I like to buy on five times leverage and add to my holdings as and when a rise in the share price creates new equity. This is equivalent to a suicide mission. If the shares fall 10 pc, which will happen frequently to the shares I buy, IG will start selling me out. If the shares fall 20pc, which also happens frequently, I will be sold out completely.

There must be a better way. I have an idea. Buy a reasonable holding, say $25,000 to $50,000 worth of shares requiring $5,000 to $10,000 of equity. Let’s suppose you have bought $50,000 worth. The shares rise one per cent, creating a profit of 50,000/100 = $500. You do NOT reinvest the $500. Instead, you transfer it to your bank account. You continue to do this with every one per cent rise in the shares.

Let us suppose, for the sake of argument, that the company in which you hold shares reports brilliant results. They should do otherwise you should not have bought the shares in the first place. The shares rise 20pc. On a five-times leveraged account, this will double your money. You cash in the whole $50,000 and bank your profits. You still have your original $50,000 holding, now at almost no cost.

This strategy is not incompatible with a long-term approach. You bank all your profits, but only with a view to reinvesting in the shares on the next buy signal. This reinvestment will establish a new base level of holding, say $80,000 with profits taken on every one per cent or more rise in the price. Ideally, with this strategy, you hold each share in a separate spread betting account.

Shares tend to rise ahead of anticipated good news. If the news is even better than expected, they may have another jump, but often that is it for a while. It makes sense to factor in this investor behaviour into your buying and selling strategies.

The one thing to watch out for is a major ‘something new’, which may transform the parameters of how the shares behave. However, in this strategy, we never sell our initial investment; we retain an exposure to the shares, so taking profits is always the prudent thing to do.

The second buy signal rule.

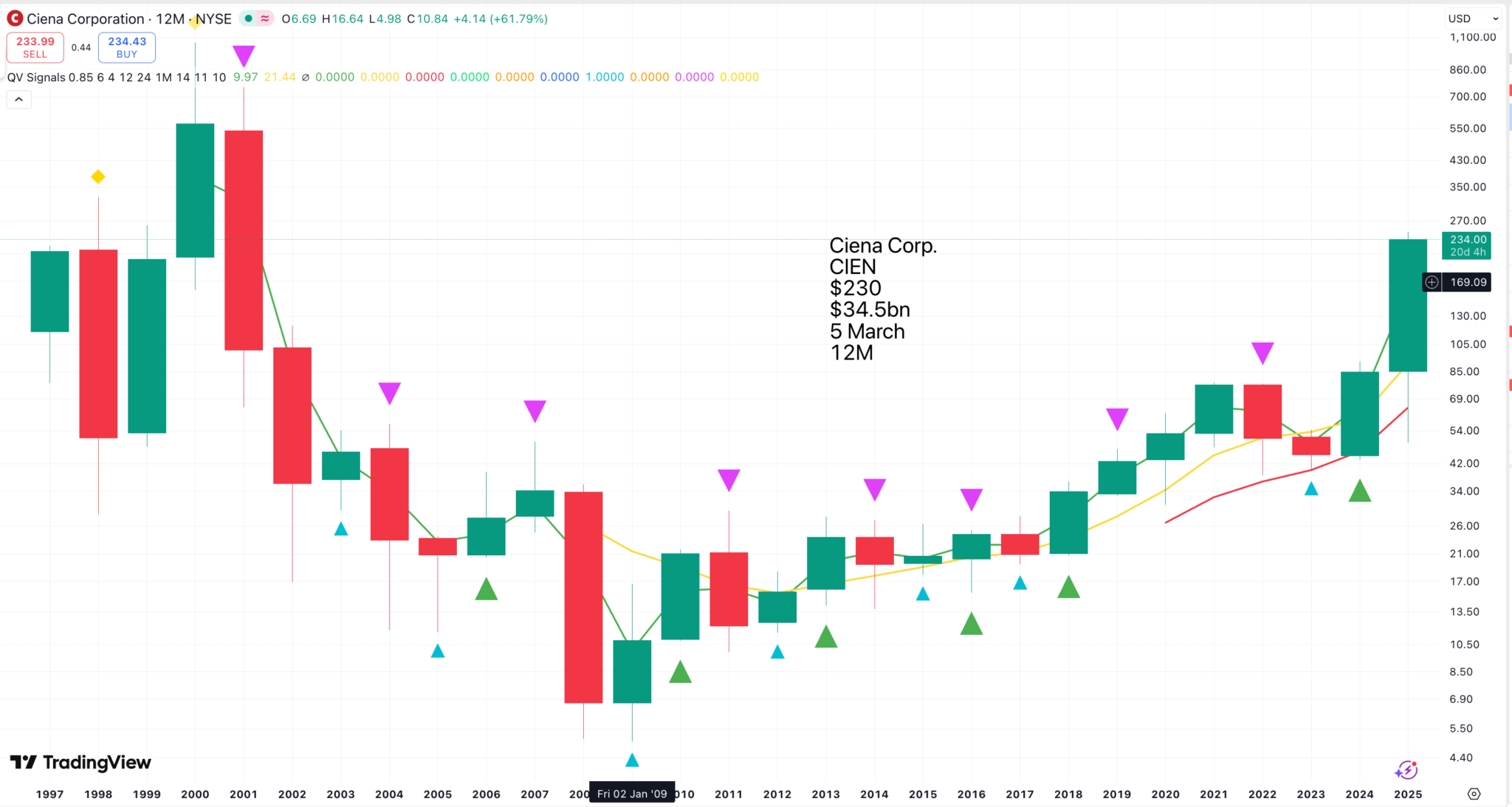

This is a long-term chart of Ciena with each candlestick representing a year. There has been a massive breakout in the last 12 months. The shares were a buy on a close above $100, and you might have been taking profits ever since.

On the chart, you can see a phenomenon which happens on many charts. The shares give a buy signal and then fall, sometimes sharply, before a new uptrend is established, signalled by a second buy signal. This suggests the advisability of having funds in reserve to double up your holding on the second buy signal. After that, hopefully you will be able to start banking profits.

The main significance of the Coppock sell signals (magenta downward-facing triangles) is that they set the scene for a new buy signal. We don’t sell in fear of further falls; we sell to take profits.

Ciena is an AI play.

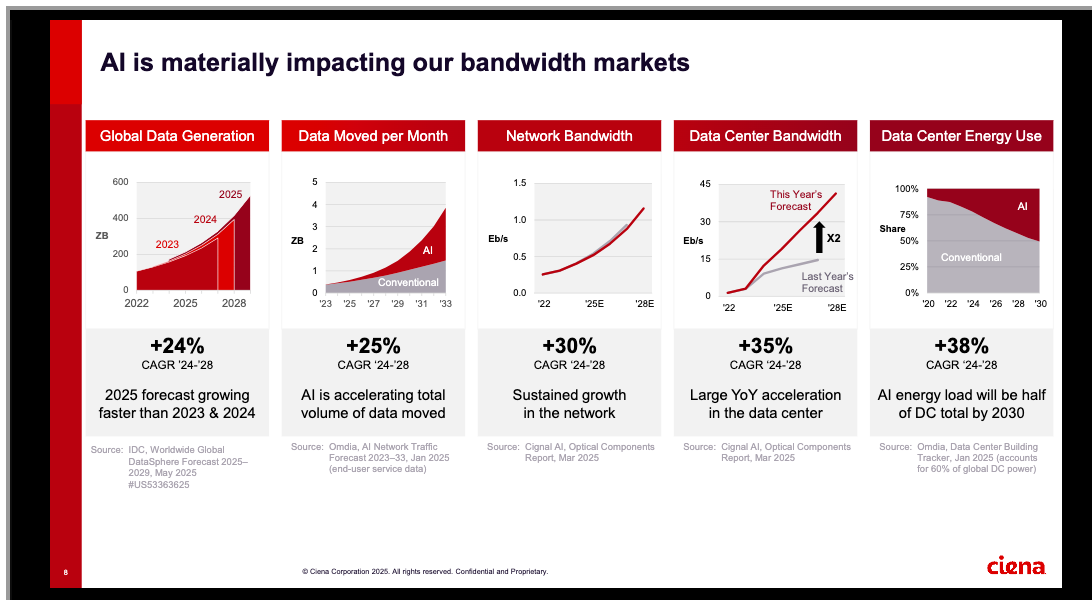

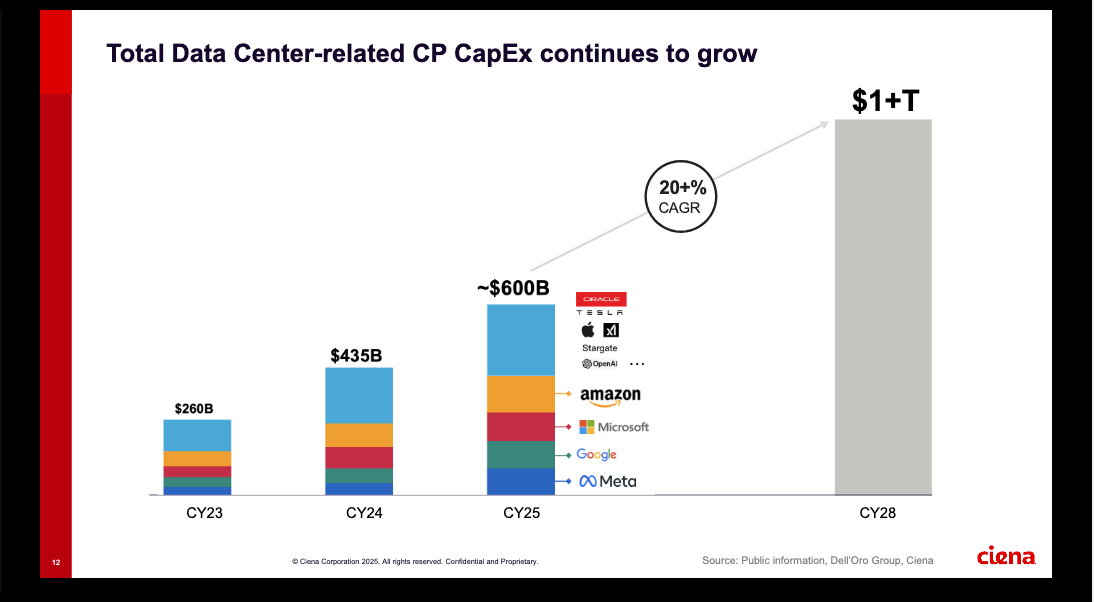

This is a powerful boom.

I flipped through their latest 52-page presentation. It was mostly incomprehensible except that the rise of the data centre and the associated spending boom are producing huge opportunities for Ciena. This means future results from the company are likely to be good for the share price. The business is experiencing accelerating momentum.

Today, we reported record fiscal fourth quarter and full-year revenue of $1.35 billion and $4.77 billion, respectively. These records are a direct result of our sustained purposeful investment and focus on leading high-speed connectivity technologies, together with disciplined execution and deep collaboration with our customers. Combined, these advantages have positioned and will continue to position Ciena Corporation to deliver value in the AI ecosystem, serving both cloud and service provider customers for many years to come. Our progress in driving value from our operating model is also reflected in Q4 earnings per share of $0.91, up 69% year over year, and full-year EPS of $2.64, up 45% from fiscal 2024.

Lastly, we generated record orders for the year of $7.8 billion, which resulted in our entering this year again with a record backlog. These strong results underscore our overall market leadership position as well as the ramping broad-based demand across our business. To this point, I’d like to provide some insight into what we believe to be robust and durable demand over the next several years. Firstly, we continue to see accelerating demand from our cloud customer providers, including the large hyperscalers and the emerging Neoscaler* segment that we talked with you about last quarter. In fact, cloud providers today are as focused on scaling their network as they are on their access to power.

*Neoscalers (or neoclouds) are a new category of specialized cloud infrastructure providers that focus exclusively on delivering high-performance, GPU-as-a-Service (GPUaaS) for intensive Artificial Intelligence (AI) and High-Performance Computing (HPC) workloads. Unlike traditional, general-purpose hyperscalers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, neoscalers are purpose-built and optimized for the unique demands of the AI era.

Orders from cloud providers are very strong and ramping across our portfolio, and they constitute a substantial portion of our growing backlog. It’s important to note that this accelerating demand is being driven by several dynamics. As counterintuitive as it may seem, the cloud providers have largely actually underinvested in their networks to date, particularly relative to other areas of AI infrastructure. The major hyperscalers who are seeing rapid traffic growth not only have the capital to invest but also have real sustainable business models that are currently constrained by the need to dramatically scale their global networks. These cloud providers cannot and do not intend to strand their significant investments in AI-related data center infrastructure.

I would stress that traffic needs to leave the data center to be monetized and operationalized, and we are their strategic technology partner for those network requirements. Secondly, demand from our service provider customers continues to grow steadily as they too reinvest in their transport infrastructure after years of digesting accumulated inventory and also focused on other areas of their networks, most notably 5G. In addition, service providers’ businesses are also being fueled by AI through the enterprise cloud demand and specifically cloud providers’ need for managed optical fiber networks or MOFN.

As a proof point here, we have recently won and are working to deploy a large MOFN project in India with two service providers for a major hyperscaler. Additionally, in the quarter, we have secured multiple major MOFN wins in other regions, including several in new and emerging geographies for our business. As a result of these dynamics, service provider orders were up nearly 70% for the year. In fact, our top three service providers’ revenue from 2024 to 2025 grew 16%.

Due to the increasing momentum across both cloud and service providers, Ciena Corporation’s optical market share has continued to grow and extend our overall leadership, adding two points year to date, and we expect further gains in 2026. In order to address this accelerating demand, we are committed to increasing investments and working with our supply chain partners to scale the business. With product delivery lead times extending in the face of this unprecedented demand, we are proactively expanding our capacity to ensure our ability to timely meet our customers’ demands. This has already yielded results for fiscal 2025, as we delivered double our initial revenue growth expectations for the year.

Gary Smith, CEO, Ciena Corp., Q4 2025, 11 December 2025

It is staggering what is happening.

The simple truth is that AI continues to drive network expansion across all our customer segments, and the scale of investment currently underway is massive and accelerating faster than anything we or indeed the industry have seen to date. I would also mention that unlike the COVID-inspired supply-demand imbalance, we are seeing this demand be installed and leveraged for real near-term revenue opportunities at our customers, as evidenced by accelerated implementation services that increased in revenue by 34% in fiscal 2025.

With that, I’d like to take a moment to share our broader perspective on the AI opportunity as it relates to high-speed connectivity. As bandwidth continues to grow inside the data center and as this traffic flows out of the data center, AI inference models are moving closer to the network edge. For the reasons that I mentioned earlier, we will continue to expand our existing leadership and addressable market in high-speed connectivity in the WAN. In addition to the wide area network, we’re also seeing a significant addressable market opportunity in and around the data center.

It is, I think, well understood that cloud providers are investing heavily in data centers to deliver on the current and future promises of AI. Many third parties are estimating capital spending of more than $7 trillion through the end of the decade in all AI-related infrastructure. This is obviously necessitating the need for both training and inference workloads at massive scale. As a result of the massive growth in AI workloads and to address growing power and space constraints, cloud providers are planning and building distributed AI data center training clusters, or AI factories, which require multiple clusters to act as one.

Along with those power and space constraints, the ability of the cloud providers and specifically the major hyperscalers to scale their global networks is becoming the critical long pole in the tent for them to operationalize AI for both training and inference purposes. Within these data center environments, there are three key connectivity requirements: to scale up within a data center rack, to scale out between racks in a data center, and finally to scale across between geographically distributed data centers, which must operate at the highest levels of performance, with super high capacity and the lowest latency possible. With our innovation and time-to-market leadership in high-speed connectivity solutions, our position could not be better to fulfill this critical demand.

This growing AI-driven opportunity for Ciena Corporation is what we refer to as in and around the data center. In fact, our in and around the data center opportunities grew threefold from 2024 to 2025 and are a major contributor to our 2026 expected growth rate. We have proactively invested in our portfolio to this growing market segment, with a few notable examples. First is our interconnects portfolio, comprising both our power and space-saving ZR and ZR plus pluggables and our optical components. We expect interconnects to play a meaningful role in scale-up, scale-out, and in fact scale across workloads.

Gary Smith, CEO, Ciena Corp., Q4 2025, 11 December 2025

These guys want you to know that things are going well.

I really want to reiterate that as we leave Q4 and indeed the entirety of 2025, we have absolute conviction that the positive market dynamics and our technology leadership provide us with increasing confidence that the durability of demand and our business and financial trajectory are very strong.

Gary Smith, CEO, Ciena Corp., Q4 2025, 11 December 2025

These statements are not made lightly. “Very strong’ is a very strong statement and will have been checked with the company’s lawyers. Misleading statements lead to lawsuits from unhappy shareholders.

I will be adding Ciena to my Top 50 list.

Share Recommendations

Ciena Corp. CIEN