Thomson Reuters has been around for ever in one form or another. I used to have a subscription but things have changed in the stock market since I was a subscriber and there are more changes to come. in 2020 a new CEO, Steve Hacker and shortly thereafter a new CFO, Mike Eastwood, arrived and in 2021 instituted a two year Change Program. Investors have been impressed. Hacker has got a serious CV including a stint at management consultants, McKinsey and Co., which is often a springboard to greater things.

The plan with the two year Change Program, which has already been completed, has been to accelerate the group’s journey towards being a leading content-driven technology company, powering the world’s most informed professional, which sounds a cool thing to be.

Table of Contents

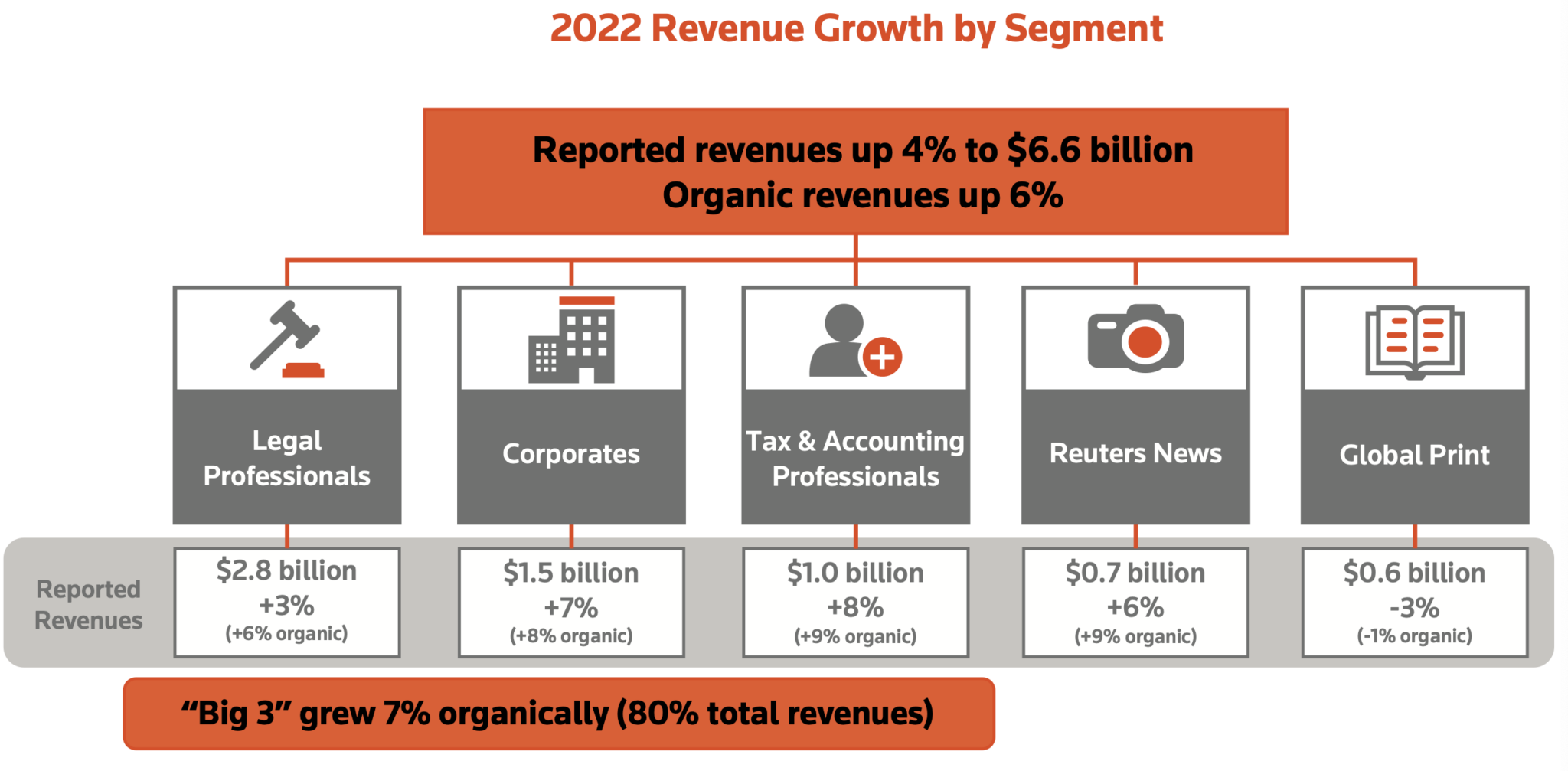

The graphic below shows how the group’s customer base breaks down.

Change is coming thick and fast.

We invested nearly $600m on technology, organizational and market-related initiatives. As of December 31, 2022, we achieved $540m of annualized run-rate operating expense savings.

Annual report 2022

The business model is primarily subscription based.

We derive most of our revenues from selling information and software solutions, primarily on a recurring subscription basis. Our solutions blend deep domain knowledge with software and automation tools. We believe our workflow solutions make our customers more productive by streamlining how they operate, enabling them to focus on higher value activities. Many of our customers use our solutions as part of their workflows, which has led to strong customer retention. We believe that our customers trust us because of our history and dependability and our deep understanding of their businesses and industries, and they rely on our services for navigating a rapidly changing and increasingly complex digital world. Over the years, our business model has proven to be capital efficient and cash flow generative, and it has enabled us to maintain leading and scalable positions in our chosen market segments.

Annual report 2022

Now that the changes have been made the group can focus on growth.

For Thomson Reuters, 2022 was a year of significant progress. Relative to our financial results, we met or exceeded our organic revenue growth, adjusted EBITDA margin and free cash flow performance metrics in our 2022 updated outlook, which we confirmed in November 2022. We made significant progress transforming Thomson Reuters into a more streamlined and scalable business that we believe now has a strong foundation for sustainable future growth. The highlight of our product and innovation efforts was the launch of Westlaw Precision, a significant upgrade to our flagship legal research offering. In November 2022, we signed a definitive agreement to acquire SurePrep, LLC (SurePrep), a provider of tax automation software and services for $500m. We closed the acquisition in January 2023.

Annual report 2022

Acquisitions remain very much on the agenda.

We expect that acquisitions will continue to play an important role in our strategy, and we may make tactical acquisitions from time to time that we believe will strengthen our positions in key growth segments. Generally, the businesses we acquire initially have lower margins than our existing businesses, largely reflecting the costs of integration.

Annual report 2022

The company has raised $1bn from selling London Stock Exchange Group shares, acquired as the result of the latter’s acquisition of a data business called Refinitiv, and has around $5.5bn worth left which are likely to be sold.

The stock market share price is in rocket mode

All this activity has had a sharply positive effect on the share price.

The chat shows a spectacular chart breakout in 2019, since when the shares have risen around 156pc. This kind of explosive breakout is often the first leg in a sustained secular uptrend and it is exciting to see how much the new management team has achieved in such a short period of time.

A company that provides information on subscription with such a recognisable brand name is superbly placed to benefit from AI so I think this could be a good one.

Financial strategy

Part of the plan with Quentinvest as a new bull market takes shape is to find new names that may prove leaders in the next uptrend. TRI looks like a candidate and I also like the fact that acquisitions are planned as these can turbocharge growth. It is a little strange to call as venerable a business as Thomson Reuters a new name but the business is much changed and that is what makes it new. It is also new to the QV portfolio.

The combination of such spectacular name recognition, Reuters was founded in 1851, with a massive ‘something new’ in the form of a high energy new management team and a dramatic chart breakout gives Thomson Reuters all the characteristics of a stock which could run a long way.

Share recommendations

Thomson Reuters. TRI. Buy @ $128