Another fast-growing fintech tearing chunks off the carcase of the traditional banking industry

Affirm Holdings. AFRM. Buy @ $134 Times recommended: 3 First recommended: $109 Last recommended: $116. Lowest recommended: $105.5

Affirm is a fast-growing and incredibly innovative financial technology (fintech) company about which I have written before. Like Upstart Holdings, the more I look at Affirm the more excited I become. I think they could become a very large company indeed. Since Affirm was founded in the same year, 2012, as Upstart and is worth more you could say they are moving even faster than the latter business. I would certainly say that Affirm is right up there for excitement and potential with Upstart. These are two amazing businesses.

Much of their opportunity comes from the dire state of the traditional banking industry. Companies like Goldman Sachs are somewhat different because they make so much of their money from fees for advising on things like IPOs and mergers and acquisitions and from wealth management which may offer some protection. But old style branch-based consumer banking, the banking with which you and I come into contact, is desperately vulnerable.

When I think of banks I think maybe they are not too bad at providing a home for the liquid part of your savings. They take deposit and function reasonably well as a piggy bank although to the extent that they hold cash in current accounts with zero return that is not great for their customers.

Everything else they do they do badly. They are slow to make payments, they are inflexible when it comes to lending money, they are outrageously expensive when it comes to transferring money internationally and there are innumerable hidden charges in their operations. This may reflect their high costs but whatever the reason they are a disaster for consumers and there must be a better way.

They are a bit like organised religion, heavily dependent on people who grew up using them and are too old to learn new tricks. My wife and I bank with Barclays. My children are increasingly moving their banking type operations to fintechs like Revolut and Wise. Payments into my business increasingly come through PayPal and Stripe and there was even somebody from the former on the phone to me the other day offering me a loan through something called PayPal Working Capital.

I have never had somebody on the phone from Barclays offering to lend me money.

As we saw from my recent stories Upstart does work with banks but I slightly wonder how long that will last. They need banks for their reputation, their ability to provide and attract customers and for the capital they can provide but it seems to me all these things could change in the future and Upstart could simply dispense with the banks and find its customers and its capital elsewhere. We shall see.

Affirm Holdings makes no pretence of working with the banks. It has other partners, really powerful partners like Wal-Mart, Shopify and Amazon and it has its own increasingly sophisticated ways of raising the capital it needs. Loads of companies don’t need banks anymore. Apple, Alphabet (Google) and Microsoft have stronger balance sheets by far than any bank and if they want to borrow they go direct to capital markets.

Affirm doesn’t see itself as a bank but rather as a highly innovative software engineering business. They are using cutting edge technology to help people pay for stuff in ways they want to. In particular they see themselves as replacing credit cards or, as they put it, unbundling credit cards.

Credit cards developed after the war when Americans lorded their way around a desperate-for-dollars Europe brandishing their platinum Diners Club and American Express credit cards. Some were so powerful they gave the holder almost unlimited credit and were huge status symbols. Not surprisingly we entered a period when everybody wanted to have one.

The trick to using them was not to use the credit but to pay them off every month but many people failed to do this and were dragged into a never ending cycle of debt repayments at outrageously high interest rates. The cards were powerful. No need for cash if you had one but very dangerous. As a result millennials, Gen Z and many older consumers have completely sworn off them and prefer to use debit cards which settle in full every month with no interest charges.

But that is not really the answer either. Most people do need credit to pay for all sorts of things. They want or need whatever it is up front from a dress to a car to a house with the ability to pay for it in instalments later and emergencies also require money from somewhere.

This is why demand for personal loans is one of the fastest growing loan categories driving the growth we have already seen at Upstart and why companies like Affirm are growing almost as fast from coming at the same problem in another way.

Affirm’s mantra is to bring absolute honesty and transparency to the whole process of making payments and borrowing money. They present this as a moral crusade which is a very strong commitment to this approach. When you buy something paying with Affirm you know exactly how much it is going to cost you with no secret nasties in the fine print. As with Upstart their software is very good at determining who will actually make their payments so they have minimal bad debts.

Consumers love their offering, especially because often the cost of making the payments is subsidised by the merchant. Merchants like to use Affirm because they make more sales at higher prices so it is a win win for everybody – good for the consumer, good for the merchant and good for Affirm which receives a fee for providing the platform that makes all this possible.

Instalment payments with interest are ideal for larger items where consumers need many instalments to pay for their purchase. The next step was to introduce buy now pay later (BNPL) for smaller items such as fashion or travel where the entire cost of the advance is paid by the merchant and customers can pay for their purchases in four payments with no interest payable or hidden charges of any kind.

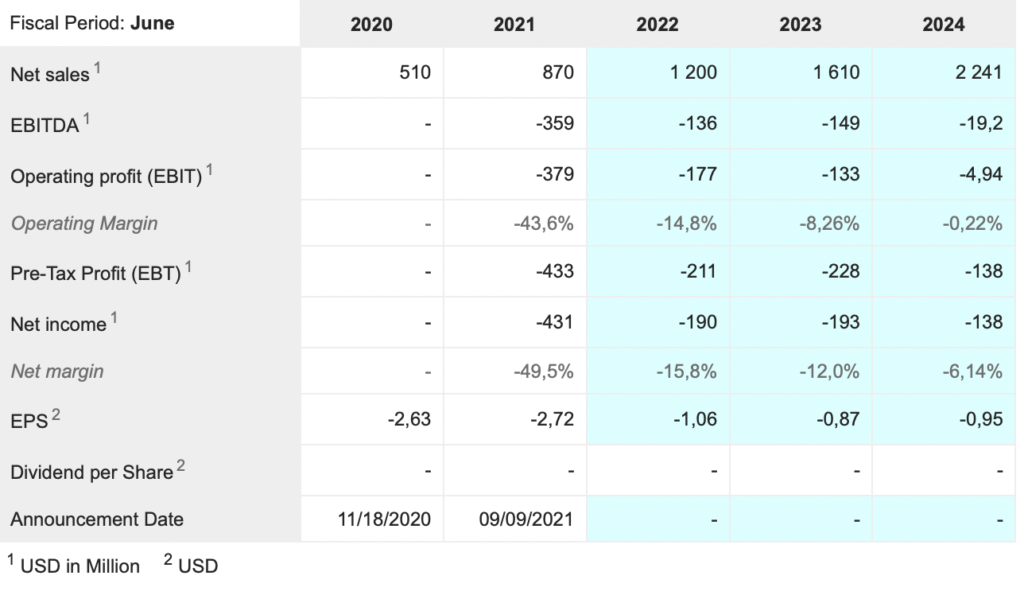

These two business together have been driving rapid growth at Affirm. We are talking really rapid growth. Affirm and other BNPL businesses measure a metric called GMV (gross merchandising volume), which is the amount of business done over their platform. In Q4 2021 (for the period ending 30 June 2021) GMV across their platform grew by 106pc. If we exclude their largest customer Peleton, which grew an insane 328pc in the same quarter a year earlier when lockdown was driving massive demand for exercise bikes, the growth was 178pc. Revenue for the quarter grew by 71pc and has been growing at a supercharged rate for some time. If we just take the last three years the figures are $264m, $509m and $870m for 2019, 2020 and 2021 respectively.

Now the company is taking the fight to the banks in an even stronger way with the launch of the Affirm Debit Pus card. This card enables holders to buy stuff and then after making their purchases decide how they want to pay for it, either up front, in four interest-free BNPL payments or over a longer period with clearly indicated interest and total repayment costs and no small print.

CEO and co-founder, Max Levchin, who among other things was a co-founder of PayPal, describes the new card in glowing terms.

“Our team has designed and developed the most meaningful innovation debit card since its inception more than 50 years ago, putting unparalleled choice and flexibility directly into the hands of the consumer. The consumer can use the Affirm Debit Plus card in place of the regular debit card. It connects seamlessly to their existing bank account, and no new checking account is required. Once you swipe or tap your card, you can use the intuitive Debit Plus companion app to turn any eligible transaction into an Affirm pay-over-time product.

All it takes is a couple of taps within a day after the transaction occurs. It’s just that simple. This effortless access to a smarter, more transparent way of paying over time at brick-and-mortar and online is very close to being indistinguishable from magic. But as always with Affirm, there are no magic tricks, or tricks of any kind, just excellent technology.

The beauty of our card is that it’s powered by software, which means that you can expect us to regularly add new features and functionality via app updates. I believe Debit Plus is a revolutionary idea that can truly help millions of people enjoy life with a lot less angst about spending and saving money. With a beta test wrapping up this month, we’re very excited to bring this card out of the nearly million-strong waiting list of existing Affirm customers and then to the general public. I invite you to sign up for yours at affirm.com/card.”

The card is not going to be all new business because it encompasses all the ways you can pay using Affirm but it does offer sensational convenience, is likely to be incredibly popular and should certainly add to the overall business being done, perhaps very strongly.

Nor is that the end of the innovations we are seeing from Affirm which is a company built on innovation. I am not going to go into details but there is a ton of stuff going on.

“With our company’s deep roots in product development and engineering, we are at our happiest and most productive when building and innovating. With so many new ways to delight consumers and solve merchants’ problems planned for the coming years, we’re poised to expand our addressable market to grow Affirm and delivering our ambitious mission to improve lives.”

If Affirm Holdings is in any way a bank it is one so different from the old school banks we are used to as to be a wholly different animal and Max Levchin as a CEO is as different from a traditional banking CEO as could be imagined with much more in common with people like Elon Musk and the late Steve Jobs.

One way of looking at the BNPL companies is that Afterpay, which is in process of being acquired by Square, is the top dog in Australasia, Klarna is the top dog in the UK and Affirm is the top dog in the US. Other differences are that Affirm offers a wider range of repayment options including the longer term interest bearing option for larger items.

Affirm is also moving fast to do deals with partners who can help the business drive forward at an accelerated pace. We have seen how the arrangement with Peleton accelerated growth in 2020. The company has also done a deal with Wal-Mart to offer buy now pay later terms to Wal-Mart customers. More recently it has teamed up with Shopify to enable merchants using the Shopify platform to offer powered by Affirm terms to their customers and most recently it has teamed up with Amazon and most recently still Target, a US supermarket group with 1,904 locations.

The Shopify link has already added merchants in the hundreds of thousands using the platform. The Amazon deal is too recent to have any data but clearly Amazon is a very powerful partner and Target will add more business still.

There is an incredible sense of momentum and purpose at Affirm Holdings.

“So, what comes next? We have an ambitious plan for the fiscal year, and more importantly, for the decade ahead. To feed the expansion of our business and to increase our share of the growing market, we’re focusing on three key areas for fiscal year ’22: increasing our consumer reach and frequency, growing our merchant and partner network, and extending our product offering. Our partnerships with enterprise merchants and platforms like Shopify introduced more consumers and high-velocity merchants to Affirm’s honest and transparent offering. In our current fiscal year, we have continued to ramp merchant activation of Shop Pay Installment.”

I have used this quote before but it is still worth repeating. “In closing, I’ve never been more excited about how well Affirm is positioned to win. Even at our blistering pace of growth, the opportunity before us is fast. Adoption by consumers and merchants alike continues to accelerate. Yet, at the same time, we’re just getting started.”

I am still learning about Affirm Holdings as a business but it looks like another game changing disruptor to me. Max Levchin is an amazing guy, very determined, very articulate and with an incredible sense of mission that must be very inspiring to all the employees at Affirm. They really are changing the way merchants engage with consumers and the way the latter fund their purchases. Banks looks like clod hopping dinosaurs by contrast.

The opportunity looks enormous for the technology they already have let alone where that technology is going over the next 10 years. I am sure banks would love to compete but how can they. What tech superstar or fresh out of Stanford computer science graduate is going to choose to work for Barclays when he could work for Affirm doing more exciting and life changing work, earning more money with far more valuable stock options and a far more stimulating working environment.

These new wave technology companies are like heat seeking missiles blowing to smithereens every industry at which they take aim as they reinvent our world for the Internet age and the 21st century.

Another issue is valuation. Not only are shares hard to value when the underlying business is growing this fast but with tech giants now valued in the trillions of dollars we have to see billions as the new millions. Fifty years ago Affirm’s market value of $37bn was probably more than the GDP of most countries. Now it is the value of a mid-sized US company. Big companies are valued in the hundreds of billions and I expect many mid-sized companies in the Quentinvest list, very probably including names like Affirm and Upstart, to become big companies in due course.