12 UK shares every subscriber should own and thoughts on ‘selling the red’

Over recent years I have been very negative on UK shares relative to US shares. This has been more than justified by the outperformance of US indices. which have been on a roll while UK and European indices generally have languished. Nevertheless there are some wonderful UK quoted businesses in the QV portfolio and I think the 12 below should be on every subscribers’ buy list. They are not only classic 3G businesses but they all have serious magic, top quality management and a great record of doing ‘something new’ again and again.

Most of them are not full-on technology businesses but they do what they do superbly and are best in class globally in their market niches. They are listed below with some brief comments.

Ashtead. AHT Buy @ 5660p. MV: £11.9bn. Next figures: Times recommended: 20. First recommended: 1803p. Last recommended: 5386p

Increasingly businesses are learning to focus exclusively on what they do best and leave everything else to be provided as services by others. In the case off construction companies, event organisers and other people who need equipment to do what they do this means letting businesses like Ashtead do the heavy lifting in terms of providing the equipment. There are numerous advantages for their clients. Ashtead finances the equipment so taking a load of their customers’ balance sheets and it makes sure the kit is always relatively new and well maintained.

Thanks to Ashtead’s growth it is also very readily available as the company builds out an extensive network of depots even to the extensive where new depots sometimes cannibalise sales from existing depots.

The growth has been amazing because Ashtead is a UK quoted company but most of the stores have been rolled out in the vast North American market where there has been a secular shift from owning equipment to renting it. There has also been a tendency for a fragmented industry to coalesce in the hands of two dominant players, United Rentals and Ashtead. Both are good businesses but I see Ashtead as the real class act.

Croda International. CRDA Buy @ 7704p. MV: £10.7bn Next figures: 26 July Times recommended: 12 First recommended: 4499p. Last recommended: 7440p

back in the early days of the oil boom there was incredible growth in chemical companies which propelled ICI to be the biggest company in the UK. Many chemicals have since become commodities and ICI was long ago broken up with its pharmaceutical division becoming the foundation for what is now AstraZeneca. Companies like Croda International picked up the chemicals baton but they don’t do the commodity stuff and quickly become known as specialist chemicals companies. Croda makes specialised chemicals that are the active ingredient in numerous beauty, skin care and health care products. This means they have strong growth as companies like L’Oreal and Estee Lauder go from to strength to strength. They also have pricing power because the chemicals they do make are important differentiators for their customers and make their products work.

Now it seems Croda has decided to further intensify its focus on parts of the market that can deliver growth and high margins. It is has decided to step aside from its performance technologies and industrial chemicals division, which already account for less than 20pc of profits. Croda may not even be a chemicals company anymore. It describes what it does as using smart science to improve lives and is embarking on what looks like a serious transformation of the business.

In the latest year great progress has been made. “Accelerating strategic delivery with almost £1bn of organic and inorganic investments including Avanti and Iberchem acquisitions, part-funded by an equity placing raising gross proceeds of £627m.” Avanti in particular looks a real game changer. “Acquisition of Avanti Polar Lipids adds delivery technology to Croda’s patient health care, leverages scale-up synergy and opens up wide range of future mRNA and gene therapy drug and vaccine applications.”

Croda is also heavily involved in the Pfizer vaccine rollout, another demonstration of the new direction at the business. On another front its latest acquisition, just announced, was of a French fine fragrances company based in Grasse.

Dechra Pharmaceuticals. DPH. Buy @ 4710p. MV: £4.95bn. Next figures: 5 September. Times recommended: 4 First recommended: 3892p Last recommended: 4408p

Dechra was recently featured in my ‘Pets in Paradise’ alert so I am not going to repeat myself here. It is an impressive business using acquisitions to supplement strong organic growth which has been an incredible performer in the new millennium. I have described Dechra as a pets and live stock version of Halma (see below). Its latest deal is a classic example. It has bought Osurnia which makes a treatment for outer ear inflammation in dogs. The cost was $135m to buy $31m of sales.

Dechra is now a big enough and complicated enough business that there is endless scope for improvement in what it does, in its pipeline and in recently made acquisitions with many areas to infill with further acquisitions. It is a terrific formula for continuing growth.

Games Workshop GAW Buy @ 11610p. MV: £3.75bn. Next figures: 26 July. Times recommended: 21 First recommended: 1356p Last recommended: 11900p

Games Workshop is another superstar UK growth stock. It survived the pandemic in amazing style. Many stores were closed for an extended period but the online side grew strongly and a big though unspecified chunk of the rapidly growing third party (trade) sales are multichannel. On the demand side millions of children, not able to attend school, had a wonderful opportunity to discover the GAW ecosystem and find a wonderful new hobby.

There is now the prospect of strong growth across the channels with e-commerce and bricks and mortar sales growing strongly together. The business is also becoming ever more international with enlarged distribution capabilities in North America and partnerships in Asia to develop figurines tailored to the Asian market.

Royalties have also become increasingly important with partnerships in place to develop video games based on the World of Warhammer of a quality the company has never had before.

Investors often imagine that businesses need to be small to grow fast. The truth is often the exact opposite. It is when companies reach a certain critical size that they have the power to drive growth and the multiplicity of opportunities to make it all possible. Games Workshop issued a positive trading update in May showing the growing footprint of the business.

“For the year to 30 May 2021, we estimate the group’s sales to be not less than £350m (2019/20: £270m) and the group’s profit before tax to be not less than £150m (2019/20: £89m). This includes royalties receivable from licensing which are estimated to be approximately £15m (2019/20: £17m). As in the prior year, in recognition of our staff’s contribution to these results, we will have paid during the year profit share bonuses amounting in total to £12m (2019/20: £2m).”

Not long ago it would have seemed inconceivable that Games Workshop could have grown to this scale and there were fears that the company would struggle in a world of computer games. Not any more; now it is clear that the company can flourish very happily in a more online world and the global opportunity looks huge.

Halma. HLMA. Buy @ 2805p. MV: £10.5bn. Next figures: 23 November. Times recommended: 14 First recommended: 1490p Last recommended: 2731p. Lowest recommended: 1385p

I regard Halma as the greatest UK growth stock of all time. Its growth story began in the 1970s under the leadership of a business genius called David Barber. In those days I was still meeting CEOs face to face and met Barber several times. He was an amazingly gifted man with a brilliantly thought out strategy to build his group with a series of acquisitions focused in areas the company knew well, funded from internally generated cash flow with the aim of creating little mini monopolies with great pricing power delivering high returns on capital

Andrew Williams, who as been CEO since 2005, is a leader in the same mould as Barber and has done a brilliant job keeping the acquisitions flowing, directing the focus of the business at safety, environment and health and more recently overseeing a digital transformation of the group.

The business has weathered Covid-19 almost as though it wasn’t there with sales falling slightly but profits, earnings and dividends all still rising. The dividend has risen by five per cent or more for 42 consecutive years!

Liontrust Asset Management. LIO. Buy @ 1968p. MV: £1.14bn. Next figures: 24 November. Times recommended: 11 First recommended: 1200p Last recommended: 1912p. Lowest recommended: 1030p

I have written quite a lot about Liontrust recently and its star team of fund managers so I will keep this short. The core thesis is that in a bull market a well run fund management business is always going to be one of the best investments. The group is moving aggressively to increase assets under management which have risen from £16.1bn to £30.9bn in the latest year. It is doing this by a combination of acquisitions, organic growth and rising stock market values.

Higher assets under management have a double whammy effect on profits because the group’s own turnover is a small percentage of AUM so rises in line while costs typically rise more slowly unless the group steps up investment in sales and marketing to grow AUM strongly. Either way shareholders benefit and it is hard for any of the funds managed by the business to generate returns as good as those offered by shares in the the fund manager.

Maxcyte. MXCT. Buy @ 1130p. MV: £864m. Next figures: 26 September. Times recommended: 3 First recommended: 665p Last recommended: 910p. Highest recommended: 1020p

Maxcyte takes me well out of my comfort zone because it offers services based on advanced technology which I struggle to get my head around. This is what they say. “MaxCyte is a leading provider of cell-engineering platform technologies that are driving the next‐generation of cell therapies and making a meaningful difference for patients. The company’s technology is employed by leading drug developers worldwide, including all of the top ten global biopharmaceutical companies.”

There is a razors and razor blades element to the business. Maxcyte supplies equipment and makes recurring profits from the consumables needed to operate them .Increasingly the company is also doing partnership deals which give it a stake in the success of the programme as can be seen from a just announced deal “Celularity will obtain non-exclusive rights to use MaxCyte’s Flow Electroporation® technology and ExPERT™ platform enabling Celularity to accelerate the development of innovative, off the shelf allogeneic cell therapies, including genetically modified natural killer (NK) cell therapies and CAR T-cell therapies derived from the postpartum placenta. In return, MaxCyte is entitled to platform licensing fees and program-related milestone payments.”

The latest driver for the shares is plans to seek a dual listing on Nasdaq and London. This is presumably being done to raise the group’s US profile and help it enter into more partnerships so looks a good move plus US-pharma related businesses command high valuations.

Polar Capital Technology Trust. PCT Buy @ 2430p. MV: £3.28bn. Next figures: 13 July Times recommended: 7 First recommended: 1690p Last recommended: 2380p

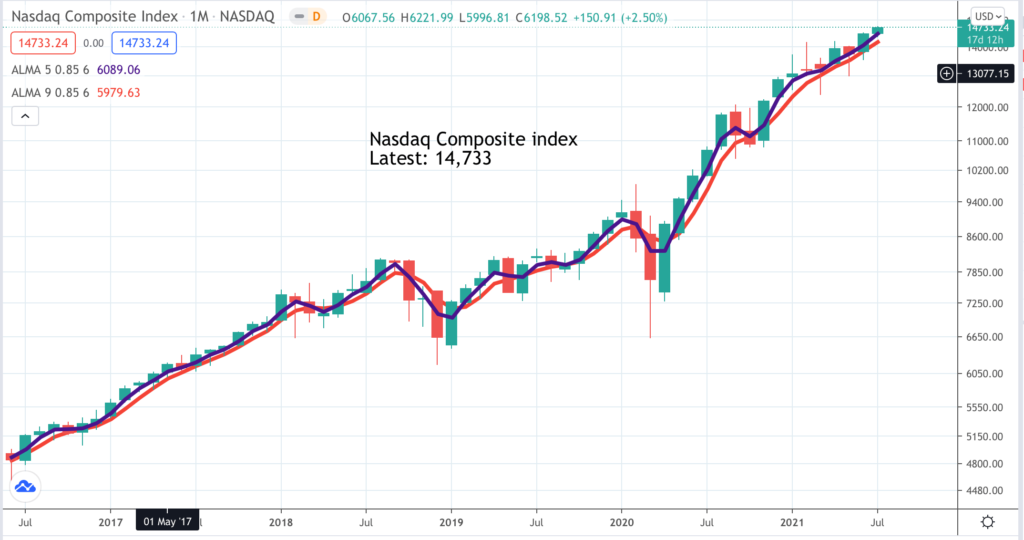

PCT is an investment trust which specialises in, duh, technology shares and has the bulk of its portfolio invested in the US. Since the tech-heavy Nasdaq bottomed out in late 2002 the trust has appreciated by just over 27 times. This compares with a Nasdaq 100 index which is up a little over 18 times over the same period. This is an impressive performance and shows the benefits of their intense specialisation in a sector which has been the place to be in the new millennium.

The company sees no change in the positive trend for technology. “In the short term, the technology sector has given back some of its considerable long-term outperformance of the wider market. Ben Rogoff, manager of Polar Capital Technology Trust (PCT), is unfazed by this. The COVID-19 pandemic has accelerated many societal shifts that Ben believes will be permanent. Areas such as e- commerce, cloud computing, video conferencing, digital entertainment and telemedicine have benefited. At the same time, advances in sectors such as electric vehicles (EVs) and artificial intelligence (AI) will revolutionise a swathe of industries. Ahead of the recent sell-off, Ben saw pockets of overvaluation in the sector but no new technology bubble. The long-term potential that he sees for PCT’s portfolio does not merit today’s 7.9pc discount to NAV.”

I totally agree and expect more of the same from PCT in the future.

S4 Capital SFOR. Buy @ 682p. MV: £3.55bn. Next figures: 25 March Times recommended: 9 First recommended: 300p. Last recommended: 621p

Martin Sorrell is an extraordinary man. He has been a key figure in three of the most successful media businesses of the last half century. First came Saatchi and Saatchi where he was the finance director and often described as the third Saatchi. Then came WPP which he turned from a cash shell called Wire & Plastics Industries into one of the world’s largest advertising services businesses. Now, at the age of 74, he has a new vehicle with S4 Capital, which is being built from the ground up as a marketing services business for the digital era. The formula is similar to WPP with a string of acquisitions to acquire talent, a wider range of service offerings and a growing client base. WPP did some giant deals; that hasn’t happened at S4 Capital where the deals have been more niche, perhaps because there aren’t any giant digital media businesses to buy yet.

Back in the 1960s there was a film called ‘The Knack’ about a man who was brilliant at pulling women. Sorrell has the knack for spotting good acquisitions and persuading the owners to sell. Buffett is still actively involved with his business at 90 so I am sure Sorrell thinks he has plenty of time to build S4 Capital into a powerful force in media services.

The company has just reported an excellent first quarter ahead of expectations. “The company grew strongly in the first quarter, showing an acceleration in the like-for-like gross profit (net revenue) growth rate from 27pc in the fourth quarter of 2020 to 33pc and compared to 19pc in the pandemic-affected first quarter last year. The two recent “whopper” wins started to have a significant positive impact in March. This represents an excellent start to achieving the group’s 2021-23 three-year plan of doubling its size on a like-for-like basis and of also achieving the previous 2019-21 and 2020-22 three-year plans, which both also called for a doubling.”

The strong figures are backed by a steady flow of deals with more to come. “We continue to examine merger opportunities, especially in high growth functional areas of the content and data & digital marketing practices. We are prepared to leverage the company to around two times EBITDA and are preparing a bond issue to lock in our long-term debt capacity at attractive rates. This, together with cash in hand and the 50:50 cash:equity merger structure we commonly use, will give us £500m of merger transaction firepower.”

Spirax-Sarco. SPX. Buy @ 14195p. MV: £10.4bn. Next figures: 10 August. Times recommended: 12 First recommended: 8100p Last recommended: 13800p

At first sight Spiral-Sarco looks too old school to be a success story in the digital age. An engineering company, which specialises in steam. But when you look closer you realise that this is a truly wonderful business. 85pc of sales come from repair and maintenance budgets so similar to the recurring income so highly valued at SaaS technology companies. The return on capital in 2020 was a staggering 49pc. Dividends paid have grown by 11pc annually for 53 years! And the company has a huge moat with proprietary technology, a large diversity of customers, geographies, markets and products.

It has a direct sales model, over 55pc of sales from defensive end markets, a sales presence in 68 countries and manufacturing facilities in 14. It is all about steam, fluids and heating and we are never going to stop needing those and SPX’s expertise and presence in the field. Nobody is going to come along with some whizz-bang technology to disrupt Spirax-Sarco.

The only thing that fazes the company is global recessions and then everybody is hurting, mostly much more than Spirax-Sarco. S4 Capital talks about its business being a royalty on digital media spending. Spirax-Sarco’s business is like a royalty on the growth of global industrial production.

Victoria Carpets. VCP. Buy @ 1100p. MV: £1.3bn. Next figures: 19 July Times recommended: 10 First recommended: 614p Last recommended: 1070p. Lowest recommended: 528p

Victoria Carpets is an acquisition machine specialising in floor coverings. The executive chairman, Geoff Wilding, is a former investment banker and VCP reminds me of LVMH in its approach, very acquisitive, very effective at integrating acquisitions and very good at using economies of scale. The shares like many others initially tumbled when Covid struck on fears that spending on floor coverings would collapse but the workforce and the factories would still need to be paid for. Demand fell but not as badly as feared. The company has cut costs. It has also acquired a powerful backer in the form of Koch Industries, a giant private US business, which is also involved in the bid for Morrisons Supermarkets.

Helped by Koch’s financial backing Victoria has a powerful war chest and is using it to make acquisitions in Europe and now America, while the floor coverings industry is still somewhat in disarray. Demand for floor coverings has picked up and in tune with buoyant property markets in many countries including the UK is currently running very strongly indeed.

CEO, Philippe Hamers, said recently “In my 30 years in the industry, I have never known it to be busier at this time of the year. Our continually enhanced service proposition has proven to be the cornerstone of the company’s growth trajectory. Victoria’s production is running at full capacity and some of our factories have orders taking all their output through until autumn. We are out-sourcing some production to ensure service standards are met and market share gains sustained. The value of our management team’s depth of industry experience and entrepreneurial initiative has proven invaluable as we have been able to overcome the risk of potential raw material shortages by leveraging our long-term relationships, size, and extensive knowledge of supply chain options.I am confident shareholders will be very pleased with the way the business is performing this year.”

Subsequent to that statement the group announced the acquisition of Cali Bamboo Holdings saying- “Cali is an exceptionally high-growth US-based business that has achieved an organic CAGR of 17pc for the past five years via its online B2C customer acquisition model, data-driven analytics, a high-touch consultative sales team, and direct delivery capability, alongside B2B channels.”

Like Sorrell’s S4 Capital there is plenty more m & a activity to come. “We continue to have substantial amounts of capital to deploy and are in active discussions with additional high-quality opportunities to grow our business. Therefore, shareholders can expect further acquisitions.”

Watches of Switzerland Group WOSG. Buy @ 938p. MV: £2.2bn. Next figures: 16 December. Times recommended: 3 First recommended: 782p. Last recommended: 820p

Apple sells more watches than the whole of the Swiss watch industry and there did seem to be a moment when Swiss watches were yesterday’s technology and an industry in decline. It turns out not to be like that at all. Swiss watches are luxury goods, status symbols, reassuring reminders of financial success and last but not least things of great beauty in a way that Apple watches will never be. I have an old Rolex on my wrist bought over 40 years ago for what it would cost to service the watch now and I love it. It tells me the time and the date, if I hold it far enough away. I would feel lost without it even though my iPhone can tell me the time. It’s a small miracle of engineering.

Nothing small about Rolex though. The company is Swiss, private and very secretive. However based on information which is publicly available I would not be surprised if Rolex was worth €100bn. You can’t buy a watch from Rolex or go to them for a service. You have to use an intermediary and WOSG is one of the most important of those which is a huge opportunity for the group in a world going crazy for luxury goods.

As well as Rolex, WOSG will sell you Patek Philippe, Audemars Piguet, Cartier, OMEGA, TAG Heuer and Breitling. The group was transformed in 2014 and has been growing strongly ever since. So far the Americans don’t share our obsession with luxury Swiss watches but WOSG is over them hoping to help them catch the bug.

It’s a fantastic position for WOSG to be in because the Swiss brands manage their watches for scarcity value like Hermes with its bags and Mercedes with its cars. They also front up for all the marketing spend being for example official timekeepers at Wimbledon and having players such as Roger Federer, Angelique Kerber and Bjorn Borg as brand ambassadors. They do the spending and the customers flock to Watches of Switzerland to buy the watches.

Despite lockdown store closures the group continued to invest in growth, saw booming e-commerce sales, accelerating momentum in the US where it makes a little over a quarter of sales and even managed to deliver higher sales and profits.

Prospects look outstanding. “As market leaders in a category with unique long term growth dynamics and high barriers to entry, we are well positioned to continue to build on our strong foundations so that we continue to succeed and create value for our shareholders.”

Intriguingly the group is achieving this success while having no presence in markets like Asia and continental Europe which account for 83.2pc of Swiss watch sales. What it does have is a rock solid base in the UK, where many sales will be made to tourists once travel returns to normal and a huge shot at repeating its UK leadership in the US which is the global market most up for grabs.

A recent issue of QV for Shares, based on a read-through of the entire QV portfolio, alerted nearly 200 shares for buying. It included every single share in the portfolio giving any kind of buy signal from buying the green (buying on a green candlestick) to programmatic (a golden cross by the moving averages) to break outs (shares punching higher from a period of consolidation).

It set me thinking because the implication is that every share not on the list is giving some kind of sell signal. I started to wonder if it would make sense to use this information to develop a trading variant of buy and hold. In this variant you hold the shares while the candlesticks are green and step aside (sell) when they are red, buying back again on the next green ad infinitum. The problem is that for subscribers it would involve a great deal of buying and selling and I am not at all sure that it would lead to an improved result in the end. It certainly isn’t what Jeff Bezos does with his Amazon shares and he has done very well.

I am going to continue thinking about it. What I do like about it is the potential to keep rebalancing your portfolio around the strongest performers. Meanwhile, I love the 12 shares listed above for their sheer quality. It is the cornerstone of my belief about investing. If you buy the best you will achieve the best long term performance. It is similar to my approach with property. Buy the best house you can afford, ideally one with which you have fallen in love and even f you have paid over the odds you will end up doing very well.

As noted in the issue with the near 200 alerts I buy a decent holding in shares and then add to positions on subsequent buy signals. Another way of using the buy signals would be a zero commission, fractional share approach where you invest a fixed (small) amount in each share in your portfolio on buy signals over a long period of time. This should virtually ensure that your average entry price is low. Inevitably every buying strategy works best with shares that are in secular uptrends so the key to a great performance is still stock selection.