Although I don’t fully understand how their business works, my impression is that AppLovin is a phenomenally exciting company. The quote below came at the end of their last earnings conference.

Nat Schindler: Yes. Hi, guys. Thanks a lot for taking the question. I am going to go really high level and touch back on an earlier question someone asked about whether or not you were interested in some of those Google assets if they ever came up. You are growing at obviously absurd rates, and it sounds like you are going to continue doing so in your core market in gaming, and you are adding, e-commerce, which is an enormous opportunity. I guess, a lot of this is because your conversion rates keep improving. You guys have been great at that over time. But some of it has to do with inventory itself.

So at some point, conversion rates can improve too much. And if e-commerce is a lower converting area than gaming, when do you run out of inventory on your core gamer market?

Adam Foroughi: Yeah. We don’t know is the simple answer. There is a long way to go, we think. Just because we have so little advertiser density today. There has never been any company that has been set up like ours in the advertising space in history. What we reported, I think it was in Q1, was $11 billion plus of ad spend. Then the disclosures we have given you across web advertisers and gaming advertisers puts their numbers in the low thousands. So you have got such a high amount of spend for such a low amount of advertisers across over a billion daily active users. What happens when we get more density [of advertisers]? You get more data.

You get more density. You get more time to improve your models. That conversion rate will go up. If you think about social, it is not like there are more users on social over time. The growth in social revenue has consistently come over the last few years, from more customers getting a higher conversion rate because the technologies are getting better. We think we are going to see the same thing, but we will be able to pair it with advertiser recruitment. We are starting from such a low point. This will continue for many quarters, possibly many years. There is plenty of growth and rising conversion rates to come before we start worrying about supply [see below: supply comes from publishers with potential customers and advertising opportunities to offer; demand comes from advertisers with goods and services to sell].

Now that said, it is interesting to us to help the broader set of publishers both in the open web and connected TV to better monetize. We get pinged all the time. It is no secret that we are really good at performance advertising*. So at some point, we would like to broaden out the supply base as well. Because why not? That builds a really good growth catalyst into the future. But today, we are really heads down focused on the demand side of the platform because there is so much work to do there. At some point, you will see us talking about both sides.

*Performance advertising is a digital marketing strategy where you only pay for specific, measurable results, like clicks, leads, or sales, instead of just ad exposure, making it highly results-driven and ROI-focused by directly linking ad spend to tangible outcomes. It differs from traditional advertising by emphasizing accountability, allowing for real-time optimization to achieve business goals efficiently, and utilizing channels like PPC (pay per click) , affiliate marketing, and social media ads.

Analysts’ meeting, Q3 2025, 5 November 20

In Q1, Applovin had $11bn of ad spend on its platform. Out of this $11bn, $1.5bn (13.6pc) translates into revenue for Applovin. This ad spend was generated by a few thousand advertisers.

Their penetration of the advertising market is minute.

While we’ve seen great performance so far in our web advertising pilot, we’re currently less than 0.1% of the potential market of total advertisers. Each new partner adds to our growth. It will take a few quarters to refine these tools for a broader release, but when we launch self-service globally, we expect it to unlock a massive opportunity.

Adam Foroughi, CEO and co-founder, Q1 2025, 7 May 2025

Self-service is what it sounds like.

We’re also developing a self-service dashboard, and we’ll be launching it this quarter for select customers. Once fully rolled out, this tool will enable seamless automation, allowing new advertisers to set objectives, budgets, upload ads, and let our system deliver results.

Adam Foroughi, CEO and co-founder, Q1 2025, 7 May 2025

A key factor is the conversion rate. What is the conversion rate?

For AppLovin, the conversion rate (CVR) means the percentage of users who see an ad and complete a specific, desired action (a “conversion”), like installing an app, making a purchase, or signing up, with the goal of using better AI to personalize ads and boost these rates for growth. It’s a key performance indicator showing how effectively ads turn interest into valuable actions, calculated as (Conversions / Total Exposures) x 100%.

Key aspects of AppLovin’s view on conversion rate:

Action-Oriented: A conversion is any valuable step you want users to take, from a simple click to a final purchase, tracked through their platform.

Growth Driver: AppLovin sees increasing conversion rates as a primary path to growth, leveraging AI (like their Axon engine) to match the right ads to the right users.

Efficiency Metric: A higher conversion rate means more efficient ad spend, as it shows ads are successfully driving desired outcomes, reducing acquisition costs.

AI & Personalization: They focus on enhancing AI to improve recommendation systems, which personalizes ads and, in turn, boosts conversion rates by showing more relevant content.

Performance Marketing: CVR [Conversion rate is the percentage of users who complete a desired action, such as clicking an ad, installing an app, or making a purchase] is fundamental for measuring campaign success, product-market fit, and user intent within the mobile app ecosystem.

Example Calculation:

If 10,000 people see an ad, and 500 install the app: (500 / 10,000) = 0.05, or a 5% conversion rate.

AI overview, 5 December 2025

What I am seeing is that AppLovin generates ad revenue on its platform from a minimal number of advertisers, and conversion rates are low. This suggests that the growth potential comes in two ways: from having more advertisers using the platform and from a higher conversion rate. Higher conversion rates are coming from using things like AI to tweak the technology. More advertisers are coming from opening the platform beyond people selling games to gamers to all kinds of businesses selling all kinds of stuff to gamers and ultimately to all kinds of people.

The 1 billion users on AppLovin‘s platform are primarily users of mobile games and other mobile apps who see ads delivered by the platform, not all of them are necessarily “gamers” in the traditional sense. The audience includes a wide demographic of people who happen to play free mobile games during their downtime.

Here is a breakdown of the user base:

Mobile App Users: AppLovin’s ad platform, powered by its AXON AI engine, serves ads to users across a vast network of over 100,000 free mobile games and other apps. The user base is large, with reports citing approximately 1 billion daily active users (DAUs) or more.

Diverse Demographics: While the ads appear within games, the audience is diverse. Demographics often include a majority of females, an average age in the mid-30s, and working adults who are often parents. Many users may not identify as “gamers” but play casual games nonetheless.

Expanding Focus: AppLovin has historically focused on advertising other mobile games. However, the company is actively expanding its platform to target non-gaming advertisers, such as e-commerce and direct-to-consumer (DTC) brands, meaning the user base is increasingly exposed to a wider variety of ad types.

In essence, the “1 billion users” refers to the massive reach of AppLovin’s advertising network, which is integrated into many different mobile experiences, with mobile games being the primary channel.

AI overview, 5 December 2025

Applovin talks about being supply-constrained. What does the company mean by supply?

In the context of its advertising technology platform, AppLovin means by “supply” the available advertising inventory or ad slots within mobile apps and other digital properties (like Connected TV channels) where ads can be shown to users. This inventory is provided by publishers (app developers or content owners).

Here is a breakdown of what “supply” entails for AppLovin:

Ad Inventory: This refers to the specific ad spaces (e.g., banner ads, interstitial ads, video ads) that exist within various apps and platforms.

Publishers: These are the app developers and media companies (like those using Wurl for CTV – connected TV) who use AppLovin’s platform to monetize their content by selling these ad spaces.

Supply-Side Platform (SSP): AppLovin operates its own SSP called MAX, which is a core part of its software platform. The MAX platform helps publishers automate the sale of their inventory to advertisers, ensuring they maximize their revenue potential through efficient auctions.

Scale: AppLovin has access to a massive amount of “premium supply” through direct integrations with thousands of apps, reaching billions of daily active users. The acquisition of MoPub significantly expanded this supply base.

Data and Optimization: The data generated from this vast supply is fed into AppLovin’s AXON AI engine, which helps optimize which ads are shown to which users, benefiting both publishers (higher revenue) and advertisers (better return on ad spend).

In simple terms, if advertisers are the demand for ad space, then the available ad space itself is the supply.

AI overview, 5 December 2025

To complete the picture, what does Applovin mean by demand?

In the context of its advertising platform, AppLovin uses “demand” to refer to the advertisers and ad networks who want to buy ad space (inventory) in mobile apps to reach new users.

This demand is generated by:

Advertisers (businesses, app developers, brands, e-commerce companies) who use AppLovin’s platform to run user acquisition campaigns and drive sales.

Ad networks and other demand-side platforms (DSPs) that connect to the AppLovin Exchange (ALX) to bid for ad impressions on behalf of their own advertisers.

AppLovin’s primary demand-side solution is a platform called AppDiscovery, which uses AI (specifically its AXON engine) to match advertiser bids with available ad inventory from publishers in real-time auctions. The goal for these advertisers is to find high-value users and achieve a strong return on ad spend (ROAS).

AI overview, 5 December 2025

The industry glossary is useful to know.

MAX: AppLovin’s supply-side platform enabling in-app bidding for mobile app advertising inventory, connecting publishers and advertisers in real time.

Axon Ads: AppLovin’s self-service advertising platform for onboarding advertisers, including those outside core gaming, enabling automated campaign creation and management.

GDPR: General Data Protection Regulation, the European Union data privacy law impacting digital advertising practices and requiring compliance for serving ads within the EU.

LTV: Lifetime Value; a measure of the total net profit attributed to the entire relationship with a customer.

Referral program: AppLovin’s mechanism for admitting new advertisers to the Axon Ads platform through invitations, facilitating quality control during early scaling phases.

AI overview, 5 December 2025

Applovin’s self-service platform is off to an encouraging start.

I am particularly proud of our team because even while executing a strong quarter, we also delivered our major 1 October 2025 launch of our self-service platform and referral form. We did so without any significant hiccups. This speaks volumes about our ability to automate and execute. I know everyone wants stats on how self-service is going, and instead of something specific around accounts or ramp-up since we are still very early, I would like to note no major bugs and effective filtering out of low-quality ad accounts. Enter Ram spend.

We are already seeing spend from these self-service advertisers grow, something I was personally monitoring closely, around roughly 50% week over week. It is too soon to be significant. But this type of early growth gives us even more confidence that our platform will excel at being an open platform to any type of advertiser. Our focus for Q4 and 2026 will be to give priority to improving our models for all advertisers. We will continue tuning our onboarding flows and ramping more AI agents into the workflow to support a seamless experience for new advertisers. Once we are satisfied with the quality and experience, we will open the platform broadly beyond referral basis.

Adam Foroughi, CEO and co-founder, Q3 2025, 5 November 2025

Plans are in place to enhance the quality of ads on the platform.

We will be testing generative AI-based ad creatives. Over time, if we can move to mostly automated creative generation, we believe user response rates to more customized ads on our platform will materially improve. We are actively testing paid marketing to promote the Axon Ads platform to new customers. We will continue tuning this acquisition method so that when we launch the platform beyond referral in 2026, we can scale advertiser account without a reliance on a large salesforce. If we maintain execution discipline, we are well-positioned to acquire a large volume of new advertisers in the coming years. We believe that giving our powerful recommendation engine a more diverse set of advertisers to recommend will dramatically improve conversion rates.

Adam Foroughi, CEO and co-founder, Q3 2025, 5 November 2025

More on the importance of conversion rates and plans to improve them.

We serve a lot of users today, over a billion users a day. So we are in a world today where the biggest lever for growth on our business, given we report on a net revenue basis, is increasing the conversion rate. And that happens from a couple of things. You have got the model enhancements, which we always talk about. Those are super impactful in increasing conversion rate. That is a continuous effort. We are in the very, very beginnings of understanding how to work with neural nets* and these AI.

*A neural network is a machine learning model inspired by the human brain, consisting of interconnected nodes or artificial neurons organized in layers. These networks process data by passing it through an input layer, one or more “hidden” layers for complex transformation, and an output layer that produces a result. They are used to identify patterns in data, enabling tasks like image recognition and natural language processing.

If you think about this industry and the core AI industry, it is only a few years old, this era of engineers really being able to extract this kind of value out of these tools and technologies across a broad range of industries. So as this goes forward, we will have consistent incremental improvements, sometimes large, sometimes small, but adding up to a high impact on driving up conversion rates from technology lifts. Then you will get advertiser density expanding. This will be paired with our recommendation system, giving the model a chance to personalize the advertising to the user better.

If we have less advertisers and less categories, we just have less to show. So you cannot get a diverse set of content to the customer to maximize that conversion rate. Both those things, more advertisers and more categories, will naturally happen as we go forward. The third piece is that generative AI-based creative. Today in our advertising system, the advertiser can do almost no targeting. They can pick their country. They can put in their economic goals. Can put it in a budget, and off they go. The one manual lever is creative. And in particular, in the shopping category or in this, like, website business, a lot of the customers that are coming on board, they do not have a creative that is adapted for our platform.

The average viewership of our ads is roughly thirty-five seconds. The average viewership of an ad on social is roughly seven seconds. So a lot of these customers are coming in and just porting a short ad, and trying to replicate what they have on social on our platform and it is mismatched. It diminishes their possible conversion rate. So what does that mean? Well, we get into a world where we can use generative AI tools, to automatically create ad creatives, on behalf of these customers.

They will get to a point where they can expand their conversion rate just by expanding the counter creatives into our system and ensuring that the types of creatives in our system work best on our platform and doing that at no cost. And so we are really excited about where the tools in the marketplace are going.

Adam Foroughi, CEO and co-founder, Q3 2025, 5 November 2025

This is AI on Applovin.

AppLovin stands out due to its vertically integrated, AI-powered mobile advertising ecosystem (AXON), giving it unique full-stack control, vast data, and optimization at massive scale, particularly effective in the lucrative mobile gaming space but expanding to e-commerce. Its strength lies in connecting advertisers with users via sophisticated machine learning, offering high engagement through formats like rewarded video, while its MAX mediation platform and Adjust analytics provide deep insights, creating a powerful, data-driven engine for growth.

Key Differentiators:

AI-Driven Optimization (AXON): A proprietary AI engine trained on massive datasets from its own apps and partners, enabling highly efficient user acquisition and monetization.

Full-Stack Control: Integrates ad mediation (MAX), measurement (Adjust), and user acquisition, giving it unparalleled oversight of the entire ad lifecycle.

Massive Data & Scale: Owns a vast network of apps (especially games), generating huge volumes of behavioral data to train its AI, allowing unique targeting.

Superior Ad Formats: Excels with rewarded video ads, which capture user attention better than traditional display ads, leading to higher engagement (“thumb stop rate”).

Targeted Vertical Strength: Deep roots and expertise in mobile gaming, a high-value sector, though it’s expanding into e-commerce with a self-serve platform.

Data Advantage (vs. Google): Can offer advertisers powerful targeting capabilities in a post-cookie world, sometimes in ways Google’s platforms can’t.

How it works for Publishers & Advertisers:

For Publishers: MAX mediation platform brings multiple ad networks (demand partners) to compete for inventory, maximizing revenue.

For Advertisers: Uses AppDiscovery to find high-value users, driven by the AXON AI, ensuring strong ROI.

In essence, AppLovin’s special sauce is its integrated technology, massive proprietary data, and specialized AI, creating a dominant force in mobile advertising, especially within gaming, that few others can match.

AI overview, 5 December 2025

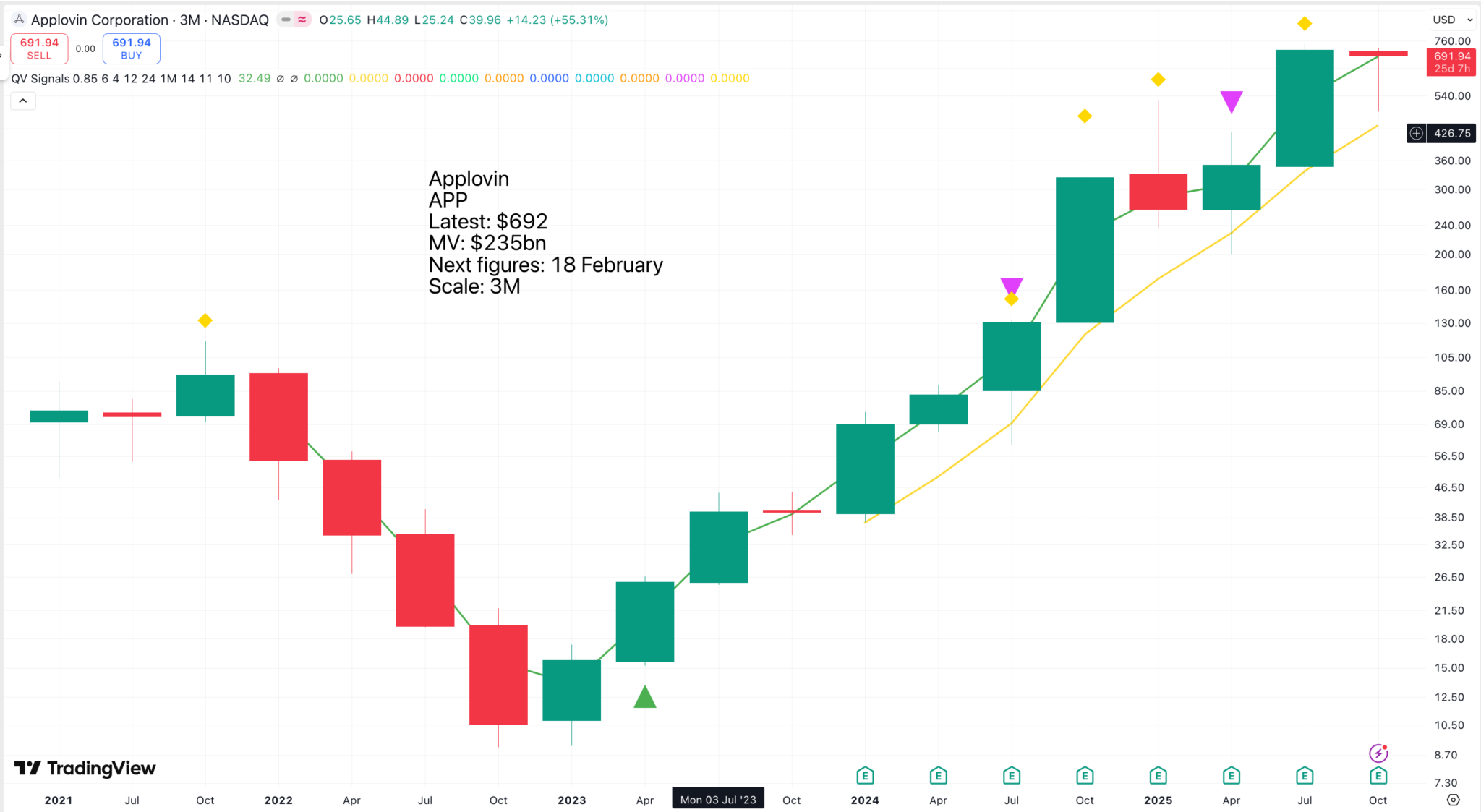

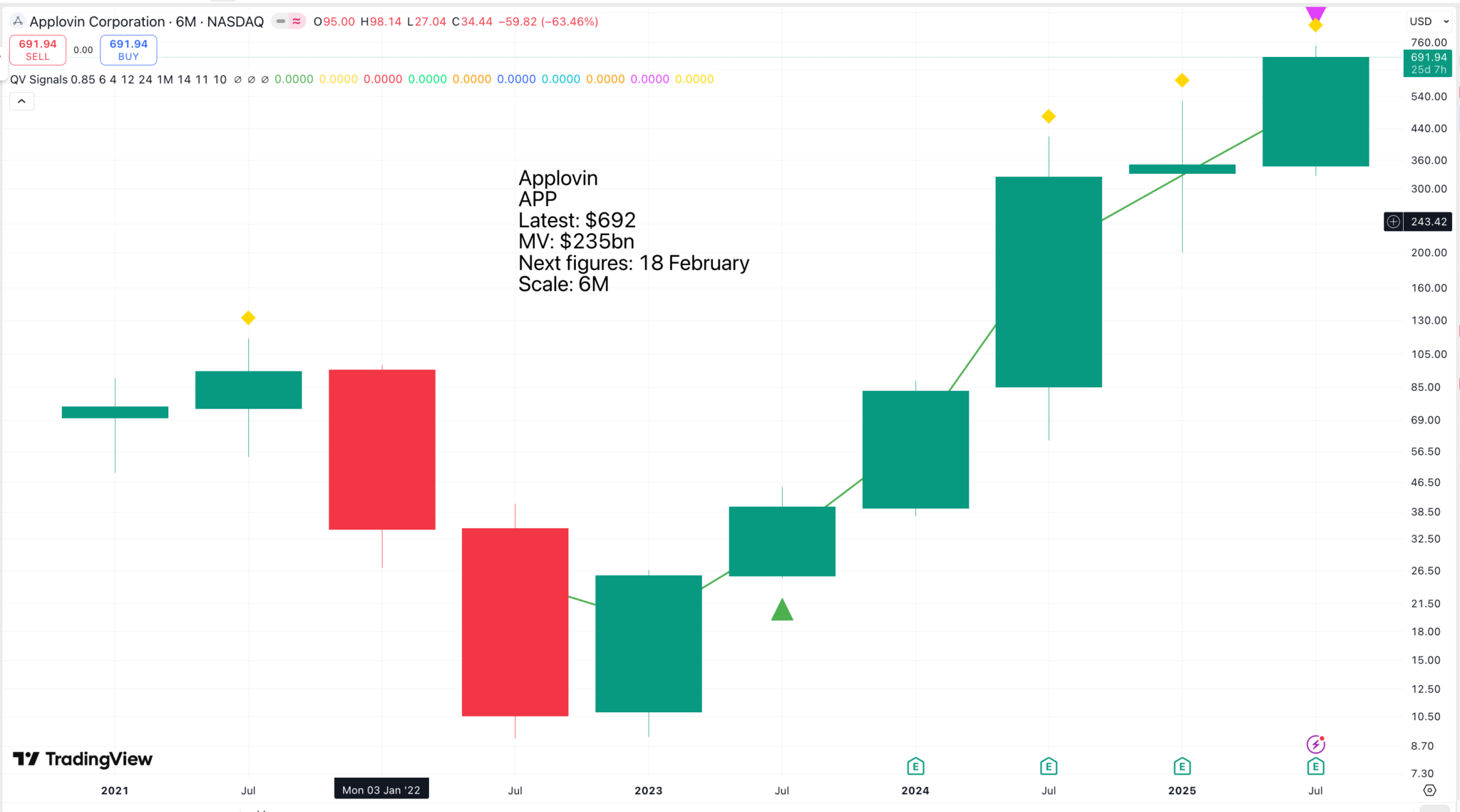

A last look at an Applovin chart.

This is a pattern known to chartists as a V-shaped reversal. It is a strong pattern and holds the promise of a massive rise in the share price. The intriguing possibility is that the trajectory of the climb will be maintained, which would take the shares dramatically higher over a relatively short time scale. Everything the company is saying about the opportunity ahead supports the potential suggested by the chart.

Share Recommendations

Applovin APP

There are many other exciting milestones ahead for Apploving, which recently won promotion to the S&P 500 index. There could be a change of name, now that the apps business has been sold, a share split and a dramatic acceleration in the share repurchase programme. It is just conceivable that three years from now, Applovin could join the select group of companies valued at over $1 trillion.

The Bulls — Why Fans Believe

Bulls like Eric Seufert and Olivia Kory argue that AppLovin isn’t just another AdTech company — it’s something fundamentally different. They point to a business model operating in a massive, fast-growing category with surprisingly few true competitors. Their core argument is that AppLovin has what almost no one else does: full-stack control, a vast data footprint across owned and operated inventory, and an optimization engine (AXON) trained at a scale that’s incredibly hard to match.

A big part of the bull thesis is that the market still underestimates the sheer size of mobile gaming. As Matt Barash put it on Twitter, “Watch the people on your next flight, bus ride, subway ride. They’re all gaming. It’s universal and real. Everyone is a gamer. But mainstream adtech people will never recognize the market.” He’s not wrong. Segwise estimates roughly 3.2 billion active mobile gamers today, growing to 3.5 billion by the end of 2025. When you account for ad spend, user acquisition budgets, and platform services, the TAM [total addressdable market] for casual gaming alone sits comfortably in the tens of billions — and likely pushes into the low hundreds of billions globally.

From this standpoint, the upside becomes clearer. If AppLovin can continue demonstrating that it drives incremental spend beyond gaming — something its early ecommerce results hint at — it opens up a much larger market that many investors still underestimate. The ecommerce push is essentially a wager that DTC [direct-to-consumer] and retail brands will tap into AppLovin’s mobile-game inventory and AXON-powered optimization to acquire customers more efficiently than on the major social platforms.

In the bull view, this is the real unlock. Proving sustainable performance for non-gaming advertisers expands AppLovin’s addressable market well beyond the core gaming ecosystem. If the company can keep delivering genuine incremental ROAS [return on ad spend] for ecommerce brands, the runway is far larger than what the street has currently priced in.

When you add it all up, this is why The Economist labeled the story “remarkable,” and why Digiday said its results are “the kind that usually end an argument.” In the bull view, AppLovin is that rare AdTech company that doesn’t just tell a great story, it repeatedly backs it up with execution.

Medium, 25 November 2025

Strategy – Buy Applovin

Applovin launched its Axon self-service advertising platform on 1 October. 5 November gave us the first hint of how the launch is going. It is already growing by 50pc a week, which is encouraging, though from tiny beginnings. The next news will come on 18 February when Applovin reports its Q4 2025 results and tells us what to expect looking into 2026. This news will be huge for the stock. Equally, technological advances often take longer than you think, but end up going even further than first anticipated. Axon could be like that; Google has had the odd hiccup over the years, but still made scintillating progress.

There is the possibility that Applovin can find itself in an exciting virtuous circle. Better technology and tailor-made creative content lead to improved conversion rates, which attract more advertisers (higher density), which provides more data, which leads to better conversion rates and so on.

In essence, Applovin is a business created to use technology to help advertisers achieve better results from their marketing budgets. It already has a massive data bank to make that happen. A bit like Nvidia, it started with gaming but is spreading its wings to the total performance marketing opportunity, which is vast. Because the company’s business processes are highly automated, the company is extremely profitable and generates cash, which can be used to invest in marketing its own platform to grow the business even more rapidly or returned to shareholders via share buybacks.

Applovin has the opportunity to become a massive force in technology-driven advertising. It is all about execution. On 18 February 2026, we will get a key update on progress.

There is a lot to read, but if you intend to buy the shares, and I think you should, it is worth doing a little homework. Note that companies change over time as they grow bigger and stronger. Google is a vastly different business from the company which floated in 2004. Applovin has a young, highly inventive, opportunistic management team. It is reasonable to expect them to be on a similar journey, a journey which has taken Google/ Alphabet from a valuation of $80bn to nearly $4 trillion.