5 times current trading levels.

What makes ARK so optimistic?

The investment team considers three big variables, when analysing Tesla’s business model: gross margins, capital efficiency and adoption of autonomous driving. ARK is most bullish on Tesla’s ability to cut costs and increase margins, assigning an 80pc probability that the company will achieve 40pc margins, “consistent with a dominant brand that is an innovation cycle ahead of commoditised competitors.” The analysts are least confident about autonomous technology adoption, saying there’s a 70pc likelihood that Tesla will fail to create a fully autonomous car. And as for capital efficiency, or how expensive it is to manufacture cars, the team is split, saying it’s just as likely that Tesla will be able to build factories for $11,000 per unit volume of capacity, as for $16,000. For context, the gas-powered auto industry average now is $14,000. “The electric vehicle is going to drop below the price of a gas-powered vehicle, like-for-like, within the next 18 months to two years, and then will continue to fall,” Wood said in an interview on Barron’s Market Brief. “So, it’s going to be a no-brainer. Electric cars are going to be cheaper and they’re better cars, they’re better calls.” Over the next five years, ARK expects sales of electric vehicles to total about one-third of all auto sales, with Tesla’s share at about 18pc — unless other manufacturers lag behind. “We’re not as worried about Tesla when it comes to that forecast, we’re more concerned that other auto manufacturers really haven’t even gotten started in this game,” Wood said. MarketWatch sat down with Wood in December for an extensive discussion about how she and her team, who are active managers of a suite of exchange-traded funds, value innovation. In that conversation, Wood called ARK Invest a “deep value manager,” and in her open letter to Musk in 2018 she called Tesla a “deep value stock today.” ARK doesn’t believe Tesla should be valued as a car company, but as a technology revolutionary bound to upend just about every facet of life as we know it today. Wood likens Tesla today to Amazon two decades ago, noting that the company that’s now considered a category-killer had its doubters, as well. That goes against much of the way the rest of Wall Street thinks. For starters, most analysts are much more skeptical. The average price target among analysts surveyed by FactSet is for $536, and most researchers only model one year or so into the future. And that’s just the analyst view. Short sellers — investors who bet that a stock will decline in value — lost nearly $6bn in January alone as Tesla’s share price rallied, according to an analysis by Ihor Dusaniwsky, managing director of Predictive Analytics at S3 Partners.

In 2011, pioneering venture capitalist Marc Andreessen wrote an op-ed called “Why software is eating the world,” introducing his thesis that what we now know as Internet 2.0, an industry of platforms like Facebook and Twitter, would replace the old world of desktop computer hardware. Nearly a decade later, if there’s any one investor best poised to pen an update, it might be Catherine Wood. Wood, 64, founded her company, ARK Invest, in 2014, to harness the opportunity created by cutting-edge technologies like genomics, autonomous vehicles, and more. But rather than deploying private markets, like venture capitalists do, Wood makes her bets in the most public approach possible: in exchange-traded funds, utilising what she calls an “open-source research ecosystem” of two-way communication with other investors, scientists, users, and many others. Wood is known in investment circles for her bullish calls on Tesla but she thinks about many different companies within the universe of what ARK calls five key “innovation platforms”: artificial intelligence, energy storage, robotics, genome sequencing and blockchain technology. ARK’s biggest fund, the Innovation ETF ARKK has $1.58bn in assets under management, out of a total $11.1bn in the firm as a whole. It has returned 32.6pc in the year to date.

We have not set up our research by sector and specialisation, we’ve set it up by innovation platform, each of which cuts across sectors. All of them include technology. The reason I started the firm and focused on disruptive innovation was I watched, after the tech and telecom bust and 2008-2009 meltdown, the accelerated shift to passive and benchmarks, which I think is the same as passive. So there evolved a void in the public markets when it came to innovation. Benchmarks are where they are because of what has happened historically. Our focus is on what’s going to happen in the future. The second reason is because there are five innovation platforms evolving at the same time now. This has never happened before. You have to go back to the late 1800s, and early 1900s, to see three innovation platforms evolving at the same time: telephone, electricity, and the internal combustion engine. They transformed the world. Not only is technology seeping into every sector, blurring the lines among and between sectors, but these five innovation platforms are converging also. Autonomous-taxi networks (draw on robotics, energy storage, and artificial intelligence.) So when it comes to a stock like Tesla, who should be following that? An auto analyst should not be following Tesla. A combination of analysts like we have here, expert in robotics, energy storage, artificial intelligence, and transportation systems, should be following it.

We have actually done an analysis on the amount of productivity that automation alone is going to provide for the economy. By 2035, if we didn’t have automation and artificial intelligence, the economy would probably grow to $28 trillion from about $20 trillion today. Instead, because of automation and AI, we think that number will be $40 trillion. A $12 trillion gap in GDP relative to what otherwise would be the case. Our job is to find out where that’s going to be. We think that more than half of the market cap that will be added to major market indices during the next 10-15 years will come from innovation. In the case of a Tesla, most auto analysts do not believe in or incorporate into their models autonomous taxi networks. As a result, it’s going to be a big surprise if we’re right. But if we’re not right, we’re not going to get killed. It actually is a luxury to be able to think the way we do. We own stocks for reasons that if we’re right, it will be, as our director of research says, it’s much better to be uniquely right on something that nobody expects than to be wrong with everybody else. We want our companies to invest aggressively. That’s why a lot of public-market investors stay away from our stocks and think they’re way too expensive. But if you have a five-year time horizon, like us, I can tell you with a straight face that I believe we’re a deep value manager because of these opportunities. I would have said a couple of years ago, if we lost Elon [Musk, the CEO] that would be a big problem for Tesla. But because I think now they’re far enough along on the autonomous road that it would hurt to lose him in terms of thinking big and really having his genius, but I think he’s put in place a company that knows where it’s going. One of the clues was, believe it or not, when JB Straubel, his chief technology officer, left. He’d been working with Elon for, I think, 15 years. I think he left because he said, my job is done. We’re on our way. Now they need to block and tackle on the manufacturing side, and get autonomous right. They’re pouring their resources into that now, which is exactly what we want them to do.”

As I write, after a spectacular run-up, Tesla shares are down 20pc on the day. This is party a response to the recent run-up but also because of caution on the short term prospects for production and sales from the Chinese gigafactory in a country on lockdown because of the coronavirus. Short term the reaction is understandable but the long-term bull case, as described by Catherine Wood of ARKK, still looks plausible and along with an investment strategy focused on innovators and disruptors makes ARKK look a worthy addition to the QV for ETFs portfolio. It also has a great chart with a breakout from a substantial area of sideways trading, very much like Tesla itself.