Anatomy Of A Chart Breakout; Coinbase and The Global Financial System

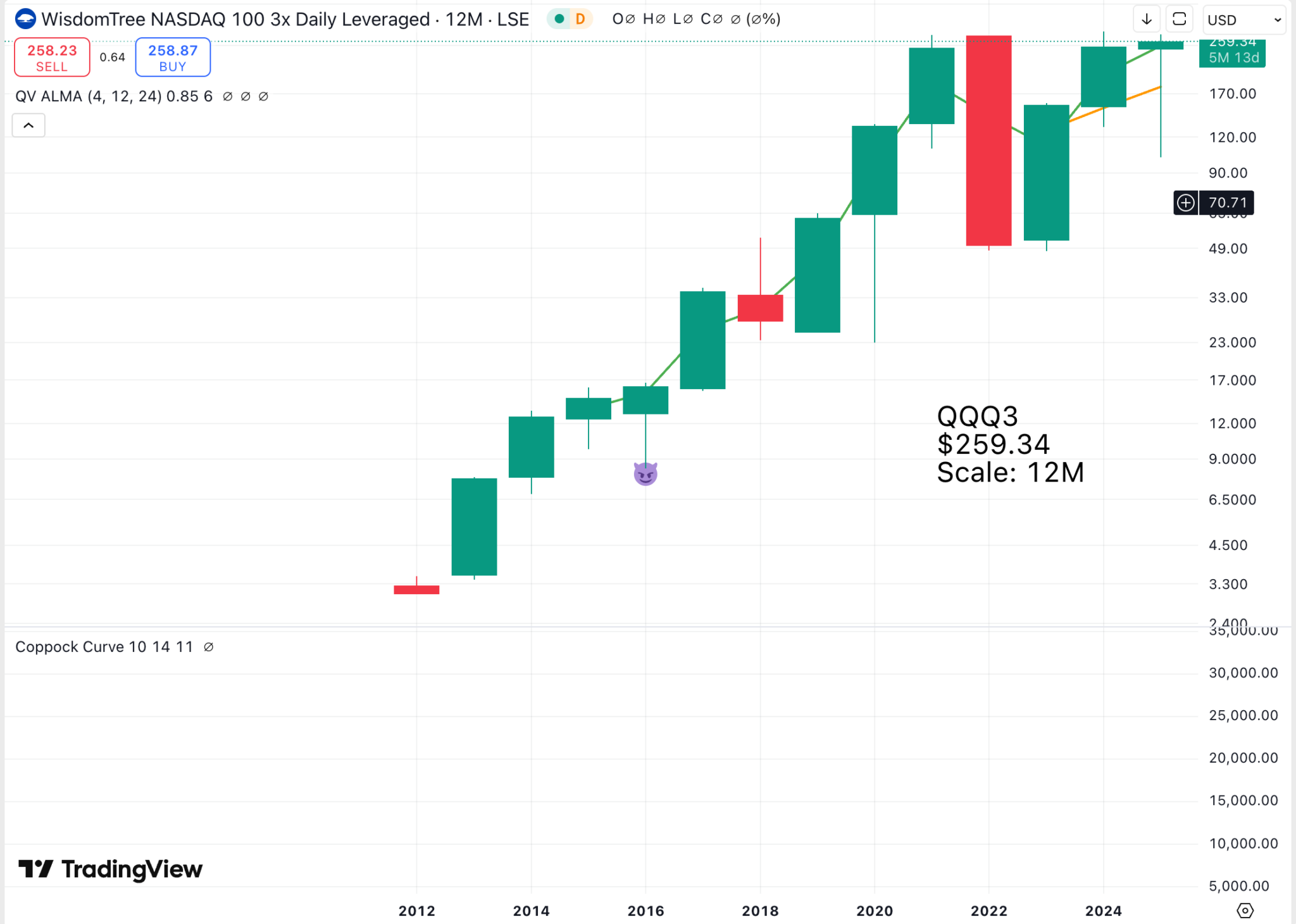

There is no more exciting phenomenon than a chart breakout from a major consolidation. In 20 years, there have been just two such breakouts on this chart of the Nasdaq 100 Technology Sector index, and the second one is happening NOW!

This could be massive. Look what happened after the last one. Over the next nine years, the Nasdaq 100 went from 1400 to 9600, an almost sevenfold rise. I am festooned with bracelets of various kinds. I don’t know why. I like the feeling. One of them is a silver bracelet with the inscription Carpe Diem, Seize the Day. This is one of those moments.

I came out of the Royal Garden Hotel around lunchtime, and I was chatting to the doorman, who suddenly appeared uncertain whether to address me as sir or madam. It is all cool with me, but I was a little surprised. Maybe it is all the jewellery.

If you want to know what a resistance level looks this chart offers a perfect example.

I don’t have any problem with buying these shares right now, but a close above $300 would be like lighting the stick of dynamite. These shares have two modes, going up, which they do most of the time, and going sideways.

The daily rebalancing works against them (I can’t remember why, but I think it is a negative when shares are flat or falling and a positive when shares are rising strongly), but it explains why the Nasdaq 100 is hitting new highs while these shares are stuck in resistance. But one day, it will happen, they will be off and away, and that daily rebalancing should favour the bulls. Between 2012 and 2021, these shares increased from $3 to $275, a 92-fold rise. Over the same period, the Nasdaq 100 rose 10-fold; that equates to over nine times leverage, not three.

I am becoming increasingly intrigued by this chart of Coinbase Global. It is potentially incredibly powerful. This aligns with the ambitious goals of co-founder and CEO Brian Armstrong, who, with his distinctive bald dome, bears a disconcerting resemblance to the Mekon, a famous adversary of Dan Dare in Eagle comics of the 1950s.

More on that later; first, I want to share a thought I have had. There are astonishing parallels between the rise of Bitcoin and the rise of Christianity, even to the fervour inspired in early enthusiasts and the mysterious beginnings lost in time.

This is significant because we know what happened to Christianity. Perhaps the future holds similar success for Bitcoin, Cryptocurrencies, Stablecoins, Blockchain, and the total reinvention of the global financial system that Brian Armstrong is discussing.

Meanwhile, here is some background on what is happening on the regulatory front.

The House of Representatives passed three major cryptocurrency bills on Thursday, capping what President Donald Trump had dubbed “Crypto Week.” But it will be a long time before they take effect.

The three bills mark important steps toward regulating this evolving medium of exchange and a victory for the intense lobbying by crypto players like the trading platform Coinbase Global to win over politicians like Trump — who went from a Bitcoin skeptic, to a crypto profiteer after taking millions of dollars in crypto-tied campaign contributions and launching several of his own digital-assets ventures.

The price of Bitcoin rose to record levels ahead of the legislative week, and other crypto coins like Ethereum and XRP jumped after the votes. Shares of Coinbase and Robinhood Markets also rose. IPO plans were announced by crypto exchange-traded fund sponsor Grayscale Investments and the crypto exchange operator Bullish.

But it could take over a year for the legislation to take force, notes TD Securities analyst Jaret Seiberg.

The bills passing the House on Thursday were the Genius Act, the Digital Asset Market Clarity Act, and the Anti-CBDC Surveillance State Act.

Only the Genius Act has also passed the Senate, and Trump signed it on Friday. It establishes a framework for federal regulation of so-called payment stable coins, whose prices are pegged to a real currency like the dollar. The bill requires issuers to maintain one to one reserves in U.S. dollars or Treasuries.

Treasury Secretary Scott Bessent argued that the law could create $3.7 trillion in additional demand for T-bills. Raymond James analyst Ed Mills noted Friday that others are far less optimistic about the resulting demand for Treasuries.

Despite Trump signing the Genius Act into law, there will be no Day One impacts on stable coin issuers like Circle internet Group or Tether, says TD’s Seiberg. Within a year, the Treasury Department is supposed to write rules on how an entity becomes qualified to issue stable coins, as well as how stable coins pegged to foreign currencies will be permitted to issue in the U.S. Under administrative law, there will be a round of public comments on the proposed rules — and perhaps litigation.

And it will be a full three years before the prohibition of stable coins that don’t comply with the new law. “This is the start of the process, and not the finish line,” Seiberg says.

Perhaps more important to the crypto industry’s thriving is the Clarity Act, which apportions crypto oversight of crypto exchanges, brokers, and tokens between the Commodity Futures Trading Commission and the Securities and Exchange Commission.

The Clarity bill must now go the Senate, which has to pass its own version of the law. The House bill had good bipartisan support, so the Senate might get its part done before the Aug. 1 recess. If they do, a final law might be ready for the president’s signature in September.

The last of the three crypto bills — the Anti-CBDC Act — prohibits the Federal Reserve from issuing a central bank digital currency, a “CBDC.” Propelling it was the crypto industry’s ostensible worry about surveillance and privacy, but perhaps some worry about government competition with their businesses.

The Anti-CBDC bill passed more narrowly than the others, and sponsors had to attach it to a national defense bill. Senate passage will entail lengthy negotiations, says Raymond James’ Mills, and could stretch until December.

Along with Trump’s well-publicized signing of the Genius Act, the government’s crypto campaign will get another nudge on Tuesday, when a president’s working group makes policy recommendations that could include a proposal for a strategic reserve of Bitcoin.

It has been a strong start. But just the start.

Dow Jones Newswires, 20 July 2025

I have been listening to CEO Brian Armstrong, talking about blockchain, crypto, Bitcoin and Coinbase. He says Fortune 500 companies are adopting stablecoins rapidly, which will benefit Coinbase with its USDC stablecoins. He expects, eventually, every payment to be tokenised with almost all friction, fees, commissions, and foreign exchange costs eliminated.

Coinbase began with a platform for trading Bitcoin and other cryptocurrencies. It has since added subscriptions and services and is moving into a new category of payments. Over time, he expects trading and payments to be the two main businesses. He also anticipates that Bitcoin will become the world’s reserve currency, which implies a massive increase in value.

As he put it in the latest quarterly report.

So in closing, it’s important to realize that crypto is eating financial services and coin base is 100% focused on crypto. We are building better financial infrastructure for the world, which will enable more economic freedom.

We have been focused on crypto since the beginning 12 years ago, and we continue to be focused there, executing at a rapid pace. With growing regulatory clarity, we believe crypto rails are poised to power an increasing share of global GDP and update every aspect of the financial system over time.

Brian Armstrong, CEO and co-founder, Coinbase Global, Q1 2025, 8 May 2025

The dependence on Bitcoin trading makes quarterly revenues volatile, but that will change over time.

We made progress in a variety of initiatives in Q1, as Brian articulated, and these contributed to over $2 billion in total revenue.

I want to start with our transaction revenue, which was $1.3 billion, down 19% quarter-over-quarter. However, we grew our trading market share across both spot and derivatives trading. Total global spot trading was down 13% with Coinbase outperforming at down 10%. Our consumer trading volume was $78 billion, down 17%. Consumer transaction revenue declined 19%, and our volume mix was similar in Q1 as compared to Q4.

Institutional trading volume was $315 billion, down 9%. Institutional transaction revenue was down 30%. There are two factors, which drove the discrepancy between the revenue decline and the volume decline. The first is the growth in our derivatives trading business. As we build this business, we are offering trading rebates and incentives to build liquidity and acquire customers. Our focus on growth is causing a decline in the transaction revenue that we get from derivatives trading as these are contra revenue and recorded in the institutional transaction revenue line item.

Second, we saw a spot volume mix shift, which was more concentrated about market makers and liquidity providers, which tend to have lower fee rates. Our subscription and services revenue grew 9%, and we saw an all-time high of $698 million, nearly $700 million in revenue.

Two drivers of this growth: first, stablecoin revenue grew 32% quarter-over-quarter to $298 million. Over the last 2 years, we have seen MDUs holding USDC double, and the average balance of USDC per holder has tripled. Coinbase One also continued to add new subscribers as we extended new benefits.

[MEDIEUS (MDUs) is a global digital currency exchange offering cryptocurrency trading, advanced tools, and staking options for beginners and experts alike.]

Alessia Haas, CFO, Coinbase Global, Q1 2025, 8 May 2025

The company has powerful arguments as to why it expects to win as a business.

The lack of regulatory clarity that we had in the past was not a moat for Coinbase. It was a barrier to the entire industry growing. So I’d much rather be in a situation we’re in today with regulatory clarity emerging and more companies coming into crypto. But make no mistake about it, we’re playing to win here.

And there’s a number of advantages that we have so I’ll just try to go through them. First, we’re 100% focused on crypto, right? I’ve seen enough cycles now where companies get interested in crypto, then they get less interested, or maybe when their core business comes under threat, they defund their crypto efforts. For us, crypto is our core business. It’s 100% of what we do, which means we do it better than anyone else.

Now second, we’ve had to solve a lot of hard problems along the way to build a crypto infrastructure, which is pretty difficult to replicate. So everything from how do you custody crypto securely with data centers around the world, how do you integrate all the different blockchains and handle their upgrades and air drops? How do you build an exchange around this and have derivatives and have a network of banks around the world for on and off-ramps that are comfortable with crypto or getting licenses all over the world with people, the regulators allowing crypto with permitted activity?

Even just the transaction processing and handling the scale of it, making that timely staking rewards, et cetera, etcetera. So these are all hard problems to solve across engineering, security, compliance, and it’s taken us a long time to build that. We are adding more at a very rapid pace. I don’t see others catching up.

Now third, this is maybe the most important point, is that for many of these new entrants to crypto, we will power some or all of their infrastructure for them. So whether it’s trading, custody, payments, wallet infrastructure, we’ve signed a number of large deals here to run on our infrastructure, and we’re going to capture part of the value chain for every new entrant that comes into the space, which is why I say it’s a TAM [total addressable market] expansion.

So a great example of that, by the way, is when the ETFs got approved, we powered custody and trading for the majority of them, while it also grew our trading business in our retail app, right? So it was additive and we got to participate in this new value chain. So the other part of your question was asking about new opportunities that exist with this increased regulatory clarity and there’s a bunch that are emerging now. Perpetual futures coming to the U.S. is a big opportunity.

Having millions of assets available for trading on our platform via the centralized exchanges, tokenizing securities and other asset classes, that should probably happen over time. How do you just rethink capital formation entirely onchain? These are all emerging opportunities. And so with increased regulatory clarity, it’s going to be a huge win for Coinbase. We want every business to come into the space, so we can partner with them and sell them our products.

Brian Armstrong, CEO and co-founder, Coinbase Global, Q1 2025, 8 May 2025

Share Recommendations

QQQ3

Coinbase Global. COIN